DESCRIPTION OF SECURITIES

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in

our capital stock. This description is summarized from, and qualified in its entirety by reference to, our certificate of incorporation, which has been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by

Reference.”

Our authorized capital stock consists of:

| |

• |

|

2,000,000,000 shares of Class A common stock, par value $0.0001 per share; |

| |

• |

|

20,000,000 shares of Class B common stock, par value $0.0001 per share; |

| |

• |

|

250,000,000 shares of Class C common stock, par value $0.0001 per share; and |

| |

• |

|

100,000,000 shares of preferred stock, par value $0.0001 per share. |

Common Stock

Class A Common

Stock

Voting Rights

Holders of Class A common stock are entitled to cast one vote per share of Class A common stock. Generally, holders of all classes of

our common stock vote together as a single class, and an action is approved by our stockholders if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. Holders of our Class A common stock

are not entitled to cumulate their votes in the election of directors.

The restated certificate of incorporation further provides that

our board of directors is divided into three classes, Class I, Class II and Class III, with each class serving staggered terms.

The restated certificate of incorporation further provides that the affirmative vote of at least

two-thirds of the total voting power of all then outstanding shares of our stock, voting as a single class, is be required to amend, alter, repeal or rescind certain provisions of the restated certificate of

incorporation, including provisions relating to voting and dividend rights, the size and classifications of the board of directors, special meetings, director and officer indemnification, forum selection, and amendments to the restated certificate

of incorporation. The affirmative vote of the holders of at least two-thirds of the voting power of all the then-outstanding shares of our voting stock, voting as a single class, will be required to amend or

repeal the bylaws, although the bylaws may be amended by a simple majority vote of our board of directors.

Dividend Rights

Each holder of our Class A common stock will share ratably (based on the number of shares of Class A common stock held) if and when

any dividend is declared by our board of directors out of funds legally available therefor, subject to restrictions, whether statutory or contractual (including with respect to any outstanding indebtedness), on the declaration and payment of

dividends and to any restrictions on the payment of dividends imposed by the terms of any outstanding preferred stock or any class or series of stock having a preference over, or the right to participate with, Class A common stock with respect

to the payment of dividends.

Liquidation, Dissolution and Winding Up

In the event of any liquidation, dissolution or winding up of our company, whether voluntary or involuntary, each holder of Class A common

stock then outstanding will participate pro rata in the funds and assets of Offerpad Solutions Inc. that may be legally distributed to its stockholders, subject to the designations, preferences, limitations, restrictions and relative rights of any

class or series of preferred stock then outstanding.

7

Other Matters

No shares of Class A common stock are subject to redemption or have preemptive rights to purchase additional shares of Class A common

stock. Holders of shares of Class A common stock do not have subscription, redemption or conversion rights.

Class B

Common Stock

Voting Rights

Prior to the “Sunset Date,” which is the earlier of: (a) the date that is nine months following the date on which Brian Bair

(x) is no longer providing services, whether upon death, resignation, removal or otherwise, to us as a member of our senior leadership team, officer or director and (y) has not provided any such services for the duration of such nine-month

period; and (b) the date as of which the Qualified Stockholders have Transferred (as such terms are defined in the restated certificate of incorporation), in the aggregate, more than seventy-five percent (75%) of the shares of our Class B

common stock that were held by the Qualified Stockholders immediately following the closing of the Business Combination transaction with OfferPad, Inc., holders of our Class B common stock will be entitled to cast 10 votes per share of

Class B common stock. From and after the Sunset Date, each share of Class B common stock will automatically convert into one share of Class A common stock. Generally, holders of all classes of common stock vote together as a single

class, and an action is approved by our stockholders if the number of votes cast in favor of the action exceeds the number of votes cast in opposition to the action. Holders of Class B common stock are not entitled to cumulate their votes in

the election of directors.

Dividend Rights

Each holder of Class B common stock will share ratably (based on the number of shares of Class B common stock held) if and when any

dividend is declared by our board of directors out of funds legally available therefor, subject to restrictions, whether statutory or contractual (including with respect to any outstanding indebtedness), on the declaration and payment of dividends

and to any restrictions on the payment of dividends imposed by the terms of any outstanding preferred stock or any class or series of stock having a preference over, or the right to participate with, Class B common stock with respect to the

payment of dividends.

Liquidation Rights

In the event of any liquidation, dissolution or winding up of our company, whether voluntary or involuntary, each holder of Class B common

stock then outstanding will participate pro rata in the funds and assets of Offerpad Solutions Inc. that may be legally distributed to its stockholders, subject to the designations, preferences, limitations, restrictions and relative rights of any

class or series of preferred stock then outstanding.

Transfers

Pursuant to the restated certificate of incorporation, shares of Class B common stock are fully transferable to any transferee, provided,

however, that such Class B common stock will automatically convert into Class A common stock upon certain transfers of such shares, subject to certain exceptions set forth in the restated certificate of incorporation, and upon the Sunset

Date.

Other Matters

No shares of Class B common stock are subject to redemption or have preemptive rights to purchase additional shares of Class B common

stock. Each share of Class B common stock is convertible into one share of Class A common stock at the option of the holder thereof at any time upon written notice to our transfer agent. Each share of Class B common stock will

automatically convert into one share of Class A common stock (a) upon certain transfers of such shares, subject to exceptions set forth in the restated certificate of incorporation or (b) on the Sunset Date.

8

Class C Common Stock will entitle its holder to have substantially the same

rights as Class A Common Stock, except it will not have any voting rights.

Transfer Agent

The transfer agent and registrar for our common stock is Continental Stock Transfer & Trust Company.

Preferred Stock

The restated certificate

of incorporation provides that our board of directors has the authority, without action by the stockholders, to designate and issue shares of preferred stock in one or more classes or series, and the number of shares constituting any such class or

series, and to fix the voting powers, designations, preferences, limitations, restrictions and relative rights of each class or series of preferred stock, including, without limitation, dividend rights, conversion rights, redemption privileges and

liquidation preferences, which rights may be greater than the rights of the holders of the common stock.

The purpose of authorizing our

board of directors to issue preferred stock and determine the rights and preferences of any classes or series of preferred stock is to eliminate delays associated with a stockholder vote on specific issuances. The simplified issuance of preferred

stock, while providing flexibility in connection with possible acquisitions, future financings and other corporate purposes, could have the effect of making it more difficult for a third party to acquire, or could discourage a third party from

seeking to acquire, a majority of our outstanding voting stock. Additionally, the issuance of preferred stock may adversely affect the holders of common stock by restricting dividends on common stock, diluting the voting power of common stock or

subordinating the dividend or liquidation rights of common stock. As a result of these or other factors, the issuance of preferred stock could have an adverse impact on the market price of common stock.

Exclusive Forum

Our restated certificate

of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery (the “Chancery Court”) of the State of Delaware (or, in the event that the Chancery Court does not have

jurisdiction, the federal district court for the District of Delaware or other state courts of the State of Delaware) and any appellate court thereof shall, to the fullest extent permitted by law, be the sole and exclusive forum for: (1) any

derivative action, suit or proceeding brought on our behalf; (2) any action, suit or proceeding asserting a claim of breach of a fiduciary duty owed by any of our current or former directors, officers, stockholders or employees of ours or our

stockholders; (3) any action, suit or proceeding asserting a claim against us arising pursuant to any provision of the DGCL, the Bylaws or the restated certificate of incorporation (as either may be amended from time to time); or (4) any

action, suit or proceeding asserting a claim against us or any current or former director, officer or stockholder governed by the internal affairs doctrine.

Our restated certificate of incorporation provides that the federal district courts of the United States of America shall be the exclusive

forum for the resolution of any complaint asserting a cause of action arising under the Securities Act. If any such foreign action is filed in a court other than the courts in the State of Delaware in the name of any stockholder, such stockholder

shall be deemed to have consented to (a) the personal jurisdiction of the state and federal courts in the State of Delaware in connection with any action brought in any such court to enforce such actions and (b) having service of process

made upon such stockholder in any such action by service upon such stockholder’s counsel in the foreign action as agent for such stockholder. Our restated certificate of incorporation also provides that any person or entity purchasing or

otherwise acquiring any interest in any of our securities shall be deemed to have notice of and consented to this choice of forum provision. It is possible that a court of law could rule that the choice of forum provision contained in our

certificate of incorporation is inapplicable or unenforceable if it is challenged in a proceeding or otherwise. This choice of forum provision has important consequences for our stockholders.

9

Anti-Takeover Effects of Provisions of the Company’s Restated Certificate of Incorporation and

Bylaws and Applicable Law

Section 203 of the DGCL provides that if a person acquires 15% or more of the voting stock of a

Delaware corporation, such person becomes an “interested stockholder” and may not engage in certain “business combinations” with such corporation for a period of three years from the time such person acquired 15% or more of such

corporation’s voting stock, unless: (1) the board of directors of such corporation approves the acquisition of stock or the merger transaction before the time that the person becomes an interested stockholder, (2) the interested

stockholder owns at least 85% of the outstanding voting stock of such corporation at the time the merger transaction commences (excluding voting stock owned by directors who are also officers and certain employee stock plans), or (3) the merger

transaction is approved by the board of directors and at a meeting of stockholders, not by written consent, by the affirmative vote of 2/3 of the outstanding voting stock which is not owned by the interested stockholder. A Delaware corporation may

elect in its certificate of incorporation or bylaws not to be governed by this particular Delaware law. Under the restated certificate of incorporation, we opted out of Section 203 of the DGCL, but provide other similar restrictions regarding

takeovers by interested stockholders; provided that Section 203 shall apply to us for the 12-month period following the filing of the restated certificate of incorporation.

Special Meetings of Stockholders

The

Certificate of Incorporation provides that a special meeting of stockholders may be called by (a) our board of directors, (b) the Chairperson of the Board of Directors or (c) our Chief Executive Officer. Notwithstanding the foregoing,

until the Sunset Date, special meetings of the stockholders may be called for any purpose or purposes by the Secretary upon the request, in writing, of any holder of record of at least 25% of the voting power of the issued and outstanding shares of

stock.

Any such special meeting may be postponed, rescheduled or cancelled by our board of directors or other person calling the special

meeting.

Action by Written Consent

The Certificate of Incorporation provides that until the Sunset Date, any action required or permitted to be taken by our stockholders may be

effected at a duly called annual or special meeting of stockholders or may, except as otherwise required by applicable law or the Certificate of Incorporation, be taken without a meeting, without prior notice and without a vote, if a consent in

writing, setting forth the action so taken, shall be signed by the holders of outstanding shares of stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares

entitled to vote thereon were present and voted and shall be delivered to us in accordance with the applicable provisions of the DGCL. Following the Sunset Date, any action required or permitted to be taken by our stockholders must be effected at an

annual or special meeting of the stockholders, and shall not be taken by written consent in lieu of a meeting.

Classified Board of Directors

Our Certificate of Incorporation provides that our board of directors is divided into three classes, with the classes as nearly equal in number

as possible and each class serving three-year staggered terms. Our board of directors or any individual director may be removed from office at any time, but only for cause and only by the affirmative vote of the holders of at least a majority of the

voting power of all of the then outstanding shares of our voting stock entitled to vote at an election of directors.

10

REGISTERED HOLDERS

The Registered Holders listed in the table below may from time to time offer and sell any or all of the shares of Class A common stock set forth below

pursuant to this prospectus. When we refer to the “Registered Holders” in this prospectus, we refer to the persons listed in the table below, and the pledgees, donees, transferees, assignees, successors and other permitted transferees that

hold any of the Registered Holders’ interest in the shares of Class A common stock after the date of this prospectus.

The following table sets

forth certain information provided by or on behalf of the Registered Holders concerning the Class A common stock that may be offered from time to time by each Registered Holder pursuant to this prospectus. The Registered Holders identified

below may have sold, transferred or otherwise disposed of all or a portion of their securities after the date on which they provided us with information regarding their securities. Moreover, the securities identified below include only the

securities being registered for resale and may not incorporate all shares deemed to be beneficially held by the Registered Holders. Any changed or new information given to us by the Registered Holders, including regarding the identity of, and the

securities held by, each Registered Holder, will be set forth in a prospectus supplement or amendments to the registration statement of which this prospectus is a part, if and when necessary. A Registered Holder may sell all, some or none of such

securities in this offering. See “Plan of Distribution.”

Percentage ownership is based on 232,571,810 shares of Class A common

stock outstanding as of February 28, 2023.

Other than as described below or elsewhere in this prospectus or the documents incorporated herein by

reference, none of the Registered Holders has any material relationship with us or any of our predecessors or affiliates.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of Registered Holder |

|

Shares Beneficially Owned

Prior to the Offering (1) |

|

|

Maximum

Number of

Shares to be

Sold Pursuant

to

this

Prospectus (2) |

|

|

Shares Beneficially Owned

After the Offering (3) |

|

| |

Shares |

|

|

Percentage |

|

|

Shares |

|

|

Percentage |

|

| Kenneth DeGiorgio (4) |

|

|

933,016 |

|

|

|

* |

|

|

|

893,016 |

|

|

|

40,000 |

|

|

|

* |

|

| Roberto Sella (5) |

|

|

145,823,391 |

|

|

|

52.7 |

% |

|

|

44,195,302 |

|

|

|

101,628,089 |

|

|

|

36.7 |

% |

| Brian Bair

(6) |

|

|

18,688,800 |

|

|

|

7.4 |

% |

|

|

893,016 |

|

|

|

17,795,784 |

|

|

|

7.7 |

% |

| First American Financial Corporation (7)) |

|

|

76,789,713 |

|

|

|

27.7 |

% |

|

|

44,650,830 |

|

|

|

32,138,883 |

|

|

|

11.6 |

% |

| VSF INVESTMENTS LLC (8) |

|

|

20,696,119 |

|

|

|

8.3 |

% |

|

|

17,860,332 |

|

|

|

2,835,787 |

|

|

|

1.1 |

% |

| John Coates Roth Contributory IRA, 6296-8536 (9) |

|

|

8,930,166 |

|

|

|

3.7 |

% |

|

|

8,930,166 |

|

|

|

— |

|

|

|

* |

|

| Ulysses Partners L.P. (10) |

|

|

9,096,563 |

|

|

|

3.8 |

% |

|

|

8,930,166 |

|

|

|

166,397 |

|

|

|

* |

|

| FABIO TERLEVICH & MARY P ROUSE JTWROS (11) |

|

|

4,759,791 |

|

|

|

2.0 |

% |

|

|

4,465,083 |

|

|

|

294,708 |

|

|

|

* |

|

| Peter C. Morse (12) |

|

|

3,836,167 |

|

|

|

1.6 |

% |

|

|

3,572,066 |

|

|

|

264,101 |

|

|

|

* |

|

| J&T Family Limited Partnership (13) |

|

|

3,572,066 |

|

|

|

1.5 |

% |

|

|

3,572,066 |

|

|

|

— |

|

|

|

* |

|

| Sarah Miller Coulson (14) |

|

|

2,679,049 |

|

|

|

1.1 |

% |

|

|

2,679,049 |

|

|

|

— |

|

|

|

* |

|

| KF Self-Directed Investments, LLC (15) |

|

|

2,143,239 |

|

|

|

* |

|

|

|

2,143,239 |

|

|

|

— |

|

|

|

* |

|

| EGADS Investments LP (16) |

|

|

1,786,033 |

|

|

|

* |

|

|

|

1,786,033 |

|

|

|

— |

|

|

|

* |

|

| Richard B. Worley (17) |

|

|

1,786,033 |

|

|

|

* |

|

|

|

1,786,033 |

|

|

|

— |

|

|

|

* |

|

| The Leslie Miller and Richard Worley Foundation (18) |

|

|

1,786,033 |

|

|

|

* |

|

|

|

1,786,033 |

|

|

|

— |

|

|

|

* |

|

| ACME Partnership, LP (19) |

|

|

1,786,033 |

|

|

|

* |

|

|

|

1,786,033 |

|

|

|

— |

|

|

|

* |

|

| Morse Charitable Foundation (20) |

|

|

1,250,223 |

|

|

|

* |

|

|

|

1,250,223 |

|

|

|

— |

|

|

|

* |

|

| The Irrevocable Deed of Trust of Richard B. Worley for Richard G. Worley (21) |

|

|

893,016 |

|

|

|

* |

|

|

|

893,016 |

|

|

|

— |

|

|

|

* |

|

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The Irrevocable Deed of Trust of Richard B. Worley for Elizabeth Mai Worley (22) |

|

|

893,016 |

|

|

|

* |

|

|

|

893,016 |

|

|

|

— |

|

|

|

* |

|

| Shivraj Mundy (23) |

|

|

893,016 |

|

|

|

* |

|

|

|

893,016 |

|

|

|

— |

|

|

|

* |

|

| Ira Brind Revocable Trust dated Jan 12, 2021 (24) |

|

|

535,809 |

|

|

|

* |

|

|

|

535,809 |

|

|

|

— |

|

|

|

* |

|

| Martha F. Morse (25) |

|

|

491,159 |

|

|

|

* |

|

|

|

491,159 |

|

|

|

— |

|

|

|

* |

|

| Samuel L Duboc (26) |

|

|

446,597 |

|

|

|

* |

|

|

|

446,597 |

|

|

|

— |

|

|

|

* |

|

| Anthony Barrett (27) |

|

|

469,508 |

|

|

|

* |

|

|

|

446,508 |

|

|

|

23,000 |

|

|

|

* |

|

| Thomson Family Limited Partnership (28) |

|

|

357,206 |

|

|

|

* |

|

|

|

357,206 |

|

|

|

— |

|

|

|

* |

|

| Ned J. Kaplin (29) |

|

|

357,206 |

|

|

|

* |

|

|

|

357,206 |

|

|

|

— |

|

|

|

* |

|

| Kaplin Investment Partnership, LP. (30) |

|

|

357,206 |

|

|

|

* |

|

|

|

357,206 |

|

|

|

— |

|

|

|

* |

|

| PETER C. MORSE REMAINDER TRUST DTD 9/1/06 FBO CLAY P. MORSE (31) |

|

|

312,555 |

|

|

|

* |

|

|

|

312,555 |

|

|

|

— |

|

|

|

* |

|

| PETER C. MORSE REMAINDER TRUST DTD 9/1/06 FBO KATE M. FRANTZ (32) |

|

|

312,555 |

|

|

|

* |

|

|

|

312,555 |

|

|

|

— |

|

|

|

* |

|

| PETER C. MORSE REMAINDER TRUST DTD 9/1/06 FBO LISA D. MORSE (33) |

|

|

312,555 |

|

|

|

* |

|

|

|

312,555 |

|

|

|

— |

|

|

|

* |

|

| David B. Brind (34) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| Ivan M. Szeftel (35) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| JLS FAMILY PARTNERS LP (36) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| Hinsdale LLC (37) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| KFP Investors Partnership (38) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| James Morrissey (39) |

|

|

267,904 |

|

|

|

* |

|

|

|

267,904 |

|

|

|

— |

|

|

|

* |

|

| Charlotte C Weber UAD 03/10/00 FBO John C. Weber Jr. (40) |

|

|

250,044 |

|

|

|

* |

|

|

|

250,044 |

|

|

|

— |

|

|

|

* |

|

| Christoph O’Donnell (41) |

|

|

178,603 |

|

|

|

* |

|

|

|

178,603 |

|

|

|

— |

|

|

|

* |

|

| MAREK SKAWINSKI & MALGORZATA SKAWINSKI JTWROS (42) |

|

|

178,603 |

|

|

|

* |

|

|

|

178,603 |

|

|

|

— |

|

|

|

* |

|

| Marjorie Miller GST Exempt Trust FBO Wendy Mnookin (43) |

|

|

89,301 |

|

|

|

* |

|

|

|

89,301 |

|

|

|

— |

|

|

|

* |

|

| Paul A. Frick & Donna M. Frick JT TEN (44) |

|

|

89,301 |

|

|

|

* |

|

|

|

89,301 |

|

|

|

— |

|

|

|

* |

|

| Stacey Spector (45) |

|

|

89,301 |

|

|

|

* |

|

|

|

89,301 |

|

|

|

— |

|

|

|

* |

|

| Regina Latella (46) |

|

|

94,801 |

|

|

|

* |

|

|

|

89,301 |

|

|

|

5,500 |

|

|

|

* |

|

| Wilbur Kim

(47) |

|

|

89,301 |

|

|

|

* |

|

|

|

89,301 |

|

|

|

— |

|

|

|

* |

|

| Matthew H. Taylor (48) |

|

|

44,650 |

|

|

|

* |

|

|

|

44,650 |

|

|

|

— |

|

|

|

* |

|

| Mark M. Froot 2020 Irrevocable Trust (49) |

|

|

44,650 |

|

|

|

* |

|

|

|

44,650 |

|

|

|

— |

|

|

|

* |

|

| David L. Froot 2020 Irrevocable Trust (50) |

|

|

44,650 |

|

|

|

* |

|

|

|

44,650 |

|

|

|

— |

|

|

|

* |

|

| Charlotte C Weber Trust FBO Peyton Weber U/A DTD 12/14/2000 (51) |

|

|

35,720 |

|

|

|

* |

|

|

|

35,720 |

|

|

|

— |

|

|

|

* |

|

| Charlotte C Weber Trust FBO John C. Weber III U/A DTD 03/31/2003 (52) |

|

|

35,720 |

|

|

|

* |

|

|

|

35,720 |

|

|

|

— |

|

|

|

* |

|

| Charlotte C Weber Trust FBO Christopher Edward Weber U/A DTD 06/08/2010 (53) |

|

|

35,720 |

|

|

|

* |

|

|

|

35,720 |

|

|

|

— |

|

|

|

* |

|

| Kevin Ays

(54) |

|

|

35,720 |

|

|

|

* |

|

|

|

35,720 |

|

|

|

— |

|

|

|

* |

|

| RUDI MINXHA & JESSIE AI (55) |

|

|

31,060 |

|

|

|

* |

|

|

|

17,860 |

|

|

|

13,200 |

|

|

|

* |

|

| * |

Represents beneficial ownership of less than 1% of our outstanding Class A common stock

|

| (1) |

The number of shares set forth in this column reflects the number of shares of Class A common stock

beneficially owned by each Registered Holder, based on its respective ownership of shares of Class A common stock, Class B common stock, Deferred Stock Units, Restricted Stock Units, Vested Options, Options vesting within 60 days,

exercisable warrants, and warrants exercisable within 60 days as of February 28, 2023, assuming conversion of the Warrants exercisable within 60 days held by each such |

12

| |

Registered Holder on that date. The percentage of shares of Class A common stock beneficially owned by each Registered Holder in this column is based on (i) an aggregate of 232,571,810

shares of Class A common stock outstanding on February 28, 2023, and (ii) the number of shares of Class A common stock underlying the Warrants held by such Registered Holder as of February 28, 2023. Such shares of

Class A common stock underlying the Warrants held by such Registered Holder, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other Registered Holder. |

| (2) |

The amount set forth in this column reflects the number of shares of common stock that may be offered by the

Registered Holders using this. These amount does not represent any other shares of our Class A common stock that the Registered Holders may own beneficially or otherwise. |

| (3) |

Assumes the resale by the Registered Holders of all of the shares of Class A common stock being offered

for resale pursuant to this prospectus. The Registered Holders may sell some, all or none of the shares being offered for resale in this offering. The percentage of shares of Class A common stock beneficially owned by each Registered Holder in

this column is based on 232,571,810 shares of Class A common stock outstanding on February 28, 2023 and assumes the sale of all 160,742,959 shares of Class A common stock underlying the Warrants that may be offered by the Registered

Holders. |

| (4) |

Consists of 893,016 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. Does not include 101,922 shares of Class A common stock for Mr. DiGiorgio associated with RSUs that have vested, but have not yet been settled in shares of our common stock, pursuant to the

named individual’s election to defer settlement thereof under the Deferred Compensation Plan. |

| (5) |

Consists of (i) 1,378,106 shares of Class A held directly, (ii) 44,195,302 shares of Class A common

stock that would be issuable upon the exercise of warrants held directly as of or within 60 days of February 28, 2023, and (iii) based solely on a Schedule 13D/A filed with the SEC on February 3, 2023, 100,249,983 shares of

Class A common stock held by LL Capital Partners I, L.P. and by SIF V, LLC. LLCP I GP, LLC is the general partner of LL Capital Partners I, L.P. and exercises voting and dispositive power over the shares noted herein held by LL Capital Partners

I, L.P. LLCP II GP, LLC is the general partner of SIF V, LLC and exercises voting and dispositive power over the shares noted herein held by SIF V, LLC. Roberto Sella is the sole manager of SIF V, LLC and LLCP II GP, LLC. As the sole manager of SIF

V, LLC and LLCP II GP, LLC, Roberto Sella may be deemed to have voting and dispositive power for the shares noted herein held by LL Capital Partners I, L.P. and SIF V, LLC. Each of LL Capital Partners I, L.P., SIF V, LLC and Roberto Sella separately

disclaim beneficial ownership over the shares noted herein except to the extent of their pecuniary interest therein. The address for these entities and individuals is c/o LL Funds, LLC, 2400 Market Street Philadelphia, PA 19103.

|

| (6) |

Consists of (i) 2,959,474 shares of our Class B Common Stock held by the BBAB 2021 Irrevocable Trust, (ii)

11,856,762 shares of Class B Common Stock held directly (iii) 2,885,690 shares of Class A common stock that would be issuable upon exercise of options exercisable as of or within 60 days of February 28, 2023 and (iv) 893,016 shares of

Class A common stock that would be issuable upon exercise of warrants exercisable as of or within 60 days of February 28, 2023. |

| (7) |

Based solely on a Schedule 13D/A filed with the SEC on February 2, 2023. Consists of (i) 32,138,883 shares

of Class A common stock held of record by First American Financial Corporation (“First American”) and (ii) 44,650,830 shares of Class A common stock that would be issuable upon the exercise of warrants held by First American as

of or within 60 days of February 28, 2023. The management of First American exercises voting and dispositive power with respect to these securities. The board of directors of First American is responsible for appointing all of the members of

management, and no member of the board of directors of First American is deemed to beneficially own the shares of common stock held by First American. The address for First American Financial Corporation is 1 First American Way, Santa Ana,

CA 97207. |

| (8) |

Consists of 17,860,332 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (9) |

Consists of 8,930,166 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

13

| (10) |

Consists of 8,930,166 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (11) |

Consists of 4,465,083 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (12) |

Consists of 3,572,066 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (13) |

Consists of 3,572,066 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (14) |

Consists of 2,679,049 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (15) |

Consists of 2,143,239 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (16) |

Consists of 1,786,033 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (17) |

Consists of 1,786,033 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (18) |

Consists of 1,786,033 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (19) |

Consists of 1,786,033 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (20) |

Consists of 1,250,223 shares of Class A common stock that would be issuable upon the exercise of warrants

as of or within 60 days of February 28, 2023. |

| (21) |

Consists of 893,016 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (22) |

Consists of 893,016 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (23) |

Consists of 893,016 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (24) |

Consists of 535,809 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (25) |

Consists of 491,159 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (26) |

Consists of 446,597 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (27) |

Consists of 446,508 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (28) |

Consists of 357,206 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (29) |

Consists of 357,206 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (30) |

Consists of 357,206 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (31) |

Consists of 312,555 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (32) |

Consists of 312,555 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (33) |

Consists of 312,555 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (34) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (35) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

14

| (36) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (37) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (38) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (39) |

Consists of 267,904 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (40) |

Consists of 250,044 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (41) |

Consists of 178,603 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (42) |

Consists of 178,603 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (43) |

Consists of 89,301 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (44) |

Consists of 89,301 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (45) |

Consists of 89,301 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (46) |

Consists of 89,301 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (47) |

Consists of 89,301 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (48) |

Consists of 44,650 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (49) |

Consists of 44,650 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (50) |

Consists of 44,650 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (51) |

Consists of 35,720 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (52) |

Consists of 35,720 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (53) |

Consists of 35,720 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (54) |

Consists of 35,720 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

| (55) |

Consists of 17,860 shares of Class A common stock that would be issuable upon the exercise of warrants as

of or within 60 days of February 28, 2023. |

Information for each additional Registered Holder, if any, will be set forth by

prospectus supplement to the extent required prior to the time of any offer or sale of such Registered Holder’s shares pursuant to this prospectus. To the extent permitted by law, a prospectus supplement may add, update, substitute or change

the information contained in this prospectus, including the identity of each Registered Holder and the number of shares of Class A common stock registered on its behalf. A Registered Holder may sell or otherwise transfer all, some or none of

such shares of Class A common stock in this offering. See “Plan of Distribution.”

15

PLAN OF DISTRIBUTION

The Registered Holders, which as used herein includes donees, pledgees, transferees, distributees or other successors-in-interest selling shares of our Class A common stock or interests in our Class A common stock received after the date of this prospectus from the Registered Holders as a gift, pledge,

partnership distribution or other transfer, may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of Class A common stock or interests in our Class A common stock on any stock exchange, market

or trading facility on which shares of our Class A common stock are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price,

at varying prices determined at the time of sale, or at negotiated prices.

The Registered Holders may use any one or more of the following methods when

disposing of their shares of Class A common stock or interests therein:

| |

• |

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

| |

• |

|

one or more underwritten offerings; |

| |

• |

|

block trades in which the broker-dealer will attempt to sell the shares of Class A common stock as agent,

but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

• |

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its accounts;

|

| |

• |

|

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

• |

|

through trading plans entered into by a Registered Holders pursuant to Rule

10b5-1 under the Exchange Act, that are in place at the time of an offering pursuant to this prospectus and any applicable prospectus supplement hereto that provide for periodic sales of their securities on

the basis of parameters described in such trading plans; |

| |

• |

|

privately negotiated transactions; |

| |

• |

|

distributions to their members, partners or shareholders; |

| |

• |

|

short sales effected after the date of the registration statement of which this prospectus is a part is declared

effective by the SEC; |

| |

• |

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange

or otherwise; |

| |

• |

|

in market transactions, including transactions on a national securities exchange or quotations service or over-the-counter market; |

| |

• |

|

directly to one or more purchasers; |

| |

• |

|

broker-dealers may agree with the Registered Holders to sell a specified number of such shares of Class A

common stock at a stipulated price per share; |

| |

• |

|

a combination of any such methods of sale; or |

| |

• |

|

any other method permitted pursuant to applicable law. |

The Registered Holders may, from time to time, pledge or grant a security interest in some shares of our Class A common stock owned by them and, if a

Registered Holder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell such shares of Class A common stock from time to time, under this prospectus, or under an amendment or supplement to

this prospectus amending the list of the Registered Holders to include the pledgee, transferee or other successors in interest as the Registered Holders under this prospectus. The Registered Holders also may transfer shares of our Class A

common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

16

In connection with the sale of shares of our Class A common stock or interests therein, the Registered

Holders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our Class A common stock in the course of hedging the positions they assume. The Registered Holders may

also sell shares of our Class A common stock short and deliver these securities to close out their short positions, or loan or pledge shares of our Class A common stock to broker-dealers that in turn may sell these securities. The

Registered Holders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities that require the delivery to such broker-dealer or other financial

institution of shares of our Class A common stock offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the Registered Holders from the sale of shares of our Class A common stock offered by them will be the purchase price of such

shares of our Class A common stock less discounts or commissions, if any. The Registered Holders reserve the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of share of

our Class A common stock to be made directly or through agents. We will not receive any of the proceeds from any offering by the Registered Holders.

The Registered Holders also may in the future resell a portion of our Class A common stock in open market transactions in reliance upon Rule 144 under

the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available exemptions from the registration requirements of the Securities Act.

The Registered Holders and any underwriters, broker-dealers or agents that participate in the sale of shares of our Class A common stock or interests

therein may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of shares of our Class A common stock may be underwriting

discounts and commissions under the Securities Act. If any Registered Holder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, then the Registered Holder will be subject to the prospectus delivery

requirements of the Securities Act. Underwriters and their controlling persons, dealers and agents may be entitled, under agreements entered into with us and the Registered Holders, to indemnification against and contribution toward specific civil

liabilities, including liabilities under the Securities Act.

To the extent required, our Class A common stock to be sold, the respective purchase

prices and public offering prices, the names of any agent, dealer or underwriter, and any applicable discounts, commissions, concessions or other compensation with respect to a particular offer will be set forth in an accompanying prospectus

supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

To facilitate the offering of

shares of our Class A common stock offered by the Registered Holders, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of our Class A common stock. This may

include over-allotments or short sales, which involve the sale by persons participating in the offering of more shares of Class A common stock than were sold to them. In these circumstances, these persons would cover such over-allotments or

short positions by making purchases in the open market or by exercising their over-allotment option, if any. In addition, these persons may stabilize or maintain the price of our Class A common stock by bidding for or purchasing shares of

Class A common stock in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if shares of Class A common stock sold by them are repurchased in connection

with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of our Class A common stock at a level above that which might otherwise prevail in the open market. These transactions may be

discontinued at any time.

Under the Subscription Agreement, we have agreed to indemnify the applicable Registered Holders party thereto against certain

liabilities that they may incur in connection with the sale of the securities registered hereunder,

17

including liabilities under the Securities Act, and to contribute to payments that such Registered Holders may be required to make with respect thereto. In addition, we and such Registered

Holders have agreed to indemnify any underwriter against certain liabilities related to the selling of the securities, including liabilities arising under the Securities Act.

We have agreed to use our commercially reasonable efforts to maintain the effectiveness of this registration statement until (1) the date as of which the

Registered Holders may sell all of the Class A common stock under Rule 144 without volume or manner-of-sale restrictions imposed on the Registered Holders pursuant

to Rule 144(b)(2) under the Securities Act; (2) January 31, 2028; or (3) the date on which the Registered Holders have sold all of the Class A common stock registered on this registration statement. We have agreed to pay all

expenses in connection with this offering, other than underwriting commissions and discounts, brokerage fees, underwriter marketing costs, and certain legal expenses. The Registered Holders will pay any underwriting commissions and discounts,

brokerage fees, underwriter marketing costs, and certain legal expenses relating to the offering.

A Registered Holder that is an entity may elect to make

an in-kind distribution of Class A common stock to its members, partners or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent

that such members, partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradable shares of Class A common stock pursuant to the distribution through a registration statement.

At the time a particular offer of shares is made, if required, a prospectus supplement will be distributed that will set forth the number of shares being

offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession

allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

We have agreed to pay all expenses in connection with this

offering, other than underwriting commissions and discounts, brokerage fees, underwriter marketing costs, and certain legal expenses. The Registered Holders will pay any underwriting commissions and discounts, brokerage fees, underwriter marketing

costs, and certain legal expenses relating to the offering.

18

LEGAL MATTERS

Latham & Watkins LLP has passed upon the validity of the securities offered by this prospectus and certain other legal matters related to this

prospectus. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The

financial statements of Offerpad Solutions Inc. incorporated by reference in this Prospectus, and the effectiveness of Offerpad Solutions Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an

independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

19

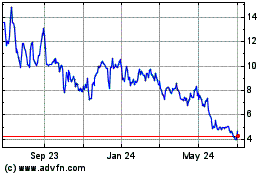

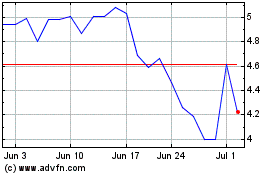

Offerpad Solutions (NYSE:OPAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Offerpad Solutions (NYSE:OPAD)

Historical Stock Chart

From Apr 2023 to Apr 2024