Third Quarter 2020 Highlights

- Consolidated net income of $36.4 million and an increase in

cash of approximately $55 million.

- Cash distributions of $80.3 million received from Gateway

Commercial Venture from proceeds generated by the sale of two

buildings at the Five Point Gateway Campus for a purchase price of

$355 million.

- Company maintains liquidity of $395.2 million at September 30,

2020.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use,

master-planned communities in California, today reported its third

quarter 2020 results. Emile Haddad, Chairman and CEO, said, “We are

pleased to present our third quarter results where we improved our

cash position by $55 million and generated consolidated net income

of $36.4 million. We are seeing continued strength in our markets

evidenced by the rate of sales at our Great Park Neighborhoods

community, the interest from homebuilders in Valencia and the

reported home price appreciation in both the Los Angeles County and

Orange County markets.”

Third Quarter 2020 Consolidated

Results

Liquidity and Capital Resources

As of September 30, 2020, total liquidity of $395.2 million was

comprised of cash and cash equivalents totaling $270.6 million and

borrowing availability of $124.7 million under our $125.0 million

unsecured revolving credit facility. Total capital was $1.9

billion, reflecting $3.0 billion in assets and $1.1 billion in

liabilities and redeemable noncontrolling interests.

Results of Operations for the Three Months Ended September 30,

2020

Revenues. Revenues of $8.4 million for the three months

ended September 30, 2020 were primarily generated from management

services.

Equity in earnings from unconsolidated entities. Equity

in earnings from unconsolidated entities was $52.4 million for the

three months ended September 30, 2020, comprised of a $4.2 million

loss from our 37.5% percentage interest in the Great Park Venture

and earnings of $56.6 million from our 75% interest in the Gateway

Commercial Venture.

Selling, general, and administrative. Selling, general,

and administrative expenses were $17.7 million for the three months

ended September 30, 2020.

Net income. Consolidated net income for the quarter was

$36.4 million. The net income attributable to noncontrolling

interests totaled $19.5 million, resulting in net income

attributable to the Company of $17.0 million.

Segment Results

Valencia Segment (formerly Newhall). Selling, general,

and administrative expenses were $2.8 million for the three months

ended September 30, 2020.

San Francisco Segment. Selling, general, and

administrative expenses were $2.0 million for the three months

ended September 30, 2020.

Great Park Segment. The Great Park segment’s net loss for

the quarter was $10.2 million, which included net income of $1.8

million from management services and a net loss of $12.0 million

attributed to the Great Park Venture. We do not include the Great

Park Venture as a consolidated subsidiary in our consolidated

financial statements but rather account for it as an equity method

investee. After adjusting to account for a difference in investment

basis, the Company’s equity in loss from the Great Park Venture was

$4.2 million for the three months ended September 30, 2020.

Commercial Segment. In August 2020, the Gateway

Commercial Venture closed on the sale of two buildings, comprising

a total of approximately 660,000 square feet of research and

development space currently leased to a subsidiary of Broadcom Inc.

for a purchase price of $355.0 million. The sale of the buildings,

which had a carrying value of approximately $278.0 million,

resulted in a gain of approximately $74.8 million, net of

transaction costs. Concurrently, the Gateway Commercial Venture

made a debt payment of $245.0 million to its lender and made total

distributions to its members of approximately $107.0 million, of

which approximately $80.3 million was distributed to us. Segment

net income was approximately $75.6 million, which included net

income of $0.1 million from management services and net income of

$75.5 million attributed to the Gateway Commercial Venture. We do

not include the Gateway Commercial Venture as a consolidated

subsidiary in our consolidated financial statements but rather

account for it as an equity method investee. Our share of equity in

earnings from the Gateway Commercial Venture totaled $56.6 million

for the three months ended September 30, 2020.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call today, Tuesday, November 10, 2020 at 5:00 pm

Eastern Time. Emile Haddad, President and Chief Executive Officer,

and Erik Higgins, Vice President and Chief Financial Officer, will

host the call. Interested investors and other parties can listen to

a live Internet audio webcast of the conference call that will be

available on the Five Point website at ir.fivepoint.com. The

conference call can also be accessed by dialing (866) 248-8441

(domestic) or (720) 452-9102 (international). A telephonic replay

will be available starting approximately two hours after the end of

the call by dialing (844) 512-2921, or for international callers,

(412) 317-6671. The passcode for the live call and the replay is

2148805 The telephonic replay will be available until 11:59 p.m.

Eastern Time on November 24, 2020.

About Five Point

Five Point, headquartered in Irvine, California, designs and

develops large mixed-use, master-planned communities in Orange

County, Los Angeles County, and San Francisco County that combine

residential, commercial, retail, educational, and recreational

elements with public amenities, including civic areas for parks and

open space. Five Point’s communities include the Great Park

Neighborhoods® in Irvine, Valencia® (formerly known as Newhall

Ranch®) in Los Angeles County, and Candlestick® and The San

Francisco Shipyard® in the City of San Francisco. These communities

are designed to include approximately 40,000 residential homes and

approximately 23 million square feet of commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. This

press release may contain forward-looking statements regarding: our

expectations of our future revenues, costs and financial

performance; future demographics and market conditions in the areas

where our communities are located; the outcome of pending

litigation and its effect on our operations; the timing of our

development activities; and the timing of future real estate

purchases or sales. We caution you that any forward-looking

statements included in this press release are based on our current

views and information currently available to us. Forward-looking

statements are subject to risks, trends, uncertainties and factors

that are beyond our control. Some of these risks and uncertainties

are described in more detail in our filings with the SEC, including

our Annual Report on Form 10-K and our Quarterly Reports on Form

10-Q, under the heading “Risk Factors.” Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those anticipated, estimated or projected. We caution you

therefore against relying on any of these forward-looking

statements. While forward-looking statements reflect our good faith

beliefs, they are not guarantees of future performance. They are

based on estimates and assumptions only as of the date hereof. We

undertake no obligation to update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events or other changes,

except as required by applicable law.

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

REVENUES:

Land sales

$

42

$

9

$

17,076

$

74

Land sales—related party

2

229

14

695

Management services—related party

7,999

11,458

22,557

33,689

Operating properties

334

318

2,257

3,016

Total revenues

8,377

12,014

41,904

37,474

COSTS AND EXPENSES:

Land sales

—

—

11,861

—

Management services

6,120

7,699

16,587

22,794

Operating properties

764

1,388

4,408

4,488

Selling, general, and administrative

17,656

25,863

58,594

77,629

Total costs and expenses

24,540

34,950

91,450

104,911

OTHER INCOME:

Interest income

71

1,724

1,303

6,494

Gain on settlement of contingent

consideration—related party

—

—

—

64,870

Miscellaneous

91

7

267

26

Total other income

162

1,731

1,570

71,390

EQUITY IN EARNINGS (LOSS) FROM

UNCONSOLIDATED ENTITIES

52,423

(1,750

)

45,417

4,463

INCOME (LOSS) BEFORE INCOME TAX

(PROVISION) BENEFIT

36,422

(22,955

)

(2,559

)

8,416

INCOME TAX (PROVISION) BENEFIT

—

—

—

(1,266

)

NET INCOME (LOSS)

36,422

(22,955

)

(2,559

)

7,150

LESS NET INCOME (LOSS) ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

19,458

(12,292

)

(1,349

)

4,517

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY

$

16,964

$

(10,663

)

$

(1,210

)

$

2,633

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY PER CLASS A SHARE

Basic

$

0.25

$

(0.16

)

$

(0.02

)

$

0.04

Diluted

$

0.25

$

(0.16

)

$

(0.02

)

$

0.04

WEIGHTED AVERAGE CLASS A SHARES

OUTSTANDING

Basic

66,746,065

66,276,694

66,709,190

66,248,431

Diluted

142,866,245

66,276,694

68,848,283

145,456,670

NET INCOME (LOSS) ATTRIBUTABLE TO THE

COMPANY PER CLASS B SHARE

Basic and diluted

$

0.00

$

(0.00

)

$

(0.00

)

$

0.00

WEIGHTED AVERAGE CLASS B SHARES

OUTSTANDING

Basic

79,233,544

79,275,234

79,233,544

79,204,883

Diluted

79,233,544

79,275,234

79,233,544

79,276,016

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except

shares)

(Unaudited)

September 30, 2020

December 31, 2019

ASSETS

INVENTORIES

$

2,021,155

$

1,889,761

INVESTMENT IN UNCONSOLIDATED ENTITIES

441,737

533,239

PROPERTIES AND EQUIPMENT, NET

33,018

32,312

INTANGIBLE ASSET, NET—RELATED PARTY

73,269

80,350

CASH AND CASH EQUIVALENTS

270,580

346,833

RESTRICTED CASH AND CERTIFICATES OF

DEPOSIT

1,330

1,741

RELATED PARTY ASSETS

100,478

97,561

OTHER ASSETS

21,357

22,903

TOTAL

$

2,962,924

$

3,004,700

LIABILITIES AND CAPITAL

LIABILITIES:

Notes payable, net

$

617,198

$

616,046

Accounts payable and other liabilities

138,066

167,711

Related party liabilities

118,897

127,882

Deferred income tax liability, net

11,628

11,628

Payable pursuant to tax receivable

agreement

173,248

172,633

Total liabilities

1,059,037

1,095,900

REDEEMABLE NONCONTROLLING INTEREST

25,000

25,000

CAPITAL:

Class A common shares; No par value;

Issued and outstanding: 2020—69,051,284 shares; 2019—68,788,257

shares

Class B common shares; No par value;

Issued and outstanding: 2020—79,233,544 shares; 2019—79,233,544

shares

Contributed capital

575,412

571,532

Retained earnings

41,439

42,844

Accumulated other comprehensive loss

(2,640

)

(2,682

)

Total members’ capital

614,211

611,694

Noncontrolling interests

1,264,676

1,272,106

Total capital

1,878,887

1,883,800

TOTAL

$

2,962,924

$

3,004,700

FIVE POINT HOLDINGS,

LLC

SUPPLEMENTAL DATA

(In thousands)

(Unaudited)

Liquidity

September 30, 2020

Cash and cash equivalents

$

270,580

Borrowing capacity (1)

124,651

Total liquidity

$

395,231

(1) As of September 30, 2020, no amounts

were drawn on the Company’s $125.0 million revolving credit

facility; however, letters of credit of approximately $0.3 million

are issued and outstanding under the revolving credit facility,

thus reducing the available capacity by the outstanding letters of

credit amount.

Debt to Total

Capitalization

September 30, 2020

Debt (1)

$

625,000

Total capital

1,878,887

Total capitalization

$

2,503,887

Debt to total capitalization

25.0

%

(1) For purposes of this calculation, debt

is not the same as the calculation of “Consolidated Funded

Indebtedness” under the Company’s revolving credit facility and

Senior Notes indenture, which would include a $94.4 million related

party contractual reimbursement obligation. Prior to the second

quarter of 2019, the Company presented this calculation inclusive

of the reimbursement obligation.

Segment Results

Valencia (formerly Newhall)

The following table summarizes the results of operations of our

Valencia segment for the three and nine months ended September 30,

2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Statement of Operations Data

Revenues

Land sales

$

42

$

9

$

17,076

$

74

Land sales—related party

2

8

14

31

Operating properties

196

134

1,807

2,481

Total revenues

240

151

18,897

2,586

Costs and expenses

Land sales

—

—

11,861

—

Operating properties

764

1,388

4,408

4,488

Selling, general, and administrative

2,798

3,663

9,244

11,364

Total costs and expenses

3,562

5,051

25,513

15,852

Other income

91

8

268

29

Segment loss

$

(3,231

)

$

(4,892

)

$

(6,348

)

$

(13,237

)

San Francisco

The following table summarizes the results of operations of our

San Francisco segment for the three and nine months ended September

30, 2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Statement of Operations Data

Revenues

Land sales—related party

$

—

$

221

$

—

$

664

Operating property

138

184

450

535

Management services—related party

—

545

835

1,816

Total revenues

138

950

1,285

3,015

Costs and expenses

Management services

—

226

488

855

Selling, general, and administrative

1,967

4,386

8,184

14,083

Total costs and expenses

1,967

4,612

8,672

14,938

Other income—gain on settlement of

contingent consideration, related party

—

—

—

64,870

Segment (loss) income

$

(1,829

)

$

(3,662

)

$

(7,387

)

$

52,947

Great Park

The following table summarizes the results of operations of our

Great Park segment for the three and nine months ended September

30, 2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Statement of Operations Data

Revenues

Land sales

$

141

$

36,198

$

21,962

$

98,743

Land sales—related party

87

2,438

1,092

132,473

Management services—related party

7,895

10,814

21,424

31,647

Total revenues

8,123

49,450

44,478

262,863

Costs and expenses

Land sales

—

24,518

15,304

153,486

Management services

6,120

7,473

16,099

21,939

Selling, general, and administrative

8,840

9,680

29,572

26,751

Management fees—related party

3,440

7,825

7,633

24,445

Total costs and expenses

18,400

49,496

68,608

226,621

Interest income

84

1,016

1,210

2,671

Segment (loss) income

$

(10,193

)

$

970

$

(22,920

)

$

38,913

The table below reconciles the Great Park segment results to the

equity in (loss) earnings from our investment in the Great Park

Venture that is reflected in the condensed consolidated statements

of operations for the three and nine months ended September 30,

2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Segment net (loss) income from

operations

$

(10,193

)

$

970

$

(22,920

)

$

38,913

Less net income of management company

attributed to the Great Park segment

1,775

3,340

5,325

9,708

Net (loss) income of the Great Park

Venture

(11,968

)

(2,370

)

(28,245

)

29,205

The Company’s share of net (loss) income

of the Great Park Venture

(4,488

)

(889

)

(10,592

)

10,952

Basis difference accretion

(amortization)

293

199

(1,204

)

(3,694

)

Other-than-temporary investment

impairment

—

—

(26,851

)

—

Equity in (loss) earnings from the Great

Park Venture

$

(4,195

)

$

(690

)

$

(38,647

)

$

7,258

Commercial

The following table summarizes the results of operations of our

Commercial segment for the three and nine months ended September

30, 2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Statement of Operations Data

Revenues

Rental and related income

$

2,935

$

6,388

$

15,797

$

19,492

Rental and related income—related

party

2,224

2,186

6,344

6,216

Property management services—related

party

104

99

298

226

Total revenues

5,263

8,673

22,439

25,934

Costs and expenses

Rental operating expenses

1,275

1,946

4,530

5,094

Interest

1,605

4,249

8,547

12,938

Depreciation

972

2,745

6,327

8,229

Amortization

23

1,032

2,100

3,090

Other expenses

640

14

812

83

Total costs and expenses

4,515

9,986

22,316

29,434

Other income—gain on asset sales, net

74,847

—

112,260

—

Segment income (loss)

$

75,595

$

(1,313

)

$

112,383

$

(3,500

)

The table below reconciles the Commercial segment results to the

equity in earnings (loss) from our investment in the Gateway

Commercial Venture that is reflected in the condensed consolidated

statements of operations for the three and nine months ended

September 30, 2020 and 2019.

Three Months Ended

September 30,

Nine Months Ended

September 30,

2020

2019

2020

2019

(in thousands)

Segment net income (loss) from

operations

$

75,595

$

(1,313

)

$

112,383

$

(3,500

)

Less net income of management company

attributed to the Commercial segment

104

99

298

226

Net income (loss) of the Gateway

Commercial Venture

75,491

(1,412

)

112,085

(3,726

)

Equity in earnings (loss) from the Gateway

Commercial Venture

$

56,618

$

(1,060

)

$

84,064

$

(2,795

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201110006153/en/

Investor Relations: Bob Wetenhall, 949-349-1087

bob.wetenhall@fivepoint.com or Media: Steve Churm, 949-349-1034

steve.churm@fivepoint.com

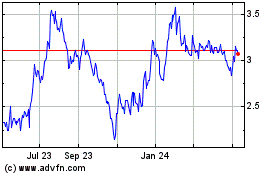

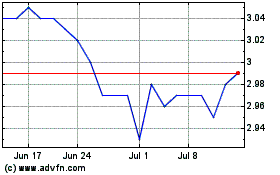

Five Point (NYSE:FPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2023 to Nov 2024