First Quarter 2019 and Recent

Highlights

- Submitted a revised plan for the first

phase of Candlestick that is expected to be approved by the City of

San Francisco in 2019. The revised plan is designed to include

approximately 1,600 homes, 750,000 square feet of office space, and

300,000 square feet of lifestyle mainly centered around

retail.

- Continued land development activity at

Valencia (formerly Newhall) in Los Angeles County positions the

Company to deliver homesites and generate revenue at this community

in the fourth quarter of 2019.

- Received approvals to build an

additional 1,056 homes at the Great Park in Irvine.

- Company maintains strong credit profile

with total liquidity of $497.3 million and debt to total

capitalization of 24.0% at March 31, 2019.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use,

master-planned communities in California, today reported its first

quarter results for 2019. Emile Haddad, Chairman and CEO, said, “In

San Francisco, we submitted our revised plan for Candlestick and

expect to receive approval from the city before the end of the

year. In Los Angeles County, despite an unusually heavy rainy

season, land development activities at Valencia remain on

schedule, and we are still anticipating delivering our first

homesites in the fourth quarter of 2019. In Irvine, at the Great

Park, we received approval to build an additional 1,056 homes. In

addition, home buyer activity has remained consistent with normal

seasonal patterns, and we are excited to report that we collected

meaningful profit participation from our guest builders this

quarter. The combination of steady operational progress, a healthy

economy supported by seven years of consistent job growth, and a

pronounced imbalance between supply and demand in our markets

provides a favorable backdrop that should benefit the company

during the remainder of the year.”

First Quarter 2019 Consolidated

Results

Liquidity and Capital Resources

As of March 31, 2019, total liquidity of $497.3 million was

comprised of cash and cash equivalents totaling $373.3 million and

borrowing availability of $124.0 million under our

$125.0 million unsecured revolving credit facility. Total

capital was $1.9 billion, reflecting $2.9 billion in assets and

$1.0 billion in liabilities and redeemable noncontrolling

interests.

Results of Operations for the Three Months Ended March 31,

2019

Revenues. Revenues of $13.1 million for the three months

ended March 31, 2019 were primarily generated from management

services.

Equity in earnings from unconsolidated entities. Equity

in earnings from unconsolidated entities was $8.9 million for the

three months ended March 31, 2019. The earnings were primarily

due to our proportionate share of the Great Park Venture’s net

income during the quarter of $37.1 million, which primarily

resulted from the sale of land entitled for an aggregate of 369

homesites on approximately 29.5 acres at the Great Park

Neighborhoods. After adjusting for amortization and accretion of

the basis difference, our equity in earnings from our 37.5%

percentage interest in the Great Park Venture was $9.4 million.

Equity in loss from our 75% interest in the Gateway Commercial

Venture was $0.6 million for the three months ended March 31,

2019.

Selling, general, and administrative. Selling, general,

and administrative expenses were $25.8 million for the three months

ended March 31, 2019.

Other income. Other income for the three months ended

March 31, 2019 consisted primarily of a $64.9 million gain

recognized by our San Francisco segment pertaining to the

settlement of our contingent consideration liability related to the

termination of the retail joint venture at Candlestick.

Income tax provision. Income tax provision was $1.3

million for the three months ended March 31, 2019. The income

tax provision is the result of an increase in our valuation

allowance against deferred tax assets associated with changes

contained in the Tax Cuts and Jobs Act limiting the utilization of

net operating losses.

Net income. Consolidated net income for the quarter was

$52.7 million. The net income attributable to noncontrolling

interests totaled $28.9 million, resulting in net income

attributable to the Company of $23.8 million.

Segment Results

Valencia Segment (formerly Newhall). Total segment

revenues were $1.6 million for the first quarter of 2019 and were

derived from agricultural land leasing and the sale of citrus

crops. Selling, general, and administrative expenses were $3.8

million for the three months ended March 31, 2019.

San Francisco Segment. Total segment revenues were $1.1

million for the first quarter of 2019. Revenues during the quarter

were mostly attributable to fees generated from management

agreements. Selling, general, and administrative expenses were $4.5

million for the three months ended March 31, 2019. As a result

of the termination of the retail joint venture at Candlestick and

agreements related thereto, the contingent consideration liability

was settled, which resulted in a gain of $64.9 million.

Great Park Segment. Total segment revenues were $169.6

million for the first quarter of 2019. Revenues were mainly

attributable to the sale of land entitled for 369 homesites on 29.5

acres at the Great Park Neighborhoods. Initial gross proceeds from

the sale were $151.9 million representing the base purchase price.

The Great Park segment’s net income for the quarter was $40.3

million, which included net income of $37.1 million attributed to

the Great Park Venture that is not consolidated in our financial

statements. After adjusting to account for a difference in

investment basis, the Company’s equity in earnings from the Great

Park Venture was $9.4 million for the three months ended

March 31, 2019.

Commercial Segment. For the three months ended

March 31, 2019, the Commercial segment recognized $8.3 million

in revenues from tenant leases at the Five Point Gateway Campus and

property management services provided by us to the Gateway

Commercial Venture. Segment expenses were mostly comprised of

depreciation, amortization and interest expense totaling $7.5

million. Segment net loss was approximately $0.8 million. Our share

of equity in loss from the Gateway Commercial Venture totaled $0.6

million for the three months ended March 31, 2019.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call today, Tuesday, May 7, 2019 at 5:00 pm Eastern

Time. Emile Haddad, President and Chief Executive Officer, and Erik

Higgins, Vice President and Chief Financial Officer, will host the

call. Interested investors and other parties can listen to a live

Internet audio webcast of the conference call that will be

available on the Five Point website at ir.fivepoint.com. The

conference call can also be accessed by dialing (888) 204-4368

(domestic) or (720) 543-0214 (international). A telephonic replay

will be available starting approximately two hours after the end of

the call by dialing (844) 512-2921, or for international callers,

(412) 317-6671. The passcode for the live call and the replay is

1393116. The telephonic replay will be available until 11:59 p.m.

Eastern Time on May 21, 2019.

About Five Point

Five Point, headquartered in Irvine, California, designs

and develops large mixed-use, master-planned communities in Orange

County, Los Angeles County, and San Francisco

County that combine residential, commercial, retail,

educational, and recreational elements with public amenities,

including civic areas for parks and open space. Five Point’s

communities include the Great Park Neighborhoods® in Irvine,

Valencia® (formerly known as Newhall Ranch®) in Los Angeles County,

and Candlestick® and The San Francisco Shipyard™ in the City

of San Francisco. These communities are designed to include

approximately 40,000 residential homes and approximately 23 million

square feet of commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements. This

press release may contain forward-looking statements regarding: our

expectations of our future revenues, costs and financial

performance; future demographics and market conditions in the areas

where our communities are located; the outcome of pending

litigation and its effect on our operations; the timing of our

development activities; and the timing of future real estate

purchases or sales. We caution you that any forward-looking

statements included in this press release are based on our current

views and information currently available to us. Forward-looking

statements are subject to risks, trends, uncertainties and factors

that are beyond our control. Some of these risks and uncertainties

are described in more detail in our filings with the SEC, including

our Annual Report on Form 10-K, under the heading “Risk Factors.”

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, estimated or projected. We

caution you therefore against relying on any of these

forward-looking statements. While forward-looking statements

reflect our good faith beliefs, they are not guarantees of future

performance. They are based on estimates and assumptions only as of

the date hereof. We undertake no obligation to update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, new information, data or methods, future

events or other changes, except as required by applicable law.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except share and per

share amounts)

(Unaudited)

Three Months EndedMarch 31, 2019

2018 REVENUES: Land sales $ 55 $ 49 Land sales—related party

230 221 Management services—related party 11,063 11,767 Operating

properties 1,725 2,930 Total revenues 13,073

14,967 COSTS AND EXPENSES: Land sales — 38 Management

services 7,616 7,089 Operating properties 1,901 2,390 Selling,

general, and administrative 25,773 28,596 Total costs

and expenses 35,290 38,113 OTHER INCOME: Adjustment

to payable pursuant to tax receivable agreement — 1,928 Interest

income 2,454 2,747 Gain on settlement of contingent

consideration—related party 64,870 — Miscellaneous 10 7,781

Total other income 67,334 12,456 EQUITY IN

EARNINGS (LOSS) FROM UNCONSOLIDATED ENTITIES 8,882 (3,607 )

INCOME (LOSS) BEFORE INCOME TAX (PROVISION) BENEFIT 53,999 (14,297

) INCOME TAX (PROVISION) BENEFIT (1,266 ) — NET INCOME

(LOSS) 52,733 (14,297 ) LESS NET INCOME (LOSS) ATTRIBUTABLE TO

NONCONTROLLING INTERESTS 28,925 (9,065 ) NET INCOME (LOSS)

ATTRIBUTABLE TO THE COMPANY $ 23,808 $ (5,232 ) NET

INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS A SHARE Basic $

0.35 $ (0.08 ) Diluted $ 0.35 $ (0.10 ) WEIGHTED AVERAGE CLASS A

SHARES OUTSTANDING Basic 66,210,916 63,367,419 Diluted 145,296,469

144,812,299 NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS

B SHARE Basic and diluted $ 0.00 $ (0.00 ) WEIGHTED AVERAGE CLASS B

SHARES OUTSTANDING Basic 79,061,835 81,420,455 Diluted 79,275,234

81,420,455

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except shares)

(Unaudited)

March 31, 2019 December 31, 2018

ASSETS INVENTORIES $ 1,744,337 $ 1,696,084 INVESTMENT IN

UNCONSOLIDATED ENTITIES 540,318 532,899 PROPERTIES AND EQUIPMENT,

NET 32,551 31,677 INTANGIBLE ASSET, NET—RELATED PARTY 91,620 95,917

CASH AND CASH EQUIVALENTS 373,292 495,694 RESTRICTED CASH AND

CERTIFICATES OF DEPOSIT 1,738 1,403 RELATED PARTY ASSETS 83,044

61,039 OTHER ASSETS 18,650 9,179 TOTAL $ 2,885,550

$ 2,923,892

LIABILITIES AND CAPITAL

LIABILITIES: Notes payable, net $ 492,171 $ 557,004 Accounts

payable and other liabilities 153,112 161,139 Related party

liabilities 129,260 178,540 Deferred income tax liability, net

10,449 9,183 Payable pursuant to tax receivable agreement 171,205

169,509 Total liabilities 956,197 1,075,375

REDEEMABLE NONCONTROLLING INTEREST $ 25,000 $ —

CAPITAL: Class A common shares; No par value; Issued and

outstanding: 2019—68,746,555 shares; 2018—66,810,980 shares Class B

common shares; No par value; Issued and outstanding:

2019—79,275,234 shares; 2018—78,838,736 shares Contributed capital

562,185 556,521 Retained earnings 57,619 33,811 Accumulated other

comprehensive loss (3,320 ) (3,306 ) Total members’ capital 616,484

587,026 Noncontrolling interests 1,287,869 1,261,491

Total capital 1,904,353 1,848,517 TOTAL $ 2,885,550

$ 2,923,892

FIVE POINT HOLDINGS, LLCSUPPLEMENTAL

DATA(In thousands)(Unaudited)

Liquidity

March 31, 2019 Cash and cash equivalents $ 373,292

Borrowing capacity (1) 124,000 Total liquidity $ 497,292

(1) As of March 31, 2019, no funds have been drawn on the

Company’s $125.0 million revolving credit facility; however,

letters of credit of $1.0 million are issued and outstanding under

the revolving credit facility, thus reducing the available capacity

by the outstanding letters of credit amount.

Debt to Total

Capitalization

March 31, 2019 Debt (1) $ 602,692 Total

capital 1,904,353 Total capitalization $ 2,507,045

Debt to total capitalization 24.0 %

(1) For purposes of this calculation, debt consists of

(i) the outstanding principal on the Company’s 7.875% senior

notes due 2025 of $500.0 million and (ii) the Company’s

related party EB-5 reimbursement obligation of

$102.7 million.

Segment Results

Valencia (formerly Newhall)

The following table summarizes the results of operations of our

Valencia segment for the three months ended March 31, 2019 and

2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Statement of Operations

Data Revenues Land sales $ 55 $ 49 Land sales—related party 9 —

Operating properties 1,551 2,749 Total revenues 1,615

2,798 Costs and expenses Land sales — 38 Operating properties 1,901

2,390 Selling, general, and administrative 3,809 4,088 Total

costs and expenses 5,710 6,516 Other income 11 6,781

Segment (loss) income $ (4,084 ) $ 3,063

San Francisco

The following table summarizes the results of operations of our

San Francisco segment for the three months ended March 31,

2019 and 2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Statement of Operations

Data Revenues Land sales—related party $ 221 $ 221 Operating

property 174 181 Management services—related party 698 1,620

Total revenues 1,093 2,022 Costs and expenses

Management services 377 399 Selling, general, and administrative

4,512 6,386 Total costs and expenses 4,889

6,785 Other income—gain on settlement of contingent

consideration, related party 64,870 — Segment income

(loss) $ 61,074 $ (4,763 )

Great Park

The following table summarizes the results of operations of our

Great Park segment for the three months ended March 31, 2019

and 2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Statement of Operations

Data Revenues Land sales $ 31,466 $ 256 Land sales—related

party 127,697 151 Management services—related party 10,396

10,057 Total revenues 169,559 10,464 Costs and

expenses Land sales 107,819 — Management services 7,239 6,690

Selling, general, and administrative 6,575 8,487 Management

fees—related party 8,217 7,632 Total costs and

expenses 129,850 22,809 Interest income 559

979 Segment income (loss) $ 40,268 $ (11,366 )

The table below reconciles the Great Park segment results to the

equity in earnings (loss) from our investment in the Great Park

Venture that is reflected in the condensed consolidated statements

of operations for the three months ended March 31, 2019 and

2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Segment net income (loss) from

operations $ 40,268 $ (11,366 ) Less net income of management

company attributed to the Great Park segment 3,157 3,367

Net income (loss) of Great Park Venture 37,111

(14,733 ) The Company’s share of net income (loss) of the Great

Park Venture 13,917 (5,525 ) Basis difference (amortization)

accretion (4,473 ) 1,471 Equity in earnings (loss) from the

Great Park Venture $ 9,444 $ (4,054 )

Commercial

The following table summarizes the results of operations of our

Commercial segment for the three months ended March 31, 2019

and 2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Statement of Operations

Data Revenues Rental and related income $ 8,380 $ 6,705

Property management fees (31 ) 90 Total revenues 8,349 6,795

Costs and expenses Rental operating expenses 1,564 839 Interest

4,331 2,282 Depreciation 2,177 1,827 Amortization 1,029 1,041 Other

expenses 29 120 Total costs and expenses 9,130 6,109

Segment (loss) income $ (781 ) $ 686

The table below reconciles the Commercial segment results to the

equity in (loss) earnings from our investment in the Gateway

Commercial Venture that is reflected in the condensed consolidated

statements of operations for the three months ended March 31,

2019 and 2018.

Three Months EndedMarch 31, 2019

2018 (in thousands) Segment net (loss) income from

operations $ (781 ) $ 686 Less net (loss) income of management

company attributed to the Commercial segment (31 ) 90 Net (loss)

income of Gateway Commercial Venture (750 ) 596 Equity in (loss)

earnings from the Gateway Commercial Venture $ (562 ) $ 447

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190507006068/en/

Investor Relations:Bob Wetenhall,

949-349-1087bob.wetenhall@fivepoint.comorMedia:Steve Churm,

949-349-1034steve.churm@fivepoint.com

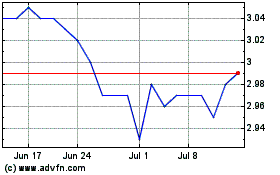

Five Point (NYSE:FPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

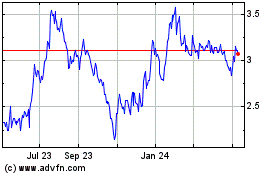

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2023 to Nov 2024