Semtech Corporation (Nasdaq: SMTC), a high-performance

semiconductor, IoT systems and cloud connectivity service provider

(“Semtech” or “Company”), today announced the closing of its

underwritten public offering of 10,496,032 shares of its common

stock, which includes the full exercise of the underwriters’ option

to purchase an additional 1,369,047 shares of its common stock, at

a public offering price of $63.00 per share. The gross proceeds to

the Company, before deducting the underwriting discounts and

commissions and estimated offering expenses payable by the Company,

were approximately $661 million.

The Company intends to use the net proceeds from the offering

for the repayment of certain indebtedness under the Company’s Third

Amended and Restated Credit Agreement, dated September 26, 2022,

with the lenders party thereto and JPMorgan Chase Bank, N.A., as

administrative agent (“Credit Agreement”).

Morgan Stanley and UBS Investment Bank acted as joint

book-running managers for the offering.

“This transaction aligns with a key objective of balance sheet

improvement and facilitates each of the three CEO near-term

priorities to focus our strategy and rationalize our portfolio,

accelerate revenue growth and drive margin expansion and promote a

high-performance culture through our Semtech Rising initiative,”

said Hong Hou, Semtech’s president and chief executive officer.

“Semtech’s execution and performance, supported by our employees,

suppliers and partners, were foundational to the success of this

transaction.”

“We are pleased with investor support of this public offering,

which facilitated an increase in transaction size and full exercise

of the greenshoe,” said Mark Lin, Semtech’s executive vice

president and chief financial officer. “Net proceeds are expected

to reduce long-term debt to less than half of the principal

outstanding as of the end of our fiscal third quarter of 2025.

Based on current interest rates on our Credit Agreement, we expect

net proceeds from the offering will result in annual cash interest

savings of approximately $48 million.”

The offering was made pursuant to the prospectus included in the

Company’s automatically effective shelf registration statement on

Form S-3, which was filed with the Securities and Exchange

Commission (the “SEC”) on December 4, 2024, and related prospectus

supplement. Copies of the prospectus and prospectus supplement

related to the offering may be obtained from Morgan Stanley &

Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd

Floor, New York, NY 10014, or by telephone at (866) 718-1649, or by

e-mail at prospectus@morganstanley.com; or UBS Securities LLC,

Attention: Prospectus Department, 1285 Avenue of the Americas, New

York, NY 10019, or by telephone at (888) 827-7275.

This press release does not constitute an offer to sell, or the

solicitation of an offer to buy, these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

Forward-Looking and Cautionary Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, as amended, based on the

Company’s current expectations, estimates and projections about its

operations, industry, financial condition, performance, results of

operations, and liquidity. Forward-looking statements are

statements other than historical information or statements of

current condition and include statements regarding the anticipated

use of proceeds from the offering; and expected annual cash

interest savings. Statements containing words such as “may,”

“believes,” “anticipates,” “expects,” “intends,” “plans,”

“projects,” “estimates,” “should,” “could,” “will,” “designed to,”

“projections,” or “business outlook,” or other similar expressions

constitute forward-looking statements.

Forward-looking statements involve known and unknown risks and

uncertainties that could cause actual results and events to differ

materially from those projected. Potential factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the

anticipated use of proceeds from the offering; the estimated cash

interest savings realized from the anticipated use of the net

proceeds from the offering; the Company’s ability to comply with,

or pursue business strategies due to the covenants under the

agreements governing its indebtedness; the Company’s ability to

forecast and achieve anticipated net sales and earnings estimates

in light of periodic economic uncertainty; downturns in the

business cycle; and decreasing average selling prices of the

Company’s products. Additionally, forward-looking statements should

be considered in conjunction with the cautionary statements

contained in the risk factors disclosed in the Company’s filings

with the SEC, including the Company’s Annual Report on Form 10-K

for the fiscal year ended January 28, 2024, which was filed with

the SEC on March 28, 2024, as such risk factors may be amended,

supplemented or superseded from time to time by subsequent reports

the Company files with the SEC. There may be other factors not

presently known to the Company or which it currently considers to

be immaterial that could cause the Company’s actual results to

differ materially from those projected in any forward-looking

statements the Company makes. In light of the significant risks and

uncertainties inherent in the forward-looking information included

herein that may cause actual performance and results to differ

materially from those predicted, any such forward-looking

information should not be regarded as representations or guarantees

by the Company of future performance or results, or that its

objectives or plans will be achieved or that any of its operating

expectations or financial forecasts will be realized. Reported

results should not be considered an indication of future

performance. Investors are cautioned not to place undue reliance on

any forward-looking information contained herein, which reflect

management’s analysis only as of the date hereof. Except as

required by law, the Company assumes no obligation to publicly

release the results of any update or revision to any

forward-looking statements that may be made to reflect new

information, events or circumstances after the date hereof or to

reflect the occurrence of unanticipated or future events, or

otherwise.

About Semtech

Semtech Corporation (Nasdaq: SMTC) is a high-performance

semiconductor, IoT systems and cloud connectivity service provider

dedicated to delivering high-quality technology solutions that

enable a smarter, more connected and sustainable planet. Our global

teams are committed to empowering solution architects and

application developers to develop breakthrough products for the

infrastructure, industrial and consumer markets. To learn more

about Semtech technology, visit us at Semtech.com or follow us on

LinkedIn or X.

Semtech and the Semtech logo are registered trademarks or

service marks of Semtech Corporation or its subsidiaries.

SMTC-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209707790/en/

Sara Kesten Semtech Corporation (805) 480-2004

webir@semtech.com

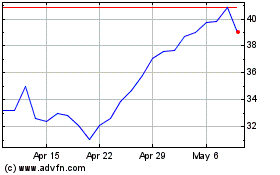

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Nov 2024 to Dec 2024

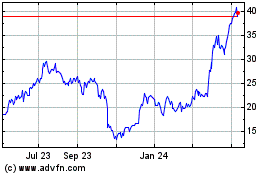

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Dec 2023 to Dec 2024