Monmouth Real Estate Investment Corporation (NYSE: MNR), or

Monmouth, today announced that it received an unsolicited

acquisition proposal from a large private investment firm primarily

focused on global real estate that participated in the strategic

alternatives review process undertaken by Monmouth’s Board of

Directors earlier this year and made a proposal to acquire Monmouth

as part of that process. Under the terms of its new proposal, the

investment firm is proposing to acquire 100% of the outstanding

equity of Monmouth for net cash consideration of approximately

$18.70 per share of Monmouth Common Stock, reflecting a stated per

share purchase price of $19.51 per share, reduced by (i) the

termination fee payable by Monmouth to Equity Commonwealth, or EQC,

of approximately $62.2 million, or $0.63 per share, if Monmouth

terminates the merger agreement it previously entered into with EQC

in accordance with its terms to accept the new proposal and (ii)

the $0.18 per share dividend on Monmouth’s common stock previously

declared by Monmouth’s Board of Directors on July 1, 2021 and

payable on or about September 15, 2021. On July 12, 2021,

Monmouth’s common shares closed at $19.00 per share.

The new unsolicited proposal was accompanied by

executed commitment letters from a global commercial bank with

respect to the investment firm’s contemplated debt financing and an

equity bridge, as well as a proposed form of merger agreement. The

new proposal states that the investment firm has obtained all

necessary internal approvals and has completed its due

diligence.

On May 4, 2021, Monmouth announced that it had

entered into a definitive merger agreement with EQC, pursuant to

which EQC agreed to acquire Monmouth in an all-stock transaction,

valued at approximately $3.4 billion, including the assumption of

debt. The combined company is expected to have a pro forma equity

market capitalization of approximately $5.5 billion.

Consistent with its fiduciary duties and in

consultation with its financial and legal advisors, Monmouth’s

Board of Directors is evaluating the new unsolicited proposal and

has not made any determination as to what action to take in

response to the proposal. Monmouth’s Board of Directors intends to

respond to the proposal in due course and remains committed to

acting in the best interests of the Company and its

shareholders.

J.P. Morgan Securities LLC and CS Capital

Advisors, LLC are acting as financial advisors and Stroock &

Stroock & Lavan LLP is serving as legal advisor to

Monmouth.

About Monmouth

Monmouth Real Estate Investment Corporation,

founded in 1968, is one of the oldest public equity REITs in the

world. The Company specializes in single tenant, net-leased

industrial properties, subject to long-term leases, primarily to

investment grade tenants. Monmouth Real Estate Investment

Corporation is a fully integrated and self-managed real estate

company, whose property portfolio consists of 120 properties

containing a total of approximately 24.5 million rentable square

feet, geographically diversified across 31 states. The Company’s

occupancy rate as of this date is 99.7%.

Forward-Looking Statements

Some of the statements contained in this press

release constitute forward-looking statements within the meaning of

the federal securities laws, including, but not limited to,

statements regarding the merger with EQC. Any forward-looking

statements contained in this press release are intended to be made

pursuant to the safe harbor provisions of Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential,” or the negative of these

words and phrases or similar words or phrases which are predictions

of or indicate future events or trends and which do not relate

solely to historical matters. You can also identify forward looking

statements by discussions of strategy, plans or intentions. Any

forward-looking statements contained in this press release reflect

Monmouth’s current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions and

changes in circumstances that may cause actual results to differ

significantly from those expressed in any forward looking

statement. For a further discussion of other factors that could

cause Monmouth’s future results to differ materially from any

forward-looking statements, see the section entitled “Risk Factors”

in Monmouth’s most recent Annual Report on Form 10-K and in its

Quarterly Reports on Form 10-Q. While forward-looking statements

reflect Monmouth’s good faith beliefs, they are not guarantees of

future performance. Monmouth disclaims any obligation to publicly

update or revise any forward-looking statement to reflect changes

in underlying assumptions or factors, of new information, data or

methods, future events or other changes.

Participants in the Solicitation

Monmouth and certain of its directors and

executive officers and other employees may be deemed to be

participants in the solicitation of proxies from Monmouth’s

stockholders in connection with the proposed merger with EQC under

the rules of the SEC. Investors may obtain information regarding

the names, affiliations and interests of directors and executive

officers of Monmouth in Monmouth’s Annual Report on Form 10-K for

Monmouth’s fiscal year ended September 30, 2020, which was filed

with the SEC on November 23, 2020, as well as in Monmouth’s other

filings with the SEC. Other information regarding the participants

in the proxy solicitation and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the proxy statement/prospectus and other relevant

proxy materials filed with the SEC in respect of the proposed

merger.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an

offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the U.S. Securities Act of 1933, as

amended.

Additional Information and Where to Find It

In connection with the proposed merger with EQC,

Monmouth intends to file a proxy statement/prospectus with the U.S.

Securities and Exchange Commission (“SEC”), which will be sent to

the common stockholders of Monmouth seeking their approval of the

proposed merger and the common stockholders of EQC seeking their

approval of the issuance of EQC common stock in connection with the

merger. Monmouth and EQC may also file other documents regarding

the proposed merger with the SEC. This press release is not

intended to be, and is not, a substitute for such filings or for

any other document that Monmouth and/or EQC may file with the SEC

in connection with the proposed merger. BEFORE MAKING ANY VOTING OR

INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO

CAREFULLY READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS, WHEN IT

BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS,

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT MONMOUTH, EQC, AND THE PROPOSED MERGER. Investors

and security holders will be able to obtain free copies of the

proxy statement/prospectus and other documents filed with the SEC

by Monmouth, when they become available, through the website

maintained by the SEC at www.sec.gov. In addition, investors and

security holders will be able to obtain free copies of the proxy

statement/prospectus and other documents filed with the SEC on

Monmouth’s website at www.mreic.reit

Contacts:

InvestorsBecky Coleridge(732)

577-9996mreic@mreic.com

MediaAndrew Siegel / Amy Feng / Kara

BrickmanJoele Frank(212) 355-4449

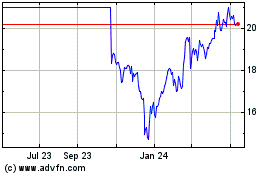

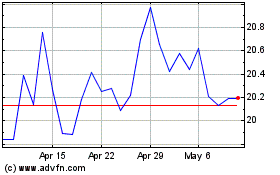

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Nov 2023 to Nov 2024