-- Full-Year Cash Provided by Operating

Activities of $858 Million --

-- Returned Approximately $390 Million to

Shareholders in 2019 --

Arrow Electronics, Inc. (NYSE:ARW) today reported fourth-quarter

2019 sales of $7.34 billion, a decrease of 7 percent from sales of

$7.92 billion in the fourth quarter of 2018. Fourth-quarter sales

as adjusted decreased 5%. The company reported fourth-quarter net

income of $112 million, or $1.36 per share on a diluted basis,

compared with net income of $231 million, or $2.63 per share on a

diluted basis, in the fourth quarter of 2018. Excluding certain

items1, net income would have been $181 million, or $2.20 per share

on a diluted basis, in the fourth quarter of 2019, compared with

net income of $227 million, or $2.59 per share on a diluted basis,

in the fourth quarter of 2018. In the fourth quarter of 2019,

changes in foreign currencies had negative impacts on growth of

approximately $65 million or 1 percent on sales and $.04 or 1

percent on earnings per share on a diluted basis compared to the

fourth quarter of 2018.

“Arrow’s commitment to delivering unmatched engineering and

design services to customers on behalf of our suppliers is serving

the company well during the ongoing industry correction,” said

Michael J. Long, chairman, president, and chief executive officer.

“Global components’ sales and margin performance continue to

demonstrate greater resiliency compared to past economic and

semiconductor industry corrections. As we prepare for economic

recovery, we continue to increase the scale of our Asia components

business, which we expect to lead to greater profit. Arrow is well

positioned to accelerate profit growth and expansion as soon as

demand from end-customers stabilizes and improves.”

Global components fourth-quarter sales of $4.74 billion

decreased 10 percent year over year. Sales, as adjusted, decreased

8 percent year over year. Asia-Pacific components sales increased 4

percent year over year. Europe components sales decreased 16

percent year over year. Sales in the region, as adjusted, decreased

12 percent year over year. Americas components sales decreased 19

percent year over year. Sales in the region, as adjusted, decreased

16 percent year over year. Global components fourth-quarter

operating income was $150 million. Fourth-quarter operating income,

excluding amortization of intangibles expense, as adjusted, was

$172 million.

“During the fourth quarter, and throughout 2019, Arrow’s

enterprise computing solutions focused on accelerating the

evolution toward selling advanced, next-generation software and

hardware architectures,” added Mr. Long. “We believe our line card

and capabilities are well positioned to assure mutual success for

suppliers, VARs and MSPs, and their customers as we begin the new

decade.”

Global enterprise computing solutions fourth-quarter sales of

$2.60 billion decreased 2 percent year over year. Global enterprise

computing solutions sales, as adjusted, decreased 1 percent year

over year. Europe sales increased 1 percent year over year. Sales

in the region, as adjusted, increased 4 percent year over year.

Americas sales decreased 4 percent year over year. Sales in the

region, as adjusted, decreased 3 percent year over year. Global

enterprise computing solutions fourth-quarter operating income was

$149 million. Fourth-quarter operating income, excluding

amortization of intangibles expense, as adjusted, was $156 million.

Fourth-quarter operating income as a percentage of sales increased

20 basis points year over year.

FULL-YEAR RESULTS

Full-year 2019 sales of $28.92 billion decreased 3 percent from

sales of $29.68 billion in 2018. Net loss for 2019 was $204

million, or $(2.44) per share, compared with net income of $716

million, or $8.10 per share on a diluted basis, in 2018. Excluding

certain items1, net income would have been $636 million, or $7.55

per share on a diluted basis, in 2019 compared with net income of

$778 million, or $8.79 per share on a diluted basis, in 2018. In

2019, changes in foreign currencies had negative impacts on growth

of approximately $513 million, or 2 percent on sales, and $.23, or

2 percent, on earnings per share on a diluted basis compared to

2018.

“With our flexibility, Arrow was able to adapt to changing

market conditions in 2019,” said Chris Stansbury, senior vice

president and chief financial officer. “Fourth-quarter and

full-year 2019 cash flow provided by operating activities were $495

million and $858 million, respectively. Disciplined working capital

management, continued profitability from our leading positions in

the markets we serve, and efficiencies from our largely complete

cost optimization activities, were all key drivers in generating

our strong cash flow. We remain committed to returning excess cash

to shareholders, and returned approximately $100 million to

shareholders through our stock repurchase program during the fourth

quarter, and approximately $390 million in 2019. At the end of the

year, we had approximately $339 million of remaining authorization

under our share repurchase program.”

FIRST-QUARTER 2020 OUTLOOK

- Consolidated sales of $6.225 billion to $6.625 billion, with

global components sales of $4.55 billion to $4.75 billion, and

global enterprise computing solutions sales of $1.675 billion to

$1.875 billion

- Earnings per share on a diluted basis of $.99 to $1.29, and

earnings per share on a diluted basis, excluding certain items1 of

$1.29 to $1.39 per share, assuming an average tax rate of

approximately 24.5 percent compared to the long-term range of 23 to

25 percent, and average diluted shares outstanding of 82

million

- Interest expense of approximately $52 million

- Expecting average USD-to-Euro exchange rate of $1.12 to €1;

changes in foreign currencies to negatively impact sales growth by

approximately $30 million, and earnings per share on a diluted

basis by $.01 compared to the first quarter of 2019

“As we look to the first quarter, we are seeing some delays and

extended lead times of products manufactured in China due to

business and transportation shutdowns, as well as the extension of

the New Year Holiday week mandated by the Chinese government. The

situation in that region remains uncertain, and we are monitoring

conditions closely. Currently, we are not able to quantify the

potential impacts to our first-quarter outlook," said Mr.

Stansbury.

“Separately, our first quarter of 2020 will close on March 28,

2020, two days earlier than the first quarter of 2019, and three

days before the end of the calendar month. We expect this will

negatively impact sales by approximately $225 million, and earnings

per share on a diluted basis by approximately $.11 compared to the

first quarter of 2019. The earlier closing date will only impact

global enterprise computing solutions. Additionally, while the

second and third quarters of 2020 will close two days earlier than

the second and third quarters of 2019, we expect impacts to

year-over-year comparisons should be negligible. We anticipate the

fourth quarter of 2020 will benefit by the corresponding amounts

lost from the first quarter.”

Please refer to the CFO commentary, which can be found at

investor.arrow.com, as a supplement to the company’s earnings

release.

Arrow Electronics guides innovation forward for over 175,000

leading technology manufacturers and service providers. With 2019

sales of $29 billion, Arrow develops technology solutions that

improve business and daily life. Learn more at

fiveyearsout.com.

1 A reconciliation of non-GAAP adjusted financial measures,

including sales, as adjusted, gross profit, operating income, as

adjusted, net income attributable to shareholders, as adjusted, and

net income per share, as adjusted, to GAAP financial measures is

presented in the reconciliation tables included herein.

Information Relating to Forward-Looking

Statements

This press release includes forward-looking statements that are

subject to numerous assumptions, risks, and uncertainties, which

could cause actual results or facts to differ materially from such

statements for a variety of reasons, including, but not limited to:

industry conditions, changes in product supply, pricing and

customer demand, competition, other vagaries in the global

components and global enterprise computing solutions markets,

changes in relationships with key suppliers, increased profit

margin pressure, changes in legal and regulatory matters,

non-compliance with certain regulations, such as export,

anti-trust, and anti-corruption laws, the company's ability to

generate cash flow, and disruptions in the company’s business due

to epidemics (such as the coronavirus). Forward-looking statements

are those statements which are not statements of historical fact.

These forward-looking statements can be identified by

forward-looking words such as “expects,” “anticipates,” “intends,”

“plans,” “may,” “will,” “believes,” “seeks,” “estimates,” and

similar expressions. Shareholders and other readers are cautioned

not to place undue reliance on these forward-looking statements,

which speak only as of the date on which they are made. The company

undertakes no obligation to update publicly or revise any of the

forward-looking statements.

For a further discussion of factors to consider in connection

with these forward-looking statements, investors should refer to

Item 1A Risk Factors of the company’s Annual Report on Form 10-K

for the year ended Dec. 31, 2019.

Certain Non-GAAP Financial

Information

In addition to disclosing financial results that are determined

in accordance with accounting principles generally accepted in the

United States (“GAAP”), the company also provides certain non-GAAP

financial information relating to sales, operating income, net

income attributable to shareholders, and net income per basic and

diluted share.

The company provides sales, gross profit, and operating expenses

as adjusted for the impact of changes in foreign currencies

(referred to as changes in foreign currencies) by re-translating

prior-period results at current period foreign exchange rates, the

impact of dispositions by adjusting the company's operating results

for businesses disposed, as if the dispositions had occurred at the

beginning of the earliest period presented (referred to as

dispositions), the impact of the company's personal computer and

mobility asset disposition business (referred to as wind down), the

impact of inventory write-downs related to the digital business

(referred to as “digital inventory write-downs and recoveries”),

and the impact of the notes receivable reserves and inventory

write-downs related to the AFS business (referred to as “AFS notes

receivable reserves and credits” and “AFS inventory write-downs and

recoveries,” respectively). Operating income is adjusted to exclude

identifiable intangible asset amortization, restructuring,

integration, and other charges, loss on disposition of businesses,

net, AFS notes receivable reserves and credits and inventory

write-downs and recoveries, digital inventory write-downs and

recoveries, the impact of non-cash charges related to goodwill,

trade names, and long-lived assets, and the impact of wind down.

Net income attributable to shareholders as adjusted to exclude

identifiable intangible asset amortization, restructuring,

integration, and other charges, and loss on disposition of

businesses, net, AFS notes receivable reserves and credits and

inventory write-downs and recoveries, digital inventory write-downs

and recoveries, the impact of non-cash charges related to goodwill,

trade names, and long-lived assets, the impact of wind down,

pension settlements, net gains and losses on investments, and

certain tax adjustments including related interest expense. A

reconciliation of the company’s non-GAAP financial information to

GAAP is set forth in the tables below.

The company believes that such non-GAAP financial information is

useful to investors to assist in assessing and understanding the

company’s operating performance and underlying trends in the

company’s business because management considers these items

referred to above to be outside the company’s core operating

results. This non-GAAP financial information is among the primary

indicators management uses as a basis for evaluating the company’s

financial and operating performance. In addition, the company’s

Board of Directors may use this non-GAAP financial information in

evaluating management performance and setting management

compensation.

The presentation of this additional non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for, or alternative to, sales, operating income, net

income and net income per basic and diluted share determined in

accordance with GAAP. Analysis of results and outlook on a non-GAAP

basis should be used as a complement to, and in conjunction with,

data presented in accordance with GAAP.

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands except per share

data)

Quarter Ended

Year Ended

December 31, 2019

December 31, 2018

December 31, 2019

December 31, 2018

(Unaudited)

(Unaudited)

Sales

$

7,338,190

$

7,918,182

$

28,916,847

$

29,676,768

Cost of sales

6,515,247

6,942,812

25,618,466

25,975,856

Gross profit

822,943

975,370

3,298,381

3,700,912

Operating expenses:

Selling, general, and administrative

expenses

513,878

583,943

2,191,612

2,303,051

Depreciation and amortization

50,051

47,183

189,790

186,384

Loss on disposition of businesses, net

5,813

—

21,252

3,604

Impairments

—

—

698,246

—

Restructuring, integration, and other

charges

15,093

9,864

89,785

60,361

584,835

640,990

3,190,685

2,553,400

Operating income

238,108

334,380

107,696

1,147,512

Equity in earnings (losses) of affiliated

companies

(610

)

(1,524

)

(2,765

)

(2,332

)

Gain (loss) on investments, net

3,967

(10,221

)

11,831

(14,166

)

Employee benefit plan expense

(21,500

)

(3,086

)

(24,849

)

(6,870

)

Interest and other financing expense,

net

(50,317

)

(54,584

)

(203,743

)

(214,771

)

Income (loss) before income taxes

169,648

264,965

(111,830

)

909,373

Provision for income taxes

57,460

32,474

88,338

187,799

Consolidated net income (loss)

112,188

232,491

(200,168

)

721,574

Noncontrolling interests

175

1,838

3,919

5,379

Net income (loss) attributable to

shareholders

$

112,013

$

230,653

$

(204,087

)

$

716,195

Net income (loss) per share:

Basic

$

1.37

$

2.66

$

(2.44

)

$

8.19

Diluted

$

1.36

$

2.63

$

(2.44

)

$

8.10

Weighted average shares outstanding:

Basic

81,613

86,559

83,568

87,476

Diluted

82,493

87,561

83,568

88,444

ARROW ELECTRONICS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands except par

value)

December 31, 2019

December 31, 2018

ASSETS

Current assets:

Cash and cash equivalents

$

300,103

$

509,327

Accounts receivable, net

8,482,687

8,945,463

Inventories

3,477,120

3,878,678

Other current assets

266,249

274,832

Total current assets

12,526,159

13,608,300

Property, plant, and equipment, at

cost:

Land

7,793

7,882

Buildings and improvements

173,370

158,712

Machinery and equipment

1,481,525

1,425,933

1,662,688

1,592,527

Less: Accumulated depreciation and

amortization

(859,578

)

(767,827

)

Property, plant, and equipment, net

803,110

824,700

Investments in affiliated companies

86,942

83,693

Intangible assets, net

271,903

372,644

Goodwill

2,061,322

2,624,690

Other assets

651,360

270,418

Total assets

$

16,400,796

$

17,784,445

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

7,046,221

$

7,631,879

Accrued expenses

880,507

912,292

Short-term borrowings, including current

portion of long-term debt

331,431

246,257

Total current liabilities

8,258,159

8,790,428

Long-term debt

2,640,129

3,239,115

Other liabilities

636,115

378,536

Equity:

Shareholders' equity:

Common stock, par value $1:

Authorized – 160,000 shares in both 2019

and 2018

Issued – 125,424 shares in both 2019 and

2018

125,424

125,424

Capital in excess of par value

1,150,006

1,135,934

Treasury stock (44,804 and 40,233 shares

in 2019 and 2018, respectively), at cost

(2,332,548

)

(1,972,254

)

Retained earnings

6,131,248

6,335,335

Accumulated other comprehensive loss

(262,211

)

(299,449

)

Total shareholders' equity

4,811,919

5,324,990

Noncontrolling interests

54,474

51,376

Total equity

4,866,393

5,376,366

Total liabilities and equity

$

16,400,796

$

17,784,445

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Quarter Ended

December 31, 2019

December 31, 2018

Cash flows from operating activities:

Consolidated net income

$

112,188

$

232,491

Adjustments to reconcile consolidated net

income to net cash provided by operations:

Depreciation and amortization

50,051

47,183

Amortization of stock-based

compensation

6,321

8,134

Equity in (earnings) losses of affiliated

companies

610

1,524

Deferred income taxes

15,196

(16,533

)

(Gain) loss on investment, net

(3,840

)

10,221

Loss on disposition of businesses, net

5,813

—

Pension settlement expense

20,111

—

Other

(155

)

3,142

Change in assets and liabilities, net of

effects of acquired and disposed businesses:

Accounts receivable

(578,059

)

(752,891

)

Inventories

40,448

(162,825

)

Accounts payable

827,614

764,726

Accrued expenses

43,649

96,946

Other assets and liabilities

(45,145

)

31,016

Net cash provided by operating

activities

494,802

263,134

Cash flows from investing activities:

Proceeds from (cash paid on) disposition

of businesses

(11,769

)

—

Acquisition of property, plant, and

equipment

(30,111

)

(30,439

)

Proceeds from sale of property, plant, and

equipment

—

5,421

Cash paid for customer relationship

intangible asset

(7,616

)

(20,000

)

Other

(4,127

)

(2,500

)

Net cash used for investing activities

(53,623

)

(47,518

)

Cash flows from financing activities:

Change in short-term and other

borrowings

(20,794

)

88,034

Proceeds from (repayment of) long-term

bank borrowings, net

(308,047

)

(114,120

)

Proceeds from exercise of stock

options

5,201

900

Repurchases of common stock

(100,009

)

(150,132

)

Net cash used for financing activities

(423,649

)

(175,318

)

Effect of exchange rate changes on

cash

20,319

(5,162

)

Net increase in cash and cash

equivalents

37,849

35,136

Cash and cash equivalents at beginning of

period

262,254

474,191

Cash and cash equivalents at end of

period

$

300,103

$

509,327

ARROW ELECTRONICS, INC.

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In thousands)

Year Ended

December 31, 2019

December 31, 2018

Cash flows from operating activities:

Consolidated net income (loss)

$

(200,168

)

$

721,574

Adjustments to reconcile consolidated net

income to net cash provided by operations:

Depreciation and amortization

189,790

186,384

Amortization of stock-based

compensation

41,070

46,238

Equity in (earnings) losses of affiliated

companies

2,765

2,332

Deferred income taxes

(50,288

)

1,236

(Gain) loss on investment, net

(11,462

)

14,166

Loss on disposition of businesses, net

21,252

3,604

Pension settlement expense

20,111

1,665

Impairments

698,246

—

Other

10,659

9,198

Change in assets and liabilities, net of

effects of acquired and disposed businesses:

Accounts receivable

338,849

(1,007,308

)

Inventories

383,058

(618,875

)

Accounts payable

(521,575

)

936,423

Accrued expenses

(27,475

)

112,123

Other assets and liabilities

(36,837

)

(136,070

)

Net cash provided by operating

activities

857,995

272,690

Cash flows from investing activities:

Cash consideration paid for acquired

businesses, net of cash acquired

—

(331,563

)

Proceeds from (cash paid on) disposition

of businesses

(13,094

)

32,013

Acquisition of property, plant, and

equipment

(143,191

)

(135,336

)

Proceeds from sale of property, plant and

equipment

—

5,421

Cash paid for customer relationship

intangible asset

(7,616

)

(20,000

)

Other

(9,682

)

(13,500

)

Net cash used for investing activities

(173,583

)

(462,965

)

Cash flows from financing activities:

Change in short-term and other

borrowings

(113,923

)

192,192

Proceeds from (repayments of) long-term

bank borrowings, net

(405,007

)

306,635

Redemption of notes

—

(300,000

)

Proceeds from exercise of stock

options

16,911

8,819

Repurchases of common stock

(404,203

)

(243,305

)

Other

(147

)

(1,174

)

Net cash provided by (used for) financing

activities

(906,369

)

(36,833

)

Effect of exchange rate changes on

cash

12,733

6,352

Net decrease in cash and cash

equivalents

(209,224

)

(220,756

)

Cash and cash equivalents at beginning of

period

509,327

730,083

Cash and cash equivalents at end of

period

$

300,103

$

509,327

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Quarter Ended

December 31, 2019

December 31, 2018

% Change

Consolidated sales, as reported

$

7,338,190

$

7,918,182

(7.3

)%

Impact of changes in foreign

currencies

—

(65,384

)

Impact of dispositions and wind down

(19,375

)

(118,184

)

Consolidated sales, as adjusted

$

7,318,815

$

7,734,614

(5.4

)%

Global components sales, as reported

$

4,738,993

$

5,261,477

(9.9

)%

Impact of changes in foreign

currencies

—

(40,608

)

Impact of dispositions and wind down

(19,375

)

(102,965

)

Global components sales, as adjusted

$

4,719,618

$

5,117,904

(7.8

)%

Americas components sales, as reported

$

1,644,757

$

2,021,033

(18.6

)%

Impact of changes in foreign

currencies

—

(214

)

Impact of dispositions and wind down

(19,239

)

(78,246

)

Americas components sales, as adjusted

$

1,625,518

$

1,942,573

(16.3

)%

Europe components sales, as reported

$

1,189,016

$

1,407,429

(15.5

)%

Impact of changes in foreign

currencies

—

(36,312

)

Impact of dispositions and wind down

(136

)

(24,719

)

Europe components sales, as adjusted

$

1,188,880

$

1,346,398

(11.7

)%

Asia components sales, as reported

$

1,905,220

$

1,833,015

3.9

%

Impact of changes in foreign

currencies

—

(4,082

)

Asia components sales, as adjusted

$

1,905,220

$

1,828,933

4.2

%

Global ECS sales, as reported

$

2,599,197

$

2,656,705

(2.2

)%

Impact of changes in foreign

currencies

—

(24,776

)

Impact of dispositions

—

(15,219

)

Global ECS sales, as adjusted

$

2,599,197

$

2,616,710

(0.7

)%

Europe ECS sales, as reported

$

959,449

$

954,343

0.5

%

Impact of changes in foreign

currencies

—

(20,834

)

Impact of dispositions

—

(15,219

)

Europe ECS sales, as adjusted

$

959,449

$

918,290

4.5

%

Americas ECS sales, as reported

$

1,639,748

$

1,702,362

(3.7

)%

Impact of changes in foreign

currencies

—

(3,942

)

Americas ECS sales, as adjusted

$

1,639,748

$

1,698,420

(3.5

)%

ARROW ELECTRONICS, INC.

NON-GAAP SALES RECONCILIATION

(In thousands)

(Unaudited)

Year Ended

December 31, 2019

December 31, 2018

% Change

Consolidated sales, as reported

$

28,916,847

$

29,676,768

(2.6

)%

Impact of changes in foreign

currencies

—

(513,217

)

Impact of dispositions and wind down

(251,614

)

(496,108

)

Consolidated sales, as adjusted

$

28,665,233

$

28,667,443

flat

Global components sales, as reported

$

20,250,735

$

20,856,851

(2.9

)%

Impact of changes in foreign

currencies

—

(337,828

)

Impact of dispositions and wind down

(240,473

)

(415,707

)

Global components sales, as adjusted

$

20,010,262

$

20,103,316

(0.5

)%

Americas components sales, as reported

$

7,167,295

$

7,816,533

(8.3

)%

Impact of changes in foreign

currencies

—

(4,496

)

Impact of dispositions and wind down

(189,963

)

(310,198

)

Americas components sales, as adjusted

$

6,977,332

$

7,501,839

(7.0

)%

Europe components sales, as reported

$

5,412,379

$

5,733,222

(5.6

)%

Impact of changes in foreign

currencies

—

(292,551

)

Impact of dispositions and wind down

(50,510

)

(105,509

)

Europe components sales, as adjusted

$

5,361,869

$

5,335,162

0.5

%

Asia components sales, as reported

$

7,671,061

$

7,307,096

5.0

%

Impact of changes in foreign

currencies

—

(40,781

)

Asia components sales, as adjusted

$

7,671,061

$

7,266,315

5.6

%

Global ECS sales, as reported

$

8,666,112

$

8,819,917

(1.7

)%

Impact of changes in foreign

currencies

—

(175,389

)

Impact of dispositions

(11,141

)

(80,401

)

Global ECS sales, as adjusted

$

8,654,971

$

8,564,127

1.1

%

Europe ECS sales, as reported

$

3,034,087

$

3,077,391

(1.4

)%

Impact of changes in foreign

currencies

—

(145,468

)

Impact of dispositions

(11,141

)

(52,908

)

Europe ECS sales, as adjusted

$

3,022,946

$

2,879,015

5.0

%

Americas ECS sales, as reported

$

5,632,025

$

5,742,526

(1.9

)%

Impact of changes in foreign

currencies

—

(29,921

)

Impact of dispositions

—

(27,493

)

Americas ECS sales, as adjusted

$

5,632,025

$

5,685,112

(0.9

)%

ARROW ELECTRONICS, INC.

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Three months ended December 31,

2019

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impact of Wind Down(6)

Tax adjustments(7)

Other(1)

Non-GAAP measure

Sales

$

7,338,190

$

—

$

—

$

—

$

—

$

(19,375

)

$

—

$

—

$

7,318,815

Gross Profit

822,943

—

—

—

1,117

5,388

—

—

829,448

Operating income

238,108

14,311

16,350

2,850

1,117

10,912

—

1,002

284,650

Income before income taxes

169,648

14,311

16,350

2,850

1,117

10,942

—

17,919

233,137

Provision for income taxes

57,460

4,050

3,042

607

156

(18,380

)

1,806

2,700

51,441

Consolidated net income

112,188

10,261

13,308

2,243

961

29,322

(1,806

)

15,219

181,696

Noncontrolling interests

175

138

—

—

—

—

—

—

313

Net income attributable to

shareholders

$

112,013

$

10,123

$

13,308

$

2,243

$

961

$

29,322

$

(1,806

)

$

15,219

$

181,383

Net income per diluted share(5)

$

1.36

$

0.12

$

0.16

$

0.03

$

0.01

$

0.36

$

(0.02

)

$

0.18

$

2.20

Effective tax rate

33.9

%

22.1

%

Three months ended December 31,

2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impact of Wind Down(6)

Tax adjustments(7)

Other(2)

Non-GAAP measure

Sales

$

7,918,182

$

—

$

—

$

—

$

—

$

(102,965

)

$

—

$

—

$

7,815,217

Gross Profit

975,370

—

—

—

—

(16,947

)

—

—

958,423

Operating income

334,380

9,493

11,126

—

—

4,471

—

—

359,470

Income before income taxes

264,965

9,493

11,126

—

—

4,114

—

11,886

301,584

Provision for income taxes

32,474

2,772

4,786

—

—

1,635

28,323

3,025

73,015

Consolidated net income

232,491

6,721

6,340

—

—

2,479

(28,323

)

8,861

228,569

Noncontrolling interests

1,838

142

—

—

—

—

—

—

1,980

Net income attributable to

shareholders

$

230,653

$

6,579

$

6,340

$

—

$

—

$

2,479

$

(28,323

)

$

8,861

$

226,589

Net income per diluted share(5)

$

2.63

$

0.08

$

0.07

$

—

$

—

$

0.03

$

(0.32

)

$

0.10

$

2.59

Effective tax rate

12.3

%

24.2

%

NON-GAAP EARNINGS

RECONCILIATION

(In thousands except per share

data)

(Unaudited)

Year ended December 31, 2019

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments(4)

Impact of Wind Down(6)

Tax adjustments(7)

Other(1)

Non-GAAP measure

Sales

$

28,916,847

$

—

$

—

$

—

$

—

$

—

$

(240,473

)

$

—

$

—

$

28,676,374

Gross Profit

3,298,381

—

—

1,868

22,332

—

(1,975

)

—

—

3,320,606

Operating income

107,696

42,383

78,429

18,037

22,332

623,796

162,244

—

1,868

1,056,785

Income before income taxes

(111,830

)

42,383

78,429

18,037

22,332

623,796

162,356

—

10,921

846,424

Provision for income taxes

88,338

11,913

19,540

4,339

5,390

64,246

12,631

(1,696

)

750

205,451

Consolidated net income

(200,168

)

30,470

58,889

13,698

16,942

559,550

149,725

1,696

10,171

640,973

Noncontrolling interests

3,919

558

—

—

—

—

—

—

—

4,477

Net income attributable to

shareholders

$

(204,087

)

$

29,912

$

58,889

$

13,698

$

16,942

$

559,550

$

149,725

$

1,696

$

10,171

$

636,496

Net income per diluted share(5)

$

(2.44

)

$

0.36

$

0.70

$

0.16

$

0.20

$

6.70

$

1.79

$

0.02

$

0.12

$

7.55

Effective tax rate

(79.0

)%

24.3

%

Year ended December 31, 2018

Reported GAAP measure

Intangible amortization

expense

Restructuring & Integration

charges

AFS Write Downs

Digital Write Downs

Impairments

Impact of Wind Down(6)

Tax adjustments(7)

Other(3)

Non-GAAP measure

Sales

$

29,676,768

$

—

$

—

$

—

$

—

$

—

$

(415,707

)

$

—

$

—

$

29,261,061

Gross Profit

3,700,912

—

—

—

—

—

(71,091

)

—

—

3,629,821

Operating income

1,147,512

38,215

49,297

—

—

—

19,910

—

3,604

1,258,538

Income before income taxes

909,373

38,215

49,297

—

—

—

19,675

—

19,435

1,035,995

Provision for income taxes

187,799

10,782

14,815

—

—

—

6,031

28,323

4,678

252,428

Consolidated net income

721,574

27,433

34,482

—

—

—

13,644

(28,323

)

14,757

783,567

Noncontrolling interests

5,379

589

—

—

—

—

—

—

—

5,968

Net income attributable to

shareholders

$

716,195

$

26,844

$

34,482

$

—

$

—

$

—

$

13,644

$

(28,323

)

$

14,757

777,599

Net income per diluted share(5)

$

8.10

$

0.30

$

0.39

$

—

$

—

$

—

$

0.15

$

(0.32

)

$

0.17

$

8.79

Effective tax rate

20.7

%

24.4

%

(1)

Other includes loss on disposition of

businesses, net, gain (loss) on investments, net, interest related

to uncertain tax position related to the Tax Act and pension

settlement.

(2)

Other includes gain (loss) on investments,

net, and pension settlement.

(3)

Other includes loss on disposition of

businesses, net, gain (loss) on investments, net, and pension

settlement.

(4)

Impairments include goodwill impairments

of $570,175, tradename impairments of $46,000, and $7,621 in

impairment charges related to various other long-lived assets.

(5)

For the year ended December 31, 2019, the

non-GAAP net income per diluted share calculation includes 752

thousand shares that were excluded from the GAAP net income per

diluted share calculation. Additionally, in all periods presented

the sum of the components for diluted EPS, as adjusted may not

agree to totals, as presented, due to rounding.

(6)

Amounts for restructuring, integration,

and other charges, identifiable intangible asset amortization, loss

on disposition of businesses, net, certain tax adjustments, and

impairments related to the personal computer and mobility asset

disposition business are included in “impact of wind down”

above.

(7)

Includes income tax expense related to

repatriation of foreign earnings and the Tax Act.

ARROW ELECTRONICS, INC.

SEGMENT INFORMATION

(In thousands)

(Unaudited)

Quarter Ended

Year Ended

December 31, 2019

December 31, 2018

December 31, 2019

December 31, 2018

Sales:

Global components

$

4,738,993

$

5,261,477

$

20,250,735

$

20,856,851

Global ECS

2,599,197

2,656,705

8,666,112

8,819,917

Consolidated

$

7,338,190

$

7,918,182

$

28,916,847

$

29,676,768

Operating income (loss):

Global components

$

149,794

$

252,313

$

(10,199

)

$

1,007,638

Global ECS

148,711

152,195

426,192

427,605

Corporate (a)

(60,397

)

(70,128

)

(308,297

)

(287,731

)

Consolidated

$

238,108

$

334,380

$

107,696

$

1,147,512

(a)

Includes restructuring, integration, and other charges of $16.4

million and $79.0 million for the fourth quarter and year ended

December 31, 2019 and $11.1 million and $49.3 million for the

fourth quarter and year ended December 31, 2018, respectively. Also

included is a net loss on disposition of $1.0 million and $1.9

million for the fourth quarter and year ended December 31, 2019 and

$3.6 million for the year ended December 31, 2018,

respectively.

NON-GAAP SEGMENT

RECONCILIATION

Quarter Ended

Year Ended

December 31, 2019

December 31, 2018

December 31, 2019

December 31, 2018

Global components operating income, as

reported

$

149,794

$

252,313

$

(10,199

)

$

1,007,638

Intangible assets amortization expense

(b)

7,135

6,600

26,594

24,226

Impairments (b)

—

—

623,796

—

Impact of wind-down (b)

10,912

5,733

161,664

8,846

AFS notes receivable reserve

2,850

—

18,037

—

Digital inventory reserve

1,117

—

22,332

—

Global components operating income, as

adjusted

$

171,808

$

264,646

$

842,224

$

1,040,710

Global ECS operating income, as

reported

$

148,711

$

152,195

$

426,192

$

427,605

Intangible assets amortization expense

7,176

2,893

15,789

13,989

Global ECS operating income, as

adjusted

$

155,887

$

155,088

$

441,981

$

441,594

(b)

Restructuring, integration, and

other charges, identifiable intangible asset amortization, loss on

disposition of businesses, net, and impairments related to the

personal computer and mobility asset disposition business are

included in “impact of wind down” above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200206005263/en/

Steven O’Brien Vice President, Investor Relations 303-824-4544

Media Contact: John Hourigan Vice President, Global Communications

303-824-4586

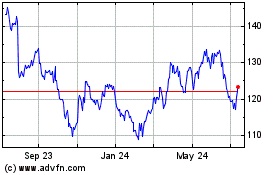

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Apr 2023 to Apr 2024