Five Point Announces Pricing & Upsizing of an Additional $125 Million of 7.875% Senior Notes due 2025 by Five Point Operating...

July 23 2019 - 5:55PM

Business Wire

Five Point Holdings, LLC (“Five Point”) (NYSE: FPH) today

announced that Five Point Operating Company, LP, through which Five

Point owns all of its assets and conducts all of its operations

(the “issuer”), and Five Point Capital Corp., a wholly owned

subsidiary of the issuer (the “co-issuer” and together with the

issuer, the “issuers”), priced an additional $125 million aggregate

principal amount, upsized from the previously announced amount of

$100 million, of their 7.875% Senior Notes due 2025 (the “new

notes”). The new notes will be issued at par plus accrued interest

from May 15, 2019. The new notes will constitute a further issuance

of the issuers’ existing 7.875% Senior Notes due 2025 issued in

November 2017 in an aggregate principal amount of $500 million.

The issuance of the new notes is expected to close on or about

July 26, 2019, subject to customary closing conditions. The issuer

intends to use proceeds of the new notes for general corporate

purposes, which may include pursuing commercial development

opportunities at its communities.

The new notes and related guarantees have not been, and will not

be, registered under the Securities Act of 1933, as amended (the

“Securities Act”), or the securities laws of any other

jurisdiction. The new notes may not be offered or sold within the

United States or to U.S. persons, except to persons reasonably

believed to be qualified institutional buyers in reliance on the

exemption from registration provided by Rule 144A and to certain

persons in offshore transactions in reliance on Regulation S.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy, any securities and shall not

constitute an offer to sell or a solicitation of an offer to buy,

or a sale of any securities, in any jurisdiction in which such

offer, solicitation or sale is unlawful.

Forward-Looking Statements

This press release includes forward-looking statements,

including statements about the proposed offering of the new notes,

including the anticipated use of proceeds therefrom, that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. We

caution you that any forward-looking statements included in this

press release are based on our current views and information

currently available to us. Forward-looking statements are subject

to risks, trends, uncertainties and factors that are beyond our

control. Some of these risks and uncertainties are described in

more detail in our filings with the Securities and Exchange

Commission, including our most recent Annual Report on Form 10-K,

under the heading “Risk Factors.” Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

anticipated, estimated or projected. We caution you therefore

against relying on any of these forward-looking statements. While

forward-looking statements reflect our good faith beliefs, they are

not guarantees of future performance. They are based on estimates

and assumptions only as of the date hereof. We undertake no

obligation to update or revise any forward-looking statement to

reflect changes in underlying assumptions or factors, new

information, data or methods, future events or other changes,

except as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190723005997/en/

Investor Relations: Bob Wetenhall, 949-349-1087

bob.wetenhall@fivepoint.com or Media: Steve Churm, 949-349-1034

steve.churm@fivepoint.com

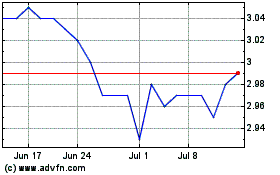

Five Point (NYSE:FPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

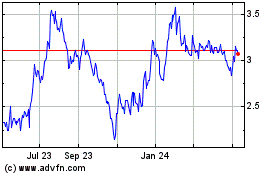

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2023 to Nov 2024