Current Report Filing (8-k)

December 17 2021 - 5:01PM

Edgar (US Regulatory)

0001411494

false

0001411494

2021-12-17

2021-12-17

0001411494

APO:ClassACommonStockMember

2021-12-17

2021-12-17

0001411494

us-gaap:SeriesAPreferredStockMember

2021-12-17

2021-12-17

0001411494

us-gaap:SeriesBPreferredStockMember

2021-12-17

2021-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): December 17, 2021

Apollo Global Management, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35107

|

|

20-8880053

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

9

West 57th Street, 43rd

Floor

New

York, New

York 10019

(Address of principal

executive offices) (Zip Code)

(212)

515-3200

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant

to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange

on

which registered

|

|

Class

A Common Stock

|

|

APO

|

|

New

York Stock Exchange

|

|

6.375%

Series A Preferred Stock

|

|

APO.PR

A

|

|

New

York Stock Exchange

|

|

6.375%

Series B Preferred Stock

|

|

APO.PR

B

|

|

New

York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

On December 17, 2021, Apollo Global Management, Inc. (“AGM”)

held a special meeting of stockholders (the “Special Meeting”) in connection with the previously announced merger transactions

(the “Merger Transactions”) involving AGM, Tango Holdings, Inc. (“Tango”) and Athene Holding Ltd. (“AHL”).

At the close of business on November 4, 2021, the record date for the Special Meeting, there were 246,579,482 shares of AGM Class A common

stock, $0.00001 par value per share (“Class A Shares”), one share of AGM Class B common stock, $0.00001 par value per share

(the “Class B Share”), and one share of AGM Class C common stock, $0.00001 par value per share (the “Class C Share”,

and together with the Class A Shares and the Class B Share, the “AGM Common Shares”), outstanding.

The holders of a majority in voting power of the outstanding Class

A Shares and the Class B Share entitled to vote on the Merger Agreement Proposal (as defined below) at the Special Meeting, voting together

as a single class, were represented at the Special Meeting in person or by proxy, which constituted a quorum for the vote on the Merger

Agreement Proposal. The holders of a majority in voting power of the outstanding Class A Shares, the Class B Share and the Class C Share

entitled to vote on the Charter Amendment Proposal (as defined below) at the Special Meeting, voting together as a single class, and including

the holder of the Class B Share, were represented at the Special Meeting in person or by proxy, which constituted a quorum for the vote

on the Charter Amendment Proposal.

The following are the final voting results on proposals considered

and voted upon at the Special Meeting, each of which is described in greater detail in AGM’s definitive proxy statement filed on

Schedule 14A with the U.S. Securities and Exchange Commission on November 5, 2021.

|

|

1.

|

To adopt the Agreement and Plan of Merger by and among AGM, AHL, Tango, Blue Merger Sub, Ltd., a Bermuda exempted company and a direct

wholly owned subsidiary of Tango, and Green Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Tango (the

“Merger Agreement Proposal”):

|

|

For

|

|

Against

|

|

Abstain

|

|

|

372,440,796

|

|

|

|

104,907

|

|

|

|

89,060

|

|

|

|

2.

|

To adopt an amended and restated certificate of incorporation of AGM (the “Charter Amendment Proposal”):

|

|

For

|

|

Against

|

|

Abstain

|

|

|

2,594,309,117

|

|

|

|

88,574

|

|

|

|

108,232

|

|

The results under the column “For” include the

affirmative vote at the Special Meeting of the holder of the outstanding Class B Share.

Because a quorum was present at the Special Meeting for the vote on the

Merger Agreement Proposal and for the vote on the Charter Amendment Proposal, and the Merger Agreement Proposal and the Charter Amendment

Proposal received the requisite votes needed for approval, a vote on the proposal to adjourn the Special Meeting, if necessary or advisable,

including to solicit additional proxies in favor of the Merger Agreement Proposal or the Charter Amendment Proposal, was not called.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Apollo

Global Management, Inc.

|

|

|

|

|

|

|

|

Dated: December 17, 2021

|

By:

|

|

/s/ John J. Suydam

|

|

|

|

|

|

Name: John J.

Suydam

|

|

|

|

|

|

Title: Chief Legal

Officer

|

|

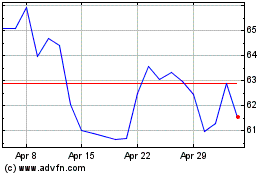

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jun 2024 to Jul 2024

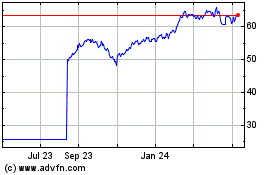

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jul 2023 to Jul 2024