Current Report Filing (8-k)

July 06 2022 - 4:28PM

Edgar (US Regulatory)

false 0001556263 0001556263 2022-07-05 2022-07-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 5, 2022

Syros Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-37813 |

|

45-3772460 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 35 CambridgePark Drive Cambridge, Massachusetts |

|

02140 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 744-1340

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, $0.001 par value |

|

SYRS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On July 5, 2022, Syros Pharmaceuticals, Inc. (the “Company”) held an investor conference call (the “Conference Call”) to discuss its previously announced entry into an agreement and plan of merger with Tyme Technologies, Inc. (“TYME”) and Tack Acquisition Corp. (such transaction being the “Merger”) and entry into a securities purchase agreement with several institutional accredited investors, pursuant to which the Company agreed to issue and sell in a private placement shares of the Company’s common stock (the “Shares”) and, in lieu of Shares to certain investors, pre-funded warrants to purchase shares of common stock, and, in each case, accompanying warrants to purchase additional shares of common stock (or pre-funded warrants to purchase common stock in lieu thereof) (such transaction being the “Private Placement” and, together with the Merger, the “Transactions”). A transcript of the Conference Call is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

During the Conference Call, Jason Haas, Chief Financial Officer of the Company, stated that the number of basic shares outstanding after the closing of the Transactions will be approximately 280 million. Such number includes the following previously-disclosed shares of common stock: (i) shares of the Company’s common stock outstanding as of immediately prior to the Transactions, (ii) shares of the Company’s common stock that are issuable upon conversion of the TYME common stock into shares of the Company’s common stock upon the consummation of the Merger in accordance with the exchange ratio for the Merger, (iii) shares of the Company’s common stock that are issuable in the Private Placement or are issuable upon the exercise of all pre-funded warrants and warrants issued in the Private Placement, and (iv) currently outstanding pre-funded warrants and restricted stock units.

On July 5, 2022, the Company made available to investors an investor presentation. A copy of the presentation is attached hereto as Exhibit 99.2 and incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act concerning the Company, Tyme, the proposed transactions and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of the Company and Tyme, as well as assumptions made by, and information currently available to, management of the Company and Tyme. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: the risk that the conditions to the closing of the proposed transactions are not satisfied,

including the failure to obtain stockholder approval for the transactions or to complete the Private Placement in a timely manner or at all; uncertainties as to the timing of the consummation of the transactions and the ability of each of the Company and Tyme to consummate the transactions, including the Private Placement; risks related to Tyme’s continued listing on the Nasdaq until closing of the proposed transactions; risks related to the Company’s and Tyme’s ability to correctly estimate their respective operating expenses and expenses associated with the transactions, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the ability of the Company or Tyme to protect their respective intellectual property rights; competitive responses to the transaction; unexpected costs, charges or expenses resulting from the transaction; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transaction; and legislative, regulatory, political and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the risk factors included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and Tyme’s Annual Report on Form 10-K for the year ended March 31, 2022, each of which is on file with the U.S. Securities and Exchange Commission (the “SEC”). In addition, the extent to which the COVID-19 pandemic continues to impact the proposed transactions will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration and severity of the pandemic, additional or modified government actions, and the actions that may be required to contain the virus or treat its impact. The Company and Tyme can give no assurance that the conditions to the transactions will be satisfied. Except as required by applicable law, the Company and Tyme undertake no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

No Offer or Solicitation

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Important Additional Information Will Be Filed with the SEC

The Company plans to file with the SEC a Registration Statement on Form S-4 in connection with the transactions and the Company and Tyme plan to file with the SEC and mail to their respective stockholders a Joint Proxy Statement/Prospectus in connection with the transactions. Investors and security holders are urged to read the Registration Statement and the Joint Proxy Statement/Prospectus carefully when they are available before making any voting or investment decision with respect to the proposed transactions. The Registration Statement and the Joint Proxy Statement/Prospectus will contain important information about the Company, Tyme, the transactions and related matters. Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus and other documents filed with the SEC by the Company and Tyme through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus from the Company by contacting hannahd@sternir.com or from Tyme by contacting investorrelations@tymeinc.com.

Participants in the Solicitation

The Company and Tyme, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement dated April 21, 2022, which is filed with the SEC. Information regarding Tyme’s directors and executive officers is contained in Tyme’s proxy statement dated July 12, 2021, which is filed with the SEC. A more complete description will be available in the Registration Statement and the Joint Proxy Statement/Prospectus.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SYROS PHARMACEUTICALS, INC. |

|

|

|

|

| Date: July 6, 2022 |

|

|

|

By: |

|

/s/ Nancy Simonian |

|

|

|

|

|

|

Nancy Simonian, M.D. President & Chief Executive Officer |

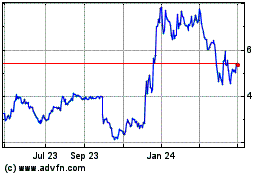

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

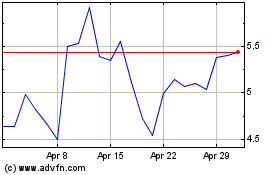

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Apr 2023 to Apr 2024