Current Report Filing (8-k)

July 15 2020 - 5:00PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): July 15, 2020

FS

KKR Capital Corp.

(Exact

name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

814-00757

|

|

26-1630040

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

|

|

|

|

201

Rouse Boulevard

Philadelphia,

Pennsylvania

|

|

19112

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (215) 495-1150

None

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange

on

which registered

|

|

Common

stock

|

|

FSK

|

|

New

York Stock Exchange

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

☐

|

Emerging

growth company

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.07.

|

Submission

of Matters to a Vote of Security Holders.

|

FS

KKR Capital Corp. (the “Company”) held its Annual Meeting of Stockholders (the “Annual Meeting”) on June

23, 2020. On June 23, 2020, the Company adjourned the Annual Meeting with respect to the Share Issuance Proposal (as defined below)

to permit additional time to solicit stockholder votes for such proposal. The reconvened meeting (the “Reconvened Meeting”)

was held on July 15, 2020. As of April 20, 2020, the record date (the “Record Date”) for the determination of stockholders

entitled to notice of, and to vote at, the Reconvened Meeting, 495,032,065 shares

of common stock were eligible to be voted in person or by proxy. As previously announced, on June 15, 2020, the Company effected

a 4 to 1 reverse split of the Company’s shares of common stock (the “Reverse Stock Split”). As a result

of the Reverse Stock Split, every four shares of the Company’s common stock issued and outstanding were automatically combined

into one share of the Company’s common stock. As adjusted to give effect to the Reverse Stock Split, at the close of business

on the Record Date, there would have been 123,758,016 shares of the Company’s common stock (instead of 495,032,065),

constituting all of the outstanding voting securities of the Company. The Reverse Stock Split did not modify the rights or preferences

of the Company’s common stock. Of the eligible shares of common stock to be voted, 63,984,787 were voted in person or by

proxy at the Reconvened Meeting.

Stockholders

were asked to consider and act upon the following proposals, each of which was described in the Company’s definitive proxy

statement filed with the Securities and Exchange Commission (the “SEC”) on April 21, 2020:

|

|

•

|

Proposal

No. 2 – to approve a proposal to allow the

Company in future offerings to sell its shares below net asset value per share in order

to provide flexibility for future sales (the “Share Issuance Proposal”).

|

The

Share Issuance Proposal was approved by the Company’s stockholders at the Reconvened Meeting. The votes for, votes against,

abstentions and broker non-votes are set below:

|

Votes

For

|

Votes

Against

|

Abstentions

|

Broker

Non-Votes

|

|

49,251,223

|

11,127,811

|

3,605,753

|

0

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FS

KKR Capital Corp.

|

|

|

|

|

|

|

Date:

July 15, 2020

|

|

|

|

By:

|

|

/s/

Stephen Sypherd

|

|

|

|

|

|

|

|

Stephen

Sypherd

|

|

|

|

|

|

|

|

General

Counsel

|

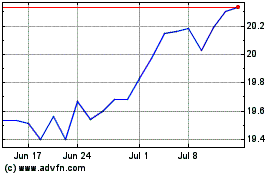

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

FS KKR Capital (NYSE:FSK)

Historical Stock Chart

From Apr 2023 to Apr 2024