GlaxoSmithKline 4Q Pretax Profit Rose But Sees Falling Earnings in 2020

February 05 2020 - 7:58AM

Dow Jones News

By Carlo Martuscelli

GlaxoSmithKline PLC (GSK.LN) reported rising profit before tax

in the final quarter of the year on Wednesday, but missed analyst

forecasts across several metrics and guided for declining earnings

in the year ahead.

Pretax profit in the fourth quarter was 1.71 billion pounds

($2.22 billion), up from GBP1.37 billion the year before. Sales

increased by 8.6% to GBP8.90 billion, missing a consensus analyst

forecast of GBP9.03 billion provided by FactSet.

Adjusted earnings per share--a metric closely watched by

analysts that strips out one-off items--fell by 16% when accounting

for currency effects, to 24.8 pence, missing analyst forecasts of

30 pence.

The British pharmaceutical major is facing heavy investments

into research as it continues to rebuild its pipeline of cancer

drugs after having divested its oncology portfolio in 2014, as well

as competition to its best-selling inhaler Advair.

Looking ahead, the FTSE 100-listed company said that it expects

adjusted EPS to decline by between 1% and 4% at constant rates in

2020, citing a two-year period of mounting investment in its key

new products.

Glaxo declared a dividend of 80 pence for the year and said it

expects the pay-out to remain unchanged in 2020.

Shares of the company at 1227 GMT traded 2.6% lower at

GBP17.68.

Write to Carlo Martuscelli at carlo.martuscelli@wsj.com;

@carlomartu

(END) Dow Jones Newswires

February 05, 2020 07:43 ET (12:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

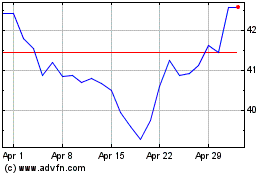

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024