UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

TechTarget, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

1-33472 |

04-3483216 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

275 Grove Street, Newton, MA |

|

02466 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 431-9200

(Former Name or Former Address, if Changed Since Last Report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below): |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act.

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.001 per value per share |

TTGT |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, TechTarget, Inc. (the “Company”) disclosed its results for the six (6) months ended June 30, 2024 in its Shareholder Letter, which is posted on the Investor Relations section of its website at www.techtarget.com. The Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in Item 2.02 of this Form 8-K (including Exhibit 99.1) is furnished in accordance with SEC Release No. 33-8216 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation by reference language in such filing, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following Exhibit 99.1 relating to Item 2.02 shall be deemed to be furnished, and not filed:

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

99.1 |

|

Shareholder Letter dated August 8, 2024. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

TechTarget, Inc. |

|

|

|

|

Date: August 8, 2024 |

|

By: |

/s/ Daniel Noreck |

|

|

|

Daniel Noreck |

|

|

|

Chief Financial Officer and Treasurer |

Exhibit 99.1

August 8, 2024

Dear Fellow Shareholders:

We are pleased to report strong performance for the second quarter of 2024, with revenue exceeding our target and increasing 14% sequentially and 1% YoY. As we noted in our first quarter Shareholder Letter, customers continue to be cautious about their budgets amidst ongoing pressure and uncertainty surrounding high interest rates, inflation, international tensions and the upcoming Presidential election. This trend continued in the second quarter as technology vendors implemented additional discretionary expense reductions, layoffs and other cost cutting measures. In our experience, investors reward technology companies for revenue growth in low interest rate environments, which in turn incentivizes technology vendors to invest in sales and marketing. As such, we believe these headwinds will continue to put pressure on technology vendors and their customers until monetary policy actions are taken to improve the interest rate environment and lower the cost of capital.

Importantly, our customers’ investments in R&D remain robust. We believe this will undoubtedly result in new products being introduced to the market in the future, and we expect customers to refocus on sales and marketing to maximize return on their R&D investments. We also continued to see consistent cash collection from our customers with our DSO1 improving to 66 days from 79 days at June 30, 2024 and 2023, respectively, and our reserve for doubtful accounts decreasing by $1.5 million from year end 2023.

In the second quarter, we continued to build on our successful track record of leveraging our strong balance sheet to invest in key areas of our business to position us for success during the next recovery. These efforts included investing in high-quality content intended to enhance our large permission-based audience and generate first party intent insights to help our customers’ sales and marketing departments prioritize their outreach, engagement and conversations to reach the right accounts and buying teams. Our efforts also included continued investment in our product strategy and roadmap to enable TechTarget to deliver value for its clients across their end-to-end GTM strategy, from R&D to ROI.

Product Update and Roadmap

In the second quarter, we announced general availability of TechTarget Account Intent Feeds, a new Priority Engine-based offering that delivers a weekly stream of highly actionable account data directly into customers’ CRM and ABM platforms. This separately purchased product injects our unique purchase insights around prospective accounts into our customers’ workflows to support programmatic and social advertising outreach, account prioritization and insights for sellers, and ABM segment creation. This is the first of many new Priority Engine-based offerings we plan to bring to market in 2024 and 2025. Looking ahead at our product roadmap, we plan to ultimately consolidate our full range of customer solutions within the Priority Engine platform to create a unified solution that easily integrates to drive insights and activation for customers, while providing expanded retention and up- and cross-sell opportunities for TechTarget.

We also announced a partnership with the 6Sense Revenue AI Platform, which is used by many of our customers to identify and engage with their most promising customers at the right time. Our partnership links TechTarget’s Account Intent Feeds through a direct

integration with the 6Sense Revenue AI Platform, allowing our mutual customers the ability to easily leverage our first party insights and get more value from their investment across both solutions. We continue to see opportunities to bring Priority Engine data directly into other martech solutions and will be expanding direct integrations with key platforms where our customers focus their marketing and sales outreach.

We also recently announced the initial rollout of TechTarget Market Monitor, a Priority Engine-based service that helps our customers more accurately understand the real-time dynamics that affect their sales and marketing outreach. This includes the types of accounts and buyers who are actively researching purchases, the topics generating the most interest, and the most viewed content. These insights help our customers decide how to focus their outreach, what segments to target, and what content angles are resonating particularly well against their objectives. Initially, we are making this service available to our Enterprise Strategy Group customers with annual subscriptions for Research, Advisory and Intent Insights. We are confident that the insights being generated through TechTarget Market Monitor provide practical value to the broader marketing use cases that we serve, and we have plans to offer elements of the service to our overall Priority Engine customer base in the back half of 2024.

For Q2 2024:

•GAAP revenue was approximately $58.9 million, an increase of 1%. Net income was approximately $1.3 million, a decrease of 51%; Net income margin was 2%. Adjusted EBITDA2 decreased 10% to $16.7 million; Adjusted EBITDA Margin2 was 28%.

•GAAP Gross Margin was 62%; Adjusted Gross Margin2 was 67%.

•Cash flow from operations was $11.9 million; Free Cash Flow2 was $7.7 million.

Update on Combination with Informa Tech’s Digital Businesses

We are pleased with our continued progress on our combination with Informa Tech’s Digital Businesses to create a leading global B2B growth accelerator. The powerful combination of our complementary technology, expertise and data is expected to deliver unmatched value to technology buyers and sellers. With a leading portfolio of trusted content and a large, high-quality permissioned audience, we expect to offer an end-to-end platform that can provide a full suite of solutions for customers across their R&D to ROI journey. In the second quarter, we took foundational steps to position the combined company for growth and value creation.

The company that will become the holding company for the combined TechTarget and Informa Tech digital businesses upon the closing of the proposed transaction, Toro CombineCo, Inc., has filed a Registration Statement on Form S-4 with the Securities and Exchange Commission (SEC) containing a preliminary proxy statement/prospectus, which may be found on the SEC’s website located at www.sec.gov. We continue to anticipate closing the transaction in the second half of 2024 and are looking forward to providing further detail on our future plans for the combined business at our upcoming Investor Morning in September.

Balance Sheet and Liquidity

As of June 30, 2024, we had approximately $339.4 million in cash, cash equivalents and short-term investments.

As of June 30, 2024, we had approximately $417 million aggregate principal amount of convertible senior notes outstanding, which are convertible into shares of our common stock contingent upon the satisfaction of certain conditions contained within the applicable indenture governing the notes. Our 2025 convertible senior notes ($3 million aggregate principal amount outstanding as of June 30, 2024) bear interest at a rate of 0.125% per annum, have regular semi-annual interest payments (June and December) and mature in December 2025. Our 2026 convertible senior notes ($414 million aggregate principal amount outstanding as of June 30, 2024) do not bear interest and mature in December 2026.

Repurchase Plan

In November 2022, we announced the adoption of a repurchase program (the “November 2022 Program”) that authorized the repurchase of up to $200 million of our outstanding common stock and convertible debt from time to time on the open market or in privately negotiated transactions with an expiration in November of 2024.

We did not have any repurchase activity during the quarter ended June 30, 2024. We may still repurchase up to $92.9 million of our outstanding common stock and convertible debt under the November 2022 Repurchase Program, subject to Informa’s approval (which may not be unreasonably withheld, conditioned, or delayed).

Upcoming Investor Day

We are pleased to announce that we will be hosting an Investor Morning on September 19, 2024. This event will take place at NASDAQ, located at 151 W 43rd Street, New York City, and will commence at 8:00 AM. We will provide further details as the event approaches.

Q3 2024 Guidance

For Q3 2024, we expect revenue to be between $57.0 million and $59.0 million. We expect Q3 2024 net loss to be between $1.2 million and $1.9 million and Adjusted EBITDA2 to be between $16.0 million and $17.0 million.

Summary

We continue to make meaningful progress across our business and are confident that the investments we are making today and our combination with Informa Tech’s Digital Businesses will position TechTarget as a leading, comprehensive solution in a growing yet fragmented market, and drive continued performance and value for our shareholders, customers, partners and employees.

Sincerely,

|

|

|

|

Michael Cotoia |

Greg Strakosch |

Chief Executive Officer |

Executive Chairman |

© 2024 TechTarget, Inc. All rights reserved. TechTarget and the TechTarget logo are registered trademarks of TechTarget. All other trademarks are the property of their respective owners.

___________________

1Key Performance Indicator. See “Non-GAAP Financial Measures And KPIs” for definition.

2Non-GAAP measures. See “Non-GAAP Financial Measures And KPIs” for definitions and reconciliations.

Conference Call and Webcast

TechTarget will discuss these financial results in a conference call at 5:00 p.m. (Eastern Time) today (August 8, 2024). Our Letter to Shareholders with supplemental financial information will be posted to the Investor Relations section of our website.

NOTE: Our Letter to Shareholders will not be read on the conference call. The conference call will include only brief remarks followed by questions and answers.

The public is invited to listen to a live webcast of TechTarget’s conference call, which can be accessed on the investor relations website at https://investor.techtarget.com. The conference call can also be heard via telephone by dialing:

•United States (Toll Free): +1 833 470 1428

•United States: +1 404 975 4839

•Canada (Toll Free): 1 833 950 0062

Please access the call at least 10 minutes prior to the start time and ask to join the TechTarget call. For those investors unable to participate in the live conference call, a replay of the conference call will be available via telephone beginning August 8, 2024 one (1) hour after the conference call through September 7, 2024. To listen to the replay:

•United States (Toll Free): 1 866 813 9403

•United States: 1 929 458 6194

The webcast replay will also be available on https://investor.techtarget.com during the same period.

Non-GAAP Financial Measures and KPIs

This letter and the accompanying tables include a discussion of Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net Income, Adjusted Net Income Per Share and Free Cash Flow, all of which are non-GAAP financial measures which are provided as a complement to results provided in accordance with GAAP.

“Adjusted EBITDA” means earnings before net interest, other income and expense such as asset impairment (including expenses related to the induced conversion of our 2025 convertible notes), income taxes, depreciation and amortization, as further adjusted to include acquired unearned revenue and to exclude stock-based compensation and other one-time charges, such as costs related to mergers, acquisitions or reduction in forces expenses, if any.

“Adjusted EBITDA Margin” means Adjusted EBITDA divided by Revenue.

“Adjusted Gross Margin” means Adjusted Gross Profit divided by Revenue.

“Adjusted Gross Profit” means gross profit adding back the effects of stock compensation, depreciation and amortization, and the impact of fair value adjustments to acquired unearned revenue.

“Adjusted Net Income” means net income adjusted for amortization, stock-based compensation, foreign exchange, interest on our debt instruments (including expenses related to the induced conversion of our 2025 convertible notes), impact of the fair value adjustment to contingent consideration and acquired unearned revenue and one-time charges, if any, as further adjusted for the related income tax impact of the adjustments.

“Adjusted Net Income Per Share” means Adjusted Net Income divided by adjusted weighted average diluted shares outstanding. We adjust the average diluted shares outstanding to include shares on the if converted basis for our convertible note.

“DSO” means days sales outstanding, which we define as net accounts receivable at quarter end divided by total revenue for the applicable period, multiplied by the number of days in the applicable period.

“Free Cash Flow” means the change in net cash provided by operations less purchases of equipment and other capitalized assets.

“Longer-Term Contracts” means contracts in excess of 270 days.

“Longer-Term Revenue” means the amount of revenue subject to Longer-Term Contracts.

“Net Income (excluding transaction and related expenses)” means GAAP Net Income less the effects of transaction and related expenses. This measure is presented as part of our full-year guidance and excludes the effects of transaction and related expenses, which we are unable to estimate for the full year of 2024 without unreasonable effort.

“Revenue from Our Legacy Global Customers” means GAAP revenue from this cohort of customers. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. In addition, our definitions of Adjusted EBITDA, Free Cash Flow, Adjusted EBITDA margin, Adjusted Gross Margin, Adjusted Net Income, and Adjusted Net Income Per Share, may not be comparable to the definitions as reported by other companies. We believe that these measures provide relevant and useful information to enable us and investors to compare our operating performance using an additional measurement. We use these measures in our internal management reporting and planning process as primary measures to evaluate the operating performance of our business, as well as potential acquisitions.

The components of Adjusted EBITDA include the key revenue and expense items for which our operating managers are responsible and upon which we evaluate their performance. In the case of senior management, Adjusted EBITDA, Adjusted Revenue growth and the percentage of revenue under Longer-Term Contracts are used as the principal financial metrics in their annual incentive compensation program. Adjusted EBITDA is also used for planning purposes and in presentations to our Board of Directors. Adjusted Net Income is useful to us and investors because it presents an additional measurement of our financial performance, taking into account depreciation, which we believe is an ongoing cost of doing business, but excluding the impact of certain non-cash expenses and items not directly tied to the core operations of our business, such as costs related to acquisitions and interest on our debt instruments. Free Cash Flow represents net cash provided by operating activities excluding purchases of property and equipment and other capitalized assets. Free Cash Flow provides useful information to management and investors about the amount of cash generated by the business after the purchases of property and equipment and other capitalized assets, which can then be used to, among other things, invest in the business and make strategic acquisitions. A limitation of the utility of Free Cash Flow as a measure of financial performance is that it does not represent the total increase or decrease in our cash balance for the period. We use revenue from our legacy global customers to monitor customer concentration trends within the Company, which we deem an important metric for evaluating revenue diversification. Furthermore, we intend to provide these non-GAAP financial measures as part of our future earnings discussions and, therefore, the inclusion of these non-GAAP financial measures will provide consistency in our financial reporting. A reconciliation of these non-GAAP measures to GAAP is provided in the accompanying tables, except that full reconciliations of certain forward-looking non-GAAP measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence and financial impact of certain items, including but not limited to, stock-based compensation and other one-time charges such as acquisitions. We use DSO as a key performance indication and as a measurement of the quality and status of our receivables since lower DSO is generally correlated with higher collection rates.

Additional Information and Where to Find It

In connection with the proposed transaction (the “proposed transaction”), Toro CombineCo, Inc. (“NewCo”) filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (File No. 333-280529) containing a preliminary proxy statement of TechTarget, Inc. (“TechTarget”) that also constitutes a preliminary prospectus of NewCo (the “Proxy Statement/Prospectus”). The Proxy Statement/Prospectus is not final and may be amended. A definitive Proxy Statement/Prospectus will be mailed to stockholders of TechTarget. TechTarget and NewCo may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for any proxy statement, registration statement or prospectus, or any other document that TechTarget or NewCo (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, TechTarget INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PRELIMINARY PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED BY TechTarget OR NEWCO WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. TechTarget investors and security holders may obtain free copies of the preliminary Proxy Statement/Prospectus filed on June 27, 2024 and will be able to obtain copies of the definitive Proxy Statement/Prospectus (when it becomes available), as well as other filings containing important information about TechTarget, NewCo, and other parties to the proposed transaction (including Informa PLC (“Informa”)), without charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by TechTarget will be available free of charge under the tab “Financials” on the “Investor Relations” page of TechTarget’s internet website at www.investor.techtarget.com or by contacting TechTarget’s Investor Relations Department at investor@techtarget.com.

Participants in the Solicitation

TechTarget, NewCo and Informa, and their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies from TechTarget’s stockholders in connection with the proposed transaction. Information regarding the directors of Informa is contained in Informa’s annual reports and accounts available on Informa’s website at www.informa.com/investors and in the National Storage Mechanism at data.fca.org.uk/#/nsm/nationalstoragemechanism. Information regarding the directors and executive officers of TechTarget is contained in TechTarget’s proxy statement for its 2024 annual meeting of stockholders, filed with the SEC on April 17, 2024, and in other documents subsequently filed with the SEC. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, is included in the preliminary Proxy Statement/Prospectus filed on June 27, 2024, and will be contained in the definitive Proxy Statement/Prospectus and other relevant materials that are filed or will be filed with the SEC (when they become available). These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This press release is for informational purposes only and is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve substantial risks and uncertainties. All statements, other than historical facts, are forward-looking statements, including: statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of NewCo following completion of the proposed transaction; legal, economic, and regulatory conditions; and any assumptions underlying any of the foregoing. Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,” “plan,” “could,” “would,” “project,” “predict,” “continue,” “target,” or the negatives of these words or other similar terms or expressions that concern TechTarget’s or NewCo’s expectations, strategy, priorities, plans, or intentions. Forward-looking statements are based upon current plans, estimates, and expectations that are subject to risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. We can give no assurance that such plans, estimates, or expectations will be achieved, and therefore, actual results may differ materially from any plans, estimates, or expectations in such forward-looking statements.

Important factors that could cause actual results to differ materially from such plans, estimates, or expectations include, among others: that one or more closing conditions to the proposed transaction, including certain regulatory approvals, may not be satisfied or waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay, or refuse to grant approval for the consummation of the proposed transaction, may require conditions, limitations, or restrictions in connection with such approvals or that the required approval by the shareholders of TechTarget may not be obtained; the risk that the proposed transaction may not be completed in the time frame expected by TechTarget, NewCo or Informa, or at all; unexpected costs, charges, or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of NewCo following completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integrating the relevant portion of Informa tech digital businesses with the business of TechTarget; the ability of NewCo to implement its business strategy; difficulties and delays in achieving revenue and cost synergies of NewCo; the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification, and liability; evolving legal, regulatory, and tax regimes; changes in economic, financial, political, and regulatory conditions, in the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade, and policy changes associated with the current or subsequent U.S. administration; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact TechTarget’s ability to pursue certain business opportunities or strategic transactions; TechTarget’s, NewCo’s and Informa’s ability to meet expectations regarding the accounting and tax treatments of the proposed transaction; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of TechTarget’s common stock; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of TechTarget to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders, strategic partners and other business relationships and on its operating results and business generally; market acceptance of TechTarget’s and the relevant portion of Informa Tech digital businesses’ products and services; the impact of pandemics and future health epidemics and any related economic downturns, on TechTarget’s business and the markets in which it and its customers operate; changes in economic or regulatory conditions or other trends affecting the internet, internet advertising and information technology industries; data privacy and artificial intelligence laws, rules, and regulations; the impact of foreign currency exchange rates; certain macroeconomic factors facing the global economy, including instability in the regional banking sector, disruptions in the capital markets, economic sanctions and economic slowdowns or recessions, rising inflation and interest rate fluctuations on TechTarget’s and the relevant portion of Informa Tech digital businesses’ results and other matters included in TechTarget’s filings with the SEC, including in Item 1A of its Annual Report on Form 10-K for the year ended December 31, 2023. These risks, as well as other risks associated with the proposed transaction, are more fully discussed the preliminary Proxy Statement/Prospectus filed on June 27, 2024, and will be contained in the definitive Proxy Statement/Prospectus and other relevant materials that are filed or will be filed with the SEC (when they become available). While the list of factors presented here and in the preliminary Proxy Statement/Prospectus are, and the list of factors to be presented in definitive Proxy Statement/Prospectus will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity,

and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication.

Any forward-looking statements speak only as of the date of this communication. None of TechTarget, NewCo or Informa undertakes any obligation to update any forward-looking statements, whether as a result of new information or developments, future events, or otherwise, except as required by law. Neither future distribution of this communication nor the continued availability of this communication in archive form on TechTarget’s website at www.investor.techtarget.com or Informa’s website at www.informa.com/investors should be deemed to constitute an update or re-affirmation of these statements as of any future date.

TechTarget, Inc.

Consolidated Balance Sheet

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

June 30,

2024 |

|

|

December 31,

2023 |

|

Assets |

|

(Unaudited) |

|

|

(Unaudited) |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

237,405 |

|

|

$ |

226,668 |

|

Short-term investments |

|

|

101,980 |

|

|

|

99,601 |

|

Accounts receivable, net of allowance for doubtful accounts of $3,465 and $5,028 respectively |

|

|

42,774 |

|

|

|

39,239 |

|

Prepaid taxes |

|

|

— |

|

|

|

1,634 |

|

Prepaid expenses and other current assets |

|

|

6,534 |

|

|

|

4,331 |

|

Total current assets |

|

|

388,693 |

|

|

|

371,473 |

|

Property and equipment, net |

|

|

26,231 |

|

|

|

24,917 |

|

Goodwill |

|

|

193,791 |

|

|

|

194,074 |

|

Intangible assets, net |

|

|

84,450 |

|

|

|

89,163 |

|

Operating lease assets with right-of-use |

|

|

15,464 |

|

|

|

17,166 |

|

Deferred tax assets |

|

|

7,871 |

|

|

|

2,445 |

|

Other assets |

|

|

648 |

|

|

|

650 |

|

Total assets |

|

$ |

717,148 |

|

|

$ |

699,888 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

6,073 |

|

|

$ |

5,312 |

|

Current operating lease liabilities |

|

|

3,697 |

|

|

|

4,049 |

|

Accrued expenses and other current liabilities |

|

|

6,883 |

|

|

|

9,041 |

|

Accrued compensation expenses |

|

|

1,777 |

|

|

|

1,345 |

|

Income taxes payable |

|

|

4,693 |

|

|

|

2,522 |

|

Contract liabilities |

|

|

18,447 |

|

|

|

14,721 |

|

Total current liabilities |

|

|

41,570 |

|

|

|

36,990 |

|

Non-current operating lease liabilities |

|

|

14,772 |

|

|

|

16,615 |

|

Convertible senior notes |

|

|

411,602 |

|

|

|

410,500 |

|

Deferred tax liabilities |

|

|

12,394 |

|

|

|

12,856 |

|

Total liabilities |

|

|

480,338 |

|

|

|

476,961 |

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 58,816,748 and 58,659,065 shares issued, respectively; 28,572,537 and 28,415,144 shares outstanding, respectively |

|

|

59 |

|

|

|

59 |

|

Treasury stock, at cost; 30,244,211 and 30,243,921 shares, respectively |

|

|

(329,118 |

) |

|

|

(329,118 |

) |

Additional paid-in capital |

|

|

494,922 |

|

|

|

471,696 |

|

Accumulated other comprehensive loss |

|

|

(5,109 |

) |

|

|

(4,542 |

) |

Retained earnings |

|

|

76,056 |

|

|

|

84,832 |

|

Total stockholders’ equity |

|

|

236,810 |

|

|

|

222,927 |

|

Total liabilities and stockholders’ equity |

|

$ |

717,148 |

|

|

$ |

699,888 |

|

TechTarget, Inc.

Consolidated Statements of Operations and Comprehensive Income (Loss)

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

For the Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

(Unaudited) |

|

|

(Unaudited) |

|

Revenue |

|

$ |

58,914 |

|

|

$ |

58,429 |

|

$ |

110,550 |

|

|

$ |

115,543 |

|

Cost of revenue(1) |

|

|

21,414 |

|

|

|

18,406 |

|

|

40,572 |

|

|

|

35,756 |

|

Amortization of acquired technology |

|

|

703 |

|

|

|

694 |

|

|

1,405 |

|

|

|

1,367 |

|

Gross profit |

|

|

36,797 |

|

|

|

39,329 |

|

|

68,573 |

|

|

|

78,420 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing(1) |

|

|

23,187 |

|

|

|

24,915 |

|

|

46,150 |

|

|

|

49,671 |

|

Product development(1) |

|

|

2,644 |

|

|

|

2,457 |

|

|

5,397 |

|

|

|

5,066 |

|

General and administrative(1) |

|

|

7,625 |

|

|

|

7,706 |

|

|

14,320 |

|

|

|

15,624 |

|

Transaction and related expenses |

|

|

2,069 |

|

|

|

— |

|

|

8,595 |

|

|

|

— |

|

Depreciation, excluding depreciation of $1,277, $919, $2,452 and $1,764, respectively, included in cost of revenue |

|

|

2,302 |

|

|

|

2,095 |

|

|

4,613 |

|

|

|

4,095 |

|

Amortization |

|

|

1,498 |

|

|

|

1,506 |

|

|

2,996 |

|

|

|

2,999 |

|

Total operating expenses |

|

|

39,325 |

|

|

|

38,679 |

|

|

82,071 |

|

|

|

77,455 |

|

Operating income (loss) |

|

|

(2,528 |

) |

|

|

650 |

|

|

(13,498 |

) |

|

|

965 |

|

Interest and other income, net |

|

|

3,277 |

|

|

|

2,915 |

|

|

6,349 |

|

|

|

5,672 |

|

Income (loss) before provision for income taxes |

|

|

749 |

|

|

|

3,565 |

|

|

(7,149 |

) |

|

|

6,637 |

|

(Benefit) provision for income taxes |

|

|

(563 |

) |

|

|

890 |

|

|

1,627 |

|

|

|

2,317 |

|

Net income (loss) |

|

$ |

1,312 |

|

|

$ |

2,675 |

|

$ |

(8,776 |

) |

|

$ |

4,320 |

|

Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investments (net of tax provision effect of $2, $(40), $(4) and $(22), respectively) |

|

$ |

9 |

|

|

$ |

(142 |

) |

|

(14 |

) |

|

$ |

(79 |

) |

Foreign currency translation gain (loss) |

|

|

89 |

|

|

|

1,658 |

|

|

(553 |

) |

|

|

3,687 |

|

Other comprehensive income (loss) |

|

|

98 |

|

|

|

1,516 |

|

|

(567 |

) |

|

|

3,608 |

|

Comprehensive income (loss) |

|

$ |

1,410 |

|

|

$ |

4,191 |

|

$ |

(9,343 |

) |

|

$ |

7,928 |

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

$ |

0.10 |

|

$ |

(0.31 |

) |

|

$ |

0.15 |

|

Diluted |

|

$ |

0.05 |

|

|

$ |

0.10 |

|

$ |

(0.31 |

) |

|

$ |

0.15 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

28,561 |

|

|

|

28,055 |

|

|

28,536 |

|

|

|

28,406 |

|

Diluted |

|

|

28,828 |

|

|

|

32,162 |

|

|

28,536 |

|

|

|

28,616 |

|

(1) Amounts include stock-based compensation expense as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

$ |

637 |

|

|

$ |

831 |

|

$ |

1,371 |

|

|

$ |

1,652 |

|

Selling and marketing |

|

|

6,300 |

|

|

|

7,844 |

|

|

12,724 |

|

|

|

15,381 |

|

Product development |

|

|

461 |

|

|

|

429 |

|

|

939 |

|

|

|

889 |

|

General and administrative |

|

|

3,945 |

|

|

|

3,580 |

|

|

7,768 |

|

|

|

7,038 |

|

TechTarget, Inc.

Consolidated Statements of Cash Flows

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended |

|

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

Operating activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

(8,776 |

) |

|

$ |

4,320 |

|

Adjustments to reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation |

|

|

7,065 |

|

|

|

5,859 |

|

Amortization |

|

|

4,401 |

|

|

|

4,366 |

|

Provision for bad debt |

|

|

(991 |

) |

|

|

1,405 |

|

Stock-based compensation |

|

|

22,802 |

|

|

|

24,960 |

|

Amortization of debt issuance costs |

|

|

1,101 |

|

|

|

1,255 |

|

Deferred tax benefit |

|

|

(5,814 |

) |

|

|

(6,574 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(2,555 |

) |

|

|

8,079 |

|

Operating lease assets with right of use |

|

|

1,395 |

|

|

|

1,104 |

|

Prepaid expenses and other current assets |

|

|

(573 |

) |

|

|

(355 |

) |

Other assets |

|

|

— |

|

|

|

(25 |

) |

Accounts payable |

|

|

764 |

|

|

|

23 |

|

Income taxes payable |

|

|

2,221 |

|

|

|

(3,444 |

) |

Accrued expenses and other current liabilities |

|

|

(2,144 |

) |

|

|

(3,141 |

) |

Accrued compensation expenses |

|

|

438 |

|

|

|

(1,386 |

) |

Operating lease liabilities with right of use |

|

|

(1,862 |

) |

|

|

(1,769 |

) |

Contract liabilities |

|

|

3,741 |

|

|

|

(6,703 |

) |

Net cash provided by operating activities |

|

|

21,213 |

|

|

|

27,974 |

|

Investing activities: |

|

|

|

|

|

|

Purchases of property and equipment, and other capitalized assets, net |

|

|

(8,400 |

) |

|

|

(7,291 |

) |

Purchases of investments |

|

|

(2,366 |

) |

|

|

(76,171 |

) |

Net cash used in investing activities |

|

|

(10,766 |

) |

|

|

(83,462 |

) |

Financing activities: |

|

|

|

|

|

|

Tax withholdings related to net share settlements |

|

|

(139 |

) |

|

|

(177 |

) |

Purchase of treasury shares and related costs |

|

|

— |

|

|

|

(50,000 |

) |

Proceeds from stock option exercises |

|

|

— |

|

|

|

18 |

|

Issuance of common stock from ESPP |

|

|

563 |

|

|

|

650 |

|

Payment of earnout liabilities |

|

|

— |

|

|

|

(2,267 |

) |

Net cash provided by (used in) financing activities |

|

|

424 |

|

|

|

(51,776 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(134 |

) |

|

|

763 |

|

Net increase (decrease) in cash and cash equivalents |

|

|

10,737 |

|

|

|

(106,501 |

) |

Cash and cash equivalents at beginning of period |

|

|

226,668 |

|

|

|

344,523 |

|

Cash and cash equivalents at end of period |

|

$ |

237,405 |

|

|

$ |

238,022 |

|

Supplemental disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid for taxes, net |

|

$ |

3,624 |

|

|

$ |

12,433 |

|

Schedule of non-cash investing and financing activities: |

|

|

|

|

|

|

Right of use assets and lease liabilities |

|

$ |

— |

|

|

$ |

314 |

|

TechTarget, Inc.

Reconciliation of Gross Profit to Adjusted Gross Profit

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Gross Profit |

|

$ |

36,797 |

|

|

$ |

39,329 |

|

|

$ |

68,573 |

|

|

$ |

78,420 |

|

Stock compensation |

|

|

637 |

|

|

|

831 |

|

|

|

1,371 |

|

|

|

1,652 |

|

Depreciation and amortization |

|

|

1,981 |

|

|

|

1,613 |

|

|

|

3,857 |

|

|

|

3,131 |

|

Adjusted Gross Profit |

|

$ |

39,415 |

|

|

$ |

41,773 |

|

|

$ |

73,801 |

|

|

$ |

83,203 |

|

Gross Margin |

|

|

62 |

% |

|

|

67 |

% |

|

|

62 |

% |

|

|

68 |

% |

Adjusted Gross Margin |

|

|

67 |

% |

|

|

71 |

% |

|

|

67 |

% |

|

|

72 |

% |

TechTarget, Inc.

Reconciliation of Cash Provided by Operations to Free Cash Flow

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net cash provided by operating activities |

|

$ |

11,918 |

|

|

$ |

9,756 |

|

|

$ |

21,213 |

|

|

$ |

27,974 |

|

Purchases of property and equipment, and other capitalized assets, net |

|

|

(4,246 |

) |

|

|

(3,743 |

) |

|

|

(8,400 |

) |

|

|

(7,291 |

) |

Free Cash Flow |

|

$ |

7,672 |

|

|

$ |

6,013 |

|

|

$ |

12,813 |

|

|

$ |

20,683 |

|

TechTarget, Inc.

Reconciliation of Net Income (Loss) to Adjusted EBITDA and Net Income (Loss) Margin to Adjusted EBITDA Margin

(in 000’s)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net income (loss) |

|

$ |

1,312 |

|

|

$ |

2,675 |

|

|

$ |

(8,776 |

) |

|

$ |

4,320 |

|

Interest income, net |

|

|

(3,321 |

) |

|

|

(2,942 |

) |

|

|

(6,502 |

) |

|

|

(5,600 |

) |

(Benefit) provision for income taxes |

|

|

(563 |

) |

|

|

890 |

|

|

|

1,627 |

|

|

|

2,317 |

|

Depreciation and amortization |

|

|

5,780 |

|

|

|

5,214 |

|

|

|

11,466 |

|

|

|

10,225 |

|

EBITDA |

|

|

3,208 |

|

|

|

5,837 |

|

|

|

(2,185 |

) |

|

|

11,262 |

|

Stock-based compensation expense |

|

|

11,343 |

|

|

|

12,684 |

|

|

|

22,802 |

|

|

|

24,960 |

|

Other expense (income), net |

|

|

44 |

|

|

|

26 |

|

|

|

153 |

|

|

|

(73 |

) |

Transaction and related expenses |

|

|

2,069 |

|

|

|

— |

|

|

|

8,595 |

|

|

|

— |

|

Adjusted EBITDA |

|

|

16,664 |

|

|

|

18,547 |

|

|

|

29,365 |

|

|

|

36,149 |

|

Net income (loss) margin |

|

|

2 |

% |

|

|

5 |

% |

|

|

-8 |

% |

|

|

4 |

% |

Adjusted EBITDA margin |

|

|

28 |

% |

|

|

32 |

% |

|

|

27 |

% |

|

|

31 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

TechTarget, Inc.

Reconciliation of Net Income (Loss) to Adjusted Net Income and

Net Income (Loss) per Diluted Share to Adjusted Net Income per Diluted Share

(in 000’s, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Nine Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

Net income (loss) |

|

$ |

1,312 |

|

|

$ |

2,675 |

|

|

$ |

(8,776 |

) |

|

$ |

4,320 |

|

(Benefit) provision for income taxes |

|

|

(563 |

) |

|

|

890 |

|

|

|

1,627 |

|

|

|

2,317 |

|

Net income (loss) before taxes |

|

|

749 |

|

|

|

3,565 |

|

|

|

(7,149 |

) |

|

|

6,637 |

|

Amortization of intangible assets |

|

|

2,201 |

|

|

|

2,200 |

|

|

|

4,401 |

|

|

|

4,366 |

|

Transaction and related expenses |

|

|

2,069 |

|

|

|

— |

|

|

|

8,595 |

|

|

|

— |

|

Stock-based compensation expense |

|

|

11,343 |

|

|

|

12,684 |

|

|

|

22,802 |

|

|

|

24,960 |

|

Foreign exchange loss and interest expense |

|

|

596 |

|

|

|

713 |

|

|

|

1,256 |

|

|

|

1,300 |

|

Adjusted income tax provision (1) |

|

|

(3,657 |

) |

|

|

(4,735 |

) |

|

|

(6,615 |

) |

|

|

(9,257 |

) |

Adjusted net income |

|

$ |

13,301 |

|

|

$ |

14,427 |

|

|

$ |

23,290 |

|

|

$ |

28,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per diluted share(2) |

|

$ |

0.05 |

|

|

$ |

0.10 |

|

|

$ |

(0.31 |

) |

|

$ |

0.15 |

|

Weighted average diluted shares outstanding |

|

|

28,828 |

|

|

|

32,162 |

|

|

|

28,536 |

|

|

|

28,616 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income per diluted share |

|

$ |

0.42 |

|

|

$ |

0.45 |

|

|

$ |

0.73 |

|

|

$ |

0.86 |

|

Adjusted weighted average diluted shares outstanding (3) |

|

|

32,020 |

|

|

|

32,162 |

|

|

|

31,952 |

|

|

|

32,494 |

|

(1)Adjusted income tax provision was calculated using an adjusted effective tax rate, excluding discrete items, for each respective period.

(2)Net income per diluted share includes add back of $0.6 million in interest expense for the 2025 and 2026 notes for the three ended June 30, 2023. For the three and six months ended June 30, 2024 and the six months ended June 30, 2023, the interest expense and amortization of note costs relating to the convertible notes were excluded from the calculation as they would have been anti-dilutive.

(3)Adjusted weighted average diluted shares outstanding for the three and six months ended June 30, 2024 includes 3.5 million and 3.4 million shares, respectively, related to unvested stock awards calculated using the treasury method and the dilutive impact on the if converted basis of our convertible bond. Adjusted weighted average diluted shares outstanding for the three and six months ended June 30, 2023 includes 4.1 million shares related to unvested stock awards calculated using the treasury method and the dilutive impact on the if converted basis of our convertible bond.

TechTarget, Inc.

Financial Guidance for the Three Months Ended September 30, 2024

(in 000’s)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, 2024 |

|

|

|

Range |

|

Revenue |

|

$ |

57,000 |

|

|

$ |

59,000 |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,900 |

) |

|

$ |

(1,200 |

) |

Depreciation, amortization and stock-based compensation |

|

|

14,400 |

|

|

|

14,400 |

|

Interest and other expense, including transaction and related expenses, net |

|

|

2,600 |

|

|

|

2,600 |

|

Provision for income taxes |

|

|

900 |

|

|

|

1,200 |

|

Adjusted EBITDA |

|

$ |

16,000 |

|

|

$ |

17,000 |

|

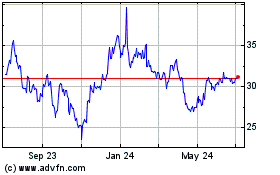

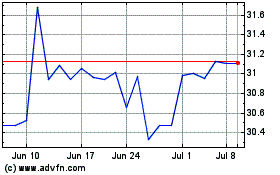

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Jul 2024 to Aug 2024

Tech Target (NASDAQ:TTGT)

Historical Stock Chart

From Aug 2023 to Aug 2024