false000162219400016221942024-05-292024-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 30, 2024 |

Easterly Government Properties, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

001-36834 |

47-2047728 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2001 K Street NW Suite 775 North |

|

Washington, District of Columbia |

|

20006 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (202) 595-9500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

DEA |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 29, 2024, Easterly Government Properties, Inc. (the “Company”), and its operating partnership, Easterly Government Properties LP (the “Operating Partnership”), entered into a master note purchase agreement (the “Purchase Agreement”), with the purchasers named therein (the “Purchasers”). Pursuant to the Purchase Agreement, on May 29, 2024, the Operating Partnership issued $150,000,000 of fixed rate, senior unsecured notes (the “Series A Notes”) and is expected to issue, on or around August 14, 2024, subject to customary closing conditions, $50,000,000 of fixed rate, senior unsecured notes (the “Series B Notes” and, together with the Series A Notes, the “Notes”), in each case to the Purchasers. The following table sets forth the principal amount, interest rate and maturity date of the Notes by series (dollars in thousands):

|

|

|

|

|

|

|

Series |

|

Principal Amount |

|

Interest Rate |

|

Maturity Date |

Series A |

|

$ 150,000 |

|

6.56% |

|

May 29, 2033 |

Series B |

|

$ 50,000 |

|

6.56% |

|

August 14, 2033 |

Interest on the Notes will be payable semiannually. Pursuant to the Purchase Agreement, the Operating Partnership will be permitted to prepay at any time all, or from time to time any part of, the Notes, in the amount not less than 5% of the aggregate principal amount of the Notes then outstanding at (i) 100% of the principal amount so prepaid, together with accrued interest, and (ii) a make-whole amount that is calculated by discounting the value of the remaining scheduled interest payments that would otherwise be payable through the scheduled maturity date of the applicable Notes on the principal amount being prepaid. The Operating Partnership will have the right to make tender offers and may be required to make other prepayment offers under the terms set forth in the Purchase Agreement.

The Company and certain subsidiaries of the Operating Partnership (the “Subsidiary Guarantors”) will guarantee the obligations under the Notes.

Subject to the terms of the Purchase Agreement and the Notes, upon certain events of default, including, but not limited to, (i) a default in the payment of any principal, “make-whole” amount or interest under the Notes, and (ii) a default in the payment of certain other indebtedness of the Operating Partnership or of the Company or of the Subsidiary Guarantors, the principal and accrued and unpaid interest and the make-whole amount on the outstanding Notes will become due and payable at the option of the holders.

The Purchase Agreement and Notes also contains various covenants (including, among others, financial covenants with respect to consolidated net worth, fixed charges and consolidated leverage and covenants relating to liens) and if the Operating Partnership or the Company breaches any of these covenants, the principal and accrued and unpaid interest and the make-whole amount on the outstanding Notes will become due and payable at the option of the holders.

Net proceeds from the private placement of the Notes are intended to be used to repay borrowings outstanding under the Company’s senior unsecured revolving credit facility, for general corporate purposes, or a combination of the foregoing. The Notes have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act. The Series A Notes were, and the Series B Notes are to be, issued and sold by the Operating Partnership in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

Item 7.01 Regulation FD Disclosure.

On May 30, 2024, the Company issued a press release announcing the issuance by the Operating Partnership of the Series A Notes and the future expected issuance of the Series B Notes. A copy of that press release is furnished as Exhibit 99.1 to this Current Report. The information in this Item 7.01 of this Current Report, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EASTERLY GOVERNMENT PROPERTIES, INC. |

|

|

|

|

Date: |

May 30, 2024 |

By: |

/s/ Franklin V. Logan |

|

|

|

Franklin V. Logan

Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

EASTERLY GOVERNMENT PROPERTIES TO ISSUE $200 MILLION IN

SENIOR UNSECURED NOTES

WASHINGTON, D.C. – May 30, 2024 – Easterly Government Properties, Inc. (NYSE: DEA) (the “Company” or “Easterly”), a fully integrated real estate investment trust focused primarily on the acquisition, development and management of Class A commercial properties leased to the U.S. Government and its adjacent partners, announced today that it has entered into a master note purchase agreement to issue $200 million of 6.56% (ICUR9 + 210 basis point spread) 9-year fixed rate, senior unsecured notes (“Senior Notes”), consisting of:

•$150 million of Series A Senior Notes issued and sold by Easterly Government Properties LP, the Company’s operating partnership (the “Partnership”), on May 29, 2024; and

•$50 million of Series B Senior Notes to be issued and sold by the Partnership on or about August 14, 2024, subject to customary closing conditions.

“We believe that Easterly’s ability to obtain competitive pricing in the unsecured debt market is a reflection of the superior credit quality of our tenant and our investment grade balance sheet,” said Allison Marino, Easterly’s Chief Financial and Chief Accounting Officer. “We favorably priced with oversubscribed levels of new and existing investor support, thus enabling Easterly to appropriately stagger and extend its weighted average debt maturities.”

The Senior Notes have not been and will not be registered under the Securities Act of 1933 or the securities laws of any state or other jurisdiction and may not be offered or sold in the United States or any other jurisdiction absent registration or an exemption from the registration requirements of the Securities Act of 1933 and the applicable securities laws of any state or other jurisdiction.

About Easterly Government Properties, Inc.

Easterly Government Properties, Inc. (NYSE:DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S. Government. Easterly’s experienced management team brings specialized insight into the strategy and needs of mission-critical U.S. Government agencies for properties leased to such agencies either directly or through the U.S. General Services Administration (GSA). For further information on the company and its properties, please visit www.easterlyreit.com.

This press release contains forward-looking statements within the meaning of federal securities laws and regulations. These forward-looking statements are identified by their use of terms and phrases such as “believe,” “expect,” “intend,” “project,” “anticipate,” “position,” and other similar terms and phrases, including references to assumptions and forecasts of future results. Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the actual results to differ materially from those anticipated at the time the forward-looking statements are made. These risks include, but are not limited to, those risks and uncertainties associated with our business described from time

to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K filed on February 27, 2024. Although we believe the expectations reflected in such forward-looking statements are based upon reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. All information in this release is as of the date of this release, and we undertake no obligation to update any forward-looking statement to conform the statement to actual results or changes in our expectations.

Contact:

Easterly Government Properties, Inc.

Lindsay S. Winterhalter

Senior Vice President, Investor Relations & Operations

202-596-3947

IR@easterlyreit.com

v3.24.1.1.u2

Document And Entity Information

|

May 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 30, 2024

|

| Entity Registrant Name |

Easterly Government Properties, Inc.

|

| Entity Central Index Key |

0001622194

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-36834

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

47-2047728

|

| Entity Address, Address Line One |

2001 K Street NW

|

| Entity Address, Address Line Two |

Suite 775 North

|

| Entity Address, City or Town |

Washington

|

| Entity Address, State or Province |

DC

|

| Entity Address, Postal Zip Code |

20006

|

| City Area Code |

(202)

|

| Local Phone Number |

595-9500

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DEA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

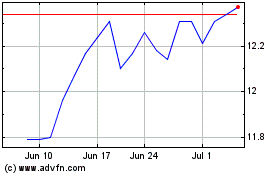

Easterly Government Prop... (NYSE:DEA)

Historical Stock Chart

From Oct 2024 to Nov 2024

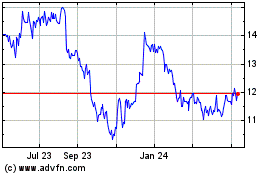

Easterly Government Prop... (NYSE:DEA)

Historical Stock Chart

From Nov 2023 to Nov 2024