Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

May 07 2019 - 4:43PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive Proxy Statement

|

|

|

☒

|

Definitive Additional Materials

|

|

|

☐

|

Soliciting Material Under Rule 14a-12

|

|

GANNETT CO., INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

MNG ENTERPRISES, INC.

MNG INVESTMENT HOLDINGS LLC

STRATEGIC INVESTMENT OPPORTUNITIES LLC

ALDEN GLOBAL CAPITAL LLC

HEATH FREEMAN

DANA NEEDLEMAN

STEVEN ROSSI

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

MNG Enterprises, Inc.,

together with the other participants in the solicitation (collectively, “MNG”), has filed a definitive proxy statement

and an accompanying BLUE proxy card with the Securities and Exchange Commission to be used to solicit proxies for the election

of its slate of director nominees at the 2019 annual meeting of stockholders of Gannett Co., Inc., a Delaware corporation.

Item 1: On May 7, 2019,

MNG issued the following press release:

MNG ENTERPRISES, INC.

mng

commenTs on GLASS LEWIS Report

Reiterates Need for Fresh Perspective

and a Shareholder Orientation on Entrenched, Incumbent Gannett Board

Urges Gannett Shareholders to Vote

on the BLUE Proxy Card “FOR” MNG Nominees Who Will Act as Catalyst to Maximize Value

May 7, 2019 – Denver, CO –

MNG Enterprises,

Inc. (“MNG”), owner and operator of one of the largest newspaper businesses in the U.S. and the largest active shareholder

in Gannett Co., Inc. (NYSE:GCI) (“Gannett” or the “Company”), with an approximate 7.4% ownership interest,

today issued the following statement in response to a report

[1]

by Glass Lewis & Co., LLC (“Glass Lewis”) regarding the election of directors to Gannett’s Board of Directors

(the “Board”) at the Company’s upcoming annual meeting of shareholders on May 16, 2019:

“While we agree with Glass Lewis that ‘Gannett’s

business has struggled on a stand-alone basis since the 2015 spin-off from TEGNA’ and that a $12.00 per share offer implies

a ‘fairly attractive premium,’ we firmly believe that shareholders must hold the incumbent Board accountable for the

Company’s track record of significant underperformance and for the Board's failure to take the necessary steps to maximize

shareholder value in favor of continuing to pursue a digital transformation strategy that Glass Lewis admits is ‘far from

proven.’

“Against the backdrop of the significant issues facing

the newspaper industry and the premium cash offer that MNG has proposed, we believe that the best way for Gannett shareholders

to effect meaningful change on the Board is to vote on the

BLUE

card

FOR ALL of MNG’s nominees

, who

are committed to acting as a catalyst to maximize shareholder value, including by supporting a full strategic alternatives process.

Without strong advocates on the Board willing to explore all possible ways to enhance value, Gannett is at risk of continuing down

the path toward complete value erosion.

“The election of ALL THREE of MNG’s nominees is

needed to send a clear message to the incumbent directors that the status quo is not acceptable, and the Board needs to explore

all possible ways to enhance value for all Gannett shareholders. MNG’s nominees –

Heath Freeman, Dana Needleman

and Steve Rossi

– deserve Gannett shareholders’ support because they possess the right mix of newspaper turnaround,

real estate, and capital allocation expertise needed to improve the Gannett Board and shareholder orientation, and provide much

needed fresh perspective that Gannett’s incumbent directors lack.”

We encourage all shareholders to review

our shareholder presentation to understand more about why change is needed now and why MNG’s nominees are best positioned

to Save Gannett. Additional information about MNG, its proposal to acquire Gannett, and its nominees is available at www.SaveGannett.com.

We urge all shareholders to

VOTE THE

BLUE

CARD “FOR” MNG’s independent slate of Director Nominees

.

Your vote is important, no matter how

many shares you own!

[1]

Permission to quote from report was neither sought nor obtained.

Please remember NOT TO RETURN the Company’s WHITE PROXY

CARD! If you return a Gannett proxy card – even by simply indicating “withhold” on the Company’s slate

– you will revoke any vote you had previously submitted for the MNG nominees on the BLUE proxy card.

Moelis & Company LLC is acting as

financial advisor to MNG. Akin Gump Strauss Hauer & Feld LLP and Olshan Frome Wolosky LLP are serving as its legal counsel.

Okapi Partners LLC is acting as MNG’s proxy solicitor.

About MNG Enterprises

MNG Enterprises, Inc. is one of the largest

owners and operators of newspapers in the United States by circulation, with approximately 200 publications including The Denver

Post, The Mercury News, The Orange County Register and The Boston Herald. MNG is a leader in local, multi-platform news and information,

distinguished by its award-winning original content and high quality, diversified portfolio of both print and local news and information

web sites and mobile apps offering rich multimedia experiences across the nation. For more information, please visit www.medianewsgroup.com.

Additional Information

MNG Enterprises, Inc., together with the

other participants in its proxy solicitation (collectively, “MNG”), have filed a definitive proxy statement and an

accompanying BLUE proxy card with the Securities and Exchange Commission (the “SEC”) to be used to solicit votes for

the election of MNG’s slate of highly-qualified director nominees at the 2019 annual meeting of stockholders (the “Annual

Meeting”) of Gannett Co., Inc. (the “Company”). Stockholders are advised to read the proxy statement and any

other documents related to the solicitation of stockholders of the Company in connection with the Annual Meeting because they contain

important information, including additional information relating to the participants in MNG’s proxy solicitation. These materials

and other materials filed by MNG in connection with the solicitation of proxies are available at no charge on the SEC’s website

at www.sec.gov. The definitive proxy statement and other relevant documents filed by MNG with the SEC are also available, without

charge, by directing a request to MNG’s proxy solicitor, Okapi Partners LLC, at its toll-free number (888) 785-6668 or via

email at info@okapipartners.com.

MEDIA CONTACT:

Reevemark

Paul Caminiti / Hugh Burns / Renée Soto

+1 212.433.4600

MNGInquiries@reevemark.com

INVESTOR CONTACT:

Okapi Partners LLC

Bruce Goldfarb/Pat McHugh

+ 212.297.0720

info@okapipartners.com

###

Item 2: On May 7, 2019,

MNG uploaded the following materials to www.savegannett.com:

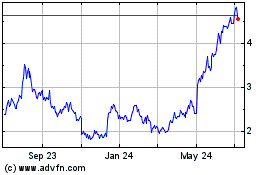

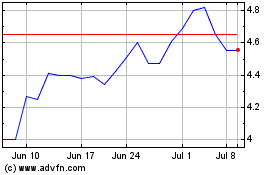

New Gannett (NYSE:GCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

New Gannett (NYSE:GCI)

Historical Stock Chart

From Apr 2023 to Apr 2024