Statement of Changes in Beneficial Ownership (4)

December 03 2021 - 5:05PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Zelter James C |

2. Issuer Name and Ticker or Trading Symbol

Apollo Global Management, Inc.

[

APO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Co-President |

|

(Last)

(First)

(Middle)

C/O APOLLO GLOBAL MANAGEMENT, INC., 9 WEST 57TH STREET, 43RD FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/1/2021 |

|

(Street)

NEW YORK, NY 10019

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 12/1/2021 | | A | | 3000000 (1)(2)(7)(8) | A | $0.00 | 4357397 (3) | D | |

| Class A Common Stock | 12/1/2021 | | A | | 2000000 (4) | A | $0.00 | 6357397 (5) | D | |

| Class A Common Stock | | | | | | | | 1061256 | I | The James C. Zelter 2021 GRAT No. 1 (6) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Consists of fully vested restricted stock units ("RSUs") that were granted under the Apollo Global Management, Inc. 2019 Omnibus Equity Incentive Plan (the "Plan"). Each such RSU represents the contingent right to receive one share of Class A common stock of the Issuer (the "Class A shares") in January 2027, provided that the reporting person on such date is subject to continued employment, or a good leaver departure (including a termination without cause, resignation with good reason or death or disability, each as defined in the applicable employment agreement) through such date. If the reporting person voluntarily resigns or retires (not with good reason) before December 31, 2026, delivery of the shares underlying the vested RSUs will be delayed until January 2032. (cont'd on FN 2) |

| (2) | (cont'd from FN 1) No shares under these RSUs will be delivered if the reporting person breaches the restrictive covenants in the applicable employment agreement in any material respect or is terminated for Cause or terminates employment at a time when the reporting person could have been terminated for Cause. |

| (3) | Reported amount includes 4,042,986 vested and unvested RSUs granted under the Plan. Each RSU represents the contingent right to receive, in accordance with the issuance schedule set forth in the applicable RSU award agreement, one share of Class A common stock of the Issuer for each vested RSU. The unvested RSUs vest in installments in accordance with the terms of the applicable RSU award agreement, provided the reporting person remains in service through the applicable vesting date. |

| (4) | Consists of unvested RSUs that were granted under the Plan. These RSUs represent the contingent right to receive one Class A share for each vested RSU and vest in January 2027, provided the reporting person remains in service through such date. These RSUs have certain accelerated vesting provisions for good leaver terminations as described in the applicable award agreements. No shares under these RSUs will be delivered if the reporting person breaches the restrictive covenants in any material respect or is terminated for Cause or terminates employment at a time when the reporting person could have been terminated for Cause. |

| (5) | Reported amount includes 6,042,986 vested and unvested RSUs granted under the Plan. |

| (6) | By The James C. Zelter 2021 GRAT No. 1, a vehicle over which the reporting person exercises voting and investment control. |

| (7) | The reported amount of RSUs will decrease by a number equal to the value of existing unvested carried interest awards that will be relinquished for vested transfer-restricted shares in the Exchange (as defined below). |

| (8) | Concurrently with the completion of the Apollo-Athene merger, the reporting person has agreed to exchange his unvested limited partner and similar carried interest rights for shares of common stock of the post-merger issuer (the "Exchange"). The shares delivered in the Exchange will be subject to transfer restrictions on the same terms as the delivery schedule for shares underlying the vested RSUs (January 2027 for continued employment and good leaver situations, and January 2032 for resignations prior to January 1, 2027). Those shares will be subject to the same forfeiture and clawback provisions for the violation of restrictive covenants and engaging in Cause termination conduct, and the same restrictions on transferability, as shares underlying the RSUs, and the issuance of such shares will reduce the shares eligible to be delivered under the vested RSUs described in footnote (7) above. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Zelter James C

C/O APOLLO GLOBAL MANAGEMENT, INC.

9 WEST 57TH STREET, 43RD FLOOR

NEW YORK, NY 10019 | X |

| Co-President |

|

Signatures

|

| /s/ Jessica L. Lomm, as Attorney-in-Fact | | 12/3/2021 |

| **Signature of Reporting Person | Date |

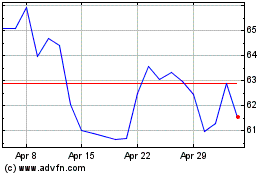

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jun 2024 to Jul 2024

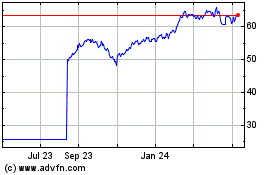

Apollo Global Management (NYSE:APO-A)

Historical Stock Chart

From Jul 2023 to Jul 2024