SDCL EDGE Acquisition Corp. Announces Redemption of Class A Ordinary Shares

November 01 2024 - 8:55PM

Business Wire

SDCL EDGE Acquisition Corporation (the “Company”) (NYSE:SEDA)

announced today that due to the Company not consummating an initial

business combination within the time period required by its amended

and restated memorandum and articles of association (the

“Charter”), the Board of Directors of the Company has elected to

dissolve and liquidate the Company in accordance with the

provisions of its Charter.

As stated in the Charter, if the Company does not consummate a

Business Combination by (i) August 2, 2024 or (ii) November 2,

2024, in the event that the Directors resolve by resolutions of the

board of Directors, to extend the amount of time to complete a

Business Combination for up to three (3) times for an additional

one (1) month each time after August 2, 2024, or such later time as

the Members may approve in accordance with the Articles, the

Company shall: (a) cease all operations except for the purpose of

winding up, (b) as promptly as reasonably possible but not more

than ten business days thereafter, redeem the Class A shares issued

as part of the units issued in the initial public offering (“Public

Shares”), at a per-share price, payable in cash, equal to the

aggregate amount then on deposit in the Company’s trust account

(the “Trust Account”) held with Continental Stock Transfer &

Trust Company (“Continental”), including interest earned on the

funds held in the Trust Account and not previously released to the

Company (less taxes payable and up to $100,000 of interest to pay

dissolution expenses), divided by the number of then Public Shares

in issue, which redemption will completely extinguish public

shareholders’ rights as shareholders (including the right to

receive further liquidation distributions, if any); and (c) as

promptly as reasonably possible following such redemption, subject

to the approval of the Company’s remaining shareholders and the

Directors, liquidate and dissolve, subject in each case to its

obligations under Cayman Islands law to provide for claims of

creditors and other requirements of applicable law.

Net of taxes and dissolution expenses, the per-share redemption

price for the Public Shares is expected to be approximately $11.31

(the “Redemption Amount”) based upon the amount held in the trust

account as of September 30, 2024, which was approximately

$58,688,796.

The Company anticipates that the Public Shares, as well as the

Company’s publicly traded units, will cease trading as of the close

of business on November 1, 2024. After November 1, 2024, the

Company shall cease all operations except for those required to

redeem the Public Shares and wind up the Company’s business. The

redemption of the Public Shares is expected to be completed within

ten business days after November 2, 2024, by November 18, 2024 (the

“Expected Redemption Date”). As of the Expected Redemption Date,

the Public Shares will be deemed cancelled and will represent only

the right to receive the Redemption Amount.

There will be no redemption rights or liquidating distributions

with respect to the Company’s warrants, which will expire

worthless. The Company’s initial shareholders waived their

redemption rights with respect to the outstanding Class B ordinary

shares issued prior to the Company’s initial public offering.

In order to provide for the disbursement of funds from the Trust

Account, the Company will instruct Continental to take all

necessary actions to liquidate the Trust Account. Registered

holders may redeem their shares for their pro rata portion of the

proceeds of the Trust Account upon presentation of their respective

share or unit certificates or other delivery of their shares or

units to Continental, the Company’s transfer agent. Beneficial

owners of Public Shares held in “street name,” however, will not

need to take any action in order to receive the Redemption

Amount.

The Company expects that The New York Stock Exchange will file a

Form 25 with the U.S. Securities and Exchange Commission (the

“SEC”) to delist its securities. The Company thereafter expects to

file a Form 15 with the SEC to terminate the registration of its

securities under the Securities Exchange Act of 1934, as

amended.

About SDCL EDGE Acquisition Corp.

SEDA is a special purpose acquisition company formed for the

purpose of effecting a merger, capital stock exchange, asset

acquisition, stock purchase, reorganization, or similar business

combination with one or more businesses. We have not selected any

business combination target and therefore in accordance with our

Charter, we will proceed with the dissolution and liquidation of

the Company. For more information above SEDA, please visit

https://www.sdcledge.com. The information contained on, or that may

be accessed through, the websites referenced in this press release

is not incorporated by reference into, and is not a part of, this

press release.

Forward-Looking Statements

Certain statements contained in this press release and certain

materials the Company files with the SEC, as well as information

included in oral statements or other written statements made or to

be made by the Company, other than statements of historical fact,

are forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Such forward-looking

statements speak only as of the date of this press release. These

forward-looking statements are based on management’s current

expectations, assumptions and beliefs regarding future events and

are based on currently available information as to the outcome and

timing of future events, certain of which are beyond the Company’s

control, and actual results may differ materially depending on a

variety of important factors. These factors include, but are not

limited to, a variety of risk factors affecting the Company’s

business and prospects disclosed in the Company’s annual, quarterly

reports and subsequent reports filed with the SEC, as amended from

time to time. Any or all of these occurrences could cause actual

results to differ from those in the forward-looking statements, and

the Company does not undertake to update the forward-looking

statements to reflect the impact of circumstances or events that

may arise after the date of the forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101539160/en/

Investor and Media Contacts Ned Davis Chief Financial

Officer SDCL EDGE Acquisition Corporation (917) 941-8334

ned.davis@sdclgroup.com

Francesca Lorenzini Investor Relations Director SDCL EDGE

Acquisition Corporation (512) 632-0292

francesca.lorenzini@sdclgroup.com

Financial Profiles, Inc. Moira Conlon mconlon@finprofiles.com

(310) 622-8220 Kelly McAndrew (310) 622-8239

kmcandrew@finprofiles.com

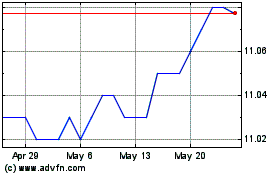

SDCL EDGE Acquisition (NYSE:SEDA)

Historical Stock Chart

From Oct 2024 to Nov 2024

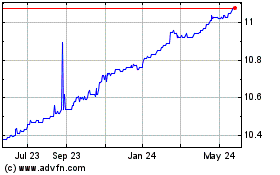

SDCL EDGE Acquisition (NYSE:SEDA)

Historical Stock Chart

From Nov 2023 to Nov 2024