OCEANEERING INTERNATIONAL INCfalse000007375600000737562024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

OCEANEERING INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-10945 | 95-2628227 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 5875 North Sam Houston Parkway West, Suite 400 | | |

Houston, | TX | 77086 |

| (Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (713) 329-4500

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $0.25 per share | OII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 24, 2024, Oceaneering International, Inc. ("Oceaneering" or "we") issued a press release announcing Oceaneering's earnings for the second quarter ended June 30, 2024. A copy of that press release is furnished as Exhibit 99.1 to this report and is incorporated by reference into this item 2.02.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, unless specifically identified in such filing as being incorporated by reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document.)

|

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | OCEANEERING INTERNATIONAL, INC. |

| | | |

| Date: | July 24, 2024 | By: | /S/ CATHERINE E. DUNN |

| | | Catherine E. Dunn |

| | | Vice President and Chief Accounting Officer |

Exhibit 99.1

Oceaneering Reports Second Quarter 2024 Results

HOUSTON, July 24, 2024 – Oceaneering International, Inc. ("Oceaneering") (NYSE:OII) today reported net income of $35.0 million, or $0.34 per share, on revenue of $669 million for the three months ended June 30, 2024. Adjusted net income was $28.6 million, or $0.28 per share, reflecting the impact of $(1.0) million of pre-tax adjustments associated with foreign exchange gains recognized during the quarter, along with $(5.5) million of expenses related to discrete tax adjustments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary of Results | |

| (in thousands, except per share amounts) | |

| | | | | | | | | | | |

| | For the Three Months Ended | | For the Six Months Ended | |

| | Jun 30, | | Mar 31, | | Jun 30, | |

| | | | | | | |

| | 2024 | | 2023 | | 2024 | | 2024 | | 2023 | |

| | | | | | | | | | | |

| Revenue | | $ | 668,808 | | | $ | 597,910 | | | $ | 599,092 | | | $ | 1,267,900 | | | $ | 1,134,897 | | |

| | | | | | | | | | | |

| Income (Loss) from Operations | | 60,364 | | | 49,199 | | | 36,693 | | | 97,057 | | | 75,949 | | |

| Net Income (Loss) | | 34,997 | | | 19,002 | | | 15,135 | | | 50,132 | | | 23,062 | | |

| | | | | | | | | | | |

| Diluted Earnings (Loss) Per Share | | $ | 0.34 | | | $ | 0.19 | | | $ | 0.15 | | | $ | 0.49 | | | $ | 0.23 | | |

| | | | | |

For the second quarter of 2024:

•Net income was $35.0 million and consolidated adjusted EBITDA was $85.9 million

•Consolidated operating income was $60.4 million

•Cash flow provided by operating activities was $52.6 million and free cash flow was $29.8 million, with an ending cash position of $383 million

As of June 30, 2024:

•Remotely Operated Vehicles (ROV): fleet count was 250; Q2 utilization was 70%; and Q2 average revenue per day utilized was $10,528

•Manufactured Products backlog was $713 million

Roderick A. Larson, President and Chief Executive Officer of Oceaneering, stated, "Activity levels in our energy-related businesses, led by Subsea Robotics (SSR), increased and outperformed our expectations. Our adjusted EBITDA was in line with our guidance and consensus estimates. Compared to the same quarter last year, our consolidated second quarter operating income was 23% higher on a 12% increase in revenue, with higher revenue in all of our business segments and improved operating income in SSR and Manufactured Products.

"As evidenced by our recently announced contract awards, we anticipate continued high levels of activity in our offshore markets throughout the remainder of the year, partially offset by lower expectations in our Aerospace and Defense Technologies (ADTech) segment. As a result, we are narrowing our consolidated adjusted EBITDA guidance range to $340 million to $370 million. We continue to expect positive free cash flow generation for 2024 in the range of $110 million to $150 million."

Second Quarter 2024 Segment Results v. Second Quarter 2023 Segment Results

SSR second quarter 2024 operating income of $61.8 million was 46% higher than the second quarter of 2023. EBITDA margin improved to 34%, as compared to the 30% margin for the same period in 2023.

ROV revenue per day utilized of $10,528 was 16% higher, utilization was flat at 70%, and ROV days utilized were relatively flat at 15,839. ROV fleet use during the quarter was 64% in drill support and 36% in vessel-based activity, compared to 61% and 39%, respectively, in the second quarter of 2023.

Manufactured Products operating income for the second quarter improved 35% on a 12% increase in revenue, with operating income margin improving to 10%. Backlog was $713 million on June 30, 2024, an increase of $295 million year-over-year. The book-to-bill ratio was 1.56 for the 12-month period ending June 30, 2024, as compared to the book-to-bill ratio of 1.19 for the same period last year.

Offshore Projects Group (OPG) operating income for the second quarter declined 23% on a 10% increase in revenue compared to the second quarter of 2023, due to the timing of pre-contract award costs that were expensed during the quarter and changes in project mix. Operating income margin declined to 9% from 13% in the same period in 2023.

As compared to the second quarter of 2023, Integrity Management and Digital Solutions (IMDS) operating income and operating income margin decreased on a 16% increase in revenue.

While ADTech experienced a 4% increase in revenue in the second quarter, operating income declined significantly as compared to the same period last year, due to a reserve taken during the quarter for a contract dispute as well as lower activity levels in our space systems business.

At the corporate level, Unallocated Expenses of $39.7 million were in line with guidance for the quarter but higher than the same period last year.

Third Quarter 2024 Guidance

On a consolidated basis, third quarter 2024 operating results are expected to continue to improve sequentially, with EBITDA in the range of $95 million to $105 million on a low- to mid-single digit percentage increase in revenue. At the segment level, for the third quarter of 2024, as compared to the second quarter 2024:

•SSR activity levels and operating profitability are expected to improve slightly;

•Manufactured Products revenue is forecasted to be higher with lower operating profitability;

•OPG revenue is expected to be similar to the second quarter of 2024 while generating significantly higher operating profitability;

•IMDS activity levels and operating profitability are expected to be relatively flat;

•ADTech revenue is projected to be flat with significantly higher operating profitability; and

•Unallocated Expenses are forecasted to be in the $40 million range.

Updated Full-Year 2024 Guidance

Full-year 2024 consolidated and segment guidance remains the same as previously provided, except as follows:

•Consolidated adjusted EBITDA is expected in the range of $340 million to $370 million,

•Net income is expected in the range of $130 million to $150 million; and

•ADTech operating income and margins are expected to be lower as compared to 2023.

Non-GAAP Financial Measures

Adjusted net income (loss) and earnings (loss) per share; EBITDA and adjusted EBITDA (as well as EBITDA and adjusted EBITDA margins); and free cash flow are non-GAAP measures that exclude the impacts of certain identified items. Reconciliations to the corresponding GAAP measures are shown in the tables Adjusted Net Income (Loss) and Diluted Earnings (Loss) per Share (EPS), EBITDA and Adjusted EBITDA and Margins, Free Cash Flow, 2024 Adjusted EBITDA and Free Cash Flow Estimates, and EBITDA and Adjusted EBITDA and Margins by Segment. These tables are included below under the caption Reconciliations of Non-GAAP to GAAP Financial Information.

Conference Call Details

Oceaneering has scheduled a conference call and webcast on Thursday, July 25, 2024 at 10:00 a.m. Central Time, to discuss its results for the second quarter of 2024, as well as more detailed guidance for the full year and third quarter of 2024. Interested parties may listen to the call through a webcast link posted in the Investor Relations section of Oceaneering's website. A replay of the conference call will be made available on the website approximately two hours following the conclusion of the live call.

This release contains "forward-looking statements," as defined in the Private Securities Litigation Reform Act of 1995, including, without limitation, statements as to the expectations, beliefs, future expected business, and financial performance and prospects of Oceaneering. More specifically, the forward-looking statements in this press release include the statements concerning Oceaneering’s: full-year 2024 guidance range for consolidated adjusted EBITDA, free cash flow, net income, and ADTech operating income and margins; third-quarter 2024 guidance for consolidated EBITDA, operating segment revenues, operating results, operating profitability, segment activity levels, and Unallocated Expenses; expectation that 2024 will generate positive free cash flow; expectations for improved financial performance and conditions in 2024, including activity levels by segment; and the characterization, whether positive or otherwise, of market fundamentals, conditions, and dynamic, robotics markets, offshore energy activity levels (including by geographic location), pricing levels, day rates, ROV days utilized, average ROV revenue per day on hire, vessel utilization, growth, bidding activity, outlook, performance, opportunities, and future financials, including as increasing, favorable, positive, encouraging, improving, seasonal, strong, supportive, robust, meaningful, healthy or significant (which is used herein to indicate a change of 20% or greater).

The forward-looking statements included in this release are based on Oceaneering's current expectations and are subject to certain risks, assumptions, trends, and uncertainties that could cause actual results to differ materially from those indicated by the forward-looking statements. Among the factors that could cause actual results to differ materially include: factors affecting the level of activity in the oil and gas industry, including worldwide demand for and prices of oil and natural gas, oil and natural gas production growth and the supply and demand of offshore drilling rigs; the indirect consequences of climate change and climate-related business trends; actions by members of OPEC and other oil exporting countries; decisions about offshore developments to be made by oil and gas exploration, development and production companies; the use of subsea completions and our ability to capture associated market share; general economic and business conditions and industry trends; the strength of the industry segments in which we are involved; cancellations of contracts, change orders and other contractual modifications, force majeure declarations and the exercise of contractual suspension rights and the resulting adjustments to our backlog; collections from our customers; our future financial performance, including as a result of the availability, terms and deployment of capital; the consequences of significant changes in currency exchange rates; the volatility and uncertainties of credit markets; changes in data privacy and security laws, regulations and standards; changes in tax laws, regulations, and interpretation by taxing authorities; changes in, or our ability to comply with, other laws and governmental regulations, including those relating to the environment; the continued availability of qualified personnel; our ability to obtain raw materials and parts on a timely basis and, in some cases, from limited sources; operating risks normally incident to offshore exploration, development and production operations; hurricanes and other adverse weather and sea conditions; cost and time associated with drydocking of our vessels; the highly competitive nature of our businesses; adverse outcomes from legal or regulatory proceedings; the risks associated with integrating businesses we acquire; rapid technological changes; and social, political, military and economic situations in foreign countries where we do business and the possibilities of civil disturbances, war, other armed conflicts or terrorist attacks. For a more complete discussion of these and other risk factors, please see Oceaneering’s latest annual report on Form 10-K and subsequent

quarterly reports on Form 10-Q filed with the Securities and Exchange Commission. You should not place undue reliance on forward-looking statements. Except to the extent required by applicable law, Oceaneering undertakes no obligation to update or revise any forward-looking statement.

Oceaneering is a global technology company delivering engineered services and products and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries.

For more information on Oceaneering, please visit www.oceaneering.com.

Contact:

investorrelations@oceaneering.com

Hilary Frisbie

Senior Director, Investor Relations

Oceaneering International, Inc.

713-329-4755

- Tables follow on next page -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| OCEANEERING INTERNATIONAL, INC. AND SUBSIDIARIES | |

| | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED BALANCE SHEETS | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Jun 30, 2024 | | Dec 31, 2023 | | |

| | | | | | | | | | | | | | | (in thousands) | |

| ASSETS | | | | | | | | | | | | | | | | | |

| Current assets (including cash and cash equivalents of $382,873 and $461,566) | | | | | | $ | 1,337,130 | | | $ | 1,305,659 | | | |

| Net property and equipment | | | | | | | 416,490 | | | 424,293 | | | |

| Other assets | | | | | | | | | | 551,246 | | | 509,054 | | | |

| | | Total Assets | | | | | | $ | 2,304,866 | | | $ | 2,239,006 | | | |

| | | | | | | | | | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | | | | | | | | |

| Current liabilities | | | | | | | | | | $ | 776,945 | | | $ | 732,476 | | | |

| Long-term debt | | | | | | | | | | 479,378 | | | 477,058 | | | |

| Other long-term liabilities | | | | | | 391,448 | | | 395,389 | | | |

| Equity | | | | | | | | | | 657,095 | | | 634,083 | | | |

| | | Total Liabilities and Equity | | | | | | $ | 2,304,866 | | | $ | 2,239,006 | | | |

| | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | For the Three Months Ended | | For the Six Months Ended | |

| | | | | | | | | Jun 30, 2024 | | Jun 30, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Jun 30, 2023 | | |

| | | | | | | | | (in thousands, except per share amounts) | | |

| | | | | | | | | | | | | | | | | | | |

| Revenue | | | | | | $ | 668,808 | | | $ | 597,910 | | | $ | 599,092 | | | $ | 1,267,900 | | | $ | 1,134,897 | | | |

| Cost of services and products | | 548,597 | | | 496,830 | | | 506,708 | | | 1,055,305 | | | 956,252 | | | |

| | Gross margin | | 120,211 | | | 101,080 | | | 92,384 | | | 212,595 | | | 178,645 | | | |

| Selling, general and administrative expense | | 59,847 | | | 51,881 | | | 55,691 | | | 115,538 | | | 102,696 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Income (loss) from operations | | | | 60,364 | | | 49,199 | | | 36,693 | | | 97,057 | | | 75,949 | | | |

| Interest income | | | | | | 2,402 | | | 4,154 | | | 3,040 | | | 5,442 | | | 8,620 | | | |

| Interest expense | | (9,516) | | | (9,517) | | | (9,204) | | | (18,720) | | | (18,800) | | | |

| Equity in income (losses) of unconsolidated affiliates | | 295 | | | 479 | | | 169 | | | 464 | | | 1,118 | | | |

| Other income (expense), net | | 1,759 | | | (5,846) | | | 1,480 | | | 3,239 | | | (5,768) | | | |

| | Income (loss) before income taxes | | 55,304 | | | 38,469 | | | 32,178 | | | 87,482 | | | 61,119 | | | |

| Provision (benefit) for income taxes | | 20,307 | | | 19,467 | | | 17,043 | | | 37,350 | | | 38,057 | | | |

| | Net Income (Loss) | | $ | 34,997 | | | $ | 19,002 | | | $ | 15,135 | | | $ | 50,132 | | | $ | 23,062 | | | |

| | | | | | | | | | | | | | | | | | | |

| Weighted average diluted shares outstanding | | 102,472 | | | 102,004 | | | 102,250 | | | 102,361 | | | 102,017 | | | |

| Diluted earnings (loss) per share | | $ | 0.34 | | | $ | 0.19 | | | $ | 0.15 | | | $ | 0.49 | | | $ | 0.23 | | | |

| | | | | | | | | | | | | | | | | | | |

| The above Condensed Consolidated Balance Sheets and Condensed Consolidated Statements of Operations should be read in conjunction with the Company's latest Annual Report on Form 10-K and Quarterly Report on Form 10-Q. | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SEGMENT INFORMATION | |

| | | | | | | | | |

| | | | | | For the Three Months Ended | | For the Six Months Ended | |

| | | | | | Jun 30, 2024 | | Jun 30, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Jun 30, 2023 | |

| | | | | ($ in thousands) | |

| Subsea Robotics | | | | | | | | | | | | | | |

| | Revenue | | | $ | 214,985 | | | $ | 186,512 | | | $ | 186,932 | | | $ | 401,917 | | | $ | 355,673 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 61,750 | | | $ | 42,227 | | | $ | 44,237 | | | $ | 105,987 | | | $ | 75,881 | | |

| Operating income (loss) % | | | 29 | % | | 23 | % | | 24 | % | | 26 | % | | 21 | % | |

| ROV days available | | | 22,750 | | | 22,750 | | | 22,750 | | | 45,500 | | | 45,250 | | |

| ROV days utilized | | | 15,839 | | | 16,032 | | | 14,536 | | | 30,375 | | | 30,260 | | |

| ROV utilization | | | 70 | % | | 70 | % | | 64 | % | | 67 | % | | 67 | % | |

| | | | | | | | | | | | | | | |

| Manufactured Products | | | | | | | | | | | | | | |

| | Revenue | | | $ | 139,314 | | | $ | 124,882 | | | $ | 129,453 | | | $ | 268,767 | | | $ | 237,821 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 14,369 | | | $ | 10,607 | | | $ | 13,190 | | | $ | 27,559 | | | $ | 21,887 | | |

| Operating income (loss) % | | | 10 | % | | 8 | % | | 10 | % | | 10 | % | | 9 | % | |

| Backlog at end of period | | | $ | 713,000 | | | $ | 418,000 | | | $ | 597,000 | | | $ | 713,000 | | | $ | 418,000 | | |

| | | | | | | | | | | | | | | |

| Offshore Projects Group | | | | | | | | | | | | | | |

| | Revenue | | | $ | 144,058 | | | $ | 130,547 | | | $ | 115,054 | | | $ | 259,112 | | | $ | 234,854 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 13,248 | | | $ | 17,132 | | | $ | 844 | | | $ | 14,092 | | | $ | 22,646 | | |

| Operating income (loss) % | | | 9 | % | | 13 | % | | 1 | % | | 5 | % | | 10 | % | |

| | | | | | | | | | | | | | | |

| Integrity Management & Digital Solutions | | | | | | | | | | | | |

| | Revenue | | | $ | 73,492 | | | $ | 63,166 | | | $ | 69,690 | | | $ | 143,182 | | | $ | 123,249 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 3,473 | | | $ | 3,844 | | | $ | 3,615 | | | $ | 7,088 | | | $ | 6,926 | | |

| Operating income (loss) % | | | 5 | % | | 6 | % | | 5 | % | | 5 | % | | 6 | % | |

| | | | | | | | | | | | | | | |

| Aerospace and Defense Technologies | | | | | | | | | | | | |

| | Revenue | | | $ | 96,959 | | | $ | 92,803 | | | $ | 97,963 | | | $ | 194,922 | | | $ | 183,300 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 7,244 | | | $ | 11,357 | | | $ | 12,808 | | | $ | 20,052 | | | $ | 19,853 | | |

| Operating income (loss) % | | | 7 | % | | 12 | % | | 13 | % | | 10 | % | | 11 | % | |

| | | | | | | | | | | | | | |

| Unallocated Expenses | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | (39,720) | | | $ | (35,968) | | | $ | (38,001) | | | $ | (77,721) | | | $ | (71,244) | | |

| | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | |

| | | Revenue | | | $ | 668,808 | | | $ | 597,910 | | | $ | 599,092 | | | $ | 1,267,900 | | | $ | 1,134,897 | | |

| | | | | | | | | | | | | |

| Operating income (loss) | | | $ | 60,364 | | | $ | 49,199 | | | $ | 36,693 | | | $ | 97,057 | | | $ | 75,949 | | |

| Operating income (loss) % | | | 9 | % | | 8 | % | | 6 | % | | 8 | % | | 7 | % | |

| |

| The above Segment Information does not include adjustments for non-recurring transactions. See the tables below under the caption "Reconciliations of Non-GAAP to GAAP Financial Information" for financial measures that our management considers in evaluating our ongoing operations. | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SELECTED CASH FLOW INFORMATION | |

| | | | | | | | | | | |

| | | | | | For the Three Months Ended | | For the Six Months Ended | |

| | | | | | Jun 30, 2024 | | Jun 30, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Jun 30, 2023 | |

| | | | | | (in thousands) | |

| | | | | | | | | | | | |

| Capital Expenditures, including Acquisitions | | | $ | 22,858 | | | $ | 22,428 | | | $ | 25,518 | | | $ | 48,376 | | | $ | 40,736 | | |

| | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | |

| Depreciation and Amortization: | | | | | | | | | | | | |

| Energy Services and Products | | | | | | | | | | | | |

| Subsea Robotics | | | $ | 11,981 | | | $ | 13,356 | | | $ | 12,810 | | | $ | 24,791 | | | $ | 28,296 | | |

| Manufactured Products | | | 3,237 | | | 3,013 | | | 3,175 | | | 6,412 | | | 6,057 | | |

| Offshore Projects Group | | | 5,584 | | | 6,976 | | | 6,435 | | | 12,019 | | | 14,104 | | |

| Integrity Management & Digital Solutions | | | 1,803 | | | 939 | | | 1,259 | | | 3,062 | | | 1,797 | | |

| Total Energy Services and Products | | | 22,605 | | | 24,284 | | | 23,679 | | | 46,284 | | | 50,254 | | |

| Aerospace and Defense Technologies | | | 616 | | | 632 | | | 603 | | | 1,219 | | | 1,285 | | |

| Unallocated Expenses | | | 2,759 | | | 1,130 | | | 2,776 | | | 5,535 | | | 2,328 | | |

| | Total Depreciation and Amortization | | | $ | 25,980 | | | $ | 26,046 | | | $ | 27,058 | | | $ | 53,038 | | | $ | 53,867 | | |

| | | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | |

RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION

In addition to financial results determined in accordance with U.S. generally accepted accounting principles ("GAAP"), this Press Release also includes non-GAAP financial measures (as defined under certain rules and regulations promulgated by the Securities and Exchange Commission). We have included Adjusted Net Income (Loss) and Diluted Earnings (Loss) per Share, each of which excludes the effects of certain specified items, as set forth in the tables that follow. As a result, these amounts are non-GAAP financial measures. We believe these are useful measures for investors to review because they provide consistent measures of the underlying results of our ongoing business. Furthermore, our management uses these measures as measures of the performance of our operations. We have also included disclosures of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), EBITDA Margins, 2023 Adjusted EBITDA Estimates, and Free Cash Flow, as well as the following by segment: EBITDA, EBITDA Margins, Adjusted EBITDA and Adjusted EBITDA Margins. We define EBITDA Margin as EBITDA divided by revenue. Adjusted EBITDA and Adjusted EBITDA Margins and related information by segment exclude the effects of certain specified items, as set forth in the tables that follow. EBITDA and EBITDA Margins, Adjusted EBITDA and Adjusted EBITDA Margins, and related information by segment are each non-GAAP financial measures. We define Free Cash Flow as cash flow provided by operating activities less organic capital expenditures (i.e., purchases of property and equipment other than those in business acquisitions). We have included these disclosures in this press release because EBITDA, EBITDA Margins and Free Cash Flow are widely used by investors for valuation purposes and for comparing our financial performance with the performance of other companies in our industry, and the adjusted amounts thereof provide more consistent measures than the unadjusted amounts. Furthermore, our management uses these measures for purposes of evaluating our financial performance. Our presentation of EBITDA, EBITDA Margins and Free Cash Flow (and the Adjusted amounts thereof) may not be comparable to similarly titled measures other companies report. Non-GAAP financial measures should be viewed in addition to and not as substitutes for our reported operating results, cash flows or any other measure prepared and reported in accordance with GAAP. The tables that follow provide reconciliations of the non-GAAP measures used in this press release to the most directly comparable GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION | |

(continued)

| |

| | | | | | | | | | | | | | | | |

| Adjusted Net Income (Loss) and Diluted Earnings (Loss) per Share (EPS) | |

| | | | | | | | | | | | | | | | |

| | | | | For the Three Months Ended | |

| | | | | Jun 30, 2024 | Jun 30, 2023 | Mar 31, 2024 | |

| | | | | Net Income (Loss) | | Diluted EPS | | Net Income (Loss) | | Diluted EPS | | Net Income (Loss) | | Diluted EPS | |

| | | | | (in thousands, except per share amounts) | |

| | | | | | | |

| Net income (loss) and diluted EPS as reported in accordance with GAAP | | $ | 34,997 | | | $ | 0.34 | | | $ | 19,002 | | | $ | 0.19 | | | $ | 15,135 | | | $ | 0.15 | | |

| Pre-tax adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | (1,034) | | | | | 4,845 | | | | | (2,197) | | | | |

| Total pre-tax adjustments | | (1,034) | | | | | 4,845 | | | | | (2,197) | | | | |

| | | | | | | | | | | | | | | | |

| Tax effect on pre-tax adjustments at the applicable jurisdictional statutory rate in effect for respective periods | | 70 | | | | | (2,387) | | | | | 790 | | | | |

| Discrete tax items: | | | | | | | | | | | | | |

| Share-based compensation | | (48) | | | | | (3) | | | | | (1,926) | | | | |

| Uncertain tax positions | | 1,706 | | | | | 4,312 | | | | | (149) | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Valuation allowances | | 520 | | | | | (8,678) | | | | | 4,571 | | | | |

| Other | | (7,645) | | | | | 1,563 | | | | | (2,336) | | | | |

| Total discrete tax adjustments | | (5,467) | | | | | (2,806) | | | | | 160 | | | | |

| Total of adjustments | | (6,431) | | | | | (348) | | | | | (1,247) | | | | |

| Adjusted Net Income (Loss) | | $ | 28,566 | | | $ | 0.28 | | | $ | 18,654 | | | $ | 0.18 | | | $ | 13,888 | | | $ | 0.14 | | |

| Weighted average diluted shares outstanding utilized for Adjusted Net Income (Loss) | | | | 102,472 | | | | | 102,004 | | | | | 102,250 | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION | |

| (continued) | |

| | | | | | | | | | | | | | | | |

| Adjusted Net Income (Loss) and Diluted Earnings (Loss) per Share (EPS) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | For the Six Months Ended | |

| | | | | | Jun 30, 2024 | Jun 30, 2023 | |

| | | | | | | | | Net Income (Loss) | | Diluted EPS | | Net Income (Loss) | | Diluted EPS | |

| | | | | | | | | (in thousands, except per share amounts) | |

| | | | | | | |

| Net income (loss) and diluted EPS as reported in accordance with GAAP | | | | | | $ | 50,132 | | | $ | 0.49 | | | $ | 23,062 | | | $ | 0.23 | | |

| Pre-tax adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | | | | | (3,231) | | | | | 4,578 | | | | |

| Total pre-tax adjustments | | | | | | (3,231) | | | | | 4,578 | | | | |

| | | | | | | | | | | | | | | | |

| Tax effect on pre-tax adjustments at the applicable jurisdictional statutory rate in effect for respective periods | | | | | | 860 | | | | | (2,303) | | | | |

| Discrete tax items: | | | | | | | | | | | | | |

| Share-based compensation | | | | | | (1,974) | | | | | (1,370) | | | | |

| Uncertain tax positions | | | | | | 1,557 | | | | | 4,401 | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Valuation allowances | | | | | | 5,091 | | | | | (5,102) | | | | |

| Other | | | | | | (9,981) | | | | | 770 | | | | |

| Total discrete tax adjustments | | | | | | (5,307) | | | | | (1,301) | | | | |

| Total of adjustments | | | | | | (7,678) | | | | | 974 | | | | |

| Adjusted Net Income (Loss) | | | | | | $ | 42,454 | | | $ | 0.41 | | | $ | 24,036 | | | $ | 0.24 | | |

| Weighted average diluted shares outstanding utilized for Adjusted Net Income (Loss) | | | | | | | | 102,361 | | | | | 102,017 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION |

| (continued) |

| | | | | | | | | | | | | |

| EBITDA and Adjusted EBITDA and Margins |

| | | | | | | | | | | | | |

| | | | | For the Three Months Ended | | For the Six Months Ended |

| | | | | Jun 30, 2024 | | Jun 30, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Jun 30, 2023 |

| | | | | ($ in thousands) |

| | | | | | | | | | | | | |

| Net income (loss) | | | $ | 34,997 | | | $ | 19,002 | | | $ | 15,135 | | | $ | 50,132 | | | $ | 23,062 | |

| Depreciation and amortization | | | 25,980 | | | 26,046 | | | 27,058 | | | 53,038 | | | 53,867 | |

| Subtotal | | | 60,977 | | | 45,048 | | | 42,193 | | | 103,170 | | | 76,929 | |

| Interest expense, net of interest income | | 7,114 | | | 5,363 | | | 6,164 | | | 13,278 | | | 10,180 | |

| Amortization included in interest expense | | (1,504) | | | 37 | | | (1,479) | | | (2,983) | | | 63 | |

| Provision (benefit) for income taxes | | | 20,307 | | | 19,467 | | | 17,043 | | | 37,350 | | | 38,057 | |

| EBITDA | | | 86,894 | | | 69,915 | | | 63,921 | | | 150,815 | | | 125,229 | |

| Adjustments for the effects of: | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Foreign currency (gains) losses | | | (1,034) | | | 4,845 | | | (2,197) | | | (3,231) | | | 4,578 | |

| | Total of adjustments | | | (1,034) | | | 4,845 | | | (2,197) | | | (3,231) | | | 4,578 | |

| Adjusted EBITDA | | | $ | 85,860 | | | $ | 74,760 | | | $ | 61,724 | | | $ | 147,584 | | | $ | 129,807 | |

| | | | | | | | | | | | | |

| Revenue | | | $ | 668,808 | | | $ | 597,910 | | | $ | 599,092 | | | $ | 1,267,900 | | | $ | 1,134,897 | |

| | | | | | | | | | | | | |

| EBITDA margin % | | | 13 | % | | 12 | % | | 11 | % | | 12 | % | | 11 | % |

| Adjusted EBITDA margin % | | | 13 | % | | 13 | % | | 10 | % | | 12 | % | | 11 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

| | | | | | | | | | | |

| | | | | | | | | | | |

| Free Cash Flow |

| | | | | | | | | | | |

| | | For the Three Months Ended | | For the Six Months Ended |

| | | Jun 30, 2024 | | Jun 30, 2023 | | Mar 31, 2024 | | Jun 30, 2024 | | Jun 30, 2023 |

| | | (in thousands) |

| Net Income (loss) | | $ | 34,997 | | | $ | 19,002 | | | $ | 15,135 | | | $ | 50,132 | | | $ | 23,062 | |

| Non-cash adjustments: | | | | | | | | | | |

| Depreciation and amortization | | 25,980 | | | 26,046 | | | 27,058 | | | 53,038 | | | 53,867 | |

| | | | | | | | | | | |

| Other non-cash | | 1,744 | | | 2,923 | | | 2,682 | | | 4,426 | | | 2,735 | |

| Other increases (decreases) in cash from operating activities | | (10,098) | | | (27,520) | | | (114,592) | | | (124,690) | | | (102,132) | |

| Cash flow provided by (used in) operating activities | | 52,623 | | | 20,451 | | | (69,717) | | | (17,094) | | | (22,468) | |

| Purchases of property and equipment | | (22,858) | | | (22,428) | | | (25,518) | | | (48,376) | | | (40,736) | |

| Free Cash Flow | | $ | 29,765 | | | $ | (1,977) | | | $ | (95,235) | | | $ | (65,470) | | | $ | (63,204) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION |

| (continued) |

| | | | | | | | | | | |

| 2024 Adjusted EBITDA Estimates |

| | | | | | | | | | | |

| | | | | | | | | For the Three Months Ending |

| | | | | | | | | September 30, 2024 |

| | | | | | | | | Low | | High |

| | | | | | | | | (in thousands) |

| Income (loss) before income taxes | | | | | | | | $ | 65,000 | | | $ | 70,000 | |

| Depreciation and amortization | | | | | | | | 24,000 | | | 28,000 | |

| Subtotal | | | | | | | | 89,000 | | | 98,000 | |

| Interest expense, net of interest income | | | | | | | | 6,000 | | | 7,000 | |

| Adjusted EBITDA | | | | | | | | $ | 95,000 | | | $ | 105,000 | |

| | | | | | | | | | | |

| | | | | | | | | For the Year Ending |

| | | | | | | | | December 31, 2024 |

| | | | | | | | | Low | | High |

| | | | | | | | | (in thousands) |

| Income (loss) before income taxes | | | | | | | | $ | 215,000 | | | $ | 232,000 | |

| Depreciation and amortization | | | | | | | | 100,000 | | | 110,000 | |

| Subtotal | | | | | | | | 315,000 | | | 342,000 | |

| Interest expense, net of interest income | | | | | | | | 25,000 | | | 28,000 | |

| Adjusted EBITDA | | | | | | | | $ | 340,000 | | | $ | 370,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 2024 Free Cash Flow Estimate |

| | | | | | | | | | | |

| | | | | | | | | For the Year Ending |

| | | | | | | | | December 31, 2024 |

| | | | | | | | | Low | | High |

| | | | | | | | | (in thousands) |

| Net income (loss) | | | | | | | | $ | 130,000 | | | $ | 150,000 | |

| Depreciation and amortization | | | | | | | | 100,000 | | | 110,000 | |

| Other increases (decreases) in cash from operating activities | | | | | | (10,000) | | | 20,000 | |

| Cash flow provided by (used in) operating activities | | | | | | 220,000 | | | 280,000 | |

| Purchases of property and equipment | | | | | | | | (110,000) | | | (130,000) | |

| Free Cash Flow | | | | | | | | $ | 110,000 | | | $ | 150,000 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION |

| (continued) |

| | |

| EBITDA and Adjusted EBITDA and Margins by Segment |

|

| | | | For the Three Months Ended June 30, 2024 |

| | | | SSR | | MP | | OPG | | IMDS | | ADTech | | Unallocated Expenses and other | | Total |

| | | | ($ in thousands) |

| Operating Income (Loss) as reported in accordance with GAAP | | $ | 61,750 | | $ | 14,369 | | $ | 13,248 | | $ | 3,473 | | $ | 7,244 | | $ | (39,720) | | $ | 60,364 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| Depreciation and amortization | | 11,981 | | 3,237 | | 5,584 | | 1,803 | | 616 | | 2,759 | | 25,980 |

| Other pre-tax | | — | | — | | — | | — | | — | | 550 | | 550 |

| EBITDA | | 73,731 | | 17,606 | | 18,832 | | 5,276 | | 7,860 | | (36,411) | | 86,894 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | — | | — | | — | | — | | — | | (1,034) | | (1,034) |

| | Total of adjustments | | — | | — | | — | | — | | — | | (1,034) | | (1,034) |

| Adjusted EBITDA | | $ | 73,731 | | $ | 17,606 | | $ | 18,832 | | $ | 5,276 | | $ | 7,860 | | $ | (37,445) | | $ | 85,860 |

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 214,985 | | $ | 139,314 | | $ | 144,058 | | $ | 73,492 | | $ | 96,959 | | | | $ | 668,808 |

| Operating income (loss) % as reported in accordance with GAAP | | 29 | % | | 10 | % | | 9 | % | | 5 | % | | 7 | % | | | | 9 | % |

| EBITDA Margin | | 34 | % | | 13 | % | | 13 | % | | 7 | % | | 8 | % | | | | 13 | % |

| Adjusted EBITDA Margin | | 34 | % | | 13 | % | | 13 | % | | 7 | % | | 8 | % | | | | 13 | % |

| | | | | | | | | | | | | | | | |

| | | | For the Three Months Ended June 30, 2023 |

| | | | SSR | | MP | | OPG | | IMDS | | ADTech | | Unallocated Expenses and other | | Total |

| | | | ($ in thousands) |

| Operating Income (Loss) as reported in accordance with GAAP | | $ | 42,227 | | $ | 10,607 | | $ | 17,132 | | $ | 3,844 | | $ | 11,357 | | $ | (35,968) | | $ | 49,199 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| Depreciation and amortization | | 13,356 | | 3,013 | | 6,976 | | 939 | | 632 | | 1,130 | | 26,046 |

| Other pre-tax | | — | | — | | — | | — | | — | | (5,330) | | (5,330) |

| EBITDA | | 55,583 | | 13,620 | | 24,108 | | 4,783 | | 11,989 | | (40,168) | | 69,915 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | — | | — | | — | | — | | — | | 4,845 | | 4,845 |

| | Total of adjustments | | — | | — | | — | | — | | — | | 4,845 | | 4,845 |

| Adjusted EBITDA | | $ | 55,583 | | $ | 13,620 | | $ | 24,108 | | $ | 4,783 | | $ | 11,989 | | $ | (35,323) | | $ | 74,760 |

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 186,512 | | $ | 124,882 | | $ | 130,547 | | $ | 63,166 | | $ | 92,803 | | | | $ | 597,910 |

| Operating income (loss) % as reported in accordance with GAAP | | 23 | % | | 8 | % | | 13 | % | | 6 | % | | 12 | % | | | | 8 | % |

| EBITDA Margin | | 30 | % | | 11 | % | | 18 | % | | 8 | % | | 13 | % | | | | 12 | % |

| Adjusted EBITDA Margin | | 30 | % | | 11 | % | | 18 | % | | 8 | % | | 13 | % | | | | 13 | % |

| | | | | | | | | | | | | | | | |

`

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION |

| (continued) |

| | |

| EBITDA and Adjusted EBITDA and Margins by Segment |

|

| | | | For the Three Months Ended March 31, 2024 |

| | | | SSR | | MP | | OPG | | IMDS | | ADTech | | Unallocated Expenses and other | | Total |

| | | | ($ in thousands) |

| Operating Income (Loss) as reported in accordance with GAAP | | $ | 44,237 | | $ | 13,190 | | $ | 844 | | $ | 3,615 | | $ | 12,808 | | $ | (38,001) | | $ | 36,693 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| Depreciation and amortization | | 12,810 | | 3,175 | | 6,435 | | 1,259 | | 603 | | 2,776 | | 27,058 |

| Other pre-tax | | — | | — | | — | | — | | — | | 170 | | 170 |

| EBITDA | | 57,047 | | 16,365 | | 7,279 | | 4,874 | | 13,411 | | (35,055) | | 63,921 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | — | | — | | — | | — | | — | | (2,197) | | (2,197) |

| | Total of adjustments | | — | | — | | — | | — | | — | | (2,197) | | (2,197) |

| Adjusted EBITDA | | $ | 57,047 | | $ | 16,365 | | $ | 7,279 | | $ | 4,874 | | $ | 13,411 | | $ | (37,252) | | $ | 61,724 |

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 186,932 | | $ | 129,453 | | $ | 115,054 | | $ | 69,690 | | $ | 97,963 | | | | $ | 599,092 |

| Operating income (loss) % as reported in accordance with GAAP | | 24 | % | | 10 | % | | 1 | % | | 5 | % | | 13 | % | | | | 6 | % |

| EBITDA Margin | | 31 | % | | 13 | % | | 6 | % | | 7 | % | | 14 | % | | | | 11 | % |

| Adjusted EBITDA Margin | | 31 | % | | 13 | % | | 6 | % | | 7 | % | | 14 | % | | | | 10 | % |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL INFORMATION |

| (continued) |

| | |

| EBITDA and Adjusted EBITDA and Margins by Segment |

|

| | | | For the Six Months Ended June 30, 2024 |

| | | | SSR | | MP | | OPG | | IMDS | | ADTech | | Unallocated Expenses and other | | Total |

| | | | ($ in thousands) |

| Operating Income (Loss) as reported in accordance with GAAP | | $ | 105,987 | | $ | 27,559 | | $ | 14,092 | | $ | 7,088 | | $ | 20,052 | | $ | (77,721) | | $ | 97,057 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| Depreciation and amortization | | 24,791 | | 6,412 | | 12,019 | | 3,062 | | 1,219 | | 5,535 | | 53,038 |

| Other pre-tax | | — | | — | | — | | — | | — | | 720 | | 720 |

| EBITDA | | 130,778 | | 33,971 | | 26,111 | | 10,150 | | 21,271 | | (71,466) | | 150,815 |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | — | | — | | — | | — | | — | | (3,231) | | (3,231) |

| | Total of adjustments | | — | | — | | — | | — | | — | | (3,231) | | (3,231) |

| Adjusted EBITDA | | $ | 130,778 | | $ | 33,971 | | $ | 26,111 | | $ | 10,150 | | $ | 21,271 | | $ | (74,697) | | $ | 147,584 |

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 401,917 | | $ | 268,767 | | $ | 259,112 | | $ | 143,182 | | $ | 194,922 | | | | $ | 1,267,900 |

| Operating income (loss) % as reported in accordance with GAAP | | 26 | % | | 10 | % | | 5 | % | | 5 | % | | 10 | % | | | | 8 | % |

| EBITDA Margin | | 33 | % | | 13 | % | | 10 | % | | 7 | % | | 11 | % | | | | 12 | % |

| Adjusted EBITDA Margin | | 33 | % | | 13 | % | | 10 | % | | 7 | % | | 11 | % | | | | 12 | % |

| | | | | | | | | | | | | | | | |

| | | | For the Six Months Ended June 30, 2023 |

| | | | SSR | | MP | | OPG | | IMDS | | ADTech | | Unallocated Expenses and other | | Total |

| | | | ($ in thousands) |

| Operating Income (Loss) as reported in accordance with GAAP | | $ | 75,881 | | | $ | 21,887 | | | $ | 22,646 | | | $ | 6,926 | | | $ | 19,853 | | | $ | (71,244) | | | $ | 75,949 | |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| Depreciation and amortization | | 28,296 | | | 6,057 | | | 14,104 | | | 1,797 | | | 1,285 | | | 2,328 | | | 53,867 | |

| Other pre-tax | | — | | | — | | | — | | | — | | | — | | | (4,587) | | | (4,587) | |

| EBITDA | | 104,177 | | | 27,944 | | | 36,750 | | | 8,723 | | | 21,138 | | | (73,503) | | | 125,229 | |

| Adjustments for the effects of: | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Foreign currency (gains) losses | | — | | | — | | | — | | | — | | | — | | | 4,578 | | | 4,578 | |

| | Total of adjustments | | — | | | — | | | — | | | — | | | — | | | 4,578 | | | 4,578 | |

| Adjusted EBITDA | | $ | 104,177 | | | $ | 27,944 | | | $ | 36,750 | | | $ | 8,723 | | | $ | 21,138 | | | $ | (68,925) | | | $ | 129,807 | |

| | | | | | | | | | | | | | | | |

| Revenue | | $ | 355,673 | | | $ | 237,821 | | | $ | 234,854 | | | $ | 123,249 | | | $ | 183,300 | | | | | $ | 1,134,897 | |

| Operating income (loss) % as reported in accordance with GAAP | | 21 | % | | 9 | % | | 10 | % | | 6 | % | | 11 | % | | | | 7 | % |

| EBITDA Margin | | 29 | % | | 12 | % | | 16 | % | | 7 | % | | 12 | % | | | | 11 | % |

| Adjusted EBITDA Margin | | 29 | % | | 12 | % | | 16 | % | | 7 | % | | 12 | % | | | | 11 | % |

| | | | | | | | | | | | | | | | |

Document and Entity Information Document

|

Jul. 24, 2024 |

| Cover Page [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

OCEANEERING INTERNATIONAL INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-10945

|

| Entity Tax Identification Number |

95-2628227

|

| Entity Address, Address Line One |

5875 North Sam Houston Parkway West, Suite 400

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77086

|

| City Area Code |

713

|

| Local Phone Number |

329-4500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.25 per share

|

| Trading Symbol |

OII

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000073756

|

| Document Period End Date |

Jul. 24, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

oii_CoverPageAbstract |

| Namespace Prefix: |

oii_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

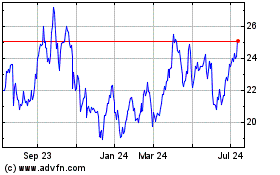

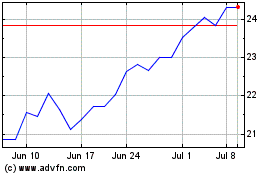

Oceaneering (NYSE:OII)

Historical Stock Chart

From Jan 2025 to Feb 2025

Oceaneering (NYSE:OII)

Historical Stock Chart

From Feb 2024 to Feb 2025