0001616533FALSE00016165332023-10-122023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 12, 2023

SMART GLOBAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number 001-38102

| | | | | |

| Cayman Islands | 98-1013909 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

| | | | | |

| c/o Walkers Corporate Limited | |

| 190 Elgin Avenue | |

| George Town, Grand Cayman | |

| Cayman Islands | KY1-9008 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 623-1231

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares, $0.03 par value per share | SGH | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 12, 2023, SMART Global Holdings, Inc. (the “Company”) issued a press release and will hold a conference call announcing its financial results for the fourth quarter and full year fiscal 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (“Form 8-K”) and is incorporated herein by reference.

The Company refers to non-GAAP financial information in both the press release and on the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

The information furnished pursuant to Item 2.02 of this Form 8-K, including the information contained in Exhibit 99.1 of this Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | |

Exhibit

No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: October 12, 2023 | SMART Global Holdings, Inc. |

| By: | /s/ Ken Rizvi |

| | Senior Vice President and Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

Exhibit 99.1

Press Release

FOR IMMEDIATE RELEASE

SGH REPORTS FOURTH QUARTER AND

FULL YEAR FISCAL 2023 FINANCIAL RESULTS

Record GAAP and Non-GAAP Gross Margins for FY2023

Milpitas, Calif. – October 12, 2023 – SMART Global Holdings, Inc. (“SGH” or the “Company”) (NASDAQ: SGH) today reported financial results for the fourth quarter and full year fiscal 2023.

On June 13, 2023, we entered into an agreement to sell an 81% interest in our SMART Brazil operations. The transaction is expected to close at the end of calendar 2023 or early 2024, subject to required regulatory approvals and satisfaction of customary closing conditions. Accordingly, our SMART Brazil operations are classified as discontinued operations in the accompanying financial statements for all periods presented.

The following discussion relates to our continuing operations, which exclude SMART Brazil.

Fiscal 2023 Highlights for Continuing Operations

•Net sales of $1.44 billion, up 3.3% versus fiscal year 2022

•Record GAAP gross margin of 28.8%, up 80 basis points versus fiscal year 2022

•Record Non-GAAP gross margin of 31.7%, up 250 basis points versus fiscal year 2022

•GAAP EPS of $0.15 versus $0.41 in fiscal year 2022

•Non-GAAP EPS of $2.52 versus $2.65 in fiscal year 2022

Fourth Quarter Fiscal 2023 Highlights for Continuing Operations

•Net sales of $316.7 million, down 12.6% versus the year-ago quarter

•GAAP gross margin of 28.9%, up 290 basis points versus the year-ago quarter

•Non-GAAP gross margin of 31.7%, up 460 basis points versus the year-ago quarter

•GAAP EPS of $1.17 versus $0.18 in the year-ago quarter

•Non-GAAP EPS of $0.35 versus $0.63 in the year-ago quarter

“Throughout fiscal 2023 the team has made significant progress in our transformational journey towards becoming an enterprise solutions company focused on higher quality revenue and improving gross margins. In the fourth quarter, in what remains a challenging global economic environment, non-GAAP gross margin increased to 31.7%, an improvement of 460 basis points from the same period last year, and non-GAAP earnings were $0.35 per share. In addition, we exited the fourth quarter with a strong balance sheet, including cash, cash equivalents and short term investments of $391 million,” commented the Company’s CEO Mark Adams.

Annual Financial Results of Continuing Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP (1) | | Non-GAAP (2) |

| (in thousands, except per share amounts) | FY23 | | FY22 | | FY21 | | FY23 | | FY22 | | FY21 |

| Net sales: | | | | | | | | | | | |

| Memory Solutions | $ | 443,264 | | | $ | 551,705 | | | $ | 486,205 | | | $ | 443,264 | | | $ | 551,705 | | | $ | 486,205 | |

| Intelligent Platform Solutions | 749,708 | | | 440,986 | | | 344,757 | | | 749,708 | | | 440,986 | | | 344,757 | |

| LED Solutions | 248,278 | | | 403,185 | | | 224,567 | | | 248,278 | | | 403,185 | | | 224,567 | |

| Total net sales | $ | 1,441,250 | | | $ | 1,395,876 | | | $ | 1,055,529 | | | $ | 1,441,250 | | | $ | 1,395,876 | | | $ | 1,055,529 | |

| | | | | | | | | | | |

| Gross profit | $ | 415,171 | | | $ | 391,045 | | | $ | 237,973 | | | $ | 456,578 | | | $ | 408,082 | | | $ | 257,162 | |

| Operating income (loss) | 8,745 | | | 67,176 | | | (15,706) | | | 179,794 | | | 177,461 | | | 83,484 | |

| Net income (loss) attributable to SGH | 7,858 | | | 22,372 | | | (43,150) | | | 127,681 | | | 139,287 | | | 62,122 | |

| Diluted earnings (loss) per share | $ | 0.15 | | | $ | 0.41 | | | $ | (0.89) | | | $ | 2.52 | | | $ | 2.65 | | | $ | 1.23 | |

Quarterly Financial Results of Continuing Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP (1) | | Non-GAAP (2) |

| (in thousands, except per share amounts) | Q4 FY23 | | Q3 FY23 | | Q4 FY22 | | Q4 FY23 | | Q3 FY23 | | Q4 FY22 |

| Net sales: | | | | | | | | | | | |

| Memory Solutions | $ | 105,181 | | | $ | 109,458 | | | $ | 134,611 | | | $ | 105,181 | | | $ | 109,458 | | | $ | 134,611 | |

| Intelligent Platform Solutions | 145,432 | | | 170,854 | | | 144,730 | | | 145,432 | | | 170,854 | | | 144,730 | |

| LED Solutions | 66,045 | | | 64,106 | | | 83,118 | | | 66,045 | | | 64,106 | | | 83,118 | |

| Total net sales | $ | 316,658 | | | $ | 344,418 | | | $ | 362,459 | | | $ | 316,658 | | | $ | 344,418 | | | $ | 362,459 | |

| | | | | | | | | | | |

| Gross profit | $ | 91,585 | | | $ | 100,480 | | | $ | 94,420 | | | $ | 100,300 | | | $ | 108,990 | | | $ | 98,356 | |

| Operating income (loss) | (1,639) | | | (2,386) | | | 23,060 | | | 30,295 | | | 42,327 | | | 41,866 | |

Net income (loss) attributable to SGH | 64,841 | | | (19,648) | | | 8,862 | | | 18,406 | | | 28,731 | | | 31,610 | |

Diluted earnings (loss) per share | $ | 1.17 | | | $ | (0.40) | | | $ | 0.18 | | | $ | 0.35 | | | $ | 0.57 | | | $ | 0.63 | |

(1)GAAP represents U.S. Generally Accepted Accounting Principles.

(2)Non-GAAP represents GAAP excluding the impact of certain activities. Further information regarding the Company’s use of non-GAAP measures and reconciliations between GAAP and non-GAAP measures is included within this press release.

Business Outlook

As of October 12, 2023, SGH is providing the following financial outlook for its continuing operations for the first quarter of fiscal 2024:

| | | | | | | | | | | | | | |

| | GAAP Outlook | Adjustments | Non-GAAP Outlook |

| Net sales | $275 million +/- $25 million | — | $275 million +/- $25 million |

| Gross margin | 28.5% +/- 1% | 3% | (A) | 31.5% +/- 1% |

| Operating expenses | $82 million +/- $1 million | ($15) million | (B)(C) | $67 million +/- $1 million |

Diluted earnings (loss) per share | $(0.16) +/- $0.15 | $0.31 | (A)(B)(C)(D) | $0.15 +/- $0.15 |

Diluted shares | 55.6 million | (1.6) million | 54 million |

| | | | | |

| Non-GAAP adjustments (in millions) | |

| (A) Share-based compensation and amortization of acquisition-related intangibles included in cost of sales | $ | 8 | |

| (B) Share-based compensation and amortization of acquisition-related intangibles included in R&D and SG&A | 13 | |

| (C) Other adjustments included in operating expenses | 2 | |

| (D) Estimated income tax effects | (6) | |

| $ | 17 | |

Fourth Quarter Fiscal 2023 Earnings Conference Call and Webcast Details

SGH will hold a conference call and webcast to discuss the fourth quarter and full year fiscal 2023 results and related matters today, October 12, 2023, at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). Interested parties may access the call by dialing +1-833-470-1428 in the U.S. or +1-929-526-1599 from international locations, using the access code 759938. The earnings presentation and a live webcast of the conference call can be accessed from the Company’s investor relations website (https://ir.smartm.com/investors/default.aspx) where they will remain available for approximately one year.

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements concerning or regarding future events and the future financial and operating performance of SGH; statements regarding the extent and timing or and expectations regarding SGH’s future revenues and expenses and customer demand; statements regarding sale of the Company’s SMART Brazil operations and expected closing timeline; and statements regarding the business and financial outlook for the next fiscal quarter described under “Business Outlook” above.

These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe,” “could,” and other words of similar meaning. Forward-looking statements provide SGH’s current expectations or forecasts of future events, circumstances, results or aspirations and are subject to a number of significant risks, uncertainties and other factors, many of which are outside of SGH’s control, including but not limited to, issues, delays or complications in integrating the operations of Stratus Technologies; global business and economic conditions and growth trends in technology industries, SGH’s customer markets and various geographic regions; uncertainties in the geopolitical environment; the unpredictable nature of the COVID-19 pandemic; disruptions in SGH’s operations or supply chain as a result of the downstream effects of the COVID-19 pandemic or otherwise; the ability to manage SGH’s cost structure, including SGH’s success in implementing restructuring or other plans intended to improve SGH’s operating efficiency; workforce reductions; uncertainties in the global macro-economic environment; changes in demand for SGH’s segments; changes in trade regulations or adverse developments in international trade relations and agreements; changes in currency exchange rates; availability of our cash and cash equivalents; overall information technology spending; appropriations for government spending; the success of

SGH’s strategic initiatives including additional investments in new products and additional capacity; acquisitions of companies or technologies, the failure to successfully integrate and operate them or customers’ negative reactions to them, including any resulting impairment of goodwill or gain (loss) on extinguishment of debt; the proposed divestiture of SMART Brazil, the failure to execute on the separation and transition of SMART Brazil and its business, the failure to satisfy all conditions to complete the proposed divestiture within the expected timeframe, and the failure to achieve the intended benefits of the sale of SMART Brazil and its business; limitations on, or changes in the availability of, supply of materials and components; fluctuations in material costs; the temporary or volatile nature of pricing trends in memory or elsewhere; deterioration in customer relationships; SGH’s dependence on a select number of customers and timing and volume of customer orders; production or manufacturing difficulties; competitive factors; technological changes; difficulties with, or delays in, the introduction of new products; slowing or contraction of growth in the memory market in Brazil or in the LED market; reduction in, or termination of, incentives for local manufacturing in Brazil; changes to applicable tax regimes or rates; reversal of the valuation allowance for a significant portion of our deferred tax assets, including any potential inability to realize these assets in the future; prices for the end products of SGH’s customers; strikes or labor disputes; deterioration in or loss of relations with any of SGH’s limited number of key vendors; the inability to maintain or expand government business; and the continuing availability of borrowings under term loans and revolving lines of credit and our ability to raise capital through debt or equity financings. These and other risks, uncertainties and factors are described in greater detail under the sections titled “Risk Factors,” “Critical Accounting Estimates,” “Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk,” and “Liquidity and Capital Resources” contained in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and the Company’s other filings with the U.S. Securities and Exchange Commission. In addition, such risks, uncertainties and factors as outlined above and in such filings do not constitute all risks, uncertainties and factors that could cause actual results of SGH to be materially different from such forward-looking statements. Accordingly, investors are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements that the Company makes in this press release speak only as of the date of this press release. Except as required by law, SGH does not undertake to update the forward-looking statements contained in this press release to reflect the impact of circumstances or events that may arise after the date that the forward-looking statements were made.

Statement Regarding Use of Non-GAAP Financial Measures

SGH management uses non-GAAP measures to supplement SGH’s financial results under GAAP. Management uses these measures to analyze its operations and make decisions as to future operational plans and believes that this supplemental non-GAAP information is useful to investors in analyzing and assessing the Company’s past and future operating performance. These non-GAAP measures exclude certain items, such as share-based compensation expense, amortization of acquisition-related intangible assets (consisting of amortization of developed technology, customer relationships, trademarks/trade names and backlog acquired in connection with business combinations), acquisition-related inventory adjustments, acquisition-related expenses, restructure charges and integration expenses, impairment of goodwill, changes in the fair value of contingent consideration, gains (losses) from changes in currency exchange rates, amortization of debt discount and other costs, gain (loss) on extinguishment of debt, other infrequent or unusual items and related tax effects and other tax adjustments. While amortization of acquisition-related intangible assets is excluded, the revenues from acquired companies is reflected in the Company’s non-GAAP measures and these intangible assets contribute to revenue generation. Management believes the presentation of operating results that exclude certain items provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses adjusted EBITDA, which represents GAAP net income (loss), adjusted for net interest expense, income tax expense, depreciation and amortization expense, share-based compensation expense, acquisition-related inventory adjustments, acquisition-related expenses, restructure charges and integration expenses, impairment of goodwill, changes in the fair value of contingent consideration, gain (loss) on extinguishment of debt and other infrequent or unusual items.

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP, as they exclude important information about SGH’s financial results, as noted above. The presentation of these adjusted amounts varies from amounts presented in accordance with GAAP and therefore may not be comparable to amounts reported by other companies. In addition, adjusted EBITDA does not purport

to represent cash flow provided by, or used for, operating activities in accordance with GAAP and should not be used as a measure of liquidity. Investors are encouraged to review the “Reconciliation of GAAP to Non-GAAP Measures” tables below.

About SMART Global Holdings – SGH

At SGH, we design and develop high-performance, high-availability, enterprise solutions that help our customers solve for the future. Across our computing, memory, and LED lines of business, we focus on serving our customers by providing deep technical knowledge and expertise, custom design engineering, build-to-order flexibility, and a commitment to best-in-class quality.

Learn more about us at SGHcorp.com.

SMART Global Holdings, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | August 25,

2023 | | May 26,

2023 | | August 26,

2022 | | August 25,

2023 | | August 26,

2022 | | August 27,

2021 |

| Net sales: | | | | | | | | | | | |

| Memory Solutions | $ | 105,181 | | | $ | 109,458 | | | $ | 134,611 | | | $ | 443,264 | | | $ | 551,705 | | | $ | 486,205 | |

| Intelligent Platform Solutions | 145,432 | | | 170,854 | | | 144,730 | | | 749,708 | | | 440,986 | | | 344,757 | |

| LED Solutions | 66,045 | | | 64,106 | | | 83,118 | | | 248,278 | | | 403,185 | | | 224,567 | |

| Total net sales | 316,658 | | | 344,418 | | | 362,459 | | | 1,441,250 | | | 1,395,876 | | | 1,055,529 | |

| Cost of sales | 225,073 | | | 243,938 | | | 268,039 | | | 1,026,079 | | | 1,004,831 | | | 817,556 | |

| Gross profit | 91,585 | | | 100,480 | | | 94,420 | | | 415,171 | | | 391,045 | | | 237,973 | |

| | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Research and development | 20,883 | | | 20,338 | | | 19,160 | | | 90,565 | | | 77,472 | | | 59,933 | |

| Selling, general and administrative | 65,026 | | | 67,914 | | | 52,215 | | | 260,722 | | | 204,839 | | | 158,174 | |

| Impairment of goodwill | 1,534 | | | — | | | — | | | 19,092 | | | — | | | — | |

| Change in fair value of contingent consideration | 4,100 | | | 14,800 | | | — | | | 29,000 | | | 41,324 | | | 32,400 | |

| Other operating (income) expense | 1,681 | | | (186) | | | (15) | | | 7,047 | | | 234 | | | 3,172 | |

| Total operating expenses | 93,224 | | | 102,866 | | | 71,360 | | | 406,426 | | | 323,869 | | | 253,679 | |

| Operating income (loss) | (1,639) | | | (2,386) | | | 23,060 | | | 8,745 | | | 67,176 | | | (15,706) | |

| | | | | | | | | | | |

| Non-operating (income) expense: | | | | | | | | | | | |

| Interest expense, net | 9,183 | | | 9,314 | | | 7,485 | | | 36,421 | | | 24,345 | | | 17,141 | |

| Other non-operating (income) expense | (462) | | | 354 | | | 170 | | | 11,837 | | | 350 | | | (582) | |

| Total non-operating (income) expense | 8,721 | | | 9,668 | | | 7,655 | | | 48,258 | | | 24,695 | | | 16,559 | |

| Income (loss) before taxes | (10,360) | | | (12,054) | | | 15,405 | | | (39,513) | | | 42,481 | | | (32,265) | |

| | | | | | | | | | | |

| Income tax provision (benefit) | (75,890) | | | 7,216 | | | 6,075 | | | (49,203) | | | 18,074 | | | 9,689 | |

| Net income (loss) from continuing operations | 65,530 | | | (19,270) | | | 9,330 | | | 9,690 | | | 24,407 | | | (41,954) | |

| Net income (loss) from discontinued operations, net of tax | (205,685) | | | (4,807) | | | 11,097 | | | (195,384) | | | 44,185 | | | 64,460 | |

| Net income (loss) | (140,155) | | | (24,077) | | | 20,427 | | | (185,694) | | | 68,592 | | | 22,506 | |

| Net income attributable to noncontrolling interest | 689 | | | 378 | | | 468 | | | 1,832 | | | 2,035 | | | 1,196 | |

| Net income (loss) attributable to SGH | $ | (140,844) | | | $ | (24,455) | | | $ | 19,959 | | | $ | (187,526) | | | $ | 66,557 | | | $ | 21,310 | |

| | | | | | | | | | | |

| Basic earnings (loss) per share: | | | | | | | | | | | |

| Continuing operations | $ | 1.28 | | | $ | (0.40) | | | $ | 0.18 | | | $ | 0.16 | | | $ | 0.45 | | | $ | (0.89) | |

| Discontinued operations | (4.05) | | | (0.10) | | | 0.23 | | | (3.94) | | | 0.90 | | | 1.33 | |

| $ | (2.77) | | | $ | (0.50) | | | $ | 0.41 | | | $ | (3.78) | | | $ | 1.35 | | | $ | 0.44 | |

| | | | | | | | | | | |

| Diluted earnings (loss) per share: | | | | | | | | | | | |

| Continuing operations | $ | 1.17 | | | $ | (0.40) | | | $ | 0.18 | | | $ | 0.15 | | | $ | 0.41 | | | $ | (0.89) | |

| Discontinued operations | (3.71) | | | (0.10) | | | 0.22 | | | (3.80) | | | 0.81 | | | 1.33 | |

| $ | (2.54) | | | $ | (0.50) | | | $ | 0.40 | | | $ | (3.65) | | | $ | 1.22 | | | $ | 0.44 | |

| | | | | | | | | | | |

| Shares used in per share calculations: | | | | | | | | | | | |

| Basic | 50,807 | | | 49,380 | | | 49,238 | | | 49,566 | | | 49,467 | | | 48,558 | |

| Diluted | 55,523 | | | 49,380 | | | 50,504 | | | 51,322 | | | 54,443 | | | 48,558 | |

SMART Global Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | August 25,

2023 | | May 26,

2023 | | August 26,

2022 | | August 25,

2023 | | August 26,

2022 | | August 27,

2021 |

| GAAP gross profit | $ | 91,585 | | | $ | 100,480 | | | $ | 94,420 | | | $ | 415,171 | | | $ | 391,045 | | | $ | 237,973 | |

| Share-based compensation expense | 1,789 | | | 1,595 | | | 1,569 | | | 6,334 | | | 6,296 | | | 3,871 | |

| Amortization of acquisition-related intangibles | 5,876 | | | 6,704 | | | 2,367 | | | 25,661 | | | 10,741 | | | 8,228 | |

| Flow-through of inventory step up | — | | | — | | | — | | | 2,599 | | | — | | | 7,090 | |

| Cost of sales-related restructure | 1,050 | | | 211 | | | — | | | 6,813 | | | — | | | — | |

| Non-GAAP gross profit | $ | 100,300 | | | $ | 108,990 | | | $ | 98,356 | | | $ | 456,578 | | | $ | 408,082 | | | $ | 257,162 | |

| | | | | | | | | | | | |

| GAAP gross margin | 28.9 | % | | 29.2 | % | | 26.0 | % | | 28.8 | % | | 28.0 | % | | 22.5 | % |

| Effect of adjustments | 2.8 | % | | 2.4 | % | | 1.1 | % | | 2.9 | % | | 1.2 | % | | 1.9 | % |

| Non-GAAP gross margin | 31.7 | % | | 31.6 | % | | 27.1 | % | | 31.7 | % | | 29.2 | % | | 24.4 | % |

| | | | | | | | | | | |

| GAAP operating expenses | $ | 93,224 | | | $ | 102,866 | | | $ | 71,360 | | | $ | 406,426 | | | $ | 323,869 | | | $ | 253,679 | |

| Share-based compensation expense | (7,785) | | | (8,047) | | | (7,890) | | | (32,894) | | | (30,988) | | | (27,090) | |

| Amortization of acquisition-related intangibles | (5,443) | | | (4,905) | | | (3,247) | | | (18,940) | | | (12,988) | | | (12,027) | |

| Acquisition and integration expenses | (2,676) | | | (8,637) | | | (3,620) | | | (20,869) | | | (7,090) | | | (5,314) | |

| Impairment of goodwill | (1,534) | | | — | | | — | | | (19,092) | | | — | | | — | |

| Change in fair value of contingent consideration | (4,100) | | | (14,800) | | | — | | | (29,000) | | | (41,324) | | | (32,400) | |

| Restructure charge | (1,681) | | | 186 | | | 15 | | | (7,047) | | | (234) | | | (3,172) | |

| Other | — | | | — | | | (128) | | | (1,800) | | | (624) | | | 2 | |

| Non-GAAP operating expenses | $ | 70,005 | | | $ | 66,663 | | | $ | 56,490 | | | $ | 276,784 | | | $ | 230,621 | | | $ | 173,678 | |

| | | | | | | | | | | | |

| GAAP operating income (loss) | $ | (1,639) | | | $ | (2,386) | | | $ | 23,060 | | | $ | 8,745 | | | $ | 67,176 | | | $ | (15,706) | |

| Share-based compensation expense | 9,574 | | | 9,642 | | | 9,459 | | | 39,228 | | | 37,284 | | | 30,961 | |

| Amortization of acquisition-related intangibles | 11,319 | | | 11,609 | | | 5,614 | | | 44,601 | | | 23,729 | | | 20,255 | |

| Flow-through of inventory step up | — | | | — | | | — | | | 2,599 | | | — | | | 7,090 | |

| Cost of sales-related restructure | 1,050 | | | 211 | | | — | | | 6,813 | | | — | | | — | |

| Acquisition and integration expenses | 2,676 | | | 8,637 | | | 3,620 | | | 20,869 | | | 7,090 | | | 5,314 | |

| Impairment of goodwill | 1,534 | | | — | | | — | | | 19,092 | | | — | | | — | |

| Change in fair value of contingent consideration | 4,100 | | | 14,800 | | | — | | | 29,000 | | | 41,324 | | | 32,400 | |

| Restructure charge | 1,681 | | | (186) | | | (15) | | | 7,047 | | | 234 | | | 3,172 | |

| Other | — | | | — | | | 128 | | | 1,800 | | | 624 | | | (2) | |

| Non-GAAP operating income | $ | 30,295 | | | $ | 42,327 | | | $ | 41,866 | | | $ | 179,794 | | | $ | 177,461 | | | $ | 83,484 | |

SMART Global Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| | August 25,

2023 | | May 26,

2023 | | August 26,

2022 | | August 25,

2023 | | August 26,

2022 | | August 27,

2021 |

| GAAP net income (loss) attributable to SGH | $ | 64,841 | | | $ | (19,648) | | | $ | 8,862 | | | $ | 7,858 | | | $ | 22,372 | | | $ | (43,150) | |

| Share-based compensation expense | 9,574 | | | 9,642 | | | 9,459 | | | 39,228 | | | 37,284 | | | 30,961 | |

| Amortization of acquisition-related intangibles | 11,319 | | | 11,609 | | | 5,614 | | | 44,601 | | | 23,729 | | | 20,255 | |

| Flow-through of inventory step up | — | | | — | | | — | | | 2,599 | | | — | | | 7,090 | |

| Cost of sales-related restructure | 1,050 | | | 211 | | | — | | | 6,813 | | | — | | | — | |

| Acquisition and integration expenses | 2,676 | | | 8,637 | | | 3,620 | | | 20,869 | | | 7,090 | | | 5,314 | |

| Impairment of goodwill | 1,534 | | | — | | | — | | | 19,092 | | | — | | | — | |

| Change in fair value of contingent consideration | 4,100 | | | 14,800 | | | — | | | 29,000 | | | 41,324 | | | 32,400 | |

| Restructure charge | 1,681 | | | (186) | | | (15) | | | 7,047 | | | 234 | | | 3,172 | |

| Amortization of debt discount and other costs | 1,010 | | | 937 | | | 2,788 | | | 4,064 | | | 9,999 | | | 8,419 | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 15,924 | | | 653 | | | — | |

| Foreign currency (gains) losses | (276) | | | 410 | | | 97 | | | (221) | | | 9 | | | 389 | |

| Other | — | | | — | | | 128 | | | 1,800 | | | 624 | | | (1,004) | |

| Income tax effects | (79,103) | | | 2,319 | | | 1,057 | | | (70,993) | | | (4,031) | | | (1,724) | |

| Non-GAAP net income attributable to SGH | $ | 18,406 | | | $ | 28,731 | | | $ | 31,610 | | | $ | 127,681 | | | $ | 139,287 | | | $ | 62,122 | |

| | | | | | | | | | | |

| Weighted-average shares outstanding - Diluted: | | | | | | | | | | | |

| GAAP weighted-average shares outstanding | 55,523 | | | 49,380 | | | 50,504 | | | 51,322 | | | 54,443 | | | 48,558 | |

| Adjustment for dilutive securities and capped calls | (2,233) | | | 754 | | | — | | | (558) | | | (1,851) | | | 2,129 | |

| Non-GAAP weighted-average shares outstanding | 53,290 | | | 50,134 | | | 50,504 | | | 50,764 | | | 52,592 | | | 50,687 | |

| | | | | | | | | | | |

| Diluted earnings (loss) per share from continuing operations: | | | | | | | | | | | |

| GAAP diluted earnings (loss) per share | $ | 1.17 | | | $ | (0.40) | | | $ | 0.18 | | | $ | 0.15 | | | $ | 0.41 | | | $ | (0.89) | |

| Effect of adjustments | (0.82) | | | 0.97 | | | 0.45 | | | 2.37 | | | 2.24 | | | 2.12 | |

| Non-GAAP diluted earnings per share | $ | 0.35 | | | $ | 0.57 | | | $ | 0.63 | | | $ | 2.52 | | | $ | 2.65 | | | $ | 1.23 | |

| | | | | | | | | | | | |

| Net income (loss) attributable to SGH | $ | 64,841 | | | $ | (19,648) | | | $ | 8,862 | | | $ | 7,858 | | | $ | 22,372 | | | $ | (43,150) | |

| Interest expense, net | 9,183 | | | 9,314 | | | 7,485 | | | 36,421 | | | 24,345 | | | 17,141 | |

| Income tax provision (benefit) | (75,890) | | | 7,216 | | | 6,075 | | | (49,203) | | | 18,074 | | | 9,689 | |

| Depreciation expense and amortization of intangible assets | 18,830 | | | 18,554 | | | 11,646 | | | 71,632 | | | 46,665 | | | 34,937 | |

| Share-based compensation expense | 9,574 | | | 9,642 | | | 9,459 | | | 39,228 | | | 37,284 | | | 30,961 | |

| Flow-through of inventory step up | — | | | — | | | — | | | 2,599 | | | — | | | 7,090 | |

| Cost of sales-related restructure | 1,050 | | | 211 | | | — | | | 6,813 | | | — | | | — | |

| Acquisition and integration expenses | 2,676 | | | 8,637 | | | 3,620 | | | 20,869 | | | 7,090 | | | 5,314 | |

| Impairment of goodwill | 1,534 | | | — | | | — | | | 19,092 | | | — | | | — | |

| Change in fair value of contingent consideration | 4,100 | | | 14,800 | | | — | | | 29,000 | | | 41,324 | | | 32,400 | |

| Restructure charge | 1,681 | | | (186) | | | (15) | | | 7,047 | | | 234 | | | 3,172 | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 15,924 | | | 653 | | | — | |

| Other | — | | | — | | | 128 | | | 1,800 | | | 624 | | | (1,004) | |

| Adjusted EBITDA | $ | 37,579 | | | $ | 48,540 | | | $ | 47,260 | | | $ | 209,080 | | | $ | 198,665 | | | $ | 96,550 | |

SMART Global Holdings, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| As of | August 25,

2023 | | August 26,

2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 365,563 | | | $ | 313,328 | |

| Short-term investments | 25,251 | | | — | |

| Accounts receivable, net | 219,247 | | | 355,002 | |

| Inventories | 174,977 | | | 263,768 | |

| Other current assets | 51,790 | | | 33,486 | |

| Current assets from discontinued operations | 70,574 | | | 186,281 | |

| Total current assets | 907,402 | | | 1,151,865 | |

| Property and equipment, net | 118,734 | | | 96,708 | |

| Operating lease right-of-use assets | 68,444 | | | 71,823 | |

| Intangible assets, net | 160,185 | | | 77,812 | |

| Goodwill | 161,958 | | | 55,121 | |

| Deferred tax assets | 74,085 | | | 4,576 | |

| Other noncurrent assets | 15,150 | | | 15,014 | |

| Noncurrent assets from discontinued operations | — | | | 99,145 | |

| Total assets | $ | 1,505,958 | | | $ | 1,572,064 | |

| | | |

| Liabilities and Equity | | | |

| Accounts payable and accrued expenses | $ | 182,035 | | | $ | 354,098 | |

| Current debt | 35,618 | | | 8,469 | |

| Deferred revenue | 48,096 | | | 30,780 | |

| Other current liabilities | 32,731 | | | 57,880 | |

| Acquisition-related contingent consideration | 50,000 | | | — | |

| Current liabilities from discontinued operations | 77,770 | | | 64,313 | |

| Total current liabilities | 426,250 | | | 515,540 | |

| Long-term debt | 754,820 | | | 575,682 | |

| Noncurrent operating lease liabilities | 66,407 | | | 66,990 | |

| Other noncurrent liabilities | 29,248 | | | 14,835 | |

| Noncurrent liabilities from discontinued operations | — | | | 20,471 | |

| Total liabilities | 1,276,725 | | | 1,193,518 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SMART Global Holdings shareholders’ equity: | | | |

| Ordinary shares | 1,726 | | | 1,586 | |

| Additional paid-in capital | 476,703 | | | 448,112 | |

| Retained earnings | 82,457 | | | 251,344 | |

| Treasury shares | (132,447) | | | (107,776) | |

| Accumulated other comprehensive income (loss) | (205,964) | | | (221,655) | |

| Total SGH shareholders’ equity | 222,475 | | | 371,611 | |

| Noncontrolling interest in subsidiary | 6,758 | | | 6,935 | |

| Total equity | 229,233 | | | 378,546 | |

| Total liabilities and equity | $ | 1,505,958 | | | $ | 1,572,064 | |

SMART Global Holdings, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| August 25,

2023 | | May 26,

2023 | | August 26,

2022 | | August 25,

2023 | | August 26,

2022 | | August 27,

2021 |

| Cash flows from operating activities | | | | | | | | | | | |

| Net income (loss) | $ | (140,155) | | | $ | (24,077) | | | $ | 20,427 | | | $ | (185,694) | | | $ | 68,592 | | | $ | 22,506 | |

| Net income (loss) from discontinued operations | (205,685) | | | (4,807) | | | 11,097 | | | (195,384) | | | 44,185 | | | 64,460 | |

| Net income (loss) from continuing operations | 65,530 | | | (19,270) | | | 9,330 | | | 9,690 | | | 24,407 | | | (41,954) | |

| Adjustments to reconcile net income (loss) from continuing operations to cash provided by operating activities | | | | | | | | | | | |

| Depreciation expense and amortization of intangible assets | 18,830 | | | 18,554 | | | 11,646 | | | 71,632 | | | 46,665 | | | 34,937 | |

| Amortization of debt discount and issuance costs | 1,010 | | | 937 | | | 2,787 | | | 4,064 | | | 10,263 | | | 8,798 | |

| Share-based compensation expense | 9,574 | | | 9,642 | | | 9,459 | | | 39,228 | | | 37,284 | | | 30,961 | |

| Impairment of goodwill | 1,534 | | | — | | | — | | | 19,092 | | | — | | | — | |

| Change in fair value of contingent consideration | 4,100 | | | 14,800 | | | — | | | 29,000 | | | 41,324 | | | 32,400 | |

| Loss on extinguishment of debt | — | | | — | | | — | | | 15,924 | | | 653 | | | — | |

| Deferred income taxes, net | (65,228) | | | (5) | | | (9) | | | (63,603) | | | (20) | | | (1,982) | |

| Other | 701 | | | (809) | | | 51 | | | 4,008 | | | 582 | | | (598) | |

| Changes in operating assets and liabilities: | | | | | | | | | | | |

| Accounts receivable | 3,007 | | | (12,525) | | | (59,249) | | | 162,515 | | | (97,801) | | | (47,773) | |

| Inventories | 28,564 | | | 56,413 | | | 55,411 | | | 95,217 | | | 30,733 | | | (99,906) | |

| Other assets | (290) | | | 16,950 | | | (5,926) | | | 6,767 | | | (10,321) | | | 15,415 | |

| Accounts payable and accrued expenses and other liabilities | (29,776) | | | (51,612) | | | (15,368) | | | (256,133) | | | (44,907) | | | 192,542 | |

| Payment of acquisition-related contingent consideration | — | | | — | | | — | | | (73,724) | | | — | | | — | |

| Net cash provided by operating activities from continuing operations | 37,556 | | | 33,075 | | | 8,132 | | | 63,677 | | | 38,862 | | | 122,840 | |

| Net cash provided by (used for) operating activities from discontinued operations | (757) | | | 7,963 | | | 12,774 | | | 40,710 | | | 66,069 | | | 30,510 | |

| Net cash provided by operating activities | 36,799 | | | 41,038 | | | 20,906 | | | 104,387 | | | 104,931 | | | 153,350 | |

| | | | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | | | |

| Capital expenditures and deposits on equipment | (7,747) | | | (11,984) | | | (5,858) | | | (39,421) | | | (20,359) | | | (16,669) | |

| Acquisition of business, net of cash acquired | — | | | — | | | — | | | (213,073) | | | — | | | (35,677) | |

| Purchases of held-to-maturity investment securities | (25,015) | | | — | | | — | | | (25,015) | | | — | | | — | |

| Other | (4,345) | | | 431 | | | (71) | | | (3,675) | | | (875) | | | (1,121) | |

| Net cash used for investing activities from continuing operations | (37,107) | | | (11,553) | | | (5,929) | | | (281,184) | | | (21,234) | | | (53,467) | |

| Net cash used for investing activities from discontinued operations | (11,640) | | | (1,273) | | | (2,997) | | | (17,385) | | | (17,736) | | | (30,711) | |

| Net cash used for investing activities | $ | (48,747) | | | $ | (12,826) | | | $ | (8,926) | | | $ | (298,569) | | | $ | (38,970) | | | $ | (84,178) | |

SMART Global Holdings, Inc.

Consolidated Statements of Cash Flows, Continued

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended |

| August 25,

2023 | | May 26,

2023 | | August 26,

2022 | | August 25,

2023 | | August 26,

2022 | | August 27,

2021 |

| Cash flows from financing activities | | | | | | | | | | | |

| Proceeds from debt | $ | — | | | $ | — | | | $ | — | | | $ | 295,287 | | | $ | 270,775 | | | $ | — | |

| Proceeds from issuance of ordinary shares | 34,615 | | | 4,180 | | | 291 | | | 43,045 | | | 12,140 | | | 14,923 | |

| Proceeds from borrowing under line of credit | — | | | — | | | — | | | — | | | 84,000 | | | 172,500 | |

| | | | | | | | | | | |

| Payment of acquisition-related contingent consideration | — | | | — | | | — | | | (28,100) | | | — | | | — | |

| Payments to acquire ordinary shares | (7,788) | | | (660) | | | (40,431) | | | (24,671) | | | (57,231) | | | (48,513) | |

| Repayments of debt | (7,212) | | | (7,211) | | | (1,719) | | | (21,634) | | | (126,719) | | | — | |

| Payment of premium in connection with convertible note exchange | — | | | — | | | — | | | (14,141) | | | — | | | — | |

| Net cash paid for settlement and purchase of Capped Calls | — | | | — | | | — | | | (4,304) | | | — | | | — | |

| Distribution to noncontrolling interest | — | | | — | | | — | | | (2,009) | | | (3,773) | | | — | |

| Repayments of borrowings under line of credit | — | | | — | | | — | | | — | | | (109,000) | | | (147,500) | |

| Other | (487) | | | (688) | | | (1,242) | | | (6,252) | | | (9,547) | | | (6,138) | |

| Net cash provided by (used for) financing activities from continuing operations | 19,128 | | | (4,379) | | | (43,101) | | | 237,221 | | | 60,645 | | | (14,728) | |

| Net cash provided by (used for) financing activities from discontinued operations | (426) | | | (255) | | | 8,770 | | | (805) | | | 13,234 | | | 17,577 | |

| Net cash provided by (used for) financing activities | 18,702 | | | (4,634) | | | (34,331) | | | 236,416 | | | 73,879 | | | 2,849 | |

| | | | | | | | | | | |

| Effect of changes in currency exchange rates | 2,035 | | | 813 | | | (1,910) | | | 4,765 | | | 239 | | | 154 | |

| Net increase (decrease) in cash and cash equivalents | 8,789 | | | 24,391 | | | (24,261) | | | 46,999 | | | 140,079 | | | 72,175 | |

| Cash and cash equivalents at beginning of period | 401,275 | | | 376,884 | | | 387,326 | | | 363,065 | | | 222,986 | | | 150,811 | |

| Cash and cash equivalents at end of period | $ | 410,064 | | | $ | 401,275 | | | $ | 363,065 | | | $ | 410,064 | | | $ | 363,065 | | | $ | 222,986 | |

| | | | | |

| Investor Contact: | PR Contact: |

| Suzanne Schmidt | Valerie Sassani |

| Investor Relations | VP of Marketing and Communications |

| +1-510-360-8596 | +1-510-941-8921 |

| ir@sghcorp.com | pr@sghcorp.com |

v3.23.3

Cover

|

Oct. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 12, 2023

|

| Entity Registrant Name |

SMART GLOBAL HOLDINGS, INC.

|

| Entity File Number |

001-38102

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Tax Identification Number |

98-1013909

|

| Entity Address, Address Line One |

c/o Walkers Corporate Limited

|

| Entity Address, Address Line Two |

190 Elgin Avenue

|

| Entity Address, City or Town |

George Town, Grand Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Postal Zip Code |

KY1-9008

|

| City Area Code |

510

|

| Local Phone Number |

623-1231

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, $0.03 par value per share

|

| Trading Symbol |

SGH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001616533

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

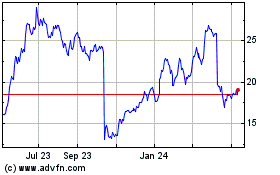

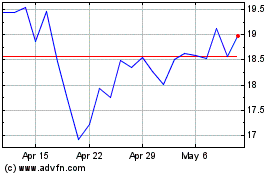

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From Apr 2024 to May 2024

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From May 2023 to May 2024