UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of September 2023

1-15240

(Commission File Number)

JAMES HARDIE INDUSTRIES plc

(Translation of registrant’s name into English)

First Floor, Block A

One Park Place

Upper Hatch Street, Dublin 2, D02, FD79, Ireland

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F..X.... Form 40-F.........

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Not Applicable

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Not Applicable

TABLE OF CONTENTS

Forward-Looking Statements

This Form 6-K contains forward-looking statements. James Hardie Industries plc (the “company”) may from time to time make forward-looking statements in its periodic reports filed with or furnished to the Securities and Exchange Commission, on Forms 20-F and 6-K, in its annual reports to shareholders, in offering circulars, invitation memoranda and prospectuses, in media releases and other written materials and in oral statements made by the company’s officers, directors or employees to analysts, institutional investors, existing and potential lenders, representatives of the media and others. Statements that are not historical facts are forward-looking statements and such forward-looking statements are statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

Examples of forward-looking statements include:

•statements about the company’s future performance;

•projections of the company’s results of operations or financial condition;

•statements regarding the company’s plans, objectives or goals, including those relating to strategies, initiatives, competition, acquisitions, dispositions and/or its products;

•expectations concerning the costs associated with the suspension or closure of operations at any of the company’s plants and future plans with respect to any such plants;

•expectations concerning the costs associated with the significant capital expenditure projects at any of the company’s plants and future plans with respect to any such projects;

•expectations regarding the extension or renewal of the company’s credit facilities including changes to terms, covenants or ratios;

•expectations concerning dividend payments and share buy-backs;

•statements concerning the company’s corporate and tax domiciles and structures and potential changes to them, including potential tax charges;

•statements regarding tax liabilities and related audits, reviews and proceedings;

•statements regarding the possible consequences and/or potential outcome of legal proceedings brought against us and the potential liabilities, if any, associated with such proceedings;

•expectations about the timing and amount of contributions to AICF, a special purpose fund for the compensation of proven Australian asbestos-related personal injury and death claims;

•expectations concerning the adequacy of the company’s warranty provisions and estimates for future warranty-related costs;

•statements regarding the company’s ability to manage legal and regulatory matters (including but not limited to product liability, environmental, intellectual property and competition law matters) and to resolve any such pending legal and regulatory matters within current estimates and in anticipation of certain third-party recoveries; and

•statements about economic or housing market conditions in the regions in which we operate, including but not limited to, the levels of new home construction and home renovations, unemployment levels, changes in consumer income, changes or stability in housing values, the availability of mortgages and other financing, mortgage and other interest rates, housing affordability and supply, the levels of foreclosures and home resales, currency exchange rates, and builder and consumer confidence.

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “predict,” “forecast,” “guideline,” “aim,” “will,” “should,” “likely,” “continue,” “may,” “objective,” “outlook” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Readers are cautioned not to place undue reliance on these forward-looking statements and all such forward-looking statements are qualified in their entirety by reference to the following cautionary statements.

Forward-looking statements are based on the Company’s current expectations, estimates and assumptions and because forward-looking statements address future results, events and conditions, they, by their very nature, involve inherent risks and uncertainties, many of which are unforeseeable and beyond the Company’s control. Such known and unknown risks, uncertainties and other factors may cause actual results, performance or other achievements to differ materially from the anticipated results, performance or achievements expressed, projected or implied by these forward-looking statements. These factors, some of which are discussed under “Risk Factors” in Section 3 of the Form 20-F filed with the Securities and Exchange Commission on 16 May 2023, include, but are not limited to: all matters relating to or arising out of the prior manufacture of products that contained asbestos by current and former Company subsidiaries; required contributions to AICF, any shortfall in AICF funding and the effect of currency exchange rate movements on the amount recorded in the Company’s financial statements as an asbestos liability; compliance with and changes in tax laws and treatments; competition and product pricing in the markets in which the Company operates; the consequences of product failures or defects; exposure to environmental, asbestos, putative consumer class action or other legal proceedings; general economic and market conditions; the supply and cost of raw materials; possible increases in competition and the potential that competitors could copy the Company’s products; compliance with and changes in environmental and health and safety laws; risks of conducting business internationally; compliance with and changes in laws and regulations; currency exchange risks; dependence on customer preference and the concentration of the Company’s customer base; dependence on residential and commercial construction markets; the effect of adverse changes in climate or weather patterns; use of accounting estimates; and all other risks identified in the Company’s reports filed with Australian, Irish and US securities regulatory agencies and exchanges (as appropriate). The Company cautions you that the foregoing list of factors is not exhaustive and that other risks and uncertainties may cause actual results to differ materially from those referenced in the Company’s forward-looking statements. Forward-looking statements speak only as of the date they are made and are statements of the Company’s current expectations concerning future results, events and conditions. The Company assumes no obligation to update any forward-looking statements or information except as required by law.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Appendix 3Y - A Erter |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| | James Hardie Industries plc |

| Date: 5 September 2023 | | By: /s/ Aoife Rockett |

| |

| | Aoife Rockett |

| | Company Secretary |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | Appendix 3Y - A Erter |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | Update - Notification of buy-back - JHX |

| | |

EXHIBIT 99.1 Appendix 3Y Change of Director’s Interest Notice |

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/09/01 Amended 01/01/11

| | |

Name of entity James Hardie Industries plc |

ARBN 097 829 895 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

| | | | | |

| Name of Director | Aaron ERTER |

| Date of last notice | 10 November 2022 |

Part 1 - Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | | | | |

| Direct or indirect interest | Direct |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | Not applicable. |

| Date of change | 17 August 2023 (US Time) |

| No. of securities held prior to change | ROCE RSUs: 119,174

TSR RSUs: 193,525

Options: 269,221 |

| Class | Unquoted restricted stock units and unquoted options.

Ordinary shares/CUFs.

|

| | |

+ See chapter 19 for defined terms. |

01/01/2011 Appendix 3Y Page 1

| | |

Appendix 3Y Change of Director’s Interest Notice |

| | | | | |

Number acquired | Ordinary shares/CUFs: 20,522

ROCE RSUs: •92,265 ROCE RSUs with a vesting date of 17/08/26.

TSR RSUs: •137,718 TSR RSUs with a vesting date of 17/08/26. |

| Number disposed | ROCE RSUs: 5,820

TSR RSUs: 31,907 |

Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation | Ordinary shares/CUFs: Nil consideration, issued in accordance with the shareholder approval provided at the 2022 Annual General Meeting.

ROCE RSUs and TSR RSUs: Nil consideration, issued in accordance with the shareholder approval provided at the 2023 Annual General Meeting. |

| No. of securities held after change | Ordinary shares/CUFs: 20,522 (5,130 are in a holding lock until 17 August 2025).

ROCE RSUs: 191,577, representing: •19,862 ROCE RSUs with a vesting date of 17/08/24; •79,450 ROCE RSUs with a vesting date of 17/08/25; •92,265 ROCE RSUs with a vesting date of 17/08/26.

TSR RSUs: 292,856, representing: •39,450 TSR RSUs with a vesting date of 17/08/24; •115,688 TSR RSUs with a vesting date of 17/08/25; •137,718 TSR RSUs with a vesting date of 17/08/26.

Options: 269,221 with a vesting date of 3/11/2025 |

| | |

+ See chapter 19 for defined terms. |

Appendix 3Y Page 2 01/01/2011

| | |

EXHIBIT 99.1 Appendix 3Y Change of Director’s Interest Notice |

| | | | | |

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | Issue of Ordinary Shares/CUFs: •Issue of 14,042 ordinary shares/CUFs on 17 August 2023 (following vesting of 14,042 ROCE RSUs that were issued in accordance with the shareholder approval provided at the 2022 Annual General Meeting). •Issue of 6,480 ordinary shares/CUFs on 17 August 2023 (following vesting of 6,480 Relative TSR RSUs that were issued in accordance with the shareholder approval provided at the 2022 Annual General Meeting).

Cancellation of RSUs: •Cancellation of 5,820 ROCE RSUs on 17 August 2023 (which were originally issued in accordance with the shareholder approval provided at the 2022 Annual General Meeting). •Cancellation of 31,907 TSR RSUs on 17 August 2023 (which were originally issued in accordance with the shareholder approval provided at the 2022 Annual General Meeting).

Issue of RSUs: •Off market issue of 92,265 ROCE RSUs on 17 August 2023 on the terms outlined in the Notice of Annual General Meeting dated 10 July 2023 and as approved by the Shareholders on 3 August 2023 (Dublin time). •Off market issue of 137,718 TSR RSUs on 17 August 2023 on the terms outlined in the Notice of Annual General Meeting dated 10 July 2023 and as approved by the Shareholders on 3 August 2023 (Dublin time). |

| | |

+ See chapter 19 for defined terms. |

01/01/2011 Appendix 3Y Page 3

| | |

Appendix 3Y Change of Director’s Interest Notice |

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | | | | |

| Detail of contract | Nil. |

Nature of interest | Nil. |

Name of registered holder (if issued securities) | Nil. |

| Date of change | Nil. |

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | Nil. |

| Interest acquired | Nil. |

| Interest disposed | Nil. |

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | Nil. |

| Interest after change | Nil. |

Part 3 – +Closed period

| | | | | |

Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? | No |

| If so, was prior written clearance provided to allow the trade to proceed during this period? | Not applicable. |

| If prior written clearance was provided, on what date was this provided? | Not applicable. |

| | |

+ See chapter 19 for defined terms. |

Appendix 3Y Page 4 01/01/2011

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 25/8/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 6,974,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.2

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 24/8/2023 1.5 Date of this announcement 25/8/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 25/8/2023 4.2 Previous day on which +securities were bought back 24/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 6,974,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 244,888,777.06000 AUD 6,648,261.65000 4.5 Highest price paid AUD 47.74000000 AUD 44.58000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 44.01000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 47.22000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,935,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 26/8/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,124,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.3

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 25/8/2023 1.5 Date of this announcement 26/8/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 28/8/2023 4.2 Previous day on which +securities were bought back 25/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,124,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 251,537,038.71000 AUD 6,659,580.35000 4.5 Highest price paid AUD 47.74000000 AUD 44.85000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 44.15000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 46.83000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,785,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 29/8/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,274,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.4

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 26/8/2023 1.5 Date of this announcement 29/8/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 29/8/2023 4.2 Previous day on which +securities were bought back 28/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,274,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 258,196,619.06000 AUD 6,694,525.09000 4.5 Highest price paid AUD 47.74000000 AUD 45.02000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 44.47000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 46.62000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,635,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 30/8/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,424,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.5

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 29/8/2023 1.5 Date of this announcement 30/8/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 30/8/2023 4.2 Previous day on which +securities were bought back 29/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,424,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 264,891,144.15000 AUD 6,771,909.96000 4.5 Highest price paid AUD 47.74000000 AUD 45.39000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 44.93000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 46.54000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,485,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 31/8/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,574,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.6

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 30/8/2023 1.5 Date of this announcement 31/8/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 31/8/2023 4.2 Previous day on which +securities were bought back 30/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,574,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 271,663,054.11000 AUD 6,884,587.30000 4.5 Highest price paid AUD 47.74000000 AUD 46.19000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 45.28000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 46.77000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,335,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 1/9/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,724,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.7

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 31/8/2023 1.5 Date of this announcement 1/9/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 1/9/2023 4.2 Previous day on which +securities were bought back 31/8/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,724,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 278,547,641.41000 AUD 6,963,447.72000 4.5 Highest price paid AUD 47.74000000 AUD 46.65000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 45.67000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 47.12000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,185,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 2/9/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 7,874,377 Total number of +securities bought back on previous day 150,000 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.8

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 1/9/2023 1.5 Date of this announcement 2/9/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 4/9/2023 4.2 Previous day on which +securities were bought back 1/9/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 7,874,377 150,000 4.4 Total consideration paid or payable for the +securities AUD 285,511,089.13000 AUD 7,042,761.23000 4.5 Highest price paid AUD 47.74000000 AUD 47.33000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 46.68000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 47.62000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 2,035,623

Notification of buy-back Notification of buy-back 1 / 6 Announcement Summary Name of entity JAMES HARDIE INDUSTRIES PLC Announcement type Update announcement Type of update Date of this announcement 5/9/2023 Reason for update Daily buy-back notification ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 The type of buy-back is: Total number of +securities bought back before previous day 8,024,377 Total number of +securities bought back on previous day 127,379 Refer to next page for full details of the announcement On market buy-back Daily buy-back notification EXHIBIT 99.9

Notification of buy-back Notification of buy-back 2 / 6 Part 1 - Entity and announcement details 1.1 Name of entity JAMES HARDIE INDUSTRIES PLC We (the entity named above) provide the following information about our buy-back. 1.2 Registration number type ARBN Registration number 097829895 1.3 ASX issuer code JHX 1.4 The announcement is 1.4a Type of update 1.4b Reason for update Daily buy-back notification 1.4c Date of initial notification of buy-back 12/12/2022 1.4d Date of previous announcement to this update 2/9/2023 1.5 Date of this announcement 5/9/2023 1.6 ASX Security code and description of the class of +securities the subject of the buy-back JHX : CHESS DEPOSITARY INTERESTS 1:1 Daily buy-back notification Update/amendment to previous announcement

Notification of buy-back Notification of buy-back 3 / 6 Part 2 - Type of buy-back 2.1 The type of buy-back is: On market buy-back

Notification of buy-back Notification of buy-back 4 / 6 Part 3 - Buy-back details Part 3A - Details of +securities, price and reason 3A.1 Total number of +securities on issue in the class of +securities to be bought back 445,855,985 3A.4 Does the entity intend to buy back a minimum number of +securities 3A.5 Does the entity intend to buy back a maximum number of securities 3A.5a Maximum number of securities proposed to be bought back 10,060,000 3A.6 Name of broker or brokers who will offer to buy back +securities on the entity's behalf Broker name: Barrenjoey Markets Pty Limited 3A.9 Are the +securities being bought back for a cash consideration? 3A.9a Is the price to be paid for +securities bought back known? 3A.9a.1 In what currency will the buy-back consideration be paid? AUD - Australian Dollar Part 3B - Buy-back restrictions and conditions 3B.1 Does the buy-back require security holder approval? No Yes Yes No

Notification of buy-back Notification of buy-back 5 / 6 Part 3C - Key dates On-market buy-back 3C.2 Proposed buy-back start date 12/12/2022 3C.3 Proposed buy-back end date 31/10/2023 Part 3D - Other Information 3D.1 Any other information the entity wishes to notify to ASX about the buy-back Based on a closing market price on ASX of A$29.26 on 9 December 2022 (being the business day immediately prior to the date of this notice) and an A$/US$ exchange rate of 0.6792 (being the applicable spot rate on the same date) this would equate to a maximum of 10.06 million ordinary shares/CUFS. However the final maximum number of shares/CUFS will depend on market price and exchange rate movements over the buy-back period. No

Notification of buy-back Notification of buy-back 6 / 6 Part 4 - Daily buy-back notification A daily buy-back notification must be submitted for Employee share scheme, On-market, Equal access share scheme and Other buy-backs at least half an hour before the commencement of trading on the +business day after any day on which +securities are bought back (per listing rule 3.8A) Please verify if the pre-populated values are accurate as they are only indicative based on previous online submissions. The pre-populated values may not be accurate if previous online submissions are still in-flight or in case of announcements made via a MS Word form. Whilst you may over-ride a pre-populated value, once over-ridden it will not be possible to retrieve the previously pre-populated value. 4.1 Date of this notification 5/9/2023 4.2 Previous day on which +securities were bought back 4/9/2023 Before previous day On previous day 4.3 Total number of +securities bought back, or in relation to which acceptances have been received 8,024,377 127,379 4.4 Total consideration paid or payable for the +securities AUD 292,553,850.36000 AUD 5,960,973.80000 4.5 Highest price paid AUD 47.74000000 AUD 47.31000000 Date highest price was paid: 16/8/2023 4.6 Lowest price paid AUD 27.06000000 AUD 46.50000000 Date lowest price was paid: 21/12/2022 4.7 Highest price allowed to be paid by entity on the previous day under listing rule 7.33: AUD 48.07000000 4.8 If the entity has disclosed an intention to buy back a maximum number of +securities, the remaining number of +securities to be bought back as at the end of the previous day 1,908,244

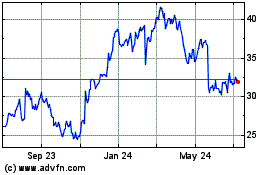

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

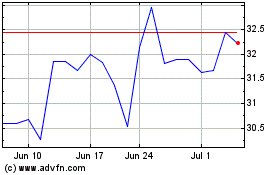

James Hardie Industries (NYSE:JHX)

Historical Stock Chart

From Apr 2023 to Apr 2024