- Quarterly Net Loss Reduced by

53% Compared to Prior Year

- YTD Net Loss Reduced by 82%

Compared to Prior Year

- Total YTD Revenues of $14.4

Million Lower by 2% Compared to Prior Year

Sonoma Pharmaceuticals, Inc. (Nasdaq: SNOA), a specialty

pharmaceutical company dedicated to identifying, developing and

commercializing unique, differentiated therapies to millions of

patients living with chronic skin conditions, today announced

financial results for the third quarter and nine months ended

December 31, 2019.

“We are pleased that our third fiscal quarter results show

continued progress towards our goal of building a sustainable

company that can deliver both growth and profitability. This

quarter is the closest we have come to break-even in the Company’s

history,” said Amy Trombly, CEO of Sonoma Pharmaceuticals. Ms.

Trombly continued, “We anticipate that 2020 will be a year of

focusing on business strategies and geographic markets that have

shown success and have future promise. We expect that our

revenues and earnings will fluctuate in the near-term as we divest

low or non-profitable business units and invest in strategies that

have shown positive results.”

Results for the Quarter Ended December

31, 2019

Total revenue of $4,678,000 for the third quarter ended December

31, 2019, decreased by $602,000, or 11%, from $5,280,000 for the

same period last year. Product revenues of $4,381,000 for the third

quarter ended December 31, 2019, were down by 13%, or $664,000,

when compared to $5,045,000 in the same period last year. This

decrease was primarily the result of decline in product revenue of

$918,000, or 31%, in the United States partly due to the launch of

Epicyn in the quarter ended December 31, 2018, and weakening

insurance reimbursements for our prescription products in the

current quarter. The decrease was partially offset by growth in

product revenue of $195,000, or 17%, in Europe and Rest of World

mostly as a result of increased sales, and an increase of product

revenue of $59,000, or 6%, in Latin America.

For the quarter ended December 31, 2019, Sonoma reported total

revenues of $4,678,000 and total cost of revenues of $2,520,000,

resulting in total gross profit of $2,158,000 or 46% of total

revenues, compared to a gross profit of $2,847,000 or 54% of total

revenues, for the same period in the prior year. Product revenues

were $4,381,000 and cost of product revenues were $2,394,000,

resulting in product gross profit of $1,987,000, or 45% of product

revenues, compared to product gross profit of $2,776,000, or 55% of

product revenues, for the same period in the prior year. The

decrease in gross profit as a percentage of product revenues was

primarily due to product mix and weakened insurance reimbursements

in the current period.

Total operating expenses during the third quarter of fiscal year

2020 were $3,140,000, down $2,057,000, or 40%, as compared to the

same period in the prior year. The decrease in total operating

expenses was primarily the result of certain cost savings measures

implemented during 2019, including a reduction in

headcount.

Net loss for the quarter ended December 31, 2019 of $1,084,000

decreased by $1,214,000, or 53%, when compared to net loss of

$2,298,000 for the quarter ended December 31, 2018. The decrease in

net loss is due to a decrease in operating expenses of $2,057,000,

or 40%, primarily due to certain cost saving measures implemented

during the latter part of fiscal year 2019. EBITDA loss for the

quarter ended December 31, 2019 of $802,000, was down $1,839,000,

or 56%, compared to an EBITDA loss of $1,037,000, for the same

period last year.

As of December 31, 2019, Sonoma had cash and

cash equivalents of $3,727,000.

Results for the Nine Months Ended December 31,

2019

Total revenues for the nine months ended December 31, 2019, of

$14,357,000 decreased by $231,000, or 2%, as compared to

$14,588,000 for the nine months ended December 31, 2018. Product

revenues for the nine months ended December 31, 2019 of $13,478,000

decreased by $297,000, or 2%, as compared to $13,775,000 for the

nine months ended December 31, 2018. This decrease in product

revenue was primarily the result of a decline of $621,000, or 8%,

in United States partly due to the launch of Epicyn in the prior

year, weakening insurance reimbursements for our prescription

products and a decrease in spending on sales and marketing efforts

in the current period. This decrease was partially offset by growth

in product revenue of $752,000, or 22% in Europe and Rest of World

mostly as a result of increased sales and an expansion of customer

base. Product revenues in Latin America for the nine months ended

December 31, 2019, of $2,577,000 decreased by $428,000, or 14%,

from $3,005,000 for the same period last year. The decrease was

primarily the result of a large initial order by our customer in

Brazil in the nine months ended December 31, 2018, offset by a

slight increase in Mexico revenue in the current period.

For the nine months ended December 31, 2019, Sonoma reported

total revenues of $14,357,000 and total cost of revenues of

$7,538,000, resulting in total gross profit of 6,819,000 or 47% of

total revenues, compared to a gross profit of $7,005,000 or 48% of

total revenues, for the same period in the prior year.

Net loss for the nine months ended December 31, 2019 of

$1,572,000 decreased by $7,004,000, when compared to net loss of

$8,576,000 for the nine months ended December 31, 2018. The

decrease in net loss is due to a decrease in operating loss of

$4,640,000 as a result of a decrease in operating expenses of

$4,826,000 primarily due to certain cost savings measures

implemented during the latter part of fiscal year 2019.

Additionally, for the nine months ended December 31, 2019,

Sonoma reported income related to the sale of certain assets to

Petagon in the amount of $2,472,000. EBITDA loss for the nine

months ended December 31, 2019 of $3,165,000, was down $3,708,000,

or 54%, compared to an EBITDA loss of $6,873,000 for the same

period last year.

About Sonoma Pharmaceuticals, Inc.

Sonoma Pharmaceuticals is a specialty pharmaceutical company

dedicated to identifying, developing and commercializing unique,

differentiated therapies to millions of patients living with

chronic skin conditions. Sonoma offers early-intervention relief

with virtually no side-effects or contraindications. The company

believes its products, which are sold throughout the United States

and internationally, have improved patient outcomes for more than

six million patients by treating and reducing certain skin diseases

including acne, atopic dermatitis, scarring, infections, itch, pain

and harmful inflammatory responses. Sonoma’s vision is to be a

catalyst for improved care and increased access for all patients.

The company's headquarters are in Petaluma, California,

with manufacturing operations in the United States and Latin

America. European marketing and sales are headquartered in

Roermond, Netherlands. More information can be found at

www.sonomapharma.com.

Forward-Looking Statements

Except for historical information herein, matters set forth

in this press release are forward-looking within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995, including statements about the commercial and

technology progress and future financial performance of Sonoma

Pharmaceuticals, Inc. and its subsidiaries (the “company”). These

forward-looking statements are identified by the use of words such

as “continue,” “reduce,” and “expand,” among others.

Forward-looking statements in this press release are subject to

certain risks and uncertainties inherent in the company’s business

that could cause actual results to vary,

including such risks that regulatory clinical and

guideline developments may change, scientific data may not be

sufficient to meet regulatory standards or receipt of required

regulatory clearances or approvals, clinical results may not

be replicated in actual patient settings, protection offered

by the company’s patents and patent applications may be

challenged, invalidated or circumvented by its

competitors, the available market

for the company’s products will not be as large as

expected, the company’s products will not be able to penetrate

one or more targeted markets, revenues will not be sufficient

to meet the company’s cash needs, fund further development and

clinical studies, as well as uncertainties relative to varying

product formulations and a multitude of diverse regulatory and

marketing requirements in different countries and municipalities,

and other risks detailed from time to time in the company’s filings

with the Securities and Exchange Commission. The company disclaims

any obligation to update these forward-looking statements, except

as required by law.

Sonoma Pharmaceuticals™ and Epicyn™ are trademarks or registered

trademarks of Sonoma Pharmaceuticals, Inc.

SONOMA PHARMACEUTICALS, INC. AND

SUBSIDIARIESCondensed Consolidated Balance

Sheets(In thousands, except share and per share

amounts) (Unaudited)

| |

|

December 31, |

|

|

March 31, |

|

| |

|

2019 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,727 |

|

|

$ |

3,689 |

|

|

Accounts receivable, net |

|

|

5,029 |

|

|

|

3,481 |

|

|

Inventories |

|

|

2,825 |

|

|

|

3,409 |

|

|

Prepaid expenses and other current assets |

|

|

2,048 |

|

|

|

1,694 |

|

|

Current portion of deferred consideration, net of discount |

|

|

229 |

|

|

|

223 |

|

|

Total current assets |

|

|

13,858 |

|

|

|

12,496 |

|

| Operating lease right-of-use

assets |

|

|

1,057 |

|

|

|

– |

|

| Property and equipment,

net |

|

|

483 |

|

|

|

727 |

|

| Deferred consideration, net of

discount, less current portion |

|

|

1,025 |

|

|

|

1,103 |

|

| Other assets |

|

|

73 |

|

|

|

122 |

|

|

Total assets |

|

$ |

16,496 |

|

|

$ |

14,448 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,159 |

|

|

$ |

1,255 |

|

|

Accrued expenses and other current liabilities |

|

|

1,423 |

|

|

|

1,501 |

|

|

Deferred revenue |

|

|

228 |

|

|

|

47 |

|

|

Deferred revenue Invekra |

|

|

57 |

|

|

|

55 |

|

|

Operating lease liabilities |

|

|

291 |

|

|

|

– |

|

|

Current portion of long-term debt |

|

|

– |

|

|

|

322 |

|

|

Current portion of capital leases |

|

|

– |

|

|

|

141 |

|

|

Common Stock liability |

|

|

– |

|

|

|

270 |

|

|

Total current liabilities |

|

|

4,158 |

|

|

|

3,591 |

|

| Operating lease liabilities

non-current |

|

|

807 |

|

|

|

– |

|

| Long-term deferred revenue

Invekra |

|

|

322 |

|

|

|

356 |

|

| Long-term debt, less current

portion |

|

|

– |

|

|

|

12 |

|

|

Total liabilities |

|

|

5,287 |

|

|

|

3,959 |

|

|

|

|

|

|

|

|

|

|

|

| Commitments and

Contingencies |

|

|

– |

|

|

|

– |

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Convertible preferred stock, $0.0001 par value; 714,286 shares

authorized at December 31, 2019 and March 31, 2019 respectively;

1.55 shares issued and outstanding at December 31, 2019 and March

31, 2019 respectively |

|

|

– |

|

|

|

– |

|

|

Common stock, $0.0001 par value; 24,000,000 shares authorized at

December 31, 2019 and March 31, 2019, respectively, 1,777,483 and

1,316,335 shares issued and outstanding at December 31, 2019 and

March 31, 2019, respectively |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

186,257 |

|

|

|

184,074 |

|

|

Accumulated deficit |

|

|

(170,869 |

) |

|

|

(169,238 |

) |

|

Accumulated other comprehensive loss |

|

|

(4,181 |

) |

|

|

(4,349 |

) |

|

Total stockholders’ equity |

|

|

11,209 |

|

|

|

10,489 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

16,496 |

|

|

$ |

14,448 |

|

| |

|

|

|

|

|

|

|

|

SONOMA PHARMACEUTICALS, INC. AND

SUBSIDIARIESCondensed Consolidated Statements of

Comprehensive Loss(In thousands, except per share

amounts)(Unaudited)

| |

|

Three Months EndedDecember

31, |

|

|

Nine Months EndedDecember

31, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

$ |

4,381 |

|

|

$ |

5,045 |

|

|

$ |

13,478 |

|

|

$ |

13,775 |

|

|

Service |

|

|

297 |

|

|

|

235 |

|

|

|

879 |

|

|

|

813 |

|

|

Total revenues |

|

|

4,678 |

|

|

|

5,280 |

|

|

|

14,357 |

|

|

|

14,588 |

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

|

2,394 |

|

|

|

2,269 |

|

|

|

7,147 |

|

|

|

7,006 |

|

|

Service |

|

|

126 |

|

|

|

164 |

|

|

|

391 |

|

|

|

577 |

|

|

Total cost of revenues |

|

|

2,520 |

|

|

|

2,433 |

|

|

|

7,538 |

|

|

|

7,583 |

|

| Gross profit |

|

|

2,158 |

|

|

|

2,847 |

|

|

|

6,819 |

|

|

|

7,005 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

248 |

|

|

|

451 |

|

|

|

856 |

|

|

|

1,191 |

|

|

Selling, general and administrative |

|

|

2,892 |

|

|

|

4,746 |

|

|

|

9,877 |

|

|

|

14,368 |

|

|

Total operating expenses |

|

|

3,140 |

|

|

|

5,197 |

|

|

|

10,733 |

|

|

|

15,559 |

|

| Loss from operations |

|

|

(982 |

) |

|

|

(2,350 |

) |

|

|

(3,914 |

) |

|

|

(8,554 |

) |

| Interest expense |

|

|

(1 |

) |

|

|

(7 |

) |

|

|

(13 |

) |

|

|

(26 |

) |

| Interest income |

|

|

33 |

|

|

|

37 |

|

|

|

117 |

|

|

|

139 |

|

| Other (expense) income |

|

|

(134 |

) |

|

|

22 |

|

|

|

(234 |

) |

|

|

(135 |

) |

| Gain on sale of assets |

|

|

– |

|

|

|

– |

|

|

|

2,472 |

|

|

|

– |

|

| Net loss |

|

$ |

(1,084 |

) |

|

$ |

(2,298 |

) |

|

$ |

(1,572 |

) |

|

$ |

(8,576 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: basic and

diluted |

|

$ |

(0.72 |

) |

|

$ |

(2.37 |

) |

|

$ |

(1.14 |

) |

|

$ |

(10.79 |

) |

| Weighted-average number of

shares used in per common share calculations: basic and

diluted |

|

|

1,500 |

|

|

|

971 |

|

|

|

1,378 |

|

|

|

795 |

|

| Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,084 |

) |

|

$ |

(2,298 |

) |

|

$ |

(1,572 |

) |

|

$ |

(8,576 |

) |

| Foreign currency translation

adjustments |

|

|

264 |

|

|

|

(291 |

) |

|

|

168 |

|

|

|

(443 |

) |

| Comprehensive loss |

|

$ |

(820 |

) |

|

$ |

(2,589 |

) |

|

$ |

(1,404 |

) |

|

$ |

(9,019 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SONOMA PHARMACEUTICALS, INC. AND

SUBSIDIARIESRECONCILIATION OF GAAP MEASURES TO

NON-GAAP MEASURES(In

thousands) (Unaudited)

| |

|

Three Months EndedDecember

31, |

|

|

Nine Months EndedDecember

31, |

|

| |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

(1) Loss from operations minus non-cash expenses EBITDA

loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP loss from operations as

reported |

|

$ |

(982 |

) |

|

$ |

(2,350 |

) |

|

$ |

(3,914 |

) |

|

$ |

(8,554 |

) |

| Non-cash adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

112 |

|

|

|

402 |

|

|

|

537 |

|

|

|

1,334 |

|

| Depreciation and

amortization |

|

|

68 |

|

|

|

109 |

|

|

|

212 |

|

|

|

347 |

|

| Non-GAAP loss from operations

minus non-cash expenses EBITDA loss |

|

$ |

(802 |

) |

|

$ |

(1,839 |

) |

|

$ |

(3,165 |

) |

|

$ |

(6,873 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) Net loss minus

non-cash expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net (loss) income as

reported |

|

$ |

(1,084 |

) |

|

$ |

(2,298 |

) |

|

$ |

(1,572 |

) |

|

$ |

(8,576 |

) |

| Non-cash adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

112 |

|

|

|

402 |

|

|

|

537 |

|

|

|

1,334 |

|

| Depreciation and

amortization |

|

|

68 |

|

|

|

109 |

|

|

|

212 |

|

|

|

347 |

|

| Non-GAAP net (loss) income

minus non-cash expenses |

|

$ |

(904 |

) |

|

$ |

(1,787 |

) |

|

$ |

(823 |

) |

|

$ |

(6,895 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) Operating expenses

minus non-cash expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating expenses as

reported |

|

$ |

3,140 |

|

|

$ |

5,197 |

|

|

$ |

10,733 |

|

|

$ |

15,559 |

|

| Non-cash adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

(95 |

) |

|

|

(378 |

) |

|

|

(486 |

) |

|

|

(1,245 |

) |

| Depreciation and

amortization |

|

|

(10 |

) |

|

|

(57 |

) |

|

|

(43 |

) |

|

|

(169 |

) |

| Non-GAAP operating expenses

minus non-cash expenses |

|

$ |

3,035 |

|

|

$ |

4,762 |

|

|

$ |

10,204 |

|

|

$ |

14,145 |

|

| (1) |

Loss from operations minus non-cash expenses (EBITDAS) is a

non-GAAP financial measure. The Company defines operating loss

minus non-cash expenses as GAAP reported operating loss minus

operating depreciation and amortization, and operating stock-based

compensation. The Company uses this measure for the purpose of

modifying the operating loss to reflect direct cash related

transactions during the measurement period. |

| |

|

| (2) |

Net loss minus non-cash expenses is a non-GAAP financial measure.

The Company defines net loss minus non-cash expenses as GAAP

reported net loss minus depreciation and amortization, stock-based

compensation, and non-cash foreign exchange transaction losses. The

Company uses this measure for the purpose of modifying the net loss

to reflect only those expenses to reflect direct cash transactions

during the measurement period. |

| |

|

| (3) |

Operating expenses minus non-cash expenses is a non-GAAP financial

measure. The Company defines operating expenses minus non-cash

expenses as GAAP reported operating expenses minus operating

depreciation and amortization, and operating stock-based

compensation. The Company uses this measure for the purpose of

identifying total operating expenses involving cash transactions

during the measurement period. |

| |

|

SONOMA PHARMACEUTICALS, INC. AND

SUBSIDIARIESPRODUCT RELATED REVENUE

SCHEDULES(In thousands) (Unaudited)

The following table presents the Company’s

disaggregated product revenues by geographic region:

| |

|

Three Months Ended December 31, |

|

|

|

|

|

|

| |

|

2019 |

|

|

2018 |

|

|

$ Change |

|

|

% Change |

|

United States |

|

$ |

2,059,000 |

|

|

$ |

2,977,000 |

|

|

$ |

(918,000 |

) |

|

|

(31 |

%) |

| Latin America |

|

|

988,000 |

|

|

|

929,000 |

|

|

|

59,000 |

|

|

|

6 |

% |

| Europe and Rest of the

World |

|

|

1,334,000 |

|

|

|

1,139,000 |

|

|

|

195,000 |

|

|

|

17 |

% |

| Total |

|

$ |

4,381,000 |

|

|

$ |

5,045,000 |

|

|

$ |

(664,000 |

) |

|

|

(13 |

%) |

| |

|

Nine Months Ended December 31, |

|

|

|

|

|

|

| |

|

2019 |

|

|

2018 |

|

|

$ Change |

|

|

% Change |

|

United States |

|

$ |

6,753,000 |

|

|

$ |

7,374,000 |

|

|

$ |

(621,000 |

) |

|

|

(8 |

%) |

| Latin America |

|

|

2,577,000 |

|

|

|

3,005,000 |

|

|

|

(428,000 |

) |

|

|

(14 |

%) |

| Europe and Rest of the

World |

|

|

4,148,000 |

|

|

|

3,396,000 |

|

|

|

752,000 |

|

|

|

22 |

% |

| Total |

|

$ |

13,478,000 |

|

|

$ |

13,775,000 |

|

|

$ |

(297,000 |

) |

|

|

(2 |

%) |

Media and Investor Contact:

Sonoma Pharmaceuticals, Inc.

ir@sonomapharmaceuticals.com

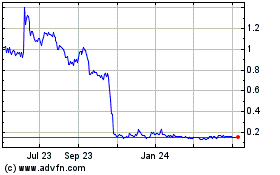

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sonoma Pharmaceuticals (NASDAQ:SNOA)

Historical Stock Chart

From Nov 2023 to Nov 2024