VEON Ltd.

and

VEON Holdings B.V.

Proposed Scheme of Arrangement of VEON

Holdings B.V.

Invitation to Submit Voting and Proxy

Forms and Notice of Scheme Meeting

Amsterdam, Netherlands, 21 December 2022

19:50 CET: Further to the announcement made today

regarding the Court order granting the Company permission to

convene the Scheme Meeting and the issuance of the Explanatory

Statement and accompanying documentation via the Scheme Website,

VEON Ltd. (NASDAQ, Euronext Amsterdam: VEON), a global digital

operator that provides converged connectivity and online services,

and its subsidiary, VEON Holdings B.V. (the

“Company”) hereby give notice that the Scheme

Meeting will take place virtually by webinar, via Zoom, on 24

January 2023 at 10:00 a.m. (London time) (or such later time or

date as the Company may decide and notify to Scheme Creditors) upon

the Company being satisfied that it has obtained all necessary

Authorisations for the Scheme Meeting to be held (including the

OFAC Licence on terms that would authorise the Company to proceed

with the Scheme Meeting). All Scheme Creditors are requested to

attend the Scheme Meeting, via Zoom (either in person, by duly

authorised representative if a corporation, or by proxy).

The Notice of Scheme Meeting, which provides

further information in relation to the Scheme Meeting, is appended

hereto as Annexure 1.

To participate and vote at the Scheme Meeting,

provided they are not precluded from doing so by law or regulation,

Scheme Creditors (or their DTC Participant on their behalf, as

applicable) must have submitted validly completed Voting and Proxy

Forms to Kroll Issuer Services Limited (as the Company’s

information agent) by the Voting Instruction Deadline (currently

anticipated to be 5:00 p.m. (London time) on 19 January 2023).

Accordingly, the Company has today made

available to Scheme Creditors (via the Scheme Website at

https://deals.is.kroll.com/veon) the Voting and Proxy Form and

hereby invites Scheme Creditors (including the ultimate beneficial

owners of the 2023 Notes issued by the Company), provided they are

not precluded from doing so by law or regulation, to submit (or

procure that their DTC Participant submits on their behalf, as

applicable) their Voting and Proxy Forms in accordance with the

instructions set out in the Explanatory Statement well in advance

of 5:00 p.m. (London time) on 19 January 2023 (being the Voting

Instruction Deadline). Instructions for completing the Voting and

Proxy Form are set out in the Voting and Proxy Form. Validly

completed Voting and Proxy Forms can be submitted to Kroll Issuer

Services Limited (as the Company’s information agent) online

via https://deals.is.kroll.com/veon or by email in pdf form

to veon@is.kroll.com.

Scheme Creditors should be aware that Clearing

Systems, DTC Participants, other Account Holders and/or

Intermediaries may have earlier deadlines that they (and their

Account Holders) may be required to comply with.

Scheme Creditors that have questions in relation

to the Explanatory Statement and accompanying documentation, the

Voting and Proxy Form or the Scheme Meeting may contact Kroll

Issuer Services Limited (as the Company’s information agent) by

email to veon@is.kroll.com or by telephone on + 44 20 7704

0880.

Scheme Creditors and/or Account Holders

requiring any assistance in completing their Voting and Proxy Forms

should contact the Information Agent by email to veon@is.kroll.com

or by telephone on + 44 20 7704 0880.

Capitalised terms used but not defined in this

announcement have the meaning given to them in the Explanatory

Statement.

About VEON

VEON is a global digital operator that currently

provides converged connectivity and online services to over 200

million customers in seven dynamic markets. We are transforming

people’s lives, empowering individuals, creating opportunities for

greater digital inclusion and driving economic growth across

countries that are home to more than 8% of the world’s population.

Headquartered in Amsterdam, VEON is listed on NASDAQ and

Euronext.

For more information visit: https://www.veon.com.

Important Notice

This release is for informational purposes only

and shall not constitute a prospectus or an offer to sell or the

solicitation of an offer to buy securities in the United States or

any other jurisdiction, nor shall there be any offer of securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under applicable

securities laws.

This press release is not a prospectus for the

purposes of Regulation (EU) 2017/1129.

This communication or information contained

herein is not an offer, or an invitation to make offers, to sell,

exchange or otherwise transfer securities in the Russian Federation

to or for the benefit of any Russian person or entity and does not

constitute an advertisement or offering of securities in the

Russian Federation within the meaning of Russian securities

laws.

Elements of this press release contain or may

contain “inside information” as defined under the Market Abuse

Regulation (EU) No. 596/2014.

Disclaimer

This release contains “forward-looking

statements,” as the phrase is defined in Section 27A of the U.S.

Securities Act of 1933, as amended, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended. Forward-looking

statements are not historical facts, and include statements

relating to, among other things, VEON’s intent to convene the

Scheme Meeting. Forward looking statements are inherently subject

to risks and uncertainties, many of which VEON cannot predict with

accuracy and some of which VEON might not even anticipate. The

forward-looking statements contained in this release speak only as

of the date of this release. VEON disclaims any obligation to

update them or to announce publicly any revision to any of the

forward-looking statements contained in this release, or to make

corrections to reflect future events or developments.

Any steps taken in respect of the Scheme and in

connection with the Amendments must be in compliance with all

applicable sanctions laws and regulations, including the sanctions

laws and regulations administered by the European Union, the United

Kingdom and the United States, and including securing any necessary

licences and approvals from competent sanctions authorities.

Contact Information

VEONGroup Director Investor RelationsNik

Kershawbonds@veon.com

Annexure 1

No. CR‑2022-004748

IN THE HIGH COURT OF JUSTICEBUSINESS

AND PROPERTY COURTS OF ENGLAND AND WALES

INSOLVENCY AND COMPANIES LIST (ChD)

In the Matter of VEON Holdings

B.V.

and

In the Matter of the Companies Act

2006

USD1,000,000,000 5.95 per cent. notes

due 13 February 2023 (ISIN: US92718WAE93 and XS0889401724) (the

“February 2023 Notes”) and USD700,000,000

7.25 per cent. notes due 26 April 2023 (ISIN:

US36251BAB18 and XS1400710726) (the “April 2023

Notes” and, together with the February 2023 Notes,

the “2023 Notes”) issued by VEON Holdings B.V.

NOTICE IS HEREBY GIVEN that, by

an order dated 21 December 2022 made in the above matter, the High

Court of Justice of England and Wales (the

“Court”) has directed that a single meeting (the

“Scheme Meeting”) be convened of the Scheme

Creditors (being the 2023 Noteholders and the 2023 Notes Trustees)

of VEON Holdings B.V. (the “Company”) for the

purposes of considering and, if thought fit, approving (with or

without modification, addition or condition approved or imposed by

the Court and/or agreed by the Company) a scheme of arrangement

proposed to be made between the Company and the Scheme Creditors in

respect of the 2023 Notes (the

“Scheme”).

The Scheme Meeting will be held at 10.00 a.m.

(London time) on 24 January 2023 (or such later time or date as the

Company may decide and notify to Scheme Creditors via

https://deals.is.kroll.com/veon/ (the “Scheme

Website”) and the Clearing Systems) upon the Company being

satisfied that it has obtained all necessary Authorisations for the

Scheme Meeting to be held (including the OFAC Licence on terms that

would authorise the Company to proceed with the Scheme

Meeting).

The Record Time for the Scheme is 5:00 p.m. (New

York time) on the date falling two (2) Business Days before the

Scheme Meeting.

A copy of the Scheme and a copy of the statement

required to be furnished pursuant to section 897 of the

Companies Act (the “Explanatory Statement”) are

available on the Scheme Website. Capitalised terms not

defined herein shall have the meaning given to them in the

Explanatory Statement.

Voting on the Scheme

The 2023 Noteholders, being the beneficial

owners of the 2023 Notes, and the 2023 Notes Trustees are the

Scheme Creditors.

Any Scheme Creditor intending to attend (in

person by webinar or, if a corporation, by a duly authorised

representative, or by proxy) and vote on the Scheme at the Scheme

Meeting must submit (or, if the Scheme Creditor holds their 2023

Notes through the DTC, procure that their DTC Participant submits

on their behalf) validly completed Voting and Proxy Forms to the

Information Agent before the Voting Instruction Deadline (5.00 pm

London time on 19 January 2023). Voting and Proxy Forms are

available on the Scheme Website and at Appendix 6 of the

Explanatory Statement. Validly completed Voting and Proxy

Forms can be submitted to the Information Agent via the Scheme

Website or by sending a scanned pdf to the Information Agent at

veon@is.kroll.com.

Scheme Creditors who hold through Euroclear or

Clearstream (and not otherwise holding through a Sanctions

Disqualified Person, including the NSD), must contact their Account

Holder (through any Intermediaries, if applicable) and instruct

their Account Holder to submit Custody Instructions to block their

2023 Notes by no later than the Custody Instruction Deadline (5.00

pm local time in the place of the relevant Clearing System on 13

January 2023) and submit a validly completed Voting and Proxy Form

to the Information Agent by the Voting Instruction Deadline.

Scheme Creditors who hold through the DTC must

ensure their Voting and Proxy Form is executed by their DTC

Participant (whose signature must be guaranteed by an Eligible

Institution by the application of the Eligible Institution’s DTC

medallion signature guarantee) and submitted to the Information

Agent on their behalf by the Voting Instruction Deadline.

Failure of a 2023 Noteholder to submit a validly

completed Voting and Proxy Form by the Voting Instruction Deadline

will mean that the voting instructions contained in that Voting and

Proxy Form will, subject to the Chair’s discretion described at

paragraph 4.18 (Chair’s Discretion to Accept Voting and Proxy Forms

Received before close of voting) of Section 4 (Summary of actions

to be taken by 2023 Noteholders) of the Explanatory Statement, be

disregarded for the purposes of voting at the Scheme Meeting and

the 2023 Noteholder will not be entitled to attend or vote at the

Scheme Meeting.

Subject to submission of a validly completed

Voting and Proxy Form, Scheme Creditors may attend the Scheme

Meeting personally, or may, if a corporation, attend by a duly

authorised representative or appoint proxies to vote at the Scheme

Meeting by completing Section A item 1 (Attendance at the Scheme

Meeting) of Part 3 (Voting Instructions and Elections) of the

Voting and Proxy Form. If a Scheme Creditor is a corporation,

it must appoint an authorised representative or proxy to vote on

its behalf at the Scheme Meeting by completing Section A item 1

(Attendance at the Scheme Meeting) of Part 3 (Voting Instructions

and Elections) of the Voting and Proxy Form in order to vote at the

Scheme Meeting. Scheme Creditors may appoint the Chair of the

Scheme Meeting as a proxy to vote on their behalf.

Compliance with applicable Sanctions

laws and regulations

Any steps taken in respect of the Scheme

Meeting, the Scheme and in connection with the Amendments must be

in compliance with all applicable Sanctions laws and regulations,

including securing any necessary licences and approvals from

competent Sanctions Authorities. “Sanctions” means

any economic or financial sanctions laws or regulations, as amended

from time to time, administered, enacted, or enforced by the United

States, the United Nations, the European Union or any member states

thereof, the United Kingdom, Bermuda and any other jurisdiction

applicable to the Company (excluding the Russian Federation and the

Republic of Belarus).

Scheme Creditors who are not Sanctions

Disqualified Persons, and are not acting for, on behalf of, at the

direction of or through Sanctions Disqualified Persons may submit

Voting and Proxy Forms and participate and vote at the Scheme

Meeting. Scheme Creditors who are, or are acting for, on

behalf of, at the direction of or through, Sanctions Disqualified

Persons are not permitted to participate or vote at the Scheme

Meeting, whether in person by webinar or by proxy. In

addition, Scheme Creditors who are not Sanctions Disqualified

Persons but who hold their 2023 Notes through Sanctions

Disqualified Person Account Holders, Intermediaries, custodians or

other members or participants in the Clearing Systems can, subject

to submitting a validly completed Voting and Proxy Form before the

Voting Instruction Deadline, participate or vote at the Scheme

Meeting (provided that they do not submit their Voting and Proxy

form, or participate or vote at the Scheme Meeting through the

Sanctions Disqualified Person Account Holder, Intermediary,

custodian or other member or participant in the Clearing

Systems). For the avoidance of doubt, a Scheme Creditor shall

not be a Sanctions Disqualified Person solely because it holds its

2023 Notes through the NSD.

Attendance and Representation at the

Scheme Meeting

The Scheme Meeting will not take place in a

physical setting and will be held virtually by webinar, via

Zoom.

Scheme Creditors who have submitted validly

completed Voting and Proxy Forms may contact the Information Agent

at veon@is.kroll.com, prior to the date of the Scheme Meeting, to

obtain the instructions for joining the Scheme Meeting.

Registration and Attending the Scheme

Meeting

Each Scheme Creditor or proxy will be required

to register their attendance at the Scheme Meeting prior to the

commencement of the Scheme Meeting so that they can be included on

a pre-prepared registration sheet which will expedite their

admission to the Scheme Meeting. Scheme Creditors who are unable to

adequately verify their identity in advance, or on the date of the

Scheme Meeting, will not be granted access to the Scheme

Meeting.

Registration will commence at 9.00 am (London

time) on the date of the Scheme Meeting and each Scheme Creditor

and each proxy must be registered no later than 15 minutes prior to

the commencement of the Scheme Meeting unless the Chair of the

Scheme Meeting determines otherwise in his or her sole discretion.

A Scheme Creditor who wishes to be represented in person at the

Scheme Meeting (or its proxy) is required to have a copy of their

validly completed Voting and Proxy Form and passport as proof of

personal identity, and the passport number must match that on the

Scheme Creditor's Voting and Proxy Form.

Upon following the meeting virtual link, Scheme

Creditors will initially be admitted to a virtual “waiting

room”. Scheme Creditors or, if a corporation, their

representative, or the proxy attending the Scheme Meeting on their

behalf will be required to verify their entitlement to attend the

Scheme Meeting as a Scheme Creditor before they will be granted

access to the Scheme Meeting by a representative of the Information

Agent.

The Chair is not required to furnish copies of

any Voting and Proxy Forms pursuant to which he or she was

appointed as the proxy to attend and vote on behalf of such Scheme

Creditor at the Scheme Meeting.

By the order referred to above, the Court has

appointed Jochem Benjamin Postma or, failing him, Asabi Omiyinka

Doris to act as Chair of the Scheme Meeting and has directed the

Chair to report the result of the Scheme Meeting to the Court.

The Scheme will be subject to the subsequent

approval of the Court and will be conditional on all other elements

of the Amendments being effected.

For further information of a general nature

regarding the scheme please contact Moelis & Company UK LLP,

the Company’s financial advisers, and for further information on

the voting procedure please contact Kroll Issuer Services Limited,

the Information Agent, and/or Akin Gump LLP, the English legal

counsel to the Company, using the following contact details:

Moelis & Company UK LLP as

the Company’s Financial AdviserEmail: Project_Verona_Ext@moelis.com

Attention: Matthew Prest & Marcel Brouwer

Kroll Information Services

Limited as the Information AgentTelephone: +44 20 7704

0880 Email: veon@is.kroll.comScheme Website:

https://deals.is.kroll.com/veon/ Attention: Paul Kamminga

Akin Gump LLP as English legal

counsel to the CompanyEmail:

AkinProjectVerona@akingump.comAttention: Emma Simmonds, Carone

Huang & Abigail Beardsworth

Dated

VEON Holdings B.V.

Neither this notice nor any part hereof

constitutes an offer to distribute, issue or sell, or a

solicitation of an offer to subscribe for or purchase or dispose

of, the Amended 2023 Notes or any other securities or right or

interest therein in any jurisdiction in which such distribution,

issue, sale or solicitation is not permitted and neither this

notice nor any part hereof may be used for or in connection with an

offer to, or the solicitation by, any person in any jurisdiction or

in any circumstances in which such offer or solicitation is not

authorised or to any person to whom it is unlawful to make such

offer or solicitation. The Securities subject to the Scheme will

not be registered with the U.S. Securities and Exchange Commission

(“SEC”) under the U.S. Securities Act, or the securities law of any

state or other jurisdiction, and, to the extent there is any deemed

delivery of securities pursuant to the Scheme, are being

transferred and delivered in reliance upon certain exemptions from

the registration requirements of the U.S. Securities Act.

This notice includes statements, estimates,

opinions and projections that are, or may be deemed to be,

“forward-looking statements”. The words “believe”, “estimate”,

“target”, “anticipate”, “expect”, “could”, “would”, “intend”,

“aim”, “goal”, “plan”, “predict”, “continue”, “assume”,

“positioned”, “may”, “will”, “should”, “will”, “risk”, their

negatives and other similar expressions that are predictions of or

indicate future events and future trends identify forward-looking

statements. By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future. Each

forward-looking statement speaks only as of the date of this notice

and is not intended to give any assurances as to future results.

The Company will comply with its obligations to publish updated

information as required by applicable law and/or by any regulatory

authority, but assumes no further obligation to publish additional

information.

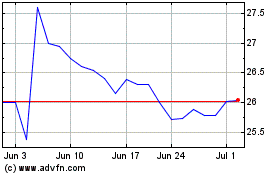

VEON (NASDAQ:VEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

VEON (NASDAQ:VEON)

Historical Stock Chart

From Apr 2023 to Apr 2024