UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________

FORM 11-K

_________________________

(Mark One)

| | | | | |

|

| x | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the fiscal year ended December 31, 2021 |

|

| OR |

|

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

| For the transition period from to |

|

| Commission file number 1-08940 |

_________________________

Deferred Profit-Sharing Plan for Hourly Employees

(Full title of the plan)

ALTRIA GROUP, INC.

6601 West Broad Street

Richmond, Virginia 23230

(Name of issuer of the securities held pursuant to the plan

and address of its principal executive office.)

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

ANNUAL REPORT ON FORM 11-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

TABLE OF CONTENTS

| | | | | |

| |

| | Page No. |

| |

| |

| |

| Financial Statements | |

| |

| |

| |

| |

| Supplemental Schedule* | |

| |

| |

| |

| |

| Exhibit | |

| |

* Other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974, as amended, are omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

To the Administrator and Plan Participants of the Deferred Profit-Sharing Plan for Hourly Employees

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Deferred Profit-Sharing Plan for Hourly Employees (the “Plan”) as of December 31, 2021 and 2020 and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021 and 2020, and the changes in net assets available for benefits for the year ended December 31, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule H - Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2021 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Richmond, Virginia

June 3, 2022

We have served as the Plan’s auditor since at least 1994. We have not been able to determine the specific year we began serving as auditor of the Plan.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

(in thousands of dollars)

| | | | | | | | | | | | | | |

| At December 31, | | 2021 | | 2020 |

| Investments at fair value: | | | | |

| Plan’s interest in Master Trust A | | $ | 311,277 | | | $ | 277,196 | |

| Plan’s interest in Master Trust B | | 474,713 | | | 432,797 | |

| Investments at fair value | | 785,990 | | | 709,993 | |

| Investments at contract value: | | | | |

| Plan’s interest in Master Trust A for fully-benefit responsive investment contracts | | 176,286 | | | 176,547 | |

| Total investments | | 962,276 | | | 886,540 | |

| Receivables: | | | | |

| Employer’s contribution | | 16,315 | | | 17,876 | |

| Participants’ contributions | | 240 | | | 323 | |

| Notes receivable from participants | | 16,454 | | | 16,110 | |

| Total receivables | | 33,009 | | | 34,309 | |

| | | | |

| Net assets available for benefits | | $ | 995,285 | | | $ | 920,849 | |

The accompanying notes are an integral part of these financial statements.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

(in thousands of dollars)

| | | | | |

| For the year ended December 31, | 2021 |

| Additions to net assets attributed to: | |

| Investment income | |

| Plan’s interest in investment income from Master Trust A | $ | 46,766 | |

| Plan’s interest in investment income from Master Trust B | 99,658 | |

| Total investment income | 146,424 | |

| |

| Interest income on notes receivable from participants | 868 | |

| |

| Contributions to the Plan: | |

| By employer | 22,898 | |

| By participants | 20,110 | |

| Total contributions | 43,008 | |

| |

| Total additions | 190,300 | |

| |

| Deductions from net assets attributed to: | |

| |

| Withdrawals and distributions | (114,573) | |

| |

| |

| Total deductions | (114,573) | |

| |

| Net increase prior to transfers | 75,727 | |

| |

| Transfer to the Salaried Plan | (1,299) | |

| Transfer from the Salaried Plan | 8 | |

| |

| Net increase | 74,436 | |

| |

| Net assets available for benefits: | |

| Beginning of year | 920,849 | |

| End of year | $ | 995,285 | |

The accompanying notes are an integral part of these financial statements.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

| | | | | |

| 1. | Description of the Plan |

The following description of the Deferred Profit-Sharing Plan for Hourly Employees (the “Plan”) provides only general information. Participants should refer to the Summary Plan Description or the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan maintained for the benefit of eligible hourly-paid employees, as discussed below in Plan Participation, of Philip Morris USA Inc. (“PM USA”), U.S. Smokeless Tobacco Company LLC (“USSTC”) and John Middleton Co. (“Middleton”) (individually, a “Participating Company”; collectively, the “Participating Companies”), all of which are subsidiaries of Altria Group, Inc. (“Altria”). The Plan is designed to provide eligible hourly-paid employees with company contributions, the opportunity for employees to make contributions on a before-tax and/or after-tax basis, company match contributions on employee contributions, and tax-advantaged investment of the Plan accounts, including a Roth contribution feature. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Ste. Michelle Wine Estates Ltd. and its subsidiaries (“SMWE”) ceased participating in the Plan on October 1, 2021 as a result of the sale of International Wine and Spirits Ltd. and its subsidiaries, including SMWE, by UST LLC, a subsidiary of Altria (“Sale of SMWE”). Employees of SMWE will be treated in the same manner as other former employees, and permitted to receive a distribution from the Plan.

In December 2019, an outbreak of a novel strain of coronavirus (“COVID-19”) emerged globally. COVID-19 continues to impact the financial markets. The ongoing extent of the impact of COVID-19, will depend on future market conditions, including the duration and continued spread of the outbreak.

Plan Administration

The administration of the Plan has generally been delegated to the Administrator (as defined in the Plan). The Altria Group Benefits Investment Committee (the “Investment Committee”) is the named fiduciary responsible for the operation and management of the investment options in the Plan, other than the investment options (the “Altria Stock Investment Option”, the “Mondelēz Stock Investment Option”, the “PMI Stock Investment Option” and the “Kraft Heinz Stock Investment Option”; collectively, the “Common Stock Investment Options”) invested exclusively in the common stock of Altria (“Altria Stock”), the Class A common stock of Mondelēz International, Inc. (“Mondelēz Stock”), the common stock of Philip Morris International Inc. (“PMI Stock”) and the common stock of The Kraft Heinz Company (“Kraft Heinz Stock”), respectively (collectively, the “Common Stocks”). Fiduciary Counselors Inc. (“Fiduciary Counselors”) is the named fiduciary with respect to the management of the investment of the Common Stock Investment Options. The Administrator, the Investment Committee and Fiduciary Counselors are hereinafter collectively referred to as the “Fiduciaries”.

Plan Participation

Eligibility for benefits under the Plan depends on an employee’s Participating Company affiliation and eligibility to participate in a company-sponsored pension plan, as follows:

•“Richmond Hourly Participants”

◦Union-represented employees of PM USA who participate in a company-sponsored pension plan are eligible to make employee contributions and to receive a company contribution and company match contributions;

◦Union-represented employees of PM USA and union-represented employees of USSTC and Middleton who are employed at a Richmond manufacturing facility and who do not participate in a company-sponsored pension plan are eligible to make employee contributions and to receive a company contribution, a supplemental company contribution and company match contributions;

•Union-represented employees of USSTC who are employed at the Nashville manufacturing facility are eligible to make employee contributions and to receive company match contributions;

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

•Hourly employees of Middleton employed at the King of Prussia manufacturing facility who are not covered by a collective bargaining agreement are eligible to make employee contributions and to receive company match contributions; and

•Prior to the Sale of SMWE, union-represented non-agricultural employees of SMWE were eligible to make employee contributions and to receive company match contributions.

Employee Contributions

Each eligible employee may make before-tax, Roth after-tax, and traditional after-tax contributions to the Plan as soon as administratively feasible after a participant’s date of hire.

No contribution is required from any participant under the Plan. However, employees hired or rehired after a date specific to their employee group are automatically enrolled in the Plan to make before-tax contributions of three percent (3%) of their eligible compensation beginning with the first payroll period after the completion of 90 days of service. Employees who are automatically enrolled can elect not to make contributions or to contribute a different percentage of their eligible compensation.

Any employees enrolled after October 2, 2017 also have their before-tax contributions automatically increased by one percent (1%) each March 1, subject to Internal Revenue Service (“IRS”) limits. Employees can opt out of this automatic increase program at any time.

The Internal Revenue Code of 1986, as amended (the “Code”), imposes a dollar limitation on the combined amount of before-tax and Roth after-tax contributions for a calendar year. A participant’s combined before-tax and Roth after-tax contributions were limited to $19,500 in 2021 and 2020. Additionally, the Plan limited the participant’s combined before-tax, Roth after-tax, and traditional after-tax contributions to thirty-five percent (35%) of eligible compensation, excluding catch-up contributions.

Participants who are age 50 or older by the end of a Plan year are eligible to make before-tax and/or Roth after-tax catch-up contributions up to the limit prescribed in the Code. For 2021 and 2020, the catch-up contribution was limited to $6,500.

The aggregate contributions actually made by participants may not cause the Plan to violate limitations on such contributions set forth in the Code.

Employer Contributions

Contributions by Participating Companies may consist of a company contribution, a supplemental company contribution and/or company match contributions as discussed below.

Contributions for highly compensated employees are subject to limitations imposed by the Code.

Company contribution – Richmond Hourly Participants, who do not participate in a company sponsored pension plan and have completed twelve months of service, and Richmond Hourly Participants, who do participate in a company sponsored pension plan and who have completed twenty-four months of service, are eligible to receive a company contribution. In general, the formula to compute the company contribution is as follows:

| | | | | | | | | | | |

| Target adjusted diluted EPS growth rate * |

| If Altria’s actual adjusted diluted EPS growth rate is: | Under the target range | Within the target range | Above the target range |

| Then the company contribution (expressed as a percentage of each eligible participant’s compensation) is: | 8% | 10% | 12% |

* Target adjusted diluted earnings per share (“EPS”) growth rate, as defined in the Plan, is announced by Altria, generally in late January of each year.

Under certain circumstances, the Chief Executive Officer of Altria has the discretion to consider other financial performance metrics in determining the company contribution.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

Supplemental company contribution – A supplemental company contribution equal to five percent (5%) of each eligible participant’s compensation is made on behalf of Richmond Hourly Participants who are eligible for a company contribution and who do not participate in a company-sponsored pension plan, subject to the limitations below.

Limit on company and supplemental company contribution – The aggregate company and supplemental company contribution to the Plan cannot exceed three percent (3%) of Altria’s Consolidated Earnings, as defined in the Plan document, allocated between the Plan and the Deferred Profit-Sharing Plan for Salaried Employees (the “Salaried Plan”) proportionally based on the aggregate compensation of eligible participants in each plan.

Company match contributions – Participants who make before-tax, Roth after-tax, and/or traditional after-tax contributions for a payroll period will receive company match contributions, as follows:

•Richmond Hourly Participants who do not participate in a company-sponsored pension plan - dollar for dollar, up to the first three percent (3%) of eligible compensation that is contributed for payroll periods following the completion of 90 days of service;

•Richmond Hourly Participants who participate in a company-sponsored pension plan - dollar for dollar, up to the first five percent (5%) of eligible compensation that is contributed for a payroll period;

•USSTC participants who are employed at the Nashville manufacturing facility - dollar for dollar, up to the first six percent (6%) of eligible compensation that is contributed for payroll periods following the completion of one year of service;

•non-union hourly employees at the Middleton King of Prussia manufacturing facility who are not represented by a collective bargaining agreement - dollar for dollar, up to the first three percent (3%) of eligible compensation that is contributed for payroll periods following the completion of 90 days of service; and

•prior to the Sale of SMWE, SMWE participants - fifty percent (50%) for each dollar, up to the first six percent (6%) of eligible compensation that was contributed for payroll periods following the completion of one year of service.

Eligible Plan participants are generally eligible for company and supplemental company contributions, as well as a true-up matching contribution for a particular year (other than SMWE participants) if they are employed by one of the Participating Companies on the last business day of the calendar year (the “Last Day Rule”). This requirement to be employed on the last business day of the year is waived if participants leave employment due to retirement (as defined in the Plan), death or disability. Company contributions are based on compensation through the participant’s departure date.

Participant Accounts

Each participant’s Plan accounts are adjusted by any employee and employer contributions, as well as the allocated share of the investment activities and administrative expenses for each investment option held.

Vesting

Participants are fully vested at all times in their Plan account balances.

Investment Options

Participants can direct all contributions among ten investment options and may change their investment elections at any time, subject to excessive trading policy restrictions and short-term redemption fees that may be applicable to certain of the investment options and other applicable laws. If a participant has not provided an investment election, any contributions are invested in the Balanced Fund Investment Option, for which the underlying investment is a collective investment fund.

The Mondelēz Stock Investment Option, the PMI Stock Investment Option and the Kraft Heinz Stock Investment Option (individually and collectively, the “Non-Altria Stock Investment Option”) are “closed” to further investments so that participants are not permitted to purchase shares of Mondelēz Stock, PMI Stock and Kraft Heinz Stock (individually and collectively, “Non-Altria Stock”) in the Plan or to perform an exchange into a Non-Altria Stock Investment Option from any other investment option.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

Employee Stock Ownership Plan

The employee stock ownership plan (“ESOP”) portion of the Plan permits each participant who invests in the Altria Stock Investment Option to elect, no later than the business day immediately preceding an ex-dividend date with respect to a cash dividend payable on shares of Altria Stock, to have the dividend paid to them in cash and treated as a taxable distribution from the Plan, or have the dividend reinvested in additional shares of Altria Stock. Altria Stock dividends paid in cash directly to participants for the year ended December 31, 2021 were approximately $17 million. Altria Stock dividends payable in cash directly to participants at December 31, 2021 and 2020 were each approximately $4 million.

Any cash dividends paid on Non-Altria Stock held in a Non-Altria Stock Investment Option cannot be reinvested in Non-Altria Stock, but instead will be invested according to the participant’s current investment elections. If the participant has not provided an investment election, cash dividends are invested in the Balanced Fund Investment Option. The participant does not have the right to elect to have dividends for Non-Altria Stock paid to them in cash.

Master Trusts

Certain assets of the Plan are co-invested with certain assets of the Salaried Plan in a commingled investment fund known as the Altria Client Services Deferred Profit-Sharing Master Trust (“Master Trust A”) for which State Street Bank and Trust Company (“State Street”) serves as the trustee. Certain assets of the Plan are co-invested with certain assets of the Salaried Plan in a commingled investment fund known as the Altria Client Services Deferred Profit-Sharing Trust for Altria Stock and Non-Altria Stock (“Master Trust B”) for which Fidelity Management Trust Company serves as the trustee.

Master Trust A and Master Trust B are hereinafter collectively referred to as the “Master Trusts.”

Withdrawals and Distributions

Participants may make in-service withdrawals in accordance with the provisions outlined in the Plan.

Participants may receive a distribution upon termination of employment, including retirement, in a lump sum, partial distributions, or installments.

The Plan adopted certain optional relief permitted by the CARES Act, which was passed on March 27, 2020. The Plan allowed eligible participants who were impacted by the COVID-19 pandemic to take “coronavirus-related distributions” of up to $100,000 without penalty during 2020. The distributions are repayable to the Plan within three years. In addition, the required minimum distributions were waived for the 2020 calendar year and resumed for the 2021 calendar year.

On December 20, 2019, the Setting Every Community Up for Retirement Enhancement Act (commonly known as the SECURE Act) was signed into law. The age requirement for minimum distributions was raised to 72 from 70-1/2, for any participant who turned 70-1/2 on or after January 1, 2020.

Notes Receivable from Participants

Participants are permitted to borrow from their Plan accounts in accordance with the loan provisions and applicable interest rate as outlined in the Plan. Interest on participant loans is fixed for the term of the loan. The minimum loan amount is $1,000 and the maximum loan amount is the lesser of fifty percent (50%) of a participant’s account balance at the time of the loan request or $50,000, less the participant’s highest outstanding loan balance during the twelve-month period preceding the loan request. Loan repayment periods are up to twenty-five years depending on the type of loan.

As permitted by the CARES Act, the Plan allowed eligible participants impacted by the COVID-19 pandemic to suspend loan repayments with due dates on or after March 27, 2020 through December 31, 2020. Effective January 1, 2021, loans were re-amortized and payments recommenced.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

| | | | | |

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The financial statements are prepared using the accrual basis of accounting. Certain immaterial prior year amounts have been adjusted to conform with the current year’s presentation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Plan’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, in the financial statements and related disclosures. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan has diversified investment options in investment securities, including the Common Stock Investment Options. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk and overall market volatility. The financial markets, both domestically and internationally, can experience significant volatility on a daily basis that affects the valuation of investments. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur and that such changes could materially affect participant account balances and the amounts reported in the financial statements. Substantially all of the assets of Master Trust B are invested in Common Stocks, each of which could be subject to significant market fluctuations.

Interest in Master Trusts

The Plan’s interest in the Master Trusts and share of investment activities are based upon the total of the participants’ Plan accounts.

Valuation of the Master Trusts’ Investments and Income Recognition

The Master Trusts’ investment assets are reported at fair value except for fully benefit-responsive investment contracts, which are reported at contract value. Fair value is defined as the exchange price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. See Note 5 - Fair Value Measurements for further discussion of fair value measurements. Contract value is the relevant measure for fully benefit-responsive investment contracts because this is the amount participants generally receive if they were to initiate permitted transactions under the terms of the Plan. See Note 3 - Master Trust A Investments for further discussion of fully benefit-responsive investment contracts.

Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date; interest income is recorded as earned on an accrual basis. In accordance with the policy of stating investments at fair value, the net appreciation (depreciation) in the fair value of investments reflects both realized gains or losses and the change in the unrealized appreciation (depreciation) of investments held at year-end. Realized gains or losses from security transactions are reported on the average cost method.

Withdrawals and Distributions

Withdrawals and distributions are recorded when paid.

Expenses

Investment management fees, fund manager administrative fees, brokerage commissions (excluding those for the Common Stocks held in Master Trust B) and other investment related expenses are part of the total operating expenses of an investment option, and are charged against the net asset value of the specific investment option and reduce investment return.

Plan administrative fees such as trustee fees, participant recordkeeping, communications, audit and certain legal fees are paid by the Master Trusts and evenly distributed to all participant accounts.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

Individual participant transaction fees (including fees associated with the trading of Common Stocks), managed account fees, and short-term redemption fees for sales of an investment option within a specified period of time after purchase are paid by the Master Trusts and are charged solely to the accounts of the participant who initiated the transaction or service.

| | | | | |

| 3. | Master Trust A Investments |

At December 31, 2021 and 2020, the net assets of Master Trust A were as follows (in thousands of dollars):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | Master Trust Balances | | Plan’s interest in Master Trust Balances | | Master Trust Balances | | Plan’s interest in Master Trust Balances |

| Investments at fair value: | | | | | | | | |

| Collective investment funds | | $ | 2,144,853 | | | $ | 237,317 | | | $ | 1,883,885 | | | $ | 208,984 | |

| Registered investment companies | | 477,054 | | | 45,402 | | | 403,530 | | | 36,606 | |

| Government securities | | 139,969 | | | 23,743 | | | 157,097 | | | 28,945 | |

| Other | | 17,602 | | | 4,815 | | | 11,431 | | | 2,661 | |

| Investments at fair value | | 2,779,478 | | | 311,277 | | | 2,455,943 | | | 277,196 | |

| Investments at contract value: | | | | | | | | |

| Fully benefit-responsive investment contracts | | 686,313 | | | 176,286 | | | 694,324 | | | 176,547 | |

| Total Investments | | 3,465,791 | | | 487,563 | | | 3,150,267 | | | 453,743 | |

| | | | | | | | |

| Receivables: | | | | | | | | |

| Interest and dividend income | | 216 | | | — | | | 436 | | | — | |

| | | | | | | | |

| | | | | | | | |

| Payables: | | | | | | | | |

| Administrative expenses | | (308) | | | $ | — | | | (232) | | | $ | — | |

| | | | | | | | |

| Net assets | | $ | 3,465,699 | | | $ | 487,563 | | | $ | 3,150,471 | | | $ | 453,743 | |

Master Trust A investment activities for the year ended December 31, 2021 were as follows (in thousands of dollars):

| | | | | |

| Interest and dividends | $ | 57,732 | |

| Net appreciation in fair value of investments | 374,290 | |

| Investment income, net | $ | 432,022 | |

As discussed in Note 2 - Summary of Significant Accounting Policies - Valuation of the Master Trusts’ Investments and Income Recognition, the Plan’s interest in Master Trust A and share of investment activities are based upon the total of the participants’ Plan accounts. Certain transactions in process at year-end may result in differences between Master Trust A net assets and the total of the participants’ Plan accounts. These differences were not material as of December 31, 2021 and 2020.

Investment contracts held in the Interest Income Fund Investment Option (a stable value investment option) may consist of traditional and/or synthetic guaranteed investment contracts (“GIC” or “GICs”) as determined by the investment manager for the Interest Income Fund. Master Trust A had no traditional GICs as of December 31, 2021 and 2020.

A synthetic GIC provides for the preservation of principal at a specified rate of interest over a specified period of time through fully benefit-responsive wrapper contracts issued by a third party, which are backed by underlying assets owned by Master Trust A. The wrapper contract provider guarantees, except in the case of the occurrence of certain events discussed below, that participant withdrawals are made at contract or book value. The aggregate contract value of the synthetic GICs was approximately $686 million and $694 million at December 31, 2021 and 2020, respectively.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

There are certain events not initiated by Plan participants that could limit the ability of the Plan to transact at contract value with the contract issuer. Specific coverage provided by each synthetic GIC may be different for each issuer, and can be found in the individual synthetic GIC contracts held by the Plan. Examples of such events include: the Plan’s failure to qualify under the Code; full or partial termination of the Plan; involuntary termination of employment as a result of a corporate merger, divestiture, spin-off, or other significant business restructuring, which may include early retirement incentive programs or bankruptcy; changes to the administration of the Plan which decrease employee or employer contributions such as the establishment of a competing plan by the Plan sponsor, the introduction of a competing investment option, or other plan amendment that has not been approved by the contract issuers; dissemination of a participant communication that is designed to induce participants to transfer assets from a stable value option; or events resulting in a material and adverse financial impact on the contract issuer, including changes in the tax code, laws or regulations.

The Fiduciaries do not believe that the occurrence of any such event that would limit the Plan’s ability to transact at contract value with participants is probable.

Contract issuers are not allowed to terminate any of the above synthetic GICs and settle at an amount different from contract value unless there is a breach of the contract that is not cured within the applicable period. Actions that will result in a breach (after any relevant cure period) include: material misrepresentation; failure to pay synthetic GIC fees or any other payment due under the contract; or failure to adhere to investment guidelines.

| | | | | |

| 4. | Master Trust B Investments |

At December 31, 2021 and 2020, the net assets of Master Trust B were as follows (in thousands of dollars):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| | Master Trust Balances | | Plan’s interest in Master Trust Balances | | Master Trust Balances | | Plan’s interest in Master Trust Balances |

| Investments at fair value: | | | | | | | | |

| Common stocks: | | | | | | | | |

| Altria Stock | | $ | 1,310,077 | | | $ | 403,187 | | | $ | 1,149,521 | | | $ | 360,356 | |

| PMI Stock | | 278,081 | | | 55,826 | | | 270,720 | | | 56,701 | |

| Mondelēz Stock | | 61,937 | | | 9,634 | | | 61,106 | | | 9,677 | |

Kraft Heinz Stock | | 11,108 | | | 1,779 | | | 11,828 | | | 1,918 | |

| Cash and cash equivalents | | 33 | | | 17 | | | 30 | | | 15 | |

| Total investments at fair value | | 1,661,236 | | | 470,443 | | | 1,493,205 | | | 428,667 | |

| | | | | | | | |

| Receivable - dividend income | | 19,129 | | | 4,270 | | | 18,568 | | | 4,130 | |

| | | | | | | | |

| Net assets | | $ | 1,680,365 | | | $ | 474,713 | | | $ | 1,511,773 | | | $ | 432,797 | |

Master Trust B investment activities for the year ended December 31, 2021 were as follows (in thousands of dollars):

| | | | | |

| Dividends on common stocks | $ | 115,014 | |

| Net appreciation in common stocks | 229,019 | |

| Investment income, net | $ | 344,033 | |

| | | | | |

| 5. | Fair Value Measurements |

Financial Accounting Standards Board authoritative guidance provides a framework for measuring fair value. Fair value is defined as the exchange price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

date. The Plan uses a fair value hierarchy, which gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of inputs used to measure fair value are:

Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 – Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

Following is a description of the valuation methodologies used for investments measured at fair value.

There were no transfers between Level 1 and Level 2 holdings in the Master Trusts’ investments assets during 2021 and 2020. In addition, there were no Level 3 holdings or transactions in the Master Trusts’ investment assets at December 31, 2021 and 2020.

The methods described below are not necessarily indicative of net realizable value or reflective of future fair values, nor is categorization of a security in any particular valuation level necessarily an indication of the risk associated with an investment in that security. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

Registered Investment Companies

Investments in registered investment companies are valued at the closing net asset value (“NAV”) publicly reported on the last business day of the year.

Government Securities

Government securities consist of investments in U.S. Treasury securities. Government securities are valued at a price that is based on a compilation of primarily observable market information, such as broker quotes. Matrix pricing, yield curves and indices are used when broker quotes are not available.

Common Stocks

Common stocks are valued based on the price of the security as listed on an open active exchange on last trade date.

Collective Investment Funds

Collective investment funds consist of pools of investments used by institutional investors to obtain exposure to equity and fixed income markets. Master Trust A collective investment funds include equity index funds, a U.S. diversified bond fund and a balanced fund, consisting of a mix of equities and fixed income securities, that are intended to mirror indices such as the Standard & Poor’s 500 Index and Morgan Stanley Capital International Europe, Australasia, and the Far East Index. They are valued on the basis of the relative interest of each participating investor in the fair value of the underlying assets of each of the respective collective investment funds. The underlying assets are valued based on the NAV, which is provided by the investment account manager as a practical expedient to estimate fair value. These investments are not classified by level but are disclosed to permit reconciliation to the fair value of Master Trust A investment assets.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

The fair values of the Master Trusts’ investment assets by asset category as of December 31, 2021 were as follows (in thousands of dollars):

| | | | | | | | | | | | | | | | | | | | | | |

| Master Trust A | | Level 1 | | Level 2 | | | | Totals |

| Registered investment companies | | $ | 477,054 | | | $ | — | | | | | $ | 477,054 | |

| Government securities | | — | | | 139,969 | | | | | 139,969 | |

| Other | | — | | | 17,602 | | | | | 17,602 | |

| | | | | | | | |

| | $ | 477,054 | | | $ | 157,571 | | | | | 634,625 | |

Investments measured at NAV as a practical expedient for fair value: | | | | | | | | |

Collective investment funds | | | | | | | | 2,144,853 | |

| | | | | | | | |

| Total Master Trust A investments at fair value | | | | | | | | $ | 2,779,478 | |

| | | | | | | | |

| Master Trust B | | | | | | | | |

| Common stocks | | $ | 1,661,236 | | | $ | — | | | | | $ | 1,661,236 | |

| | | | | | | | |

| | | | | | | | |

| Total Master Trust B investments at fair value | | $ | 1,661,236 | | | $ | — | | | | | $ | 1,661,236 | |

| | | | | | | | |

| | | | | | | | |

The fair values of the Master Trusts’ investment assets by asset category as of December 31, 2020 were as follows (in thousands of dollars):

| | | | | | | | | | | | | | | | | | | | | | |

| Master Trust A | | Level 1 | | Level 2 | | | | Totals |

| Registered investment companies | | $ | 403,530 | | | $ | — | | | | | $ | 403,530 | |

| Government securities | | — | | | 157,097 | | | | | 157,097 | |

| Other | | — | | | 11,431 | | | | | 11,431 | |

| | | | | | | | |

| | $ | 403,530 | | | $ | 168,528 | | | | | 572,058 | |

Investments measured at NAV as a practical expedient for fair value: | | | | | | | | |

Collective investment funds | | | | | | | | 1,883,885 | |

| | | | ` | | | | |

| Total Master Trust A investments at fair value | | | | | | | | $ | 2,455,943 | |

| | | | | | | | |

| Master Trust B | | | | | | | | |

| Common stocks | | $ | 1,493,205 | | | $ | — | | | | | $ | 1,493,205 | |

| | | | | | | | |

| | | | | | | | |

| Total Master Trust B investments at fair value | | $ | 1,493,205 | | | $ | — | | | | | $ | 1,493,205 | |

The following table summarizes additional disclosures related to Master Trust A investments measured at NAV as a practical expedient to estimate fair value as of December 31, 2021 and 2020 (in thousands of dollars):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value | | | | | | |

| Collective Investment Funds | | 2021 | | 2020 | | Redemption Frequency | | | | Redemption Notice Period |

| U.S. equity index | | $ | 1,585,739 | | | $ | 1,356,114 | | | Daily | | | | None |

| International equity index | | $ | 251,657 | | | $ | 226,586 | | | Daily | | | | None |

| U.S. fixed income | | $ | 307,457 | | | $ | 301,185 | | | Daily | | | | None |

| | | | | | | | | | |

| | | | | |

| 6. | Related Party and Party-In-Interest Transactions |

Master Trust B includes participant investments in Altria Stock. During the years ended 2021 and 2020, Master Trust B participant purchases of Altria Stock were approximately $252 million and $310 million, respectively, and participant sales of Altria Stock were approximately $273 million and $322 million, respectively. Net appreciation activity from the investment in Altria Stock, including dividends received, caused Master Trust B to increase by approximately $280 million for the year ended December 31, 2021. Master Trust A investments include collective investment funds managed by SSgA, an affiliate of State Street. State Street is a trustee as defined by the Plan. The investment balance in these collective investment funds was approximately $904 million and $843 million as of December 31, 2021 and 2020, respectively. These investments and transactions in these investments do not constitute prohibited transactions under ERISA.

| | | | | |

| 7. | Plan Amendment and Termination |

The Altria Board of Directors (the “Board”) has the right, subject to the applicable provisions of ERISA and the Code, to amend (retroactively or otherwise) the Plan, suspend making the company contribution, supplemental company contribution and/or company match contributions to the Plan or to terminate the Plan. The Board has delegated to the Altria Corporate Employee Benefit Committee and the Administrator the right to amend the Plan, provided that the annual cost of such amendment does not exceed specified dollar limits. Each Participating Company has the right to terminate its participation in the Plan. However, no such action may deprive any participant or beneficiary under the Plan of any vested right.

By letter dated September 6, 2017, the IRS has determined that the Plan constitutes a qualified plan under Section 401(a) of the Code. Consequently, the related Master Trusts are exempt from federal income taxes under the provisions of Section 501(a) of the Code. The Plan has been amended since the receipt of the determination letter; however, the Administrator believes the Plan continues to be designed and operated in accordance with the applicable provisions of the Code.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain tax position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The tax provisions of the Plan have been analyzed as of December 31, 2021 and 2020, and there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements.

DEFERRED PROFIT-SHARING PLAN FOR HOURLY EMPLOYEES

NOTES TO FINANCIAL STATEMENTS

| | | | | |

| 9. | Reconciliation of Financial Statements to Form 5500 |

The following are reconciliations of the Plan’s interest in Master Trust A and the net assets available for benefits per the financial statements to the Form 5500 for the years ended December 31, 2021 and 2020 (in thousands of dollars):

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Plan’s interest in Master Trust A at fair value | | $ | 311,277 | | | $ | 277,196 | |

Plan’s interest in Master Trust A for fully benefit-responsive investment contracts at contract value | | 176,286 | | | 176,547 | |

| | 487,563 | | | 453,743 | |

Adjustment from contract value to fair value for fully benefit-responsive investment contracts | | 4,303 | | | 10,208 | |

| Plan’s interest in Master Trust A at fair value per the Form 5500 | | $ | 491,866 | | | $ | 463,951 | |

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Net assets available for benefits per the financial statements | | $ | 995,285 | | | $ | 920,849 | |

Adjustment from contract value to fair value for fully benefit-responsive investment contracts | | 4,303 | | | 10,208 | |

| Net assets available for benefits per the Form 5500 | | $ | 999,588 | | | $ | 931,057 | |

The following is a reconciliation of the change in net assets available for benefits per the financial statements to the Form 5500 for the year ended December 31, 2021 (in thousands of dollars):

| | | | | |

| | 2021 |

| Change in net assets available for benefits per the financial statements | $ | 74,436 | |

| Adjustment for the net change in contract value of fully benefit-responsive investment contracts | (5,905) | |

| Change in net assets available for benefits per the Form 5500 | $ | 68,531 | |

Effective January 1, 2022, the Plan was amended with the following changes:

•Hourly employees of Middleton employed at its King of Prussia facility who are not covered by a collective bargaining agreement and who have completed twelve months of service are eligible to receive the company contribution and the five percent (5%) supplemental company contribution, provided that they satisfy the Last Day Rule; and

•Union-represented employees of USSTC employed at its Nashville manufacturing facility are eligible for an increased match as of January 1, 2022. Eligible participants will receive a dollar-for-dollar match on the first seven percent (7%) of eligible compensation (previously six percent (6%)) each pay period, after completing 120 days of service (previously one year). In addition, beginning in 2022, union-represented employees of USSTC employed at its Nashville manufacturing facility who have completed one year of service will be eligible for the five percent (5%) supplemental company contribution, provided that they satisfy the Last Day Rule.

Deferred Profit-Sharing Plan for Hourly Employees

Schedule H – Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | |

| (a) | | (b) Identity of issue, borrower,

lessor, or similar party | | (c) Description of investment including maturity date, rate of interest, collateral, par, or maturity value | | (d) Cost | | (e) Current value |

| | | | |

| * | | Altria Client Services Deferred

Profit-Sharing Master Trust | | Master Trust | | n/a | | $ | 491,865,491 | |

| | | | |

| * | | Altria Client Services Deferred

Profit-Sharing Trust for Altria Stock and Non-Altria Stock | | Master Trust | | n/a | | $ | 474,712,698 | |

| | | | |

| * | | Notes receivable from participants | | Interest rates range from

3.25% to 9.00%

Maturity dates through 2046 | | n/a | | $ | 16,453,826 | |

* indicates party-in-interest

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Vice President, Total Rewards, HR Services and Aviation of Altria Client Services LLC, having administrative responsibility of the Plan, has duly caused this annual report to be signed by the undersigned hereunto duly authorized.

| | | | | |

| |

| DEFERRED PROFIT-SHARING

PLAN FOR HOURLY EMPLOYEES |

| |

| By | /s/ THOMAS H. WATSON |

| Thomas H. Watson

Vice President, Total Rewards, HR Services & Aviation,

Altria Client Services LLC |

Date: June 3, 2022

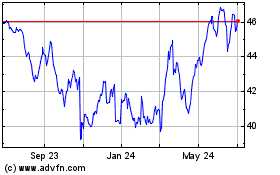

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

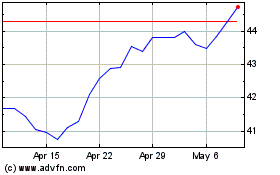

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024