First Quarter 2021 and Recent

Highlights

- Company maintains liquidity of $354.3 million at March 31,

2021.

- Revenues of $13.2 million; net loss of $21.0 million.

- Extended the maturity date of $125 million unsecured revolving

credit facility to April 2024.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use,

master-planned communities in California, today reported its first

quarter 2021 results. Emile Haddad, Chairman and CEO, said,

“Housing continues to be a bright spot of the economy. Strong

demand for housing is being driven by low interest rates and people

having a newfound appreciation for their homes and for how housing

fits into their evolving lives. As evidence of this strong demand,

year to date home sales at the Great Park Neighborhoods are over

twice the amount of sales during the same period in 2020. The

planning and amenities that go into our communities are embraced

even more today than in past years. In Valencia, with approximately

60 model homes under construction, we are excited about our guest

builders opening for sale and welcoming our first homeowners later

this year.”

First Quarter 2021 Consolidated

Results

Liquidity and Capital Resources

As of March 31, 2021, total liquidity of $354.3 million was

comprised of cash and cash equivalents totaling $229.7 million and

borrowing availability of $124.7 million under our $125.0 million

unsecured revolving credit facility. Total capital was $1.9

billion, reflecting $2.9 billion in assets and $1.1 billion in

liabilities and redeemable noncontrolling interests.

Results of Operations for the Three Months Ended March 31,

2021

Revenues. Revenues of $13.2 million for the three months

ended March 31, 2021 was primarily generated from management

services.

Equity in loss from unconsolidated entities. Equity in

loss from unconsolidated entities was $3.6 million for the three

months ended March 31, 2021, comprised of a $3.9 million loss from

our 37.5% percentage interest in the Great Park Venture offset by

earnings of $0.4 million from our 75% interest in the Gateway

Commercial Venture.

Selling, general, and administrative. Selling, general,

and administrative expenses were $19.5 million for the three months

ended March 31, 2021.

Net loss. Consolidated net loss for the quarter was $21.0

million. Net loss attributable to noncontrolling interests totaled

$11.3 million, resulting in net loss attributable to the Company of

$9.8 million. Net loss attributable to noncontrolling interests

represents the portion of loss allocated to related party partners

and members that hold units of the operating company and the San

Francisco Venture. Holders of units of the operating company and

the San Francisco Venture can redeem their interests for our Class

A common shares on a one-for-one basis or, at our election, cash.

In connection with any redemption or exchange, our ownership of our

operating subsidiaries will increase and reduce the amount of

income allocated to noncontrolling interests.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call on Monday, May 10, 2021 at 5:00 p.m. Eastern Time.

Emile Haddad, President and Chief Executive Officer, and Erik

Higgins, Vice President and Chief Financial Officer, will host the

call. Interested investors and other parties can listen to a live

Internet audio webcast of the conference call that will be

available on the Five Point website at ir.fivepoint.com. The

conference call can also be accessed by dialing (800) 437-2398

(domestic) or (929) 477-0577 (international). A telephonic replay

will be available starting approximately two hours after the end of

the call by dialing (844) 512-2921, or for international callers,

(412) 317-6671. The passcode for the live call and the replay is

7087320. The telephonic replay will be available until 11:59 p.m.

Eastern Time on May 24, 2021.

About Five Point

Five Point, headquartered in Irvine, California, designs and

develops large mixed-use, master-planned communities in Orange

County, Los Angeles County, and San Francisco County that combine

residential, commercial, retail, educational, and recreational

elements with public amenities, including civic areas for parks and

open space. Five Point’s communities include the Great Park

Neighborhoods® in Irvine, Valencia® (formerly known as Newhall

Ranch®) in Los Angeles County, and Candlestick® and The San

Francisco Shipyard® in the City of San Francisco. These communities

are designed to include approximately 40,000 residential homes and

approximately 23 million square feet of commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. This

press release may contain forward-looking statements regarding: our

expectations of our future revenues, costs and financial

performance; future demographics and market conditions in the areas

where our communities are located; the outcome of pending

litigation and its effect on our operations; the timing of our

development activities; and the timing of future real estate

purchases or sales. We caution you that any forward-looking

statements included in this press release are based on our current

views and information currently available to us. Forward-looking

statements are subject to risks, trends, uncertainties and factors

that are beyond our control. Some of these risks and uncertainties

are described in more detail in our filings with the SEC, including

our Annual Report on Form 10-K, under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, estimated or projected. We

caution you therefore against relying on any of these

forward-looking statements. While forward-looking statements

reflect our good faith beliefs, they are not guarantees of future

performance. They are based on estimates and assumptions only as of

the date hereof. We undertake no obligation to update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, new information, data or methods, future

events or other changes, except as required by applicable law.

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended

March 31,

2021

2020

REVENUES:

Land sales

$

22

$

6

Land sales—related party

19

10

Management services—related party

12,439

8,244

Operating properties

700

960

Total revenues

13,180

9,220

COSTS AND EXPENSES:

Land sales

—

—

Management services

10,777

6,051

Operating properties

1,585

1,945

Selling, general, and administrative

19,538

24,626

Total costs and expenses

31,900

32,622

OTHER INCOME:

Interest income

27

1,006

Miscellaneous

1,204

88

Total other income

1,231

1,094

EQUITY IN LOSS FROM UNCONSOLIDATED

ENTITIES

(3,556

)

(30,911

)

LOSS BEFORE INCOME TAX BENEFIT

(21,045

)

(53,219

)

INCOME TAX BENEFIT

—

—

NET LOSS

(21,045

)

(53,219

)

LESS NET LOSS ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

(11,266

)

(28,413

)

NET LOSS ATTRIBUTABLE TO THE COMPANY

$

(9,779

)

$

(24,806

)

NET LOSS ATTRIBUTABLE TO THE COMPANY PER

CLASS A SHARE

Basic

$

(0.14

)

$

(0.36

)

Diluted

$

(0.14

)

$

(0.37

)

WEIGHTED AVERAGE CLASS A SHARES

OUTSTANDING

Basic

67,288,860

66,649,866

Diluted

67,288,860

68,792,585

NET LOSS ATTRIBUTABLE TO THE COMPANY PER

CLASS B SHARE

Basic and diluted

$

(0.00

)

$

(0.00

)

WEIGHTED AVERAGE CLASS B SHARES

OUTSTANDING

Basic and diluted

79,233,544

79,233,544

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except

shares)

(Unaudited)

March 31, 2021

December 31, 2020

ASSETS

INVENTORIES

$

2,043,407

$

1,990,859

INVESTMENT IN UNCONSOLIDATED ENTITIES

439,239

442,850

PROPERTIES AND EQUIPMENT, NET

32,452

32,769

INTANGIBLE ASSET, NET—RELATED PARTY

63,901

71,747

CASH AND CASH EQUIVALENTS

229,670

298,144

RESTRICTED CASH AND CERTIFICATES OF

DEPOSIT

1,330

1,330

RELATED PARTY ASSETS

108,164

103,681

OTHER ASSETS

17,048

20,605

TOTAL

$

2,935,211

$

2,961,985

LIABILITIES AND CAPITAL

LIABILITIES:

Notes payable, net

$

617,843

$

617,581

Accounts payable and other liabilities

144,239

135,331

Related party liabilities

101,832

113,149

Deferred income tax liability, net

12,578

12,578

Payable pursuant to tax receivable

agreement

172,726

173,248

Total liabilities

1,049,218

1,051,887

REDEEMABLE NONCONTROLLING INTEREST

25,000

25,000

CAPITAL:

Class A common shares; No par value;

Issued and outstanding: March 31, 2021—68,758,347 shares; December

31, 2020—69,051,284 shares

Class B common shares; No par value;

Issued and outstanding: March 31, 2021—79,233,544 shares; December

31, 2020—79,233,544 shares

Contributed capital

576,826

578,278

Retained earnings

32,442

42,221

Accumulated other comprehensive loss

(2,811

)

(2,833

)

Total members’ capital

606,457

617,666

Noncontrolling interests

1,254,536

1,267,432

Total capital

1,860,993

1,885,098

TOTAL

$

2,935,211

$

2,961,985

FIVE POINT HOLDINGS,

LLC

SUPPLEMENTAL DATA

(In thousands)

(Unaudited)

Liquidity

March 31, 2021

Cash and cash equivalents

$

229,670

Borrowing capacity (1)

124,651

Total liquidity

$

354,321

(1)

As of March 31, 2021, no amounts were

drawn on the Company’s $125.0 million revolving credit facility;

however, letters of credit of approximately $0.3 million were

issued and outstanding under the revolving credit facility, thus

reducing the available capacity by the outstanding letters of

credit amount.

Debt to Total

Capitalization and Net Debt to Total Capitalization

March 31, 2021

Debt (1)

$

625,000

Total capital

1,860,993

Total capitalization

$

2,485,993

Debt to total capitalization

25.1

%

Debt (1)

$

625,000

Less: Cash and cash equivalents

229,670

Net debt

395,330

Total capital

1,860,993

Total net capitalization

$

2,256,323

Net debt to total capitalization

(2)

17.5

%

(1)

For purposes of this calculation, debt is

the amount due on the Company’s notes payable before offsetting for

capitalized deferred financing costs.

(2)

Net debt to total capitalization is a

non-GAAP financial measure defined as net debt (debt less cash and

cash equivalents) divided by total net capitalization (net debt

plus total capital). The Company believes the ratio of net debt to

total capitalization is a relevant and a useful financial measure

to investors in understanding the leverage employed in the

Company’s operations. However, because net debt to total

capitalization is not calculated in accordance with GAAP, this

financial measure should not be considered in isolation or as an

alternative to financial measures prescribed by GAAP. Rather, this

non-GAAP financial measure should be used to supplement the

Company's GAAP results.

Segment

Results

The following table reconciles the results

of operations of our segments to our consolidated results for the

three months ended March 31, 2021 (in thousands):

Valencia

San

Francisco

Great Park

Commercial

Total

reportable

segments

Corporate and

unallocated

Total under

management

Removal of

unconsolidated

entities(1)

Total

consolidated

REVENUES:

Land sales

$

22

$

—

$

741

$

—

$

763

$

—

$

763

$

(741

)

$

22

Land sales—related party

19

—

219

—

238

—

238

(219

)

19

Management services—related party

—

—

12,340

99

12,439

—

12,439

—

12,439

Operating properties

551

149

—

2,101

2,801

—

2,801

(2,101

)

700

Total revenues

592

149

13,300

2,200

16,241

—

16,241

(3,061

)

13,180

COSTS AND EXPENSES:

Land sales

—

—

—

—

—

—

—

—

—

Management services

—

—

10,777

—

10,777

—

10,777

—

10,777

Operating properties

1,585

—

—

159

1,744

—

1,744

(159

)

1,585

Selling, general, and administrative

4,040

1,125

7,568

1,159

13,892

14,373

28,265

(8,727

)

19,538

Management fees—related party

—

—

6,118

—

6,118

—

6,118

(6,118

)

—

Total costs and expenses

5,625

1,125

24,463

1,318

32,531

14,373

46,904

(15,004

)

31,900

OTHER INCOME (EXPENSE):

Interest income

—

—

242

—

242

27

269

(242

)

27

Interest expense

—

—

—

(303

)

(303

)

—

(303

)

303

—

Miscellaneous

134

1,070

—

—

1,204

—

1,204

—

1,204

Total other income (expense)

134

1,070

242

(303

)

1,143

27

1,170

61

1,231

EQUITY IN LOSS FROM UNCONSOLIDATED

ENTITIES

—

—

—

—

—

—

—

(3,556

)

(3,556

)

SEGMENT (LOSS) PROFIT/LOSS BEFORE INCOME

TAX BENEFIT

(4,899

)

94

(10,921

)

579

(15,147

)

(14,346

)

(29,493

)

8,448

(21,045

)

INCOME TAX BENEFIT

—

—

—

—

—

—

—

—

—

SEGMENT (LOSS) PROFIT/NET LOSS

$

(4,899

)

$

94

$

(10,921

)

$

579

$

(15,147

)

$

(14,346

)

$

(29,493

)

$

8,448

$

(21,045

)

(1)

Represents the removal of the Great Park

Venture’s and Gateway Commercial Venture’s operating results that

are included in the Great Park segment and Commercial segment

operating results, respectively, but are not included in our

consolidated results.

The table below reconciles the Great Park

segment results to the equity in loss from our investment in the

Great Park Venture that is reflected in the condensed consolidated

statement of operations for the three months ended March 31, 2021

(in thousands):

Segment loss from operations

$

(10,921

)

Less net income of management company

attributed to the Great Park segment

1,563

Net loss of the Great Park Venture

(12,484

)

The Company’s share of net loss of the

Great Park Venture

(4,682

)

Basis difference accretion

766

Equity in loss from the Great Park

Venture

$

(3,916

)

The table below reconciles the Commercial

segment results to the equity in earnings from our investment in

the Gateway Commercial Venture that is reflected in the condensed

consolidated statement of operations for the three months ended

March 31, 2021 (in thousands):

Segment profit from operations

$

579

Less net income of management company

attributed to the Commercial segment

99

Net income of the Gateway Commercial

Venture

480

Equity in earnings from the Gateway

Commercial Venture

$

360

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210510005871/en/

Investor Relations: Bob Wetenhall, 949-349-1087

bob.wetenhall@fivepoint.com

or

Media: Steve Churm, 949-349-1034 steve.churm@fivepoint.com

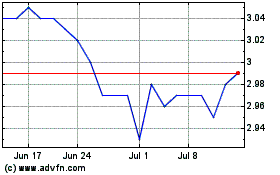

Five Point (NYSE:FPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

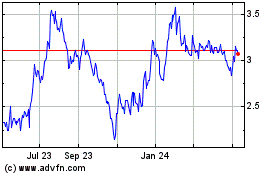

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2023 to Nov 2024