- Revenue and Margin Gains Drive 74%

Increase in Net Income to $1.01 Per Share

- Closings Increased 17% to 6,031

Homes

- Home Sale Revenues Increased 25% to

$2.6 Billion

- Gross Margin Increased 10 Basis

Points to 24.0%

- SG&A Decreased 180 Basis Points

to 9.8% of Home Sale Revenues

- Operating Margin Expanded 190 Basis

Points to 14.2%

- Net New Orders Increased 1% to

5,350; Value of Net New Orders Increased 1% to $2.3

Billion

- Unit Backlog Up 3% to 11,164 Homes;

Backlog Value Increased 5% to $4.9 Billion

- Company Repurchased 2.4 Million

Shares for $67 Million

PulteGroup, Inc. (NYSE: PHM) announced today financial results

for its third quarter ended September 30, 2018. For the quarter,

the Company reported net income of $290 million, or $1.01 per share

compared with prior year net income of $178 million, or $0.58 per

share. The higher net income for the period was primarily the

result of a 25% increase in homebuilding revenues, in combination

with a 190 basis point expansion of operating margin.

“Consistent with our stated strategies, PulteGroup continues to

successfully deliver strong earnings growth, while achieving high

returns on invested capital and equity,” said Company President and

CEO, Ryan Marshall. “By focusing on intelligently growing our

business, while realizing increased operating efficiencies, we

leveraged 25% growth in homebuilding revenues into a 74% gain in

earnings to $1.01 per share.”

“The critical underpinnings that have supported a slow but

steady housing recovery, including a strong economy, low

unemployment, high consumer confidence and limited home inventory,

remain solidly in place,” continued Marshall. “While buyer concerns

around affordability and rising mortgage rates appear to have

impacted near term market dynamics, traffic trends indicate that

buyer interest levels are still high and that the overall housing

recovery remains on track.”

Third Quarter Results

Home sale revenues for the third quarter increased 25% over the

prior year to $2.6 billion. The higher revenues for the period

reflect a 17% increase in closings to 6,031 homes, combined with a

7%, or $27,000, increase in average sales price to $427,000.

Home sale gross margin for the third quarter was 24.0%, which is

up 10 basis points over the prior year and consistent with the

Company’s reported gross margin for the second quarter of 2018.

Homebuilding SG&A expense for the quarter was $253 million, or

9.8% of home sale revenues, compared with $237 million, or 11.6% of

home sale revenues, in the prior year. Operating margin for the

third quarter expanded 190 basis points over last year to

14.2%.

Net new orders for the third quarter increased 1% to 5,350

homes. The value of third quarter net new orders was $2.3 billion,

which is an increase of 1% over the prior year. For the quarter,

the Company operated out of 843 communities compared with 778

communities in the third quarter of 2017.

Unit backlog for the quarter was up 3% over the third quarter of

last year to 11,164 homes, with backlog value increasing 5% to $4.9

billion. The average price of homes in backlog increased 2% over

the prior year to $440,000.

Third quarter pretax income for the Company's financial services

operations increased 10% to $20 million. The increase in pretax

income for the period was driven by higher mortgage origination

volumes resulting from growth in the Company’s homebuilding

operations. Mortgage capture rate for the quarter was 75%, compared

with 80% in the prior year.

During the quarter, the Company repurchased 2.4 million common

shares for $67 million, or an average price of $28.14 per

share.

A conference call discussing PulteGroup's third quarter 2018

results is scheduled for Tuesday, October 23, 2018, at 8:30 a.m.

Eastern Time. Interested investors can access the live webcast via

PulteGroup's corporate website at www.pultegroupinc.com.

Forward-Looking Statements

This press release includes "forward-looking statements." These

statements are subject to a number of risks, uncertainties and

other factors that could cause our actual results, performance,

prospects or opportunities, as well as those of the markets we

serve or intend to serve, to differ materially from those expressed

in, or implied by, these statements. You can identify these

statements by the fact that they do not relate to matters of a

strictly factual or historical nature and generally discuss or

relate to forecasts, estimates or other expectations regarding

future events. Generally, the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,”

“might,” "should", “will” and similar expressions identify

forward-looking statements, including statements related to any

impairment charge and the impacts or effects thereof, expected

operating and performing results, planned transactions, planned

objectives of management, future developments or conditions in the

industries in which we participate and other trends, developments

and uncertainties that may affect our business in the future.

Such risks, uncertainties and other factors include, among other

things: interest rate changes and the availability of mortgage

financing; competition within the industries in which we operate;

the availability and cost of land and other raw materials used by

us in our homebuilding operations; the impact of any changes to our

strategy in responding to the cyclical nature of the industry,

including any changes regarding our land positions and the levels

of our land spend; the availability and cost of insurance covering

risks associated with our businesses; shortages and the cost of

labor; weather related slowdowns; slow growth initiatives and/or

local building moratoria; governmental regulation directed at or

affecting the housing market, the homebuilding industry or

construction activities; uncertainty in the mortgage lending

industry, including revisions to underwriting standards and

repurchase requirements associated with the sale of mortgage loans;

the interpretation of or changes to tax, labor and environmental

laws, including, but not limited to the Tax Cuts and Jobs Act which

could have a greater impact on our effective tax rate or the value

of our deferred tax assets than we anticipate; economic changes

nationally or in our local markets, including inflation, deflation,

changes in consumer confidence and preferences and the state of the

market for homes in general; legal or regulatory proceedings or

claims; our ability to generate sufficient cash flow in order to

successfully implement our capital allocation priorities; required

accounting changes; terrorist acts and other acts of war; and other

factors of national, regional and global scale, including those of

a political, economic, business and competitive nature. See

PulteGroup's Annual Report on Form 10-K for the fiscal year ended

December 31, 2017, and other public filings with the Securities and

Exchange Commission (the "SEC") for a further discussion of these

and other risks and uncertainties applicable to our businesses.

PulteGroup undertakes no duty to update any forward-looking

statement, whether as a result of new information, future events or

changes in PulteGroup's expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America's largest homebuilding companies with operations in

approximately 50 markets throughout the country. Through its brand

portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta

Homes and John Wieland Homes and Neighborhoods, the Company is one

of the industry's most versatile homebuilders able to meet the

needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup conducts extensive research to provide

homebuyers with innovative solutions and consumer inspired homes

and communities to make lives better.

For more information about PulteGroup, Inc. and PulteGroup

brands, go to www.pultegroupinc.com; www.pulte.com; www.centex.com;

www.delwebb.com; www.divosta.com and www.jwhomes.com.

PulteGroup, Inc. Consolidated Statements of

Operations ($000's omitted, except per share data)

(Unaudited) Three Months

Ended Nine Months Ended September

30, September 30, 2018 2017

2018 2017 Revenues: Homebuilding

Home sale revenues $ 2,572,236 $ 2,055,891 $ 6,933,888 $ 5,606,953

Land sale and other revenues 25,510 28,215 104,971

39,848 2,597,746 2,084,106 7,038,859 5,646,801

Financial Services 51,620 46,952 150,322

135,995 Total revenues 2,649,366 2,131,058

7,189,181 5,782,796

Homebuilding Cost of

Revenues: Home sale cost of revenues (1,954,160 ) (1,564,605 )

(5,276,232 ) (4,332,221 ) Land sale cost of revenues (22,060 )

(25,123 ) (71,791 ) (115,950 ) (1,976,220 ) (1,589,728 ) (5,348,023

) (4,448,171 )

Financial Services expenses (32,213 )

(29,304 ) (96,650 ) (86,150 )

Selling, general, and

administrative expenses (252,757 ) (237,495 ) (719,706 )

(689,974 )

Other expense, net (3,488 ) (6,282 ) (6,753 )

(28,439 )

Income before income taxes 384,688 268,249

1,018,049 530,062

Income tax expense (95,153 ) (90,710 )

(233,674 ) (160,255 )

Net income $ 289,535 $ 177,539

$ 784,375 $ 369,807

Per share:

Basic earnings $ 1.01 $ 0.59 $ 2.72 $ 1.18

Diluted earnings $ 1.01 $ 0.58 $ 2.71 $

1.18 Cash dividends declared $ 0.09 $ 0.09 $

0.27 $ 0.27

Number of shares used in

calculation: Basic 283,489 298,538 285,127 309,453 Effect of

dilutive securities 1,183 1,690 1,301 1,861

Diluted 284,672 300,228 286,428 311,314

PulteGroup, Inc. Condensed

Consolidated Balance Sheets ($000's omitted)

(Unaudited)

September 30, 2018

December 31, 2017

ASSETS Cash and equivalents $ 728,631 $

272,683 Restricted cash 30,381 33,485 Total cash, cash equivalents,

and restricted cash 759,012 306,168 House and land inventory

7,489,454 7,147,130 Land held for sale 65,905 68,384 Residential

mortgage loans available-for-sale 349,784 570,600 Investments in

unconsolidated entities 54,278 62,957 Other assets 797,976 745,123

Intangible assets 130,642 140,992 Deferred tax assets, net 408,029

645,295 $ 10,055,080 $ 9,686,649

LIABILITIES AND

SHAREHOLDERS’ EQUITY Liabilities: Accounts payable $

465,833 $ 393,815 Customer deposits 342,376 250,779 Accrued and

other liabilities 1,251,518 1,356,333 Income tax liabilities 10,324

86,925 Financial Services debt 250,733 437,804 Notes payable

3,005,418 3,006,967 5,326,202 5,532,623 Shareholders' equity

4,728,878 4,154,026 $ 10,055,080 $ 9,686,649

PulteGroup,

Inc. Consolidated Statements of Cash Flows ($000's

omitted) (Unaudited) Nine Months

Ended September 30, 2018

2017 Cash flows from operating activities: Net income

$ 784,375 $ 369,807 Adjustments to reconcile net income to net cash

from operating activities: Deferred income tax expense 230,335

127,856 Land-related charges 13,973 131,254 Depreciation and

amortization 36,717 38,689 Share-based compensation expense 21,521

26,505 Other, net (3,466 ) (1,438 ) Increase (decrease) in cash due

to: Inventories (263,734 ) (758,006 ) Residential mortgage loans

available-for-sale 218,900 173,148 Other assets (22,117 ) 22,120

Accounts payable, accrued and other liabilities (1,524 ) 122,544

Net cash provided by (used in) operating activities

1,014,980 252,479

Cash flows from investing

activities: Capital expenditures (46,529 ) (23,548 )

Investments in unconsolidated entities (1,000 ) (22,007 ) Other

investing activities, net 15,545 5,788 Net cash

provided by (used in) investing activities (31,984 ) (39,767 )

Cash flows from financing activities: Repayments of debt

(82,655 ) (7,001 ) Borrowings under revolving credit facility

1,566,000 971,000 Repayments under revolving credit facility

(1,566,000 ) (888,000 ) Financial Services borrowings (repayments)

(187,071 ) (85,797 ) Debt issuance costs (8,165 ) — Stock option

exercises 5,462 22,765 Share repurchases (179,439 ) (665,812 )

Dividends paid (78,284 ) (86,018 ) Net cash provided by (used in)

financing activities (530,152 ) (738,863 ) Net increase (decrease)

in cash, cash equivalents, and restricted cash 452,844 (526,151 )

Cash, cash equivalents, and restricted cash at beginning of period

306,168 723,248 Cash, cash equivalents, and

restricted cash at end of period $ 759,012 $ 197,097

Supplemental Cash Flow Information: Interest paid

(capitalized), net $ 16,747 $ 11,516 Income taxes

paid, net $ 88,544 $ 17,206

PulteGroup, Inc. Segment Data ($000's omitted)

(Unaudited) Three Months

Ended Nine Months Ended September

30, September 30, 2018 2017

2018 2017 HOMEBUILDING: Home

sale revenues $ 2,572,236 $ 2,055,891 $ 6,933,888 $ 5,606,953 Land

sale and other revenues 25,510 28,215 104,971

39,848 Total Homebuilding revenues 2,597,746 2,084,106

7,038,859 5,646,801 Home sale cost of revenues (1,954,160 )

(1,564,605 ) (5,276,232 ) (4,332,221 ) Land sale cost of revenues

(22,060 ) (25,123 ) (71,791 ) (115,950 ) Selling, general, and

administrative expenses ("SG&A") (252,757 ) (237,495 ) (719,706

) (689,974 ) Other expense, net (3,714 ) (6,420 ) (7,263 ) (28,832

) Income before income taxes $ 365,055 $ 250,463 $

963,867 $ 479,824

FINANCIAL SERVICES:

Income before income taxes $ 19,633 $ 17,786 $ 54,182

$ 50,238

CONSOLIDATED: Income before

income taxes $ 384,688 $ 268,249 $ 1,018,049 $

530,062

OPERATING METRICS: Gross margin

% (a)(b) 24.0 % 23.9 % 23.9 % 22.7 % SG&A % (a) (9.8 )% (11.6

)% (10.4 )% (12.3 )% Operating margin % (a) 14.2 % 12.3 % 13.5 %

10.4 %

(a) As a percentage of home sale

revenues.

(b) Gross margin equals home sale revenues

minus home sale cost of revenues.

PulteGroup, Inc. Segment Data,

continued ($000's omitted) (Unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Home sale revenues $ 2,572,236 $

2,055,891 $ 6,933,888 $ 5,606,953

Closings - units

Northeast 350 318 1,002 846 Southeast 1,101 966 3,097 2,751 Florida

1,241 897 3,262 2,639 Midwest 1,014 1,001 2,653 2,576 Texas 1,114

927 3,019 2,809 West 1,211 1,042 3,365 2,799 6,031 5,151 16,398

14,420

Average selling price $ 427 $ 399 $ 423 $ 389

Net new orders - units Northeast 353 316 1,251 1,103

Southeast 948 1,044 3,300 3,314 Florida 1,173 991 3,964 3,121

Midwest 823 868 2,980 3,119 Texas 1,005 881 3,511 3,281 West 1,048

1,200 3,560 3,883 5,350 5,300 18,566 17,821

Net new orders -

dollars $ 2,278,357 $ 2,260,082 $ 7,866,177 $ 7,331,311

Unit backlog Northeast 761 644 Southeast 1,919 1,934 Florida

2,380 1,900 Midwest 1,814 1,850 Texas 1,918 1,884 West 2,372 2,611

11,164 10,823

Dollars in backlog $ 4,911,353 $ 4,665,871

PulteGroup, Inc. Segment Data,

continued ($000's omitted) (Unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 MORTGAGE ORIGINATIONS: Origination volume 3,692

3,428 10,319 9,631 Origination principal $

1,138,389 $ 1,002,108 $ 3,170,206 $ 2,778,151

Capture rate 75.0 % 79.6 % 76.0 % 79.5 %

Supplemental Data ($000's omitted) (Unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Interest in inventory, beginning of period $

243,627 $ 212,850 $ 226,611 $ 186,097 Interest capitalized 42,743

46,077 130,474 135,949 Interest expensed (43,583 ) (36,381 )

(114,298 ) (99,500 ) Interest in inventory, end of period $ 242,787

$ 222,546 $ 242,787 $ 222,546

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181023005253/en/

PulteGroup, Inc.Investors:Jim Zeumer,

404-978-6434jim.zeumer@pultegroup.com

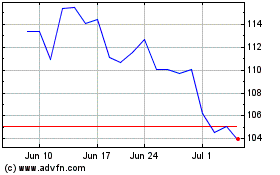

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024