Trending: Dell Cuts Guidance, Sees Increasing Consumer Caution

August 26 2022 - 11:05AM

Dow Jones News

10:35 ET -- Dell Technologies Inc. is one of the most talked

about companies in the U.S. across all news items in the last 12

hours, according to Factiva data. The company scaled back its

financial guidance and sounded a cautious note on consumer demand

amid a tough economic environment, echoing other big tech companies

including Lenovo Group Ltd., which has seen sales flatten after a

two-year pandemic-fueled boom for personal computers. Dell logged

2Q EPS of 68 cents, down from 80 cents last year, while on an

adjusted basis EPS was $1.68, toward the top end of the company's

projection for up to $1.70. Revenue overall rose 9.2%, to $26.4

billion, but was down 9% for its consumer arm. With a shift in the

expected demand environment for the back-half of fiscal-year 2023,

Dell now forecasts 3Q revenue of $23.8 billion-$25 billion, below

the $26.55 billion FactSet consensus, and flat to up 2% for the

fiscal year where it previously anticipated 6% growth. Dell shares

are down 8.8% in early trade, for a drop of 22% year-to-date. Dow

Jones & Co. owns Factiva. (robb.stewart@wsj.com)

(END) Dow Jones Newswires

August 26, 2022 10:50 ET (14:50 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

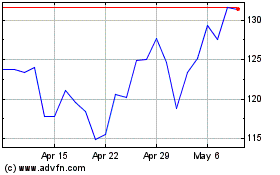

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dell Technologies (NYSE:DELL)

Historical Stock Chart

From Apr 2023 to Apr 2024