false000158454900-000000000015845492023-08-092023-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 09, 2023 |

VILLAGE FARMS INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ontario |

001-38783 |

Not applicable |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4700-80th Street British Columbia Canada |

|

Delta, British Columbia, Canada |

|

V4K 3N3 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (604) 940-6012 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, without par value |

|

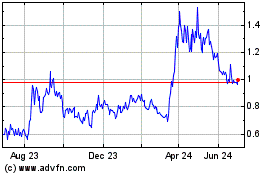

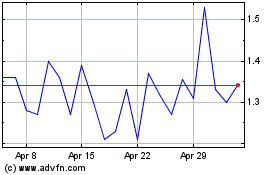

VFF |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 9, 2023, Village Farms International, Inc. (the “Company” or “Village Farms”) issued a press release announcing its financial results for the first quarter ended June 30, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Current Report on Form 8-K under Item 2.02, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information contained in this Current Report on Form 8-K under Item 2.02, including Exhibit 99.1, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Village Farms International, Inc. |

|

|

|

|

Date: |

August 9, 2023 |

By: |

/s/ Stephen C. Ruffini |

|

|

|

Stephen C. Ruffini

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Village Farms International Reports Significantly Improved Second Quarter

•Canadian Cannabis Retail Branded Sales Increase 18% Year-Over-Year (24% in Canadian Dollars), Significantly Outpacing Market Growth

•Canadian Cannabis Delivers Positive Net Income and 19th Consecutive Quarter of Positive Adjusted EBITDA

•Canadian Cannabis Maintains Top-Three Market Share Position Nationally and Takes Over Number One Market Share Position in Quebec

•Canadian Cannabis Exports Increase 189% (217% in Canadian Dollars) Year-Over-Year

•US Cannabis Delivers Sequential Revenue Growth and Positive Net Income, Adjusted EBITDA and Cash Flow

•Fresh Produce Delivers Fourth Consecutive Quarter of Significant Sequential Improvement with Positive Adjusted EBITDA

Vancouver, BC, August 9, 2023 – Village Farms International, Inc. (“Village Farms” or the “Company”) (NASDAQ: VFF) today announced its financial results for the second quarter ended June 30, 2023. All figures are in U.S. dollars unless otherwise indicated.

Management Commentary

“The second quarter saw the continuation of strong growth in Retail Branded sales in our Canadian Cannabis business, steady performance in our U.S. Cannabis business, and marked improvement in our Fresh Produce business, all of which contributed to significantly improved financial results on both a year-over-year and sequential basis,” said Michael DeGiglio, Chief Executive Officer, Village Farms.

“Our Canadian Cannabis business delivered 24% year-over-year growth in Canadian dollar Retail Branded sales – all of which was generated organically – once again significantly outpacing expansion of the overall market. We maintained our top-three market share position nationally for the second quarter of 2023. Importantly, the business delivered these strong competitive results while generating positive net income and its 19thconsecutive quarter of positive adjusted EBITDA, which was up 97% in Canadian dollars year-over-year.”

Mr. DeGiglio continued, “The continuing standout performance of our Canadian Cannabis business is the result of a deliberate strategy and execution to win in Canada’s challenging market environment. In the last year-and-a-half we have launched seven new brands – the latest, Super Toast, last month – and more than 300 new SKUs. At the same time, we are realizing continuous production efficiencies to support future growth in Canada and internationally. Market share growth and leadership in Canada require continuous, consumer-focused innovation, and with the rock-solid foundation we have built, our undivided attention is on leveraging our leading position in dried flower and top brands to deliver new strains, products and

formats that meet the evolving preferences of the cannabis market. Finally, we are using our extensive experience in Canada to aggressively pursue international opportunities, via both export and in-country operations, delivering more than a 200% year-over-year growth in Canadian dollar sales to international markets during the second quarter.”

“In our U.S. Cannabis business, the success of our innovative new products and prudent cost management have stabilized this business. Sales for the second quarter increased sequentially, while each of net income, adjusted EBITDA and cash flow were all positive. There is no company better positioned to benefit from favourable changes in CBD regulation than Balanced Health Botanicals (“BHB”) in what we continue to believe will be a high-growth, multi-billion-dollar market. Recent positive regulatory discussions are encouraging based on BHB’s competitive advantages: a stable, profitable business with a leading online presence, DSHEA compliance, internalized manufacturing capabilities, multiple published studies and a track record of safety.”

“Our Cannabis business performance this year is strong evidence of why we continue to believe, as we have since day one, that Village Farms can be the leader for the long-term in the global cannabis industry.”

Mr. DeGiglio added, “In our Fresh Produce business, we continue to benefit from the actions we have taken under our multi-part plan to return this business to profitability as the macro-environment also improves. The result was another quarter of substantial improvement in financial performance, highlighted by an $11.6 million increase in adjusted EBITDA to positive $1.3 million, which contributed to a $16.8 million improvement and positive adjusted EBITDA for the year to date. Looking ahead, we are strengthening our operations with investments in infrastructure and AI technology, while innovating with new higher margin varieties that have been well received by retailers and consumers alike. With our strong results thus far in 2023, we continue to track toward our goal of achieving positive adjusted EBITDA for the full year.”

1. Based on estimated retail sales from HiFyre, other third parties and provincial boards.

Second Quarter Financial Highlights

(All comparable periods are for the second quarter of 2022 unless otherwise stated)

Consolidated

•Consolidated sales decreased (7%) year-over-year to $77.2 million from $82.9 million;

•Operating loss before tax improved to ($42 thousand) compared with an operating loss before tax of ($43.8 million);

•Consolidated net loss improved to ($1.4 million), or ($0.01) per share, compared with ($36.6 million), or ($0.41) per share; and,

•Consolidated adjusted EBITDA (a non-GAAP measure) improved to $4.5 million from negative ($10.3 million).

Canadian Cannabis (Pure Sunfarms and Rose LifeScience)

•Net sales decreased (6%) to $28.1 million (C$37.7 million) from $29.8 million (C$38.0 million) (a decrease of (1%) in Canadian dollars);

•Retail branded sales increased 24% (in Canadian dollars);

•International (export) sales increased 217% (in Canadian dollars);

•Net income was $1.2 million (C$1.7 million) compared with net income of $1.8 million (C$2.3 million); and,

•Adjusted EBITDA increased 78% to $4.8 million (C$6.7 million) from $2.7 million (C$3.4 million) (an increase of 97% on a constant currency basis).

U.S. Cannabis (Balanced Health Botanicals)

•Net sales were $5.3 million, with gross margin of 67%, net income of $0.2 million and adjusted EBITDA of $0.4 million.

Village Farms Fresh (Produce)

•Sales decreased (7%) to $43.8million from $47.2 million;

•Net loss improved significantly to ($0.7 million) from ($9.4 million); and,

•Adjusted EBITDA improved significantly to $1.3million from negative ($10.3 million).

Strategic Growth and Operational Highlights

Canadian Cannabis

•Maintained top-three producer market share ranking nationally for the second quarter of 20231;

•Became the number one producer for Quebec by market share for the second quarter of 20231;

•Was the number two ranked cannabis producer in the dried flower category nationally (held number one position prior to acquisition of market share by a competitor);

•Had the number one dried flower brands in the core and premium price categories (Pure Sunfarms and Soar, respectively) and the fastest growing dried flower brand in the value category (The Original Fraser Valley Weed Co.) in Canada’s largest provincial market, Ontario; and,

•Subsequent to quarter end, further expanded its brand portfolio with the addition of Super Toast, a brand focused on convenience and ready-to-go products.

1. Based on estimated retail sales from HiFyre, other third parties and provincial boards.

Canadian Cannabis Performance Summary

|

|

|

|

|

|

(millions except % metrics) |

Three Months Ended June 30, |

|

|

2023 |

2022 |

Change of C$ |

|

C$ |

US$ |

C$ |

US$ |

|

Total Gross Sales |

$56.5 |

$42.1 |

$52.3 |

$41.0 |

+8% |

Total Net Sales |

$37.7 |

$28.1 |

$38.0 |

$29.8 |

-1% |

Total Cost of Sales |

$23.3 |

$17.3 |

$23.3 |

$18.3 |

0% |

Gross Margin |

$14.4 |

$10.8 |

$14.7 |

$11.5 |

-2% |

Gross Margin % |

38% |

38% |

39% |

39% |

+36% |

SG&A1 |

$10.5 |

$7.8 |

$10.9 |

$8.6 |

-4% |

Net income |

$1.7 |

$1.2 |

$2.3 |

$1.8 |

-26% |

|

|

|

|

|

|

Adjusted EBITDA 2 |

$6.7 |

$4.8 |

$3.4 |

$2.7 |

+97% |

Adjusted EBITDA Margin 2 |

18% |

18% |

9% |

9% |

+100% |

|

|

|

|

|

|

(millions except % metrics) |

Six Months Ended June 30, |

|

|

2023 |

2022 |

Change of C$ |

|

C$ |

US$ |

C$ |

US$ |

|

Total Gross Sales |

$109.3 |

$80.9 |

$91.2 |

$71.7 |

+20% |

Total Net Sales |

$71.7 |

$53.2 |

$65.6 |

$51.6 |

+9% |

Total Cost of Sales |

$45.8 |

$34.0 |

$38.9 |

$30.5 |

+18% |

Gross Margin |

$25.9 |

$19.2 |

$26.7 |

$21.1 |

-3% |

Gross Margin % |

36% |

36% |

41% |

41% |

-12 |

SG&A1 |

$19.8 |

$14.7 |

$20.5 |

$15.9 |

-3% |

Net income |

$1.5 |

$1.1 |

$4.1 |

$2.8 |

-63% |

Adjusted EBITDA 2 |

$12.3 |

$8.7 |

$6.0 |

$4.8 |

+105% |

Adjusted EBITDA Margin 2 |

17% |

17% |

9% |

9% |

+89% |

1 SG&A for the three and six months ended June 30, 2023 includes share-based compensation of C$375 (US$291) and C$850 (US$663), respectively, compared with C$338 (US$219) and C$804 (US$586), respectively, for the three and six months ended June 30, 2022.

2 Adjusted EBITDA is not a recognized earnings measure and does not have a standard meaning prescribed in by GAAP.

Canadian Cannabis’ Percent of Sales by Channel

|

|

|

|

|

|

(millions except % metrics) |

Three Months Ended June 30, |

|

|

2023 |

2022 |

Change of C$ |

|

C$ |

US$ |

C$ |

US$ |

|

Retail Branded Sales |

$49.9 |

$37.2 |

$40.3 |

$31.6 |

+24% |

International Sales |

$1.9 |

$1.4 |

$0.6 |

$0.5 |

+217% |

Non-Branded Sales |

$3.9 |

$2.9 |

$10.3 |

$8.1 |

-62% |

Other |

$0.8 |

$0.6 |

$1.1 |

$0.8 |

+27% |

Less: Excise Taxes |

$(18.8) |

$(14.0) |

$(14.3) |

$(11.2) |

+31% |

Net Sales |

$37.7 |

$28.1 |

$38.0 |

$29.8 |

-1% |

|

|

|

|

|

|

(millions except % metrics) |

Six Months Ended June 30, |

|

|

2023 |

2022 |

Change of C$ |

|

C$ |

US$ |

C$ |

US$ |

|

Retail Branded Sales |

$96.6 |

$71.7 |

$71.8 |

$56.4 |

+35% |

International Sales |

$4.1 |

$3.1 |

$0.8 |

$0.6 |

+413% |

Non-Branded Sales |

$7.1 |

$5.2 |

$16.6 |

$13.1 |

-57% |

Other |

$1.3 |

$0.9 |

$2.0 |

$1.6 |

-35% |

Less: Excise Taxes |

$(37.4) |

$(27.7) |

$(25.6) |

$(20.1) |

+46% |

Net Sales |

$71.7 |

$53.2 |

$65.6 |

$51.5 |

+9% |

Presentation of Financial Results

The Company’s financial statements for the three and six months ended June 30, 2023, as well as the comparative periods for 2022, have been prepared and presented under United States Generally Accepted Accounting Principals (“GAAP”).

RESULTS OF OPERATIONS

(In thousands of U.S. dollars, except per share amounts, and unless otherwise noted)

Consolidated Financial Performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Sales |

|

$ |

77,212 |

|

|

$ |

82,903 |

|

|

$ |

141,868 |

|

|

$ |

153,059 |

|

Cost of sales |

|

|

(65,713 |

) |

|

|

(76,580 |

) |

|

|

(118,069 |

) |

|

|

(136,832 |

) |

Gross margin |

|

|

11,499 |

|

|

|

6,323 |

|

|

|

23,799 |

|

|

|

16,227 |

|

Selling, general and administrative expenses |

|

|

(16,753 |

) |

|

|

(18,516 |

) |

|

|

(34,158 |

) |

|

|

(36,451 |

) |

Interest expense |

|

|

(1,411 |

) |

|

|

(665 |

) |

|

|

(2,544 |

) |

|

|

(1,348 |

) |

Interest income |

|

|

283 |

|

|

|

— |

|

|

|

479 |

|

|

|

110 |

|

Foreign exchange gain (loss) |

|

|

738 |

|

|

|

(527 |

) |

|

|

669 |

|

|

|

(208 |

) |

Other income (expense), net |

|

|

5,602 |

|

|

|

(30 |

) |

|

|

5,632 |

|

|

|

(38 |

) |

Write-off of joint venture loan |

|

|

— |

|

|

|

(592 |

) |

|

|

— |

|

|

|

(592 |

) |

Impairments |

|

|

— |

|

|

|

(29,799 |

) |

|

|

— |

|

|

|

(29,799 |

) |

Loss before taxes and loss from equity method investments |

|

|

(42 |

) |

|

|

(43,806 |

) |

|

|

(6,123 |

) |

|

|

(52,099 |

) |

(Provision for) recovery of income taxes |

|

|

(1,299 |

) |

|

|

9,714 |

|

|

|

(1,933 |

) |

|

|

11,380 |

|

Loss including non-controlling interests and before equity losses |

|

|

(1,341 |

) |

|

|

(34,092 |

) |

|

|

(8,056 |

) |

|

|

(40,719 |

) |

Less: net loss attributable to non-controlling interests, net of tax |

|

|

(39 |

) |

|

|

152 |

|

|

|

40 |

|

|

|

314 |

|

Loss from equity method investments |

|

|

— |

|

|

|

(2,615 |

) |

|

|

— |

|

|

|

(2,667 |

) |

Net loss attributable to Village Farms International Inc. |

|

$ |

(1,380 |

) |

|

$ |

(36,555 |

) |

|

$ |

(8,016 |

) |

|

$ |

(43,072 |

) |

Adjusted EBITDA (1) |

|

$ |

4,475 |

|

|

$ |

(10,308 |

) |

|

$ |

4,994 |

|

|

$ |

(16,419 |

) |

Basic loss per share |

|

$ |

(0.01 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.49 |

) |

Diluted loss per share |

|

$ |

(0.01 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.49 |

) |

1 Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company because it excludes non-recuring and other items that do not reflect our business performance. Adjusted EBITDA includes the Company’s 70% interest in Rose LifeScience since acquisition.

We caution that our results of operations for the three and six months ended June 30, 2023 and 2022 may not be indicative of our future performance, particularly in light of global inflation and lingering supply-chain shortages due to the Ukrainian conflict.

SEGMENTED RESULTS OF OPERATIONS

(In thousands of U.S. dollars, except per share amounts, and unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended June 30, 2023 |

|

|

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

|

Sales |

$ |

43,846 |

|

|

$ |

28,065 |

|

|

$ |

5,301 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

77,212 |

|

|

Cost of sales |

|

(46,607 |

) |

|

|

(17,349 |

) |

|

|

(1,743 |

) |

|

|

(14 |

) |

|

|

— |

|

|

|

(65,713 |

) |

|

Selling, general and administrative expenses |

|

(2,854 |

) |

|

|

(7,827 |

) |

|

|

(3,386 |

) |

|

|

(1 |

) |

|

|

(2,685 |

) |

|

|

(16,753 |

) |

|

Other income (expense), net |

|

5,135 |

|

|

|

(806 |

) |

|

|

— |

|

|

|

(19 |

) |

|

|

902 |

|

|

|

5,212 |

|

|

Operating (loss) income |

|

(480 |

) |

|

|

2,083 |

|

|

|

172 |

|

|

|

(34 |

) |

|

|

(1,783 |

) |

|

|

(42 |

) |

|

Provision for income taxes |

|

(218 |

) |

|

|

(818 |

) |

|

|

— |

|

|

|

— |

|

|

|

(263 |

) |

|

|

(1,299 |

) |

|

(Loss) income from consolidated entities |

|

(698 |

) |

|

|

1,265 |

|

|

|

172 |

|

|

|

(34 |

) |

|

|

(2,046 |

) |

|

|

(1,341 |

) |

|

Less: net (income) loss attributable to non-controlling interests, net of tax |

|

— |

|

|

|

(91 |

) |

|

|

— |

|

|

|

— |

|

|

|

52 |

|

|

|

(39 |

) |

|

Net (loss) income |

$ |

(698 |

) |

|

$ |

1,174 |

|

|

$ |

172 |

|

|

$ |

(34 |

) |

|

$ |

(1,994 |

) |

|

$ |

(1,380 |

) |

|

Adjusted EBITDA (1) |

$ |

1,330 |

|

|

$ |

4,778 |

|

|

$ |

354 |

|

|

$ |

(35 |

) |

|

$ |

(1,952 |

) |

|

$ |

4,475 |

|

|

(Loss) income per share |

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

(0.00 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

Diluted (loss) income per share |

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

(0.00 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended June 30, 2022 |

|

|

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

Sales |

$ |

47,176 |

|

|

$ |

29,793 |

|

|

$ |

5,793 |

|

|

$ |

141 |

|

|

$ |

— |

|

|

$ |

82,903 |

|

Cost of sales |

|

(56,143 |

) |

|

|

(18,285 |

) |

|

|

(1,956 |

) |

|

|

(196 |

) |

|

|

— |

|

|

|

(76,580 |

) |

Selling, general and administrative expenses |

|

(2,808 |

) |

|

|

(8,616 |

) |

|

|

(4,369 |

) |

|

|

(7 |

) |

|

|

(2,716 |

) |

|

|

(18,516 |

) |

Other expense, net |

|

(402 |

) |

|

|

(231 |

) |

|

|

(12 |

) |

|

|

— |

|

|

|

(577 |

) |

|

|

(1,222 |

) |

Write-off of joint venture loan |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(592 |

) |

|

|

(592 |

) |

Impairments |

|

— |

|

|

|

— |

|

|

|

(29,799 |

) |

|

|

— |

|

|

|

— |

|

|

|

(29,799 |

) |

Operating (loss) income |

|

(12,177 |

) |

|

|

2,661 |

|

|

|

(30,343 |

) |

|

|

(62 |

) |

|

|

(3,885 |

) |

|

|

(43,806 |

) |

Recovery of (provision for) income taxes |

|

2,827 |

|

|

|

(991 |

) |

|

|

7,025 |

|

|

|

— |

|

|

|

853 |

|

|

|

9,714 |

|

(Loss) income from consolidated entities |

|

(9,350 |

) |

|

|

1,670 |

|

|

|

(23,318 |

) |

|

|

(62 |

) |

|

|

(3,032 |

) |

|

|

(34,092 |

) |

Less: net loss attributable to non-controlling interests, net of tax |

|

— |

|

|

|

152 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

152 |

|

Loss from equity method investments |

|

— |

|

|

|

— |

|

|

|

(331 |

) |

|

|

— |

|

|

|

(2,284 |

) |

|

|

(2,615 |

) |

Net (loss) income |

$ |

(9,350 |

) |

|

$ |

1,822 |

|

|

$ |

(23,649 |

) |

|

$ |

(62 |

) |

|

$ |

(5,316 |

) |

|

$ |

(36,555 |

) |

Adjusted EBITDA (1) |

$ |

(10,282 |

) |

|

$ |

2,743 |

|

|

$ |

(633 |

) |

|

$ |

(63 |

) |

|

$ |

(2,073 |

) |

|

$ |

(10,308 |

) |

(Loss) income per share |

$ |

(0.11 |

) |

|

$ |

0.02 |

|

|

$ |

(0.29 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.41 |

) |

Diluted (loss) income per share |

$ |

(0.11 |

) |

|

$ |

0.02 |

|

|

$ |

(0.29 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.41 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Six Months Ended June 30, 2023 |

|

|

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

Sales |

$ |

78,413 |

|

|

$ |

53,177 |

|

|

$ |

10,278 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

141,868 |

|

Cost of sales |

|

(80,559 |

) |

|

|

(34,007 |

) |

|

|

(3,482 |

) |

|

|

(21 |

) |

|

|

— |

|

|

|

(118,069 |

) |

Selling, general and administrative expenses |

|

(5,770 |

) |

|

|

(14,675 |

) |

|

|

(7,003 |

) |

|

|

(30 |

) |

|

|

(6,680 |

) |

|

|

(34,158 |

) |

Other income (expense), net |

|

4,591 |

|

|

|

(1,410 |

) |

|

|

3 |

|

|

|

(19 |

) |

|

|

1,071 |

|

|

|

4,236 |

|

Operating (loss) income |

|

(3,325 |

) |

|

|

3,085 |

|

|

|

(204 |

) |

|

|

(70 |

) |

|

|

(5,609 |

) |

|

|

(6,123 |

) |

Recovery of (provision for) income taxes |

|

8 |

|

|

|

(1,956 |

) |

|

|

— |

|

|

|

— |

|

|

|

15 |

|

|

|

(1,933 |

) |

(Loss) income from consolidated entities |

|

(3,317 |

) |

|

|

1,129 |

|

|

|

(204 |

) |

|

|

(70 |

) |

|

|

(5,594 |

) |

|

|

(8,056 |

) |

Less: net loss (income) attributable to non-controlling interests, net of tax |

|

— |

|

|

|

(60 |

) |

|

|

— |

|

|

|

— |

|

|

|

100 |

|

|

|

40 |

|

Net (loss) income |

$ |

(3,317 |

) |

|

$ |

1,069 |

|

|

$ |

(204 |

) |

|

$ |

(70 |

) |

|

$ |

(5,494 |

) |

|

$ |

(8,016 |

) |

Adjusted EBITDA(1) |

$ |

335 |

|

|

$ |

8,688 |

|

|

$ |

203 |

|

|

$ |

(71 |

) |

|

$ |

(4,161 |

) |

|

$ |

4,994 |

|

(Loss) income per share |

$ |

(0.03 |

) |

|

$ |

0.01 |

|

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

Diluted (loss) income per share |

$ |

(0.03 |

) |

|

$ |

0.01 |

|

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Six Months Ended June 30, 2022 |

|

|

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

Sales |

$ |

88,525 |

|

|

$ |

51,562 |

|

|

$ |

12,836 |

|

|

$ |

136 |

|

|

$ |

— |

|

|

$ |

153,059 |

|

Cost of sales |

|

(101,782 |

) |

|

|

(30,544 |

) |

|

|

(4,287 |

) |

|

|

(219 |

) |

|

|

— |

|

|

|

(136,832 |

) |

Selling, general and administrative expenses |

|

(5,948 |

) |

|

|

(15,916 |

) |

|

|

(8,760 |

) |

|

|

(39 |

) |

|

|

(5,788 |

) |

|

|

(36,451 |

) |

Other (expense) income, net |

|

(432 |

) |

|

|

(977 |

) |

|

|

(12 |

) |

|

|

(6 |

) |

|

|

(57 |

) |

|

|

(1,484 |

) |

Write-off of joint venture loan |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(592 |

) |

|

|

(592 |

) |

Impairments |

|

— |

|

|

|

— |

|

|

|

(29,799 |

) |

|

|

— |

|

|

|

— |

|

|

|

(29,799 |

) |

Operating (loss) income |

|

(19,637 |

) |

|

|

4,125 |

|

|

|

(30,022 |

) |

|

|

(128 |

) |

|

|

(6,437 |

) |

|

|

(52,099 |

) |

Recovery of (provision for) income taxes |

|

4,542 |

|

|

|

(1,630 |

) |

|

|

7,025 |

|

|

|

— |

|

|

|

1,443 |

|

|

|

11,380 |

|

(Loss) income from consolidated entities |

|

(15,095 |

) |

|

|

2,495 |

|

|

|

(22,997 |

) |

|

|

(128 |

) |

|

|

(4,994 |

) |

|

|

(40,719 |

) |

Less: net loss attributable to non-controlling interests, net of tax |

|

— |

|

|

|

314 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

314 |

|

Loss from equity method investments |

|

— |

|

|

|

— |

|

|

|

(383 |

) |

|

|

— |

|

|

|

(2,284 |

) |

|

|

(2,667 |

) |

Net (loss) income |

$ |

(15,095 |

) |

|

$ |

2,809 |

|

|

$ |

(23,380 |

) |

|

$ |

(128 |

) |

|

$ |

(7,278 |

) |

|

$ |

(43,072 |

) |

Adjusted EBITDA (1) |

$ |

(16,483 |

) |

|

$ |

4,847 |

|

|

$ |

(53 |

) |

|

$ |

(122 |

) |

|

$ |

(4,608 |

) |

|

$ |

(16,419 |

) |

(Loss) income per share |

$ |

(0.17 |

) |

|

$ |

0.03 |

|

|

$ |

(0.29 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.49 |

) |

Diluted (loss) income per share |

$ |

(0.17 |

) |

|

$ |

0.03 |

|

|

$ |

(0.29 |

) |

|

$ |

(0.00 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.49 |

) |

1 Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA may not be comparable to similar measures presented by other issuers. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company because it excludes non-recuring and other items that do not reflect our business performance. Adjusted EBITDA includes the Company’s 70% interest in Rose LifeScience.

A detailed discussion of our consolidated and segment results can be found in the 10Q MD&A on the Village Farms website under Financial Reports (https://villagefarms.com/financial-reports/) within the Investors section.

Reconciliation of Net Income to Adjusted EBITDA

The following tables reflects a reconciliation of net income to Adjusted EBITDA, as presented by the Company:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended June 30, 2023 |

|

(in thousands of U.S. dollars) |

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

Net (loss) income |

$ |

(698 |

) |

|

$ |

1,174 |

|

|

$ |

172 |

|

|

$ |

(34 |

) |

|

$ |

(1,994 |

) |

|

$ |

(1,380 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

1,302 |

|

|

|

1,494 |

|

|

|

87 |

|

|

|

— |

|

|

|

63 |

|

|

|

2,946 |

|

Foreign currency exchange gain |

|

(80 |

) |

|

|

(22 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

(663 |

) |

|

|

(766 |

) |

Interest expense, net |

|

588 |

|

|

|

728 |

|

|

|

— |

|

|

|

— |

|

|

|

(237 |

) |

|

|

1,079 |

|

Provision for income taxes |

|

218 |

|

|

|

818 |

|

|

|

— |

|

|

|

— |

|

|

|

263 |

|

|

|

1,299 |

|

Share-based compensation |

|

— |

|

|

|

119 |

|

|

|

95 |

|

|

|

— |

|

|

|

385 |

|

|

|

599 |

|

Interest expense for JV's |

|

— |

|

|

|

34 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34 |

|

Amortization for JVs |

|

— |

|

|

|

367 |

|

|

|

— |

|

|

|

— |

|

|

|

231 |

|

|

|

598 |

|

Foreign currency exchange loss for JVs |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Share-based compensation for JV's |

|

— |

|

|

|

40 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

40 |

|

Other expenses for JV's |

|

— |

|

|

|

(9 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(9 |

) |

Deferred financing fees |

|

— |

|

|

|

34 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34 |

|

Other expense, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Adjusted EBITDA (2) |

$ |

1,330 |

|

|

$ |

4,778 |

|

|

$ |

354 |

|

|

$ |

(35 |

) |

|

$ |

(1,952 |

) |

|

$ |

4,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Six Months Ended June 30, 2023 |

|

(in thousands of U.S. dollars) |

VF Fresh

(Produce) |

|

|

Cannabis Canada |

|

|

Cannabis U.S. |

|

|

Clean

Energy |

|

|

Corporate |

|

|

Total |

|

Net (loss) income |

$ |

(3,317 |

) |

|

$ |

1,069 |

|

|

$ |

(204 |

) |

|

$ |

(70 |

) |

|

$ |

(5,494 |

) |

|

$ |

(8,016 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

2,556 |

|

|

|

3,284 |

|

|

|

226 |

|

|

|

— |

|

|

|

124 |

|

|

|

6,190 |

|

Foreign currency exchange (gain) loss |

|

(27 |

) |

|

|

(35 |

) |

|

|

19 |

|

|

|

(1 |

) |

|

|

(689 |

) |

|

|

(733 |

) |

Interest expense, net |

|

1,131 |

|

|

|

1,289 |

|

|

|

(24 |

) |

|

|

— |

|

|

|

(380 |

) |

|

|

2,016 |

|

(Recovery of) provision for income taxes |

|

(8 |

) |

|

|

1,956 |

|

|

|

— |

|

|

|

— |

|

|

|

(15 |

) |

|

|

1,933 |

|

Share-based compensation |

|

— |

|

|

|

263 |

|

|

|

185 |

|

|

|

— |

|

|

|

1,834 |

|

|

|

2,282 |

|

Interest expense for JV's |

|

— |

|

|

|

34 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

34 |

|

Amortization for JVs |

|

— |

|

|

|

699 |

|

|

|

— |

|

|

|

— |

|

|

|

459 |

|

|

|

1,158 |

|

Foreign currency exchange loss for JVs |

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

Share-based compensation for JV's |

|

— |

|

|

|

74 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

74 |

|

Other expense for JV's |

|

— |

|

|

|

(15 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(15 |

) |

Deferred financing fees |

|

— |

|

|

|

68 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

68 |

|

Other expense, net |

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

Adjusted EBITDA (2) |

$ |

335 |

|

|

$ |

8,688 |

|

|

$ |

203 |

|

|

$ |

(71 |

) |

|

$ |

(4,161 |

) |

|

$ |

4,994 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Three Months Ended June 30, 2022 |

|

(in thousands of U.S. dollars) |

VF Fresh

(Produce) |

|

|

|

Cannabis Canada |

|

|

|

Cannabis U.S. |

|

|

|

Clean

Energy |

|

|

|

Corporate |

|

|

Total |

|

Net (loss) income |

$ |

(9,350 |

) |

|

|

|

$ |

1,822 |

|

|

|

|

$ |

(23,649 |

) |

|

|

|

$ |

(62 |

) |

|

|

|

$ |

(5,316 |

) |

|

$ |

(36,555 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

1,242 |

|

|

|

|

|

1,385 |

|

|

|

|

|

141 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

2,768 |

|

Foreign currency exchange loss |

|

236 |

|

|

|

|

|

28 |

|

|

|

|

|

14 |

|

|

|

|

|

— |

|

|

|

|

|

292 |

|

|

|

570 |

|

Interest expense, net |

|

428 |

|

|

|

|

|

195 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

82 |

|

|

|

705 |

|

(Recovery of) provision for income taxes |

|

(2,827 |

) |

|

|

|

|

991 |

|

|

|

|

|

(7,025 |

) |

|

|

|

|

— |

|

|

|

|

|

(853 |

) |

|

|

(9,714 |

) |

Share-based compensation |

|

— |

|

|

|

|

|

219 |

|

|

|

|

|

107 |

|

|

|

|

|

— |

|

|

|

|

|

788 |

|

|

|

1,114 |

|

Interest expense for JV's |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

26 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

26 |

|

Amortization for JVs |

|

— |

|

|

|

|

|

130 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

130 |

|

Foreign currency exchange gain for JVs |

|

— |

|

|

|

|

|

(28 |

) |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

(28 |

) |

Deferred financing fees |

|

— |

|

|

|

|

|

61 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

61 |

|

Impairments |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

29,799 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

29,799 |

|

JV exit-related costs |

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

2,876 |

|

|

|

2,876 |

|

Gain on disposal of assets |

|

(2 |

) |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

(2 |

) |

Purchase price adjustment (1) |

|

— |

|

|

|

|

|

(2,059 |

) |

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

|

(2,059 |

) |

Other expense, net |

|

(9 |

) |

|

|

|

(1 |

) |

|

|

|

(46 |

) |

|

|

|

(1 |

) |

|

|

|

58 |

|

|

|

1 |

|

Adjusted EBITDA (2) |

$ |

(10,282 |

) |

|

|

$ |

2,743 |

|

|

|

$ |

(633 |

) |

|

|

$ |

(63 |

) |

|

|

$ |

(2,073 |

) |

|

$ |

(10,308 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The Six Months Ended June 30, 2022 |

|

(in thousands of U.S. dollars) |

VF Fresh

(Produce) |

|

|

|

Cannabis Canada |

|

|

|

Cannabis U.S. |

|

|

|

Clean

Energy |

|

|

|

Corporate |

|

|

Total |

|

Net (loss) income |

$ |

(15,095 |

) |

|

|

|

$ |

2,809 |

|

|

|

|

$ |

(23,380 |

) |

|

|

|

$ |

(128 |

) |

|

|

|

$ |

(7,278 |

) |

|

$ |

(43,072 |

) |

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization |

|

2,501 |

|

|

|

|

2,687 |

|

|

|

|

282 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

5,470 |

|

Foreign currency exchange loss (gain) |

|

236 |

|

|

|

|

117 |

|

|

|

|

14 |

|

|

|

|

2 |

|

|

|

|

(118 |

) |

|

|

251 |

|

Interest expense, net |

|

428 |

|

|

|

|

776 |

|

|

|

|

— |

|

|

|

|

4 |

|

|

|

|

70 |

|

|

|

1,278 |

|

(Recovery of) provision for income taxes |

|

(4,542 |

) |

|

|

|

|

1,630 |

|

|

|

|

|

(7,025 |

) |

|

|

|

|

— |

|

|

|

|

|

(1,443 |

) |

|

|

(11,380 |

) |

Share-based compensation |

|

— |

|

|

|

|

586 |

|

|

|

|

202 |

|

|

|

|

— |

|

|

|

|

1,290 |

|

|

|

2,078 |

|

Interest expense for JV's |

|

— |

|

|

|

|

— |

|

|

|

|

39 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

39 |

|

Amortization for JVs |

|

— |

|

|

|

|

224 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

224 |

|

Foreign currency exchange loss for JVs |

|

— |

|

|

|

|

1 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

1 |

|

Deferred financing fees |

|

— |

|

|

|

|

127 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

127 |

|

Impairment |

|

— |

|

|

|

|

— |

|

|

|

|

29,799 |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

29,799 |

|

JV exit-related costs |

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

2,876 |

|

|

|

2,876 |

|

Gain on disposal of assets |

|

(2 |

) |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

(2 |

) |

Purchase price adjustment (1) |

|

— |

|

|

|

|

(4,109 |

) |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

(4,109 |

) |

Other expense, net |

|

(9 |

) |

|

|

|

(1 |

) |

|

|

|

16 |

|

|

|

— |

|

|

|

|

(5 |

) |

|

|

1 |

|

Adjusted EBITDA (2) |

$ |

(16,483 |

) |

|

|

$ |

4,847 |

|

|

|

$ |

(53 |

) |

|

|

$ |

(122 |

) |

|

|

$ |

(4,608 |

) |

|

$ |

(16,419 |

) |

1 The purchase price adjustment primarily reflects the non-cash accounting charge resulting from the revaluation of Pure Sunfarms’ inventory to fair value at the acquisition date on November 2, 2020, Pure Sunfarms' intangible amortization and Rose intangible amortization resulting from the September 30, 2022 finalization of the Rose purchase price accounting.

2 Adjusted EBITDA is not a recognized earnings measure and does not have a standardized meaning prescribed by GAAP. Therefore, Adjusted EBITDA presented for these segments may not be comparable to similar measures presented for comparable segments by other issuers. Management believes that Adjusted EBITDA is a useful supplemental measure in evaluating the performance of the Company’s segments because it excludes non-recurring and other items that do not reflect the business performance of our segments. Adjusted EBITDA for Canadian Cannabis includes the 70% interest in Rose LifeScience since acquisition and Adjusted EBITDA for “Corporate” and “Total” includes our 65% interest in VFH.

This press release is intended to be read in conjunction with the Company’s Consolidated Financial Statements ("Financial Statements”) and Management’s Discussion & Analysis ("MD&A”) for the three

months ended June 30, 2023 in the Company Form 10-Q, which will be filed on (www.sec.gov/edgar.shtml) and SEDAR (www.sedar.com) and will be available at www.villagefarms.com.

Conference Call

Village Farms’ management team will host a conference call to discuss second quarter financial results today, Wednesday August 9, 2023, at 8:30 a.m. ET. Participants can access the conference call via a webcast at Village Farms Second Quarter 2023 Conference Call Webcast or on the Company website at Village Farms - Events. Participants wanting to access the conference call by telephone must register in advance at Village Farms Second Quarter 2023 Conference Call to receive telephone dial-in information.

The live question and answer session will be limited to analysts, however others are invited to submit their questions ahead of the conference call via email at investorrelations@villagefarms.com. Management will address questions received via email as part of the conference call question and answer session as time permits.

Conference Call Archive Access Information

For those unable to participate in the conference call at the scheduled time, it will be archived for replay beginning approximately one hour following completion of the call on Village Farms’ web site at http://villagefarms.com/investor-relations/investor-calls.

About Village Farms International

Village Farms leverages decades of experience as a large-scale, Controlled Environment Agriculture-based, vertically integrated supplier for high-value, high-growth plant-based Consumer Packaged Goods opportunities, with a strong foundation as a leading fresh produce supplier to grocery and large-format retailers throughout the US and Canada, and new high-growth opportunities in the cannabis and CBD categories in North America and selected markets internationally.

In Canada, the Company's wholly-owned Canadian subsidiary, Pure Sunfarms, is one of the single largest cannabis operations in the world, the lowest-cost greenhouse producer and one of Canada’s best-selling brands. The Company also owns 70% of Québec-based, Rose LifeScience, a leading third-party cannabis products commercialization expert in the Province of Québec,

In the US, wholly-owned Balanced Health Botanicals is one of the leading CBD brands and e-commerce platforms in the country. Subject to compliance with all applicable US federal and state laws and stock exchange rules, Village Farms plans to enter the US high-THC cannabis market via multiple strategies, leveraging one of the largest greenhouse operations in the country (more than 5.5 million square feet in West Texas), as well as the operational and product expertise gained through Pure Sunfarms' cannabis success in Canada.

Internationally, Village Farms is targeting selected, nascent, legal cannabis and CBD opportunities with significant medium- and long-term potential, with an initial focus on the Asia-Pacific region and Europe.

Cautionary Statement Regarding Forward-Looking Information

As used in this Press Release, the terms “Village Farms”, “Village Farms International”, the “Company”, “we”, “us”, “our” and similar references refer to Village Farms International, Inc. and our consolidated subsidiaries, and the term “Common Shares” refers to our common shares, no par value. Our financial information is presented in U.S. dollars and all references in this Press Release to “$” means U.S. dollars and all references to “C$” means Canadian dollars.

This Press Release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is subject to the safe harbor created by those sections. This Press Release also contains "forward-looking information" within the meaning of applicable Canadian securities laws. We refer to such forward-looking statements and forward-looking information collectively as "forward-looking statements". Forward-looking statements may relate to the Company's future outlook or financial position and

anticipated events or results and may include statements regarding the financial position, business strategy, budgets, expansion plans, litigation, projected production, projected costs, capital expenditures, financial results, taxes, plans and objectives of or involving the Company. Particularly, statements regarding future results, performance, achievements, prospects or opportunities for the Company, the greenhouse vegetable or produce industry and the cannabis industry and market are forward-looking statements. In some cases, forward-looking information can be identified by such terms as "can", "outlook", "may", "might", "will", "could", "should", "would", "occur", "expect", "plan", "anticipate", "believe", "intend", "try", "estimate", "predict", "potential", "continue", "likely", "schedule", "objectives", or the negative or grammatical variation thereof or other similar expressions concerning matters that are not historical facts. The forward-looking statements in this Press Release are subject to risks that may include, but are not limited to: our limited operating history in the cannabis and cannabinoids industry, including that of Pure Sunfarms, Inc. (“Pure Sunfarms”), Rose LifeScience Inc. (“Rose” or “Rose LifeScience”) and Balanced Health Botanicals, LLC (“Balanced Health”); the legal status of the cannabis business of Pure Sunfarms and Rose and the hemp business of Balanced Health; risks relating to the integration of Balanced Health and Rose into our consolidated business; risks relating to obtaining additional financing on acceptable terms, including our dependence upon credit facilities and dilutive transactions; potential difficulties in achieving and/or maintaining profitability; variability of product pricing; risks inherent in the cannabis, hemp, CBD, cannabinoids, and agricultural businesses; our market position and competitive position; our ability to leverage current business relationships for future business involving hemp and cannabinoids; the ability of Pure Sunfarms and Rose to cultivate and distribute cannabis in Canada; existing and new governmental regulations, including risks related to regulatory compliance and regarding obtaining and maintaining licenses required under the Cannabis Act (Canada), the Criminal Code and other Acts, S.C. 2018, C. 16 (Canada) for its Canadian operational facilities, and changes in our regulatory requirements; legal and operational risks relating to expected conversion of our greenhouses to cannabis production in Canada and in the United States; risks related to rules and regulations at the U.S. Federal (Food and Drug Administration and United States Department of Agriculture), state and municipal levels with respect to produce and hemp, cannabidiol-based products commercialization; retail consolidation, technological advances and other forms of competition; transportation disruptions; product liability and other potential litigation; retention of key executives; labor issues; uninsured and underinsured losses; vulnerability to rising energy costs; inflationary effects on costs of cultivation and transportation; recessionary effects on demand of our products; environmental, health and safety risks, foreign exchange exposure, risks associated with cross-border trade; difficulties in managing our growth; restrictive covenants under our credit facilities; natural catastrophes; rising interest rates; and tax risks.

The Company has based these forward-looking statements on factors and assumptions about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy and financial needs. Although the forward-looking statements contained in this Press Release are based upon assumptions that management believes are reasonable based on information currently available to management, there can be no assurance that actual results will be consistent with these forward-looking statements. Forward-looking statements necessarily involve known and unknown risks and uncertainties, many of which are beyond the Company's control, which may cause the Company's or the industry's actual results, performance, achievements, prospects and opportunities in future periods to differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, the factors contained in the Company's filings with securities regulators, including this Press Release.

When relying on forward-looking statements to make decisions, the Company cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties and should not be read as guarantees of future results, performance, achievements, prospects and opportunities. The forward-looking statements made in this Press Release relate only to events or information as of the date on which the statements are made in this Press Release. Except as required by

law, the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Contact Information

|

Lawrence Chamberlain Investor Relations LodeRock Advisors (416) 519-4196 lawrence.chamberlain@loderockadvisors.com |

Village Farms International, Inc.

Condensed Consolidated Statements of Financial Position

(In thousands of United States dollars, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

26,659 |

|

|

$ |

16,676 |

|

Restricted cash |

|

|

5,000 |

|

|

|

5,000 |

|

Trade receivables |

|

|

29,509 |

|

|

|

27,558 |

|

Inventories |

|

|

73,733 |

|

|

|

70,582 |

|

Other receivables |

|

|

10,504 |

|

|

|

309 |

|

Income tax receivable, net |

|

|

1,741 |

|

|

|

6,900 |

|

Prepaid expenses and deposits |

|

|

9,563 |

|

|

|

5,959 |

|

Total current assets |

|

|

156,709 |

|

|

|

132,984 |

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment |

|

|

207,374 |

|

|

|

207,701 |

|

Investments |

|

|

2,109 |

|

|

|

2,109 |

|

Goodwill |

|

|

67,239 |

|

|

|

66,225 |

|

Intangibles |

|

|

36,532 |

|

|

|

37,157 |

|

Deferred tax asset |

|

|

4,201 |

|

|

|

4,201 |

|

Right-of-use assets |

|

|

12,962 |

|

|

|

9,132 |

|

Other assets |

|

|

1,976 |

|

|

|

5,776 |

|

Total assets |

|

$ |

489,102 |

|

|

$ |

465,285 |

|

LIABILITIES |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Line of credit |

|

$ |

4,000 |

|

|

$ |

7,529 |

|

Trade payables |

|

|

20,551 |

|

|

|

24,894 |

|

Current maturities of long-term debt |

|

|

9,373 |

|

|

|

9,646 |

|

Accrued sales taxes |

|

|

13,211 |

|

|

|

11,594 |

|

Accrued loyalty program |

|

|

1,821 |

|

|

|

2,060 |

|

Accrued liabilities |

|

|

19,384 |

|

|

|

13,064 |

|

Lease liabilities - current |

|

|

1,755 |

|

|

|

1,970 |

|

Other current liabilities |

|

|

1,680 |

|

|

|

1,458 |

|

Total current liabilities |

|

|

71,775 |

|

|

|

72,215 |

|

Non-current liabilities |

|

|

|

|

|

|

Long-term debt |

|

|

41,615 |

|

|

|

43,821 |

|

Deferred tax liability |

|

|

19,138 |

|

|

|

19,756 |

|

Lease liabilities - non-current |

|

|

11,816 |

|

|

|

7,785 |

|

Other liabilities |

|

|

1,927 |

|

|

|

1,714 |

|

Total liabilities |

|

|

146,271 |

|

|

|

145,291 |

|

Commitments and contingencies |

|

|

|

|

|

|

MEZZANINE EQUITY |

|

|

|

|

|

|

Redeemable non-controlling interest |

|

|

16,223 |

|

|

|

16,164 |

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

Common stock, no par value per share - unlimited shares authorized;

110,238,929 shares issued and outstanding at June 30, 2023 and 91,788,929 shares issued and outstanding at December 31, 2022. |

|

|

386,719 |

|

|

|

372,429 |

|

Additional paid in capital |

|

|

24,888 |

|

|

|

13,372 |

|

Accumulated other comprehensive loss |

|

|

(3,284 |

) |

|

|

(8,371 |

) |

Retained earnings |

|

|

(82,383 |

) |

|

|

(74,367 |

) |

Total Village Farms International, Inc. shareholders’ equity |

|

|

325,940 |

|

|

|

303,063 |

|

Non-controlling interest |

|

|

668 |

|

|

|

767 |

|

Total shareholders’ equity |

|

|

326,608 |

|

|

|

303,830 |

|

Total liabilities, mezzanine equity and shareholders’ equity |

|

$ |

489,102 |

|

|

$ |

465,285 |

|

Village Farms International, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands of United States dollars, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Sales |

|

$ |

77,212 |

|

|

$ |

82,903 |

|

|

$ |

141,868 |

|

|

$ |

153,059 |

|

Cost of sales |

|

|

(65,713 |

) |

|

|

(76,580 |

) |

|

|

(118,069 |

) |

|

|

(136,832 |

) |

Gross margin |

|

|

11,499 |

|

|

|

6,323 |

|

|

|

23,799 |

|

|

|

16,227 |

|

Selling, general and administrative expenses |

|

|

(16,753 |

) |

|

|

(18,516 |

) |

|

|

(34,158 |

) |

|

|

(36,451 |

) |

Interest expense |

|

|

(1,411 |

) |

|

|

(665 |

) |

|

|

(2,544 |

) |

|

|

(1,348 |

) |

Interest income |

|

|

283 |

|

|

|

— |

|

|

|

479 |

|

|

|

110 |

|

Foreign exchange gain (loss) |

|

|

738 |

|

|

|

(527 |

) |

|

|

669 |