Filed by Woodside Petroleum Ltd.

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: BHP Group Ltd (Commission File No.: 001-09526)

|

|

|

|

|

| ASX Announcement

Friday, 8 April 2022

ASX: WPL OTC: WOPEY |

|

|

|

Woodside Petroleum Ltd.

ACN 004 898 962 Mia Yellagonga

11 Mount Street Perth WA 6000

Australia T +61 8 9348 4000

www.woodside.com.au |

WOODSIDE AND BHP PETROLEUM MERGER INVESTOR PRESENTATION

Attached is a presentation summarising the strategic rationale of the proposed merger between Woodside and BHP’s petroleum business.

The presentation should be read in conjunction with the Merger Explanatory Memorandum and Independent Expert Report (which should be read in their entirety)

released to the ASX today.

This presentation will be used for investor and stakeholder engagement in advance of the shareholder vote on the merger at

Woodside’s 2022 Annual General Meeting to be held at 10.00am (AWST) on 19 May 2022.

Contacts:

|

|

|

|

|

| INVESTORS

Damien Gare W: +61 8 9348 4421

M: +61 417 111 697 E: investor@woodside.com.au |

|

MEDIA

Christine Forster M: +61 484 112 469

E: christine.forster@woodside.com.au |

|

|

This ASX announcement was approved and authorised for release by Woodside’s Disclosure Committee.

WOODSIDE AND BHP PETROLEUM MERGER 8

April 2022 www.woodside.com.au investor@woodside.com.au INVESTOR PRESENTATION

Disclaimer, important notes and

assumptions Transaction and presentation of information on a pro forma, post-merger basis The proposed combination of Woodside Petroleum Ltd (“Woodside”) and BHP Group Limited’s (“BHP”) oil and gas business by an

all-stock merger as outlined in this presentation (“Transaction”) is subject to the satisfaction or waiver of certain regulatory and third party conditions precedent, including obtaining the approval of Woodside shareholders. Details of

the key terms of the Transaction are outlined in the Merger Explanatory Memorandum and Independent Expert Report released 8 April 2022. There is no certainty or assurance that all remaining conditions precedent will be satisfied or waived, or that

the Transaction will complete, on the intended schedule or at all. Nevertheless, all information in this presentation is presented on a post-merger, pro forma basis unless indicated to the contrary. Information This presentation contains information

in summary form that is current as of the date of this presentation. It summarises the strategic rationale of the Transaction and should be read in conjunction with the Merger Explanatory Memorandum and Independent Expert Report released 8 April

2022. The purpose of the Merger Explanatory Memorandum is to provide Woodside shareholders with information that the Woodside directors believe to be material to deciding whether or not to approve the Transaction. It therefore should be read in its

entirety before making any decision as to whether or not to vote in favour of the Transaction or any other investment decision. This presentation has been prepared by Woodside and includes information extracted from the Merger Explanatory Memorandum

that has been provided by BHP (“BHP Information”). Except as outlined in this disclaimer, the information contained in this presentation has been prepared by Woodside and is its responsibility alone. Except as outlined in this

disclaimer, neither BHP, nor any of its related bodies corporate, (nor any of each of their respective officers, directors, employees, advisers or representatives (“Beneficiaries”) assume any responsibility for the accuracy or

completeness of that information. BHP has prepared and provided the BHP Information and is responsible for that information. None of Woodside nor any of its related bodies corporate, nor any of their Beneficiaries assume any responsibility for the

accuracy or completeness of the BHP Information. This presentation contains industry, market and competitive position data that is based on industry publications and studies conducted by third parties as well as Woodside’s internal estimates

and research. These industry publications and third party studies generally state that the information they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such

information. While Woodside believes that each of these publications and third party studies is reliable, Woodside has not independently verified the market and industry data obtained from these third party sources. Neither ASIC nor ASX, nor their

respective officers, take any responsibility for the contents of this presentation. No offer or advice This presentation does not constitute or contain an offer to Woodside shareholders (or any other person), or a solicitation of an offer from

Woodside shareholders (or any other person), in any jurisdiction. This presentation has been prepared without reference to the investment objectives, financial and taxation situation or particular needs of any Woodside shareholder or any other

person. The information and recommendations contained in this presentation do not constitute, and should not be taken as, financial product advice. The Woodside board encourages you to seek independent financial and taxation advice before making any

decision as to whether or not to vote in favour of the Transaction or any investment decision. General Statements made in this presentation are made only as at the date of this presentation. The information in this presentation remains subject to

change without notice. Woodside may in its absolute discretion, but without being under any obligation to do so, update or supplement this presentation. However, except as required by law, none of Woodside or its Beneficiaries intends to, or

undertakes to, or assumes any obligation to, provide any additional information or revise the statements in this presentation, whether as a result of a change in expectations or assumptions, new information, future events, results or circumstances

Key risks Please see section 8 of the Merger Explanatory Memorandum for details on the key risks relating to the merger, the Merged Group and Woodside shares. Investors should carefully consider these risk factors, as well as other information

contained in the Merger Explanatory Memorandum, before making any investment decision. Forward looking statements This presentation contains forward-looking statements. The words ‘guidance’, ‘foresee’, ‘likely’,

‘potential’ ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’, ‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’,

‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or expressions are intended to identify forward-looking statements. Similarly, statements that describe the

objectives, plans, goals or expectations of Woodside are or may be forward-looking statements.

Disclaimer, important notes and

assumptions Forward looking statements (continued) You should be aware that those statements and any assumptions on which they are based are only opinions and are subject to inherent known and unknown risks and uncertainties, many of which are

beyond the control of Woodside and its Beneficiaries. Those risks and uncertainties include factors and risks specific to the industries in which Woodside operates, as well as general economic conditions, prevailing exchange rates and interest rates

and conditions in financial markets (for example (not exhaustive) price fluctuations, actual demand, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results,

engineering estimates, reserve estimates, loss of market, industry competition, environmental risks, physical risks, legislative, fiscal and regulatory developments, economic and financial markets conditions in various countries, approvals and cost

estimates). If any of these variables or other assumptions were to change or be found to be incorrect, this would likely cause outcomes to differ from the statements made in this presentation. Investors are strongly cautioned not to place undue

reliance on forward-looking statements, particularly in light of the current economic climate and the significant uncertainty and disruption caused by the COVID-19 pandemic and the conflict in Ukraine. None of Woodside nor any of its related bodies

corporate, nor any of their Beneficiaries, nor any person named in this presentation or involved in the preparation of this presentation, makes any representation or warranty (either express or implied) as to the accuracy or likelihood of fulfilment

of any forward-looking statement, or any events or results expressed or implied in any forward-looking statement. Accordingly, you are cautioned not to place undue reliance on those statements. The forward-looking statements in this presentation

reflect views held only at the date of this presentation. Subject to any continuing obligations under the ASX Listing Rules or the Corporations Act, Woodside and its related bodies corporate, and their Beneficiaries, disclaim any obligation or

undertaking to distribute after the date of this presentation any updates or revisions to any forward-looking statements to reflect any change in expectations in relation to those statements or any change in events, conditions or circumstances on

which any statement is based. Past performance and pro forma historical information is given for illustrative purposes only. It should not be relied on and is not indicative of future performance, including future security prices. Additional

information for US investors Refer to Appendix titled ‘Additional information for US investors’ on slide 17 of this presentation. Estimates of petroleum reserves Refer to Appendix titled ‘Notes to petroleum resource

estimates’ on slide 18 of this presentation. Key assumptions The following assumptions apply to information in this presentation unless stated otherwise. Financial data is presented as at 31 December 2021 or for the 12-month period to 31

December 2021. Woodside’s financial reporting otherwise will continue to be on a January to December basis. All figures are USD unless otherwise stated. Production data is for the 12-month period to 31 December 2021. Woodside reserves data is

presented as at 31 December 2021. BHP reserves data is presented as at 31 December 2021. Any forecasts set out in this presentation have been estimated on the basis of a variety of assumptions including: Brent oil forward price curve (as at 24 March

2022) of US$107/bbl (2022), US$93/bbl (2023), US$84/bbl (2024), US$79/bbl (2025), US$76/bbl (2026) followed by a long-term Brent oil price of US$65/bbl (2022 real terms) from 2027 Foreign exchange rate long term of 0.75 USD per 1.00 AUD Currently

sanctioned projects being delivered in accordance with their current project schedules The merged entity holding equity interests of 100% of Scarborough, 82% of Sangomar and 51% of Pluto Train 2. Note: If any of these assumptions or any other

assumptions used in preparing the information in this presentation were to change or be found to be incorrect, this would likely cause outcomes to be different from the statements made in this presentation. Woodside applies a conversion factor of

5.7 Bcf of dry gas per 1 MMboe. BHP applies a conversion factor of 6.0 Bcf of dry gas per 1 MMboe. Figures, amounts, percentages, estimates, calculations of value and other fractions used in this presentation are subject to the effect of

rounding.

All-stock merger of Woodside and BHP

Petroleum Provides information on items of business to be considered at the Annual General Meeting Shareholder vote to approve the Merger 19 May 2022 Seek approval for the issue of shares Shareholder materials Explanatory Memorandum Independent

Expert Report Target Implementation date 1 June 2022 Distribution of new Woodside Shares to BHP Shareholders Outstanding conditions precedents include National Offshore Petroleum Titles Administrator approval and Woodside shareholder approval.

Provides information on the Merger Detailed disclosure on the combined Woodside and BHP Petroleum assets Concludes that the Merger is in the best interests of Woodside Shareholders Concludes the 52/48 Merger ratio is broadly supported by various

financial and other relative contribution measures Unanimous support of the Woodside Board Shareholder vote1

Transaction and distribution mechanics

The number of New Woodside Shares to be issued assumes that no additional Woodside Shares are issued in connection with a Permitted Equity Raise and no further declaration of Woodside Dividends will occur prior to Implementation. Based on last

practicable date, 24 March 2022. This estimate is based on Woodside’s current expectations of BHP Petroleum net cash flows (adjusted for permitted adjustments) for the period from 1 July 2021 to 1 June 2022 (when Implementation is

expected to occur). Given this is an estimate only, the actual amount of the Locked Box Payment may vary (potentially significantly) from the amount currently anticipated by Woodside due to a variety of factors, including the volatility of

commodity prices. Please refer to the “Disclaimer and important notices” section (including under the heading “Forward-looking statements”) for important cautionary information relating to forward-looking statements.

Post completion. Market capitalisation assumes total Woodside number of shares of 1,898,749,771 which is post issuance of 914,768,948 new Woodside shares to BHP and a closing share price of A$33.20 on 24 March 2022. Pre-tax. Refer to slide 14 for

details of identified opportunities and expected costs of and timing for achieving synergies. SHARE CONSIDERATION Market capitalisation4 ~A$63 billion Estimated annual synergies5 $400+ million 914,768,948 New Woodside Shares issued to BHP, with

subsequent distribution to BHP shareholders1 BHP Shareholders receive ~0.1807 new Woodside shares per BHP share2 Pro forma equity ownership of approximately 52% Woodside and 48% BHP shareholders Effective transaction date 1 July 2021 Woodside

entitled to ~$1,600 million for net cash flow from the BHP Petroleum business from 1 July 20213 BHP entitled to $830 million for dividends paid by Woodside since 1 July 2021 Primary listing ASX Pursuing secondary listings NYSE & LSE 1 CASH

ADJUSTMENT 2

Merger strategic rationale PORTFOLIO

QUALITY CASH GENERATION AND BALANCE SHEET SHAREHOLDER RETURNS AND CAPITAL DISCIPLINE DEVELOPMENT OPTIONALITY ENERGY TRANSITION LEADERSHIP SYNERGIES AND VALUE CREATION Strengthens cash generation and balance sheet Complementary, long-life, high

margin assets Supports superior returns through continued capital discipline Strong growth profile and wide range of growth options Increased capacity to navigate the energy transition Expected to unlock pre-tax synergies of $400+ million per annum1

Unanimous support of the Woodside Board Independent Expert has concluded the Merger is in the best interests of Woodside Shareholders See slide 15 for an overview of risks relating to the implementation of the Merger, the Merged Group and ownership

of Woodside Shares, and the reasons for shareholders to vote against the Merger Refer to slide 14 for details of identified opportunities and expected costs of and timing for achieving synergies. Explanatory Memorandum page 9

International asset portfolio Combined

Woodside and BHP Petroleum total production for the 12 months to 31 December 2021. Excludes Algeria and Neptune production. Comprised of 53% BHP Petroleum production and 47% Woodside production. Top 10 global independent energy company by

hydrocarbon production. Woodside analysis based on the Wood Mackenzie Corporate Benchmarking Tool Q4 2021, 1 December 2021. See the section titled ‘Disclaimer and Important Notices’ in the Explanatory Memorandum for clarification of

independent energy company. Equivalent to 88 MMboe, combined Woodside and BHP Petroleum LNG production for the 12 months to 31 December 2021. Comprises 20% BHP Petroleum production and 80% Woodside production. Explanatory Memorandum page 10

Perth Gulf of Mexico Senegal Trinidad & Tobago Western Australia East coast Australia Shenzi | Wildling | Atlantis | Mad Dog Angostura | Ruby Scarborough | Pluto | North West Shelf | Pyrenees | Macedon | Wheatstone | Ngujima-Yin | Okha Bass

Strait Houston Sangomar Mad Dog 2, Sangomar, Shenzi North and Scarborough projects under construction 2021 production1 ~193 MMboe Global independent producer2 Top 10 LNG production3 10.3 Mtpa The Merger creates a strategic portfolio of

complementary, high-margin oil and long-life conventional gas assets

Oil and condensate (29%) LPG, NGLs and

other natural gas (10%) LNG (46%) East coast Australia domestic gas (10%) Western Australia domestic gas (6%) Diversified, large-scale, low-risk portfolio Combined Woodside and BHP Petroleum for the 12 months to 31 December 2021. Excludes Algeria

and Neptune production. Totals do not add due to rounding. For comparative purposes, on a Woodside stand-alone basis for the 12 months to 31 December 2021; the balanced production mix is: 78% LNG, 19% Oil and condensate, 3% Western Australia

domestic gas, 0% East coast Australia domestic gas and <1% LPG, NGLs and other natural gas. Likewise, on a Woodside stand-alone basis the geographic diversification is 100% Western Australia. Source: Wood Mackenzie estimates based on 2022

production of peers with market capitalisation >US$10 billion, excluding NOCs and companies with free float below 65%. Woodside analysis. Chart approximates positions of various companies based on this data. Dataset: Apache, BP, Chevron,

ConocoPhillips, Coterra, Continental, Devon, Diamondback, ENI, EOG, Exxon, Hess, Inpex, Marathon, Occidental, Ovinitiv, Pioneer, Repsol, Santos, Shell, Total and Woodside. Santos is shown on a pro forma basis after the merger with Oil Search. For

comparative purposes, Woodside on a standalone basis consists of 100% OECD and 100% conventional production, based on this data set. Explanatory Memorandum page 11 US independents Majors Other APAC Majority of global majors Majority of U.S.

Independents Greater OECD production (%) Greater conventional production (%) 95% OECD 100% conventional Attractive conventional portfolio in low-risk jurisdictions2 Balanced product mix (2021 production)1 Geographic diversification (2021

production)1 US Gulf of Mexico (15%) Trinidad and Tobago (5%) Western Australia (65%) East coast Australia (15%) Enhanced resilience through the commodity price cycle, through increased diversification and long-life assets in OECD

countries

Strong reserves position and sustained

production Merged Group 2P and 2C volumes as at 31 December 2021. Excludes Algeria and Neptune volumes. For comparative purposes, Woodside stand-alone volumes as at 31 December 2021 include 2P reserves: 2,292 MMboe, 89% Gas and 11% Liquids and 2C

resources: 6,599 MMboe, 92% Gas and 8% Liquids. Indicative only. The production profile is intended to provide an overall future production profile for the Merged Group. It is based on the assumptions that current sanctioned projects are delivered

within their target schedules, and that the Merged Group holds an 82% participating interest in Sangomar and 100% in Scarborough. It also assumes no sell-down of participating interests in Sangomar or Scarborough. To avoid doubt, production from

Algeria and Neptune is excluded. The production profile is given in advance of completion of the Merger and based, in some respects, on external views of the BHP Petroleum asset base. Accordingly, the production profile is provided for illustrative

purposes only and should not be relied on as guidance of future production of the Merged Group. Please refer to the “Disclaimer and important notices” section (including under the heading “Forward-looking statements”) for

important cautionary information relating to forward-looking statements. Explanatory Memorandum pages 11 and 12 Production profile by December 20212 Proved plus Probable (2P) Developed and Undeveloped Reserves1 Best Estimate Contingent (2C)

Resources1 Gas 85% Liquids 15% Gas 79% Liquids 21% 3,609 MMboe 8,373 MMboe

Resilient cash flow profile Pro

forma basis is for 12 months to 31 December 2021. Ratings affirmed following announcement of the Merger (S&P, 28 October 2021; Moody’s, 15 December 2021). Profiles are indicative only, and are intended to provide an overall future profile

for operating cash flow and free cash flow. The profiles assume a Brent oil price forward curve (as at 24 March 2022) of $107/bbl in 2022, $93/bbl in 2023, $84/bbl in 2024, $79/bbl in 2025, $76/bbl in 2026 followed by a long term $65/bbl (real terms

2022) from 2027. Includes unsanctioned U.S. GOM and Western Australia subsea tiebacks. Assumes 82% Sangomar and 100% Scarborough, noting the equity selldown processes for Sangomar and Scarborough are ongoing. To avoid doubt, production from Algeria

and Neptune is excluded. Excludes financing costs. Assumes long-term foreign exchange rate of 0.75 USD per 1.00 AUD. Assumes currently sanctioned projects being delivered in accordance with their current project schedules. Assumes transaction costs

of $410 million. Excludes integration costs, cost of attainment of synergies and synergies. Please refer to the “Disclaimer and important notices” section (including under the heading “Forward-looking statements”) for

important cautionary information relating to forward-looking statements. Explanatory Memorandum page 12 Operating cash flow profile3 Free cash flow profile3 Woodside BHP Petroleum Net free cash flow EARNINGS CASH FLOW Supports funding of

Scarborough, Sangomar, Mad Dog 2, Shenzi North and other growth projects Supported by enlarged and diversified portfolio of producing assets Woodside BHP Petroleum Net operating cash flow Operating cash flow1 >$6 billion Revenue1 >$12 billion

Earnings before interest and tax1 >$5 billion Enlarged and diversified portfolio of producing assets is expected to support significantly increased and sustained cash flows BALANCE SHEET Commitment to investment-grade credit rating throughout the

investment cycle2 Gearing1 ~8 % Combined portfolio cash flow supports funding of existing projects in construction

Shareholder returns through

continued capital discipline Payback refers to RFSU + X years. Target is for net equity Scope 1 and 2 greenhouse gas emissions, relative to a starting base of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and

may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an FID prior to 2021. Following Implementation (which remains subject to Conditions including regulatory approvals), the starting base will be adjusted

for the then combined Woodside and BHP petroleum portfolio. CCUS refers to carbon capture utilisation and storage. Explanatory Memorandum page 13 Capital allocation framework guides investment decisions OFFSHORE High cash generation Shorter payback

period Quick to market Stable long-term cash flow profile Resilient to commodity pricing Long-term cash flow Strong forecast demand Upside potential Developing market Lower capital requirement Lower risk profile IRR > 15% Payback within 5 years1

IRR > 12% Payback within 7 years1 PIPELINE LNG DIVERSIFIED OIL GAS NEW ENERGY Generate high returns to fund diversified growth, focusing on high quality resources Leveraging infrastructure to monetise undeveloped gas, including optionality for

hydrogen New energy products and lower carbon services to reduce customers’ emissions; hydrogen, ammonia, CCUS3 FOCUS OPPORTUNITY TARGETS CURRENT CHARACTERISTICS 30% net emissions reduction by 2030, net zero aspiration by 2050 or sooner2 IRR

> 10% Payback within 10 years1 EMISSIONS REDUCTIONS Merged entity dividend policy based on NPAT with minimum 50% payout ratio Additional opportunities to provide returns through special dividends and share buy-backs Eligible Australian

shareholders of merged entity benefit from franking credit balance

Focused growth opportunities

competing for capital Illustrative of the considerations. Not an exhaustive list. Explanatory Memorandum page 14 Gulf of Mexico tiebacks to existing infrastructure Oil opportunities Large longer-term LNG and pipeline gas New energy opportunities

Such as hydrogen, ammonia, carbon capture, utilisation and storage Opportunity evaluation considerations1 Portfolio evaluation considerations1 Growth opportunities are screened against portfolio metrics using price, scenario and climate analysis EPS

Free cash flow Funding capacity Emissions profile Breakeven Risk Payback period IRR/NPV Strategic fit

Increased capacity to navigate the

energy transition Investment target assumes completion of the proposed merger with BHP’s petroleum business. Individual investment decisions are subject to Woodside’s investment hurdles. Not guidance. Target is for net equity Scope 1 and

2 greenhouse gas emissions, relative to a starting base of the gross annual average equity Scope 1 and 2 greenhouse gas emissions over 2016-2020 and may be adjusted (up or down) for potential equity changes in producing or sanctioned assets with an

FID prior to 2021. Following Implementation (which remains subject to Conditions including regulatory approvals), the starting base will be adjusted for the then combined Woodside and BHP Petroleum portfolio. Explanatory Memorandum pages 13 and 14

15% by 2025 30% by 2030 Net zero aspiration by 2050 Equity emissions reduction targets2 Scope 1 and 2 emissions (Mtpa CO2-e) 30% reduction target WPL Merged Group’s net equity Scope 1 and 2 greenhouse gas emission reduction targets2 Existing

emissions reduction targets expected to apply to the merged entity Progressing several new energy and assessing carbon capture opportunities $5 billion target for investment in new energy products and lower-carbon services by 20301

Expected pre-tax annual synergies

and value creation categories (real term 2022) Consolidate third party spend and rationalise information technology applications, licences and subscriptions Continue efficiency and cost reduction programs, consolidate operations and execute

efficient practices across the portfolio High-grade and focus on high-quality prospects that have a clear path to commercialisation High-grade investment opportunities and improve phasing of the enlarged opportunity set $400+ million per annum

(Pre-tax 100% basis) Expected pre-tax annual synergies of US$400+ million Explanatory Memorandum pages 15 and 59-60 Significant reduction in executive level positions and management layers Removal of duplicative or overlapping staffing levels

Synergies expected to be fully implemented by early 20241 One-off costs of ~$500 – 600 million to deliver synergies2 There is no guarantee or assurance given that some or all of these synergies will be achieved or that any assumptions

underlying them are correct. Please refer to the “Disclaimer and important notices” section (including under the heading “Forward-looking statements”) for important cautionary information relating to forward-looking

statements. The estimate excludes costs to implement marketing synergies discussed in Section 6.5.6 of the Merger Explanatory Memorandum, which Woodside expects to determine post Implementation.

Risks and reasons not to vote for

the Merger Implementation will reduce Woodside Shareholders’ aggregate interest in Woodside’s assets from 100% to approximately 52% as a result of the issue of the new Woodside Shares, though Woodside Shareholders will gain exposure to

BHP Petroleum’s assets Your percentage shareholding and voting power in Woodside will be diluted by the issue of the share consideration You may not agree with the recommendation of the Woodside Board and/or the conclusion of the Independent

Expert The risk profile of the Merged Group will change, which you may consider to be disadvantageous to you relative to the risk profile of the current Woodside business Notwithstanding the unanimous recommendation of the Woodside Board and the

conclusion of the Independent Expert, you may believe the Merger is not in your interests If the Merger is implemented, Woodside Shareholders will become exposed to additional risks associated with having an indirect equity interest in BHP Petroleum

(which will be owned by Woodside following Implementation) and with Implementation more generally These risks include, but are not limited to, the Merged Group not realising the expected growth opportunities and synergies The Merged Group’s

increased scale of operations as a result of the Merger will increase the exposure to the risks that Woodside currently faces (as described in the Explanatory Memorandum, Section 8.3), including the exposure to challenges associated with climate

change and the energy transition However, following Implementation, the Merged Group’s diversified portfolio of assets will mean that Woodside Shareholders have a reduced risk exposure to any one asset 1 2 3 Explanatory Memorandum page 9,

pages 15-16 and pages 86-108 Woodside Shares may trade below the current price 4 The price at which Woodside Shares trade on ASX after the Merger is implemented may be influenced by a range of factors and Woodside Shares may trade below the price of

Woodside Shares on the Last Practicable Date (being A$33.20) or on the date of the Meeting or the date of Implementation The levels of liquidity and volatility at which Woodside Shares may trade after the Merger is implemented could differ from

those at which Woodside Shares currently trade, including as a result of the sale facility to be conducted by the Sale Agent (refer to the Explanatory Memorandum, Section 10.4) There is no guarantee that Woodside Shares will trade in or above the

Independent Expert’s range of A$26.25 to A$29.81 per Woodside Share or that they will trade at or above the price of Woodside Shares on the Last Practicable Date of A$33.20 RISKS: There are a range of risks relating to the Implementation

of the Merger, the Merged Group and the ownership of Woodside Shares. These risk are described in detail in the Explanatory Memorandum, including at pages 86 – 108 Please see Section 8 of the Merger Explanatory Memorandum for details on

the key risks relating to the Merger, the Merged Group and Woodside shares. Investors should carefully consider these risk factors, as well as other information contained in the Merger Explanatory Memorandum, before making any decision.

Merger strategic rationale PORTFOLIO

QUALITY CASH GENERATION AND BALANCE SHEET SHAREHOLDER RETURNS AND CAPITAL DISCIPLINE DEVELOPMENT OPTIONALITY ENERGY TRANSITION LEADERSHIP SYNERGIES AND VALUE CREATION Strengthens cash generation and balance sheet Complementary, long-life, high

margin assets Supports superior returns through continued capital discipline Strong growth profile and wide range of growth options Increased capacity to navigate the energy transition Expected to unlock pre-tax synergies of $400+ million per annum1

Unanimous support of the Woodside Board Independent Expert has concluded the Merger is in the best interests of Woodside Shareholders Refer to slide 14 for details of identified opportunities and expected costs of and timing for achieving synergies.

Explanatory Memorandum page 9

Additional information for US

investors Disclosure of reserve information and cautionary note to US investors Unless expressly stated otherwise, all estimates of oil and gas reserves and contingent resources disclosed in this presentation have been prepared using definitions and

guidelines consistent with the 2018 Society of Petroleum Engineers (SPE)/World Petroleum Council (WPC)/American Association of Petroleum Geologists (AAPG)/Society of Petroleum Evaluation Engineers (SPEE) Petroleum Resources Management System (PRMS).

Estimates of reserves and contingent resource in this presentation will differ from corresponding estimates prepared in accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”) and disclosure requirements of

the U.S. Financial Accounting Standards Board (“FASB”), and those differences may be material. For additional information regarding BHP’s reserves, please see BHP’s annual report on Form 20-F filed with the SEC. This

presentation also includes estimates of contingent resources. Estimates of contingent resources are by their nature more speculative than estimates of proved reserves and would require substantial capital spending over a significant number of years

to implement recovery. Actual locations drilled and quantities that may be ultimately recovered from our properties will differ substantially. In addition, we have made no commitment to drill, and likely will not drill, all of the drilling locations

that have been attributable to these quantities. In connection with the Transaction, a registration statement will be filed with the SEC. Such registration statement will include, among other things, disclosure of reserves and other oil and gas

information in accordance with U.S. federal securities law and applicable SEC rules and regulations (collectively, "SEC requirements"). The SEC permits oil and gas companies that are subject to domestic issuer reporting requirements under U.S.

federal securities law, in their filings with the SEC, to disclose only estimated proved, probable and possible reserves that meet the SEC's definitions of such terms. In addition, the registration statement will include notes to the financial

statements included therein that include supplementary disclosure in respect of oil and gas activities, including estimates of proved oil and gas reserves and a standardized measure of discounted future net cash flows relating to proved oil and gas

reserve quantities. This supplementary financial statement disclosure will be presented in accordance with FASB requirements, which align with corresponding SEC requirements concerning reserves estimation and reporting. No offer or solicitation This

communication relates to the proposed Transaction between Woodside and BHP. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of

any vote or approval with respect to the Transaction or otherwise, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offer of securities in the United States shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933. Important additional

information In connection with the proposed Transaction, Woodside intends to file with the US Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 (the “Registration Statement”) to register the

distribution of the Woodside securities to be issued in connection with the proposed Transaction (including a prospectus therefor). Woodside and BHP have filed and plan to file other documents with the SEC regarding the proposed Transaction. This

communication is not a substitute for the Registration Statement or the prospectus or for any other document that Woodside or BHP may file with the SEC in connection with the Transaction. US INVESTORS AND US HOLDERS OF WOODSIDE AND BHP SECURITIES

ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE PROPOSED TRANSACTION. Shareholders will be able to obtain free copies of the Registration Statement, prospectus and other documents containing important

information about Woodside and BHP once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of such documents may also be obtained from Woodside and BHP without charge.

Notes to petroleum resource

estimates Unless otherwise stated, all petroleum resource estimates in this presentation are expressed on a pro forma, post-merger basis as a combination of (by arithmetic summation): Woodside petroleum resource estimates sourced from, and quoted as

at the balance date (i.e. 31 December) of the Reserves and Resources Statement in Woodside’s most recent Annual Report released to the Australian Securities Exchange (ASX) and available at

https://www.woodside.com.au/news-and-media/announcements, net Woodside share at standard oilfield conditions of 14.696 psi (101.325 kPa) and 60 degrees Fahrenheit (15.56 degrees Celsius); and BHP petroleum resource estimates sourced directly

from BHP and quoted as at the balance date of 31 December 2021. Other than as identified in paragraph 1(a) above, Woodside is not aware of any new information or data that materially affects the information included in the Woodside Reserves

and Resources Statement. All the material assumptions and technical parameters underpinning the estimates in the Woodside Reserves and Resources Statement continue to apply and have not materially changed. Woodside has conducted due diligence in

relation to BHP’s petroleum estimates but has not independently verified all such information and expressly disclaims any responsibility for it, to the maximum extent permitted by law. No representation or warranty, express or implied, is made

as to the fairness, currency, accuracy, adequacy, reliability or completeness of BHP’s petroleum estimates. Given Woodside has not independently validated BHP’s petroleum estimates, it should not be regarded as reporting, adopting or

otherwise endorsing those estimates. Woodside is not aware of any new information or data that materially affects the information in relation to BHP petroleum estimates in the BHP Additional Information. Woodside reports its reserves net of the fuel

and flare required for production, processing and transportation up to a reference point. For Woodside’s offshore oil projects, the reference point is defined as the outlet of the floating production storage and offloading facility (FPSO),

while for its onshore gas projects the reference point is defined as the inlet to the downstream (onshore) processing facility. BHP Petroleum includes all onshore and offshore fuel used in operations as reserves. Woodside and BHP Petroleum use both

deterministic and probabilistic methods for estimation of its petroleum resources at the field and project levels. Unless otherwise stated, all Woodside and BHP Petroleum estimates reported at the company or region level are aggregated by arithmetic

summation by category. Note that the aggregated Proved level may be a very conservative estimate due to the portfolio effects of arithmetic summation. ‘MMboe’ means millions (106) of barrels of oil equivalent. Dry gas volumes, defined as

‘C4 minus’ hydrocarbon components and non-hydrocarbon volumes that are present in sales product, are converted to oil equivalent volumes via a constant conversion factor, which for Woodside is 5.7 Bcf of dry gas per 1 MMboe. Volumes of

oil and condensate, defined as ‘C5 plus’ petroleum components, are converted from MMbbl to MMboe on a 1:1 ratio. BHP Petroleum reports petroleum resources on the basis of products including oil, condensate, natural gas and natural gas

liquids. BHP Petroleum applies a conversion factor of 6.0 Bcf of dry gas per 1 MMboe The estimates of Woodside’s petroleum resources are based on and fairly represent information and supporting documentation prepared under the supervision of

Mr Jason Greenwald, Woodside’s Vice President Reservoir Management, who is a full-time employee of the company and a member of the Society of Petroleum Engineers. Mr Greenwald’s qualifications include a Bachelor of Science (Chemical

Engineering) from Rice University, Houston, Texas, and more than 20 years of relevant experience.

appendix Glossary $, $m, $B US

dollar unless otherwise stated, millions of dollars, billions of dollars ADSs or American Depositary Shares American depositary shares A$, AUD Australian dollar ASX Australian Securities Exchange 2P Proved plus Probable reserves 2C Best Estimate of

Contingent resources Bcf Billion cubic feet BHP Group BHP and its direct and indirect subsidiaries from time to time BHP Petroleum BHP Petroleum International Pty Ltd ACN 006 923 897 and, unless context otherwise requires, its subsidiaries,

presented on a post-Restructure basis and excludes the Restructure Entities. References to “BHP Petroleum International Pty Ltd” are to “BHP Petroleum International Pty Ltd” excluding its subsidiaries BHP Shares Fully paid

ordinary shares in the capital of BHP, including shares held by the custodian in respect of which BHP ADSs have been issued BHP Shareholder A holder of BHP Shares boe, MMboe, Bboe Barrel of oil equivalent, million barrels of oil equivalent, billion

barrels of oil equivalent CCS Carbon capture and storage CCUS Carbon capture, utilisation and storage Conventional Conventional resources exist in porous and permeable rock with pressure equilibrium. The hydrocarbons are trapped in discrete

accumulations related local geological structure feature and/or stratigraphic condition DES Delivered ex-ship EBITDA Calculated as a profit before income tax, PRRT, net finance costs, depreciation and amortisation and impairment EBITDAX Calculated

as a profit before income tax, PRRT, net finance costs, depreciation and amortisation, impairment and exploration and evaluation expense Explanatory Memorandum Annexure A to the notice of annual general meeting of Woodside Shareholders dated 8 April

2022 FEED Front-end engineering design FID Final investment decision FPSO Floating production storage and offloading FPU Floating production unit Free cash flow Cash flow from operating activities less cash flow from investing activities Gearing Net

debt divided by net debt and equity attributable to the equity holders of the parent GOM Gulf of Mexico Implementation Completion of the Merger pursuant to the Share Sale Agreement Independent Expert KPMG Financial Advisory Services (Australia) Pty

Ltd, being the independent expert appointed by Woodside IRR Internal rate of return JV Joint venture kbpd Thousand barrels per day KGP Karratha Gas Plant kt Kilotonnes (metric) Last Practicable Date 24 March 2022 LNG Liquefied natural gas LPG

Liquefied petroleum gas Meeting The Woodside annual general meeting to be held at 10.00am (AWST) on 19 May 2022 Merged Group The Group following Implementation, which will comprise Woodside and its subsidiaries (including BHP Petroleum) Merger The

acquisition of BHP Petroleum by a member of Woodside Group pursuant to the Share Sale Agreement MMbbl Million barrels MMBtu Million British thermal units mmscf/d Million standard cubic feet per day Mtpa Million tonnes per annum New Woodside Shares

Woodside Shares to be issued on Implementation as Share Consideration NGLs Non gas liquids NOC National oil company NPAT Net profit after tax NWS North West Shelf OECD Organisation for Economic Co-operation and Development Permitted Equity Raise A

specified form of Woodside equity raise under the Share Sale Agreement, undertaken by Woodside after 17 August 2021, which may have the effect of increasing the number of Woodside Shares comprising the Share Consideration PRRT Petroleum Resource

Rent Tax Restructure The transfer out of BHP Petroleum of the Restructure Entities to members of the BHP Group which do not otherwise form part of BHP Petroleum Restructure Entities The following entities which hold non-oil and gas and/or legacy

assets and operations BHP BK Limited, BHP Billiton Petroleum Great Britain Limited, BHP Mineral Resources Inc., BHP Copper Inc., Resolution Copper Mining LLC, BHP Resolution Holdings LLC, and BHP Capital Inc RFSU Ready for start-up Shareholder or

Woodside Shareholder A holder of Woodside Shares from time to time Share Sale Agreement The Share Sale Agreement between Woodside and BHP dated 22 November 2021 SPA Sale and purchase agreement T&T Trinidad and Tobago Tcf Trillion cubic feet

Ullage Available capacity USD United States dollar Unit production cost Production cost divided by production volume Woodside Woodside Petroleum Ltd (to be renamed Woodside Energy Group Ltd, subject to approval by Woodside Shareholders at the

Meeting) ACN 004 898 962 Woodside Shareholder See ‘Shareholder’ Woodside Shares or Shares Fully paid ordinary shares in the capital of Woodside YTD Year to date

No offer or solicitation

This communication relates to the proposed Transaction between Woodside and BHP. This communication is not intended to and does not constitute an offer to sell

or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approval with respect to the Transaction or otherwise, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities in the United States shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933.

Important additional information and where to find it

In connection with the proposed Transaction, Woodside intends to file with the US Securities and Exchange Commission (the “SEC”) a registration

statement on Form F-4 (the “Registration Statement”) to register the Woodside securities to be issued in connection with the proposed Transaction (including a prospectus therefor). Woodside and BHP

also plan to file other documents with the SEC regarding the proposed Transaction. This communication is not a substitute for the Registration Statement or the prospectus or for any other document that Woodside or BHP may file with the SEC in

connection with the Transaction. US INVESTORS AND US HOLDERS OF WOODSIDE AND BHP SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS

TO THOSE DOCUMENTS) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE PROPOSED TRANSACTION. Shareholders will be able to obtain free

copies of the Registration Statement, prospectus and other documents containing important information about Woodside and BHP once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies

of such documents may also be obtained from Woodside and BHP without charge.

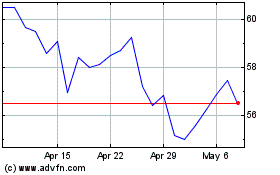

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

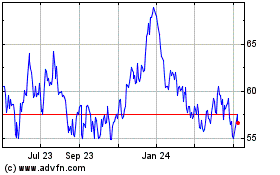

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024