WHERE

YOU CAN FIND MORE INFORMATION

We

have filed a registration statement on Form S-1 with the SEC under the Securities Act of 1933, as amended. This prospectus is part of

the registration statement, but the registration statement includes additional information and exhibits. We file annual, quarterly and

current reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information

statements and other information regarding companies, such as ours, that file documents electronically with the SEC. The website address

is www.sec.gov. The information on the SEC’s website is not part of this prospectus, and any references to this website or any

other website are inactive textual references only.

QUESTIONS

AND ANSWERS RELATING TO THE RIGHTS OFFERING

The

following are examples of what we anticipate will be common questions about this Rights Offering. The answers are based on selected information

included elsewhere in this prospectus. The following questions and answers do not contain all of the information that may be important

to you and may not address all of the questions that you may have about the Rights Offering. This prospectus and the documents incorporated

by reference into this prospectus contain more detailed descriptions of the terms and conditions of the Rights Offering and provides

additional information about us and our business, including potential risks related to the Rights Offering, the Units offered hereby,

and our business. We urge you to read this entire prospectus and the documents incorporated by reference into this prospectus.

Why

are we conducting the Rights Offering?

We

are conducting the Rights Offering to raise additional capital for general corporate purposes and to fund ongoing operations and expansion

of our business.

What

is a Unit?

Each Unit consists of one share of Series D Convertible

Preferred Stock and, based on the Estimated Conversion Price, 5,426 warrants to purchase common stock, at a subscription price

of $1,000 per Unit. No fractional Units will be issued. Each share of Preferred Stock will have a stated value of $1,000 and will be

convertible into shares of our common stock at a conversion price equal to the Conversion Price determined on the expiration date. Each

Class A Warrant entitles you to purchase one share of common stock at a per share exercise price equal to the Conversion Price,

from the date of issuance through its expiration five years after the date of issuance. Each Class B Warrant entitles you to purchase

one share of common stock at a per share exercise price equal to the Conversion Price, from the date of issuance through its expiration

three years after the date of issuance. The Preferred Stock do not generally have any voting rights and will not be certificated.

The shares of Preferred Stock and warrants that comprise each Unit are immediately separable and will be issued separately in this Rights

Offering, however, they may only be purchased as a Unit, and the Units will not trade as a separate security.

What

is the Rights Offering?

We

are distributing, at no charge, to holders of our common stock, Series B Preferred Stock, Series C Preferred Stock and holders of the

Participating Warrants, as of the Record Date, non-transferable Subscription Rights to purchase Units at a price of $1,000 per Unit.

The Subscription Rights will not be tradable. Each Unit consists of one share of our Preferred Stock and, based on the Estimated Conversion

Price, 5,426 Warrants. See “Are there risks in exercising my Subscription Rights?” below. Each Warrant will be exercisable

for one share of our common stock. Upon expiration of the Rights Offering, the Preferred Stock and Warrants comprising the Units will

immediately separate and will be issued separately but may only be purchased as a Unit, and the Units will not trade as a separate security.

There is no public trading market for the Preferred Stock or the Warrants and they will not be listed for trading on Nasdaq or any other

securities exchange or market. The common stock to be issued upon conversion of the Preferred Stock or exercise of the Warrants, like

our existing shares of common stock, will be traded on the NASDAQ Capital Market under the symbol “SINT.” You will receive

one Subscription Right for every share of common stock (including each share of common stock issuable upon conversion of Series B Preferred

Stock, Series C Preferred Stock and exercise of Participating Warrants) that you owned as of 5:00 p.m., Eastern Time, on the Record Date.

Each Subscription Right entitles the record holder to a Basic Subscription Right and an Over-Subscription Privilege. The Subscription

Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on October 12, 2022, unless we extend or earlier terminate

the Rights Offering.

What

are the Basic Subscription Rights?

For every share you owned (including each share of

common stock issuable upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants) as

of the Record Date, you will receive one Basic Subscription Right, which gives you the opportunity to purchase one Unit, consisting of

one share of our Preferred Stock and, based on the Estimated Conversion Price, 5,426 Warrants, for a price of $1,000 per Unit.

For example, if you owned 100 shares of common stock as of the Record Date, you will receive 100 Subscription Rights and will have the

right to purchase 100 shares of our Preferred Stock and, based on the Estimated Conversion Price, Warrants to purchase 542,600

shares of our common stock for $1,000 per Unit (or a total payment of $100,000). You may exercise all or a portion of your Basic Subscription

Rights or you may choose not to exercise any Basic Subscription Rights at all.

If

you are a record holder of our common stock, Series B Preferred Stock, Series C Preferred Stock or Participating Warrants, the number

of shares you may purchase pursuant to your Basic Subscription Rights is indicated on the enclosed Rights Certificate. If you hold your

common shares, Series B Preferred Stock, Series C Preferred Stock or Participating Warrants in the name of a broker, dealer, bank or

other nominee who uses the services of the Depository Trust Company, or DTC, you will not receive a Rights Certificate. Instead, DTC

will issue one Subscription Right to your nominee record holder for each share of our common stock (including each share of common stock

issuable upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants) that you beneficially

own as of the Record Date. If you are not contacted by your nominee, you should contact your nominee as soon as possible.

What

is the Over-Subscription Privilege?

If

you exercise your Basic Subscription Rights in full, you may also choose to exercise your Over-Subscription Privilege to purchase a portion

of any Units that are not purchased by other holders of common stock, Series B Preferred Stock, Series C Preferred Stock or Participating

Warrant holders and remain available under the Rights Offering. You should indicate on your Rights Certificate, or the form provided

by your nominee if your shares are held in the name of a nominee, how many additional Units you would like to purchase pursuant to your

Over-Subscription Privilege, which we refer to as your Over-Subscription Request.

Subject

to stock ownership limitations, if enough Units are available, we will seek to honor your Over-Subscription Request in full. If Over-

Subscription Requests exceed the number of Units available, however, we will allocate the available Units pro-rata among the stockholders

and warrant holders exercising the Over-Subscription Privilege in proportion to the number of shares of our common stock (including each

share of common stock issuable upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants)

each of those stockholders and warrant holders owned on the Record Date, relative to the number of shares (including each share of common

stock issuable upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants) owned on

the Record Date by all record holders exercising the Over-Subscription Privilege. If this pro-rata allocation results in any stockholders

or warrant holders receiving a greater number of Units than the stockholder or warrant holders subscribed for pursuant to the exercise

of the Over-Subscription Privilege, then such stockholder or warrant holder will be allocated only that number of Units for which the

stockholder or warrant holder oversubscribed, and the remaining Units will be allocated among all other stockholders and warrant holders

exercising the Over-Subscription Privilege on the same pro rata basis described above. The proration process will be repeated until all

Units have been allocated. See “The Rights Offering- Limitation on the Purchase of Units” for a description of certain stock

ownership limitations.

To

properly exercise your Over-Subscription Privilege, you must deliver to the Subscription Agent the subscription payment related to your

Over- Subscription Privilege before the Rights Offering expires. Because we will not know the total number of unsubscribed Units before

the expiration of the Rights Offering, if you wish to maximize the number of Units you purchase pursuant to your over-subscription privilege,

you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of Units available, assuming

that no common, Series B or Series C stockholder or warrant holders other than you has purchased any Units pursuant to such stockholder’s

or warrant holder’s basic subscription right and over-subscription privilege. See “The Rights Offering- The Subscription

Rights-Over-Subscription Privilege.” To the extent you properly exercise your Over-Subscription Privilege for a number of

Units that exceeds the number of unsubscribed Units available to you, any excess subscription payments will be returned to you within

10 business days after the expiration of the Rights Offering, without interest or deduction.

American

Stock Transfer & Trust Company, LLC, our Subscription Agent for the Rights Offering, will determine the allocation of Over-Subscription

Requests based on the formula described above.

May

the Subscription Rights that I exercise be reduced for any reason?

Yes. While we are distributing to holders of our

common stock, Series B Preferred Stock, Series C Preferred Stock, and holders of the Participating Warrants, one Subscription Right for

every share of common stock (including each share of common stock issuable upon conversion of Series B Preferred Stock, Series C Preferred

Stock and exercise of Participating Warrants) owned on the Record Date, we are only seeking to raise $10 million in gross proceeds in

this Rights Offering. As a result, based on 24,727,789 shares of common stock outstanding as of August 31, 2022, 19,306

shares of common stock issuable upon conversion of 26 shares of Series B Preferred Stock, 33,753 shares of common stock issuable

upon conversion of 50 shares of Series C Preferred Stock and 1,115,729 shares of common stock issuable upon exercise of

Participating Warrants, we would grant Subscription Rights to acquire 25,896,283 Units but will only accept subscriptions for

10,000 Units. Accordingly, enough Units may not be available to honor your subscription in full. If exercises of Basic Subscription Rights

exceed the number of Units available in the Rights Offering, we will allocate the available Units pro-rata among the record holders exercising

the Basic Subscription Rights in proportion to the number of shares of our common stock (including each share of common stock issuable

upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants) each of those record holders

owned on the Record Date, relative to the number of shares owned on the Record Date by all record holders exercising the Basic Subscription

Right. If this pro-rata allocation results in any record holders receiving a greater number of Units than the record holder subscribed

for pursuant to the exercise of the Basic Subscription Rights, then such record holder will be allocated only that number of Units for

which the record holder subscribed, and the remaining Units will be allocated among all other record holders exercising their Basic Subscription

Rights on the same pro rata basis described above. The proration process will be repeated until all Units have been allocated. Please

also see the discussion under “The Rights Offering-The Subscription Rights-Over-Subscription Privilege” and “The Rights

Offering-Limitation on the Purchase of Units” for a description potential proration as to the Over-Subscription Privilege and certain

stock ownership limitations.

If

for any reason the number of Units allocated to you is less than you have subscribed for, then the excess funds held by the Subscription

Agent on your behalf will be returned to you, without interest, as soon as practicable after the Rights Offering has expired and all

prorating calculations and reductions contemplated by the terms of the Rights Offering have been effected, and we will have no further

obligations to you.

What

are the terms of the Series D Convertible Preferred Stock?

Each

share of Preferred Stock will be convertible at the option of the holder at any time, into the number of shares of our common stock determined

by dividing the $1,000 stated value per share of the Preferred Stock by a conversion price equal to the Conversion Price determined

on the expiration date. The Preferred Stock has certain conversion rights and dividend rights as described in more detail herein.

What

are the terms of the Warrants?

Each Class A Warrant entitles the holder to

purchase one share of our common stock at a per share exercise price equal to the Conversion Price from the date of issuance through

its expiration five years from the date of issuance. Each Class B Warrant entitles the holder to purchase one share of our common

stock at a per share exercise price equal to the Conversion Price from the date of issuance through its expiration three years from the

date of issuance. The Warrants will be exercisable for cash, or, solely during any period when a registration statement for the exercise

of the Warrants is not in effect, on a cashless basis.

Are

the Preferred Stock or Warrants listed?

There

is no public trading market for the Preferred Stock or Warrants and they will not be listed for trading on Nasdaq or any other securities

exchange or market. The Warrants will be issued in registered form under a warrant agent agreement with American Stock Transfer &

Trust Company, LLC, as warrant agent.

Will

fractional shares be issued upon exercise of Subscription Rights, the conversion of Preferred Stock, or the exercise of Warrants?

No.

We will not issue fractional shares of common stock in the Rights Offering. We will only distribute Subscription Rights to acquire whole

Units, rounded down to the nearest whole number of underlying common shares giving rise to such Subscription Rights. Any excess subscription

payments received by the Subscription Agent will be returned within 10 business days after expiration of the Rights Offering, without

interest or deduction.

Additionally,

no fractional shares of common stock will be issued as a result of the conversion of shares of Preferred Stock or the exercise of Warrants.

Instead, for any such fractional share that would otherwise have been issuable upon conversion of shares of Preferred Stock, we may,

at our election, pay a cash payment equal to such fraction multiplied by the conversion price or round up to the next whole share, and

for any such fractional share that would have otherwise been issued upon exercise of Warrants, we will round up such fraction to the

next whole share.

What

effect will the Rights Offering have on our outstanding common stock?

Assuming no other transactions by us involving our

capital stock prior to the expiration of the Rights Offering, and if the Rights Offering is fully subscribed, upon consummation of the

Rights Offering we will have, based on shares of common stock outstanding as of August 31, 2022, 24,727,789 shares of common stock

issued and outstanding, 26 shares of Series B Preferred Stock issued and outstanding convertible into an aggregate of 19,306 shares

of our common stock, 50 shares of Series C Preferred Stock issued and outstanding convertible into an aggregate of 33,753 shares of our

common stock, and 10,000 shares of Preferred Stock issued and outstanding convertible into an aggregate of 27,130,000 shares of

our common stock, based on the Estimated Conversion Price, and Warrants to purchase an additional 54,260,000 shares of our common

stock, based on the Estimated Conversion Price, issued and outstanding. The exact number of shares of Preferred Stock and Warrants that

we will issue in this offering will depend on the number of Units that are subscribed for in the Rights Offering. In addition, because

the Conversion Price will be determined on the expiration date, the actual number of shares of common stock underlying the Preferred

Stock and Warrants will not be known until the expiration date.

How

was the Subscription Price determined?

In

determining the Subscription Price, the directors considered, among other things, the following factors:

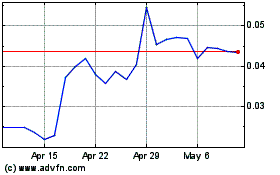

| |

● |

the

current and historical trading prices of our common stock; |

| |

|

|

| |

● |

the

price at which stockholders might be willing to participate in the Rights Offering; |

| |

|

|

| |

● |

the

value of the common stock issuable upon conversion of the Preferred Stock being issued as a component of the Unit; |

| |

|

|

| |

● |

the

value of the Warrant being issued as a component of the Unit; |

| |

|

|

| |

● |

our

need for additional capital and liquidity; |

| |

|

|

| |

● |

the

cost of capital from other sources; and |

| |

|

|

| |

● |

comparable

precedent transactions, including the percentage of shares offered, the terms of the subscription rights being offered, the subscription

price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings. |

In

conjunction with the review of these factors, the board of directors also reviewed our history and prospects, including our past and

present earnings and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition.

The board of directors also believed that the Subscription Price should be designed to provide an incentive to our current stockholders

to participate in the Rights Offering and exercise their Basic Subscription Right and their Over-Subscription Privilege.

The

Subscription Price does not necessarily bear any relationship to any established criteria for value. You should not consider the Subscription

Price as an indication of actual value of our company or our common stock. The market price of our common stock may decline during or

after the Rights Offering. You should obtain a current price quote for our common stock and perform an independent assessment of our

Preferred Stock and Warrants before exercising your Subscription Rights and make your own assessment of our business and financial condition,

our prospects for the future, the terms of the Rights Offering, the information in this prospectus and the other considerations relevant

to your circumstances. Once made, all exercises of Subscription Rights are irrevocable. In addition, there is no established trading

market for the Preferred Stock or the Warrants to be issued pursuant to this offering, and the Preferred Stock and the Warrants may not

be widely distributed.

Am

I required to exercise all the Basic Subscription Rights I receive in the Rights Offering?

No.

You may exercise any number of your Basic Subscription Rights, or you may choose not to exercise any Basic Subscription Rights. If you

do not exercise any Basic Subscription Rights, the number of shares of our common stock you own (including each share of common stock

issuable upon conversion of Series B Preferred Stock, Series C Preferred Stock and exercise of Participating Warrants) will not change.

However, if you choose to not exercise your Basic Subscription Rights in full and other holders of Subscription Rights do exercise, your

proportionate ownership interest in our company will decrease. If you do not exercise your Basic Subscription Rights in full, you will

not be entitled to exercise your Over-Subscription Privilege.

How

soon must I act to exercise my Subscription Rights?

If

you received a Rights Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your

completed and signed Rights Certificate and payment for both your Basic Subscription Rights and any Over-Subscription Privilege you elect

to exercise before the Rights Offering expires on October 12, 2022, at 5:00 p.m., Eastern Time, unless we extend or earlier terminate

the Rights Offering. If you hold your common shares, Series B Preferred Stock, Series C Preferred Stock, or Participating Warrants in

the name of a broker, dealer, bank or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering

by which you must provide it with your instructions to exercise your Subscription Rights, along with the required subscription payment.

May

I transfer my Subscription Rights?

No.

The Subscription Rights may be exercised only by the common, Series B Preferred and Series C Preferred stockholders and Participating

Warrant holders to whom they are distributed, and they may not be sold, transferred, assigned or given away to anyone else, other than

by operation of law. As a result, Rights Certificates may be completed only by the stockholder or warrant holder who receives the certificate.

We do not intend to apply for the listing of the Subscription Rights on any securities exchange or recognized trading market.

Will

our directors and executive officers participate in the Rights Offering?

To

the extent they hold common stock, Series B Preferred Stock, Series C Preferred Stock, or Participating Warrants as of the Record Date,

our directors and executive officers will be entitled to participate in the Rights Offering on the same terms and conditions applicable

to other Rights holders.

Are

we requiring a minimum subscription to complete the Rights Offering?

There

is no aggregate minimum we must receive to complete the Rights Offering.

Has

the board of directors made a recommendation to stockholders regarding the Rights Offering?

No.

Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. Rights holders who exercise Subscription

Rights will incur investment risk on new money invested. We cannot predict the price at which our shares of common stock will trade after

the Rights Offering. On September 21, 2022, the last reported sale price of our common stock on Nasdaq was $0.4005 per

share. You should make your decision based on your assessment of our business and financial condition, our prospects for the future,

the terms of the Rights Offering, the information contained in this prospectus and other considerations relevant to your circumstances.

See “Risk Factors” for discussion of some of the risks involved in investing in our securities.

How

do I exercise my Subscription Rights?

If

you are a common or Series B Preferred or Series C Preferred stockholder or Participating Warrant holder of record (meaning you hold

your shares of our common stock, Series B Preferred Stock, Series C Preferred Stock, or Participating Warrants in your name and not through

a broker, dealer, bank or other nominee) and you wish to participate in the Rights Offering, you must deliver a properly completed and

signed Rights Certificate, together with payment of the Subscription Price for both your Basic Subscription Rights and any Over-Subscription

Privilege you elect to exercise, to the Subscription Agent before 5:00 p.m., Eastern Time, on October 12, 2022. If you are exercising

your Subscription Rights through your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or

other nominee and submit your subscription documents and payment for the Units subscribed for in accordance with the instructions and

within the time period provided by your broker, dealer, bank or other nominee.

What

if my shares are held in “street name”?

If

you hold your shares of our common stock, Series B Preferred Stock, Series C Preferred Stock, or Participating Warrants in the name of

a broker, dealer, bank or other nominee, then your broker, dealer, bank or other nominee is the record holder of the shares you beneficially

own. The record holder must exercise the Subscription Rights on your behalf. Therefore, you will need to have your record holder act

for you.

If

you wish to participate in this Rights Offering and purchase Units, please promptly contact the record holder of your shares or Participating

Warrants. We will ask the record holder of your shares or Participating Warrants, who may be your broker, dealer, bank or other nominee,

to notify you of this Rights Offering.

What

form of payment is required?

You

must timely pay the full Subscription Price for the full number of Units you wish to acquire pursuant to the exercise of Subscription

Rights by delivering to the Subscription Agent a:

| |

● |

personal

check drawn on a U.S. bank; |

| |

|

|

| |

● |

certified

check drawn on a U.S. bank; |

| |

|

|

| |

● |

U.S.

Postal money order; or |

| |

|

|

| |

● |

wire

transfer. |

If

you send payment by personal uncertified check, payment will not be deemed to have been delivered to the Subscription Agent until the

check has cleared. As such, any payments made by personal check should be delivered to the Subscription Agent no fewer than three business

days prior to the expiration date.

If

you send a payment that is insufficient to purchase the number of Units you requested, or if the number of Units you requested is not

specified in the forms, the payment received will be applied to exercise your Subscription Rights to the fullest extent possible based

on the amount of the payment received.

Will

I receive interest on any funds I deposit with the Subscription Agent?

No.

You will not be entitled to any interest on any funds that are deposited with the Subscription Agent pending completion or cancellation

of the Rights Offering. If the Rights Offering is cancelled for any reason, the Subscription Agent will return this money to subscribers,

without interest or penalty, as soon as practicable.

When

will I receive my new shares of Preferred Stock and Warrants?

As

soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions

and for the Subscription Agent to arrange for the issuance of the shares of Preferred Stock and Warrants purchased in the Rights Offering.

At closing, all prorating calculations and reductions contemplated by the terms of the Rights Offering will have been effected and payment

to us for the subscribed-for Units will have cleared. All shares and Warrants that you purchase in the Rights Offering will be issued

in book-entry, or uncertificated, form meaning that you will receive a direct registration, or DRS, account statement from our transfer

agent reflecting ownership of these securities if you are a holder of record. If you hold your common, Series B Preferred or Series C

Preferred Stock or Participating Warrants in the name of a broker, dealer, bank or other nominee, DTC will credit your account with your

nominee with the securities you purchase in the Rights Offering. American Stock Transfer & Trust Company, LLC, is acting as the warrant

agent in this offering.

After

I send in my payment and Rights Certificate to the Subscription Agent, may I cancel my exercise of Subscription Rights?

No.

Exercises of Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise

of your Subscription Rights. You should not exercise your Subscription Rights unless you are certain that you wish to purchase Units

at the Subscription Price.

How

much will our company receive from the Rights Offering?

Assuming that all Units are sold in the Rights Offering,

we estimate that the net proceeds from the Rights Offering will be approximately $9.2 million, based on the Subscription Price of $1,000

per Unit, after deducting fees and expenses payable to the dealer-manager, before deducting other estimated expenses payable by us and

excluding any proceeds received upon exercise of any Warrants. If all Warrants included in the Units are exercised for cash at the Estimated

Conversion Price of $0.36864 per share, we will receive an additional approximately $20 million. We intend to use the net

proceeds for general corporate purposes and to fund ongoing operations and expansion of our business. See “Use of Proceeds.”

Are

there risks in exercising my Subscription Rights?

Yes.

The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of shares of our Preferred

Stock and Warrants to purchase common stock and you should consider this investment as carefully as you would consider any other investment.

In addition, our Preferred Stock and Warrants will not be listed on Nasdaq and a market for the Preferred Stock and Warrants does not

exist. See “Risk Factors” for discussion of additional risks involved in investing in our securities.

Can

the board of directors terminate, extend or amend the Rights Offering?

Yes.

Our board of directors may decide to terminate the Rights Offering at any time and for any reason before the expiration of the Rights

Offering. We also have the right to extend the Rights Offering for additional periods in our sole discretion for up to an additional

45 days. We do not presently intend to extend the Rights Offering. We will notify stockholders and the public if the Rights Offering

is terminated or extended by issuing a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business

day after the most recently announced expiration date of the Rights Offering. In the event that we decide to extend the Rights Offering

and you have already exercised your Subscription Rights, your subscription payment will remain with the Subscription Agent until such

time as the Rights Offering closes or is terminated.

Our

board of directors also reserves the right to amend or modify the terms of the Rights Offering in its sole discretion. If we should make

any fundamental changes to the terms of the Rights Offering set forth in this prospectus, we will file a post-effective amendment to

the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity

to cancel such subscriptions and issue a refund of any money advanced by such stockholder and recirculate an updated prospectus after

the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the Expiration Date of the

Rights Offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation.

Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and

the new expiration date. The terms of the Rights Offering cannot be modified or amended after the Expiration Date of the Rights Offering.

Although we do not presently intend to do so, we may choose to amend or modify the terms of the Rights Offering for any reason, including,

without limitation, in order to increase participation in the Rights Offering. Such amendments or modifications may include a change

in the subscription price, although no such change is presently contemplated. If we should make any fundamental changes to the terms

set forth in this prospectus, we will (i) file a post-effective amendment to the registration statement of which this prospectus forms

a part, (ii) offer potential purchasers who have subscribed for rights the opportunity to cancel such subscriptions, and (iii) issue

a refund of any money advanced by such stockholder or eligible warrant holder and recirculate an updated prospectus after the post-effective

amendment is declared effective with the SEC.

If

the Rights Offering is not completed or is terminated, will my subscription payment be refunded to me?

Yes.

The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If we do

not complete the Rights Offering, all subscription payments received by the Subscription Agent will be returned within 10 business days

after the termination or expiration of the Rights Offering, without interest or deduction. If you own shares in “street name,”

it may take longer for you to receive your subscription payment because the Subscription Agent will return payments through the record

holder of your shares. In addition, if we should make any fundamental changes to the terms set forth in this prospectus, we will (i)

file a post-effective amendment to the registration statement of which this prospectus forms a part, (ii) offer potential purchasers

who have subscribed for rights the opportunity to cancel such subscriptions, and (iii) issue a refund of any money advanced by such stockholder

or eligible warrant holder and recirculate an updated prospectus after the post-effective amendment is declared effective with the SEC.

How

do I exercise my Rights if I live outside the United States?

The

Subscription Agent will hold Rights Certificates for stockholders having addresses outside the United States. To exercise Subscription

Rights, foreign stockholders must notify the Subscription Agent and timely follow other procedures described in the section entitled

“The Rights Offering - Foreign Stockholders.”

What

fees or charges apply if I purchase shares in the Rights Offering?

We

are not charging any fee or sales commission to issue Subscription Rights to you or to issue shares of Preferred Stock or Warrants to

you if you exercise your Subscription Rights. If you exercise your Subscription Rights through a broker, dealer, bank or other nominee,

you are responsible for paying any fees your broker, dealer, bank or other nominee may charge you.

What

are the U.S. federal income tax consequences of receiving and/or exercising my Subscription Rights?

For

U.S. federal income tax purposes, we do not believe you should recognize income or loss in connection with the receipt or exercise of

Subscription Rights in the Rights Offering, but the receipt and exercise of the Subscription Rights is unclear in certain respects. You

should consult your own tax advisor as to your tax consequences resulting from the receipt and exercise of Subscription Rights, including

the receipt, ownership and disposition of our Preferred Stock, Warrants, and common stock received upon the conversion of Preferred Stock

or the exercise of Warrants. For further information, see “Material U.S. Federal Income Tax Consequences.”

To

whom should I send my forms and payment?

If

your shares of common stock, Series B Preferred stock, Series C Preferred stock, or Participating Warrants are held in the name of a

broker, dealer, bank or other nominee, then you should send your subscription documents and subscription payment to that broker, dealer,

bank or other nominee. If you are the record holder, then you should send your subscription documents, Rights Certificate, and subscription

payment to the Subscription Agent by hand delivery, first class mail or courier service to:

If

delivering by mail, hand or overnight courier:

American

Stock Transfer & Trust Company, LLC

Operations

Center

Attn:

Reorganization Department

6201

15th Avenue

Brooklyn,

New York 11219

You

or, if applicable, your nominee are solely responsible for completing delivery to the Subscription Agent of your subscription documents,

Rights Certificate and payment. You should allow sufficient time for delivery of your subscription materials to the Subscription Agent

and clearance of payment before the expiration of the Rights Offering at 5:00 p.m. Eastern Time on October 12, 2022.

Whom

should I contact if I have other questions?

If

you have other questions or need assistance, please contact the Information Agent: D.F. King & Co., Inc., toll free at (866) 620-2536,

by mail at D.F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005 or by email at sintx@dfking.com.

Who

is the dealer-manager?

Maxim

Group LLC is acting as the sole dealer-manager for the Rights Offering. Under the terms and subject to the conditions contained in the

dealer-manager agreement, the dealer-manager will use its best efforts to solicit the exercise of Subscription Rights. We have agreed

to pay the dealer-manager certain fees for acting as dealer-manager and to reimburse the dealer-manager for certain out-of-pocket expenses

incurred in connection with this offering. The dealer-manager is not underwriting or placing any of the Subscription Rights or the shares

of our Preferred Stock or Warrants being issued in the Rights Offering and is not making any recommendation with respect to such Subscription

Rights (including with respect to the exercise or expiration of such Subscription Rights), shares of Preferred Stock or Warrants.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision with respect to our securities, we urge you to

carefully consider the risks described in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended

December 31, 2021 and our subsequent Quarterly Reports on Form 10-Q, which are incorporated by reference into this prospectus. These

risk factors relate to our business, intellectual property, regulatory matters, and ownership of our common stock. In addition, the following

risk factors present material risks and uncertainties associated with the Rights Offering. The risks and uncertainties incorporated by

reference into this prospectus or described below are not the only ones we face. Additional risks and uncertainties not presently known

or which we consider immaterial as of the date hereof may also have an adverse effect on our business. If any of the matters discussed

in the following risk factors were to occur, our business, financial condition, results of operations, cash flows or prospects could

be materially adversely affected, the market price of our common stock could decline and you could lose all or part of your investment

in our securities.

Risks

Related to the Rights Offering

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds

and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of the net proceeds from this offering and could use them for purposes other than

those contemplated at the time of commencement of this offering. Accordingly, you will be relying on the judgment of our management regarding

the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds

are being used appropriately. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable,

or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business,

financial condition, operating results and cash flows.

Your

interest in our company may be diluted as a result of this Rights Offering.

Stockholders

and warrant holders who do not fully exercise their Subscription Rights should expect that they will, at the completion of this offering,

own a smaller proportional interest in our company on a fully-diluted basis than would otherwise be the case had they fully exercised

their Subscription Rights. Further, the shares issuable upon the exercise of the Warrants to be issued pursuant to the Rights Offering

will dilute the ownership interest of stockholders not participating in this offering or holders of Warrants who have not exercised them.

Further,

if you purchase Units in this offering at the Subscription Price, you may suffer immediate and substantial dilution in the net tangible

book value of our common stock. See “Dilution” in this prospectus for a more detailed discussion of the dilution which may

incur in connection with this offering.

Completion

of the Rights Offering is not subject to us raising a minimum offering amount.

Completion

of the Rights Offering is not subject to us raising a minimum offering amount and, therefore, proceeds may be insufficient to meet our

objectives, thereby increasing the risk to investors in this offering, including investing in a company that continues to require capital.

See “Use of Proceeds.”

This

Rights Offering may cause the trading price of our common stock to decrease.

The

Subscription Price, together with the number of shares of common stock issuable upon conversion of the Preferred Stock and Warrants we

propose to issue and ultimately will issue if this Rights Offering is completed, may result in an immediate decrease in the market price

of our common stock. This decrease may continue after the completion of this Rights Offering. If that occurs, you may have committed

to buy shares of our common stock at a price greater than the prevailing market price. We cannot predict the effect, if any, that the

availability of shares for future sale represented by the Warrants issued in connection with the Rights Offering will have on the market

price of our common stock from time to time. Further, if a substantial number of Subscription Rights are exercised and the holders of

the shares received upon exercise of those Subscription Rights or the related Warrants choose to sell some or all of the shares underlying

the Subscription Rights or the related Warrants, the resulting sales could depress the market price of our common stock.

Certain

of our outstanding shares of convertible preferred stock and warrants contain full-ratchet anti-dilution protection, which may cause

significant dilution to our stockholders.

As

of September 7, 2022, we had outstanding 24,727,789 shares of common stock. As of that date we had outstanding 26 shares of Series B

convertible preferred stock convertible into an aggregate of 19,306 shares of common stock and warrants issued in May 2018 that are exercisable

for an aggregate of 310,585 shares of common stock. The Series B convertible preferred stock and May 2018 warrants contain full-ratchet

anti-dilution provisions which, subject to limited exceptions, would reduce the conversion price of the Series B preferred stock (and

increase the number of shares issuable under the Series B preferred stock) and reduce the exercise price of the May 2018 warrants in

the event that we in the future issue common stock, or securities convertible into or exercisable to purchase common stock, at a price

per share lower than the conversion price or exercise price then in effect. Our outstanding 26 shares of Series B preferred stock are,

prior to this offering, convertible into 19,306 shares of Common Stock at a conversion price of $1.4814 per share. The May 2018

warrants currently are exercisable at an exercise price of $1.4814 per share. These full ratchet anti-dilution provisions will likely

be triggered by the issuance of the Preferred Stock and the Warrants in the Rights Offering.

Holders

of our Preferred Stock and Warrants will have no rights as a common stockholder until such holders convert or exercise their Preferred

Stock or Warrants, respectively, and acquire our common stock.

Until

holders of Preferred Stock or Warrants acquire shares of our common stock upon conversion or exercise of the Preferred Stock or Warrants,

respectively, holders of such securities will have no rights with respect to the shares of our common stock underlying such Preferred

Stock or Warrants. Upon conversion or exercise of the Preferred Stock or Warrants, respectively, the holders thereof will be entitled

to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date. Prior to

conversion, holders of Preferred Stock will have limited voting rights.

The

number of shares of common stock underlying the Preferred Stock and Warrants included in the Units will not be known until the expiration

date of the rights offering.

Because

the actual Conversion Price will be determined on the expiration date, rights holders will not know the Conversion Price, nor will they

know the number of shares underlying the Preferred Stock and the Warrants, at the time of exercise. The actual number of shares of common

stock underlying the Preferred Stock and the Warrants may be significantly different from the number expected based on the current trading

price of our common stock.

If

we terminate this offering for any reason, we will have no obligation other than to return subscription monies within 10 business days.

We

may decide, in our sole discretion and for any reason, to cancel or terminate the Rights Offering at any time prior to the expiration

date. If this offering is cancelled or terminated, we will have no obligation with respect to Subscription Rights that have been exercised

except to return within 10 business days, without interest or deduction, all subscription payments deposited with the Subscription Agent.

If we terminate this offering and you have not exercised any Subscription Rights, such Subscription Rights will expire and be worthless.

The

Subscription Price determined for this offering is not an indication of the fair value of our common stock.

In

determining the Subscription Price, our board of directors considered a number of factors, including, but not limited to, our need to

raise capital in the near term to continue our operations, the current and historical trading prices of our common stock, a price that

would increase the likelihood of participation in the Rights Offering, the cost of capital from other sources, the value of the Preferred

Stock and Warrants being issued as components of the Unit, and comparable precedent transactions. The Subscription Price does not necessarily

bear any relationship to any established criteria for value. No valuation consultant or investment banker has opined upon the fairness

or adequacy of the Subscription Price. You should not consider the Subscription Price as an indication of the value of our company or

our common stock.

If

you do not act on a timely basis and follow subscription instructions, your exercise of Subscription Rights may be rejected.

Holders

of Subscription Rights who desire to purchase shares of our Preferred Stock and Warrants in this offering must act on a timely basis

to ensure that all required forms and payments are actually received by the Subscription Agent prior to 5:00 p.m., New York City time,

on the expiration date, unless extended. If you are a beneficial owner of shares of common stock, Series B Preferred Stock, Series C

Preferred Stock, or Participating Warrants and you wish to exercise your Subscription Rights, you must act promptly to ensure that your

broker, dealer, bank, trustee or other nominee acts for you and that all required forms and payments are actually received by your broker,

dealer, bank, trustee or other nominee in sufficient time to deliver such forms and payments to the Subscription Agent to exercise the

Subscription Rights granted in this offering that you beneficially own prior to 5:00 p.m., New York City time on the expiration date,

as may be extended. We will not be responsible if your broker, dealer, bank, trustee or other nominee fails to ensure that all required

forms and payments are received by the Subscription Agent prior to 5:00 p.m., New York City time, on the expiration date.

If

you fail to complete and sign the required subscription forms, send an incorrect payment amount, or otherwise fail to follow the subscription

procedures that apply to your exercise in this Rights Offering, the Subscription Agent may, depending on the circumstances, reject your

subscription or accept it only to the extent of the payment received. Neither we nor the Subscription Agent undertakes to contact you

concerning an incomplete or incorrect subscription form or payment, nor are we under any obligation to correct such forms or payment.

We have the sole discretion to determine whether a subscription exercise properly follows the subscription procedures.

You

may not receive all of the Units for which you subscribe.

While we are distributing

to holders of our common stock, Series B Preferred Stock, Series C Preferred Stock, and Participating Warrants, one Subscription Right

for every share of common stock (including each share of common stock issuable upon conversion of Series B Preferred Stock, Series C

Preferred Stock, and exercise of Participating Warrants) owned on the Record Date, we are only seeking to raise $10 million in gross

proceeds in this Rights Offering. As a result, based on 24,727,495 shares of common stock outstanding as of August 31,

2022, and 19,306 shares of common stock issuable upon conversion of 26 shares of our Series B Preferred Stock, 33,753 shares of

common stock issuable upon conversion of 50 shares of our Series C Preferred Stock and 1,115,729 shares of common stock

issuable upon exercise of Participating Warrants, we would grant Subscription Rights to acquire 25,896,283 Units but will only

accept subscriptions for 10,000 Units. Accordingly, enough Units may not be available to honor your subscription in full. If excess Units

are available after the exercise of Basic Subscription Rights, holders who fully exercise their Basic Subscription Rights will be entitled

to subscribe for an additional number of Units. Over-Subscription Privileges will be allocated pro rata among Rights holders who over-subscribed,

based on the number of over-subscription Units to which they have subscribed. We cannot guarantee that you will receive any or the entire

number of Units for which you subscribed. If for any reason the number of Units allocated to you is less than you have subscribed for,

then the excess funds held by the Subscription Agent on your behalf will be returned to you, without interest, as soon as practicable

after the Rights Offering has expired and all prorating calculations and reductions contemplated by the terms of the Rights Offering

have been effected, and we will have no further obligations to you.

Unless

we otherwise agree in writing, a person or entity, together with related persons or entities, may not exercise Subscription Rights (including

Over-Subscription Privileges) to purchase Units that, when aggregated with their existing ownership, would result in such person or entity,

together with any related persons or entities, owning in excess of 19.99% of our issued and outstanding shares of common stock following

the closing of the transactions contemplated by this Rights Offering. If the number of shares allocated to you is less than your subscription

request, then the excess funds held by the Subscription Agent on your behalf will be returned to you, without interest, as soon as practicable

after the Rights Offering has expired and all prorating calculations and reductions contemplated by the terms of the Rights Offering

have been effected, and we will have no further obligations to you.

If

you make payment of the Subscription Price by personal check, your check may not clear in sufficient time to enable you to purchase shares

in this Rights Offering.

Any

personal check used to pay for shares and Warrants to be issued in this Rights Offering must clear prior to the expiration date of this

Rights Offering, and the clearing process may require five or more business days. If you choose to exercise your Subscription Rights,

in whole or in part, and to pay for shares and Warrants by personal check and your check has not cleared prior to the expiration date

of this Rights Offering, you will not have satisfied the conditions to exercise your Subscription Rights and will not receive the shares

and Warrants you wish to purchase.

The

receipt of Subscription Rights may be treated as a taxable distribution to you.

We

believe the distribution of the Subscription Rights in this Rights Offering should be a non-taxable distribution to holders of shares

of common stock, Series B Preferred Stock, Series C Preferred Stock, and holders of Participating Warrants, under Section 305(a) of the

Internal Revenue Code of 1986, as amended, or the Code. Please see the discussion under the heading “Material U.S. Federal Income

Tax Consequences” below. This position is not binding on the IRS, or the courts, however. If this Rights Offering is deemed to

be part of a “disproportionate distribution” under Section 305 of the Code, your receipt of Subscription Rights in this Rights

Offering may be treated as the receipt of a taxable distribution to you equal to the fair market value of the Subscription Rights.

Any such distribution would be treated as dividend income to the extent of our current and accumulated earnings and profits, if any,

with any excess being treated as a return of capital to the extent thereof and then as capital gain. Each holder of shares of common

stock or Preferred Stock and each holder of Participating Warrants is urged to consult his, her or its own tax advisor with respect

to the particular tax consequences of this Rights Offering.

Proposed

legislation in the U.S. Congress, including changes in U.S. tax law, and the recently enacted Inflation Reduction Act of 2022,

may adversely impact the Company and the value of our Subscription Rights, shares of our common stock and Preferred Stock, and Warrants.

Changes

to U.S. tax laws (which changes may have retroactive application) could adversely affect the Company or holders of our Subscription Rights,

shares of our common stock and Preferred Stock, and Warrants. In recent years, many changes to U.S. federal income tax laws have been

proposed and made, and additional changes to U.S. federal income tax laws are likely to continue to occur in the future.

The

U.S. Congress is currently considering numerous items of legislation which may be enacted prospectively or with retroactive effect, which

legislation could adversely impact the Company’s financial performance and the value of our Subscription Rights, shares of our

common stock and Preferred Stock and Warrants. Additionally, states in which we operate or own assets may impose new or increased

taxes. If enacted, most of the proposals would be effective for 2022 or later years. The proposed legislation remains subject to change,

and its impact on the Company and holders of our Subscription Rights, shares of our common stock and Preferred Stock and Warrants is

uncertain.

In addition, the Inflation Reduction Act of 2022 was recently signed

into law and includes provisions that will impact the U.S. federal income taxation of corporations. Among other items, this legislation

includes provisions that will impose a minimum tax on the book income of certain large corporations and an excise tax on certain corporate

stock repurchases that would be imposed on the corporation repurchasing such stock. It is unclear how this legislation will be implemented

by the U.S. Department of the Treasury and we cannot predict how this legislation or any future changes in tax laws might affect the

Company or holders of our Subscription Rights, shares of our common stock and Preferred Stock and Warrants

Exercising

the Subscription Rights limits your ability to engage in certain hedging transactions that could provide you with financial benefits.

By

exercising the Subscription Rights, you are representing to us that you have not entered into any short sale or similar transaction with

respect to our common stock since the Record Date for the Rights Offering. In addition, the Subscription Rights provide that, upon exercise

of the Subscription Right, you agree not to enter into any short sale or similar transaction with respect to our common stock for so

long as you continue to hold Warrants issued in connection with the exercise of the Subscription Right. These requirements prevent you

from pursuing certain investment strategies that could provide you greater financial benefits than you might have realized if the Subscription

Rights did not contain these requirements.

The

Subscription Rights are not transferable, and there is no market for the Subscription Rights.

You

may not sell, transfer, assign or give away your Subscription Rights. Because the Subscription Rights are non-transferable, there is

no market or other means for you to directly realize any value associated with the Subscription Rights. You must exercise the Subscription

Rights to realize any potential value from your Subscription Rights.

There

is no public market for the Preferred Stock in this offering.

There

is no established public trading market for the Preferred Stock, and we do not expect a market to develop. In addition, we do not currently

intend to apply for listing of the Preferred Stock on any securities exchange or recognized trading system. Purchasers of the Preferred

Stock may be unable to resell their shares of Preferred Stock or sell them only at an unfavorable price for an extended period of time,

if at all.

Absence

of a public trading market for the Warrants may limit your ability to resell the Warrants.

There

is no established trading market for the Warrants to be issued pursuant to this offering, and they will not be listed for trading on

Nasdaq or any other securities exchange or market, and the Warrants may not be widely distributed. Purchasers of the Warrants may be

unable to resell the Warrants or sell them only at an unfavorable price for an extended period of time, if at all.

The

market price of our common stock may never exceed the exercise price of the Warrants issued in connection with this offering.

The

Class A Warrants being issued in connection with this offering become exercisable upon issuance and will expire five years from

the date of issuance. The Class B Warrants being issued in connection with this offering become exercisable upon issuance and will

expire three years from the date of issuance. The market price of our common stock may never exceed the exercise price of the Warrants

prior to their date of expiration. Any Warrants not exercised by their date of expiration will expire worthless and we will be under

no further obligation to the Warrant holder.

The

Warrants contain features that may reduce your economic benefit from owning them.

For

so long as you continue to hold warrants, you will not be permitted to enter into any short sale or similar transaction with respect

to our common stock. This could prevent you from pursuing investment strategies that could provide you greater financial benefits from

owning the warrant.

The

dealer-manager is not underwriting, nor acting as placement agent of, the Subscription Rights or the securities underlying the Subscription

Rights.

Maxim

Group LLC is acting as sole dealer-manager for the Rights Offering. As provided in the dealer-manager agreement, the dealer-manager will

provide marketing assistance in connection with this offering. The dealer-manager is not underwriting or placing any of the Subscription

Rights or the shares of our Preferred Stock or Warrants being issued in this offering and is not making any recommendation with respect

to such Subscription Rights (including with respect to the exercise or expiration of such Subscription Rights), shares or Warrants. The

dealer-manager will not be subject to any liability to us in rendering the services contemplated by the dealer-manager agreement except

for any act of bad faith, gross negligence or willful misconduct by the dealer-manager. The Rights Offering may not be successful despite

the services of the dealer-manager to us in this offering.

Since

the Warrants are executory contracts, they may have no value in a bankruptcy or reorganization proceeding.

In

the event a bankruptcy or reorganization proceeding is commenced by or against us, a bankruptcy court may hold that any unexercised Warrants

are executory contracts that are subject to rejection by us with the approval of the bankruptcy court. As a result, holders of the Warrants

may, even if we have sufficient funds, not be entitled to receive any consideration for their Warrants or may receive an amount less

than they would be entitled to if they had exercised their Warrants prior to the commencement of any such bankruptcy or reorganization

proceeding.

We

may amend or modify the terms of the Rights Offering at any time prior to the expiration of the Rights Offering in our sole discretion.

Our

board of directors reserves the right to amend or modify the terms of the Rights Offering in its sole discretion. If we should make any

fundamental changes to the terms of the Rights Offering set forth in this prospectus, we will file a post-effective amendment to the

registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity

to cancel such subscriptions and issue a refund of any money advanced by such stockholder and recirculate an updated prospectus after

the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the Expiration Date of the

Rights Offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation.

Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and

the new expiration date. The terms of the Rights Offering cannot be modified or amended after the Expiration Date of the Rights Offering.

Although we do not presently intend to do so, we may choose to amend or modify the terms of the Rights Offering for any reason, including,

without limitation, in order to increase participation in the Rights Offering. Such amendments or modifications may include a change

in the subscription price, although no such change is presently contemplated.

Risks

Related to Our Business

Investors

should carefully consider the risks and uncertainties and all other information contained or incorporated by reference in this prospectus,

including the risks and uncertainties discussed under “Risk Factors” in our most recent Annual Report on Form 10-K,

as may be amended from time to time, and in subsequent filings that are incorporated herein by reference. All these risk factors are

incorporated by reference herein in their entirety. These risks and uncertainties are not the only ones facing us. Our business, financial

condition or results of operations could be materially adversely affected by any of these risks. The trading price of our common stock

could decline due to any of these risks, and you may lose all or part of your investment. This prospectus and the incorporated documents

also contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated

in these forward-looking statements as a result of certain factors, including the risks mentioned in this prospectus.

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated herein by reference contain forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are based on our management’s current beliefs, expectations and assumptions about

future events, conditions and results and on information currently available to us. Discussions containing these forward-looking statements

may be found, among other places, in the Sections entitled “Business,” “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” incorporated by reference from our most recent Annual

Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the SEC.

All

statements, other than statements of historical fact, included or incorporated herein regarding our strategy, future operations, financial

position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,”

“think,” “may,” “could,” “will,” “would,” “should,” “continue,”

“potential,” “likely,” “opportunity” and similar expressions or variations of such words are intended

to identify forward-looking statements but are not the exclusive means of identifying forward-looking statements. Examples of our forward-looking

statements include:

| |

● |

our

ability to achieve sufficient market acceptance of any of our products or product candidates; |

| |

|

|

| |

● |

our

ability to enter into and maintain successful OEM arrangements with third parties; |

| |

|

|

| |

● |

our

perception of the growth in the size of the potential market for our products and product candidates; |

| |

|

|

| |

● |

our

estimate of the advantages of our silicon nitride technology platform; |

| |

|

|

| |

● |

our

ability to become a profitable biomaterial technology company; |

| |

|

|

| |

● |

our

estimates regarding our needs for additional financing and our ability to obtain such additional financing on suitable terms; |

| |

|

|

| |

● |

our

ability to succeed in obtaining FDA clearance or approvals for our product candidates; |

| |

|

|

| |

● |

our

ability to receive CE Marks for our product candidates; |

| |

|

|

| |

● |

the

timing, costs and other limitations involved in obtaining regulatory clearance or approval for any of our product candidates and

product candidates and, thereafter, continued compliance with governmental regulation of our existing products and activities; |

| |

|

|

| |

● |

our

ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of

others; |

| |

|

|

| |

● |

our

ability to obtain sufficient quantities and satisfactory quality of raw materials to meet our manufacturing needs; |

| |

|

|

| |

● |

the

availability of adequate coverage reimbursement from third-party payers in the United States; |

| |

|

|

| |

● |

our

estimates regarding anticipated operating losses, future product revenue, expenses, capital requirements and liquidity; |

| |

|

|

| |

● |

our

ability to maintain and continue to develop our sales and marketing infrastructure; |

| |

|

|

| |

● |

our

ability to enter into and maintain suitable arrangements with an adequate number of distributors; |

| |

|

|

| |

● |

our

manufacturing capacity to meet future demand; |

| |

|

|

| |

● |

our

ability to develop effective and cost-efficient manufacturing processes for our products; |

| |

|

|

| |

● |

our

reliance on third parties to supply us with raw materials and our non-silicon nitride products and instruments; |

| |

|

|

| |

● |

the

safety and efficacy of products and product candidates; |

| |

|

|

| |

● |

the

timing of and our ability to conduct clinical trials; |

| |

|

|

| |

● |

potential

changes to the healthcare delivery systems and payment methods in the United States or internationally; |

| |

|

|

| |

● |

any

potential requirement by regulatory agencies that we restructure our relationships with referring surgeons; |

| |

|

|

| |

● |

our

ability to develop and maintain relationships with surgeons, hospitals and marketers of our products; and |

| |

|

|

| |

● |

our

ability to attract and retain a qualified management team, engineering team, sales and marketing team, distribution team, design

surgeons, surgeon advisors and other qualified personnel and advisors. |

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some

of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events

and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially

from those projected in the forward- looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties

may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required

by applicable law, we do not plan to publicly update or revise any forward- looking statements contained herein, whether as a result

of any new information, future events, changed circumstances or otherwise.

This

prospectus and the documents incorporated herein by reference also refer to estimates and other statistical data made by independent

parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and

limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of

our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty

and risk.

USE

OF PROCEEDS

Assuming that all Units

are subscribed for in the Rights Offering, we estimate that the net proceeds from the Rights Offering will be approximately $9.2

million, after deducting expenses relating to this offering payable by us estimated at approximately $0.8 million, including dealer-manager

fees and expenses which include fees payable to Ascendiant Capital Markets, LLC, for certain financial advisor services provided in connection

with the Rights Offering, before deducting other estimated expenses payable by us and excluding any proceeds received upon exercise

of any Warrants.

We

intend to use the net proceeds from the exercise of Subscription Rights for general corporate purposes, which may include research and

development expenses, capital expenditures, working capital and general and administrative expenses, and potential acquisitions of or

investments in businesses, products and technologies that complement our business, although we have no present commitments or agreements

to make any such acquisitions or investments as of the date of this prospectus. We expect to use any proceeds we receive from the exercise

of Warrants for substantially the same purposes and in substantially the same manner. Pending these uses, we intend to invest the funds

in short-term, investment grade, interest-bearing securities. It is possible that, pending their use, we may invest the net proceeds

in a way that does not yield a favorable, or any, return for us.

Our

management will have broad discretion as to the allocation of the net proceeds from this offering and could use them for purposes other

than those contemplated at the time of commencement of this offering.

DILUTION

Purchasers

of Units in the Rights Offering will experience an immediate dilution of the net tangible book value per share of our common stock. Our

net tangible book value as of June 30, 2022, was approximately $12,020,000, or $0.49 per share of our common

stock (based upon 24,719,574 shares of our common stock outstanding). Net tangible book value per share is equal to our total

tangible assets less our total liabilities, divided by the number of shares of our outstanding common stock.

Dilution

per share of common stock equals the difference between the amount paid by purchasers of Units in the Rights Offering (ascribing no value

to the Warrants contained in the Units) and the net tangible book value per share of our common stock immediately after the Rights Offering.

Based

on the sale by us in this Rights Offering of a maximum of Units at the Subscription Price of $1,000 per Unit (assuming no exercise of

the Warrants), and after deducting estimated offering expenses and dealer-manager fees and expenses payable by us, our pro forma net

tangible book value as of June 30, 2022, would have been approximately $21,009,000 million, or $0.41 per share.

This represents an immediate decrease in pro forma net tangible book value to existing stockholders of ($0.08) per share

and an immediate increase to purchasers in the Rights Offering of $0.07 per share. The following table illustrates this

per-share dilution:

| Subscription

Price | |

$ | 1,000.00 | |

| Net

tangible book value per share as of June 30, 2022 | |

$ | 0.49 | |

| Decrease in net tangible book value per share attributable

to Rights Offering | |

$ | (0.08 | ) |

| Pro

forma net tangible book value per share as of June 30, 2022, after giving effect to Rights Offering | |

$ | 0.41 | |

| Increase

in net tangible book value per share to purchasers

in the Rights Offering | |

$ | 0.07 | |

The

information above is as of June 30, 2022 and excludes:

| |

● |

1,291,207

shares of our common stock issuable upon the exercise of stock options, with a weighted-average exercise price of $2.38 per share,

and vesting of restricted stock units; |

| |

● |

19,306

shares of our common stock issuable upon the conversion of outstanding shares of Series B Preferred Stock; |

| |

● |

34,428

shares of our common stock issuable upon the