Filed by Cadeler

A/S

Pursuant to Rule

425 under the Securities Act of 1933, as amended

and deemed filed

pursuant to Rule 14d-2 of the Securities Exchange Act of 1934, as amended

Subject Company:

Eneti Inc. (Commission File No.: 001-36231)

Registration Statement File

No.: 333-275092

Stock Exchange announcement

CADELER A/S ANNOUNCES LAUNCH OF SHARE EXCHANGE OFFER FOR ALL OF

THE OUTSTANDING SHARES OF COMMON STOCK OF ENETI INC.

Copenhagen, November 7, 2023: With reference to the stock exchange

announcement published by Cadeler A/S (OSE: CADLR) (“Cadeler”) on June 16, 2023, regarding the signing of a business

combination agreement between Cadeler and Eneti Inc. (NYSE: NETI) (“Eneti”), Cadeler today announces the commencement of

a share exchange offer (the “Offer”) for all of the outstanding shares of common stock of Eneti. The Offer is expected to

close within Q4 2023. Cadeler will host a conference call on November 8, 2023 at 9:00 a.m. ET / 3:00 p.m. CET (see below

for webcast details).

The Offer

The Offer is being made on the terms and subject to the conditions

and procedures set forth in the Prospectus/Offer to Exchange, dated November 7, 2023 (the “Prospectus/Offer to Exchange”),

and in the related letter of transmittal, together with any amendments or supplements thereto.

The Offer is being made pursuant to the Business Combination Agreement,

dated as of June 16, 2023 (as it may be amended from time to time, the “Business Combination Agreement”), by and between

Cadeler and Eneti. The Business Combination Agreement provides, among other things, that Cadeler will make the Offer and, subject to

the satisfaction or waiver of certain conditions, Cadeler will accept for exchange, and promptly thereafter exchange, shares of Eneti

Common Stock validly tendered in the Offer and not validly withdrawn. The Business Combination Agreement is more fully described in the

Prospectus/Offer to Exchange.

The combined group will be named Cadeler, and be headquartered in

Copenhagen, Denmark, with its shares to be listed on the New York Stock Exchange in addition to its current listing on the Oslo Stock

Exchange.

The current CEO of Cadeler Mikkel Gleerup will continue as CEO after

the combination, while Peter Brogaard Hansen will continue as CFO. Andreas Sohmen-Pao will continue as Chairman of the Board of Directors

and Emanuele Lauro, current CEO of Eneti, will expectedly be nominated for election to the Board of Directors as Vice Chairman shortly

after the completion of the Offer.

Commenting on the transaction, Mr. Andreas Sohmen-Pao, Chairman

of Cadeler said: “This is a strategic transaction combining two leading offshore wind companies. It underpins Cadeler’s vision

and capability to facilitate the renewable transition, and I continue to support the transaction on its industrial and financial merits”.

Mr. Emanuele Lauro, Executive Chairman and CEO of Eneti said:

“More than four months after announcing this transaction, it really feels like the right combination for all stakeholders. As I

previously mentioned, our scale and respective capabilities will create significant value at a time when offshore wind needs reliable

partners and reliable solutions. The track record of Seajacks has been built on the tireless efforts of our shore and seagoing professionals,

and we are delighted Cadeler values this legacy so dearly. The prospects for our combined companies, in the context of industry demands

over the coming decade, could not be brighter”.

Mr. Mikkel Gleerup, CEO of Cadeler said: “The combination

will represent a significant step up in our ability to meet the increased demand globally for projects with larger scopes and project

sizes in service of the much-needed green transition. To deliver on this ambition, we will provide our customers with the largest and

most diverse fleet in the industry, operated by highly skilled teams with unique expertise and track records. Particularly in light of

increasing value chain bottlenecks, the combined scale and fleet diversity will unlock unrivalled value for our customers, due to increased

cross-utilization of resources and improved flexibility, capacity, and agility”.

Background for the Offer

The business combination unites two companies with established track

records to offer one of the largest, most diversified and modern fleet of wind turbine and foundation installation vessels in the industry,

at a time where increasing value chain bottlenecks drive demand for larger companies that can provide reliable and flexible solutions.

The business combination will position Cadeler as a robust and reliable

player in the market with true global presence through scale, local presence and complimentary industry relationships. The business combination

will enable the combined company to operate more efficiently, and target still larger and more complex projects as requested by customers.

Cadeler’s management anticipates that the business combination

will deliver annual synergies of €106 million, excluding transaction, change of control and integration costs, to enable meaningful

shareholder value creation.

Offer Consideration

Cadeler is offering to exchange for each outstanding share of Eneti,

par value $0.01 per share (the “Eneti Common Stock”), validly tendered and not validly withdrawn in the Offer, 0.85225 American

Depositary Shares (the “Cadeler ADSs”), each one (1) Cadeler ADS representing four (4) shares of Cadeler, nominal

value DKK 1 per share (the “Cadeler Shares”) providing for the previously agreed and announced exchange ratio of 3.409 Cadeler

Shares for each share of Eneti Common Stock, subject to payment of cash compensation in lieu of any fractional Cadeler ADSs, without

interest and subject to reduction for any applicable withholding taxes.

Offer Conditions

The Offer is not subject to any financing condition. The Offer is

conditioned upon, among other things, there having been validly tendered and not validly withdrawn in accordance with the terms of the

Offer a number of shares of Eneti Common Stock that, upon the consummation of the Offer, together with any shares of Eneti Common Stock

then owned by Cadeler, would represent at least 85.01% of the aggregate voting power of the shares of Eneti Common Stock outstanding

immediately after the consummation of the Offer. The Offer is also subject to, and conditioned upon, the satisfaction or waiver of certain

other conditions described in the Prospectus/Offer to Exchange.

All antitrust and foreign direct investment regulators notified of

the transactions contemplated by the Business Combination Agreement have either cleared the transaction or confirmed they have no intention

to investigate. Cadeler will submit an application for admission of the Cadeler ADSs to be issued in the Offer and the Cadeler Shares

underlying such Cadeler ADSs to be listed on the New York Stock Exchange, and have such Cadeler Shares admitted to trading and listing

on the Oslo Stock Exchange following approval of an EU/EEA Listing Prospectus by the Danish FSA after the expiration of the Offer.

Tender and Support Agreements

Eneti’s largest shareholder, together with certain of its affiliates

collectively holding approximately 28.8% of all of the issued and outstanding shares of Eneti Common Stock, and each of Eneti’s

directors and executive officers, solely in their capacities as stockholders of Eneti, have entered into tender and support agreements

with Cadeler (the “Tender and Support Agreements”), pursuant to which they agreed, among other things, to irrevocably tender

all of their shares of Eneti Common Stock prior to the deadline for tendering shares of Eneti Common Stock into the Offer. The Tender

and Support Agreements are more fully described in the Prospectus/Offer to Exchange.

Withdrawal Rights

Shares of Eneti Common Stock tendered pursuant to the Offer may be

withdrawn at any time prior to 4:30 p.m., Eastern time, on December 7, 2023 (the “Expiration Date”).

Offer Period

The Offer has commenced today and will expire at 4:30 p.m., Eastern

time, on the Expiration Date, unless extended or terminated as provided in the Prospectus/Offer to Exchange. Assuming that the conditions

to the Offer are satisfied or waived at the Expiration Date, Cadeler expects that the settlement date will be on or about December 12,

2023.

Subsequent squeeze-out merger

Following completion of the Offer, Cadeler intends, indirectly through

a wholly owned subsidiary, to initiate a squeeze-out merger under Marshall Islands law such that, following the merger, Eneti’s

business will be wholly owned by Cadeler. The precise consideration minority Eneti stockholders will receive in such merger may be different

in form and/or value from the consideration that they would have received had they tendered their Eneti Common Stock in the Offer.

Indicative Timetable

The following table sets out the expected dates and times of the key

events relating to the Offer. This is an indicative timetable and is subject to change.

| Event | |

Calendar

date |

| Commencement of the Offer; Publication

of summary advertisement of Offer | |

November 7, 2023 |

| Expiration Date (deadline for tendering

shares of Eneti Common Stock into the Offer) | |

December 7, 2023 |

| Announcement by Cadeler on whether or

not the conditions to the Offer have been satisfied or, to the extent legally permitted, waived | |

On or prior to December 8, 2023 |

| Commencement of trading of Cadeler ADSs

on the New York Stock Exchange on a “when issued” basis | |

On or about December 8, 2023 |

| Expected date for approval of an EU/EEA

Listing Prospectus for the new Cadeler Shares | |

On or about December 11, 2023 |

| Expected settlement date | |

On or about December 12, 2023 |

| Admission to trading of the new Cadeler

Shares on the Oslo Stock Exchange | |

On or about December 12, 2023 |

The times and dates above are subject, where applicable, to the right

of Cadeler to extend, re-open, amend, limit, terminate or withdraw the Offer, subject to applicable law. Accordingly, the actual timetable

may differ significantly from the expected timetable set out above.

Cadeler is not providing for guaranteed delivery procedures and

therefore Eneti Stockholders who hold their shares through a DTC participant must allow sufficient time for the necessary tender procedures

to be completed during normal business hours of DTC prior to the expiration of the Offer. Eneti Stockholders must tender their shares

of Eneti Common Stock in accordance with the procedures set forth in the Prospectus/Offer to Exchange and related letter of transmittal.

The Prospectus/Offer to Exchange and the related letter of transmittal

contain important information. Holders of shares of Eneti Common Stock should carefully read both documents in their entirety before

any decision is made with respect to the Offer.

Further Information

Requests for copies of the Prospectus/Offer to Exchange and information

in relation to the procedures for tendering should be directed to:

D.F. King & Co., Inc.

48 Wall Street, 22nd floor

New York, NY 10005

Shareholders Call Toll Free: (800) 967-4607

Banks & Brokers Call Collect: (212) 269-5550

Email: NETI@dfking.com

Conference Call on November 8, 2023 at 9:00 a.m. ET /

3:00 p.m. CET

Cadeler will host a conference call on November 8, 2023 at 9:00

a.m. ET / 3:00 p.m. CET.

Those wishing to listen to the call should dial 1 (877) 513-1694 (U.S.)

or 1 (412) 902-4269 (International) at least 15 minutes prior to the start of the call to ensure connection. The information provided

on the teleconference is only accurate at the time of the conference call, and Cadeler will take no responsibility for providing updated

information.

There will also be a simultaneous live webcast over the internet.

Participants to the live webcast should register on the website approximately 15 minutes prior to the start of the webcast.

Please see below webcast link. The link will also be made available

on the Cadeler website.

https://edge.media-server.com/mmc/p/mpcmsd68

Advisors

DNB Markets, a part of DNB Bank ASA, is acting as financial advisor

to Cadeler. Gorrissen Federspiel Advokatpartnerselskab, Davis Polk & Wardwell London LLP, Advokatfirmaet Thommessen AS and Campbell

Johnston Clark are serving as legal advisors to Cadeler.

Perella Weinberg Partners LP is serving as financial advisor to Eneti.

Seward & Kissel LLP, CMS Cameron McKenna Nabarro Olswang LLP and Bech-Bruun advokatpartnerselskab are serving as legal advisors

to Eneti.

Cadeler Contact Details

Point of contact for investors:

Mikkel Gleerup, CEO

+45 3246 3102

mikkel.gleerup@cadeler.com

Point of contact for media:

Karen Roiy, Head of Marketing & Communication

+45 6020 8706

karen.roiy@cadeler.com

About Cadeler A/S

Cadeler A/S is a key supplier within the offshore wind industry for

installation services and marine and engineering operations with a strong focus on safety and the environment. Cadeler’s experience

as provider of high-quality offshore wind support services, combined with innovative vessel designs, positions the company to deliver

premium services to the industry. Cadeler facilitates the global energy transition towards a future built on renewable energy. Cadeler

is listed on the Oslo Stock Exchange (OSE: CADLR).

About Eneti Inc.

Eneti Inc. is a leading provider of installation and maintenance vessels

to the offshore wind sector and has invested in the next generation of wind turbine installation vessels. Eneti Inc. is listed on the

New York Stock Exchange (NYSE: NETI).

Additional Information and Where to Find It

Important Additional Information Will be Filed with

the SEC

Cadeler A/S (“Cadeler”) commenced an offer to exchange

all of the issued and outstanding shares of Eneti Inc. (“Eneti”) for shares or American Depositary Shares (“ADSs”)

representing shares in Cadeler on November 7, 2023. This communication is for informational purposes only and is neither an offer

to purchase nor a solicitation of an offer to sell shares, nor is it a substitute for any offer materials that Cadeler or Eneti have

filed or will file with the U.S. Securities and Exchange Commission (the “SEC”). Cadeler has filed or will file with the

SEC (1) a Tender Offer Statement on Schedule TO, (2) a Registration Statement on Form F-4 that includes an offering prospectus

with respect to the exchange offer, and (3) a Registration Statement on Form F-6, and Eneti has filed or will file with the

SEC a Solicitation/Recommendation Statement on Schedule 14D-9, in each case with respect to the exchange offer. INVESTORS AND STOCKHOLDERS

ARE URGED TO READ THE REGISTRATION STATEMENT/PROSPECTUS, THE EXCHANGE OFFER MATERIALS (INCLUDING THE OFFER TO EXCHANGE, A RELATED LETTER

OF TRANSMITTAL AND CERTAIN OTHER EXCHANGE OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, IF AND WHEN THEY BECOME

AVAILABLE, AND ANY OTHER DOCUMENTS FILED BY EACH OF CADELER AND ENETI WITH THE SEC, OR APPROVED BY THE DANISH FSA, IN CONNECTION

WITH THE PROPOSED BUSINESS COMBINATION (INCLUDING THE EXCHANGE OFFER) OR INCORPORATED BY REFERENCE THEREIN CAREFULLY AND IN THEIR ENTIRETY

AS THESE DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT CADELER, ENETI, THE PROPOSED TRANSACTION AND RELATED MATTERS THAT HOLDERS

OF THE COMPANY’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING EXCHANGING THEIR SECURITIES. Investors and

stockholders will be able to obtain the registration statement/prospectus, the exchange offer materials (including the offer to exchange,

a related letter of transmittal and certain other exchange offer documents), the solicitation/recommendation statement and other documents

filed with the SEC by Cadeler and Eneti at no cost to them through the website maintained by the SEC at www.sec.gov. In addition,

investors and stockholders may obtain copies of any document filed with the SEC by Cadeler free of charge from Cadeler’s website

at www.cadeler.com and copies of any document filed with the SEC by Eneti free of charge from Eneti’s website at www.eneti-inc.com.

The contents of this communication should not be construed as financial, legal, business, investment, tax or other professional advice.

Each recipient should consult with its own professional advisors for any such matter and advice.

Important Notice

This communication and the prospectus referred to above do not constitute

a prospectus as defined by Regulation (EU) No. 2017/1129 of 14 June 2017 (the “EU/EEA Prospectus Regulation”) and

no public takeover offer is made pursuant to the Directive 2004/25/EC of 21 April 2004 on takeover bids in connection with the exchange

offer referred to above. A prospectus pursuant to the EU/EEA Prospectus Regulation is expected to be published by Cadeler following completion

of the Offer Period set out herein for the purpose of admission to trading of the new Cadeler Shares underlying the Cadeler ADSs to the

Oslo Stock Exchange. This communication does not contain all the information that should be considered concerning the Offer and is not

intended to form the basis of any investment decision or any other decision in respect of the proposed transaction.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer

to sell or the solicitation of an offer to subscribe for, exchange or buy or an invitation to purchase, exchange or subscribe for any

securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transaction or otherwise, nor shall there be

any sale, issuance or transfer of securities in any jurisdiction, in each case in contravention of applicable law. No offer of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and applicable European

or UK, as appropriate, regulations. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained,

the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of

the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission,

telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

This communication is addressed to and directed only at, persons who

are outside the United Kingdom or, in the United Kingdom, at authorised or exempt persons within the meaning of the Financial Services

and Markets Act 2000 or persons who have professional experience in matters relating to investments falling within Article 19(5) of

the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), persons falling within Article 49(2)(a) to

(d) of the Order or persons to whom it may otherwise lawfully be communicated pursuant to the Order, (all such persons together

being referred to as, “Relevant Persons”). This communication is directed only at Relevant Persons. Other persons should

not act or rely on this communication or any of its contents. Any investment or investment activity to which this communication relates

is available only to Relevant Persons and will be engaged in only with such persons. Solicitations resulting from this communication

will only be responded to if the person concerned is a Relevant Person.

Forward-Looking Statements

This communication includes forward-looking statements within the

meaning of the federal securities laws (including Section 27A of the United States Securities Act of 1933, as amended, the “Securities

Act”) with respect to the proposed transaction between Eneti and Cadeler, including statements regarding the benefits of the transaction,

the anticipated timing of the transaction, the products and services offered by Eneti and Cadeler and the markets in which they operate,

and Eneti’s and Cadeler’s projected future financial and operating results. These forward-looking statements are generally

identified by terminology such as “believe,” “may,” “will,” “potentially,” “estimate,”

“continue,” “anticipate,” “intend,” “could,” “would,” “should,”

“project,” “target,” “plan,” “expect,” or the negatives of these terms or variations

of them or similar terminology. The absence of these words, however, does not mean that the statements are not forward-looking. These

forward-looking statements are based upon current expectations, beliefs, estimates and assumptions that, while considered reasonable

as and when made by Eneti and its management, and Cadeler and its management, as the case may be. Such forward-looking statements are

subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied

by such forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks

and uncertainties. Neither Eneti nor Cadeler undertake any obligation to update any such statements in light of any future event or circumstance,

or to conform such statements to actual results. Past performance should not be relied upon, and is not, a guarantee of future performance.

Many factors could cause actual future events to differ materially

from the forward-looking statements in this communication, including but not limited to: (i) the risk that the transaction may not

be completed in a timely manner or at all, which may adversely affect the price of Eneti’s and Cadeler’s securities, (ii) the

failure to satisfy the conditions to the consummation of the transaction, including the acceptance of the proposed exchange offer by

the requisite number of Eneti shareholders and the receipt of certain governmental and regulatory approvals, (iii) general domestic

and international political conditions or hostilities, including the war between Russia and Ukraine; (iv) the occurrence of any

event, change or other circumstance that could give rise to the termination of the business combination agreement, (v) the effects

of public health threats, pandemics and epidemics, and the adverse impact thereof on Eneti’s or Cadeler’s business, financial

condition and results of operations, (vi) the effect of the announcement or pendency of the transaction on Eneti’s or Cadeler’s

business relationships, performance, and business generally, (vii) risks that the proposed transaction disrupts current plans of

Eneti or Cadeler and potential difficulties in Eneti’s or Cadeler’s employee retention as a result of the proposed transaction,

(viii) the outcome of any legal proceedings that may be instituted against Eneti or Cadeler related to the business combination

agreement or the proposed transaction or as a result of the operation of their respective businesses, (ix) the risk that Cadeler

is unable to list the ADSs to be offered as consideration, or the underlying shares in Cadeler, on the New York Stock Exchange or the

Oslo Stock Exchange, as applicable, (x) volatility in the price of the combined company’s securities due to a variety of factors,

including changes in the competitive markets in which the combined company plans to operate, variations in performance across competitors,

changes in laws and regulations affecting such business and changes in the combined capital structure, (xi) factors affecting the

duration of contracts, the actual amount of downtime and the respective backlogs of Eneti and Cadeler, (xii) factors that reduce

applicable dayrates or contract profitability, operating hazards inherent to offshore operations and delays, (xiii) dependency on

third parties in relation to, for example, technical, maintenance and other commercial services, (xiv) risks associated with operations

outside the US, actions by regulatory authorities, credit rating agencies, customers, joint venture partners, contractors, lenders and

other third parties, legislation and regulations affecting the combined company’s operations, compliance with regulatory requirements,

violations of anti-corruption laws, shipyard risk and timing, hurricanes and other weather conditions, and the future price of energy

commodities, (xv) the ability to implement business plans, forecasts, and other expectations (including with respect to synergies

and financial and operational metrics, such as EBITDA and free cash flow) after the completion of the proposed transaction, and to identify

and realize additional opportunities, (xvi) the failure to realize anticipated benefits of the proposed transaction, (xvii) risks

related to the ability to correctly estimate operating expenses and expenses associated with the business combination, (xviii) risks

related to the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations,

(xix) the potential impact of announcement or consummation of the proposed transaction on relationships with third parties, (xx) changes

in law or regulations affecting Eneti, Cadeler or the combined company, (xxi) international, national or local economic, social

or political conditions that could adversely affect the companies and their business, (xxii) dependency on Eneti and Cadeler’s

customers, (xxiii) volatility in demand, increased competition or reduction in contract values, (xxiv) the risk that technological

progress might render the technologies used by each of Cadeler and Eneti obsolete, (xxv) conditions in the credit markets that may

negatively affect the companies and their business, (xxvi) risks deriving from the restrictive covenants and conditions relevant

to Eneti and Cadeler’s financing and their respective ability to obtain future financing, including for remaining installations

on ordered newbuild vessels, (xxvii) risks associated with assumptions that parties make in connection with the parties’ critical

accounting estimates and other judgements, (xxviii) the risk that Eneti and Cadeler have a limited number of vessels and are vulnerable

in the event of a loss of revenue relating to any such vessel(s), (xxix) risks relating to delays in, or increases in the cost of,

already ordered newbuild vessels and the risk of a failure to obtain contracts for such newbuild vessels and (xxx) risks associated

with changes in exchange rates including the USD/NOK and USD/EUR rates. The foregoing list of factors is not exhaustive and the factors

identified are not set out in any particular order. There can be no assurance that future developments affecting Eneti, Cadeler or the

combined company will be those that the companies have anticipated.

These forward-looking statements involve a number of risks, uncertainties

(some of which are beyond Eneti’s or Cadeler’s control) or other assumptions that may cause actual results or performance

to be materially different from those expressed or implied by these forward-looking statements or from our historical experience and

our present expectations or projects. You should carefully consider the foregoing factors and the other risks and uncertainties that

affect the parties’ businesses, including those described in Eneti’s Annual Report on Form 20-F, Current Reports on

Form 6-K and other documents filed from time to time by Eneti with the SEC and those described in Cadeler’s annual reports,

relevant reports and other documents published from time to time by Cadeler. Eneti and Cadeler wish to caution you not to place undue

reliance on any forward-looking statements, which speak only as of the date hereof. This communication and related materials speak

only as of the date hereof and except as required by law, Eneti and Cadeler are not undertaking any obligation to update or revise any

forward-looking statements whether as a result of new information, future events or otherwise.

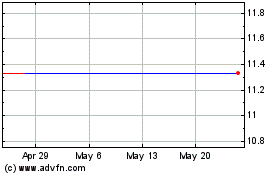

Eneti (NYSE:NETI)

Historical Stock Chart

From Apr 2024 to May 2024

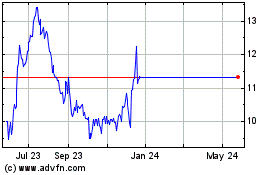

Eneti (NYSE:NETI)

Historical Stock Chart

From May 2023 to May 2024