The Boards of Trustees/Directors of the PIMCO closed-end funds

(each, a “Fund” and, collectively, the “Funds”) have declared a

monthly distribution for each Fund’s common shares as summarized

below. The distributions are payable on May 1, 2020 to shareholders

of record on April 13, 2020, with an ex-dividend date of April 9,

2020.

|

|

|

Monthly Distribution Per

Share |

|

Fund |

NYSE Symbol |

Amount |

Change From Previous Month |

Percentage Change From Previous Month |

| PIMCO Corporate & Income

Strategy Fund |

(NYSE: PCN) |

$0.112500 |

- |

- |

| PIMCO Corporate & Income

Opportunity Fund |

(NYSE: PTY) |

$0.130000 |

- |

- |

| PIMCO Global StocksPLUS® &

Income Fund |

(NYSE: PGP) |

$0.093940 |

- |

- |

| PIMCO High Income Fund |

(NYSE: PHK) |

$0.061331 |

- |

- |

| PIMCO Income Opportunity

Fund |

(NYSE: PKO) |

$0.190000 |

- |

- |

| PIMCO Strategic Income Fund,

Inc. |

(NYSE: RCS) |

$0.061200 |

- |

- |

| PCM Fund, Inc. |

(NYSE: PCM) |

$0.080000 |

- |

- |

| PIMCO Income Strategy

Fund |

(NYSE: PFL) |

$0.090000 |

- |

- |

| PIMCO Income Strategy Fund

II |

(NYSE: PFN) |

$0.080000 |

- |

- |

| PIMCO Dynamic Income Fund |

(NYSE: PDI) |

$0.220500 |

- |

- |

| PIMCO Dynamic Credit and

Mortgage Income Fund |

(NYSE: PCI) |

$0.174000 |

- |

- |

| PIMCO Municipal Income

Fund |

(NYSE: PMF) |

$0.054000 |

- |

- |

| PIMCO California Municipal

Income Fund |

(NYSE: PCQ) |

$0.065000 |

- |

- |

| PIMCO New York Municipal

Income Fund |

(NYSE: PNF) |

$0.042000 |

- |

- |

| PIMCO Municipal Income Fund

II |

(NYSE: PML) |

$0.059000 |

- |

- |

| PIMCO California Municipal

Income Fund II |

(NYSE: PCK) |

$0.032000 |

- |

- |

| PIMCO New York Municipal

Income Fund II |

(NYSE: PNI) |

$0.040045 |

- |

- |

| PIMCO Municipal Income Fund

III |

(NYSE: PMX) |

$0.046000 |

- |

- |

| PIMCO California Municipal

Income Fund III |

(NYSE: PZC) |

$0.038000 |

- |

- |

| PIMCO New York Municipal

Income Fund III |

(NYSE: PYN) |

$0.035490 |

- |

- |

| |

|

|

|

|

|

Distributions from PMF, PML, PMX, PCQ, PCK, PZC,

PNF, PNI and PYN are generally exempt from regular federal income

taxes. In addition, distributions from PCQ, PCK and PZC are also

generally exempt from California state income taxes, and

distributions from PNF, PNI and PYN are generally exempt from New

York State and city income taxes. There can be no assurance that

all distributions paid by these Funds will be exempt from federal

income taxes or applicable state or local income taxes.

Distributions may include ordinary income, net

capital gains and/or returns of capital. Generally, a return of

capital occurs when the amount distributed by a Fund includes a

portion of (or is comprised entirely of) your investment in the

Fund in addition to (or rather than) your pro-rata portion of the

Fund’s net income or capital gains. A Fund’s distributions in any

period may be more or less than the net return earned by the Fund

on its investments, and therefore should not be used as a measure

of performance or confused with “yield” or “income.” A return of

capital is not taxable; rather it reduces a shareholder’s tax basis

in his or her shares of the Fund. If a Fund estimates that a

portion of its distribution may be comprised of amounts from

sources other than net investment income in accordance with its

policies and accounting practices, such Fund will notify

shareholders of the estimated composition of such distribution

through a separate written Section 19 Notice. Such notices are

provided for informational purposes only, and should not be used

for tax reporting purposes. Final tax characteristics of all Fund

distributions will be provided on Form 1099-DIV, which is mailed

after the close of the calendar year.

It is important to note that differences exist

between a Fund’s daily internal accounting records and practices, a

Fund’s financial statements presented in accordance with U.S. GAAP,

and recordkeeping practices under income tax regulations.

Accordingly, among other consequences, it is possible that a Fund

may not issue a Section 19 Notice in situations where the Fund’s

financial statements prepared later and in accordance with U.S.

GAAP and/or the final tax character of those distributions might

later report that the sources of those distributions included

capital gains and/or a return of capital. Please see the Funds’

most recent shareholder reports and Section 19 Notice, if

applicable, for more details.

A Fund’s distribution rate may be affected by

numerous factors, including changes in realized and projected

market returns, Fund performance, and other factors. There can be

no assurance that a change in market conditions or other factors

will not result in a change in a Fund’s distribution rate at a

future time.

Certain Funds may engage in investment

strategies, including the use of derivatives, to, among other

things, seek to generate current, distributable income without

regard to possible declines in the Fund’s net asset value. A Fund’s

income and gain generating strategies, including certain

derivatives strategies, may generate current, distributable income,

even if such strategies could potentially result in declines in the

Fund’s net asset value. A Fund’s income and gain-generating

strategies, including certain derivatives strategies, may generate

current income and gains taxable as ordinary income sufficient to

support monthly distributions even in situations when the Fund has

experienced a decline in net assets due to, for example, adverse

changes in the broad U.S. or non-U.S. equity markets or the Fund’s

debt investments, or arising from its use of derivatives.

A Fund may enter into opposite sides of interest

rate swap and other derivatives for the principal purpose of

generating distributable gains on the one side (characterized as

ordinary income for tax purposes) that are not part of the Fund’s

duration or yield curve management strategies (“paired swap

transactions”), and with a substantial possibility that the Fund

will experience a corresponding capital loss and decline in net

asset value with respect to the opposite side transaction (to the

extent it does not have corresponding offsetting capital gains).

Consequently, common shareholders may receive distributions and owe

tax on amounts that are effectively a taxable return of the

shareholder’s investment in the Fund at a time when their

investment in a Fund has declined in value, which may be taxed at

ordinary income rates. The tax treatment of certain derivatives in

which a Fund invests may be unclear and thus subject to

recharacterization. Any recharacterization of payments made or

received by a Fund pursuant to derivatives potentially could affect

the amount, timing or character of Fund distributions. In addition,

the tax treatment of such investment strategies may be changed by

regulation or otherwise.

The common shares of the Funds trade on the New

York Stock Exchange. As with any stock, the price of a Fund’s

common shares will fluctuate with market conditions and other

factors. If you sell your common shares of a Fund, the price

received may be more or less than your original investment.

Shares of closed-end investment management

companies, such as the Funds, frequently trade at a discount from

their net asset value and may trade at a price that is less than

the initial offering price and/or the net asset value of such

shares. Further, if a Fund’s shares trade at a price that is more

than the initial offering price and/or the net asset value of such

shares, including at a substantial premium and/or for an extended

period of time, there is no assurance that any such premium will be

sustained for any period of time and will not decrease, or that the

shares will not trade at a discount to net asset value

thereafter.

The Funds’ daily New York Stock Exchange closing

market prices, net asset values per share, as well as other

information, including updated portfolio statistics and performance

are available at pimco.com/closedendfunds or by calling the Funds’

shareholder servicing agent at (844) 33-PIMCO. Updated portfolio

holdings information about a Fund will be available approximately

15 calendar days after such Fund’s most recent fiscal quarter end,

and will remain accessible until such Fund files a Form N-PORT or a

shareholder report for the period which includes the date of the

information.

About PIMCO

PIMCO is one of the world’s premier fixed income

investment managers. With our launch in 1971 in Newport Beach,

California, PIMCO introduced investors to a total return approach

to fixed income investing. In the 45+ years since, we have

continued to bring innovation and expertise to our partnership with

clients seeking the best investment solutions. Today we have

offices across the globe and 2,150+ professionals united by a

single purpose: creating opportunities for investors in every

environment. PIMCO is owned by Allianz S.E., a leading global

diversified financial services provider.

Except for the historical information and

discussions contained herein, statements contained in this news

release constitute forward-looking statements. These statements may

involve a number of risks, uncertainties and other factors that

could cause actual results to differ materially, including the

performance of financial markets, the investment performance of

PIMCO's sponsored investment products and separately managed

accounts, general economic conditions, future acquisitions,

competitive conditions and government regulations, including

changes in tax laws. Readers should carefully consider such

factors. Further, such forward-looking statements speak only on the

date at which such statements are made. PIMCO undertakes no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statement.

This material has been distributed for

informational purposes only and should not be considered as

investment advice or a recommendation of any particular security,

strategy or investment product. No part of this material may be

reproduced in any form, or referred to in any other publication,

without express written permission. PIMCO is a trademark of Allianz

Asset Management of America L.P. in the United States and

throughout the world. ©2020, PIMCO

For information on PIMCO Closed-End

Funds:Financial Advisors: (800) 628-1237 Shareholders: (844)

337-4626 or (844) 33-PIMCOPIMCO Media Relations: (212) 597-1054

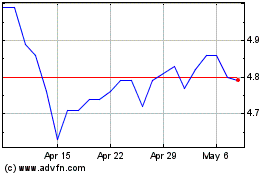

Pimco High Income (NYSE:PHK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pimco High Income (NYSE:PHK)

Historical Stock Chart

From Nov 2023 to Nov 2024