Schlumberger Up; Cutting Capital Spending

March 24 2020 - 12:41PM

Dow Jones News

By Michael Dabaie

Schlumberger Ltd. shares were up 8.3% to $13.89 in midday

trading.

The company earlier said it is cutting capital spending by up to

30% from 2019 levels amid the Covid-19 pandemic. Schlumberger,

which provides technology for reservoir characterization, drilling,

production, and processing to the oil and gas industry, said its

capital expenditures will be almost entirely allocated toward

international markets. The company said more than 80% of its free

cash flow is generated internationally.

The magnitude of the reduction depends on changes to customer

plans, the company said.

The company said it is implementing a "downturn playbook" with

strict cost control and cash discipline.

Schlumberger said will accelerate North America land operations

restructuring and personnel and compensation reductions.

The company said its second-quarter outlook for North America

land operations is for a rapid reduction in rig counts and

completions activity. Rig count is projected to potentially reach

2016 trough levels, Schlumberger said.

Internationally, the company said that it expects that in the

second quarter the escalating Covid-19 situation will impact field

crews and some operations. The company said it is planning for

reduced activity due to customer budget cuts.

Stephens Inc. maintained its Equal-Weight rating on the

stock.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

March 24, 2020 12:26 ET (16:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

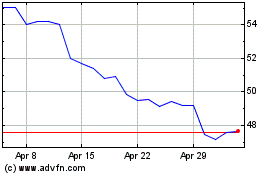

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

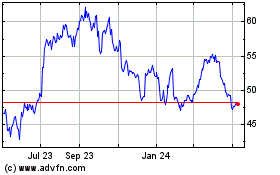

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024