Nuveen Dividend Advantage Municipal Income Fund Announces Intention to Redeem Preferred Shares

September 19 2014 - 4:40PM

Business Wire

Nuveen Investments, a leading global provider of investment

services to institutions as well as individual investors, today

announced that the Board of Trustees of Nuveen Dividend Advantage

Municipal Income Fund (NVG) has approved the fund’s plan to

redeem a portion of its preferred shares. The fund has filed with

the Securities and Exchange Commission a notice of intention to

redeem a portion of its outstanding Variable Rate Demand Preferred

(VRDP) shares.

VRDP shares will be redeemed at their $100,000 liquidation

preference per share, plus an optional redemption premium and an

additional amount representing the final accumulated dividend

amounts owed. The fund intends to finance its preferred share

redemption with cash on hand and from the proceeds of sales of

securities in its investment portfolio. The redemption is

contingent upon the completion of the fund’s previously announced

common share tender offer, which may be delayed or extended as

determined by the Board. Formal notice of the redemption will be

delivered to preferred shareholders at a later date through The

Depository Trust Company (DTC).

The fund intends to redeem a portion of its preferred shares are

as follows:

Fund Common

Share Symbol VRDP CUSIP

Nuveen Dividend Advantage Municipal Income

Fund

NVG 67071L 700

The anticipated redemption date is October 21, 2014.

The address of the VRDP shares tender and paying agent, The Bank

of New York Mellon, is 101 Barclay Street, New York, New York

10286.

No VRDP shares have been registered under the Securities Act of

1933 (the Securities Act) or any state securities laws. Unless so

registered, no VRDP shares may be offered or sold in the United

States except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws. This press release is neither an offer to sell nor a

solicitation of an offer to buy any of these securities.

Nuveen Investments provides high-quality investment services

designed to help secure the long-term goals of institutional and

individual investors as well as the consultants and financial

advisors who serve them. Nuveen Investments markets a wide range of

specialized investment solutions which provide investors access to

capabilities of its high-quality boutique investment

affiliates—Nuveen Asset Management, LLC, Symphony Asset Management

LLC, NWQ Investment Management Company, LLC, Santa Barbara Asset

Management, LLC, Tradewinds Global Investors, LLC, Winslow Capital

Management, LLC and Gresham Investment Management LLC, all of which

are registered investment advisers and subsidiaries of Nuveen

Investments, Inc. Funds distributed by Nuveen Securities, LLC, a

subsidiary of Nuveen Investments, Inc. In total, Nuveen Investments

managed $231 billion as of June 30, 2014. For more information,

please visit the Nuveen Investments website

at www.nuveen.com.

FORWARD LOOKING STATEMENTS

Certain statements made in this release are forward-looking

statements. Actual future results or occurrences may differ

significantly from those anticipated in any forward-looking

statements due to numerous factors. These include, but are not

limited to:

- the consummation of the fund’s common

share tender offer for a portion of its outstanding common

shares;

- having the cash on hand or generating

enough proceeds from the sale of portfolio securities sufficient

for the fund to redeem a portion of its VRDP shares;

- other legal and regulatory

developments; and

- other additional risks and

uncertainties.

Nuveen and the closed-end funds managed by Nuveen and its

affiliates undertake no responsibility to update publicly or revise

any forward-looking statement.

The Annual and Semi-Annual Reports and other regulatory filings

of the Nuveen closed-end funds with the Securities and Exchange

Commission (“SEC”) are accessible on the SEC’s web site

at www.sec.gov and on Nuveen’s web site at

www.nuveen.com and may discuss the above-mentioned or other

factors that affect the Nuveen closed-end funds. The information

contained on the SEC’s web site and our web site is not a part of

this press release.

CI-9442921 v2

Nuveen InvestmentsMedia Contact:Kristyna Munoz, (312)

917-8343kristyna.munoz@nuveen.com

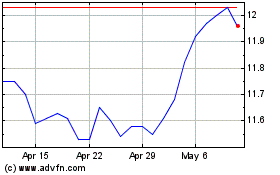

Nuveen AMT Free Municipa... (NYSE:NVG)

Historical Stock Chart

From Oct 2024 to Nov 2024

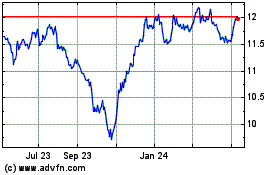

Nuveen AMT Free Municipa... (NYSE:NVG)

Historical Stock Chart

From Nov 2023 to Nov 2024