SuRo Capital Corp. (“SuRo Capital”, the

“Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) today announced its financial results for

the quarter ended March 31, 2023. Net assets totaled approximately

$215.0 million, or $7.59 per share, at March 31, 2023 as compared

to $7.39 per share at December 31, 2022 and $12.22 per share at

March 31, 2022.

“As we have consistently demonstrated, SuRo

Capital is committed to initiatives that enhance shareholder value,

and we believe the market is currently undervaluing our portfolio.

Given the discount our stock has traded at compared to net asset

value per share, we believe our recent Modified Dutch Auction

Tender Offer was an efficient and accretive deployment of capital.

As announced in the first quarter and executed subsequent to

quarter-end, the Modified Dutch Auction Tender Offer resulted in

the purchase of 3.0 million shares of common stock for $4.50 per

share,” said Mark Klein, Chairman and Chief Executive Officer of

SuRo Capital.

“We are encouraged by reports that in the first

quarter, secondary transactions were closed at an approximately 50%

discount to a company’s last primary financing. While still

relatively expensive compared to public comparables, this discount,

coupled with increasing secondary trade volumes, may indicate that

the market is finding a level where investors will

transact. With over $120.0 million of investable

capital at quarter-end, we remain poised to continue investing in

both primary and secondary opportunities for later-stage,

high-growth companies at what we believe will be compelling

valuations,” Mr. Klein concluded.

Investment Portfolio as of March 31,

2023

At March 31, 2023, SuRo Capital held positions

in 37 portfolio companies – 33 privately held and 4 publicly held –

with an aggregate fair value of approximately $165.1 million,

excluding short-term US treasuries. The Company’s top

five portfolio company investments accounted for approximately 59%

of the total portfolio at fair value as of March 31, 2023.

Top Five Investments as of March 31,

2023

|

Portfolio Company ($ in millions) |

Cost Basis |

Fair Value |

% of Total Portfolio |

|

Learneo, Inc. (f/k/a Course Hero, Inc.) |

$ |

15.0 |

|

$ |

50.8 |

|

|

30.8 |

% |

|

Colombier Sponsor LLC |

|

2.7 |

|

|

14.8 |

|

|

9.0 |

|

| Blink

Health, Inc. |

|

15.0 |

|

|

11.7 |

|

|

7.1 |

|

| Locus

Robotics Corp. |

|

10.0 |

|

|

10.0 |

|

|

6.1 |

|

|

Architect Capital PayJoy SPV |

|

10.0 |

|

|

10.0 |

|

|

6.1 |

|

|

Total(1) |

$ |

52.7 |

|

$ |

97.3 |

|

|

58.9 |

% |

__________________(1) Total may not

sum due to rounding.

First Quarter 2023 Investment Portfolio

Activity

During the three months ended March 31, 2023,

SuRo Capital funded the following follow-on investments (excluding

short-term US treasuries):

|

Portfolio Company |

Investment |

Transaction Date |

Amount |

|

Orchard Technologies, Inc. |

Series 1 Senior Preferred |

1/13/2023 |

$2.0 million |

| True

Global Ventures 4 Plus Pte Ltd(1) |

Limited Partner Fund Investment |

3/31/2023 |

$1.3 million |

__________________(1)

The previously unfunded capital commitment of $1.3 million was

deemed fully contributed in lieu of cash distributions.

During the three months ended March 31, 2023,

SuRo Capital exited or received proceeds from the following

investments (excluding short-term US treasuries):

|

Portfolio Company |

Transaction Date |

Shares Sold |

Average Net Share Price(1) |

Net Proceeds |

Realized Gain/(Loss) |

| Kahoot! ASA(2) |

Various |

38,305 |

$1.97 |

$0.1 million |

$(0.1 million) |

| NewLake Capital Partners,

Inc.(3) |

Various |

123,938 |

$18.50 |

$2.3 million |

$(0.2 million) |

| Rent The Runway, Inc.(4) |

1/4/2023 |

79,191 |

$3.05 |

$0.2 million |

$(1.0 million) |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(5) |

Various |

N/A |

N/A |

$0.3 million |

$- |

| True Global Ventures 4 Plus

Pte Ltd(6) |

3/31/2023 |

N/A |

N/A |

$1.3 million |

$1.3 million |

__________________(1)

The average net share price is the net share price realized after

deducting all commissions and fees on the sale(s), if applicable.

(2) As of March 8, 2023, SuRo Capital had sold its remaining

Kahoot! ASA public common shares.(3) As of March 31, 2023, SuRo

Capital held 105,820 remaining NewLake Capital Partners, Inc.

public common shares.(4) As of January 4, 2023, SuRo Capital had

sold its remaining Rent the Runway, Inc. public common shares.(5)

During the three months ended March 31, 2023, approximately $0.3

million was received from Residential Homes For Rent, LLC (d/b/a

Second Avenue) related to the 15% term loan due December 23, 2023.

Of the proceeds received, approximately $0.3 million repaid a

portion of the outstanding principal and the remaining was

attributed to interest.(6) The previously unfunded capital

commitment of $1.3 million was deemed fully contributed in lieu of

cash distributions.

Subsequent to quarter-end, through May 9, 2023,

SuRo Capital exited or received proceeds from the following

investments (excluding short-term US treasuries):

|

Portfolio Company |

Transaction Date |

Net Proceeds |

Realized Loss |

| Ozy Media, Inc.(1) |

5/4/2023 |

$- |

$(10.9 million) |

| Residential Homes For Rent,

LLC (d/b/a Second Avenue)(2) |

4/21/2023 |

$0.1 million |

$- |

__________________(1) On May 4, 2023,

SuRo Capital abandoned its investment in Ozy Media, Inc.(2)

Subsequent to March 31, 2023, $0.1 million was received from

Residential Homes for Rent, LLC (d/b/a Second Avenue) related to

the 15% term loan due December 23, 2023. Of the proceeds received,

$0.1 million repaid a portion of the outstanding principal and the

remaining proceeds were attributed to interest.

First Quarter 2023 Financial

Results

|

|

Quarter EndedMarch 31, 2023 |

Quarter EndedMarch 31, 2022 |

|

$ in millions |

per share(1) |

$ in millions |

per share(1) |

|

|

|

|

|

|

|

Net investment loss |

$ |

(4.2 |

) |

$ |

(0.15 |

) |

$ |

(4.2 |

) |

$ |

(0.14 |

) |

|

|

|

|

|

|

| Net

realized gain on investments |

|

0.2 |

|

|

0.01 |

|

|

3.1 |

|

|

0.10 |

|

|

|

|

|

|

|

| Net

change in unrealized appreciation of investments |

|

8.6 |

|

|

0.30 |

|

|

21.6 |

|

|

0.69 |

|

|

|

|

|

|

|

| Net

increase in net assets resulting from operations – basic (2) |

$ |

4.6 |

|

$ |

0.16 |

|

$ |

20.5 |

|

$ |

0.66 |

|

|

|

|

|

|

|

|

Dividends declared |

|

- |

|

|

- |

|

|

(3.4 |

) |

|

(0.11 |

) |

|

|

|

|

|

|

| Issuance

of common stock from public offering |

|

- |

|

|

- |

|

|

0.2 |

|

|

0.01 |

|

|

|

|

|

|

|

|

Repurchase of common stock |

|

- |

|

|

- |

|

|

(1.4 |

) |

|

(0.06 |

) |

|

|

|

|

|

|

|

Stock-based compensation |

|

0.4 |

|

|

0.04 |

|

|

(0.0 |

) |

|

0.01 |

|

|

|

|

|

|

|

|

Increase in net asset value(2) |

$ |

5.0 |

|

$ |

0.20 |

|

$ |

15.9 |

|

$ |

0.50 |

|

__________________(1) Based on basic

weighted-average number of shares outstanding for the relevant

period.(2) Total may not sum due to rounding.

Weighted-average common basic shares outstanding

were approximately 28.4 million and 31.2 million for the quarters

ended March 31, 2023 and 2022, respectively. As of March 31, 2023,

there were 28,338,580 shares of the Company’s common stock

outstanding.

SuRo Capital’s liquid assets were approximately

$135.6 million as of March 31, 2023, consisting of cash, short-term

US treasuries, and securities of publicly traded portfolio

companies not subject to lock-up restrictions at quarter-end.

Modified Dutch Auction Tender

Offer

On March 17, 2023, our Board of Directors

authorized a Modified Dutch Auction Tender Offer (“Tender Offer”)

to purchase up to 3.0 million shares of our common stock at a price

per share between $3.00 and $4.50, using available cash. In

accordance with the Tender Offer, on April 21, 2023, the Company

repurchased 3,000,000 shares at a price of $4.50 per share,

representing 10.6% of its outstanding shares. The per share

purchase price of properly tendered shares represents 60.9% of net

asset value per share as of December 31, 2022.

Share Repurchase Program

Under the Share Repurchase Program, the Company

may repurchase its outstanding common stock in the open market

provided it complies with the prohibitions under its insider

trading policies and procedures and the applicable provisions of

the Investment Company Act of 1940, as amended, and the Securities

Exchange Act of 1934, as amended.

The dollar value of shares that may yet be

purchased by SuRo Capital under the Share Repurchase Program is

approximately $16.4 million. The Share Repurchase Program is

authorized through October 31, 2023.

Conference Call and Webcast

Management will hold a conference call and

webcast for investors at 2:00 p.m. PT (5:00 p.m. ET) on May 9,

2023. The conference call access number for U.S. participants is

866-580-3963, and the conference call access number for

participants outside the U.S. is +1 786-697-3501. The conference ID

number for both access numbers is 0401553. Additionally, interested

parties can listen to a live webcast of the call from the "Investor

Relations" section of SuRo Capital’s website at www.surocap.com. An

archived replay of the webcast will also be available for 12 months

following the live presentation.

A replay of the conference call may be accessed

until 5:00 p.m. PT (8:00 p.m. ET) on May 16, 2023 by dialing

866-583-1035 (U.S.) or +44 (0) 20 3451 9993 (International) and

using conference ID number 0401553.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of any market volatility that may be detrimental to our business,

our portfolio companies, our industry, and the global economy, that

could cause actual results to differ materially from the plans,

intentions, and expectations reflected in or suggested by the

forward-looking statements. Risk factors, cautionary statements,

and other conditions which could cause SuRo Capital's actual

results to differ from management's current expectations are

contained in SuRo Capital's filings with the Securities and

Exchange Commission. SuRo Capital undertakes no obligation to

update any forward-looking statement to reflect events or

circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on Twitter, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

ASSETS AND LIABILITIES (UNAUDITED)

| |

March 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Investments at fair

value: |

|

|

|

|

Non-controlled/non-affiliate investments (cost of $154,328,296 and

$155,103,810, respectively) |

$ |

128,088,500 |

|

|

$ |

130,901,546 |

|

| Non-controlled/affiliate

investments (cost of $41,140,804 and $41,140,804,

respectively) |

|

11,270,798 |

|

|

|

12,591,162 |

|

| Controlled investments (cost

of $19,883,894 and $19,883,894, respectively) |

|

25,728,742 |

|

|

|

13,695,870 |

|

|

Total Portfolio Investments |

|

165,088,040 |

|

|

|

157,188,578 |

|

| Investments in U.S. Treasury

bills (cost of $75,497,157 and $84,999,598, respectively) |

|

75,986,912 |

|

|

|

85,056,817 |

|

| Total Investments (cost of

$290,850,151 and $301,128,106, respectively) |

|

241,074,952 |

|

|

|

242,245,395 |

|

| Cash |

|

48,113,676 |

|

|

|

40,117,598 |

|

| Escrow proceeds

receivable |

|

609,685 |

|

|

|

628,332 |

|

| Interest and dividends

receivable |

|

105,008 |

|

|

|

138,766 |

|

| Deferred financing costs |

|

539,120 |

|

|

|

555,761 |

|

| Prepaid expenses and other

assets(1) |

|

654,202 |

|

|

|

727,006 |

|

|

Total Assets |

|

291,096,643 |

|

|

|

284,412,858 |

|

|

LIABILITIES |

|

|

|

| Accounts payable and accrued

expenses(1) |

|

2,389,773 |

|

|

|

708,827 |

|

| Dividends payable |

|

188,357 |

|

|

|

296,170 |

|

| 6.00% Notes due December 30,

2026(2) |

|

73,475,444 |

|

|

|

73,387,159 |

|

|

Total Liabilities |

|

76,053,574 |

|

|

|

74,392,156 |

|

| |

|

|

|

| Net

Assets |

$ |

215,043,069 |

|

|

$ |

210,020,702 |

|

| NET

ASSETS |

|

|

|

|

Common stock, par value $0.01 per share (100,000,000 authorized;

28,338,580 and 28,429,499 issued and outstanding,

respectively) |

$ |

283,386 |

|

|

$ |

284,295 |

|

| Paid-in capital in excess of

par |

|

331,306,021 |

|

|

|

330,899,254 |

|

| Accumulated net investment

loss |

|

(69,054,370 |

) |

|

|

(64,832,605 |

) |

| Accumulated net realized gain

on investments, net of distributions |

|

2,741,808 |

|

|

|

2,552,465 |

|

| Accumulated net unrealized

appreciation/(depreciation) of investments |

|

(50,233,776 |

) |

|

|

(58,882,707 |

) |

|

Net Assets |

$ |

215,043,069 |

|

|

$ |

210,020,702 |

|

|

Net Asset Value Per Share |

$ |

7.59 |

|

|

$ |

7.39 |

|

__________________________________________________(1) This

balance includes a right of use asset and corresponding operating

lease liability, respectively.(2) As of March 31, 2023, the 6.00%

Notes due December 30, 2026 (effective interest rate of 6.53%) had

a face value $75,000,000. As of December 31, 2022, the 6.00% Notes

due December 30, 2026 (effective interest rate of 6.53%) had a face

value $75,000,000.

SURO CAPITAL CORP. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (UNAUDITED)

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| INVESTMENT

INCOME |

|

|

|

| Non-controlled/non-affiliate

investments: |

|

|

|

|

Interest income |

$ |

49,475 |

|

|

$ |

162,455 |

|

|

Dividend income |

|

63,145 |

|

|

|

130,645 |

|

| Controlled investments: |

|

|

|

|

Interest income |

|

236,000 |

|

|

|

290,000 |

|

| Interest income from U.S.

Treasury bills |

|

950,462 |

|

|

|

— |

|

|

Total Investment Income |

|

1,299,082 |

|

|

|

583,100 |

|

| OPERATING

EXPENSES |

|

|

|

| Compensation expense |

|

2,136,754 |

|

|

|

1,860,702 |

|

| Directors’ fees |

|

160,565 |

|

|

|

160,565 |

|

| Professional fees |

|

990,834 |

|

|

|

1,272,713 |

|

| Interest expense |

|

1,213,286 |

|

|

|

1,200,786 |

|

| Income tax expense |

|

529,780 |

|

|

|

2,050 |

|

| Other expenses |

|

489,628 |

|

|

|

310,989 |

|

|

Total Operating Expenses |

|

5,520,847 |

|

|

|

4,807,805 |

|

|

Net Investment Loss |

|

(4,221,765 |

) |

|

|

(4,224,705 |

) |

| Realized Gain on

Investments: |

|

|

|

| Non-controlled/non-affiliated

investments |

|

189,343 |

|

|

|

3,096,275 |

|

|

Net Realized Gain on Investments |

|

189,343 |

|

|

|

3,096,275 |

|

| Change in Unrealized

Appreciation/(Depreciation) of Investments: |

|

|

|

| Non-controlled/non-affiliated

investments |

|

(2,063,577 |

) |

|

|

21,743,987 |

|

| Non-controlled/affiliate

investments |

|

(1,320,364 |

) |

|

|

(289,102 |

) |

| Controlled investments |

|

12,032,872 |

|

|

|

130,000 |

|

|

Net Change in Unrealized Appreciation/(Depreciation) of

Investments |

|

8,648,931 |

|

|

|

21,584,885 |

|

|

Net Change in Net Assets Resulting from

Operations |

$ |

4,616,509 |

|

|

$ |

20,456,455 |

|

|

Net Change in Net Assets Resulting from Operations per

Common Share: |

|

|

|

|

Basic |

$ |

0.16 |

|

|

$ |

0.66 |

|

|

Diluted(1) |

$ |

0.16 |

|

|

$ |

0.66 |

|

| Weighted-Average

Common Shares Outstanding |

|

|

|

|

Basic |

|

28,378,529 |

|

|

|

31,228,046 |

|

|

Diluted(1) |

|

28,378,529 |

|

|

|

31,228,046 |

|

_____________________________________(1) For the

three months ended March 31, 2023 and March 31, 2022, there were no

potentially dilutive securities outstanding.

SURO CAPITAL CORP. AND

SUBSIDIARIESFINANCIAL HIGHLIGHTS

(UNAUDITED)

| |

Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| Per Basic Share

Data |

|

|

|

| Net asset value at beginning

of the year |

$ |

7.39 |

|

|

$ |

11.72 |

|

|

Net investment loss(1) |

|

(0.15 |

) |

|

|

(0.14 |

) |

|

Net realized gain on investments(1) |

|

0.01 |

|

|

|

0.10 |

|

|

Net change in unrealized appreciation/(depreciation) of

investments(1) |

|

0.30 |

|

|

|

0.69 |

|

|

Dividends declared |

|

— |

|

|

|

(0.11 |

) |

|

Issuance of common stock from public offering(1) |

|

— |

|

|

|

0.01 |

|

|

Repurchase of common stock(1) |

|

— |

|

|

|

(0.06 |

) |

|

Stock-based compensation(1) |

|

0.04 |

|

|

|

0.01 |

|

| Net asset value at end of

period |

$ |

7.59 |

|

|

$ |

12.22 |

|

| Per share market value at end

of period |

$ |

3.62 |

|

|

$ |

8.63 |

|

| Total return based on market

value(2) |

|

(4.74 |

)% |

|

|

(31.72 |

)% |

| Total return based on net

asset value(2) |

|

2.71 |

% |

|

|

5.03 |

% |

| Shares outstanding at end of

period |

|

28,338,580 |

|

|

|

31,164,443 |

|

| Ratios/Supplemental

Data: |

|

|

|

| Net assets at end of

period |

$ |

215,043,069 |

|

|

$ |

380,701,527 |

|

| Average net assets |

$ |

209,347,362 |

|

|

$ |

364,015,960 |

|

| Ratio of net operating

expenses to average net assets(3) |

|

10.70 |

% |

|

|

5.39 |

% |

| Ratio of net investment loss

to average net assets(3) |

|

(8.18 |

)% |

|

|

(4.73 |

)% |

| Portfolio Turnover Ratio |

|

1.24 |

% |

|

|

— |

% |

________________(1) Based on weighted-average

number of shares outstanding for the relevant period.(2) Total

return based on market value is based upon the change in market

price per share between the opening and ending market values per

share in the period, adjusted for dividends and equity issuances.

Total return based on net asset value is based upon the change in

net asset value per share between the opening and ending net asset

values per share in the period, adjusted for dividends and equity

issuances.(3) Financial highlights for periods of less than one

year are annualized and the ratios of operating expenses to average

net assets and net investment loss to average net assets are

adjusted accordingly. Because the ratios are calculated for the

Company’s common stock taken as a whole, an individual investor’s

ratios may vary from these ratios.

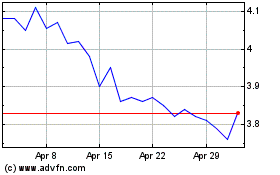

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025