0001509470

false

0001509470

2023-07-11

2023-07-11

0001509470

SSSS:CommonStockParValue0.01PerShareMember

2023-07-11

2023-07-11

0001509470

SSSS:Sec6.00NotesDue2026Member

2023-07-11

2023-07-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 11, 2023

SURO CAPITAL CORP.

(Exact name of registrant as specified in its charter)

| Maryland |

1-35156 |

27-4443543 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

640 Fifth Avenue

12th Floor

New York, NY 10019

(Address of principal executive offices and zip

code)

Registrant’s telephone number, including

area code: (212) 931-6331

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class: |

Trading symbol: |

Name of each exchange on which

registered: |

| Common Stock, par value $0.01 per share |

SSSS |

Nasdaq Global Select Market |

| 6.00% Notes due 2026 |

SSSSL |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On July 11, 2023, SuRo

Capital Corp. (“SuRo Capital” or the “Company”) issued a press release containing preliminary estimates of its results

for the second quarter ended June 30, 2023 (the “Press Release”). A copy of the Press Release is included as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

The information disclosed

under this Item 2.02, including the information set forth in Exhibit 99.1 hereto, is being “furnished” and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document

pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act, except as otherwise

expressly stated in any such filing.

Preliminary Estimates and Investment Portfolio Update

On July 11, 2023, the Company disclosed the following

information in the Press Release.

Preliminary Estimates of Results for the Quarter Ended June 30,

2023

As previously reported, SuRo

Capital’s net assets totaled approximately $215.0 million, or $7.59 per share, at March 31, 2023, and approximately $280.2 million,

or $9.24 per share at June 30, 2022. As of June 30, 2023, SuRo Capital’s net asset value is estimated to be between $7.15 and $7.65

per share.

As of June 30, 2023, there were 25,398,640 shares

of the Company’s common stock outstanding.

Investment Portfolio Update

As of June 30, 2023, the Company

held positions in 37 portfolio companies – 33 privately held and 4 publicly held, excluding short-term U.S. treasuries.

During the three months ended

June 30, 2023, the Company made the following new and follow-on investments, excluding short-term U.S. treasuries:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| PayJoy, Inc. | |

Simple Agreement for Future Equity (SAFE) | |

5/25/2023 | |

$0.5 million |

| ServiceTitan, Inc. | |

Common Shares | |

6/30/2023 | |

$10.0 million |

During the three months ended

June 30, 2023, the Company exited or received proceeds from the following investments, excluding short-term U.S. treasuries:

| Portfolio Company |

|

Transaction

Date |

|

Shares

Sold |

|

Average Net

Share Price(1) |

|

Net

Proceeds |

|

Realized

Loss |

| Nextdoor Holdings, Inc.(2) |

|

Various |

|

950,000 |

|

$3.05 |

|

$2.9 million |

|

$(2.4 million) |

| Ozy Media, Inc.(3) |

|

5/4/2023 |

|

N/A |

|

N/A |

|

$-- |

|

$(10.9 million) |

| Residential Homes For Rent, LLC (d/b/a Second Avenue)(4) |

|

Various |

|

N/A |

|

N/A |

|

$0.3 million |

|

$-- |

| True Global Ventures 4 Plus Pte Ltd |

|

6/30/2023 |

|

N/A |

|

N/A |

|

$0.3 million |

|

$-- |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on

the sale(s), if applicable. |

| (2) | As of June 30, 2023, SuRo Capital held 852,416 remaining Nextdoor Holdings, Inc. public common shares. |

| (3) | On May 4, 2023, SuRo Capital abandoned its investment in Ozy Media, Inc. |

| (4) | During the three months ended June 30, 2023, approximately $0.3 million was received from Residential

Homes For Rent, LLC (d/b/a Second Avenue) related to the 15% term loan due December 23, 2023. Of the proceeds received, approximately

$0.3 million repaid a portion of the outstanding principal and the remainder was attributed to interest. |

Subsequent to quarter-end

through July 11, 2023, the Company made the following new investment:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| FourKites, Inc. | |

Common Shares | |

7/7/2023 | |

$4.2 million |

Subsequent to quarter-end

through July 11, 2023, the Company received proceeds from the following investment:

| Portfolio Company |

|

Transaction

Date |

|

Shares

Sold |

|

Average Net

Share Price(1) |

|

Net

Proceeds |

|

Realized

Loss |

| Nextdoor Holdings, Inc.(2) |

|

Various |

|

100,000 |

|

$3.16 |

|

$0.3 million |

|

$(0.2 million) |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on

the sale(s), if applicable. |

| (2) | As of July 11, 2023, SuRo Capital held 752,416 remaining Nextdoor Holdings, Inc. public common shares. |

Preliminary Estimates and Guidance

The preliminary financial

estimates provided herein are unaudited and have been prepared by, and are the responsibility of, the management of the Company. Neither

the Company’s independent registered public accounting firm, nor any other independent accountants, have audited, reviewed, compiled,

or performed any procedures with respect to the preliminary financial data included herein. Actual results may differ materially.

The Company expects to announce

its second quarter ended June 30, 2023 results in August 2023.

Forward-Looking Statements

Statements included herein,

including statements regarding the Company’s beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking

statements". The Company cautions that any forward-looking statements are not guarantees of future performance and that actual results

or developments may differ materially from those projected or implied in these statements. All forward-looking statements involve a number

of risks and uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies,

our industry, and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations

reflected in or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause

the Company’s actual results to differ from management's current expectations, are contained in the Company’s filings with

the Securities and Exchange Commission. The Company undertakes no obligation to update any forward-looking statement to reflect events

or circumstances that may arise after the date of this Current Report on Form 8-K.

| Item 9.01. | Financial Statements and Exhibits. |

* The press release attached hereto as Exhibit 99.1 is “furnished”

and not “filed,” as described in Item 2.02 of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| Date: July 11, 2023 |

SURO CAPITAL CORP. |

| |

|

| |

|

| |

By: |

/s/ Allison Green |

| |

|

Allison Green |

| |

|

Chief Financial Officer, Chief Compliance Officer, Treasurer and Corporate Secretary |

Exhibit 99.1

SuRo Capital Corp. Second Quarter 2023 Preliminary

Investment Portfolio Update

Net Asset Value Anticipated to be $7.15 to $7.65

Per Share

NEW YORK, NY, July 11, 2023 (GLOBE NEWSWIRE)

– SuRo Capital Corp. (“SuRo Capital”, the “Company”, “we”, “us”, and “our”)

(Nasdaq: SSSS) today provided the following preliminary update on its investment portfolio for the second quarter ended

June 30, 2023.

“Over the last several quarters we have

noted the convergence of private company valuations with their respective public company comparables. While there have been many opportunities

to invest in exciting companies, most continued to remain too expensive. Remaining steadfast to our thesis that potential investments

would become available in the secondary market, we were able to act on two new secondary opportunities at compelling prices. During the

second quarter, we invested $10.0 million in ServiceTitan, Inc., a software business for home and commercial trades, and subsequent to

quarter-end, we invested $4.2 million in FourKites, Inc., a supply chain visibility software company. Further, we have other potential

investments in progress that we anticipate completing during the third quarter. We believe the combination of being strategically opportunistic

during times of volatility, along with over $100.0 million of investable capital as of quarter-end, allows SuRo Capital to seize unique

opportunities with high potential returns,” said Mark Klein, Chairman and Chief Executive Officer of SuRo Capital.

Mr. Klein continued, “We believe the market

is currently undervaluing our portfolio, which gives us opportunities to enhance shareholder value through stock repurchases. We also

remain highly focused on balancing our remaining capital between these repurchases and new investment opportunities. In addition to our

new investments, we executed our recent Modified Dutch Auction Tender Offer, which we believe was an efficient and accretive deployment

of capital. As announced in the first quarter and executed during the second quarter, the Modified Dutch Auction Tender Offer resulted

in the purchase of 3.0 million shares of common stock for $4.50 per share. Additionally, as of quarter-end, SuRo Capital has approximately

$16.4 million available under its Share Repurchase Program. This capacity allows us to continue balancing new investments with share repurchases

as we look toward the second half of 2023.”

As previously reported, SuRo Capital’s net

assets totaled approximately $215.0 million, or $7.59 per share, at March 31, 2023, and approximately $280.2 million, or $9.24 per share

at June 30, 2022. As of June 30, 2023, SuRo Capital’s net asset value is estimated to be between $7.15 to $7.65 per share.

As of June 30, 2023, there were 25,398,640 shares

of the Company’s common stock outstanding.

Investment Portfolio Update

As of June 30, 2023, SuRo Capital held positions

in 37 portfolio companies – 33 privately held and 4 publicly held, excluding short-term US treasuries.

During the three months ended June 30, 2023, SuRo

Capital made the following new and follow-on investments, excluding short-term US treasuries:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| PayJoy, Inc. | |

Simple Agreement for Future Equity (SAFE) | |

5/25/2023 | |

$0.5 million |

| ServiceTitan, Inc. | |

Common Shares | |

6/30/2023 | |

$10.0 million |

During the three months ended June 30, 2023, SuRo

Capital exited or received proceeds from the following investments, excluding short-term US treasuries:

| Portfolio Company |

|

Transaction

Date |

|

Shares

Sold |

|

Average Net

Share Price(1) |

|

Net

Proceeds |

|

Realized

Loss |

| Nextdoor Holdings, Inc.(2) |

|

Various |

|

950,000 |

|

$3.05 |

|

$2.9 million |

|

$(2.4 million) |

| Ozy Media, Inc.(3) |

|

5/4/2023 |

|

N/A |

|

N/A |

|

$- |

|

$(10.9 million) |

| Residential Homes For Rent, LLC (d/b/a Second Avenue)(4) |

|

Various |

|

N/A |

|

N/A |

|

$0.3 million |

|

$- |

| True Global Ventures 4 Plus Pte Ltd |

|

6/30/2023 |

|

N/A |

|

N/A |

|

$0.3 million |

|

$- |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable. |

| (2) | As of June 30, 2023, SuRo Capital held 852,416 remaining Nextdoor Holdings, Inc. public common shares. |

| (3) | On May 4, 2023, SuRo Capital abandoned its investment in Ozy Media, Inc. |

| (4) | During the three months ended June 30, 2023, approximately $0.3 million was received from Residential

Homes For Rent, LLC (d/b/a Second Avenue) related to the 15% term loan due December 23, 2023. Of the proceeds received, approximately

$0.3 million repaid a portion of the outstanding principal and the remaining was attributed to interest. |

Subsequent to quarter-end through July 11, 2023,

SuRo Capital made the following new investment:

| Portfolio Company | |

Investment | |

Transaction Date | |

Amount |

| FourKites, Inc. | |

Common Shares | |

7/7/2023 | |

$4.2 million |

Subsequent to quarter-end through July 11, 2023,

SuRo Capital received proceeds from the following investment:

| Portfolio Company |

|

Transaction

Date |

|

Shares

Sold |

|

Average Net

Share Price(1) |

|

Net

Proceeds |

|

Realized

Loss |

| Nextdoor Holdings, Inc.(2) |

|

Various |

|

100,000 |

|

$3.16 |

|

$0.3 million |

|

$(0.2 million) |

| (1) | The average net share price is the net share price realized after deducting all commissions and fees on the sale(s), if applicable. |

| (2) | As of July 11, 2023, SuRo Capital held 752,416 remaining Nextdoor Holdings, Inc. public common shares. |

SuRo Capital’s liquid assets were approximately

$112.0 million as of June 30, 2023, consisting of cash, short-term US treasuries, and securities of publicly traded portfolio companies

not subject to lock-up restrictions at quarter-end.

Modified Dutch Auction Tender Offer

On March 17, 2023, our Board of Directors authorized

a Modified Dutch Auction Tender Offer (“Tender Offer”) to purchase up to 3.0 million shares of our common stock at a price

per share between $3.00 and $4.50, using available cash. In accordance with the Tender Offer, on April 21, 2023, the Company repurchased

3,000,000 shares at a price of $4.50 per share, representing 10.6% of its outstanding shares. The per share purchase price of properly

tendered shares represents 60.9% of net asset value per share as of December 31, 2022.

Share Repurchase Program

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 5.8 million shares of its common stock for an aggregate purchase price of approximately

$38.6 million. The dollar value of shares that may yet be purchased by the Company under the Share Repurchase Program is approximately

$16.4 million. The Share Repurchase Program is authorized through October 31, 2023.

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market provided it complies with the prohibitions under its insider trading policies

and procedures and the applicable provisions of the Investment Company Act of 1940, as amended, and the Securities Exchange Act of 1934,

as amended.

Preliminary Estimates and Guidance

The preliminary financial estimates provided herein

are unaudited and have been prepared by, and are the responsibility of, the management of SuRo Capital. Neither our independent registered

public accounting firm, nor any other independent accountants, have audited, reviewed, compiled, or performed any procedures with respect

to the preliminary financial data included herein. Actual results may differ materially.

The Company expects to announce its second quarter

ended June 30, 2023 results in August 2023.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or strategies for the future, may constitute "forward-looking statements".

SuRo Capital cautions you that forward-looking statements are not guarantees of future performance and that actual results or developments

may differ materially from those projected or implied in these statements. All forward-looking statements involve a number of risks and

uncertainties, including the impact of any market volatility that may be detrimental to our business, our portfolio companies, our industry,

and the global economy, that could cause actual results to differ materially from the plans, intentions, and expectations reflected in

or suggested by the forward-looking statements. Risk factors, cautionary statements, and other conditions which could cause SuRo Capital's

actual results to differ from management's current expectations are contained in SuRo Capital's filings with the Securities and Exchange

Commission. SuRo Capital undertakes no obligation to update any forward-looking statement to reflect events or circumstances that may

arise after the date of this press release.

About SuRo Capital Corp.

SuRo Capital

Corp. (Nasdaq: SSSS) is a publicly traded investment fund that seeks to invest in

high-growth, venture-backed private companies. The fund seeks to create a portfolio of high-growth emerging private companies via a repeatable

and disciplined investment approach, as well as to provide investors with access to such companies through its publicly traded common

stock. SuRo Capital is headquartered in New York, NY and has offices in San Francisco, CA. Connect with the company on Twitter, LinkedIn,

and at www.surocap.com.

Contact

SuRo Capital Corp.

(212) 931-6331

IR@surocap.com

v3.23.2

Cover

|

Jul. 11, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 11, 2023

|

| Entity File Number |

1-35156

|

| Entity Registrant Name |

SURO CAPITAL CORP.

|

| Entity Central Index Key |

0001509470

|

| Entity Tax Identification Number |

27-4443543

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

640 Fifth Avenue

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

931-6331

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.01 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SSSS

|

| Security Exchange Name |

NASDAQ

|

| 6.00% Notes due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.00% Notes due 2026

|

| Trading Symbol |

SSSSL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_CommonStockParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SSSS_Sec6.00NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

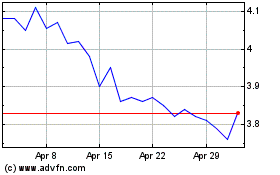

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025