Tesla Pulls Up Lithium Producer Stocks Despite Glut

February 11 2020 - 11:41AM

Dow Jones News

By Micah Maidenberg

Tesla's surge has helped lift shares of lithium producers to

double-digit gains in 2020, powered by investors' bets that demand

for the electric-car battery component will outpace a recent supply

glut.

Shares of Livent Corp., which has a lithium-extraction site in

Argentina, have moved up 19% this year, while the stock for

Albemarle Corp., a major producer with facilities in Chile and

elsewhere, is up about 16%. American depositary receipts for

Chile-based Sociedad Química y Minera de Chile SA, or SQM, have

risen 12%.

The increases show how investors' enthusiasm for Tesla has

spread to companies and industries tied to the electric-vehicle

market. Tesla's stock is up around 84% so far in 2020, fueled in

part by many investors' belief that the company and Chief Executive

Elon Musk stand poised to upend the automotive industry.

"I think whenever you have something like that going on,

generating renewed excitement around electric vehicles and around

batteries, you have people looking around and saying, 'Who else

could benefit from this?'" Seaport Global Securities analyst

Michael Harrison said.

Lithium prices, weighed down by excess supply, have fallen 22

consecutive months through January, according to an index

maintained by research firm Benchmark Mineral Intelligence. While

the metal has industrial applications and other uses, producers

have pitched the link to electric vehicles explicitly, saying the

projected adoption of such cars and trucks will support long-term

growth.

"Once the sticker price of an EV becomes at or below that of a

combustion engine, the whole conversation changes," Albemarle's top

technology executive for its lithium business, Glen Merfeld, told

investors in December. The Charlotte-based company at the time

projected lithium demand to rise 24% on a compound annual basis

between last year and 2025.

There are other factors supporting stock-price gains among

lithium producers. China has indicated it will stick to its target

of 2 million electric-vehicle sales this year, which would be up

from 1.2 million last year, according to Andrew Miller, product

director at Benchmark. Panasonic Corp. last week said automotive

battery sales increased in its latest quarter and the battery

factory in Nevada it funded with Tesla turned profitable in the

period.

Electric-vehicle adoption is still in its infancy, however. Last

year, 2.2 million light-duty electric vehicles were sold around the

world, a fraction of the 78.2 million total car and light-truck

sales, according to S&P Global Platts. This year, analysts

forecast electric vehicles sales to rise to 2.5 million as total

light-duty sales move lower.

"The supply side has overshot where the industry is today," Mr.

Miller said. Benchmark's lithium price index fell 39% between

January and the year earlier.

Some producers have considered cutting back on adding more

capacity, as prices hover near 2016 levels for two types of

lithium, according to Benchmark. In January, lithium carbonate cost

$7,508 a ton on average, while lithium hydroxide prices stood at

$9,619 a ton. Both grades can be used in batteries.

SQM said in January the company and a partner had deferred

making a final investment decision on moving ahead with a lithium

development in Australia called Mount Holland until the first

quarter of next year. The companies said over the coming months

they will look for ways to potentially improve operations at the

development and reduce capital spending there.

Livent last month cut its financial outlook for the fourth

quarter and for 2019, citing in part lower prices for lithium. The

company also disclosed it was reviewing current capacity expansion

plans due to what Chief Executive Paul Graves described as

challenging market conditions.

"In an oversupplied market, things turn rapidly," Eric Norris,

Albemarle's president overseeing lithium, said in December.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

February 11, 2020 11:26 ET (16:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

Livent (NYSE:LTHM)

Historical Stock Chart

From Jul 2024 to Aug 2024

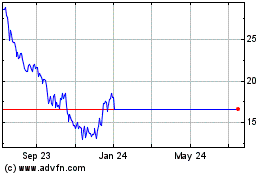

Livent (NYSE:LTHM)

Historical Stock Chart

From Aug 2023 to Aug 2024