Stran & Company, Inc. ("Stran" or the

"Company") (NASDAQ: SWAG) (NASDAQ: SWAGW), a leading outsourced

marketing solutions provider that leverages its promotional

products and loyalty incentive expertise, today provided a business

update and reported financial results for the three months ended

March 31, 2024 and the three and six months ended June 30, 2024.

Andy Shape, President and CEO of Stran,

commented, “With the restatement of our 2023 and 2022 financial

statements completed, we were able to focus our attention and

successfully finalize our 2024 first and second quarter filings. We

experienced a 17.9% increase in revenue to approximately $18.8

million for the first quarter of 2024 compared to the first quarter

of 2023 and a 6.4% increase in revenue to approximately $35.5

million for the six months ended June 30, 2024 when compared to the

same period in 2023, demonstrating our continued ability to execute

on our growth strategy in 2024. Additionally, we maintained a

strong cash position, with approximately $21.5 million in cash,

equivalents, and investments as of June 30, 2024.”

“We believe our strong results reflect our

continued market penetration, securing and expanding contracts with

leading brands that showcase our ability to meet the diverse needs

of our customers. To further strengthen our position, we acquired

strategic assets from Gander Group, enhancing our technology,

product offerings, and services while supporting our long-term

growth strategy. Our focus remains on accelerating growth,

expanding our customer base, and strengthening our market position.

We are confident in our ability to execute our strategy, and

sustain long-term growth, positioning us for continued success in

the years ahead.”

“Stran is poised for an exciting 2025 as we

continue our growth trajectory and seek market expansion. We expect

to host a detailed conference call with shareholders following the

filing of Stran’s third quarter 2024 financial results.”

Financial Results

First Quarter 2024 Results

Sales increased 17.9% to approximately $18.8

million for the three months ended March 31, 2024, from

approximately $16.0 million for the three months ended March 31,

2023. The increase was primarily due to higher spending from

existing clients as well as business from new customers.

Additionally, the Company benefited from the acquisition of the

assets of T R Miller Co., Inc. (“T R Miller”) in June 2023.

Gross profit increased 3.8% to approximately

$5.6 million, or 29.8% of sales, for the three months ended March

31, 2024, from approximately $5.4 million, or 33.9% of sales, for

the three months ended March 31, 2023. The increase in the dollar

amount of gross profit was due to an increase in sales, partially

offset by an increase in cost of sales. The decrease in gross

profit margin to 29.8% for the three months ended March 31, 2024

compared to 33.9% for the three months ended March 31, 2023 was

primarily due to increases in product costs from vendors.

Net loss for the three months ended March 31,

2024 was approximately $0.5 million, compared to approximately $0.5

million for the three months ended March 31, 2023. These results

were primarily due to the increase in sales for the three months

ended March 31, 2024 from the acquisition of the assets of T R

Miller to approximately $2.0 million from $0 for the three months

ended March 31, 2023, and the increase of approximately $1.2

million from recurring organic sales for the three months ended

March 31, 2024 compared to the three months ended March 31, 2023.

These factors were offset by an increase in operating expenses and

an increase in cost of sales.

Second Quarter 2024 Results

Sales decreased 4.1% to approximately $16.7

million for the three months ended June 30, 2024, from

approximately $17.3 million for the three months ended June 30,

2023. The decrease was primarily due to lower spending from new and

existing clients, partially offset from the acquisition of the

assets of T R Miller in June 2023.

Gross profit increased 4.2% to approximately

$5.5 million, or 32.8% of sales, for the three months ended June

30, 2024, from approximately $5.2 million, or 30.1% of sales, for

the three months ended June 30, 2023. The increase in the dollar

amount of gross profit was due to a decrease in cost of sales of

approximately $0.9 million, which was offset by a decrease in sales

of approximately $0.7 million. The increase in gross profit margin

to 32.8% for the three months ended June 30, 2024 compared to 30.1%

for the three months ended June 30, 2023 was primarily due to

improvements in purchasing from suppliers.

Net loss for the three months ended June 30,

2024 was approximately $1.0 million, compared to approximately $0.9

million for the three months ended June 30, 2023. This change was

primarily due to the increase in operating expenses, partially

offset by the increase in gross profit.

Six Months Ended June 30, 2024

Results

Sales increased 6.4% to approximately $35.5

million for the six months ended June 30, 2024, from approximately

$33.4 million for the six months ended June 30, 2023. The increase

was primarily due to higher spending from existing clients as well

as business from new customers.

Our gross profit increased 4.0% to approximately

$11.1 million, or 31.2% of sales, for the six months ended June 30,

2024, from approximately $10.7 million, or 31.9% of sales, for the

six months ended June 30, 2023. The increase in the dollar amount

of gross profit was due to an increase in sales of approximately

$2.1 million, partially offset by an increase in cost of sales of

approximately $1.7 million in aggregate. The decrease in gross

profit margin to 31.2% for the six months ended June 30, 2024

compared to 31.9% for the six months ended June 30, 2023 was

primarily due to increases in product costs from vendors during the

three months ended March 31, 2024, partially offset by improvements

in purchasing from vendors in the three months ended June 30,

2024.

Net loss for the six months ended June 30, 2024

was approximately $1.5 million, compared to approximately $1.4

million for the six months ended June 30, 2023. This change was

primarily due to an increase in costs of sales and general and

administrative expenses, partially offset by an increase in

sales.

About Stran

For over 30 years, Stran has grown to become a

leader in the promotional products industry, specializing in

complex marketing programs to help recognize the value of

promotional products, branded merchandise, and loyalty incentive

programs as a tool to drive awareness, build brands and impact

sales. Stran is the chosen promotional programs manager of many

Fortune 500 companies, across a variety of industries, to execute

their promotional marketing, loyalty and incentive, sponsorship

activation, recruitment, retention, and wellness campaigns. Stran

provides world-class customer service and utilizes cutting-edge

technology, including efficient ordering and logistics technology

to provide order processing, warehousing and fulfillment functions.

The Company’s mission is to develop long-term relationships with

its clients, enabling them to connect with both their customers and

employees in order to build lasting brand loyalty. Additional

information about the Company is available at: www.stran.com.

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and

uncertainties. All statements, other than statements of historical

fact, contained in this press release are forward-looking

statements. Forward-looking statements contained in this press

release may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“target,” “aim,” “should,” "will” “would,” or the negative of these

words or other similar expressions, although not all

forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are

subject to inherent uncertainties, risks and assumptions that are

difficult to predict. Further, certain forward-looking statements

are based on assumptions as to future events that may not prove to

be accurate. These and other risks and uncertainties are described

more fully in the section titled “Risk Factors” in the Company’s

periodic reports which are filed with the Securities and Exchange

Commission. Forward-looking statements contained in this

announcement are made as of this date, and the Company undertakes

no duty to update such information except as required under

applicable law.

Contacts:

Investor Relations Contact:Crescendo

Communications, LLCTel: (212) 671-1021SWAG@crescendo-ir.com

Press Contact:Howie Turkenkopf

press@stran.com

|

|

|

BALANCE SHEETS(in thousands, except share

and per share amounts) |

|

|

|

|

|

March 31,2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,486 |

|

|

$ |

8,059 |

|

|

Investments |

|

|

10,710 |

|

|

|

10,393 |

|

|

Accounts receivable, net |

|

|

14,209 |

|

|

|

16,223 |

|

|

Accounts receivable - related parties |

|

|

878 |

|

|

|

853 |

|

|

Inventory |

|

|

4,231 |

|

|

|

4,782 |

|

|

Prepaid corporate taxes |

|

|

— |

|

|

|

62 |

|

|

Prepaid expenses |

|

|

948 |

|

|

|

953 |

|

|

Deposits |

|

|

1,578 |

|

|

|

1,717 |

|

| Total current assets |

|

|

42,040 |

|

|

|

43,042 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

1,664 |

|

|

|

1,521 |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS: |

|

|

|

|

|

|

|

|

| Intangible assets - customer

lists, net |

|

|

3,029 |

|

|

|

3,114 |

|

|

Other assets |

|

|

23 |

|

|

|

23 |

|

|

Right of use asset - office leases |

|

|

1,192 |

|

|

|

1,336 |

|

|

Total other assets |

|

|

4,244 |

|

|

|

4,473 |

|

| Total assets |

|

$ |

47,948 |

|

|

$ |

49,036 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDER’S EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

3,347 |

|

|

$ |

4,745 |

|

|

Accrued payroll and related |

|

|

1,710 |

|

|

|

2,568 |

|

|

Unearned revenue |

|

|

592 |

|

|

|

1,116 |

|

|

Rewards program liability |

|

|

2,850 |

|

|

|

875 |

|

|

Sales tax payable |

|

|

595 |

|

|

|

344 |

|

|

Current portion of contingent earn-out liabilities |

|

|

224 |

|

|

|

224 |

|

|

Current portion of installment payment liabilities |

|

|

781 |

|

|

|

786 |

|

|

Current portion of lease liability |

|

|

540 |

|

|

|

528 |

|

|

Total current liabilities |

|

|

10,639 |

|

|

|

11,186 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term contingent earn-out liabilities |

|

|

763 |

|

|

|

763 |

|

|

Long-term installment payment liabilities |

|

|

639 |

|

|

|

639 |

|

|

Long-term lease liability |

|

|

661 |

|

|

|

798 |

|

|

Total long-term liabilities |

|

|

2,063 |

|

|

|

2,200 |

|

| Total liabilities |

|

|

12,702 |

|

|

|

13,386 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDER’S EQUITY: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 50,000,000 shares authorized, 0

shares issued and outstanding as of March 31, 2024 and December 31,

2023, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 300,000,000 shares authorized,

18,589,086 and 18,539,000 shares issued and outstanding as of March

31, 2024 and December 31, 2023, respectively |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

38,413 |

|

|

|

38,263 |

|

|

Accumulated deficit |

|

|

(3,089 |

) |

|

|

(2,602 |

) |

|

Accumulated other comprehensive loss |

|

|

(80 |

) |

|

|

(13 |

) |

|

Total stockholders’ equity |

|

|

35,246 |

|

|

|

35,650 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

47,948 |

|

|

$ |

49,036 |

|

| |

|

STATEMENTS OF OPERATIONSTHREE MONTHS ENDED

MARCH 31, 2024 AND 2023(in thousands, except share

and per share amounts) |

| |

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

(Restated) |

|

| SALES |

|

|

|

|

|

|

|

Sales |

|

$ |

18,781 |

|

|

$ |

15,971 |

|

|

Sales – related parties |

|

|

46 |

|

|

|

— |

|

| Total sales |

|

|

18,827 |

|

|

|

15,971 |

|

| |

|

|

|

|

|

|

|

|

| COST OF SALES: |

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

13,178 |

|

|

|

10,562 |

|

|

Cost of sales - related parties |

|

|

35 |

|

|

|

— |

|

| Total cost of sales |

|

|

13,213 |

|

|

|

10,562 |

|

| |

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

5,614 |

|

|

|

5,409 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

6,279 |

|

|

|

5,991 |

|

| Total operating expenses |

|

|

6,279 |

|

|

|

5,991 |

|

| |

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(665 |

) |

|

|

(582 |

) |

| |

|

|

|

|

|

|

|

|

| OTHER INCOME: |

|

|

|

|

|

|

|

|

|

Other income |

|

|

15 |

|

|

|

— |

|

|

Interest income |

|

|

93 |

|

|

|

138 |

|

|

Realized gain on investments |

|

|

70 |

|

|

|

12 |

|

| Total other income |

|

|

178 |

|

|

|

150 |

|

| |

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAXES |

|

|

(487 |

) |

|

|

(432 |

) |

| |

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

— |

|

|

|

52 |

|

| |

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(487 |

) |

|

$ |

(484 |

) |

| |

|

|

|

|

|

|

|

|

| NET LOSS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

|

Diluted |

|

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

|

| WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING |

|

|

|

|

|

|

|

|

|

Basic |

|

|

18,574,748 |

|

|

|

18,477,419 |

|

|

Diluted |

|

|

18,574,748 |

|

|

|

18,477,419 |

|

|

|

|

BALANCE SHEETS(in thousands, except share

and per share amounts) |

|

|

|

|

|

June 30,2024 |

|

|

December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,874 |

|

|

$ |

8,059 |

|

|

Investments |

|

|

9,603 |

|

|

|

10,393 |

|

|

Accounts receivable, net |

|

|

12,015 |

|

|

|

16,223 |

|

|

Accounts receivable - related parties |

|

|

828 |

|

|

|

853 |

|

|

Inventory |

|

|

3,974 |

|

|

|

4,782 |

|

|

Prepaid corporate taxes |

|

|

32 |

|

|

|

62 |

|

|

Prepaid expenses |

|

|

617 |

|

|

|

953 |

|

|

Deposits |

|

|

1,910 |

|

|

|

1,717 |

|

| Total current assets |

|

|

40,853 |

|

|

|

43,042 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

1,715 |

|

|

|

1,521 |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS: |

|

|

|

|

|

|

|

|

| Intangible assets - customer

lists, net |

|

|

2,943 |

|

|

|

3,114 |

|

|

Other assets |

|

|

23 |

|

|

|

23 |

|

|

Right of use asset - office leases |

|

|

1,061 |

|

|

|

1,336 |

|

|

Total other assets |

|

|

4,027 |

|

|

|

4,473 |

|

| Total assets |

|

$ |

46,595 |

|

|

$ |

49,036 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDER’S EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

3,875 |

|

|

$ |

4,745 |

|

|

Accrued payroll and related |

|

|

1,211 |

|

|

|

2,568 |

|

|

Unearned revenue |

|

|

854 |

|

|

|

1,116 |

|

|

Rewards program liability |

|

|

3,350 |

|

|

|

875 |

|

|

Sales tax payable |

|

|

227 |

|

|

|

344 |

|

|

Current portion of contingent earn-out liabilities |

|

|

224 |

|

|

|

224 |

|

|

Current portion of installment payment liabilities |

|

|

398 |

|

|

|

786 |

|

|

Current portion of lease liability |

|

|

519 |

|

|

|

528 |

|

|

Total current liabilities |

|

|

10,658 |

|

|

|

11,186 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

|

Long-term contingent earn-out liabilities |

|

|

763 |

|

|

|

763 |

|

|

Long-term installment payment liabilities |

|

|

339 |

|

|

|

639 |

|

|

Long-term lease liability |

|

|

550 |

|

|

|

798 |

|

|

Total long-term liabilities |

|

|

1,652 |

|

|

|

2,200 |

|

| Total liabilities |

|

|

12,310 |

|

|

|

13,386 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDER’S EQUITY: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 50,000,000 shares authorized, 0

shares issued and outstanding as of June 30, 2024 and December 31,

2023, respectively |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 300,000,000 shares authorized,

18,589,086 and 18,539,000 shares issued and outstanding as of June

30, 2024 and December 31, 2023, respectively |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

38,433 |

|

|

|

38,263 |

|

|

Accumulated deficit |

|

|

(4,118 |

) |

|

|

(2,602 |

) |

|

Accumulated other comprehensive loss |

|

|

(32 |

) |

|

|

(13 |

) |

|

Total stockholders’ equity |

|

|

34,285 |

|

|

|

35,650 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

46,595 |

|

|

$ |

49,036 |

|

| |

|

STATEMENTS OF OPERATIONSTHREE AND SIX

MONTHS ENDED JUNE 30, 2024 AND 2023(in thousands,

except share and per share amounts) |

| |

| |

|

For the Three Months EndedJune

30, |

|

|

For the Six Months Ended June

30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

(Restated) |

|

|

|

|

|

(Restated) |

|

| SALES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

16,693 |

|

|

$ |

17,285 |

|

|

$ |

35,474 |

|

|

$ |

33,256 |

|

|

Sales – related parties |

|

|

— |

|

|

|

130 |

|

|

|

46 |

|

|

|

130 |

|

| Total sales |

|

|

16,693 |

|

|

|

17,415 |

|

|

|

35,520 |

|

|

|

33,386 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| COST OF SALES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

|

11,226 |

|

|

|

12,067 |

|

|

|

24,405 |

|

|

|

22,629 |

|

|

Cost of sales - related parties |

|

|

— |

|

|

|

100 |

|

|

|

35 |

|

|

|

100 |

|

| Total cost of sales |

|

|

11,226 |

|

|

|

12,167 |

|

|

|

24,440 |

|

|

|

22,729 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GROSS PROFIT |

|

|

5,467 |

|

|

|

5,248 |

|

|

|

11,080 |

|

|

|

10,657 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

6,575 |

|

|

|

6,245 |

|

|

|

12,857 |

|

|

|

12,236 |

|

| Total operating expenses |

|

|

6,575 |

|

|

|

6,245 |

|

|

|

12,857 |

|

|

|

12,236 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

|

|

(1,108 |

) |

|

|

(997 |

) |

|

|

(1,777 |

) |

|

|

(1,579 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

1 |

|

|

|

17 |

|

|

|

16 |

|

|

|

17 |

|

|

Interest income |

|

|

82 |

|

|

|

146 |

|

|

|

175 |

|

|

|

284 |

|

|

Realized gain on investments |

|

|

3 |

|

|

|

9 |

|

|

|

73 |

|

|

|

21 |

|

| Total other income |

|

|

86 |

|

|

|

172 |

|

|

|

264 |

|

|

|

322 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS BEFORE INCOME TAXES |

|

|

(1,022 |

) |

|

|

(825 |

) |

|

|

(1,513 |

) |

|

|

(1,257 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income

taxes |

|

|

3 |

|

|

|

99 |

|

|

|

3 |

|

|

|

151 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

|

$ |

(1,025 |

) |

|

$ |

(924 |

) |

|

$ |

(1,516 |

) |

|

$ |

(1,408 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.06 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

|

Diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.08 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

18,589,086 |

|

|

|

18,532,342 |

|

|

|

18,581,957 |

|

|

|

18,504,761 |

|

|

Diluted |

|

|

18,589,086 |

|

|

|

18,532,342 |

|

|

|

18,581,957 |

|

|

|

18,504,761 |

|

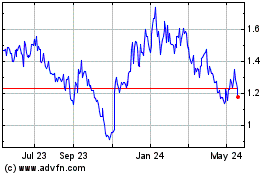

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

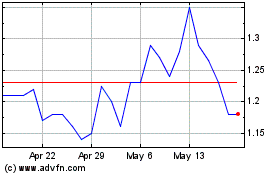

Stran (NASDAQ:SWAG)

Historical Stock Chart

From Feb 2024 to Feb 2025