UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

QUOTIENT TECHNOLOGY INC.

|

(Name of Registrant as Specified in Its Charter)

|

| |

ENGAGED CAPITAL FLAGSHIP MASTER FUND, LP

ENGAGED CAPITAL FLAGSHIP FUND, LP

ENGAGED CAPITAL FLAGSHIP FUND, LTD.

ENGAGED CAPITAL, LLC

ENGAGED CAPITAL HOLDINGS, LLC

GLENN W. WELLING

CHRISTOPHER B. HETRICK

MATTHEW O’GRADY

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

PRELIMINARY COPY

SUBJECT TO COMPLETION

DATED APRIL 28, 2022

ENGAGED CAPITAL FLAGSHIP MASTER FUND, LP

___________________, 2022

Dear Fellow Quotient Stockholder:

Engaged Capital Flagship

Master Fund, LP and its affiliates (collectively, “Engaged Capital” or “we”) are the beneficial owners of an aggregate

of 6,107,150 shares of common stock, par value $0.00001 per share (the “Common Stock”), of Quotient Technology Inc., a Delaware

corporation (“Quotient” or the “Company”), representing approximately 6.4% of the outstanding shares of Common

Stock. For the reasons set forth in the attached Proxy Statement, we believe meaningful changes to the composition of the Board of Directors

of the Company (the “Board”) are necessary in order to ensure that the Company is being run in a manner consistent with your

best interests. We are seeking your support for the election of our two (2) nominees as Class II directors at the annual meeting of stockholders

scheduled to be held at [_________], on [________], 2022 at [_:__ _.m., local time] (including any adjournments or postponements thereof

and any meeting which may be called in lieu thereof, the “Annual Meeting”). We are seeking representation on the Board because

we believe that the Board will benefit from the addition of directors who collectively possess the relevant skill sets and a shared objective

of enhancing value for the benefit of all Quotient stockholders and who will bring a stockholder’s perspective into the boardroom.

The individuals that we have nominated are highly-qualified, capable and ready to serve the stockholders of Quotient.

Our extensive due diligence

has led us to believe there is significant value to be realized at Quotient given the Company’s valuable assets, data and tremendous

potential. However, we are concerned that the Board is not taking the appropriate actions to address the Company’s prolonged underperformance

and, instead, has taken a number of defensive actions in an apparent attempt to avoid stockholder-driven accountability at the Annual

Meeting. Given the Company’s financial and stock price underperformance under the oversight of the current Board and history of

poor corporate governance practices, we strongly believe that the Board must be reconstituted to ensure that the interests of stockholders,

the true owners of Quotient, are appropriately represented in the boardroom.

The Company has a classified

Board, which is currently divided into three (3) classes. The terms of two (2) Class II directors expire at the Annual Meeting. Through

the attached Proxy Statement and enclosed BLUE proxy card, we are soliciting proxies to elect only our two (2) nominees. Accordingly,

the enclosed BLUE proxy card may only be voted for our nominees and does not confer voting power with respect to any of the

Company’s director nominees. You can only vote for the Company’s director nominees by signing and returning a proxy card provided

by the Company. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other

information concerning the Company’s nominees. There is no assurance that any of the Company’s nominees will serve as directors

if all or some of our nominees are elected. If elected, our nominees will constitute a minority on the Board and there can be no guarantee

that our nominees will be able to implement any actions that they may believe are necessary to unlock stockholder value.

We urge you to carefully

consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed

BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy card are first being mailed to stockholders

on or about ____________, 2022.

If you have already voted for the incumbent

management slate, you have every right to change your vote by signing, dating and returning a later dated BLUE proxy card or

by voting in person at the Annual Meeting.

If you have any questions

or require any assistance with your vote, please contact Saratoga Proxy Consulting LLC, which is assisting us, at its address and toll-free

numbers listed below.

Thank you for your support,

/s/ Glenn W. Welling

Glenn W. Welling

Engaged Capital Flagship Master Fund, LP

|

If you have any questions, require assistance in

voting your BLUE proxy card,

or need additional copies of Engaged Capital’s

proxy materials,

please contact Saratoga at the phone numbers listed

below.

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

PRELIMINARY COPY

SUBJECT TO COMPLETION

DATED APRIL 28, 2022

ANNUAL MEETING OF STOCKHOLDERS

OF

QUOTIENT TECHNOLOGY INC.

_________________________

PROXY STATEMENT

OF

ENGAGED CAPITAL FLAGSHIP MASTER FUND, LP

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

Engaged Capital Flagship

Master Fund, LP (“Engaged Capital Flagship Master”), Engaged Capital Flagship Fund, LP (“Engaged Capital Fund”),

Engaged Capital Flagship Fund, Ltd. (“Engaged Capital Offshore”), Engaged Capital, LLC (“Engaged Capital LLC”),

Engaged Capital Holdings, LLC (“Engaged Holdings”) and Glenn W. Welling (collectively, “Engaged Capital” or “we”)

are significant stockholders of Quotient Technology Inc., a Delaware corporation (“Quotient” or the “Company”),

who, together with the other participants in this solicitation, beneficially own an aggregate of 6,107,150 shares of common stock, par

value $0.00001 per share (the “Common Stock”), of the Company, representing approximately 6.4% of the outstanding shares of

Common Stock. We believe that the Board of Directors of the Company (the “Board”) must be meaningfully reconstituted to ensure

that the Board takes the necessary steps for the Company’s stockholders to realize the maximum value of their investments. We have

nominated directors who have strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder

value. We are seeking your support at the annual meeting of stockholders scheduled to be held at [_________], on [________], 2022 at [_:__

_.m., local time] (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual

Meeting”), for the following:

| 1. | To elect Engaged Capital’s two (2) director nominees, Christopher B. Hetrick and Matthew O’Grady

(each a “Nominee” and collectively, the “Nominees”), to the Board as Class II directors to serve until the 2025

annual meeting of stockholders and until their respective successors are duly elected and qualified; |

| 2. | To vote on the Company’s proposal to approve, on an advisory basis, the compensation of the Company’s

named executive officers, as disclosed in the Company’s proxy statement in accordance with Securities and Exchange Commission (“SEC”)

rules; |

| 3. | To vote on the Company’s proposal to ratify the selection by the Audit Committee of the Board of

Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022; and |

| 4. | To transact such other business as may properly come before the Annual Meeting. |

This Proxy Statement and

the enclosed BLUE proxy card are first being mailed to stockholders on or about [____________], 2022.

As of the date hereof,

the participants in this solicitation collectively own 6,107,150 shares of Common Stock (the “Engaged Capital Group Shares”).

We intend to vote such shares FOR the election of the Nominees, [FOR / AGAINST] approval of the advisory vote on

the compensation of the Company’s named executive officers and FOR the ratification of the selection of Ernst & Young

LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022, as described herein.

The Company has set the

close of business on [_______], 2022 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting

(the “Record Date”). The mailing address of the principal executive offices of the Company is 1260 East Stringham Avenue,

Suite 600, Salt Lake City, Utah 84106. Stockholders of record at the close of business on the Record Date will be entitled to vote at

the Annual Meeting. According to the Company, as of the Record Date, there were [_______] shares of Common Stock outstanding and entitled

to vote at the Annual Meeting.

THIS SOLICITATION IS BEING

MADE BY ENGAGED CAPITAL AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT

BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH ENGAGED CAPITAL IS NOT AWARE OF

A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE

PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

ENGAGED CAPITAL URGES YOU

TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT

A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS

PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS.

ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR

THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at

www.[_____________________].com

IMPORTANT

Your vote is important,

no matter how few shares of Common Stock you own. Engaged Capital urges you to sign, date, and return the enclosed BLUE proxy card

today to vote FOR the election of the Nominees and in accordance with Engaged Capital’s recommendations on the other proposals on

the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE

proxy card and return it to Engaged Capital, c/o Saratoga Proxy Consulting LLC (“Saratoga”), in the enclosed postage-paid

envelope today. |

| · | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial

owner of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you

by your broker or bank. As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how

to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. |

| · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the

Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating

and returning the enclosed voting form. |

Since only your latest

dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management

proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously

sent to us. Remember, you can vote for our two (2) Nominees only on our BLUE proxy card. So please make certain that the latest

dated proxy card you return is the BLUE proxy card.

|

If you have any questions, require assistance in

voting your BLUE proxy card,

or need additional copies of Engaged Capital’s

proxy materials,

please contact Saratoga at the phone numbers listed

below.

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com

|

Background to the Solicitation

The following is a chronology

of material events leading up to this proxy solicitation:

| · | In mid-2020, Engaged Capital became interested in a potential investment in the Company and began conducting

investment due diligence with respect to the Company. |

| · | In August 2020, representatives from Engaged Capital had several introductory calls with the Company’s

investor relations team. |

| · | In October 2020, Engaged Capital first began building a position in the Company due to its belief that

the Company’s shares were deeply undervalued. |

| · | On November 10, 2020, representatives from Engaged Capital had a discussion with Chairman and CEO Steven

Boal and other representatives from the Company regarding Quotient’s Q3 2020 earnings, which caused the Company’s stock price

to decline significantly. Engaged Capital expressed disappointment with the Company’s reduction in guidance for the next quarter

and fiscal year. |

| · | On February 11, 2021, representatives from Engaged Capital had a discussion with Mr. Boal and other representatives

from the Company regarding Quotient’s Q4 2020 earnings. Engaged Capital questioned how much visibility the Company had into its

guidance and how much conservatism was used to avoid misses experienced in past years. The Company informed Engaged Capital that it took

a different approach to guidance and that it was now a fact-based approach that included a new level of conservatism. |

| · | On February 12, 2021, Glenn W. Welling had a telephone call with Mr. Boal. The parties discussed the Company’s

business generally and Mr. Welling informed Mr. Boal that Engaged Capital may nominate directors for election to the Board at the 2021

annual meeting of stockholders (the “2021 Annual Meeting”). |

| · | On March 3, 2021, Engaged Capital delivered a letter to the Company (the “2021 Nomination Letter”),

in accordance with its Amended and Restated Bylaws (the “Bylaws”), nominating a gender diverse candidate (the “2021

Candidate”) for election to the Board at the 2021 Annual Meeting. |

| · | On March 26, 2021, Messrs. Welling and Boal had a discussion regarding Engaged Capital’s nomination

of the 2021 Candidate. Mr. Welling encouraged Mr. Boal to strongly consider the 2021 Candidate for the Board given that she was the Chief

Information Officer of a large consumer packaged goods (CPG) company that did not have a material business relationship with Quotient

and, as such, would be a very relevant and value additive member of the Board. Mr. Boal communicated to Mr. Welling that, even though

the 2021 Candidate’s employer did not have much of a commercial relationship with Quotient, he viewed her candidacy as a conflict.

Mr. Boal also indicated that he would consider an alternate candidate put forth by Engaged Capital if it could identify a candidate who

currently or previously served as an advertising executive. |

| · | On March 29, 2021, Mr. Welling introduced an alternate director candidate (the “Alternate Candidate”)

to Mr. Boal via email. The Alternate Candidate was the former Chief Executive Officer of a major, multi-national advertising agency. |

| · | On March 31, 2021, the 2021 Candidate had a meeting with Mr. Boal regarding her candidacy. |

| · | On April 19, 2021, Engaged Capital delivered a letter to the Company, in accordance with the Bylaws, updating

the 2021 Nomination Letter with information current as of the record date for the 2021 Annual Meeting. |

| · | On April 22, 2021, Messrs. Welling and Boal had a discussion regarding the Alternate Candidate and the

2021 Nomination Letter. Mr. Welling communicated that Engaged Capital would be required to file its proxy statement soon in connection

with the 2021 Annual Meeting if the parties are unable to come to a resolution regarding the Board. |

| · | Later on April 22, 2021, the Company filed its definitive proxy statement in connection with the 2021

Annual Meeting. |

| · | Subsequently on April 22, 2021, Engaged Capital’s legal counsel (“Engaged Counsel”)

contacted Quotient’s legal counsel (“Company Counsel”) to remind Company Counsel that Engaged Capital had an active

nomination in connection with the 2021 Annual Meeting and that the Company was required to file a preliminary proxy statement rather than

a definitive proxy statement. |

| · | On April 26, 2021, Mr. Welling emailed Mr. Boal explaining that the Company should have filed a preliminary

proxy statement and not a definitive proxy statement because Engaged Capital had not withdrawn the 2021 Nomination Letter. Mr. Welling

made clear that he did not think it would benefit either party to drag out the process with a proxy contest at this time, but that Engaged

Capital would be back next year if the Company failed to make significant progress. Engaged Capital expressed its optimism that the Board

would find the Alternate Candidate to be a valuable addition to the Board and that the Company and Engaged Capital would continue to work

together to find a mutually agreed independent director. The communication concluded with Engaged Capital withdrawing the 2021 Nomination

Letter and reiterating its desire to continue a constructive dialogue and work together to maximize stockholder value. |

| · | On April 30, 2021, the Alternate Candidate had a call with director Robert McDonald, the Chair of the

Nominating and Corporate Governance Committee, regarding his candidacy. |

| · | On May 7, 2021, representatives from Engaged Capital had a discussion with Mr. Boal and other representatives

from the Company regarding Quotient’s Q1 2021 earnings. Engaged Capital expressed its concern regarding how the Company would achieve

its fiscal year targets, which implied a very strong 2H 2021, given the Company’s Q1 2021 results and Q2 2021 guidance. |

| · | On August 5, 2021, the Company filed a Form 8-K disclosing that director Michelle McKenna resigned from

the Board, effective July 30, 2021, and that Alison Hawkins was appointed as a director, effective July 30, 2021. At the time of Ms. McKenna’s

resignation, she served as a Class II director with a term expiring at the upcoming Annual Meeting; however, Ms. Hawkins was appointed

as a Class I director with a term expiring at the 2024 annual meeting of stockholders (the “2024 Annual Meeting”). In Engaged

Capital’s view, this was a blatant entrenchment maneuver to reduce the number of candidates up for election at the Annual Meeting,

especially considering its prior efforts to constructively engage with the Company. |

| · | On August 9, 2021, representatives from Engaged Capital had a discussion with Mr. Boal and other representatives

from the Company regarding Quotient’s Q2 2021 earnings. Engaged Capital expressed concern with the Company’s weak Q3 2021

guidance and questioned why the Company was still maintaining its full year guidance for 2021. |

| · | On November 4, 2021, representatives from Engaged Capital had a discussion with Mr. Boal and other representatives

from the Company regarding Quotient’s Q3 2021 earnings. Engaged Capital expressed dissatisfaction with the Company’s dramatic

reduction in guidance as well as concern regarding the Company’s ability to forecast the business. Engaged Capital also expressed

concern regarding the longer term outlook of the business given the announcement of the loss of the partnership with Albertsons Companies,

Inc. |

| · | On November 11, 2021, the Company issued a press release announcing it adopted a tax benefits preservation

plan, dated as of November 11, 2021 (the “NOL Pill”), that generally prohibits stockholders from acquiring 4.9% or more of

the Company’s outstanding shares of Common Stock. |

| · | On November 17, 2021, Engaged Capital issued a public letter (the “November 17th Letter”)

to the Board expressing its concerns with the Company’s consistently poor performance, both in regards to share price and operations.

Engaged Capital also expressed alarm regarding what it considers to be the Board’s disregard for good governance and use of strategies

to entrench itself, including the Board’s manipulation of director classes in July 2021 and the adoption of the NOL Pill. |

| · | Also on November 17, 2021, Engaged Capital sent a separate letter to the Board formally requesting an

exemption to be granted by the Board pursuant to the terms of the NOL Pill to allow Engaged Capital to acquire beneficial ownership of

up to 9.99% of the then outstanding shares of Common Stock (the “Exemption Request”). |

| · | Also on November 17, 2021, Engaged Capital filed a Schedule 13D disclosing beneficial ownership of approximately

6.5% of the outstanding shares of Common Stock. The Schedule 13D also disclosed the November 17th Letter and the Exemption

Request. |

| · | On December 1, 2021, Mr. Welling had a call with Mr. Boal regarding the NOL Pill and the Exemption Request.

Mr. Boal communicated that the Company was still running calculations under Section 382 of the Internal Revenue Code of 1986, as amended

(the “382 Analysis”), and would get back to Engaged Capital regarding the Exemption Request. In response, Mr. Welling expressed

his belief that the 382 Analysis should have been completed before adopting the NOL Pill and the failure to do so reinforces Engaged Capital’s

belief that the NOL Pill was adopted for entrenchment purposes. |

| · | On December 3, 2021, Engaged Capital sent the Company a demand pursuant to Section 220 of the Delaware

General Corporation Law (the “DGCL”) to inspect certain books and records relating to the Board’s decision to adopt

the NOL Pill and manipulate director classes (the “220 Demand Letter”). |

| · | From December 2021 through February 2022, Company Counsel and Engaged Counsel communicated regarding the

220 Demand Letter and the production of the materials demanded pursuant thereto (the “Demand Materials”). |

| · | On December 15, 2021, Mr. Welling had a telephone call with Mr. McDonald and Lead Independent Director

Andrew (Jody) Gessow. During the call, Mr. Welling expressed Engaged Capital’s views and relayed its concerns with respect to the

Company. |

| · | Later on December 15, 2021, Engaged Capital sent a private letter (the “December 15th

Letter”) to the Board. In the letter, Engaged Capital expressed its concerns regarding the Board’s failure to complete the

382 Analysis prior to adopting the NOL Pill and cautioned the Board against entering into any dilutive transaction or private placement

of shares of Common Stock. |

| · | On December 17, 2021, the Company responded to the Exemption Request, denying Engaged Capital’s

request but granting a limited exemption to the NOL Pill allowing Engaged Capital to increase its economic exposure to up to 9.9% of the

outstanding shares through the acquisition of cash-settled derivative securities (the “Limited Exemption”). |

| · | On December 17, 2021, the Company filed a Form 8-K disclosing further information regarding the NOL Pill

and its estimate of the 382 Analysis. |

| · | On January 10, 2022, Engaged Capital issued a public letter (the “January 10th Letter”)

to the Board informing the Board that it was brought to Engaged Capital’s attention from multiple credible sources that Mr. Boal

approached third parties regarding the potential sale of up to 19.9% of the outstanding shares of Common Stock. Engaged Capital made clear

its belief that such a transaction would represent a blatant vote-buying scheme ahead of a likely proxy contest and contradict the Board’s

purported rationale for adopting the NOL Pill. |

| · | Also on January 10, 2022, Engaged Capital filed an amendment to its Schedule 13D disclosing the January

10th Letter, the December 15th Letter (which was included as an exhibit to the January 10th Letter) and

the Limited Exemption. |

| · | On January 12, 2022, the Company sent a public letter to Engaged Capital confirming that the Company would

not enter into any transaction of the nature described in the January 10th Letter. |

| · | On January 18, 2022, Engaged Capital filed an amendment to its Schedule 13D disclosing beneficial ownership

of approximately 6.5% of the outstanding shares of Common Stock and aggregate economic exposure to approximately 9.9% of the outstanding

shares of Common Stock after purchasing certain cash-settled total return swaps, in accordance with the Limited Exemption, representing

economic exposure to approximately 3.4% of the outstanding shares of Common Stock. |

| · | On February 10, 2022, representatives from Engaged Capital had a discussion with Mr. Boal and other representatives

from the Company regarding Quotient’s Q4 2021 earnings. Engaged Capital expressed disappointment with the Company’s fiscal

year 2021 results and dissatisfaction with the Company’s guidance for 2022, which was significantly below consensus estimates. |

| · | On February 11, 2022, Engaged Counsel sent a letter (the “February 11th Letter”)

to Company Counsel stating that the Company has failed to properly comply with its obligations under Section 220 of the DGCL given its

limited and highly redacted production to date and requested complete production of the Demand Materials. Specifically, Engaged Counsel

stated in the letter that the Company’s first production of Demand Materials came after nearly two months of delay and that the

Company clearly omitted information that would constitute Demand Materials, which were even referenced in the limited Demand Materials

that were provided. Engaged Counsel further stated that the redactions to the Demand Materials that were provided were, in its view, illegitimate

and not credible. The letter concluded by stating that, despite Engaged Capital’s patience to date, it was prepared to commence

legal proceedings if the Company does not complete production of the Demand Materials, including the removal of inappropriate redactions,

by February 18, 2022. |

| · | On February 17, 2022, Mr. Welling had dinner with Mr. Boal. Mr. Welling expressed Engaged Capital’s

views with respect to the Company and the parties discussed their mutual desire to avoid a proxy contest. Mr. Welling gave Mr. Boal his

commitment to work in good faith towards a mutually acceptable solution to avoid a contested Annual Meeting. |

| · | On February 18, 2022, Company Counsel delivered a letter to Engaged Counsel in response to the February

11th Letter and provided additional Demand Materials. |

| · | On February 22 and 24, 2022, Mr. Welling had several calls with Greg Taxin of Spotlight Advisors, LLC,

an advisor to the Company responsible for settlement discussions with Engaged Capital. |

| · | On March 1, 2022, Engaged Capital delivered a letter (the “Nomination Letter”) to the Company,

in accordance with the Bylaws, nominating Christopher B. Hetrick and Matthew O’Grady for election to the Board at the Annual Meeting. |

| · | Also on March 1, 2022, Engaged Capital filed an amendment to its Schedule 13D disclosing the delivery

of the Nomination Letter. |

| · | From March 3 through March 22, 2022, Mr. Welling engaged in numerous settlement-related discussions and

communications with Mr. Taxin. These discussions contemplated governance changes in addition to Board refreshment with Engaged Capital’s

focus on bringing more independence to the boardroom and meaningful change to the Company. During these calls, the Company indicated an

unwillingness to add an employee of Engaged Capital to the Board as part of a settlement, so in an effort to be constructive, Engaged

Capital identified an additional candidate unaffiliated with Engaged Capital (the “Additional Candidate”) who could join the

Board with Mr. O’Grady. |

| · | On March 21, 2022, Engaged Capital received a settlement term sheet from the Company. |

| · | Also on March 21, 2022, the Additional Candidate met virtually with Mr. Boal for an interview discussion. |

| · | On March 22, 2022, Engaged Capital sent the Company a revised settlement term sheet reflecting Engaged

Capital’s proposed changes thereto. |

| · | On March 23, 2022, the Additional Candidate met virtually with Ms. Hawkins for an interview discussion. |

| · | Also on March 23, 2022, Mr. O’Grady had two separate virtual interviews, one with Mr. Boal and one

with Ms. Hawkins. |

| · | On March 24, 2022, the Company issued a press release (the “March 24th Release”)

announcing various governance changes including (i) Mr. Boal retiring as CEO by year-end and not standing for re-election at the Annual

Meeting, (ii) designating current Chief Technology Officer Matthew Krepsik as Mr. Boal’s successor and as a director nominee for

the Annual Meeting, (iii) separating the Chair and CEO roles and naming Mr. McDonald as Chair, (iv) appointing Eric Higgs to the Board

as a Class I director with a term expiring at the 2024 Annual Meeting and (v) forming a Strategic Board Committee. The March 24th

Release also offered to add Mr. O’Grady to the Board provided Engaged Capital withdraws the Nomination Letter. No such offer was

communicated to Mr. O’Grady or Engaged Capital in advance of the March 24th Release. |

| · | On March 25, 2022, Engaged Capital issued a press release commenting on the March 24th Release

and its surprise related thereto considering the settlement discussions that were taking place between the parties prior thereto. Engaged

Capital expressed its belief that the Company’s announced changes constitute defensive tactics that provide the illusion of meaningful

change. Engaged Capital reaffirmed its commitment to seeking the election of the Nominees at the Annual Meeting. |

| · | On March 28, 2022, the Company sent a letter (the “March 28th Letter”) to Mr. O’Grady

inviting him to join the Board subject to Engaged Capital withdrawing the Nomination Letter. Engaged Capital was not copied on the letter. |

| · | Later on March 28, 2022, Mr. O’Grady sent a letter to the Company in response to the March 28th

Letter. Mr. O’Grady explained that it was inappropriate to receive the March 28th Letter after the Company already publicly

announced on the morning of March 24, 2022 that it was extending an offer for him to join the Board. Mr. O’Grady made clear that

commonsense and normal practice dictates that the March 28th Letter (or at least some communication notifying him of the offer

therein) should have been sent before making such a public announcement. Mr. O’Grady advised the Company that he remains able and

willing to serve as a director upon his election to the Board at the Annual Meeting or in connection with his appointment to the Board

pursuant to an amicable resolution between the Company and Engaged Capital. Mr. O’Grady also informed the Company that future communications

concerning his nomination or potential appointment to the Board should be directed to Engaged Capital and Engaged Counsel. |

| · | On March 29, 2022, the Company filed a Form 8-K disclosing the March 24th Release and that

Pamela Strayer, the Company’s Chief Financial Officer and Treasurer, submitted her resignation on March 24, 2022, to be effective

April 5, 2022. |

| · | On April 13, 2022, the Company filed a Form 8-K disclosing the appointment of Yuneeb Khan as Chief Financial

Officer, Principal Accounting Officer and Treasurer of the Company, and that Mr. Khan is expected to join the Company by July 2022. The

Company also announced the appointment of John Kellerman, the Company’s Vice President - Chief Accounting Officer, as the Company’s

interim Chief Financial Officer until Mr. Khan joins the Company. Engaged Capital noted that the Form 8-K also disclosed that the Board

determined to appoint Mr. Khan on March 28, 2022, more than two weeks before the filing was made. |

| · | On

April 13, 2022, Engaged Capital filed its preliminary proxy statement in connection with

the Annual Meeting. |

| · | Also on April 13, 2022, the Company responded to the revised term sheet

that Engaged Capital had sent to the Company on March 22, 2022. In response, Engaged Capital cited a lack of trust of the Company following

the surprise March 24th Release and indicated that the Company would need to find a way to rebuild Engaged Capital’s

trust in order to negotiate a settlement in good faith. |

| · | Also

on April 13, 2022, Engaged Capital sent the Company a demand pursuant to Section 220 of the

DGCL to inspect certain stockholder list materials and related information in connection

with the Annual Meeting (the “Stockholder List Demand”). |

| · | On

April 20, 2022, Company Counsel sent a letter to Engaged Counsel responding to the Stockholder

List Demand (the “Demand Response”) and providing a proposed confidentiality

agreement in connection therewith. |

| · | On

April 21, 2022, Engaged Counsel responded to Company Counsel with proposed changes to the

confidentiality agreement and seeking clarification of certain matters in connection with

the Demand Response. |

| · | On

April 22, 2022, Company Counsel advised Engaged Counsel that it would be back to Engaged

Counsel with responses to its April 21st correspondence. |

| · | On

April 22, 2022, the Company sent Engaged Capital a draft cooperation agreement. |

| · | On

April 22, 2022, Engaged Capital requested a call with two independent directors of the Company

prior to responding to the draft cooperation agreement. |

| · | On

April 27, 2022, Engaged Counsel followed up with Company Counsel regarding the Stockholder

List Demand and seeking responses in connection with its April 21st correspondence. |

| · | On

April 28, 2022, Company Counsel responded to Engaged Counsel regarding the Stockholder List

Demand and certain of Engaged Counsel’s questions in connection with its April 21st

correspondence. |

| · | On

April 28, 2022, Mr. Welling had a call with two independent members of the Board, Ms. Hawkins

and David Oppenheimer. |

| · | On

April 28, 2022, Engaged Capital sent the Company a revised cooperation agreement reflecting

Engaged Capital’s proposed changes thereto. |

| · | On

April 28, 2022, Engaged Capital filed this revised preliminary proxy statement in connection

with the Annual Meeting. |

REASONS FOR THE SOLICITATION

WE BELIEVE THAT MEANINGFUL CHANGE TO

QUOTIENT’S BOARD IS URGENTLY NEEDED

Over the past two years, Engaged Capital has

conducted extensive due diligence on the Company. We have conducted detailed research into Quotient, including its data, technology and

relevant markets, and engaged privately with the Company’s leadership team on numerous occasions. Our conclusion from this work

and interactions is that we believe Quotient has valuable assets, data and tremendous potential. We believe the Company offers attractive

solutions for its customers and enjoys a unique market position in an industry that should benefit from secular tailwinds. Unfortunately,

Quotient has been unable to capitalize on its potential or the market opportunity and we believe that urgent change is required to finally

deliver value for stockholders.

We believe the Company’s performance has

been exceptionally poor, both operationally and in terms of stock performance. Quotient’s stockholders have suffered, as the Company’s

stock price has declined significantly over any relevant time period and has dramatically underperformed on a relative basis when compared

to peers. The Company’s operational performance has been abysmal as evidenced by consistent unprofitable growth with Adjusted EBITDA

declining over the past four years, despite material increases in revenue. We also believe the Company has damaged its credibility with

investors, as Quotient has a long history of missing its own guidance. We are concerned that despite these consistently poor results,

the incumbent Board has been reluctant to make meaningful changes to correct this underperformance.

Our concern surrounding the Board’s historical

lack of action is compounded by the Company’s corporate governance practices, which we believe are unfriendly towards stockholders.

Specifically, Quotient utilizes a number of governance mechanisms that serve to entrench incumbent directors, including a classified Board,

the NOL Pill, supermajority vote thresholds and an inability of stockholders to act by written consent or call special meetings. Recent

actions by the incumbent Board have worsened Quotient’s corporate governance track record, including the manipulation of director

classes and the addition to the Board of a former subordinate of Quotient’s Chairperson. Notably, despite years of underperformance,

it was not until after we publicly nominated that the Board announced its recent defensive and reactionary governance changes, which we

believe fall well short of what is required to improve the Company.

We believe urgent and meaningful change to the

Board is required to correct the years of poor performance that has persisted under incumbent leadership. We believe that installing new,

independent directors without ties to existing management or incumbent directors, including a direct stockholder representative from one

of the Company’s largest stockholders, is critical to creating value for all stockholders. That is why we have nominated a slate

of two (2) highly qualified director candidates who we believe will bring, if elected, significant experience, accountability and an unbiased

owner’s view into the boardroom.

The Incumbent Board Has Overseen Tremendous

Value Destruction

Under the leadership of the incumbent Board,

Quotient has proven itself unable to create value for stockholders. Since the Company’s initial public offering (IPO) in 2014, Quotient’s

stock is down a staggering 61% and has rarely traded at or above the IPO price.

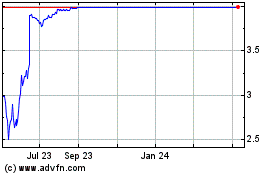

It is clear to us that Quotient’s abysmal

stock performance is due to company specific failures rather than industry- or market-wide forces. Quotient’s stock has declined

over nearly every relevant time-period, in contrast to its peers and broader market indices, which have increased substantially. When

compared to peers, the magnitude of relative value destruction is staggering, as over the past five years Quotient has underperformed

its peer group by approximately 173%.

Source: FactSet as of 4/12/2022

*Peer Group consists of current public companies listed as peers in Quotient’s 2021 Proxy Statement including: BNFT, BOX, EGHT,

LPSN, QNST, RPD, SPSC, SSTK, TRIP, TRUE, TWOU, WK, YELP, ZUO and companies which have been acquired during 2021: Cloudera, Cornerstone

OnDemand, QAD, and Stamps.com. For acquired companies, performance through acquisition is included in the average.

It is evident to us that the significant destruction

of stockholder value that has persisted over the near and long term under the leadership of the incumbent Board warrants urgent change.

We are Concerned by the Company’s Degrading

Operating Performance

We believe Quotient’s disastrous stock

performance is a direct result of the poor operational performance that has persisted under the incumbent leadership team. Despite an

attractive industry backdrop, numerous strategic initiatives and investments, Quotient has been unable to improve its bottom line. While

the Company has grown revenue by approximately $200 million over the past four years (an increase of over 60%), Adjusted EBITDA has actually

decreased by 14% or approximately $6.5 million.

We believe this decline in profitability is largely

attributable to a lack of focus on the Company’s economics and cost structure. We are concerned the Company’s leadership may

not truly understand the economics of its own business, as Quotient has increasingly pursued revenue from products that generate inferior

margins. This dynamic of chasing revenue at all costs is clearly demonstrated by trends in the Company’s gross margin profile which

has been declining for years. We believe that Quotient leadership, including the Board, should have recognized this fact years ago and

taken action to correct these operational issues.

The Company has Repeatedly Missed its Financial

Commitments to Stockholders

Quotient has shown an extraordinary inability

to forecast its own business and deliver on its commitments to stockholders. The Company has missed its own annual guidance every year

over the past four years by a sizable amount. With financial forecasts that have proven to be completely unreliable and untrustworthy,

we find it disturbing that the incumbent Board has permitted management to persist in making such overly lofty public guidance.

This history of setting unrealistic expectations

is also prevalent in the Company’s long-term plan, the approval of which is a direct responsibility of the Board. The plan this

Board approved and presented to stockholders just over a year ago is already wildly off track. Currently, consensus Adjusted EBITDA estimates

are more than 30% below the Company’s publicly stated 2023 targets. Based on this clear pattern of overpromising and under-delivering,

it is unsurprising that Quotient’s Board and management team have lost credibility with investors, as reflected in the Company’s

stock price.

We Believe Quotient’s Poor Corporate

Governance Practices and Limitations of Stockholder Rights Contribute to Quotient’s Underperformance

Quotient suffers from abysmal corporate governance

practices which, we believe, contribute to the Company’s drastic underperformance. We believe the following features minimize accountability

and entrench the existing Board and management team:

| Ø | Classified Board. The Board is classified into three separate classes, meaning the Company’s

directors are only subject to re-election by stockholders once every three years. This classified structure impedes stockholders’

ability to regularly and effectively evaluate the performance of directors and insulates and entrenches the current Board members. |

| Ø | Manipulation of Director Classes. While having a classified Board is bad enough, Quotient manipulated

the classes on which directors serve to further limit stockholders’ say on the composition of the Board. Specifically, Michelle

McKenna served as a Class II director with a term expiring at the upcoming Annual Meeting at the time she resigned on July 30, 2021. However,

her ostensible replacement appointed to the Board on the very same day, Alison Hawkins, joined as a Class I director with a term expiring

at the 2024 Annual Meeting. In our view, this was a blatant entrenchment maneuver to reduce the number of candidates up

for election at this Annual Meeting, which becomes even more apparent considering our efforts to constructively engage with the Company

prior to such time. |

| Ø | 4.9% NOL Pill. The NOL Pill entered into on November 11, 2021 effectively prohibits stockholders

from acquiring 4.9% or more of the Company’s outstanding shares. Notwithstanding the Board’s purported justification for adopting

the NOL Pill, we believe the primary reason the Board implemented the NOL Pill was to prevent disgruntled stockholders from acquiring

larger stakes which could jeopardize the incumbent Board’s chances in a potential proxy contest (which has come to fruition). |

| Ø | No Action by Written Consent or Ability to Call Special Meetings. Stockholders are prohibited from

calling special meetings and cannot act by written consent, which in effect means that stockholders cannot seek Board change between annual

meetings. |

| Ø | Supermajority Vote to Amend Bylaws and Restrictive Charter Provisions. In order for stockholders

to amend the Bylaws, a prohibitively high supermajority vote of 66-2/3% of the outstanding shares is required. Similarly, in addition

to Board approval, a supermajority vote of 66-2/3% of the outstanding shares is required to amend anti-stockholder provisions in the Charter

such as the classified Board structure and inability of stockholders to call special meetings, act by written consent or fill vacancies

on the Board, among others. The supermajority vote requirement significantly reduces stockholders’ ability to remediate these poor

corporate governance practices. |

| Ø | Plurality Voting Standard in Uncontested Elections. The use of a plurality voting standard reduces

director accountability and entrenches the Board because it guarantees the election of the candidates nominated by the Board in uncontested

elections. |

We find these governance provisions and tactics

to be self-serving and an improper use of the Company’s corporate machinery to insulate the Board.

We are Concerned by the Lack of Accountability

at Quotient

We believe the incumbent Board has failed to

foster a culture of accountability at Quotient. Stockholders have suffered under the oversight of this Board, which failed to take corrective

action for years despite the dramatic underperformance in Quotient’s stock price. Furthermore, this Board tolerated years of poor

operational performance and countless guidance misses without holding management responsible. The incumbent Board cannot claim ignorance

regarding these performance issues when management has put forth disappointing guidance in 15 of the past 16 quarters.

With such horrific performance, investors would

have hoped a responsible Board governing on their behalf would have demanded accountability from management, specifically CEO Steven Boal.

However, the incumbent Board appears content to see blame deflected. While Mr. Boal currently remains CEO, 11 of the 14 top executives

who spoke at recent investor days have been replaced. We believe this is emblematic of a corporate culture that insulates the incumbent

Board and Mr. Boal from accountability, rather than doing what is best for stockholders.

We do not Believe the Company’s

Defensive and Reactionary Measures Constitute the Meaningful Change Necessary to Stop Further Value Destruction

After tolerating years of underperformance without

accountability, the incumbent Board has recently announced certain “changes” at Quotient, including Mr. Boal’s retirement

as CEO by year-end and his not standing for re-election at the upcoming Annual Meeting. To us, it is clear the Company’s announced

changes were both defensive and reactionary as they occurred several weeks after we publicly announced our Nominees for election

to the Board at the upcoming Annual Meeting. Based on this Board’s history of inaction, we believe the true motivation behind these

“changes” was to defend incumbent leadership and allow Mr. Boal to escape accountability yet again rather than letting stockholders

express their views of his leadership at the ballot box. While skirting a potential exit from the Company at the hands of stockholders,

Mr. Boal will still maintain control of the Company as CEO for a considerable time, and it would not surprise us to see him land a new

position of influence with the Company once he transitions from the CEO role or even be reappointed to the Board (neither of which the

Company has ruled out).

Furthermore, we are concerned that Robert McDonald’s

appointment as Chair of the Board will perpetuate the status quo and cement Mr. Boal’s influence with the Company notwithstanding

his departure as CEO by year end. We believe Mr. McDonald is a close ally of Mr. Boal and we understand he has prioritized Mr. Boal’s

interests in the past to the detriment of others. It is not lost on us that Mr. McDonald’s last stint as a public company Chair,

at The Procter & Gamble Company (“P&G”), ended abruptly after widespread stockholder discontent concerning the company’s

performance under his leadership. Mr. McDonald’s track record at Quotient provides little reason for encouragement, as Quotient’s

stock has declined by approximately 49% during his tenure.1

Additionally, we believe the Company’s

recent appointment of Eric Higgs to the Board (in a class not up for election until the 2024 Annual Meeting, no less) is another “change”

intended to maintain the status quo. Messrs. Higgs and McDonald overlapped together at P&G for 18 years and have ties to Duke University’s

Fuqua School of Business, where Mr. McDonald served on the Board of Visitors from 2005 – 2012 (including as Chair from 2011 –

2012) and Mr. Higgs received his MBA. Given his pre-existing connections to an influential incumbent director, and now Chairperson, we

question whether Mr. Higgs was added to the Board to help create value or to further buttress the incumbents in the boardroom.

Further, we believe that without significant

additional Board change, the announced formation of the Strategic Board Committee is a non-event. Based on direct conversations with

industry participants, we believe past approaches by potential buyers have been rebuffed by Mr. Boal without any disclosure to the full

Board. This is unsurprising given Mr. Boal has indicated to us numerous times in the past that he would only consider acquisition offers

which value Quotient at an over 200% premium to current prices, a stock price the Company has not seen in over seven years. We believe

stockholders cannot rely on a Board which has overseen such tremendous value destruction, while consistently deferring to Mr. Boal’s

interests, to properly evaluate strategic options. Until there are new independent directors in place working on behalf of stockholders,

we have zero confidence this committee will earnestly assess how to maximize value by prioritizing the Board’s fiduciary duty to

stockholders.

We Believe the Board Failed to Engage

in Good Faith Discussions to Avoid a Proxy Contest

We believe the Board’s interactions with

us to date have been disingenuous and indicative of a leadership team willing to use underhanded tactics. After nominating director candidates

at the beginning of March, we agreed with Mr. Boal to enter private settlement discussions with the Board and its advisors to see if there

was a path to delivering the necessary governance enhancements at Quotient without engaging in a public proxy contest. We negotiated in

good faith and even allowed Company representatives to interview our candidates. While we remained engaged constructively and were awaiting

an exchange of redlined term sheets from the Company’s advisors, the Company, without any warning, issued a public press release

on the morning of March 24th effectively ending settlement discussions. It was a surprise to us, as we even had a settlement

related interview scheduled for later that day. It now appears obvious to us that the Board was negotiating in bad faith all along and

had no intention of working constructively with one of the Company’s largest stockholders to reach an amicable resolution.

1 Calculated from 11/19/2018 to 4/12/2022.

Additionally, we find the Board’s

claim on March 24th that the Company extended an offer to Matthew O’Grady to join the Board to be extremely misleading.

In reality, the Company only contacted Mr. O’Grady with this “offer” on March 28th, a full four days later.

The “offer” for Mr. O’Grady to join the Board was contingent on Engaged Capital withdrawing its Nomination Letter. At

no point did the Company, or its advisors, actually contact Engaged Capital regarding this proposal. To make matters worse, in the week

prior to extending this “offer,” we understand that Mr. Boal recorded multiple virtual meetings with our candidates without

their consent. We are disturbed, but unfortunately not surprised, by this behavior.

We Believe that Direct Stockholder Representation

on the Board is Necessary

While the Company’s strategy to drive stockholder

value creation remains ambiguous, what has become clear after our extensive interactions with Quotient is that stockholder representation

on the Board is vital to enact meaningful change. Over the past several years, the incumbent Board has demonstrated an unwillingness to

promote accountability and consider new, innovative ways to positively impact stockholder value. Our Nominees include one of the most

experienced operators in the global media, advertising and data industries, Matthew O’Grady, the former Global Commercial President

of International Media at Nielsen and CEO of Nielsen Catalina Solutions. As the former CEO of one of Quotient’s primary competitors,

we believe Mr. O’Grady will provide credible, objective opinions regarding the Company’s turnaround options and an unbiased

view as to the best path forward for the Company. Christopher Hetrick, Director of Research at Engaged Capital, one of the Company’s

largest stockholders, brings extensive investment experience in a broad range of industries as well as expertise in corporate strategy,

capital allocation, executive compensation and investor communications –areas we believe the Company urgently needs to improve.

We believe Quotient’s poor performance under the oversight of the incumbent Board, coupled with the Board’s self-serving defensive

maneuvers, warrants the addition of directors who we are confident will bring a renewed commitment and sense of urgency to driving stockholder

value.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company currently has

a classified Board, which is divided into three (3) classes. The directors in each class are elected for staggered terms of three (3)

years so that the term of office of one (1) class of directors expires at each annual meeting of stockholders. We believe that the terms

of two (2) Class II directors expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our two (2) Nominees,

Christopher B. Hetrick and Matthew O’Grady, in opposition to the Company’s two (2) Class II director nominees, for terms ending

at the 2025 annual meeting of stockholders. Your vote to elect the Nominees will have the legal effect of replacing two (2) incumbent

directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board, and therefore

it is not guaranteed that they will be able to implement any actions that they may believe are necessary to enhance stockholder value.

There is no assurance that any incumbent director will serve as a director if our Nominees are elected to the Board. You should refer

to the Company’s proxy statement for the names, background, qualifications and other information concerning the Company’s

nominees.

THE NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices,

or employments for the past five (5) years of each of the Nominees. The nominations were made in a timely manner and in compliance with

the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills

that led us to conclude that the Nominees should serve as directors of the Company are set forth above in the section entitled “Reasons

for the Solicitation” and below. This information has been furnished to us by the Nominees. All of the Nominees are citizens of

the United States of America.

Christopher B. Hetrick,

age 43, has served as the Director of Research at Engaged Capital, LLC, a constructive activist fund that invests in small and mid-cap

public companies, since the firm’s founding in 2012. Prior to joining Engaged Capital, Mr. Hetrick held multiple positions at Relational

Investors LLC, a former $6 billion activist equity fund, from 2002 to 2012, including most recently serving as its senior consumer analyst

overseeing over $1 billion in consumer sector investments. Throughout his career, Mr. Hetrick has covered major investments in the consumer,

technology and financial sectors. Since June 2017, Mr. Hetrick has served as a director of Rent-A-Center, Inc. (NASDAQ:RCII), an industry

leading omni-channel lease-to-own provider, where he also serves as Chairman of its Compensation Committee. Mr. Hetrick graduated summa

cum laude with degrees in Economics and Finance from Pepperdine University. He is also a CFA charterholder.

Engaged Capital believes

that Mr. Hetrick’s extensive investment experience in a broad range of industries as well as his expertise in corporate strategy,

capital allocation, executive compensation and investor communications well qualifies him to serve on the Board.

Matthew O’Grady,

age 61, currently serves as an Executive Media Consultant at 12th Street Measurement, a media and data consulting firm he founded in January

2021. Prior to that, Mr. O’Grady served as Global Commercial President of International Media at Nielsen Holdings plc (NYSE: NLSN)

(“Nielsen”), an information, data and market measurement firm, from February 2019 to December 2020. Previously, Mr. O’Grady

served as Chief Executive Officer of Nielsen Catalina Solutions, a purchase-based ad targeting and ROAS measurement firm, from January

2016 to January 2019. Mr. O’Grady served as Executive Vice President & Managing Director of Local Media for Nielsen from 2012

to 2015, where he also served as Executive Vice President, Audience Measurement from 2009 to 2012. Prior to that, Mr. O’Grady served

as President of Claritas, LLC, a data-driven marketing company, from 2007 to 2009, where he also served as Executive Vice President, Sales

& Client Service from 2000 to 2007. Mr. O’Grady’s prior professional experience also includes, among other positions,

serving as Group Vice President, Product Management & Client Service at National Decision Systems Inc., an analytics provider, and

Regional Sales Vice President of Equifax Inc. (NYSE:EFX), a multinational consumer credit reporting agency. Mr. O’Grady has served

as a Strategic Advisor to each of Beatgrid Media B.V., an AdTech measurement company, since May 2021, and NEXT Boatworks, LLC, a coastal

rowing craft company, since August 2021. Mr. O’Grady previously served on the boards of directors of Nielsen Admosphere, a.s., a

research agency part of the Nielsen network (from January 2019 to December 2020), Nielsen IBOPE México S.A. de C.V., a business

to business service subsidiary of Nielsen (from January 2019 to November 2020), Media Behavior Institute LLC, a company engaged in developing

tools, services and projects to understand and measure multimedia (from 2011 to 2014), Scarborough Research, a market research subsidiary

of Nielsen (from 2011 to 2013), and The Direct Marketing Association (n/k/a Data & Marketing Association), a trade association for

marketers (from 2008 to 2012). Mr. O’Grady earned his B.S. in Environmental Science from the University of California at Santa Barbara.

Engaged Capital believes

Mr. O’Grady’s extensive experience as a senior level executive in the global media, advertising and data industries, together

with his deep expertise in enterprise data and analytics, will make him a valuable addition to the Board.

The principal business

address of Mr. Hetrick is 610 Newport Center Drive, Suite 250, Newport Beach, California 92660. The principal business address of Mr.

O’Grady is PO Box 3004, Sag Harbor, New York 11937.

As of the date of this

Notice, the Nominees do not directly or indirectly own, beneficially or of record, any securities of the Company and have not entered

into any transactions in securities of the Company during the past two years.

Each of the Nominees may

be deemed to be a member of a “group” with the other participants in this solicitation for the purposes of Section 13(d)(3)

of the Exchange Act, and such group may be deemed to beneficially own the 6,107,150 shares of Common Stock owned in the aggregate by all

of the participants. Each participant disclaims beneficial ownership of the shares of Common Stock that he or it does not directly own.

Engaged Capital believes

that each Nominee presently is, and if elected as a director of the Company, each such Nominee would be, an “independent director”

within the meaning of (i) applicable New York Stock Exchange listing standards applicable to board composition and (ii) Section 301 of

the Sarbanes-Oxley Act of 2002. Notwithstanding the foregoing, Engaged Capital acknowledges that no director of a NYSE listed company

qualifies as “independent” under the NYSE listing standards unless the board of directors affirmatively determines that such

director is independent under such standards. Accordingly, Engaged Capital acknowledges that if any Nominee is elected, the determination

of such Nominee’s independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board.

No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s

applicable independence standards.

On February 28, 2022, Engaged

Capital Flagship Master and Mr. O’Grady entered into a Consulting Agreement pursuant to which Mr. O’Grady agreed to provide

general advisory and professional consulting services with respect to the global media, advertising and data industries, and in connection

with Engaged Capital Flagship Master’s nomination of individuals for election to the Board at the Annual Meeting. For performance

of the services, Engaged Capital Flagship Master agreed to pay Mr. O’Grady (i) a consulting fee of $25,000, (ii) a supplemental

fee of $25,000 upon filing a preliminary proxy statement with the SEC in favor of Mr. O’Grady’s election as a director at

the Annual Meeting and (iii) a contingent fee, in the event (A) Engaged Capital Flagship Master nominates Mr. O’Grady for election

as a director at the Annual Meeting and (B) subsequently there is either (x) approval of a sale of the Company by the Company’s

stockholders prior to the conclusion of the Annual Meeting, (y) a withdrawal of Engaged Capital Flagship Master’s nomination of

Mr. O’Grady for election as a director at the Annual Meeting following the Company’s entry into a definitive agreement providing

for a sale of the Company or (z) a settlement or similar agreement is reached between Engaged Capital Flagship Master and the Company

in connection with the Annual Meeting that does not result in Mr. O’Grady’s appointment to the Board and the Company enters

into a definitive agreement providing for a sale of the Company within six months of the Annual Meeting, equal to 1% (or 0.5% if triggered

by clause (z)) of the aggregate realized profit earned by Engaged Capital Flagship Master in respect of its investment in the Company

(the “Contingent Fee”), provided that any such Contingent Fee would be no less than $200,000 and no more than $750,000 (or

no less than $100,000 and no more than $325,000 if triggered by clause (z)).

On February 28, 2022, Engaged

Capital Flagship Master entered into an indemnification letter agreement with Mr. O’Grady pursuant to which it and its affiliates

agreed to indemnify Mr. O’Grady against claims arising from the solicitation of proxies from the Company’s stockholders in

connection with the Annual Meeting and any related transactions.

On February 28, 2022, Engaged

Capital and the Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement pursuant to which

the Group agreed, among other things, (a) to solicit proxies for the election of the Nominees at the Annual Meeting, (b) not to transact

in securities of the Company without the prior written consent of Engaged Capital for so long as the NOL Pill remains in effect, and (c)

that Engaged Capital would bear all expenses incurred in connection with the Group’s activities.

Each of the Nominees has

granted Mr. Welling a power of attorney to execute certain SEC filings in connection with the solicitation of proxies from the Company’s

stockholders in connection with the Annual Meeting and any related transactions.

Other than as stated herein,

there are no arrangements or understandings between the members of the Group or any other person or persons pursuant to which the nomination

of the Nominees described herein is to be made, other than the consent by each Nominee to be named in this Proxy Statement and to serve

as a director of the Company if elected as such at the Annual Meeting. Other than as stated herein, none of the Nominees is a party adverse

to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material

pending legal proceeding.

We do not expect that any

of the Nominees will be unable to stand for election, but, in the event any Nominee is unable to serve or for good cause will not serve,

the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s), to the extent

this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the

Company makes or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the

effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would

identify and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the

enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s),

to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing

size or increases the number of directors whose terms expire at the Annual Meeting.

WE STRONGLY URGE YOU TO VOTE “FOR”

THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further

detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the

Company’s named executive officers. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address

any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy,

policies and practices described in the Company’s proxy statement. Accordingly, the Board is asking the stockholders to vote for

the following resolution:

“RESOLVED, that the

compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the

Compensation Discussion and Analysis, compensation tables and narrative discussion, is hereby APPROVED.”

As disclosed in the Company’s

proxy statement, the stockholder vote on the say-on-pay proposal is an advisory vote only and is not binding on the Board or the Company.

Nevertheless, the Company has disclosed that the views expressed by the stockholders, whether through this vote or otherwise, are important

to management and the Board and, accordingly, the Board and the Compensation Committee intend to consider the results of this vote in

making determinations in the future regarding executive compensation arrangements.

[WE MAKE NO RECOMMENDATION] WITH RESPECT

TO THE ADVISORY VOTE ON EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR SHARES “[FOR / AGAINST]” THIS PROPOSAL.

PROPOSAL NO. 3

RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further

detail in the Company’s proxy statement, the Audit Committee of the Board has appointed Ernst & Young LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2022. The Company is submitting the appointment

of Ernst & Young LLP for ratification by the stockholders at the Annual Meeting.

As disclosed in the Company’s

proxy statement, stockholder approval is not required to appoint Ernst & Young LLP as the Company’s independent registered public

accounting firm, but the Company is submitting the selection of Ernst & Young LLP to stockholders for ratification as a matter of

good corporate governance. The Company has disclosed that if this proposal does not receive the affirmative approval of a majority of

the votes cast on the proposal, the Audit Committee would reconsider the appointment. The Company has further disclosed that, notwithstanding

its selection and even if the stockholders ratify the selection, the Company’s Audit Committee, in its discretion, may appoint another

independent registered public accounting firm at any time during the year if the Audit Committee believes that such a change would be

in the best interests of the Company and its stockholders.

WE MAKE NO RECOMMENDATION WITH RESPECT

TO THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR

THE FISCAL YEAR ENDING DECEMBER 31, 2022 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record

on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record

on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record

Date. Based on publicly available information, Engaged Capital believes that the only outstanding class of securities of the Company entitled

to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock

represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific

instructions, will be voted FOR the election of the Nominees, [FOR / AGAINST] the advisory vote on executive compensation

and FOR the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the

fiscal year ending December 31, 2022.

Based on publicly available

information, we believe the current Board intends to nominate two (2) candidates for election as Class II directors at the Annual Meeting.

This Proxy Statement is soliciting proxies to elect only our two (2) Nominees as Class II directors. Accordingly, the enclosed BLUE

proxy card may only be voted for the Nominees and does not confer voting power with respect to the Company’s nominees. As explained

below, the Company has a plurality vote standard for contested director elections so the two (2) nominees for director receiving the highest

vote totals will be elected as directors of the Company. The participants in this solicitation intend to vote the Engaged Capital Group

Shares in favor of the Nominees. Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications

and other information concerning the Company’s nominees.

While we currently intend

to vote all of the Engaged Capital Group Shares in favor of the election of the Nominees, we reserve the right to vote some or all of

the Engaged Capital Group Shares for some or all of the Company’s director nominees, as we see fit, in order to achieve a Board

composition that we believe is in the best interest of all stockholders. We would only intend to vote some or all of the Engaged Capital

Group Shares for some or all of the Company’s director nominees in the event it were to become apparent to us, based on the projected

voting results at such time, that less than all of the Nominees would be elected at the Annual Meeting and that by voting the Engaged

Capital Group Shares we could help elect the Company nominees that we believe are the most qualified to serve as directors and thus help

achieve a Board composition that we believe is in the best interest of all stockholders. Stockholders should understand, however, that

all shares of Common Stock represented by the enclosed BLUE proxy card will be voted at the Annual Meeting as marked.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. For the Annual Meeting, the presence, in person or by proxy, of a majority of the voting power of the shares of stock

entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting.

Abstentions or withheld

votes are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes”

also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name

and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have

discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker will not have discretionary authority

to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder

of record, you must deliver your vote by mail, attend the Annual Meeting in person and vote, vote by Internet or vote by telephone in

order to be counted in the determination of a quorum.

If you are a beneficial

owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum.

Brokers do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy

card or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be

voted on the proposals.

VOTES REQUIRED FOR APPROVAL

Election of Directors