Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

November 22 2022 - 8:04AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2022

Commission File Number 1-14732

COMPANHIA SIDERÚRGICA NACIONAL

(Exact name of registrant as specified in its charter)

National Steel Company

(Translation of Registrant's name into English)

Av. Brigadeiro Faria Lima 3400, 20º andar

São Paulo, SP, Brazil

04538-132

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA SIDERÚRGICA NACIONAL

Publicly Held Company

Corporate Taxpayer ID 33.042.730/0001-04

NIRE 35300396090

MATERIAL FACT

CHANGE OF RELEVANT PARTICIPATION

Companhia Siderúrgica Nacional ("Companhia"

or "CSN") informs its shareholders and the market in general that, on that date, it has received

a correspondence letter from its shareholder Vicunha Aços S.A. ("Vicunha Aços") and CFL Participações

S.A. ("CFL"), stating the following:

Communication from Vicunha Aços:

·

On November 20th, 2022, an Equity

Restructuring Agreement, Transaction and Other Covenants ("Transaction") was concluded between Rio Purus Participações

S.A. ("Rio Purus") and CFL Participações S.A. ("CFL"), shareholders who directly and indirectly

hold the entire tying of Vicunha Aços shares. According to this Transaction, the closing of the corporate relationship in the investment

vehicle at Companhia Siderúrgica Nacional S.A. (“CSN”), among others, and the legal disputes were agreed. The

Transaction will be submitted to the “Conselho Administrativo de Defesa Econômica” - CADE, so that its clauses will

only take effect after the due approval.

·

The implementation of the Transaction will result in (a) withdrawal of CFL from the structure

of Vicunha Aços which will be held indirectly only by Rio Purus, (b) the ownership by a CFL subsidiary of 135,904,451 common shares,

book-entry and non-value of CSN's issuance, representing on this date 10.25% (ten point twenty-five percent) of its share capital, (c)

ownership by Vicunha Aços of 543,617,803 common shares, book-entry and no nominal value issued by CSN representing on this date

of 40.99% (forty point ninety-nine percent) of its share capital, and ownership by Rio Iaco Participações S.A., controlled

by Rio Purus, of 45,706,242 common shares, book-entry and no nominal value issued by CSN representing on this date of 3.45% (three comma

forty-five percent) of its share capital; and (d) conclusion of a Shareholders' Agreement between Vicunha Aços and the said subsidiary

of CFL, highlighting the following rules (d.1) lock-up of sale for nine (nine) months of the shares held by the subsidiary of CFL, (d.2)

after the lock-up period, a limitation of the sales volume of the shares held by the Subsidiary of CFL, (d.3) preemptive right in favor

of Vicunha Aços in the sale of CSN shares held by the CFL subsidiary, (d.4) vote of the CFL subsidiary to follow the vote of Vicunha

Aços or to abstain in deliberation regarding election to positions of CSN's management.

| · | The parties also undertook to vote in favor at CSN's Ordinary General

Meeting on the financial statements for the year 2022 ("OGM 2023"), to approve a dividend in the amount of up to BRL

2,314,000,000.00, including the amount of interest on equity and dividends that may eventually be declared by the Board of Directors before

2023. Such payments will be in addition to the balance of dividends approved at CSN's Ordinary General Meeting held on 04/29/2022, in

the amount of BRL 452,235,758.72, and of the dividends approved at a Board Meeting

held on this date, in the amount of BRL 1,564,114,553.54, based on the profit reserves contained in the financial statements of December

31, 2021, all of which will be paid from December 02, 2022, as disclosed in the notice to shareholders published by CSN on this date. |

| · | Thus, with the end of the disputes between Rio Purus and CFL and the

Shareholders' Agreement, the signatory predicts that there will be no more controversy over the exercise of control. |

CFL Communication:

| · | At the present date, CFL shareholder owns 40% of the common shares issued

by Vicunha Steel S.A. ("Vicunha Steel"), the controlling shareholder of Vicunha Aços S.A. ("Vicunha Aços"),

in turn a controlling shareholder of the Company, and 12.82% of the preferred shares issued by Vicunha Aços; |

| · | On this date, CFL has entered into "Asset

Restructuring Agreement, Transaction and Other Covenants" with Rio Purus Participações

S.A. ("Purus River"), which provides, among other obligations, for the implementation

of corporate restructuring of Vicunha Aços and Vicunha Steel ("Equity Restructuring Agreement" and "Corporate

Reorganization"); |

| · | Upon the implementation of the Corporate Reorganization:

(i) a wholly owned subsidiary of CFL will become the owner of 135,904,451 common shares, book-entry and without nominal value issued by

the Company, representing on this date approximately 10.25% of CSN's share capital, (ii) Vicunha Aços will become the holder of

543,617,803 book-entry common shares and with no nominal value issued by the Company, approximately 40.99%

of CSN's share capital; and (iii) the subsidiary of CFL and Vicunha Aços, with the intervention and approval of CFL, Rio Purus,

and the Company, will enter into a Shareholders' Agreement regulating, among other matters, the voting orientation for the election of

the Company's Board of Directors, and the rules for the transfer of shares linked to the Shareholders' Agreement; |

| · | Additionally, as a result of the implementation of the

Corporate Reorganization, CFL will no longer own shares issued by Vicunha Steel and Vicunha Aços, companies that will be controlled,

directly and indirectly, exclusively by Rio Purus. Thus, CFL and its subsidiary, directly and indirectly, will be minority shareholders

of the Company, with the purpose of investing in this company; and |

| · | The consummation of the Asset Restructuring

is subject to the prior approval by the Administrative Council of Economic Defense, as well as to the verification of other previous conditions,

which are common in operations of this nature. |

Regarding the above

communications, the Company believes that the enhanced stability and predictability in its governance resulting from the

Equity, Transaction and Other Covenants Restructuring Agreement

benefits all its shareholders. In addition, the Company clarifies that the dividend distributions referred to in Vicunha

Aços' communication do not alter the Company's leverage guidance.

São Paulo, November 21, 2022.

Marcelo Cunha Ribeiro

Executive Director of Finance and Investor Relations

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 21, 2022

|

COMPANHIA SIDERÚRGICA NACIONAL |

|

|

|

By: |

/S/ Benjamin Steinbruch

|

| |

Benjamin Steinbruch

Chief Executive Officer

|

|

|

|

|

|

By: |

/S/ Marcelo Cunha Ribeiro

|

| |

Marcelo Cunha Ribeiro

Chief Financial and Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

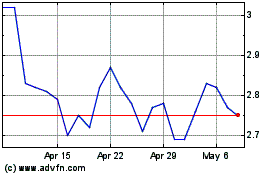

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Oct 2024 to Nov 2024

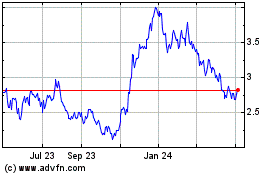

Companhia Siderurgica Na... (NYSE:SID)

Historical Stock Chart

From Nov 2023 to Nov 2024