SuRo Capital Corp. (“SuRo Capital”, the

“Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) today provided the following preliminary

update on its investment portfolio for the second quarter ended

June 30, 2023.

“Over the last several quarters we have noted

the convergence of private company valuations with their respective

public company comparables. While there have been many

opportunities to invest in exciting companies, most continued to

remain too expensive. Remaining steadfast to our thesis that

potential investments would become available in the secondary

market, we were able to act on two new secondary opportunities at

compelling prices. During the second quarter, we invested $10.0

million in ServiceTitan, Inc., a software business for home and

commercial trades, and subsequent to quarter-end, we invested $4.2

million in FourKites, Inc., a supply chain visibility software

company. Further, we have other potential investments in progress

that we anticipate completing during the third quarter. We believe

the combination of being strategically opportunistic during times

of volatility, along with over $100.0 million of investable capital

as of quarter-end, allows SuRo Capital to seize unique

opportunities with high potential returns,” said Mark Klein,

Chairman and Chief Executive Officer of SuRo Capital.

Mr. Klein continued, “We believe the market is

currently undervaluing our portfolio, which gives us opportunities

to enhance shareholder value through stock repurchases. We also

remain highly focused on balancing our remaining capital between

these repurchases and new investment opportunities. In addition to

our new investments, we executed our recent Modified Dutch Auction

Tender Offer, which we believe was an efficient and accretive

deployment of capital. As announced in the first quarter and

executed during the second quarter, the Modified Dutch Auction

Tender Offer resulted in the purchase of 3.0 million shares of

common stock for $4.50 per share. Additionally, as of quarter-end,

SuRo Capital has approximately $16.4 million available under its

Share Repurchase Program. This capacity allows us to continue

balancing new investments with share repurchases as we look toward

the second half of 2023.”

As previously reported, SuRo Capital’s net

assets totaled approximately $215.0 million, or $7.59 per share, at

March 31, 2023, and approximately $280.2 million, or $9.24 per

share at June 30, 2022. As of June 30, 2023, SuRo Capital’s net

asset value is estimated to be between $7.15 to $7.65 per

share.

As of June 30, 2023, there were 25,398,640

shares of the Company’s common stock outstanding.

Investment Portfolio Update

As of June 30, 2023, SuRo Capital held positions

in 37 portfolio companies – 33 privately held and 4 publicly held,

excluding short-term US treasuries.

During the three months ended June 30, 2023,

SuRo Capital made the following new and follow-on investments,

excluding short-term US treasuries:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

| PayJoy, Inc. |

Simple Agreement for Future Equity (SAFE) |

5/25/2023 |

$0.5 million |

| ServiceTitan, Inc. |

Common Shares |

6/30/2023 |

$10.0 million |

During the three months ended June 30, 2023,

SuRo Capital exited or received proceeds from the following

investments, excluding short-term US treasuries:

|

|

Transaction |

Shares |

Average Net |

Net |

Realized |

|

Portfolio Company |

Date |

Sold |

Share Price(1) |

Proceeds |

Loss |

| Nextdoor Holdings,

Inc.(2) |

Various |

950,000 |

$3.05 |

$2.9 million |

$(2.4 million) |

| Ozy Media, Inc.(3) |

5/4/2023 |

N/A |

N/A |

$- |

$(10.9 million) |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(4) |

Various |

N/A |

N/A |

$0.3 million |

$- |

| True Global Ventures 4 Plus

Pte Ltd |

6/30/2023 |

N/A |

N/A |

$0.3 million |

$- |

__________________(1) The average net

share price is the net share price realized after deducting all

commissions and fees on the sale(s), if applicable.(2) As of June

30, 2023, SuRo Capital held 852,416 remaining Nextdoor Holdings,

Inc. public common shares.(3) On May 4, 2023, SuRo Capital

abandoned its investment in Ozy Media, Inc.(4) During the three

months ended June 30, 2023, approximately $0.3 million was received

from Residential Homes For Rent, LLC (d/b/a Second Avenue) related

to the 15% term loan due December 23, 2023. Of the proceeds

received, approximately $0.3 million repaid a portion of the

outstanding principal and the remaining was attributed to

interest.

Subsequent to quarter-end through July 11, 2023,

SuRo Capital made the following new investment:

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

|

FourKites, Inc. |

Common Shares |

7/7/2023 |

$4.2 million |

Subsequent to quarter-end through July 11, 2023,

SuRo Capital received proceeds from the following investment:

|

|

Transaction |

Shares |

Average Net |

Net |

Realized |

|

Portfolio Company |

Date |

Sold |

Share Price(1) |

Proceeds |

Loss |

| Nextdoor Holdings,

Inc.(2) |

Various |

100,000 |

$3.16 |

$0.3 million |

$(0.2 million) |

__________________(1) The average net

share price is the net share price realized after deducting all

commissions and fees on the sale(s), if applicable.(2) As of July

11, 2023, SuRo Capital held 752,416 remaining Nextdoor Holdings,

Inc. public common shares.

SuRo Capital’s liquid assets were approximately

$112.0 million as of June 30, 2023, consisting of cash, short-term

US treasuries, and securities of publicly traded portfolio

companies not subject to lock-up restrictions at quarter-end.

Modified Dutch Auction Tender

Offer

On March 17, 2023, our Board of Directors

authorized a Modified Dutch Auction Tender Offer (“Tender Offer”)

to purchase up to 3.0 million shares of our common stock at a price

per share between $3.00 and $4.50, using available cash. In

accordance with the Tender Offer, on April 21, 2023, the Company

repurchased 3,000,000 shares at a price of $4.50 per share,

representing 10.6% of its outstanding shares. The per share

purchase price of properly tendered shares represents 60.9% of net

asset value per share as of December 31, 2022.

Share Repurchase Program

Since inception of the Share Repurchase Program

in August 2017, SuRo Capital has repurchased over 5.8 million

shares of its common stock for an aggregate purchase price of

approximately $38.6 million. The dollar value of shares that may

yet be purchased by the Company under the Share Repurchase Program

is approximately $16.4 million. The Share Repurchase Program is

authorized through October 31, 2023.

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market

provided it complies with the prohibitions under its insider

trading policies and procedures and the applicable provisions of

the Investment Company Act of 1940, as amended, and the Securities

Exchange Act of 1934, as amended.

Preliminary Estimates and

Guidance

The preliminary financial estimates provided

herein are unaudited and have been prepared by, and are the

responsibility of, the management of SuRo Capital. Neither our

independent registered public accounting firm, nor any other

independent accountants, have audited, reviewed, compiled, or

performed any procedures with respect to the preliminary financial

data included herein. Actual results may differ materially.

The Company expects to announce its second

quarter ended June 30, 2023 results in August 2023.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of any market volatility that may be detrimental to our business,

our portfolio companies, our industry, and the global economy, that

could cause actual results to differ materially from the plans,

intentions, and expectations reflected in or suggested by the

forward-looking statements. Risk factors, cautionary statements,

and other conditions which could cause SuRo Capital's actual

results to differ from management's current expectations are

contained in SuRo Capital's filings with the Securities and

Exchange Commission. SuRo Capital undertakes no obligation to

update any forward-looking statement to reflect events or

circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on Twitter, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

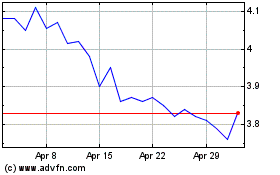

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025