Current Report Filing (8-k)

May 12 2022 - 4:55PM

Edgar (US Regulatory)

false000147409800014740982021-09-232021-09-230001474098us-gaap:CommonStockMember2021-09-232021-09-230001474098us-gaap:SeriesEPreferredStockMember2021-09-232021-09-230001474098us-gaap:SeriesFPreferredStockMember2021-09-232021-09-230001474098us-gaap:SeriesGPreferredStockMember2021-09-232021-09-230001474098us-gaap:SeriesHPreferredStockMember2021-09-232021-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 11, 2022

PEBBLEBROOK HOTEL TRUST

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-34571 | | 27-1055421 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | |

| | |

4747 Bethesda Avenue, Suite 1100, Bethesda, Maryland | | 20814 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (240) 507-1300

| | |

| Not Applicable |

| Former name or former address, if changed since last report |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares, $0.01 par value per share | | PEB | | New York Stock Exchange |

| Series E Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PE | | New York Stock Exchange |

| Series F Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PF | | New York Stock Exchange |

| Series G Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PG | | New York Stock Exchange |

| Series H Cumulative Redeemable Preferred Shares, $0.01 par value | | PEB-PH | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.02. Unregistered Sales of Equity Securities.

On May 11, 2022, Pebblebrook Hotel Trust (the “Company”) acquired the 119-room Inn on Fifth (the “Hotel”) located in Naples, Florida, and a small development parcel adjacent to the Hotel from unaffiliated third parties. The purchase price of $156.0 million was paid in the form of approximately $78.0 million in cash, funded in part by borrowings under the Company’s senior unsecured revolving credit facility, an aggregate of 16,291 units of limited partnership interest of Pebblebrook Hotel, L.P. (the “Operating Partnership”) designated as common units (“Common Units”) and an aggregate of 3,104,400 units of limited partnership of the Operating Partnership newly designated as 6.0% Series Z Cumulative Perpetual Preferred Units (“Series Z Preferred Units”). At issuance, the 16,291 Common Units had a deemed value of $23.94 per unit and the 3,104,400 Series Z Preferred Units had a deemed value of $25.00 per unit. In each case, the issuances were made in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

The Company retained Noble House to manage the Hotel.

Item 7.01. Regulation FD Disclosure.

The Company issued a press release on May 12, 2022 announcing the Hotel’s acquisition.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is hereby incorporated by reference herein.

Item 8.01. Other Events.

The information set forth under Item 3.02 above is hereby incorporated by reference hereunder.

On May 11, 2022, in connection with the acquisition of the Hotel, the Company, as general partner of the Operating Partnership, entered into the Sixth Amendment to the Second Amended and Restated Agreement of Limited Partnership of the Operating Partnership (the “Sixth Amendment”), to provide for the issuance of 3,104,400 Series Z Preferred Units. The Series Z Preferred Units rank senior to the Common Units and on a parity with the Operating Partnership’s Series E, Series F, Series G and Series H Preferred Units. Holders of Series Z Preferred Units are entitled to receive quarterly distributions at an annual rate of 6.0% of liquidation preference value.

Series Z Preferred Units may be redeemed or converted. At any time, holders of Series Z Preferred Units may elect to convert some or all of their units into any other series of the Operating Partnership’s preferred units outstanding at that time. After the second anniversary of issuance of the Series Z Preferred Units, holders may elect to redeem some or all of their units for, at the Company’s election, cash, common shares of beneficial interest of the Company (“Common Shares”) having an equivalent value or preferred shares of beneficial interest of the Company (“Preferred Shares”) on a one-for-one basis. After the fifth anniversary of their issuance, the Company may redeem the Series Z Preferred Units for cash, Common Shares having an equivalent value or Preferred Shares on a one-for-one basis. At any time following a change of control of the Company, holders of Series Z Preferred Units may elect to redeem some or all of their units for, at the Company’s election, cash or Common Shares having an equivalent value.

This description of the Sixth Amendment is not complete and is qualified in its entirety by reference to the copy of the Sixth Amendment filed as Exhibit 3.1 to this Current Report on Form 8-K, which is hereby incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Sixth Amendment to the Second Amended and Restated Agreement of Limited Partnership of Pebblebrook Hotel., L.P., dated as of May 11, 2022. |

| | Press release, issued May 12, 2022, announcing the acquisition of Inn on Fifth in Naples, Florida. |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PEBBLEBROOK HOTEL TRUST |

| | |

| May 12, 2022 | By: | /s/ Raymond D. Martz |

| | Name: | Raymond D. Martz |

| | | Title: | Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

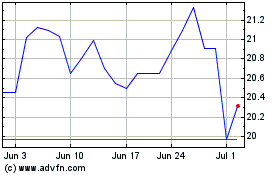

Pebblebrook Hotel (NYSE:PEB-F)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pebblebrook Hotel (NYSE:PEB-F)

Historical Stock Chart

From Apr 2023 to Apr 2024