LyondellBasell Shares Up After $2 Billion JV Deal With Sasol

October 02 2020 - 11:00AM

Dow Jones News

By Robb M. Stewart

LyondellBasell Industries' shares strengthened Friday after the

chemicals and refining company struck a deal to buy half of certain

Sasol Ltd. assets in Louisiana for $2 billion and form a joint

venture.

In morning trading, the shares were 3.8% higher at $70.73. They

are 25% lower year-to-date.

LyondellBasell said it signed a definitive agreement to buy 50%

of the South African company's ethane cracker, low and linear-low

density polyethylene plants and associated infrastructure. The deal

includes rights for each partner regarding the potential future

sale of its ownership interest.

Under the terms of the agreement, each joint-venture partner

will provide pro-rata shares of ethane feedstocks and will take

pro-rata shares of cracker and polyethylene products at cost.

LyondellBasell will operate the U.S. base chemicals assets on

behalf of the 50-50 joint venture.

Some of Sasol's U.S. employees will become employees of

LyondellBasell. Sasol will retain full ownership and operational

control of its Lake Charles Research and Development complex, Lake

Charles East Plant ethane cracker and U.S. Performance Chemicals

Business assets in Lake Charles, which produce Ziegler alcohols and

alumina, ethoxylates, Guerbet alcohols, paraffins, comonomers,

linear alkyl benzene, ethylene oxide and ethylene glycol

The assets of the venture, which will operate under the name

Louisiana Integrated PolyEthylene JV LLC, are located on the U.S.

Gulf Coast. LyondellBasell said its investment allows it to expand

in a core area of its business and it will realize immediate

returns and eliminate customary construction risks associated with

new projects.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 02, 2020 10:45 ET (14:45 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

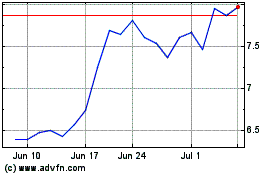

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

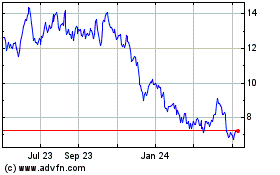

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024