- Net income of $35.4 million in 2020, as compared to $36.0

million for 2019, including an increase in provision for loan and

lease losses in 2020 of $6.0 million.

- Loans & Leases, Net of Fees had record growth of $694.5

million, or 39% during the year ended 2020 and by $82.7 million, or

3% in the fourth quarter of 2020 as compared to the third quarter

of 2020

- Deposits increased by $456.2 million, or 21% during the year

ended 2020 and by $32.9 million, or 1% in the fourth quarter of

2020 as compared to the third quarter of 2020

- The Company's return on average assets was 1.22%, return on

average equity was 10.80%, and diluted earnings per share were

$2.32 for the twelve months ended 2020.

Sierra Bancorp (Nasdaq: BSRR), parent of Bank of the Sierra,

today announced fourth quarter of 2020 net income of $9.0 million,

or $0.58 per diluted share, compared to net income of $9.3 million,

or $0.60 per diluted share, in the fourth quarter of 2019. The

Company's return on average assets was 1.12% in the fourth quarter

of 2020, as compared to 1.41% in the fourth quarter of 2019, with

return on average equity of 10.49% as compared to 11.97%, for the

same comparative periods. The nominal change in net income is

driven primarily by a higher provision for loan and lease losses

and noninterest expense, which was mostly offset by higher net

interest income due mostly to higher loan balances combined with a

lower cost of funds on interest bearing liabilities and higher

noninterest income.

For the year ended 2020, the Company recognized net income of

$35.4 million, or $2.32 per diluted share, as compared to $36.0

million, or $2.33 per diluted share, for the same period in

2019.

“Success is no accident. It is hard work,

perseverance, learning, studying, sacrifice and most of all, love

of what you are doing.” - Pele

"In 2020, our banking team pivoted operationally, continued to

focus on quality growth, and demonstrated their commitment to

providing the best experience possible for our customers," stated

Kevin McPhaill, President and CEO. "All banks encountered new

challenges this past year due to an unprecedented pandemic which

continued into the fourth quarter. We are proud of how our Bank met

these challenges. Our strong results demonstrate that our focus on

the communities that we serve provided the core loans and deposits

needed to continue this success in 2021!" McPhaill concluded.

Financial Highlights

Quarterly Changes (comparisons to the fourth quarter of

2019)

- The $4.0 million increase in net interest income is due to a

$2.0 million increase in interest income attributable mostly to

higher loan volumes partially offset by lower rates. The interest

income growth was enhanced by a $2.0 million decrease in interest

expense due to an increase in noninterest bearing deposits and

lower rates on the remaining deposits and borrowed funds.

- The provision for loan & lease losses is $1.7 million

higher primarily due to the increase in core loan volume as well as

continued uncertainty in the economy.

- The $0.2 million favorable increase in noninterest income is

due to a $0.2 million loss from the sale of debt securities in the

fourth quarter of 2019. Customer service charges on deposit

accounts were lower in the quarterly comparison, but increases in

debit card interchange income mostly offset the decrease.

- Noninterest expense increased by $2.8 million, due mostly to a

$2.1 million increase in salaries and benefits, a $0.2 million

increase in FDIC assessments, and a $0.5 million increase in legal

expenses.

Year to-Date Changes (comparisons to the year ended

2019)

- Net income decreased by $0.5 million, or 1%. While overall net

income remained relatively flat year-over-year, there were some

changes in individual line items, including a $6.0 million increase

in the provision for loan and lease losses and a $5.3 million

increase in noninterest expense, which were mostly offset by a $7.5

million increase in net interest income as well as increases in

noninterest income.

- The primary driver of the favorable change in net interest

income was from the growth in noninterest bearing and low-interest

bearing deposits in 2020. In addition, the impact of lower rates on

earning assets was mostly offset by both a growth in loan balances

and a shift in earning assets from investments to loans.

- Noninterest income increased by $2.7 million, or 11%, due in

part to the fourth quarter changes described above in the quarterly

comparison, but also because of an increase in the fair market

value of restricted stock, fluctuations in income on BOLI

associated with deferred compensation plans, lower tax credit fund

expenses which are netted out of revenue, a $1.5 million gain from

the disposal of a tax credit fund investment and a $0.4 million

gain from the sale of debt securities.

- Noninterest expense increased $5.3 million, or 8%, due mostly

to a $4.2 million increase in salaries and benefits expense.

Deposit services and other professional services also contributed

to the difference in the year-to-date comparisons.

Balance Sheet Changes (comparisons to December 31,

2019)

- Total assets increased by $626.9 million, or 24%, to $3.2

billion, for the year.

- Net loan growth of $694.5 million, or 39%, during 2020, was

highlighted by a $507.9 million increase in non-agricultural real

estate loans, as well as a $118.6 million increase in mortgage

warehouse lines and $119.4 million in Paycheck Protection Program

(PPP) loans.

- Deposits increased by $456.2 million, or 21%, during 2020. The

growth in deposits came primarily from noninterest bearing or

low-cost transaction accounts, including savings accounts. The

increase in brokered deposits offset the decrease in customer time

deposits.

- Other interest bearing liabilities increased by $136.3 million

as we utilized overnight FHLB borrowings and fed funds purchased to

partially fund loan growth in 2020, including PPP loans and

increased utilization of mortgage warehouse lines.

Other financial highlights are reflected in the following

table.

FINANCIAL HIGHLIGHTS

(Unaudited)

(Dollars in thousands, except per share

data)

At or For the

At or For the

At or For the

Three Months Ended

Three Months Ended

Twelve Months Ended

12/31/2020

9/30/2020

12/31/2019

12/31/2020

12/31/2019

Net Income

$

8,979

$

10,356

$

9,285

$

35,444

$

35,961

Diluted Earnings per share

$

0.58

$

0.67

$

0.60

$

2.32

$

2.33

Return on Average Assets

1.12%

1.34%

1.41%

1.22%

1.40%

Return on Average Equity

10.49%

12.34%

11.97%

10.80%

12.23%

Net Interest Margin (Tax-Equivalent)

3.91%

3.98%

4.15%

3.95%

4.19%

Yield on Average Loans and Leases

4.41%

4.56%

5.33%

4.65%

5.47%

Cost of Average Total Deposits

0.09%

0.10%

0.43%

0.16%

0.53%

Efficiency Ratio (Tax-Equivalent)¹

58.68%

53.74%

57.30%

57.18%

57.46%

Total Assets

$

3,220,742

$

3,199,618

$

2,593,819

$

3,220,742

$

2,593,819

Loans & Leases Net of Deferred

Fees

$

2,459,964

$

2,377,222

$

1,765,461

$

2,459,964

$

1,765,461

Noninterest Demand Deposits

$

943,664

$

975,750

$

690,950

$

943,664

$

690,950

Total Deposits

$

2,624,606

$

2,591,713

$

2,168,374

$

2,624,606

$

2,168,374

Noninterest-bearing Deposits over Total

Deposits

36.0%

37.6%

31.9%

36.0%

31.9%

Shareholders Equity / Total Assets

10.7%

10.5%

11.9%

10.7%

11.9%

Tangible Common Equity Ratio

9.8%

9.6%

10.4%

9.8%

10.4%

Book Value per Share

$

22.35

$

21.92

$

20.24

$

22.35

$

20.24

Tangible Book Value per Share

$

20.29

$

19.48

$

18.09

$

20.29

$

18.09

(1)

Noninterest expense as a percentage of the

sum of net interest income and noninterest income excluding net

gains (losses) from securities.

INCOME STATEMENT HIGHLIGHTS

Net Interest Income

Net interest income increased $4.0 million to $28.8 million for

the fourth quarter of 2020 over the fourth quarter of 2019 and

increased $7.5 million to $104.8 million for the year ended 2020

relative to the same period in 2019. For the fourth quarter of

2020, growth in average interest-earning assets totaled $568.9

million, or 24%, as compared to the fourth quarter of 2019.

Although the yield on these balances was 61 basis points lower for

the same period, the decrease in our cost of interest-bearing

liabilities for the same period was 54 basis points resulting in an

overall decline in net interest margin of 24 basis points. The

increase in net interest income for the comparative year-to-date

periods was due to volume increases of average interest earning

assets as well as a favorable change in our deposit mix, which more

than made up for the decrease in the net interest margin.

Our 2020 net interest margin has been impacted primarily by the

following:

- Market conditions, including five interest rate cuts by the

Federal Open Market Committee totaling 225 bps over the past 12

months, negatively impacted our yield on existing adjustable and

variable rate portfolio loans and created a lower initial interest

rate for new loan volumes. In addition, given the low rate

environment, loan demand for our mortgage warehouse lines

increased, resulting in a $87.1 million, or a 65% increase in

average balances during the year ended 2020. The average yield on

mortgage warehouse lines declined to 3.22% from 4.24% for the

comparative periods.

- Origination of SBA PPP loans, issuing 1,336 loans with a

remaining balance of $119.4 million to assist our customers

impacted by the COVID-19 Pandemic. We have collected $5.0 million

in loan fees related to PPP loans from the SBA, of which net of

costs, $2.7 million has accreted into income with the remaining

deferred balance accreting over the stated life of the loan.

On December 31, 2020, our outstanding fixed-rate loans

represented 26% of our loan portfolio. Adjustable-rate loans

represent 64% of our loan portfolio and range in adjustment periods

from 30 days to 10 years, with most of these subject to repricing

after 3-years. There are $64.0 million of these adjustable-rate

loans scheduled to adjust in the next quarter. Approximately 79% or

$1.2 billion of these loans will not begin repricing until after

three years, with $795.0 million repricing after five years. About

10% of our total portfolio, or $242.2 million, consists of variable

rate loans. Of these variable rate loans, approximately $90.9

million have floors, with $78.1 million at their floors, which

limited the overall reduction in rates.

Discount accretion on loans from whole-bank acquisitions

enhanced our net interest margin by two basis points in the fourth

quarter of 2020 as compared to five basis points in the fourth

quarter of 2019 and two basis points for the year ended 2020

relative to four basis points for the same period in 2019. On

December 31, 2020, the remaining balance of loan discount available

to be accreted was $3.1 million.

Interest expense was $0.9 million for the fourth quarter of

2020, a favorable decline of $2.0 million, or 69%, relative to the

fourth quarter of 2019. For the year ended 2020, compared to the

same period in 2019, interest expense declined $8.2 million, or

60%, to $5.4 million due to lower rates, higher low or no cost

deposits, and lower time deposits. The average balance of

higher-cost time deposits declined by $60.4 million, or 11%, in the

fourth quarter of 2020 as compared to the fourth quarter of 2019.

The average 2020 year-to-date balance of such time-deposits

declined by $60.8 million, or 11%, compared to the same period in

2019. The average balance of lower or no cost transaction and

savings accounts increased $485.6 million, or 31.9%, for the fourth

quarter of 2020 compared to the same period in 2019 and increased

by $313.5 million, or 20.8%, for the year ended 2020 compared to

the same period in 2019.

Provision for Loan and Lease Losses

The Company recorded a loan and lease loss provision of $2.2

million in the fourth quarter of 2020 relative to a provision of

$0.5 million in the fourth quarter of 2019, and a year ended loan

loss provision of $8.6 million at December 31, 2020 as compared to

$2.6 million for the same period in 2019. The Company is subject to

the adoption of the Current Expected Credit Loss ("CECL")

accounting method under Financial Accounting Standards Board (FASB)

Accounting Standards Update 2016-03 and related amendments,

Financial Instruments – Credit Losses (Topic 326) in 2020. However,

in March 2020, the Company initially elected under Section 4014 of

the Coronavirus Aid, Relief, and Economic Security (CARES) Act to

defer the implementation of CECL until the earlier of when the

national emergency related to the outbreak of COVID-19 ends or

December 31, 2020. In December 2020, the Consolidated

Appropriations Act, 2021, extended the deferral of implementation

of CECL from December 31, 2020, to the earlier of the first day of

the fiscal year, beginning after the national emergency terminates

or January 1, 2022. The Company initially elected in the first

quarter of 2020 to postpone implementation and will now continue to

postpone implementation in order to provide additional time to

assess better the impact of the COVID-19 pandemic on the expected

lifetime credit losses. At the time the initial decision was made,

there was a significant economic uncertainty on the local,

regional, and national levels as a result of local and state

stay-at-home orders, as well as relief measures provided at a

national, state, and local level. Further, the Company took actions

to serve our communities during the pandemic, including permitting

short-term payment deferrals to current customers, as well as

originating bridge loans and SBA PPP loans. It was determined that

more time is still needed to assess the impact of the uncertainty

and related actions on the Company's allowance for loan and lease

losses under the CECL methodology.

The Company's $1.7 million, or 340%, increase in provision for

loan and lease losses in the fourth quarter of 2020 as compared to

the fourth quarter of 2019, and the $6.0 million, or 235% increase

for the year ended 2020 compared to the same period in 2019 is due

to growth in organic non-owner occupied commercial real estate

loans, downgrades of certain loans deferred under section 4013 of

the Cares Act and the continued uncertainty surrounding the

estimated impact that COVID-19 has had on the economy and our loan

customers. Management evaluated its qualitative risk factors under

our current incurred loss model and adjusted these factors for

economic conditions, changes in the mix of the portfolio due to

loans subject to a payment deferral, potential changes in

collateral values due to reduced cash flows, and external factors

such as government actions. In particular, the uncertainty

regarding our customers' ability to repay loans could be adversely

impacted by COVID-19, temporary business shut-downs, and reduced

consumer and business spending.

Noninterest Income

Total noninterest income reflected an increase of $0.2 million,

or 3%, for the quarter ended December 31, 2020, as compared to the

same period in 2019, and $2.7 million, or 11%, for the year ended

December 31, 2020, as compared to the same period in 2019. The

fourth quarter of 2020 increase in comparison to the same period in

2019 primarily resulted from a loss from the sale of investment

securities in the fourth quarter of 2019. In comparing the year

ended December 31, 2020, to the same period in 2019, the variances

in noninterest income came from a $1.5 million gain from the wrap

up of low-income housing tax credit fund investments, a decrease of

$0.9 million in low-income housing tax credit fund expenses, an

increase of $0.2 million in the valuation gain of restricted equity

investments owned by the Company and a $0.6 million increase in the

net gain on the sale of debt securities. Fluctuations in BOLI

associated with deferred compensation plans contributed $0.2

million to the increase.

Service charges on customer deposit account income declined by

$0.3 million, or 10%, to $3.0 million in the fourth quarter of 2020

as compared to the fourth quarter of 2019. This service charge

income was $1.0 million lower, or 8%, for the year ended December

31, 2020, as compared to the same period in 2019. These declines

are primarily a result of decreases in overdraft income offset by

increases in interchange income and other deposit fees, including

analysis fees.

Noninterest Expense

Total noninterest expense increased by $2.8 million, or 15%, in

the fourth quarter of 2020 relative to the fourth quarter of 2019,

and by $5.3 million, or 8%, during the year ended December 31,

2020, as compared to the same period in 2019.

Salaries and Benefits were $2.1 million, or 23%, higher in the

fourth quarter of 2020 as compared to the fourth quarter of 2019

and $4.2 million, or 12%, higher for the year ended December 31,

2020, compared to the same period in 2019. The reason for this

increase is due to several factors, including merit increases for

employees due to annual performance evaluations for 2019, new loan

production teams for the northern and southern California markets,

and a focus on hiring additional senior-level staff and management.

Salary expense deferrals related to loan originations were $0.8

million lower in the fourth quarter of 2020 relative to the fourth

quarter of 2019 and $0.4 million lower for the year ended December

31, 2020, compared to the same period in 2019. There have not been

any permanent or temporary reductions in employees as a result of

COVID-19, although total full-time equivalent employees have

declined from 513 at December 31, 2019, to 501 at December 31,

2020.

Occupancy expenses decreased $0.1 million, or 4% for the fourth

quarter as compared to the fourth quarter of 2019 but remained

relatively flat for the respective year-to-date periods. Other

noninterest expenses increased $0.8 million, or 12%, for the fourth

quarter of 2020 as compared to the fourth quarter in 2019, and $1.1

million, or 5%, for the year ended December 31, 2020, as compared

to the same period in 2019. The variance for the fourth quarter of

2020 compared to the same period in 2019 was primarily driven by a

$0.2 million increase in deposit services expense, a $0.2 million

increase in data processing expense, a $0.6 million increase in

professional services, partially offset by a $0.2 million decrease

in advertising costs. The $0.6 million change in professional

services includes a $0.2 million increase in FDIC assessments due

to the Small Bank Assessment credits applied against FDIC deposit

insurance costs in the comparative quarter for 2019, and a $0.5

million increase in legal expenses partially offset by a $0.1

million decrease in director's deferred compensation expense, which

is linked to the changes in BOLI income. For the year ended

December 31, 2020, the $1.1 million increase in other noninterest

expense was primarily driven by a $0.4 million increase in loan

services costs (half of which was in foreclosed assets), a $0.5

million increase in deposit services costs, a $0.4 million increase

in professional services (mostly in legal expenses and FDIC

assessments), a $0.3 million increase in sundry losses, partially

offset by a $0.7 million decrease in advertising costs.

The Company's provision for income taxes was 24.6% of pre-tax

income in the fourth quarter of 2020 relative to 23.8% in the

fourth quarter of 2019, and 23.8% of pre-tax income for the year

ended December 31, 2020, relative to 24.6% for the same period in

2019. The decrease in tax rate for the year ended December 31, 2020

is due mostly to a higher percent of tax-exempt income.

Balance Sheet Summary

Balance sheet changes for the year ended December 31, 2020

include an increase in total assets of $626.9 million, or 24%, due

mostly to a $694.5 million increase, or 39%, in the net loan

portfolio. This significant increase in loan balances in 2020 is

due to a $507.9 million increase in non-agricultural real estate

loans, a $119.4 million increase in PPP loans, and a $118.6 million

increase in mortgage warehouse line utilization. Non-agricultural

real estate loan balances increased due to deliberate efforts of

our Northern and Southern market loan production teams. These real

estate loans cover a variety of diverse purposes and were

underwritten at conservative loan-to-values. Our loan pipeline at

December 31, 2020, softened from the previous quarter due to a

strategic shift to focus on further diversifying our loan mix,

especially as it relates to non-owner occupied commercial real

estate. Based on this pipeline, we expect continued loan growth in

2021 but at a significantly lower rate than what was experienced in

2020. Mortgage warehouse loan balances increased due to market

factors favorably impacting line utilization due to both mortgage

originations and refinancing activity, as well as normal seasonal

mortgage activity.

The Company is participating in the second round of SBA PPP

lending as permitted by the Consolidated Appropriations Act, 2021

for existing and potentially new customers.

With regards to line utilization, excluding mortgage warehouse

and consumer overdraft lines, unused commitments were $259.6

million on December 31, 2020, as compared to $303.4 million on

December 31, 2019. Commercial line utilization was 58% at December

31, 2020, as compared to 61% on December 31, 2019. Mortgage

warehouse utilization was 71% at December 31, 2020, as compared to

59% on December 31, 2019.

The Company's core deposit intangible assets decreased $1.1

million to $4.3 million at December 31, 2020, from $5.4 million at

December 31, 2019, due to amortization. Goodwill remained at $27.4

million at year end 2020 and was approximately 8% of total capital

at December 31, 2020. The Company performed its annual goodwill

assessment test at year end and, because the Company was trading

above both book and tangible book value, indicating fair value

above book value, no quantitative test of goodwill impairment was

performed. The Company will continue to evaluate goodwill and will

perform additional tests if necessary.

As of December 31, 2020, deposit balances reflected growth of

$456.2 million, or 21%, for the year ended 2020. Core non-maturity

deposits increased by $457.7 million, or 28%, during the year,

while customer time deposits decreased by $51.4 million, or 11%.

Wholesale brokered deposits increased $50.0 million, or 100%,

during the year ended December 31, 2020. Overall

noninterest-bearing deposits as a percent of total deposits at

December 31, 2020, increased to 36.0% compared to 31.9% at December

31, 2019. Other interest-bearing liabilities of $217.2 million on

December 31, 2020, are comprised of $39.1 million of customer

repurchase agreements, $37.9 million in overnight FHLB borrowings,

$5.0 million in short-term FHLB borrowings, $100.0 million in

overnight fed funds purchased, and $35.1 million in subordinated

debentures. The overall increase in borrowed funds was due mostly

to support organic growth in non-owner occupied commercial real

estate loans, PPP loans, and increased mortgage warehouse line

utilization. It is anticipated that normal seasonal volatility will

reduce utilization on mortgage warehouse lines, and PPP loans will

start to be forgiven in 2021.

The Company continues to have substantial liquidity. At December

31, 2020, and December 31, 2019, the Company had the following

sources of primary and secondary liquidity ($ in thousands):

Primary and Secondary Liquidity

Sources

December

31, 2020

December

31, 2019

Cash and Due From Banks

$

71,417

$

80,077

Unpledged Investment Securities

311,983

366,012

Excess Pledged Securities

52,892

70,955

FHLB Borrowing Availability

535,404

443,200

Unsecured Lines of Credit

230,000

80,000

Funds Available through Fed Discount

Window

58,127

59,198

Totals

$

1,259,823

$

1,099,441

In addition to the primary and secondary sources of liquidity

listed above, the Company has also been approved to borrow from the

Federal Reserve's Paycheck Protection Program Liquidity Facility

(PPPLF) for any current balances of PPP loans at the time of

borrowing. Should the Company wish to draw on the PPPLF, it would

be required do so prior to March 31, 2021, and will be required to

pledge individual SBA PPP loans as collateral. The loans are taken

as collateral at their face value. Due to the Company's liquidity

at December 31, 2020, and expected liquidity in the first quarter

of 2021, it has elected not to utilize the PPPLF at this time.

Total capital of $343.9 million at December 31, 2020, reflects

an increase of $34.6 million, or 11%, relative to year-end 2019.

The increase in equity during the year ended 2020 was due to the

addition of $35.4 million in net income and a $12.5 million

favorable swing in accumulated other comprehensive income/loss, net

of $12.2 million in dividends paid, and $2.6 million in stock

repurchases prior to March 15, 2020. The remaining difference is

related to stock options exercised during the year.

Asset Quality

Total nonperforming assets, comprised of nonaccrual loans and

foreclosed assets, increased by $2.0 million to $8.6 million for

the year ended 2020. The Company's ratio of nonperforming loans to

gross loans decreased to 0.31% at December 31, 2020, from 0.33% at

December 31, 2019. All of the Company's impaired assets are

periodically reviewed and are either well-reserved based on current

loss expectations, carried at the fair value of the underlying

collateral, net of expected disposition costs, or are sufficiently

collateralized or supported by expected borrower payments such that

no specific reserve or impairment is necessary for the impaired

asset in question. There was a $1.2 million decrease during the

year ended December 31, 2020, in past-due loans between 30-89 days

and still accruing to $1.7 million. The Company's allowance for

loan and lease losses was $17.7 million at December 31, 2020, as

compared to a balance of $9.9 million at December 31, 2019. The

$7.8 million increase during the year resulted from the addition of

a $8.6 million loan loss provision for the year ended 2020, less

$0.7 million in net charge offs recorded during the year. The

additional loan loss provision in the year ended 2020 was

precipitated primarily by the increase in non-owner-occupied

commercial real estate loan balances, the downgrade of certain

loans deferred due to COVID-19, as well as the impact of changes to

qualitative factors associated with economic uncertainty during

these unprecedented times. For further information regarding the

Company's decision to defer the implementation of CECL under

Section 4014 of the CARES Act, and its extension of such deferral

under the Consolidated Appropriations Act, 2021, as well as further

detail on the increase in provision during the year ended 2020,

please see the discussion above under Provision for Loan and Lease

Losses. The allowance was 0.72% of total loans at December 31,

2020, and 0.56% at December 31, 2019. Management's detailed

analysis indicates that the Company's allowance for loan and lease

losses should be sufficient to cover credit losses inherent in loan

and lease balances outstanding as of December 31, 2020, but no

assurance can be given that the Company will not experience

substantial future losses relative to the size of the

allowance.

As discussed above under the Provision for Loan and Lease

Losses, the Company recorded $8.6 million in provision for loan and

lease losses in the year ended December 31, 2020, as compared to

$2.6 million for the comparative period in 2019. This increase is

primarily due to organic growth of non-owner occupied commercial

real estate loans, certain downgrades to loans on deferral not

treated as TDR loan modifications, and the uncertainty of economic

risks associated with the COVID-19 pandemic.

The Company provided loan modifications not designated as TDRs

to its customers of $386.2 million, $28.3 million, and $2.8 million

during the second, third, and fourth quarters of 2020,

respectively.

At December 31, 2020, approximately 295 previously modified

loans for $396.3 million have resumed normal payments and are

classified as performing loans. Previously modified loans charged

off or past due greater than 30 days were less than $0.05

million.

Loan modifications not treated as TDRs were $29.5 million at

December 31, 2020. Two loans for $6.3 million were extensions of

loans previously modified, which had matured but needed additional

time to resume payments. Of the total loans modified at year end,

$14.7 million, or 50%, are hotels, and $14.0 million, or 47%, are

lessors of non-residential buildings. Approximately 59% of loans

currently under modification have maturities within 90 days, with

the remaining 41% maturing within 180 days. All loans are well

secured based on the most recent appraisal.

About Sierra Bancorp

Sierra Bancorp is the holding company for Bank of the Sierra

(www.bankofthesierra.com), which is in its 44th year of operations

and is the largest independent bank headquartered in the South San

Joaquin Valley. Bank of the Sierra is a community-centric regional

bank, which offers a broad range of retail and commercial banking

services through full-service branches located within the counties

of Tulare, Kern, Kings, Fresno, Los Angeles, Ventura, San Luis

Obispo, and Santa Barbara. The Bank also maintains an online branch

and provides specialized lending services through an agricultural

credit center, an SBA center, and a dedicated loan production

office in Rocklin, California. In 2020, Bank of the Sierra was

recognized as one of the strongest and top-performing community

banks in the country, with a 5-star rating from Bauer

Financial.

Forward-Looking Statements

The statements contained in this release that are not historical

facts are forward-looking statements based on management's current

expectations and beliefs concerning future developments and their

potential effects on the Company. Readers are cautioned not to

unduly rely on forward-looking statements. Actual results may

differ from those projected. These forward-looking statements

involve risks and uncertainties including but not limited to our

borrowers' actual payment performance as loan deferrals related to

the COVID-19 pandemic expire, changes to statutes, regulations, or

regulatory policies or practices as a result of, or in response to

COVID-19, including the potential adverse impact of loan

modifications and payment deferrals implemented consistent with

recent regulatory guidance, the health of the national and local

economies, the Company's ability to attract and retain skilled

employees, customers' service expectations, the Company's ability

to successfully deploy new technology, the success of acquisitions

and branch expansion, changes in interest rates, loan portfolio

performance, and other factors detailed in the Company's SEC

filings, including the "Risk Factors" and "Management's Discussion

and Analysis of Financial Condition and Results of Operations"

sections of the Company's most recent Form 10-K and Form 10-Q.

STATEMENT OF CONDITION

(balances in $000's, unaudited)

ASSETS

12/31/2020

9/30/2020

6/30/2020

3/31/2020

12/31/2019

Cash and Due from Banks

$

71,417

$

88,933

$

156,611

$

106,992

$

80,077

Investment Securities

543,974

577,278

599,333

620,154

600,799

Real Estate Loans (Non-Agricultural)

1,766,018

1,695,918

1,463,235

1,259,448

1,258,081

Agricultural Real Estate Loans

129,905

127,963

134,454

141,740

144,033

Agricultural Production Loans

44,872

45,782

48,516

49,199

48,036

Commercial & Industrial Loans &

Leases

209,048

217,224

221,502

111,990

115,532

Mortgage Warehouse Lines

307,679

287,516

338,124

228,608

189,103

Consumer Loans

5,589

5,897

6,266

7,040

7,780

Gross Loans & Leases

2,463,111

2,380,300

2,212,097

1,798,025

1,762,565

Deferred Loan & Lease Fees

(3,147)

(3,078)

(2,617)

2,741

2,896

Allowance for Loan & Lease Losses

(17,738)

(15,586)

(13,560)

(11,453)

(9,923)

Net Loans & Leases

2,442,226

2,361,636

2,195,920

1,789,313

1,755,538

Bank Premises & Equipment

27,505

27,216

27,779

28,425

27,435

Other Assets

135,620

144,555

130,401

125,585

129,970

Total Assets

$

3,220,742

$

3,199,618

$

3,110,044

$

2,670,469

$

2,593,819

LIABILITIES & CAPITAL

Noninterest Demand Deposits

$

943,664

$

975,750

$

949,662

$

704,700

$

690,950

Interest-Bearing Transaction Accounts

668,346

656,922

641,815

576,014

549,812

Savings Deposits

368,420

361,857

346,262

304,894

294,317

Money Market Deposits

131,232

126,918

125,420

113,766

118,933

Customer Time Deposits

412,944

420,266

433,595

450,017

464,362

Wholesale Brokered Deposits

100,000

50,000

10,000

30,000

50,000

Total Deposits

2,624,606

2,591,713

2,506,754

2,179,391

2,168,374

Junior Subordinated Debentures

35,124

35,079

35,035

34,990

34,945

Other Interest-Bearing Liabilities

182,038

194,657

204,449

103,461

45,711

Total Deposits & Interest-Bearing

Liabilities

2,841,768

2,821,449

2,746,238

2,317,842

2,249,030

Other Liabilities

35,078

41,922

36,373

33,168

35,504

Total Capital

343,896

336,247

327,433

319,459

309,285

Total Liabilities & Capital

$

3,220,742

$

3,199,618

$

3,110,044

$

2,670,469

$

2,593,819

GOODWILL & INTANGIBLE

ASSETS

(balances in $000's, unaudited)

12/31/2020

9/30/2020

6/30/2020

3/31/2020

12/31/2019

Goodwill

$

27,357

$

27,357

$

27,357

$

27,357

$

27,357

Core Deposit Intangible

4,307

4,575

4,844

5,112

5,381

Total Intangible Assets

$

31,664

$

31,932

$

32,201

$

32,469

$

32,738

CREDIT QUALITY

(balances in $000's, unaudited)

12/31/2020

9/30/2020

6/30/2020

3/31/2020

12/31/2019

Non-Accruing Loans

$

7,598

$

7,186

$

5,808

$

7,351

$

5,737

Foreclosed Assets

971

2,970

2,893

766

800

Total Nonperforming Assets

$

8,569

$

10,156

$

8,701

$

8,117

$

6,537

Performing TDR's (not included in

NPA's)

$

11,382

$

7,708

$

9,192

$

8,188

$

8,415

Net Charge Offs

$

735

$

687

$

363

$

270

$

2,377

Past Due & Still Accruing (30-89)

$

1,656

$

7,201

$

2,333

$

4,071

$

2,875

Loans deferred under CARES Act

$

29,500

$

405,858

$

386,243

$

-

$

-

Non-Performing Loans to Gross Loans

0.31%

0.30%

0.26%

0.41%

0.33%

NPA's to Loans plus Foreclosed Assets

0.35%

0.43%

0.39%

0.45%

0.37%

Allowance for Loan Losses to Loans

0.72%

0.65%

0.61%

0.64%

0.56%

SELECT PERIOD-END STATISTICS

(unaudited)

12/31/2020

9/30/2020

6/30/2020

3/31/2020

12/31/2019

Shareholders Equity / Total Assets

10.7%

10.5%

10.5%

12.0%

11.9%

Gross Loans / Deposits

93.8%

91.8%

88.2%

82.5%

81.3%

Non-Interest Bearing Deposits / Total

Deposits

36.0%

37.6%

37.9%

32.3%

31.9%

CONSOLIDATED INCOME STATEMENT

(in $000's, unaudited)

Qtr Ended:

Qtr Ended:

Year Ended:

12/31/2020

9/30/2020

12/31/2019

12/31/2020

12/31/2019

Interest Income

$

29,762

$

29,043

$

27,775

$

110,243

$

110,947

Interest Expense

930

969

2,953

5,408

13,578

Net Interest Income

28,832

28,074

24,822

104,835

97,369

Provision for Loan & Lease Losses

2,200

2,350

500

8,550

2,550

Net Interest after Provision

26,632

25,724

24,322

96,285

94,819

Service Charges

3,013

2,950

3,356

11,765

12,742

BOLI Income

415

1,310

567

2,412

2,184

Gain (Loss) on Investments

-

-

(227)

390

(198)

Other Noninterest Income

2,611

2,845

2,150

11,583

8,749

Total Noninterest Income

6,039

7,105

5,846

26,150

23,477

Salaries & Benefits

11,042

9,698

8,957

40,178

35,978

Occupancy Expense

2,452

2,559

2,550

9,842

9,845

Other Noninterest Expenses

7,263

7,046

6,475

25,892

24,755

Total Noninterest Expense

20,757

19,303

17,982

75,912

70,578

Income Before Taxes

11,914

13,526

12,186

46,523

47,718

Provision for Income Taxes

2,935

3,170

2,901

11,079

11,757

Net Income

$

8,979

$

10,356

$

9,285

$

35,444

$

35,961

TAX DATA

Tax-Exempt Muni Income

$

1,475

$

1,467

$

1,257

$

5,707

$

4,534

Interest Income - Fully Tax Equivalent

$

30,154

$

29,433

$

28,109

$

111,760

$

112,152

PER SHARE DATA

(unaudited)

Qtr Ended:

Qtr Ended:

Year Ended:

12/31/2020

9/30/2020

12/31/2019

12/31/2020

12/31/2019

Basic Earnings per Share

$

0.59

$

0.68

$

0.61

$

2.33

$

2.35

Diluted Earnings per Share

$

0.58

$

0.67

$

0.60

$

2.32

$

2.33

Common Dividends

$

0.20

$

0.20

$

0.19

$

0.80

$

0.74

Weighted Average Shares Outstanding

$

15,222,044

$

15,192,838

$

15,285,413

$

15,216,749

$

15,311,113

Weighted Average Diluted Shares

$

15,456,984

$

15,387,309

$

15,393,381

$

15,280,325

$

15,437,111

Book Value per Basic Share (EOP)

$

22.35

$

$21.92

$

20.24

$

22.35

$

20.24

Tangible Book Value per Share (EOP)

$

20.29

$

$19.84

$

$18.09

$

20.29

$

$18.09

Common Shares Outstanding (EOP)

$

15,388,423

$

15,341,723

$

15,284,538

$

15,388,423

$

15,284,538

KEY FINANCIAL RATIOS

(unaudited)

Qtr Ended:

Qtr Ended:

Year Ended:

12/31/2020

9/30/2020

12/31/2019

12/31/2020

12/31/2019

Return on Average Equity

10.49%

12.34%

11.97%

10.80%

12.23%

Return on Average Assets

1.12%

1.34%

1.41%

1.22%

1.40%

Net Interest Margin (Tax-Equivalent)

3.91%

3.98%

4.15%

3.95%

4.19%

Efficiency Ratio (Tax-Equivalent)¹

58.68%

53.74%

57.30%

57.18%

57.46%

Net C/O's to Avg Loans (not

annualized)

0.00%

0.01%

0.10%

0.04%

0.14%

(1)

Noninterest expense as a percentage of the

sum of net interest income and noninterest income excluding net

gains (losses) from securities.

AVERAGE BALANCES AND RATES

(balances in $000's, unaudited)

For the quarter ended

For the quarter ended

For the quarter ended

December 31, 2020

September 30, 2020

December 31, 2019

Average Balance (1)

Income/ Expense

Yield/ Rate (2)

Average Balance (1)

Income/ Expense

Yield/ Rate (2)

Average Balance (1)

Income/ Expense

Yield/ Rate (2)

Assets

Investments:

Federal funds sold/interest-earning due

from's

$ 4,071

$ 2

0.20%

$ 6,942

$ 2

0.11%

$ 11,592

$ 49

1.68%

Taxable

338,554

1,657

1.95%

366,046

1,832

1.99%

422,813

2,448

2.30%

Non-taxable

225,583

1,461

3.26%

227,283

1,467

3.25%

181,633

1,257

3.48%

Total investments

568,208

3,120

2.46%

600,271

3,301

2.45%

616,038

3,754

2.63%

Loans and Leases: (3)

Real estate

1,866,418

21,629

4.61%

1,700,241

20,467

4.79%

1,413,347

19,719

5.54%

Agricultural Production

45,143

418

3.68%

47,733

435

3.63%

47,964

647

5.35%

Commercial

213,725

2,077

3.87%

226,511

2,485

4.36%

110,760

1,344

4.81%

Consumer

5,873

239

16.19%

6,226

236

15.08%

8,148

379

18.45%

Mortgage warehouse lines

270,401

2,250

3.31%

262,593

2,087

3.16%

203,593

1,883

3.67%

Other

1,617

29

7.13%

1,868

32

6.82%

2,596

49

7.49%

Total loans and leases

2,403,177

26,642

4.41%

2,245,172

25,742

4.56%

1,786,408

24,021

5.33%

Total interest earning assets (4)

2,971,385

29,762

4.04%

2,845,443

29,043

4.12%

2,402,446

$ 27,775

4.64%

Other earning assets

20,092

13,190

21,243

Non-earning assets

202,996

215,819

189,357

Total assets

$ 3,194,473

$ 3,074,452

$ 2,613,046

Liabilities and shareholders'

equity

Interest bearing deposits:

Demand deposits

$ 123,717

$ 69

0.22%

$ 140,634

$ 75

0.21%

$ 92,132

$ 69

0.30%

NOW

536,127

93

0.07%

516,915

89

0.07%

457,008

131

0.11%

Savings accounts

366,080

52

0.06%

354,331

51

0.06%

291,107

78

0.11%

Money market

129,536

27

0.08%

126,567

28

0.09%

126,211

45

0.14%

Time Deposits

416,069

310

0.30%

428,171

383

0.35%

479,441

1,779

1.47%

Wholesale Brokered Deposits

53,750

28

0.21%

29,696

15

0.20%

50,761

247

1.93%

Total interest bearing deposits

1,625,279

579

0.14%

1,596,314

641

0.16%

1,496,660

2,349

0.62%

Borrowed funds:

Junior Subordinated Debentures

35,098

253

2.87%

35,052

258

2.93%

34,919

430

4.89%

Other Interest-Bearing Liabilities

175,025

98

0.00%

107,596

70

0.26%

56,029

174

1.23%

Total borrowed funds

210,123

351

0.66%

142,648

328

0.91%

90,948

604

2.63%

Total interest bearing liabilities

1,835,402

930

0.20%

1,738,962

969

0.22%

1,587,608

2,953

0.74%

Demand deposits - Noninterest bearing

979,593

958,233

679,718

Other liabilities

39,106

43,521

38,038

Shareholders' equity

340,372

333,736

307,682

Total liabilities and shareholders'

equity

$ 3,194,473

$ 3,074,452

$ 2,613,046

Interest income/interest earning

assets

4.04%

4.12%

4.64%

Interest expense/interest earning

assets

0.13%

0.14%

0.49%

Net interest income and margin

(5)

$ 28,832

3.91%

$ 28,074

3.98%

$ 24,822

4.15%

(1)

Average balances are obtained from the

best available daily or monthly data and are net of deferred fees

and related direct costs.

(2)

Yields and net interest margin have been

computed on a tax equivalent basis utilizing a 21% effective tax

rate.

(3)

Loans are gross of the allowance for

possible loan losses. Loan fees have been included in the

calculation of interest income. Net loan fees and loan acquisition

FMV amortization were $1.0 million and $(0.04) million for the

quarters ended December 31, 2020 and 2019, respectively, and $1.3

million for the quarter ended September 30, 2020.

(4)

Non-accrual loans have been included in

total loans for purposes of computing total earning assets.

(5)

Net interest margin represents net

interest income as a percentage of average interest-earning

assets.

Distribution,

Rate & Yield

(dollars in thousands, except

footnotes)

Year Ended December

31,

2020

2019

2018

Average

Income/

Average

Average

Income/

Average

Average

Income/

Average

Assets

Balance(1)

Expense

Rate/Yield(2)

Balance(1)

Expense

Rate/Yield(2)

Balance(1)

Expense

Rate/Yield(2)

Investments:

Federal funds sold/due from banks

$

25,228

$

156

0.62%

$

16,346

$

376

2.30%

$

13,237

$

238

1.80%

Taxable

379,024

8,199

2.16%

423,453

10,139

2.39%

422,848

9,548

2.26%

Non-taxable

216,387

5,707

3.34%

160,787

4,534

3.57%

140,300

4,060

2.89%

Equity

—

—

—

—

—

—

—

—

—

Total investments

620,639

14,062

2.51%

600,586

15,049

2.71%

576,385

13,846

2.40%

Loans and

Leases: (3)

Real estate

1,610,686

79,175

4.92%

1,440,465

79,777

5.54%

1,350,425

73,006

5.41%

Agricultural

47,299

1,887

3.99%

50,042

2,973

5.94%

52,031

2,980

5.73%

Commercial

179,924

6,738

3.74%

117,679

5,918

5.03%

124,809

5,969

4.78%

Consumer

6,584

1,069

16.24%

8,497

1,340

15.77%

9,755

1,251

12.82%

Mortgage warehouse

221,319

7,135

3.22%

134,171

5,695

4.24%

86,030

4,415

5.13%

Other

2,878

177

6.15%

2,894

195

6.74%

2,682

171

6.38%

Total loans and leases

2,068,690

96,181

4.65%

1,753,748

95,898

5.47%

1,625,732

87,792

5.40%

Total interest earning assets (4)

2,689,329

110,243

4.16%

2,354,334

110,947

4.76%

2,202,117

101,638

4.66%

Other earning assets

13,103

12,421

10,514

Non-earning assets

207,590

202,810

204,316

Total assets

$

2,910,022

$

2,569,565

$

2,416,947

Liabilities and shareholders'

equity

Interest bearing

deposits:

Demand deposits

$

121,867

$

278

0.23%

$

106,849

$

316

0.30%

$

119,432

$

364

0.30%

NOW

497,984

388

0.08%

444,619

524

0.12%

425,596

478

0.11%

Savings accounts

336,620

221

0.07%

289,727

308

0.11%

298,021

314

0.11%

Money market

124,755

128

0.10%

124,625

181

0.15%

149,024

146

0.10%

CDAR's

—

—

—

—

—

—

—

—

—

Certificates of deposit<$100,000

77,119

326

0.42%

88,792

1,035

1.17%

81,940

614

0.75%

Certificates of deposit>$100,000

359,687

2,361

0.66%

396,465

7,896

1.99%

310,880

5,039

1.62%

Brokered deposits

36,071

246

0.68%

48,392

1,120

2.31%

16,822

305

1.81%

Total interest bearing deposits

1,554,103

3,948

0.25%

1,499,469

11,380

0.76%

1,401,715

7,260

0.52%

Borrowed

funds:

Federal funds purchased

1,918

4

0.21%

313

1

0.32%

22

—

—

Repurchase agreements

34,614

137

0.40%

22,090

88

0.40%

14,332

57

0.40%

Short term borrowings

54,244

102

0.19%

13,229

273

2.06%

8,967

196

2.19%

TRUPS

35,031

1,217

3.47%

34,853

1,836

5.27%

34,673

1,731

4.99%

Total borrowed funds

125,807

1,460

1.16%

70,485

2,198

3.12%

57,994

1,984

3.42%

Total interest bearing liabilities

1,679,910

5,408

0.32%

1,569,954

13,578

0.86%

1,459,709

9,244

0.63%

Non-interest bearing demand deposits

862,274

664,061

665,941

Other liabilities

39,510

41,563

30,383

Shareholders' equity

328,328

293,987

260,914

Total liabilities and shareholders'

equity

$

2,910,022

$

2,569,565

$

2,416,947

Interest income/interest earning

assets

4.15%

4.76%

4.66%

Interest expense/interest earning

assets

0.20%

0.58%

0.42%

Net interest income and

margin(5)

$

104,835

3.95%

$

97,369

4.19%

$

92,394

4.24%

(1)

Average balances are obtained from the

best available daily or monthly data and are net of deferred fees

and related direct costs.

(2)

Yields and net interest margin have been

computed on a tax equivalent basis.

(3)

Loans are gross of the allowance for

possible loan losses. Net loan fees have been included in the

calculation of interest income. Net loan fees and loan acquisition

FMV amortization were $1.9 million, $(0.4) million, and $0.8

million for the years ended December 31, 2020, 2019, and 2018

respectively.

(4)

Non-accrual loans are slotted by loan type

and have been included in total loans for purposes of total

interest earning assets.

(5)

Net interest margin represents net

interest income as a percentage of average interest-earning assets

(tax-equivalent).

Category: Financial

Source: Sierra Bancorp

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210125005094/en/

Kevin McPhaill, President/CEO Phone: (559) 782‑4900 or (888)

454‑BANK Website Address: www.sierrabancorp.com

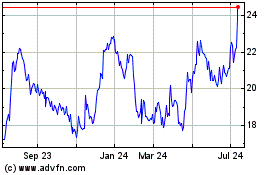

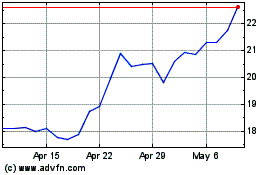

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sierra Bancorp (NASDAQ:BSRR)

Historical Stock Chart

From Apr 2023 to Apr 2024