As filed with the Securities and Exchange

Commission on November 12, 2020

Registration No. 333-245005

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SKYWEST, INC.

(Exact name of registrant as specified

in its charter)

|

Utah

|

87-0292166

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

444

South River Road

St.

George, Utah 84790

(435) 634-3000

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Robert J. Simmons

Chief Financial Officer

SkyWest, Inc.

444 South River Road

St. George, UT 84790

(435) 634-3200

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Craig M. Garner

Kevin C. Reyes

Latham & Watkins LLP

12670 High Bluff Drive

San Diego, CA 92130

(858) 523-5400

APPROXIMATE DATE OF COMMENCEMENT

OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are

being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities

offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under

the Securities Act, check the following box. x

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. x

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x

|

Accelerated filer ¨

|

|

|

|

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

|

|

|

|

Emerging growth company ¨

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be

Registered

|

Maximum

Offering Price

Per Unit

|

Proposed

Maximum

Aggregate Offering

Price

|

Amount of

registration fee

|

|

Common Stock, no par value, underlying warrants

|

357,317 (1)(2)(6)

|

$28.72(3)

|

$10,262,145(3)(6)

|

$1,333(3)(6)

|

|

Warrants to purchase common stock

|

357,317(2)(6)

|

$28.38(4)

|

$10,140,657(4)(6)

|

$1,317(4)(6)

|

|

Common Stock, no par value, underlying warrants registered herewith

|

13,403(1)(2)

|

$30.96(5)

|

$414,957(5)

|

$46(5)

|

|

Warrants to purchase common stock registered herewith

|

13,403(1)(2)

|

$28.38(4)

|

$380,378(4)

|

$42(4)

|

|

Total Registration Fee

|

|

|

|

$2,738(6)

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, such number of shares of common stock registered hereby shall include an indeterminable number of shares of common stock that may be issued in connection with a stock split, stock dividend, recapitalization or similar event. No additional consideration will be received for the common stock, and therefore no registration fee is required pursuant to Rule 457(i) under the Securities Act.

|

|

(2)

|

Represents the maximum number of shares of common stock that we expect could be issued upon exercise of the warrants to purchase common stock held by the selling securityholder.

|

|

(3)

|

The registration fee for the common stock has been calculated in accordance with Rule 457(c) under the Securities Act based on the average high and low prices reported for the registrant’s common stock on August 6, 2020.

|

|

(4)

|

The registration fee has been calculated in accordance with Rule 457(g) under the Securities Act based on the exercise price of the warrants, which is $28.38 per share of common stock.

|

|

(5)

|

The registration fee for the common stock has been calculated in accordance with Rule 457(c) under the Securities Act based on the average high and low prices reported for the registrant’s common stock on November 6, 2020.

|

|

(6)

|

Includes 357,317 warrants to purchase common stock

and 357,317 shares of common stock registered by SkyWest, Inc. on a registration statement on Form S-3 (File No. 333-245005)

filed with the Securities and Exchange Commission on August 12, 2020, for which a total filing fee of $2,650 was previously

paid based on the fee rate then in effect. In accordance with Rule 413(b) promulgated under the Securities Act, an additional

13,403 warrants and 13,403 shares of common stock are hereby registered.

|

Explanatory Note

This

registration statement is a post-effective amendment to the registration statement on Form S-3 (File

No. 333-245005) of SkyWest, Inc. (“SkyWest”) filed with the Securities and Exchange Commission (the

“SEC”) on August 12, 2020 (the “Registration Statement”). SkyWest previously registered warrants

to purchase up to 357,317 shares of common stock and 357,317 shares of common stock pursuant to the Registration Statement

for resale by the selling securityholder named herein. This post-effective amendment to the Registration Statement is being

filed for the purpose of (i) registering additional warrants and shares of common stock for resale by the selling

securityholder pursuant to Rule 413(b) under the Securities Act of 1933, as amended, for an aggregate

of warrants to purchase up to 370,720 shares of common stock and 370,720 shares of common stock

(including warrants to purchase up to 13,403 shares of common stock and 13,403 shares of common stock registered hereby)

and (ii) filing additional exhibits to the Registration Statement. This post-effective amendment shall become effective

immediately upon filing with the SEC. A prospectus to be used by the selling securityholder in connection with the resale of

the warrants and shares of SkyWest common stock is included in this Registration Statement.

PROSPECTUS

SkyWest, Inc.

370,720 Shares of Common Stock

Warrants to Purchase up to 370,720 Shares

of Common Stock

This prospectus covers the offer, resale

or other disposition from time to time by the selling securityholder named herein of: (i) warrants (each a “Warrant”

and, collectively, the “Warrants”) to purchase up to 370,720 shares of our common stock, no par value (“common

stock”), and (ii) 370,720 shares of our common stock underlying the Warrants (the “Warrant Shares”). We

will not receive any of the proceeds from any sale of Warrants or Warrant Shares by the selling securityholder.

On April 23, 2020 (the “PSP Closing

Date”), SkyWest Airlines, Inc., our wholly-owned subsidiary, entered into a Payroll Support Program Agreement (the “PSP

Agreement”) with the U.S. Department of the Treasury (“Treasury”) with respect to the grant program (the “Payroll

Support Program”) under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). In connection with

our entry into the PSP Agreement, on the PSP Closing Date, we entered into a Warrant Agreement (the “Warrant Agreement”)

with Treasury.

Pursuant to the PSP Agreement, we received

financial assistance from Treasury in the aggregate amount of approximately $450.7 million. As partial compensation to Treasury

for the provision of financial assistance under the PSP Agreement, we issued the Warrants to Treasury to purchase up to an aggregate

of 370,720 shares of our common stock at an exercise price of $28.38 per share, which was the closing price of our common stock

on the Nasdaq Global Select Market on April 9, 2020. The number of Warrant Shares to be issued is subject to adjustment as

a result of certain anti-dilution provisions contained in the Warrants.

Pursuant to the Warrant Agreement, we agreed

to file a registration statement, of which this prospectus is a part, with the Securities and Exchange

Commission (“SEC”) to register the disposition of the maximum number of Warrants and Warrant Shares.

The selling securityholder may sell the

securities described in this prospectus in a number of different ways and at varying prices. We provide more information about

how the selling securityholder may sell its Warrants and Warrant Shares in the section entitled “Plan of Distribution”

on page 13.

We may amend or supplement

this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any

amendments or supplements carefully before you make your investment decision.

Investing

in our securities involves risks. See the “Risk Factors” on page 6 of this prospectus concerning factors you

should consider before investing in our securities.

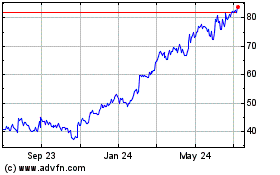

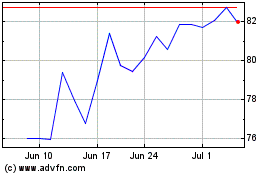

Our common stock is

listed on the Nasdaq Global Select Market under the symbol “SKYW.” On November 11, 2020, the last reported sale

price of our common stock on the Nasdaq Global Select Market was $34.38 per share.

Neither the SEC

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 12,

2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is

part of an automatic shelf registration statement that we filed with the SEC as a “well-known seasoned issuer” as defined

in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration

process. Under this process, the selling securityholder named in this prospectus may sell the Warrants or the Warrant Shares described

in this prospectus in one or more offerings from time to time. You should assume that the information appearing in this prospectus

and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, and that any

information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. You must

not rely upon any information or representation not contained or incorporated by reference in this prospectus. The selling securityholder

is offering to sell, and seeking offers to buy, Warrants and Warrant Shares in jurisdictions where it is lawful to do so. This

prospectus does not constitute an offer to sell or the solicitation of an offer to buy any Warrants or Warrant Shares other than

the registered Warrants and Warrant Shares to which they relate, nor does this prospectus constitute an offer to sell or the solicitation

of an offer to buy Warrants or Warrant Shares in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. You should read this prospectus and any applicable prospectus supplement together with additional information

described below under the heading “Where You Can Find More Information; Incorporation by Reference” before you decide

whether to invest in our securities.

The selling securityholder

may offer the securities directly, through agents, or to or through underwriters. See “Plan of Distribution” for more

information on this topic.

When we refer to “SkyWest,”

“we,” “our,” “us” and the “Company” in this prospectus, we mean SkyWest, Inc.

and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential holders

of the applicable securities.

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION BY REFERENCE

Available Information

We file reports, proxy

statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information statements

and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address

is http://www.skywest.com. The information on our website, however, is not, and should not be deemed to be, a part of this

prospectus.

This prospectus is

part of a registration statement that we filed with the SEC. Other documents establishing the terms of the offered securities are

or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement.

Statements in this prospectus about these documents are summaries and each statement is qualified in all respects by reference

to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters.

You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow

us to “incorporate by reference” information into this prospectus, which means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed

to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that

information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This prospectus incorporates

by reference the documents set forth below that have previously been filed with the SEC:

|

|

·

|

Our Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC on February 18, 2020.

|

|

|

·

|

The information specifically incorporated by reference into our Annual Report on Form 10-K

from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 13, 2020.

|

|

|

·

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30,

2020 and September 30, 2020, filed with the SEC on May 8, 2020, August 7, 2020 and November 5, 2020, respectively.

|

|

|

·

|

Our Current Reports on Form 8-K filed with the SEC on February 20,

2020, March 17,

2020, March 31,

2020, April 24,

2020, May 7, 2020, September 29, 2020, October 26,

2020 and October 29, 2020.

|

|

|

·

|

The description of our common stock contained in our Registration Statement on Form 8-A filed

with the SEC on June 15, 1986, including any amendment or report filed for the purpose of updating such description.

|

All reports and other

documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), prior to the termination of this offering but excluding any information furnished

to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this

prospectus from the date of the filing of such reports and documents.

You may request a free

copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

SkyWest, Inc.

444

South River Road

St.

George, Utah 84790

(435) 634-3000

Exhibits to the filings

will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying

prospectus supplement.

FORWARD-LOOKING STATEMENTS

Certain

of the statements contained in this prospectus, any accompanying prospectus supplement and the documents that we incorporate by

reference should be considered “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,”

“expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,”

“project,” “could,” “should,” “hope,” “likely,” and “continue”

and similar terms used in connection with statements regarding our outlook, anticipated operations, the revenue environment, our

contractual relationships, and our anticipated financial performance. These statements include, but are not limited to, statements

regarding the impact of the COVID-19 pandemic on our business, results of operations and financial condition and the impact of

any measures, including travel restrictions, taken to mitigate the effect of the pandemic, our future growth and development plans,

including our future financial and operating results, our plans, objectives, expectations and intentions and other statements that

are not historical facts. Readers should keep in mind that all forward-looking statements are based on our existing beliefs about

present and future events outside of our control and on assumptions that may prove to be incorrect. If one or more risks identified

in this prospectus materializes, or any other underlying assumption proves incorrect, our actual results will vary, and may vary

materially, from those anticipated, estimated, projected, or intended for a number of reasons, including but not limited to: the

consequences of the COVID-19 pandemic to global economic conditions, the travel industry and our major airline partners in general

and our financial condition and results of operations in particular; the challenges of competing successfully in a highly competitive

and rapidly changing industry; developments associated with fluctuations in the economy and the demand for air travel, including

as a result of the COVID-19 pandemic; the financial stability of Delta Air Lines, Inc. (“Delta”), United Airlines, Inc.

(“United”), American Airlines, Inc. (“American”) and Alaska Airlines, Inc. (“Alaska”)

(each, a “major airline partner”) and any potential impact of their financial condition on our operations; fluctuations

in flight schedules, which are determined by the major airline partners for whom SkyWest conducts flight operations; variations

in market and economic conditions; significant aircraft lease and debt commitments; realization of manufacturer residual value

guarantees on applicable SkyWest aircraft; residual aircraft values and related impairment charges; the impact of global instability;

labor relations and costs; potential fluctuations in fuel costs, and potential fuel shortages; the impact of weather-related or

other natural disasters on air travel and airline costs; new aircraft deliveries; and the ability to attract and retain qualified

pilots, as well as other factors identified under the heading “Risk Factors” in Part I, Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2019, under the heading “Risk Factors” in Part II, Item

1A of our subsequently filed Quarterly Reports on Form 10-Q, in our other filings with the SEC and other unanticipated factors.

Additionally, the risks, uncertainties and other factors set forth above or otherwise referred to in the reports that we have filed

with the SEC may be further amplified by the global impact of the COVID-19 pandemic.

There may be other factors

that may affect matters discussed in forward-looking statements set forth in this prospectus, which factors may also cause actual

results to differ materially from those discussed. We assume no obligation to publicly update any forward-looking statement to

reflect actual results, changes in assumptions or changes in other factors affecting these statements other than as required by

applicable law.

PROSPECTUS SUMMARY

This summary highlights selected information

about us and this offering. This summary is not complete and does not contain all of the information that may be important to you.

You should read carefully this prospectus, including the “Risk Factors” section, and the other documents that we refer

to and incorporate by reference herein.

The

Company

We

offer scheduled passenger service to destinations in the United States, Canada, Mexico and the Caribbean. Substantially all of

our flights are operated as Delta Connection, United Express, American Eagle or Alaska Airlines flights under code-share arrangements

(commercial agreements between airlines that, among other things, allow one airline to use another airline’s flight designator

codes on its flights) with Delta, United, American or Alaska, respectively. As of September 30, 2020, SkyWest Airlines

offered scheduled passenger service with approximately 1,600 total daily departures under COVID-19 related reduced schedules to

destinations in the United States, Canada, Mexico and the Caribbean. Our fleet of E175 regional jet aircraft, CRJ900 regional jet

aircraft and CRJ700 regional jet aircraft have a multiple-class seat configuration, whereas our CRJ200 regional jet aircraft have

a single-class seat configuration. We generally provide regional flying to our major airline partners

under long-term, fixed-fee, code-share agreements. Under these fixed-fee agreements, our major airline partners generally pay us

fixed rates for operating the aircraft primarily based on the number of completed flights, flight time and the number of aircraft

under contract. The major airline partners either directly pay for or reimburse us for specified direct operating expenses (including

fuel expense). Our operations are conducted principally from airports located in Chicago (O’Hare), Denver, Houston, Los Angeles,

Minneapolis, Phoenix, Salt Lake City, San Francisco and Seattle.

SkyWest

has been flying since 1972. During our long operating history, we have developed an industry-leading reputation for providing quality

regional airline service. As of September 30, 2020, we had a total fleet of 577 aircraft, of which 448 were in scheduled

service.

We

were incorporated in Utah in 1972. Our principal executive offices are located at 444 South River Road, St. George, Utah

84790, and our primary telephone number is (435) 634-3000. We maintain an internet website at inc.skywest.com.

The information on our website does not constitute part of this prospectus.

The Offering

|

Issuer

|

SkyWest, Inc.

|

|

|

|

|

Securities to be Offered by the Selling Securityholder

|

Warrants to purchase up to 370,720 shares of our common stock;

and

370,720 shares of our common stock underlying the Warrants.

|

|

|

|

|

Warrants

|

The Warrants have an exercise price of $28.38 per share and

are exercisable until the fifth anniversary of the issuance date of the applicable Warrant. The Warrants are exercisable either

through net share settlement or cash, at the Company’s option. The number of Warrant Shares to be issued is subject to adjustment

as a result of certain anti-dilution provisions contained in the Warrants.

You should carefully consider the information under “Description

of Common Stock” and “Description of Warrants” and all other information included or incorporated by reference

in this prospectus before investing in our securities.

|

|

|

|

|

Use of Proceeds

|

We will not receive any proceeds from the sale of Warrants or Warrant Shares covered by this prospectus.

|

|

|

|

|

Listing

|

Our common stock is listed on the Nasdaq Global Select Market

under the symbol “SKYW.” On November 11, 2020, the last reported sale price of our common stock was $34.38 per share.

The Warrants are not listed, and we do not intend to apply for

listing of the Warrants on any national securities exchange or any other nationally recognized trading system.

|

|

|

|

|

Risk Factors

|

Investing in our securities involves risks. You should carefully consider the information under “Risk Factors” and all other information included or incorporated by reference in this prospectus before investing in our securities.

|

RISK FACTORS

An investment in any securities offered

pursuant to this prospectus involves risks. You should carefully consider the risk factors incorporated by reference to our most

recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, as well as the other information included

or incorporated by reference in this prospectus, before making an investment decision. Our business, financial condition or results

of operations could be materially adversely affected by any of these risks. The market or trading price of our common stock could

decline due to any of these risks, and you may lose all or part of your investment. See the section of this prospectus entitled

“Where You Can Find More Information; Incorporation by Reference.” In addition, please read “Forward-Looking

Statements” in this prospectus, where we describe additional uncertainties associated with our business. Please note that

additional risks not presently known to us or that we currently deem immaterial may also impair our business, financial condition

or results of operations. Additionally, the risks, uncertainties and other factors otherwise referred

to in the reports that we have filed with the SEC may be further amplified by the global impact of the COVID-19 pandemic.

USE OF PROCEEDS

We are filing

the registration statement of which this prospectus forms a part pursuant to our contractual obligation to the selling securityholder.

We will not receive any of the proceeds from the resale of Warrants or Warrant Shares from time to time by such selling securityholder.

We have agreed

to pay all costs, expenses and fees relating to the registration of the Warrants and the Warrant Shares covered by this prospectus.

These may include, without limitation, all registration and filing fees, fees and expenses of our counsel and accountants, and

blue sky fees and expenses. Other than certain fees and disbursements of Treasury’s counsel, the selling securityholder will

pay any underwriting discounts and commissions and expenses they incur for brokerage, accounting, tax or legal services or any

other expenses they incur in disposing of the Warrants and the Warrant Shares covered hereby.

DESCRIPTION OF COMMON STOCK

The following is a summary of the general

terms of our common stock. This description is not complete and is subject to, and qualified in its entirety by reference to, our

Restated Articles of Incorporation (“Restated Articles”) and Amended and Restated Bylaws (“Bylaws”), copies

of which are filed as exhibits to the registration statement of which this prospectus is a part.

General

As of September 30, 2020, our authorized

capital stock consisted of 120,000,000 shares of common stock, no par value, and 5,000,000 shares of preferred stock, no par value.

Listing

Our common stock trades on the Nasdaq Global

Select Market under the symbol “SKYW.”

Voting Rights

Holders of our common stock are entitled

to one vote per share on all matters that shareholders may vote on at all meetings of our shareholders. The holders of our common

stock do not have cumulative voting rights.

Dividends

Subject to the rights of the holders of

any outstanding shares of our preferred stock, each holder of our common stock has equal ratable rights to dividends from funds

legally available therefor, if, as and when declared by our board of directors. The declaration and payment of all dividends, however,

is subject to the discretion of our board of directors.

Liquidation Rights

In the event of our liquidation or dissolution

or the winding up of our affairs, the holders of our common stock are entitled to share ratably in all assets remaining after payment

of liabilities and amounts, if any, due to holders of our preferred stock.

Other Rights

The holders of our common stock do not have

preemptive, subscription or conversion rights, and there are no redemption or sinking fund provisions applicable thereto.

Fully Paid

All the outstanding shares of our common

stock are fully paid and nonassessable.

Anti-Takeover Effects of Utah Law and Our Restated Articles

and Bylaws

Utah Control Shares Acquisitions Act

The Utah Control Shares Acquisitions Act

(the “Control Shares Act”) provides that any person or entity that acquires “control shares” of an “issuing

public corporation” in a “control share acquisition” is denied voting rights with respect to the acquired shares,

unless a majority of the disinterested shareholders of the issuing public corporation elects to restore such voting rights. The

Control Shares Act provides that a person or entity acquires “control shares” whenever it acquires shares that, but

for the operation for the Control Shares Act, would bring its voting power following such acquisition within any of the following

three ranges of all voting power of the issuing public corporation: (i) 1/5 or more but less than 1/3; (ii) 1/3

or more but less than a majority; or (iii) a majority or more. An “issuing public corporation” is any Utah corporation

that (a) has 100 or more shareholders, (b) has its principal place of business, principal office or substantial assets

within the State of Utah and (c) has more than 10% of its shareholders resident in the State of Utah, more than 10% of its

shares owned by Utah residents, or 10,000 shareholders resident in the State of Utah. A “control share acquisition”

is generally defined as the direct or indirect acquisition (including through a series of acquisitions) of either ownership or

voting power associated with issued and outstanding control shares.

Under the Control Shares Act, a person or

entity that acquires control shares pursuant to a control share acquisition acquires voting rights with respect to those shares

only to the extent granted by resolution approved by each voting group entitled to vote separately on the proposal by a majority

of all the votes entitled to be cast by that group, excluding all interested shares. The acquiring person may file an “acquiring

person statement” with the issuing public corporation setting forth the number of shares of the issuing public corporation

owned (directly or indirectly) by the acquiring person and each other member of the group and certain other specified information.

Upon delivering the statement together with an undertaking to pay the issuing public corporation’s expenses of a special

shareholders’ meeting, the issuing public corporation is required to call a special shareholders’ meeting for the purpose

of considering the voting rights to be accorded the shares acquired or to be acquired in the control shares acquisition. If no

request for a special meeting is made, the voting rights to be accorded the control shares are to be presented at the issuing public

corporation’s next special or annual meeting of shareholders. If either (i) the acquiring person does not file an acquiring

person statement with the issuing public corporation or (ii) the shareholders do not vote to restore voting rights to the

control shares, the issuing public corporation may, if its articles of incorporation or bylaws so provide, redeem the control shares

from the acquiring person at fair market value. Our Restated Articles and Bylaws do not currently provide for such a redemption

right. Unless otherwise provided in the articles of incorporation or bylaws of an issuing public corporation, all shareholders

are entitled to dissenters’ rights if the control shares are accorded full voting rights and the acquiring person has obtained

majority or more control shares. Our Restated Articles and Bylaws do not currently deny such dissenters’ rights.

The directors or shareholders of a corporation

may elect to exempt the stock of the corporation from the provisions of the Control Shares Act through adoption of a provision

to that effect in the corporation’s articles of incorporation or bylaws. To be effective, such an exemption must be adopted

prior to the control shares acquisition. We have not yet taken any such action.

The provisions of the Control Shares Act

may discourage individuals or entities interested in acquiring a significant interest in or control of us.

Undesignated Preferred Stock

The ability of our board of directors, without

action by the shareholders, to issue up to 5,000,000 shares of undesignated preferred stock with preferences as designated by our

board of directors could impede the success of any attempt to change control of us.

Shareholder Meetings

Our Bylaws provide that a special meeting

of shareholders may be called only by our chief executive officer, president or board of directors, or by the holders of not less

than one-tenth (1/10) of all of the shares entitled to vote on any issue to be considered at the proposed special meeting .

Requirements for Advance Notification of Shareholder Nominations

and Proposals

Our Bylaws establish advance notice procedures

with respect to shareholder proposals to be brought before a shareholder meeting and the nomination of candidates for election

as directors, other than nominations made by or at the direction of the board of directors or the chairman of the board of directors.

Shareholders Not Entitled to Cumulative Voting

Our Restated Articles do not permit shareholders

to cumulate their votes in the election of directors. Accordingly, the holders of a majority of the outstanding shares of our common

stock entitled to vote in any election of directors can elect all of the directors standing for election, if they choose, other

than any directors that holders of our preferred stock may be entitled to elect.

Transfer Agent and Registrar

The transfer agent and registrar for our

common stock is Zions First National Bank, N.A., Salt Lake City, Utah.

DESCRIPTION OF WARRANTS

On April 23, 2020, SkyWest Airlines, Inc.,

our wholly-owned subsidiary, entered into the PSP Agreement with Treasury with respect to the Payroll Support Program under the

CARES Act. In connection with our entry into the PSP Agreement, on the PSP Closing Date, we entered into the Warrant Agreement

with Treasury.

Pursuant to the PSP Agreement, we received

financial assistance from Treasury in the aggregate amount of approximately $450.7 million. As partial compensation to Treasury

for the provision of financial assistance under the PSP Agreement, we issued the Warrants to Treasury to purchase up to an aggregate

of 370,720 shares of our common stock at an exercise price of $28.38 per share, which was the closing price of our common stock

on the Nasdaq Global Select Market on April 9, 2020. The number of Warrant Shares to be issued is subject to adjustment as

a result of certain anti-dilution provisions contained in the Warrants.

The following is a summary of the general

terms of the Warrants. This description is not complete and is subject to, and qualified in its entirety by reference to, the Warrants

and the Warrant Agreement, copies of which are filed as exhibits to the registration statement of which this prospectus is a part.

Exercisability. The Warrants may

be exercised, in whole or in part, at any time on or after their date of issuance, by delivering to us a written notice of election

to exercise the Warrants. The Warrants are exercisable until the fifth anniversary of the issuance date of the applicable Warrant.

Exercise Price. The Warrants have

an exercise price of $28.38 per share (which was the closing price of our common stock on the Nasdaq Global Select Market on April 9,

2020).

Exercise. Upon our receiving a notice

of exercise from a holder of the Warrants, we may choose whether to settle through net cash settlement or net share settlement.

The holder of the Warrants does not elect whether the Warrants are settled in cash or in shares.

If we choose to settle through net cash

settlement, the holder of the Warrants will not receive any shares of our common stock from the exercise; the holder will be entitled

to receive cash equal to the product obtained by multiplying (A-B) by (C), where:

(A) = the average market price of a

share of our common stock for the prior 15 day trading period (the “Average Market Price”);

(B) = the exercise price per share

of common stock;

(C) = the number of shares of common

stock as to which the Warrant has been exercised.

If we choose to settle through net share

settlement, the warrant holder will be entitled to a number of shares of our common stock equal to the product obtained by multiplying

(A-B)/A by C, where the letters have the same meanings indicated above.

Adjustments to Number of Shares and Exercise

Price. The Warrants provide for proportional adjustment of the number and kind of securities issuable upon exercise of the

Warrants and the per share exercise price upon the occurrence of certain events, such as stock splits, combinations, reverse stock

splits and similar events. The Warrants also contain certain anti-dilution protections providing for the adjustment of the number

and kind of securities issuable upon exercise of the Warrants and the per share exercise price due to certain issuances of securities

or certain distributions to securityholders.

Transferability. Subject to applicable

laws, the Warrants are freely transferable. Pursuant to the Warrant Agreement, holders of the Warrants must provide us at least

30 days’ notice prior to selling the Warrants pursuant to the registration statement of which this prospectus is a part.

Rights as a Shareholder. Except as

otherwise provided in the Warrants or Warrant Agreement or by virtue of a holder’s ownership of shares of our common stock,

the holders of Warrants do not have rights or privileges of holders of our common stock, including any voting rights, until they

exercise their Warrants.

Business Combinations. In the case

of any merger, consolidation, share exchange or similar transaction that requires approval of our shareholders (“Business

Combination”) or reclassification of our common stock, a holder’s right to receive our common stock upon exercise of

the Warrants shall be converted into the right to exercise the Warrants to acquire the number of shares of stock, other securities

or property that our common stock would have been entitled to receive upon consummation of the Business Combination or reclassification.

No Fractional Shares. No fractional

shares of our common stock will be issued upon exercise of the Warrants. If, upon exercise of the Warrants, a holder would be entitled

to receive a fractional interest in a share, we will, upon exercise, round down to the nearest whole number of shares of common

stock to be issued to the holder of the Warrants and pay such holder cash in lieu of such fractional interest in our common stock.

No Listing. We do not plan on applying

to list the Warrants on the Nasdaq Global Select Market, any other national securities exchange or any other nationally recognized

trading system.

Registration. Pursuant to the Warrant

Agreement, we have agreed to use reasonable best efforts to keep the registration statement of which this prospectus is a part

continuously effective and in compliance with the Securities Act until, subject to certain exceptions, the Warrants and the Warrant

Shares: (i) have been sold pursuant to an effective registration statement; (ii) are able to be sold pursuant to Rule 144

of the Securities Act without limitation on volume or manner of sale; (iii) cease to be outstanding; or (iv) have been

sold in a private transaction in which the transferor’s rights under the Warrant Agreement are not assigned to the transferee

of the securities.

Indemnification. Under the Warrants

and Warrant Agreement, subject to certain exceptions, we agreed to indemnify the holders of the Warrants and certain related persons

and entities against any losses, claims, damages, actions, liabilities, costs and expenses, arising out of or based on any untrue

statement or alleged untrue statement of material fact contained in any registration statement or any document contained therein

prepared by us for use by the holders, including the registration statement of which this prospectus is a part.

SELLING SECURITYHOLDER

We are registering the resale or other disposition

from time to time by the selling securityholder named herein of: (i) Warrants to purchase up 370,720 shares of our common

stock and (ii) 370,720 shares of our common stock underlying the Warrants. We issued the Warrants to Treasury pursuant to

the PSP Agreement, entered into with respect to the Payroll Support Program under the CARES Act.

We issued Warrants to Treasury on April 23,

2020, May 29, 2020, July 1, 2020, July 31, 2020 and September 30, 2020 with the right to purchase 125,804 shares

of common stock, 92,605 shares of common stock, 92,605 shares of common stock, 46,303 shares of common stock and 13,403 shares

of common stock, respectively, each with an exercise price of $28.38 per share (which was the closing price of our common stock

on the Nasdaq Global Select Market on April 9, 2020). The Warrants are exercisable until the fifth anniversary of the issuance

date of the applicable Warrant.

Pursuant to the Warrant Agreement, we agreed

to file a registration statement, of which this prospectus is a part, with the SEC to register the disposition of the maximum number

of Warrants and Warrant Shares that may be issued to Treasury pursuant to the Warrant Agreement and the Warrants.

The following table sets forth information

as of November 12, 2020, with respect to the selling securityholder for whom we are registering Warrants and Warrant Shares

for sale to the public, the number of shares of our common stock owned by the selling securityholder prior to this offering, the

percentage of common stock owned by the selling securityholder prior to this offering, the number of Warrants and Warrant Shares

being offered pursuant to this prospectus, the number of shares of our common stock to be owned upon completion of this offering,

assuming all such shares are sold, and the percentage of common stock owned by the selling securityholder after this offering,

assuming all such shares are sold.

In the table below, the number of shares

of common stock that may be offered pursuant to this prospectus is the number of shares of common stock issuable pursuant to the

Warrants. Pursuant to Rule 416 under the Securities Act, this prospectus also covers any additional shares of our common stock

that may become issuable in connection with shares of common stock by reason of a stock dividend, stock split or other similar

transaction effected without us receiving any cash or other value, which results in an increase in the number of shares of our

common stock outstanding.

As used in this prospectus, the term “selling

securityholder” includes the selling securityholder listed below, and any donees, pledges, transferees or other successors

in interest selling Warrants or Warrant Shares received after the date of this prospectus from the selling securityholder as a

gift, pledge, or other non-sale related transfer. The number of shares in the column “Number of Shares Being Offered”

represents all of the Warrant Shares that the selling securityholder may offer under this prospectus. The selling securityholder

may sell some, all or none of their Warrants or Warrant Shares. The selling securityholder may sell or transfer all or a portion

of their Warrants or Warrant Shares pursuant to an available exemption from the registration requirements of the Securities Act.

We do not know how long the selling securityholder will hold the Warrants or Warrant Shares before selling them, and we currently

have no agreements, arrangements or understandings with the selling securityholder regarding the sale of any of the shares. Pursuant

to the Warrant Agreement, Treasury must provide 30 days’ notice to us prior to the sale of the Warrants or any portion thereof.

Beneficial ownership is determined in accordance

with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially owned prior to

the offering is based on 50,140,172 shares of our common stock outstanding as of October 30, 2020.

|

|

|

Shares Beneficially

Owned before the

Offering

|

|

|

Number

of

Warrant

Shares

|

|

|

Number of

Warrants

|

|

|

Shares Beneficially

Owned after the

Offering (1)

|

|

|

Name of Selling Securityholder

|

|

Shares

|

|

|

Percentage

|

|

|

Offered

|

|

|

Offered

|

|

|

Shares

|

|

|

Percentage

|

|

|

United States Department of the Treasury

|

|

|

370,720

|

(2)

|

|

|

(3

|

)

|

|

|

370,720

|

|

|

|

370,720

|

|

|

|

—

|

|

|

|

0.0

|

%

|

|

(1)

|

Assumes the selling securityholder sells all of its Warrants or shares of our common stock offered pursuant to this prospectus.

|

|

(2)

|

Represents 370,720 shares of common stock issuable to Treasury pursuant to the Warrants.

|

|

(3)

|

Less than one percent of the total shares outstanding as of October 30, 2020.

|

PLAN OF DISTRIBUTION

We are registering the Warrants and Warrant

Shares to permit the resale of the Warrants and Warrant Shares by the selling securityholder from time to time after the date of

this prospectus. We will not receive any of the proceeds from the sale by the selling securityholder of the Warrants or Warrant

Shares. We will bear all fees and expenses incident to our obligation to register the Warrants and Warrant Shares.

The selling securityholder and any of its

pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their Warrant Shares covered hereby on

the Nasdaq Global Select Market or any other stock exchange, market or trading facility on which the shares are traded or in private

transactions. These sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined

at the time of sale, or at negotiated prices. The selling securityholder may use any one or more of the following methods when

selling the Warrants or Warrant Shares:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the

block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

settlement of short sales entered into after the effective date of the registration statement, of which this prospectus is

a part;

|

|

|

·

|

in transactions through broker-dealers that agree with the selling securityholder to sell a specified number of such shares

at a stipulated price per share;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

·

|

gifts to charitable organizations, who may in turn sell such shares in accordance with the methods described herein;

|

|

|

·

|

a combination of any such methods of sale; or

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling securityholder may also sell

shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling securityholder

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

securityholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated,

but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary

brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in

compliance with FINRA IM-2440-1.

In connection with the sale of the Warrants

or Warrant Shares, the selling securityholder may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling securityholder

may also sell shares of the common stock short and deliver these securities to close out its short positions or to return borrowed

shares in connection with such short sales, or loan or pledge the common stock to broker-dealers that in turn may sell these securities.

The selling securityholder may also enter into option or other transactions with broker-dealers or other financial institutions

or create one or more derivative securities, which require the delivery to such broker-dealer or other financial institution of

Warrants and Warrant Shares offered by this prospectus, which Warrants and Warrant Shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling securityholder and any broker-dealers

or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the

resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay certain fees and

expenses incurred by us incident to the registration of the Warrants and Warrant Shares. We have agreed to indemnify the selling

securityholder against certain losses, claims, damages, actions, liabilities, costs and expenses, including liabilities under the

Securities Act, and the selling securityholder may be entitled to contribution.

The selling securityholder will be subject

to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder unless an exemption therefrom

is available.

To our knowledge, there are currently no

plans, arrangements or understandings between the selling securityholder and any underwriter, broker-dealer or agent regarding

the sale by the selling securityholder of the offered securities.

We have agreed to use reasonable best efforts

to keep the registration statement of which this prospectus is a part continuously effective and in compliance with the Securities

Act until, subject to certain exceptions, the Warrants and the Warrant Shares: (i) have been sold pursuant to an effective

registration statement; (ii) are able to be sold pursuant to Rule 144 of the Securities Act without limitation on volume

or manner of sale; (iii) cease to be outstanding; or (iv) have been sold in a private transaction in which the transferor’s

rights under the Warrant Agreement are not assigned to the transferee of the securities.

Under applicable rules and regulations

under the Exchange Act, any person engaged in the distribution of the resale shares may not simultaneously engage in market making

activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling securityholder will be subject to applicable provisions of the Exchange Act and the

rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the

common stock by the selling securityholder or any other person. We will make copies of this prospectus available to the selling

securityholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time

of the sale (including by compliance with Rule 172 under the Securities Act).

There can be no assurance that the selling

securityholder will sell any or all of the Warrants or Warrant Shares registered pursuant to the registration statement of which

this prospectus forms a part.

Once sold under the registration statement

of which this prospectus forms a part, the Warrant Shares will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

Latham &

Watkins LLP, San Diego, California, will pass upon certain legal matters relating to the securities offered hereby on behalf of

the Company. The validity of the securities will be passed upon by Parr Brown Gee & Loveless, Salt Lake City, Utah.

EXPERTS

The consolidated financial

statements of SkyWest, Inc. and its subsidiaries appearing in SkyWest, Inc.’s Annual Report (Form 10-K) for

the year ended December 31, 2019 (including the schedule appearing therein), and the effectiveness of SkyWest, Inc.’s

internal control over financial reporting as of December 31, 2019 have been audited by Ernst & Young LLP, independent

registered public accounting firm, as set forth in their reports thereon, included therein, and incorporated herein by reference.

Such consolidated financial statements and schedule and SkyWest, Inc.’s management’s assessment of the effectiveness

of internal control over financial reporting as of December 31, 2019 are incorporated herein by reference in reliance upon

such reports given on the authority of such firm as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

Item 14.

|

Other Expenses of Issuance and Distribution

|

The following is an

estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being

registered hereby.

|

SEC registration fee

|

|

$

|

2,738

|

|

|

Printing expenses

|

|

$

|

5,000

|

(1)

|

|

Legal fees and expenses

|

|

$

|

25,000

|

(1)

|

|

Accounting fees and expenses

|

|

$

|

10,000

|

(1)

|

|

Total

|

|

$

|

42,738

|

(1)

|

|

|

(1)

|

Estimated. Actual amounts to be determined from time to time.

|

|

|

Item 15.

|

Indemnification of Directors and Officers

|

The Registrant is a Utah corporation. Section 16-10a-902

of the Utah Revised Business Corporation Act (the “Revised Act”) provides that a corporation may indemnify any individual

who was made a party (a “Party”) to a proceeding (a “Proceeding”), because he or she is or was a director

of the corporation (an “Indemnifiable Director”), against liability incurred in the Proceeding, if his or her conduct

was in good faith and he or she reasonably believed that his or her conduct was in, or not opposed to, the best interests of the

corporation, and, in the case of any criminal Proceeding, he or she had no reasonable cause to believe such conduct was unlawful;

provided, however, that pursuant to Subsection 902(4): (i) the corporation may not indemnify an Indemnifiable Director

in connection with a Proceeding by or in the right of the corporation in which the Indemnifiable Director was adjudged liable to

the corporation, or in connection with any other Proceeding charging that the Indemnifiable Director derived an improper personal

benefit, whether or not involving action in his or her official capacity, in which Proceeding he or she was adjudged liable on

the basis that he or she derived an improper personal benefit; and, provided, further, however, that pursuant to Subsection 902(5) indemnification

under Section 902 in connection with a Proceeding by or in the right of the corporation is limited to payment of reasonable

expenses incurred in connection with the Proceeding.

Section 16-10a-903 of the Revised Act

provides that, unless limited by its articles of incorporation, a corporation shall indemnify an Indemnifiable Director who was

successful, on the merits or otherwise, in the defense of any Proceeding, or in the defense of any claim, issue or matter in the

Proceeding, to which he or she was a Party because he or she is or was an Indemnifiable Director of the corporation, against reasonable

expenses incurred in connection with the Proceeding or claim with respect to which he or she has been successful.

In addition to the indemnification provided

by Sections 902 and 903, Section 16-10a-905 of the Revised Act provides that, unless otherwise limited by a corporation’s

articles of incorporation, an Indemnifiable Director may apply for indemnification to the court conducting the Proceeding or to

another court of competent jurisdiction.

Section 16-10a-904 of the Revised Act

provides that a corporation may pay for or reimburse the reasonable expenses (including attorneys’ fees) incurred by an Indemnifiable

Director who is a Party to a Proceeding in advance of the final disposition of the Proceeding, upon the satisfaction of certain

conditions.

Section 16-10a-907 of the Revised Act

provides that, unless a corporation’s articles of incorporation provide otherwise, (i) an officer of the corporation

is entitled to mandatory indemnification under Section 903 and is entitled to apply for court-ordered indemnification under

Section 905, in each case to the same extent as an Indemnifiable Director, (ii) the corporation may indemnify and advance

expenses to an officer, employee, fiduciary or agent of the corporation to the same extent as an Indemnifiable Director, and (iii) a

corporation may also indemnify and advance expenses to an officer, employee, fiduciary or agent who is not an Indemnifiable Director

to a greater extent than the right of indemnification granted to an Indemnifiable Director, if not inconsistent with public policy,

and if provided for by its articles of incorporation, bylaws, general or specific action of its board of directors, or contract.

The Registrant’s Amended and Restated

Bylaws (the “Bylaws”) provide that, subject to the limitations described below, the Registrant shall, to the maximum

extent and in the manner permitted by the Revised Act, indemnify any individual made party to a proceeding because he or she is

or was one of its directors or officers against liability incurred in the proceeding if his or her conduct was in good faith, he

or she reasonably believed that his or her conduct was in, or not opposed to, the Registrant’s best interests and, in the

case of any criminal proceeding, he or she had no reasonable cause to believe such conduct was unlawful. The Registrant may not,

however, extend such indemnification to an officer or director in connection with a proceeding by the Registrant or in its right

in which such officer or director was adjudged liable to the Registrant, or in connection with any other proceeding charging that

such person derived an improper personal benefit, whether or not involving action in his or her official capacity, in which proceeding

he or she was adjudged liable on the basis that he or she derived an improper personal benefit, unless the indemnification is ordered

by a court of competent jurisdiction. Notwithstanding the foregoing, the Bylaws obligate the Registrant to indemnify an officer

or director who was successful on the merits or otherwise, in the defense of any proceeding or the defense of any claim, issue

or matter in the proceeding to which the officer or director was a party because he or she is or was one of the Registrant’s

directors or officers against reasonable expenses that he or she incurred in connection with the proceeding or claim with respect

to which he or she was successful. The Bylaws also permit the Registrant to pay for or reimburse the reasonable expenses incurred

by an officer or director who is party to a proceeding in advance of final disposition of the proceeding if (i) the officer

or director furnishes to the Registrant a written affirmation of a good faith belief that he or she has met the applicable standard

of conduct necessary for indemnification, (ii) the officer or director furnishes to the Registrant a written undertaking to

repay the advance if it is ultimately determined that he or she did not meet the standard of conduct, and (iii) a determination

is made that the facts then known to those making the determination would not preclude indemnification pursuant to the Bylaws.

The Bylaws also provide that any indemnification or advancement of expenses provided thereby shall not be deemed exclusive of any

other rights to which those seeking indemnification or advancement of expenses may be entitled under any articles of incorporation,

bylaw, agreement, vote of shareholders or disinterested directors, or otherwise, both as to action in such person’s official

capacity and as to action in another capacity while holding such office.

Utah law permits director liability to be

eliminated in accordance with Section 16-10a-841 of the Revised Act, which provides that the liability of a director to the

corporation or its shareholders for monetary damages for any action taken or any failure to take any action, as a director, may

be limited or eliminated by the corporation except for liability for (i) the amount of financial benefit received by a director

to which he or she is not entitled; (ii) an intentional infliction of harm on the corporation or its shareholders; (iii) a

violation of Section 16-10a-842 of the Revised Act, which prohibits unlawful distributions by a corporation to its shareholders;

or (iv) an intentional violation of criminal law. Such a provision may appear either in a corporation’s articles of

incorporation or bylaws; however, to be effective, such a provision must be approved by the corporation’s shareholders.

The Restated Articles of Incorporation of

the Registrant provide that the personal liability of any director to the Registrant or to its shareholders for monetary damages

for any action taken or the failure to take any action, as a director, is eliminated to the fullest extent permitted by Utah law.

The Bylaws provide that the Registrant may

purchase and maintain insurance on behalf of any person who is or was one of the Registrant’s directors, officers, employees,

fiduciaries or agents, or is or was serving at its request as a director, officer, employee, fiduciary or agent of another corporation,

partnership, joint venture, trust or other enterprise against any liability asserted against him or her or incurred by him or her

in such capacity or arising out of his or her status in such capacity, whether or not the Registrant would have the power to indemnify

him or her against such liability under the indemnification provisions of the Bylaws or the laws of the State of Utah, as the same

are amended or modified. The Registrant maintains insurance from commercial carriers against certain liabilities that may be incurred

by its directors and officers.

The Registrant entered into an indemnification agreement (each,

an “Indemnification Agreement”) with each of its directors and executive officers and the President and Chief Operating

Officer of SkyWest Airlines. On the terms and subject to the conditions set forth therein, each Indemnification Agreement

provides, among other things, that the indemnified person shall have a contractual right (i) to indemnification to the fullest

extent permitted by the Revised Act for losses suffered or expenses incurred in connection with the investigation, defense, settlement

or appeal of any threatened, pending or completed litigation or other proceeding by reason of the fact that the indemnified person

is or was claimed to be an agent of the Registrant or any of its subsidiaries or for other reasons relating to the that person’s

service as an agent of the Registrant or any of its subsidiaries; (ii) to advancement of expenses paid or incurred in connection

with such litigation or other proceeding, (iii) to coverage under the Registrant’s directors’ and officers’

insurance policies, to the extent that the Registrant maintains such insurance policies, in reasonable amounts as its Board of

Directors shall determine from time to time.

Exhibit

Number

|

|

Description

|

|

|

|

|

3.1

|

|

Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s

Registration Statement on Form S-3 (File No. 333-129831) filed on November 18, 2005).

|

|

|

|

|

3.2

|

|

Amended and Restated Bylaws (incorporated by reference to Exhibit 3.2 of the Registrant’s

Annual Report on Form 10-K filed on February 24, 2012).

|

|

|

|

|

4.1

|

|

Specimen of Common Stock Certificate (incorporated by reference to Exhibit 4.1 the Registrant’s

Registration Statement on Form S- 3 (File No. 333-42508) filed on July 28, 2000).

|

|

|

|

|

|

4.2

|

|

Warrant Agreement, dated as of April 23, 2020, by and between SkyWest, Inc. and

the United States Department of the Treasury (incorporated by reference to Exhibit 4.1 of the Registrant’s Quarterly

Report on Form 10-Q filed on August 7, 2020).

|

|

|

|

|

4.3

|

|

Form of Warrant (incorporated by reference to Annex B of Exhibit 4.1 of the Registrant’s

Quarterly Report on Form 10-Q filed on August 7, 2020).

|

|

|

|

|

|

5.1

|

|

Opinion of Parr Brown Gee & Loveless.

|

|

|

|

|

23.1

|

|

Consent of Parr Brown Gee & Loveless (included in Exhibit 5.1).

|

|

|

|

|

23.2

|

|

Consent of Ernst & Young LLP, independent registered public accounting firm.

|

|

|

|

|

24.1

|

|

Powers of Attorney (incorporated by reference to the signature page of the Registration

Statement on Form S-3 filed on August 12, 2020).

|

(a) The undersigned

registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price

set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) To

include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided, however,

that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant

pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration

statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement

as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in

reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose

of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included

in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date

of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability

purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date

of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document

incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration

statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement

that was made in the registration statement or prospectus that was part of the registration statement or made in any such document

immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities:

The undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement,

regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such

purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to

by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant

or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any

other communications that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned

registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the

registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act

of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of

the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed