UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023

Commission File Number: 001-41181

Yoshitsu Co., Ltd

Harumi Building, 2-5-9 Kotobashi,

Sumida-ku, Tokyo, 130-0022

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Reappointments of Directors, Retirements of Directors, and Appointment

of a Corporate Officer

On June 30, 2023, Yoshitsu Co., Ltd, a stock company

incorporated pursuant to the laws of Japan (the “Company”), held its 2023 annual general meeting of shareholders (the

“2023 Annual General Meeting”). Upon the conclusion of the 2023 Annual General Meeting, the terms of all six members

of the board of directors (the “Board”), Mr. Mei Kanayama, Mr. Sen Uehara, Mr. Yoichiro Haga, Mr. Tetsuya Sato, Mr.

Yoji Takenaka, and Mr. Yukihisa Kitamura, reached an end. During the 2023 Annual General Meeting, the Board recommended, and the shareholders

of the Company (the “Shareholders”) approved, the reappointments of Mr. Mei Kanayama as a director, Mr. Yoichiro Haga

as a director, Mr. Yoji Takenaka as an external director, and Mr. Tetsuya Sato as an external director, effective immediately. Mr. Sen

Uehara retired as a director, and Mr. Yukihisa Kitamura retired as an external director, effective immediately. Upon the conclusion of

the 2023 Annual General Meeting, the Board is composed of four members, including two directors and two external directors.

On June 30, 2023, the Board appointed Mr. Sen

Uehara as a corporate officer, effective immediately. The Company believes that Mr. Sen Uehara will continue to bring extensive entrepreneurial

and management experience to the Company.

Entry into Share Transfer Agreement with Respect

to Palpito Co., Ltd.

On June 30, 2023, the Company entered into a share

transfer agreement (the “Palpito STA”) with respect to the transfer of shares of Palpito Co., Ltd. (“Palpito”),

an entity that was 40% owned by the Company and 60% owned by two unrelated third parties, with SeihinKokusai Co., Ltd., an entity of which

Mr. Mei Kanayama’s wife is a director and the representative director (“SeihinKokusai”). Mr. Mei Kanayama is

the representative director and a director of the Company. The Palpito STA was negotiated at arm’s length and was approved by the

Board on June 30, 2023.

Pursuant to the Palpito STA, SeihinKokusai agreed

to purchase, and the Company agreed to sell, all of the 800 shares of common stock the Company owned in Palpito, representing 40% of the

issued share capital in Palpito, in exchange for 40,000,000 yen.

On July 1, 2023, the parties to the Palpito

STA closed the transaction, and Palpito became 40% owned by SeihinKokusai.

A copy of the Palpito STA is attached hereto as

Exhibit 10.1. The foregoing description of the Palpito STA is a summary of the material terms of such agreement, and does not purport

to be complete and is qualified in its entirety by reference to the Palpito STA.

Entry into Share Transfer Agreement with Respect

to Kaika International Co., Ltd

On June 30, 2023, the Company entered into a share

transfer agreement (the “Kaika STA”) with respect to the transfer of shares of Kaika International Co., Ltd (“Kaika”),

formerly known as Tokyo Lifestyle Co., Ltd., a wholly owned subsidiary of the Company, with SeihinKokusai, an entity of which Mr. Mei

Kanayama’s wife is a director and the representative director. Mr. Mei Kanayama is the representative director and a director of

the Company. The Kaika STA was negotiated at arm’s length and was approved by the Board on June 30, 2023.

Pursuant to the Kaika STA, SeihinKokusai agreed

to purchase, and the Company agreed to sell, 100 shares of common stock of Kaika, representing 100% of the issued share capital in Kaika,

in exchange for 5,000,000 yen.

On July 1, 2023, the parties to the Kaika STA closed the transaction, and SeihinKokusai became the sole shareholder

of Kaika.

A copy of the Kaika STA is attached hereto as

Exhibit 10.2. The foregoing description of the Kaika STA is a summary of the material terms of such agreement, and does not purport to

be complete and is qualified in its entirety by reference to the Kaika STA.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Yoshitsu Co., Ltd |

| |

|

|

| Date: July 13, 2023 |

By: |

/s/ Mei Kanayama |

| |

Name: |

Mei Kanayama |

| |

Title: |

Representative Director and Director

(Principal Executive Officer) |

EXHIBIT INDEX

3

Exhibit 10.1

[This is an English translation of the original

issued in Japanese]

[Note] The Company assumes no responsibility

for this translation or for direct, indirect, or other forms of damages arising from the translation. This document has been translated

from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese

original, the original shall prevail.

Share Transfer Agreement

Yoshitsu Co., Ltd (hereinafter referred to as

“Party A”), as the share transferor, and SeihinKokusai Co., Ltd (hereinafter, “Party B”), as the share transferee,

entered into the following contract regarding the transfer of 800 shares of common stock of Palpito Co., Ltd.

Article 1 Party A shall transfer 800 shares

of common stock of Palpito Co., Ltd. owned by Party A to Party B, and Party B shall pay Party A 40,000,000 yen in exchange for the transfer

of the shares.

Article 2 Payment of the price for the

transfer of shares prescribed in the preceding Article shall be made by the method of transfer to the financial institution account designated

by Party A within 7 days after the conclusion of this contract, and the fee of the financial institution for the transfer shall be borne

by Party B as it shall be.

Article 3 If Party B does not pay the

price for the transfer of shares specified in Article 1 within the period specified in the preceding Article, Party A may cancel this

contract.

Article 4 Party A and Party B shall indicate

that the shares of Palpito Co., Ltd. stipulated in Article 1 have been transferred from Party A to Party B without delay after Party B

has paid the price for the share transfer to Party A based on this contract, and Party B may notify Party A and request transfer of shareholder

registry.

Article 5 Party A has pledged not to transfer

the shares of Palpito Co., Ltd. to a third party other than Party B by the date of this contract, and if it is discovered later in the

unlikely event that some or all of the shares are double-transferred, the full amount of the damage suffered by Party B shall be compensated.

As a proof of the conclusion of this contract,

two copies of this contract will be prepared, and one copy will be retained by each of Party A and Party B.

June 30, 2023

Party A: Yoshitsu Co., Ltd

| By: |

/s/ Mei Kanayama |

|

| Name: |

Mei Kanayama |

|

| Title: |

Representative Director |

|

Party B: SeihinKokusai Co., Ltd

| By: |

/s/ Chiaki Kanayama |

|

| Name: |

Chiaki Kanayama |

|

| Title: |

Representative Director |

|

Exhibit 10.2

[This is an English translation of the original

issued in Japanese]

[Note] The Company assumes no responsibility

for this translation or for direct, indirect, or other forms of damages arising from the translation. This document has been translated

from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese

original, the original shall prevail.

Share Transfer Agreement

Yoshitsu Co., Ltd (hereinafter referred to as

“Party A”), as the share transferor, and SeihinKokusai Co., Ltd (hereinafter, “Party B”), as the share transferee,

entered into the following contract regarding the transfer of 100 shares of common stock of Kaika International Co., Ltd.

Article 1 Party A shall transfer 100 shares

of common stock of Kaika International Co., Ltd. owned by Party A to Party B, and Party B shall pay Party A 5,000,000 yen in exchange

for the transfer of the shares.

Article 2 Payment of the price for the

transfer of shares prescribed in the preceding Article shall be made by the method of transfer to the financial institution account designated

by Party A within 7 days after the conclusion of this contract, and the fee of the financial institution for the transfer shall be borne

by Party B as it shall be.

Article 3 If Party B does not pay the

price for the transfer of shares specified in Article 1 within the period specified in the preceding Article, Party A may cancel this

contract.

Article 4 Party A and Party B shall indicate

that the shares of Kaika International Co., Ltd. stipulated in Article 1 have been transferred from Party A to Party B without delay after

Party B has paid the price for the share transfer to Party A based on this Agreement, and Party B may notify Party A and request transfer

of shareholder registry.

Article 5 Party A has pledged not to transfer

the shares of Kaika International Co., Ltd. to a third party other than Party B by the date of this agreement, and if it is discovered

later in the unlikely event that some or all of the shares are double-transferred, the full amount of the damage suffered by Party B shall

be compensated.

As a proof of the conclusion of this contract,

two copies of this document will be prepared, and one copy will be retained with the signature of Party A and Party B.

June 30, 2023

Party A: Yoshitsu Co., Ltd

| By: |

/s/ Mei Kanayama |

|

| Name: |

Mei Kanayama |

|

| Title: |

Representative Director |

|

Party B: SeihinKokusai Co., Ltd

| By: |

/s/ Chiaki Kanayama |

|

| Name: |

Chiaki Kanayama |

|

| Title: |

Representative Director |

|

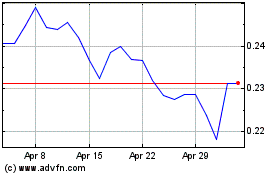

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From Apr 2024 to May 2024

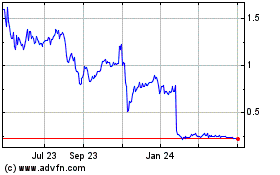

Yoshitsu (NASDAQ:TKLF)

Historical Stock Chart

From May 2023 to May 2024