Amended Annual Report (10-k/a)

November 01 2019 - 4:56PM

Edgar (US Regulatory)

0.10false--08-31FY20190000022444

0000022444

2018-09-01

2019-08-31

0000022444

2019-10-22

0000022444

2019-02-28

xbrli:shares

xbrli:pure

iso4217:USD

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

☑

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended August 31, 2019

|

|

|

|

|

|

|

☐

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to

|

Commission file number 1-4304

Commercial Metals Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

75-0725338

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

6565 N. MacArthur Blvd.

Irving, Texas 75039

(Address of Principal Executive Office) (Zip Code)

(214) 689-4300

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value

|

|

CMC

|

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

Large accelerated filer

|

☑

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the Company's common stock on February 28, 2019 held by non-affiliates of the registrant based on the closing price per share on February 28, 2019 on the New York Stock Exchange was approximately $1.9 billion.

As of October 22, 2019, 117,934,611 shares of the registrant's common stock, par value $0.01 per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the following document are incorporated by reference into the listed Part of Form 10-K:

Registrant's definitive proxy statement for the 2020 annual meeting of stockholders — Part III

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (the “Amendment”) to the Annual Report on Form 10-K for the fiscal year ended August 31, 2019 filed by Commercial Metals Company (the “Company”) on October 23, 2019 (the “Original Annual Report”) corrects a typographical error in the amount of Adjusted EBITDA contributed to the Company’s Americas Mills segment in fiscal 2019 by the Acquired Businesses (as defined in the Original Annual Report) in Item 7 of Part II - “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Segments - Fiscal Year 2019 Compared to Fiscal Year 2018 - Americas Mills.” The Original Annual Report inadvertently referenced the Acquired Businesses’ Adjusted EBITDA contribution amount for the fourth quarter of fiscal year 2019 of $58.1 million, rather than the Acquired Businesses’ Adjusted EBITDA contribution amount for fiscal year 2019 of $146.0 million.

In addition, currently dated certifications required under Section 302 of the Sarbanes-Oxley Act of 2002 are filed as exhibits to this Amendment. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted. Because no financial statements are contained within this Amendment, the Company is not filing currently dated certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, the remainder of the Original Annual Report is unchanged, and this Amendment does not reflect any event occurring after the date of the Original Annual Report.

The following section in Item 7 of Part II of the Original Annual Report is hereby amended and restated in its entirety as follows:

Americas Mills

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended August 31,

|

|

(in thousands)

|

|

2019

|

|

2018

|

|

Net sales

|

|

$

|

3,068,274

|

|

|

$

|

1,996,903

|

|

|

Adjusted EBITDA

|

|

545,215

|

|

|

301,805

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average price (per ton)

|

|

|

|

|

|

Total selling price

|

|

$

|

666

|

|

|

$

|

612

|

|

|

Cost of ferrous scrap utilized

|

|

284

|

|

|

303

|

|

|

Metal margin

|

|

382

|

|

|

309

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons (in thousands)

|

|

|

|

|

|

Melted

|

|

4,357

|

|

|

2,922

|

|

|

Rolled

|

|

4,134

|

|

|

2,673

|

|

|

Shipped

|

|

4,394

|

|

|

3,013

|

|

Net sales in 2019 increased $1.1 billion, or 54%, compared to 2018. The increase in net sales for 2019 was driven by a 1.4 million ton increase in tons shipped, primarily due to shipments by the Acquired Businesses. Also contributing to increased net sales were increased average selling prices of $54 per ton in 2019 compared to 2018, as the Section 232 trade actions recently implemented in the U.S., aimed at unfairly priced steel imports, have favorably impacted the pricing environment.

Adjusted EBITDA in 2019 increased $243.4 million compared to 2018. This increase was due, in part, to the Acquired Businesses, which contributed $146.0 million to Adjusted EBITDA in 2019, coupled with a 24% increase in metal margin. Partially offsetting margin expansion were increases in conversion costs of approximately $41 per ton excluding the increase related to the Acquired Businesses, due to increased electrode prices and repairs and maintenance expenses compared to 2018. Adjusted EBITDA included non-cash stock compensation expense of $5.6 million and $5.2 million, in 2019 and 2018, respectively.

ITEM 15. EXHIBIT

|

|

|

|

|

|

|

EXHIBIT

|

|

|

|

NO.

|

|

DESCRIPTION

|

|

31(a)

|

|

|

|

|

|

|

|

31(b)

|

|

|

|

|

|

|

|

101.INS

|

|

Inline XBRL Instance Document (filed herewith).

|

|

|

|

|

|

101.SCH

|

|

Inline XBRL Taxonomy Extension Schema Document (filed herewith).

|

|

|

|

|

|

101.CAL

|

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document (filed herewith).

|

|

|

|

|

|

101.DEF

|

|

Inline XBRL Taxonomy Extension Definition Linkbase Document (filed herewith).

|

|

|

|

|

|

101.LAB

|

|

Inline XBRL Taxonomy Extension Label Linkbase Document (filed herewith).

|

|

|

|

|

|

101.PRE

|

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document (filed herewith).

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMERCIAL METALS COMPANY

|

|

|

|

By

|

/s/ Barbara R. Smith

|

|

|

|

|

Barbara R. Smith

|

|

|

|

|

Chairman of the Board, President and Chief Executive Officer

|

|

|

|

|

Date:

|

November 1, 2019

|

|

|

|

|

|

|

|

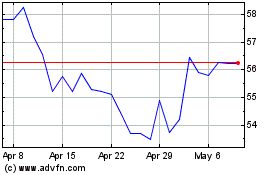

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Commercial Metals (NYSE:CMC)

Historical Stock Chart

From Apr 2023 to Apr 2024