- Net income per diluted share was $2.99

in the first quarter of 2019 compared with $1.64 in the first

quarter of 2018, which included a net benefit of $0.38 per diluted

share for non-run-rate items

- After-tax margin improved to 4.8% in

the first quarter of 2019 compared with 2.3% in the first quarter

of 2018

- Medical care ratio was 85.3% in the

first quarter, an improvement from 87.7% in the first quarter of

2018, excluding non-run-rate items in the first quarter of

2018

- Premium revenue was $4.0 billion in the

first quarter of 2019, a 9% decrease compared with the first

quarter of 2018, which was in line with the Company’s

expectations

- The Company raised full year 2019

earnings guidance to $10.50 - $11.00 from $9.25 - $9.75, which does

not include any future prior-period reserve development

Molina Healthcare, Inc. (NYSE: MOH) today reported financial

results for the first quarter of 2019 and raised full year 2019

guidance.

“These results are a testament to the achievability of the

second phase of our strategy, which is to sustain the attractive

margin position we had built in 2018,” said Joe Zubretsky,

president and CEO. “While certainly not conclusive, our first

quarter results validate our position that durable financial and

operational improvement can and should allow us to sustain these

margins, all while we begin to grow the top line again.”

Consolidated Results

First Quarter of 2019 Compared with First Quarter of

2018

Net income increased to $198 million from $107 million in the

first quarter of 2018. Net income per diluted share increased to

$2.99 from $1.64 in the first quarter of 2018.

Premium revenue decreased $371 million, or 9%, in the first

quarter of 2019 compared with the first quarter of 2018, as

expected. The decrease was primarily due to the previously

announced loss of the Company’s New Mexico Medicaid contract along

with the resizing of the Company’s Florida Medicaid contract and

the related transition out of all but two regions.

The medical care ratio (MCR) was 85.3% in the first quarter of

2019, an improvement compared with 86.1% in the first quarter of

2018. Excluding the $70 million benefit of the 2017 Marketplace

cost-sharing reduction (CSR) reimbursement recognized in first

quarter of 2018, the MCR would have been 87.7% in the first quarter

of 2018. The change in the overall MCR was due to:

- The Medicaid MCR was 88.5% in the first

quarter of 2019, an improvement compared with 90.8% in the first

quarter of 2018. This was mainly due to improvements in the

Temporary Assistance for Needy Families and Aged, Blind or Disabled

programs, partially offset by an increased MCR in the Medicaid

Expansion program, primarily in California and Ohio.

- The Marketplace MCR was 62.2% in the

first quarter of 2019, compared with 50.6% in the first quarter of

2018. The prior year MCR was positively impacted by the benefit of

the CSR, without which the Marketplace MCR would have been 66.8% in

the first quarter of 2018. The year-over-year improvement primarily

reflected increased premium revenue related to rate increases and

risk scores that are more commensurate with the acuity of the

Company’s Marketplace population.

The general and administrative (G&A) expense ratio was 7.3%

in the first quarter of 2019, an improvement compared with 7.6% in

the first quarter of 2018 primarily due to lower expenses and the

timing of certain expenditures, which were partially offset by the

impact associated with lower premium revenue.

Capital Plan Progress

In the first quarter of 2019, the Company repaid $46 million

aggregate principal amount of its 1.125% Convertible Notes and

entered into privately negotiated termination agreements to

terminate the respective portion of the related 1.125% Call Option

and 1.125% Warrants.

In April 2019, the Company repaid an additional $128 million

aggregate principal amount of its 1.125% Convertible Notes and

entered into privately negotiated termination agreements to

terminate the respective portion of the related 1.125% Call Option

and 1.125% Warrants. Following these transactions, the remaining

principal amount outstanding of the Company’s 1.125% Convertible

Notes is $78 million. In addition, the Company has received a

conversion notice for $7 million principal amount that will be

settled in August 2019.

2019 Revised Guidance

The following table summarizes 2019 Revised Guidance

(1):

2019 RevisedGuidance

2019 InitialGuidance

Premium revenue ~$15.9B ~$15.8B Premium

tax revenue ~$425M ~$375M Investment income and other

revenue ~$115M ~$195M

Total revenue ~$16.4B ~$16.3B

Medical care costs ~$13.6B ~$13.7B Medical

care ratio (2) ~86% 86.7% - 87.0%

General and administrative

expenses ~$1.3B ~$1.2B G&A ratio (3) ~7.7%

7.5% - 7.7% Premium tax expenses ~$425M ~$375M Depreciation and

amortization ~$90M ~$85M Interest expense and other expenses, net

~$90M ~$100M Income before income taxes $900M - $940M $790M - $840M

Net income $680M - $710M $600M - $630M

EBITDA (4) $1,080M - $1,120M $975M -

$1,025M Effective tax rate ~24.5% 24.5% - 25.0% After-tax

margin (3) 4.1% - 4.3% 3.7% - 3.9% Diluted weighted average shares

~64.7M ~64.7M Net income per share $10.50 - $11.00 $9.25 - $9.75

End-of-year membership by government program: Medicaid and Medicare

~3.1M ~3.2M Marketplace 270K - 280K 250K - 275K

__________________

(1) All amounts are estimates and do not include

non-recurring significant items. Earnings per diluted share as

shown is calculated on a GAAP basis; actual results may differ

materially. See the Company’s risk factors as discussed in its 2018

Form 10-K and other filings and the statements below in this press

release after the heading “Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995.” (2) Medical care ratio

represents medical care costs as a percentage of premium revenue.

(3) G&A ratio represents general and administrative expenses as

a percentage of total revenue. After-tax margin represents net

income as a percentage of total revenue. (4) See reconciliation of

non-GAAP financial measures at the end of this release.

Conference Call

Management will host a conference call and webcast to discuss

Molina Healthcare’s first quarter 2019 results at 8:30 a.m. Eastern

time on Tuesday, April 30, 2019. The number to call for the

interactive teleconference is (877) 883-0383 and the confirmation

number is 4093086. A telephonic replay of the conference call will

be available through Tuesday, May 7, 2019, by dialing (877)

344-7529 and entering confirmation number 10130214. A live audio

broadcast of this conference call will be available on Molina

Healthcare’s website, molinahealthcare.com. A 30-day online replay

will be available approximately an hour following the conclusion of

the live broadcast.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed

health care services under the Medicaid and Medicare programs and

through the state insurance marketplaces. Through its locally

operated health plans, Molina Healthcare served approximately 3.4

million members as of March 31, 2019. For more information about

Molina Healthcare, please visit molinahealthcare.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

This earnings release contains forward-looking statements

regarding the Company’s revised 2019 guidance, as well as its

plans, expectations, and anticipated future events. Actual results

could differ materially due to numerous known and unknown risks and

uncertainties. Those risks and uncertainties are discussed in the

section entitled “Risk Factors” in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2018, and the

section entitled “Forward-Looking Statements” in the Company’s

Quarterly Report on Form 10-Q for the period ended March 31,

2019.

These reports can be accessed under the investor relations tab

of the Company’s website or on the SEC’s website at sec.gov. Given

these risks and uncertainties, the Company can give no assurances

that its forward-looking statements will prove to be accurate, or

that any other results or events projected or contemplated by its

forward-looking statements will in fact occur, and the Company

cautions investors not to place undue reliance on these statements.

All forward-looking statements in this release represent the

Company’s judgment as of April 29, 2019, and, except as otherwise

required by law, the Company disclaims any obligation to update any

forward-looking statements to conform the statement to actual

results or changes in its expectations.

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended March 31,

2019 2018

(In millions, except

per-shareamounts)

Revenue: Premium revenue $ 3,952 $ 4,323 Premium tax revenue 138

104 Health insurer fees reimbursed — 61 Service revenue — 134

Investment income and other revenue 29 24

Total revenue 4,119 4,646

Operating expenses: Medical care costs 3,371 3,722 General and

administrative expenses 302 352 Premium tax expenses 138 104 Health

insurer fees — 75 Depreciation and amortization 25 26 Restructuring

costs 3 25 Cost of service revenue — 120

Total operating expenses 3,839 4,424

Operating income 280 222 Other

expenses, net: Interest expense 23 33 Other (income) expenses, net

(3 ) 10 Total other expenses, net 20

43 Income before income tax expense 260 179

Income tax expense 62 72 Net income $

198 $ 107 Net income per diluted share $ 2.99

$ 1.64 Diluted weighted average shares

outstanding 66.2 65.2

Operating Statistics: Medical care ratio 85.3 % 86.1 %

G&A ratio 7.3 % 7.6 % Premium tax ratio 3.4 % 2.3 % Effective

income tax expense rate 23.8 % 40.3 % After-tax margin 4.8 % 2.3 %

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED BALANCE

SHEETS

March 31, December

31, 2019 2018

(Dollars in millions,except

per-share amounts)

ASSETS Current assets: Cash and cash equivalents $ 3,224 $

2,826 Investments 1,508 1,681 Receivables 1,359 1,330 Prepaid

expenses and other current assets 124 149 Derivative asset

516 476 Total current assets 6,731 6,462

Property, equipment, and capitalized software, net 376 241 Goodwill

and intangible assets, net 185 190 Restricted investments 100 120

Deferred income taxes 76 117 Other assets 111

24 $ 7,579 $ 7,154

LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Medical claims and

benefits payable $ 1,995 $ 1,961 Amounts due government agencies

932 967 Accounts payable and accrued liabilities 444 390 Deferred

revenue 207 211 Current portion of long-term debt 198 241

Derivative liability 516 476 Total

current liabilities 4,292 4,246 Long-term debt 1,121 1,020 Finance

lease liabilities 234 197 Other long-term liabilities 97

44 Total liabilities 5,744

5,507 Stockholders’ equity: Common stock, $0.001 par

value, 150 million shares authorized; outstanding: 63 million

shares at March 31, 2019 and 62 million shares at December 31, 2018

— — Preferred stock, $0.001 par value; 20 million shares

authorized, no shares issued and outstanding — — Additional paid-in

capital 543 643 Accumulated other comprehensive loss (3 ) (8 )

Retained earnings 1,295 1,012 Total

stockholders’ equity 1,835 1,647 $

7,579 $ 7,154

MOLINA HEALTHCARE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended March 31,

2019 2018 (In millions)

Operating activities: Net income $ 198 $ 107 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 25 37 Deferred income taxes 15 (6 )

Share-based compensation 9 6 Amortization of convertible senior

notes and finance lease liabilities 3 7 (Gain) loss on debt

extinguishment (3 ) 10 Non-cash restructuring costs — 17 Other, net

3 2 Changes in operating assets and liabilities: Receivables (29 )

(83 ) Prepaid expenses and other current assets 20 (239 ) Medical

claims and benefits payable 34 (163 ) Amounts due government

agencies (35 ) 172 Accounts payable and accrued liabilities (30 )

319 Deferred revenue (4 ) 130 Income taxes 43

78 Net cash provided by operating activities 249

394 Investing activities: Purchases of

investments (185 ) (389 ) Proceeds from sales and maturities of

investments 366 543 Purchases of property, equipment, and

capitalized software (6 ) (4 ) Other, net (4 ) (5 )

Net cash provided by investing activities 171

145 Financing activities: Repayment of principal amount of

1.125% Convertible Notes (46 ) — Cash paid for partial settlement

of 1.125% Conversion Option (115 ) — Cash received for partial

termination of 1.125% Call Option 115 — Cash paid for partial

termination of 1.125% Warrants (103 ) — Proceeds from borrowings

under Term Loan 100 — Other, net 1 (5 ) Net

cash used in financing activities (48 ) (5 ) Net

increase in cash, cash equivalents, and restricted cash and cash

equivalents 372 534 Cash, cash equivalents, and restricted cash and

cash equivalents at beginning of period 2,926

3,290 Cash, cash equivalents, and restricted cash and cash

equivalents at end of period $ 3,298 $ 3,824

MOLINA HEALTHCARE, INC.

UNAUDITED HEALTH PLANS SEGMENT

MEMBERSHIP

March 31,2019

December 31,2018

March 31,2018

Ending Membership by Government Program: Temporary

Assistance for Needy Families (“TANF”) and Children’s Health

Insurance Program (“CHIP”) 2,016,000 2,295,000 2,435,000 Medicaid

Expansion 596,000 660,000 662,000 Aged, Blind or Disabled (“ABD”)

352,000 406,000 411,000 Total Medicaid 2,964,000 3,361,000

3,508,000 Medicare-Medicaid Plan (“MMP”) - Integrated 56,000 54,000

56,000 Medicare Special Needs Plans 41,000 44,000 44,000 Total

Medicare 97,000 98,000 100,000 Total Medicaid and Medicare

3,061,000 3,459,000 3,608,000 Marketplace 332,000 362,000 453,000

3,393,000 3,821,000 4,061,000

Ending Membership by Health

Plan: California 600,000 608,000 656,000 Florida (1) 144,000

313,000 414,000 Illinois 219,000 224,000 151,000 Michigan 369,000

383,000 388,000 New Mexico (1) 27,000 222,000 250,000 Ohio 295,000

302,000 328,000 Puerto Rico 207,000 252,000 316,000 South Carolina

126,000 120,000 117,000 Texas 377,000 423,000 476,000 Washington

815,000 781,000 779,000 Other (2) 214,000 193,000 186,000 3,393,000

3,821,000 4,061,000 __________________ (1) As reported

throughout 2018, the Company’s Medicaid contracts in New Mexico and

in all but two regions in Florida terminated in late 2018 and early

2019. During 2019, the Company continues to serve Medicare and

Marketplace members in both Florida and New Mexico, as well as

Medicaid members in two regions in Florida. (2) “Other” includes

the Idaho, Mississippi, New York, Utah and Wisconsin health plans,

which are not individually significant to the Company’s

consolidated operating results.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA—

BY GOVERNMENT PROGRAM

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended March 31, 2019

MemberMonths (1)

Premium Revenue Medical Care

Costs MCR (2)

MedicalMargin

Total PMPM Total

PMPM TANF and CHIP 6.2 $ 1,173 $ 189.36 $ 1,022 $ 165.05

87.2 % $ 151 Medicaid Expansion 1.8 664 369.62 594 330.45 89.4 70

ABD 1.1 1,167 1,068.43 1,042 953.48 89.2 125

Total Medicaid 9.1 3,004 330.75 2,658 292.60 88.5

346 MMP 0.2 388 2,355.29 333 2,026.83 86.1 55 Medicare 0.1

163 1,284.70 133 1,047.78 81.6 30 Total

Medicare 0.3 551 1,889.47 466 1,600.84 84.7 85

Total Medicaid and Medicare 9.4 3,555 379.19 3,124

333.26 87.9 431 Marketplace 1.0 397 393.53 247

244.61 62.2 150 10.4 $ 3,952 $ 380.59 $ 3,371 $ 324.65 85.3

% $ 581

Three Months Ended March 31, 2018

MemberMonths

Premium Revenue Medical Care Costs MCR

MedicalMargin

Total PMPM Total PMPM TANF and CHIP 7.4

$ 1,373 $ 185.14 $ 1,272 $ 171.56 92.7 % $ 101 Medicaid Expansion

2.0 752 372.75 641 317.46 85.2 111 ABD 1.2 1,254 1,014.23

1,155 934.55 92.1 99 Total Medicaid 10.6 3,379

316.69 3,068 287.56 90.8 311 MMP 0.2 357 2,137.88 305

1,824.21 85.3 52 Medicare 0.1 157 1,188.97 131 994.81

83.7 26 Total Medicare 0.3 514 1,718.61 436

1,457.75 84.8 78 Total Medicaid and Medicare 10.9

3,893 354.94 3,504 319.48 90.0 389 Marketplace 1.4

430 312.87 218 158.40 50.6 212 12.3 $ 4,323 $

350.25 $ 3,722 $ 301.55 86.1 % $ 601 __________________ (1)

A member month is defined as the aggregate of each month’s ending

membership for the period presented. (2) The MCR represents medical

costs as a percentage of premium revenue.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA—

MEDICAID AND MEDICARE BY HEALTH

PLAN

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended March 31, 2019

MemberMonths

Premium Revenue Medical Care

Costs MCR

MedicalMargin

Total PMPM Total

PMPM California 1.7 $ 499 $ 299.83 $ 448 $ 269.33 89.8 % $

51 Florida 0.4 162 387.48 127 303.05 78.2 35 Illinois 0.7 227

348.04 185 282.70 81.2 42 Michigan 1.1 395 363.04 326 299.99 82.6

69 Ohio 0.9 590 659.09 537 600.07 91.0 53 Puerto Rico 0.6 102

165.02 90 145.38 88.1 12 South Carolina 0.4 136 363.14 115 308.87

85.1 21 Texas 0.6 599 902.56 532 801.53 88.8 67 Washington 2.4 614

258.41 586 246.69 95.5 28 Other (1) (2) 0.6 231 370.26

178 285.13 77.0 53 9.4 $ 3,555 $ 379.19 $ 3,124 $

333.26 87.9 % $ 431

Three Months Ended March 31,

2018

MemberMonths

Premium Revenue Medical Care Costs MCR

MedicalMargin

Total PMPM Total PMPM California 1.8 $

494 $ 272.61 $ 412 $ 227.31 83.4 % $ 82 Florida 1.0 382 351.58 345

317.41 90.3 37 Illinois 0.5 141 298.17 122 257.50 86.4 19 Michigan

1.1 376 336.64 331 296.19 88.0 45 New Mexico (2) 0.7 319 466.17 310

453.30 97.2 9 Ohio 0.9 551 576.60 460 481.26 83.5 91 Puerto Rico

1.0 186 193.13 174 181.39 93.9 12 South Carolina 0.3 122 348.08 104

297.52 85.5 18 Texas 0.7 562 809.90 519 747.53 92.3 43 Washington

2.3 584 256.66 574 252.41 98.3 10 Other (1) 0.6 176 314.93

153 273.36 86.8 23 10.9 $ 3,893 $ 354.94 $ 3,504 $

319.48 90.0 % $ 389 __________________ (1) “Other” includes

the Idaho, Mississippi, New York, Utah and Wisconsin health plans,

which are not individually significant to the Company’s

consolidated operating results. (2) In 2019, “Other” includes the

New Mexico health plan. The New Mexico health plan’s Medicaid

contract terminated on December 31, 2018, and therefore its 2019

results are not individually significant to the Company’s

consolidated operating results.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA—

MARKETPLACE BY HEALTH PLAN

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended March 31, 2019

MemberMonths

Premium Revenue Medical Care

Costs MCR

MedicalMargin

Total PMPM Total

PMPM California 0.1 $ 56 $ 342.00 $ 33 $ 201.46 58.9 % $ 23

Florida 0.2 61 421.17 26 177.31 42.1 35 Michigan — 10 467.25 5

211.50 45.3 5 Ohio — 30 853.87 15 448.51 52.5 15 Texas 0.6 148

306.36 109 226.36 73.9 39 Washington — 47 711.60 29 435.90 61.3 18

Other (1) 0.1 45 476.11 30 314.70 66.1

15 1.0 $ 397 $ 393.53 $ 247 $ 244.61 62.2 % $

150

Three Months Ended March 31, 2018

MemberMonths

Premium Revenue Medical Care Costs MCR

MedicalMargin

Total PMPM Total PMPM California 0.2 $

49 $ 253.93 $ 31 $ 162.64 64.0 % $ 18 Florida 0.2 45 271.12 (16 )

(95.60 ) (35.3 ) 61 Michigan 0.1 13 224.11 9 144.16 64.3 4 New

Mexico 0.1 34 438.67 19 246.50 56.2 15 Ohio 0.1 26 403.44 17 262.87

65.2 9 Texas 0.7 229 308.74 146 196.89 63.8 83 Washington — 39

526.36 30 405.40 77.0 9 Other (2) — (5 ) NM (18 ) NM

NM 13 1.4 $ 430 $ 312.87 $ 218 $ 158.40 50.6 %

$ 212 __________________ (1) “Other” includes the New

Mexico, Utah and Wisconsin health plans, which are not individually

significant to the Company’s consolidated operating results in

2019. (2) “Other” includes the Utah and Wisconsin health plans,

where the Company did not participate in the Marketplace in 2018.

Therefore, the ratios for 2018 periods are not meaningful (NM).

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA—

TOTAL BY HEALTH PLAN

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended March 31, 2019

MemberMonths

Premium Revenue Medical Care

Costs MCR

MedicalMargin

Total PMPM Total

PMPM California 1.8 $ 555 $ 303.64 $ 481 $ 263.20 86.7 % $

74 Florida 0.6 223 396.13 153 270.76 68.4 70 Illinois 0.7 227

348.04 185 282.70 81.2 42 Michigan 1.1 405 365.09 331 298.25 81.7

74 Ohio 0.9 620 666.41 552 594.38 89.2 68 Puerto Rico 0.6 102

165.02 90 145.38 88.1 12 South Carolina 0.4 136 363.14 115 308.87

85.1 21 Texas 1.2 747 651.67 641 559.49 85.9 106 Washington 2.4 661

270.72 615 251.83 93.0 46 Other (1) (2) 0.7 276 384.08

208 288.99 75.2 68 10.4 $ 3,952 $ 380.59 $ 3,371 $

324.65 85.3 % $ 581

Three Months Ended March 31,

2018

MemberMonths

Premium Revenue Medical Care Costs MCR

MedicalMargin

Total PMPM Total PMPM California 2.0 $

543 $ 270.80 $ 443 $ 221.03 81.6 % $ 100 Florida 1.2 427 340.91 329

262.65 77.0 98 Illinois 0.5 141 298.17 122 257.50 86.4 19 Michigan

1.2 389 331.08 340 288.68 87.2 49 New Mexico (2) 0.8 353 463.33 329

431.94 93.2 24 Ohio 1.0 577 565.62 477 467.41 82.6 100 Puerto Rico

1.0 186 193.13 174 181.39 93.9 12 South Carolina 0.3 122 348.08 104

297.52 85.5 18 Texas 1.4 791 551.28 665 463.37 84.1 126 Washington

2.3 623 265.20 604 257.25 97.0 19 Other (1) 0.6 171 305.94

135 240.95 78.8 36 12.3 $ 4,323 $ 350.25 $ 3,722 $

301.55 86.1 % $ 601 __________________ (1) “Other” includes

the Idaho, Mississippi, New York, Utah and Wisconsin health plans,

which are not individually significant to the Company’s

consolidated operating results. (2) In 2019, “Other” includes the

New Mexico health plan. The New Mexico health plan’s Medicaid

contract terminated on December 31, 2018, and therefore its 2019

results are not individually significant to the Company’s

consolidated operating results.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED FINANCIAL

DATA

(In millions, except percentages and

per-member per-month amounts)

The following table provides details of

the Company’s medical care costs for the periods indicated:

Three Months Ended March 31,

2019 2018 Amount

PMPM

% ofTotal

Amount PMPM

% ofTotal

Fee for service $ 2,514 $ 242.12 74.6 % $ 2,745 $ 222.38 73.8 %

Pharmacy 413 39.73 12.2 583 47.25 15.6 Capitation 285 27.46 8.5 312

25.28 8.4 Other 159 15.34 4.7 82

6.64 2.2 $ 3,371 $ 324.65 100.0 % $ 3,722 $ 301.55

100.0 %

The following table provides details of

the Company’s medical claims and benefits payable as of the dates

indicated:

March 31, December 31, 2019 2018

Fee-for-service claims incurred but not paid (IBNP) $ 1,411 $ 1,562

Pharmacy payable 114 115 Capitation payable 59 52 Other (1)

411 232 $ 1,995 $ 1,961 __________________ (1)

“Other” medical claims and benefits payable include amounts

payable to certain providers for which the Company acts as an

intermediary on behalf of various state agencies without assuming

financial risk. Such receipts and payments do not impact the

Company’s consolidated statements of income. As of March 31, 2019

and December 31, 2018, the Company had recorded non-risk provider

payables of approximately $278 million and $107 million,

respectively.

MOLINA HEALTHCARE, INC.UNAUDITED

CHANGE IN MEDICAL CLAIMS AND BENEFITS PAYABLE(Dollars in

millions)

The Company’s claims liability includes a provision for adverse

claims deviation based on historical experience and other factors

including, but not limited to, variations in claims payment

patterns, changes in utilization and cost trends, known outbreaks

of disease, and large claims. The Company’s reserving methodology

is consistently applied across all periods presented. The amounts

displayed for “Components of medical care costs related to: Prior

period” represent the amount by which its original estimate of

claims and benefits payable at the beginning of the period was more

than the actual amount of the liability based on information

(principally the payment of claims) developed since that liability

was first reported. The following table presents the components of

the change in medical claims and benefits payable for the periods

indicated:

Three Months Ended March 31,

Year EndedDecember

31,2018

2019 2018 Medical claims and benefits

payable, beginning balance $ 1,961 $ 2,192 $ 2,192 Components of

medical care costs related to: Current period 3,560 4,033 15,478

Prior period (1) (189 ) (311 ) (341 ) Total

medical care costs 3,371 3,722

15,137 Change in non-risk provider payables

171 45 13 Payments for medical

care costs related to: Current period 2,197 2,498 13,671 Prior

period 1,311 1,438 1,710

Total paid 3,508 3,936 15,381

Medical claims and benefits payable, ending balance $ 1,995

$ 2,023 $ 1,961 Days in claims payable,

fee for service (2) 52 53 53 __________________ (1) March

31, 2018, includes the 2018 benefit of the 2017 Marketplace CSR

reimbursement of $70 million. December 31, 2018, includes the 2018

benefit of the 2017 Marketplace CSR reimbursement of $81 million.

(2) Claims payable includes primarily IBNP. It also includes

certain fee-for-service payables reported in “Other” medical claims

and benefits payable amounting to $51 million, $22 million and $43

million, as of March 31, 2019, March 31, 2018, and December 31,

2018, respectively.

MOLINA HEALTHCARE, INC.UNAUDITED

SUMMARY OF SIGNIFICANT ITEMS AFFECTING CURRENT QUARTER

ANDYEAR-TO-DATE FINANCIAL RESULTS(In millions, except

per diluted share amounts)

The table below summarizes the impact of certain items

significant to the Company’s financial performance in the periods

presented. The individual items presented below increase (decrease)

income before income tax expense.

Three Months Ended March 31, 2019

2018 Amount

Per DilutedShare

(1)

Amount

Per DilutedShare

(1)

Marketplace CSR subsidies, for 2017 dates of service $ — $ —

$ 70 $ 0.83 Restructuring costs (3 ) (0.03 ) (25 ) (0.30 ) Gain

(loss) on debt extinguishment 3 0.03

(10 ) (0.15 ) $ — $ — $ 35 $

0.38 __________________ (1) Except for

permanent differences between GAAP and tax (such as certain

expenses that are not deductible for tax purposes), per diluted

share amounts are generally calculated at the statutory income tax

rate of 22.6% and 22% for the first quarter of 2019 and 2018,

respectively.

MOLINA HEALTHCARE, INC.UNAUDITED

NON-GAAP FINANCIAL MEASURES(In millions, except per diluted

share amounts)

The Company uses non-generally accepted accounting principles,

or non-GAAP, financial measures as supplemental metrics in

evaluating the Company’s financial performance, making financing

and business decisions, and forecasting and planning for future

periods. For these reasons, management believes such measures are

useful supplemental measures to investors in comparing the

Company’s performance to the performance of other public companies

in the health care industry. These non-GAAP financial measures

should be considered as supplements to, and not as substitutes for

or superior to, GAAP measures. See further information regarding

non-GAAP measures below the tables.

Three Months Ended March 31, 2019

2018 Net income $ 198 $ 107

Adjustments: Depreciation, and amortization of intangible assets

and capitalized software 25 34 Interest expense 23 33 Income tax

expense 62 72 EBITDA $ 308 $ 246

Three Months Ended March 31,

2019 2018 Amount

Per DilutedShare

Amount

Per DilutedShare

Net income $ 198 $ 2.99 $ 107 $ 1.64 Adjustment: Amortization of

intangible assets 5 0.07 5 0.08 Income tax effect (1) (1 )

(0.02 ) (1 ) (0.01 ) Amortization of

intangible assets, net of tax effect 4 0.05

4 0.07 Adjusted net income $ 202

$ 3.04 $ 111 $ 1.71

__________________ (1) Income tax effect of adjustments

calculated at the blended federal and state statutory tax rate of

22.6% and 22% for 2019 and 2018, respectively.

The following are descriptions of the adjustments made to GAAP

measures used to calculate the non-GAAP measures used in this news

release:

Earnings before interest, taxes, depreciation and

amortization (“EBITDA”): Net income on a GAAP basis less

depreciation, and amortization of intangible assets and capitalized

software, interest expense and income tax expense. The Company

believes that EBITDA is helpful in assessing the Company’s ability

to meet the cash demands of its operating units.

Adjusted net income: Net income on a GAAP basis less

amortization of intangible assets, net of income tax effect

calculated at the statutory tax rate. The Company believes that

adjusted net income is helpful in assessing the Company’s financial

performance exclusive of the non-cash impact of the amortization of

purchased intangibles.

Adjusted net income per diluted share: Adjusted net

income divided by weighted average common shares outstanding on a

fully diluted basis.

MOLINA HEALTHCARE, INC.

2019 REVISED GUIDANCE

Reconciliation of

Non-GAAP Financial Measures

Low End High End

(In millions) Net income $ 680 $ 710 Adjustments:

Depreciation, and amortization of intangible assets and capitalized

software 90 90 Interest expense 90 90 Income tax expense 220

230 EBITDA $ 1,080 $ 1,120

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005776/en/

Ryan KubotaInvestor Relations562-435-3666, ext. 119057

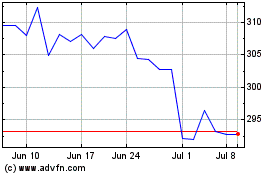

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

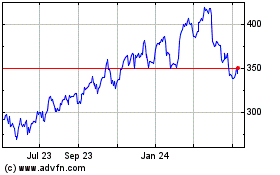

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024