- Net sales of $236.8 million, up 10% sequentially

- Record data center net sales of $43.1 million, up 58%

sequentially

- GAAP gross margin of 51.1%, up 210 basis points sequentially

and Non-GAAP gross margin of 52.4%, up 200 basis points

sequentially

- GAAP operating margin of 7.5%, up 390 basis points sequentially

and Non-GAAP operating margin of 18.3%, up 410 basis points

sequentially

- GAAP diluted loss per share of $0.10 and Non-GAAP diluted

earnings per share of $0.26

- Adjusted EBITDA margin of 21.6%, up 280 basis points

sequentially

Semtech Corporation (Nasdaq: SMTC), a high-performance

semiconductor, IoT systems and cloud connectivity service provider,

today reported unaudited financial results for its third quarter of

fiscal year 2025, which ended October 27, 2024.

"We are very pleased to report broad-based growth across each of

our end markets, and particularly in data center, where we project

AI-driven product demand to be a long-term and transformational

growth engine for Semtech. Our results validate that our customers

and target markets are moving toward us and highlight the

effectiveness of our initiatives to drive market share gain and SAM

expansion," said Hong Hou, Semtech's president and chief executive

officer. "I believe we have achieved multi-generational roadmap

alignment with customers and aspire to become the partner of choice

for key technical and product solutions we provide."

"Our reported results and outlook demonstrate leverage in our

operating model, targeting healthy net sales growth along with

prudent spending," said Mark Lin, Semtech's executive vice

president and chief financial officer. "We reported positive

operating and free cash flows, and consistent with our previously

stated capital allocation priority, we made principal prepayments

on our credit facility in both the third and fourth quarters of

this fiscal year."

Third Quarter of Fiscal Year 2025 Results

GAAP Financial Results

Non-GAAP Financial

Results

(in millions, except per share data)

Q325

Q225

Q324

Q325

Q225

Q324

Net sales

$

236.8

$

215.4

$

200.9

$

236.8

$

215.4

$

200.9

Gross margin

51.1

%

49.0

%

46.3

%

52.4

%

50.4

%

51.3

%

Operating expenses, net

$

103.2

$

97.7

$

105.3

$

80.6

$

77.9

$

82.5

Operating income (loss)

$

17.8

$

7.8

$

(12.4

)

$

43.4

$

30.5

$

20.5

Operating margin

7.5

%

3.6

%

(6.2

)%

18.3

%

14.2

%

10.2

%

Interest expense, net

$

20.3

$

28.1

$

27.7

$

18.4

$

20.5

$

22.3

Net (loss) income attributable to common

stockholders

$

(7.6

)

$

(170.3

)

$

(38.3

)

$

20.3

$

8.1

$

1.5

Diluted (loss) earnings per share

$

(0.10

)

$

(2.61

)

$

(0.60

)

$

0.26

$

0.11

$

0.02

Adjusted EBITDA

$

51.1

$

40.5

$

28.1

Adjusted EBITDA margin

21.6

%

18.8

%

14.0

%

See "Non-GAAP Financial Measures" below for additional

information about our non-GAAP financial results.

Fourth Quarter of Fiscal Year 2025 Outlook

(in millions, except per share data)

Net sales

$

250.0

+/-

$5.0

Non-GAAP Financial Measures

Gross margin

52.8

%

+/-

50 bps

Operating expenses, net

$

82.8

+/-

$1.0

Operating income

$

49.2

+/-

$2.8

Operating margin

19.7

%

+/-

70 bps

Interest expense, net

$

19.0

Normalized tax rate

15

%

Diluted earnings per share

$

0.32

+/-

$0.03

Adjusted EBITDA

$

56.9

+/-

$2.8

Adjusted EBITDA margin

22.8

%

+/-

70 bps

Diluted share count

80.0

See "Non-GAAP Financial Measures" below for additional

information about our non-GAAP financial results.

The Company is unable to include a reconciliation of

forward-looking non-GAAP results to the corresponding GAAP measures

as this is not available without unreasonable efforts due to the

high variability and low visibility with respect to the impact of

transaction, integration and restructuring expenses, share-based

awards, amortization of acquisition-related intangible assets and

other items that are excluded from these non-GAAP measures. The

Company expects the variability of the above charges to have a

potentially significant impact on its GAAP financial results.

Webcast and Conference Call

Semtech will be hosting a conference call today to discuss its

third fiscal quarter 2025 results at 2:00 p.m. Pacific time. The

dial-in number for the call is (877) 407-0312. Please use

conference ID 13749931. An audio webcast and supplemental earnings

materials for the quarter will be available on the Investor

Relations section of Semtech's website at investors.semtech.com

under "News & Events." A replay of the call will be available

through December 23, 2024 at the same website or by calling (877)

660-6853 and entering conference ID 13749931.

Non-GAAP Financial Measures

To supplement the Company's consolidated financial statements

prepared in accordance with GAAP, this release includes a

presentation of select non-GAAP financial measures. The Company's

non-GAAP measures of gross margin, product development and

engineering expense, SG&A expense, operating expenses, net,

operating income or loss, operating margin, interest expense, net,

net (loss) income attributable to common stockholders, diluted

(loss) earnings per share, normalized tax rate, adjusted EBITDA and

adjusted EBITDA margin exclude the following items, if any and as

applicable, as set forth in the reconciliations in the tables below

under "Supplemental Information: Reconciliation of GAAP to Non-GAAP

Results."

- Share-based compensation

- Intangible amortization

- Transaction and integration related costs or recoveries

(including costs associated with the acquisition and integration of

Sierra Wireless, Inc.)

- Restructuring and other reserves, including cumulative other

reserves associated with historical activity including

environmental, pension, deferred compensation and right-of-use

asset impairments

- Litigation costs or dispute settlement charges or

recoveries

- Equity method income or loss

- Investment gains, losses, reserves and impairments, including

interest income from debt investments

- Write-off and amortization of deferred financing costs

- Loss on extinguishment of debt

- Debt commitment fee

- Goodwill and intangible impairment

- Amortization of inventory step-up

In this release, the Company also presents adjusted EBITDA,

adjusted EBITDA margin and free cash flow. Adjusted EBITDA is

defined as net (loss) income attributable to common stockholders

plus interest expense, interest income, provision (benefit) for

income taxes, depreciation and amortization, and share-based

compensation, and adjusted to exclude certain expenses, gains and

losses that the Company believes are not indicative of its core

results over time. Adjusted EBITDA margin is defined as adjusted

EBITDA as a percentage of net sales. The Company considers free

cash flow, which may be positive or negative, a non-GAAP financial

measure defined as cash flows provided by (used in) operating

activities less net capital expenditures. Management believes that

the presentation of these non-GAAP measures provides useful

information to investors regarding the Company's financial

condition and results of operations. These non-GAAP financial

measures are adjusted to exclude the items identified above because

such items are either operating expenses that would not otherwise

have been incurred by the Company in the normal course of the

Company's business operations, or are not reflective of the

Company's core results over time. These excluded items may include

recurring as well as non-recurring items, and no inference should

be made that all of these adjustments, charges, costs or expenses

are unusual, infrequent or non-recurring. For example: certain

restructuring and integration-related expenses (which consist of

employee termination costs, facility closure or lease termination

costs, and contract termination costs) may be considered recurring

given the Company's ongoing efforts to be more cost effective and

efficient; certain acquisition and disposition-related adjustments

or expenses may be deemed recurring given the Company's regular

evaluation of potential transactions and investments; and certain

litigation expenses or dispute settlement charges or gains (which

may include estimated losses for which the Company may have

established a reserve, as well as any actual settlements,

judgments, or other resolutions against, or in favor of, the

Company related to litigation, arbitration, disputes or similar

matters, and insurance recoveries received by the Company related

to such matters) may be viewed as recurring given that the Company

may from time to time be involved in, and may resolve, litigation,

arbitration, disputes, and similar matters.

Notwithstanding that certain adjustments, charges, costs or

expenses may be considered recurring, in order to provide

meaningful comparisons, the Company believes that it is appropriate

to exclude such items because they are not reflective of the

Company's core results and tend to vary based on timing, frequency

and magnitude.

These non-GAAP financial measures are provided to enhance the

user's overall understanding of the Company's comparable financial

performance between periods. In addition, the Company's management

generally excludes the items noted above when managing and

evaluating the performance of the business. The financial

statements provided with this release include reconciliations of

these non-GAAP financial measures to their most comparable GAAP

measures for the second and third quarters of fiscal year 2025 and

the third quarter of fiscal year 2024.

The Company adopted a full-year, normalized tax rate for the

computation of the non-GAAP income tax provision in order to

provide better comparability across the interim reporting periods

by reducing the quarterly variability in non-GAAP tax rates that

can occur throughout the year. In estimating the full-year non-GAAP

normalized tax rate, the Company utilized a full-year financial

projection that considers multiple factors such as changes to the

Company's current operating structure, existing positions in

various tax jurisdictions, the effect of key tax law changes, and

other significant tax matters to the extent they are applicable to

the full fiscal year financial projection. In addition to the

adjustments described above, this normalized tax rate excludes the

impact of share-based awards and the amortization of

acquisition-related intangible assets. For fiscal year 2025, the

Company's projected non-GAAP normalized tax rate is 15% and will be

applied to each quarter of fiscal year 2025. The Company's non-GAAP

normalized tax rate on non-GAAP net income may be adjusted during

the year to account for events or trends that the Company believes

materially impact the original annual non-GAAP normalized tax rate

including, but not limited to, significant changes resulting from

tax legislation, acquisitions, entity structures or operational

changes and other significant events. These additional non-GAAP

financial measures should not be considered substitutes for any

measures derived in accordance with GAAP and may be inconsistent

with similar measures presented by other companies.

To provide additional insight into the Company's fourth quarter

outlook, this release also includes a presentation of

forward-looking non-GAAP financial measures. See "Fourth Quarter of

Fiscal Year 2025 Outlook" above for further information.

Forward-Looking and Cautionary Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995, as amended, based on the

Company's current expectations, estimates and projections about its

operations, industry, financial condition, performance, results of

operations, and liquidity. Forward-looking statements are

statements other than historical information or statements of

current condition and relate to matters such as future financial

performance including the fourth quarter of fiscal year 2025

outlook; future operational performance; the anticipated impact of

specific items on future earnings; the Company's expectations

regarding near term growth trends; and the Company's plans,

objectives and expectations. Statements containing words such as

"may," "believes," "anticipates," "expects," "intends," "plans,"

"projects," "estimates," "should," "could," "designed to,"

"projections," or "business outlook," or other similar expressions

constitute forward-looking statements.

Forward-looking statements involve known and unknown risks and

uncertainties that could cause actual results and events to differ

materially from those projected. Potential factors that could cause

actual results to differ materially from those in the

forward-looking statements include, but are not limited to: the

Company's ability to comply with, or pursue business strategies due

to the covenants under the agreements governing its indebtedness;

the Company's ability to remediate material weakness in its

internal control over financial reporting, discovery of additional

weaknesses, and its inability to achieve and maintain effective

disclosure controls and procedures and internal control over

financial reporting; the Company's ability to forecast and achieve

anticipated net sales and earnings estimates in light of periodic

economic uncertainty; the inherent risks, costs and uncertainties

associated with integrating Sierra Wireless, Inc. successfully and

risks of not achieving all or any of the anticipated benefits, or

the risk that the anticipated benefits may not be fully realized or

take longer to realize than expected; the uncertainty surrounding

the impact and duration of supply chain constraints and any

associated disruptions; export restrictions and laws affecting the

Company's trade and investments, and tariffs or the occurrence of

trade wars; worldwide economic and political disruptions, including

as a result of inflation and current geopolitical conflicts;

tightening credit conditions related to the United States banking

system concerns; competitive changes in the marketplace including,

but not limited to, the pace of growth or adoption rates of

applicable products or technologies; downturns in the business

cycle; decreasing average selling prices of the Company's products;

the Company's reliance on a limited number of suppliers and

subcontractors for components and materials; changes in projected

or anticipated end-user markets; future responses to and effects of

public health crises; and the Company's ability to forecast its

annual non-GAAP normalized tax rate due to material changes that

could occur during the fiscal year, which could include, but are

not limited to, significant changes resulting from tax legislation,

acquisitions, entity structures or operational changes and other

significant events. Additionally, forward-looking statements should

be considered in conjunction with the cautionary statements

contained in the risk factors disclosed in the Company's filings

with the Securities and Exchange Commission (the "SEC"), including

the Company's Annual Report on Form 10-K for the fiscal year ended

January 28, 2024, filed with the SEC on March 28, 2024 as such risk

factors may be amended, supplemented or superseded from time to

time by subsequent reports the Company files with the SEC. In light

of the significant risks and uncertainties inherent in the

forward-looking information included herein that may cause actual

performance and results to differ materially from those predicted,

any such forward-looking information should not be regarded as

representations or guarantees by the Company of future performance

or results, or that its objectives or plans will be achieved or

that any of its operating expectations or financial forecasts will

be realized. Reported results should not be considered an

indication of future performance. Investors are cautioned not to

place undue reliance on any forward-looking information contained

herein, which reflect management's analysis only as of the date

hereof. Except as required by law, the Company assumes no

obligation to publicly release the results of any update or

revision to any forward-looking statements that may be made to

reflect new information, events or circumstances after the date

hereof or to reflect the occurrence of unanticipated or future

events, or otherwise.

Amounts reported in this press release are preliminary and

subject to the finalization of the filing of our unaudited

financial results on Form 10-Q for the three and nine months ended

October 27, 2024. Reported amounts may not foot precisely due to

rounding.

About Semtech

Semtech Corporation (Nasdaq: SMTC) is a high-performance

semiconductor, IoT systems and cloud connectivity service provider

dedicated to delivering high-quality technology solutions that

enable a smarter, more connected and sustainable planet. Our global

teams are committed to empowering solution architects and

application developers to develop breakthrough products for the

infrastructure, industrial and consumer markets.

Semtech and the Semtech logo are registered trademarks or

service marks of Semtech Corporation or its subsidiaries.

SMTC-F

SEMTECH CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in millions, except per share

data)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Net sales

$

236.8

$

215.4

$

200.9

Cost of sales

113.6

107.6

97.9

Amortization of acquired technology

2.3

2.3

10.0

Total cost of sales

115.9

109.9

107.9

Gross profit

121.0

105.5

93.0

Operating expenses, net:

Product development and engineering

42.6

40.1

46.9

Selling, general and administrative

59.8

55.8

47.7

Intangible amortization

0.1

0.3

4.9

Restructuring

0.7

1.5

3.6

Goodwill impairment

—

—

2.3

Total operating expenses, net

103.2

97.7

105.3

Operating income (loss)

17.8

7.8

(12.4

)

Interest expense

(20.8

)

(28.6

)

(28.3

)

Interest income

0.5

0.4

0.6

Loss on extinguishment of debt

—

(144.7

)

—

Non-operating (expense) income, net

(1.1

)

(1.0

)

3.5

Investment impairments and credit loss

reserves, net

—

—

(2.0

)

Loss before taxes

(3.6

)

(166.1

)

(38.6

)

Provision (benefit) for income taxes

4.0

4.2

(0.3

)

Net loss attributable to common

stockholders

$

(7.6

)

$

(170.3

)

$

(38.3

)

Loss per share:

Basic

$

(0.10

)

$

(2.61

)

$

(0.60

)

Diluted

$

(0.10

)

$

(2.61

)

$

(0.60

)

Weighted average number of shares used in

computing loss per share:

Basic

75,319

65,281

64,216

Diluted

75,319

65,281

64,216

SEMTECH CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in millions)

(unaudited)

October 27, 2024

January 28, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

136.5

$

128.6

Accounts receivable, net

142.5

134.3

Inventories

163.5

145.0

Prepaid taxes

7.8

12.0

Other current assets

107.6

114.3

Total current assets

557.8

534.2

Non-current assets:

Property, plant and equipment, net

133.2

153.6

Deferred tax assets

18.7

18.0

Goodwill

541.3

541.2

Other intangible assets, net

36.8

35.6

Other assets

91.2

91.1

Total assets

$

1,379.0

$

1,373.7

LIABILITIES AND EQUITY

(DEFICIT)

Current liabilities:

Accounts payable

$

63.9

$

45.1

Accrued liabilities

171.6

172.1

Total current liabilities

235.5

217.2

Non-current liabilities:

Deferred tax liabilities

—

0.8

Long-term debt

1,190.3

1,371.0

Other long-term liabilities

92.9

92.0

Stockholders’ deficit

(139.7

)

(307.4

)

Noncontrolling interest

—

0.2

Total liabilities & equity

(deficit)

$

1,379.0

$

1,373.7

SEMTECH CORPORATION

SUPPLEMENTAL CASH FLOW

INFORMATION

(in millions)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Free cash flow:

Net cash provided by (used in) operating activities

$

29.6

$

(5.0

)

$

(5.8

)

Net capital expenditures

(0.5

)

(3.4

)

(6.6

)

Free cash flow

$

29.1

$

(8.4

)

$

(12.4

)

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in millions, except per share

data)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Gross margin (GAAP)

51.1

%

49.0

%

46.3

%

Share-based compensation

0.3

%

0.3

%

0.3

%

Amortization of acquired technology

1.0

%

1.1

%

5.0

%

Transaction and integration related costs,

net

—

%

—

%

(0.3

)%

Adjusted gross margin

(Non-GAAP)

52.4

%

50.4

%

51.3

%

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Product development and engineering

(GAAP)

$

42.6

$

40.1

$

46.9

Share-based compensation

(3.8

)

(3.4

)

(3.0

)

Transaction and integration related costs,

net

—

—

(0.1

)

Adjusted product development and

engineering (Non-GAAP)

$

38.7

$

36.6

$

43.9

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Selling, general and administrative

(GAAP)

$

59.8

$

55.8

$

47.7

Share-based compensation

(13.8

)

(13.0

)

(3.1

)

Transaction and integration related costs,

net

(3.2

)

(1.5

)

(5.9

)

Litigation costs, net

(0.9

)

(0.1

)

—

Adjusted selling, general and

administrative (Non-GAAP)

$

41.9

$

41.3

$

38.6

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Operating expenses, net (GAAP)

$

103.2

$

97.7

$

105.3

Share-based compensation

(17.6

)

(16.4

)

(6.0

)

Intangible amortization

(0.1

)

(0.3

)

(4.9

)

Transaction and integration related costs,

net

(3.2

)

(1.5

)

(6.0

)

Restructuring and other reserves, net

(0.7

)

(1.5

)

(3.6

)

Litigation costs, net

(0.9

)

(0.1

)

—

Goodwill impairment

—

—

(2.3

)

Adjusted operating expenses, net

(Non-GAAP)

$

80.6

$

77.9

$

82.5

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share

data)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Operating income (loss) (GAAP)

$

17.8

$

7.8

$

(12.4

)

Share-based compensation

18.4

17.1

6.5

Intangible amortization

2.4

2.6

14.9

Transaction and integration related costs,

net

3.2

1.5

5.5

Restructuring and other reserves, net

0.7

1.5

3.6

Litigation costs, net

0.9

0.1

—

Goodwill impairment

—

—

2.3

Adjusted operating income

(Non-GAAP)

$

43.4

$

30.5

$

20.5

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Operating margin (GAAP)

7.5

%

3.6

%

(6.2

)%

Share-based compensation

7.8

%

8.0

%

3.3

%

Intangible amortization

1.0

%

1.2

%

7.4

%

Transaction and integration related costs,

net

1.4

%

0.7

%

2.8

%

Restructuring and other reserves, net

0.3

%

0.7

%

1.8

%

Litigation costs, net

0.3

%

—

%

—

%

Goodwill impairment

—

%

—

%

1.1

%

Adjusted operating margin

(Non-GAAP)

18.3

%

14.2

%

10.2

%

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Interest expense, net (GAAP)

$

20.3

$

28.1

$

27.7

Amortization of deferred financing

costs

(2.1

)

(2.4

)

(1.8

)

Write-off of deferred financing costs

—

(5.5

)

(3.7

)

Investment income

0.2

0.2

0.1

Adjusted interest expense, net

(Non-GAAP)

$

18.4

$

20.5

$

22.3

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

Loss on extinguishment of debt

(GAAP)

$

—

$

144.7

$

—

Loss on extinguishment of debt

—

(144.7

)

—

Adjusted loss on extinguishment of debt

(Non-GAAP)

$

—

$

—

$

—

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share

data)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

GAAP net loss attributable to common

stockholders

$

(7.6

)

$

(170.3

)

$

(38.3

)

Adjustments to GAAP net loss attributable

to common stockholders:

Share-based compensation

18.4

17.1

6.5

Intangible amortization

2.4

2.6

14.9

Transaction and integration related costs,

net

3.2

2.0

5.5

Restructuring and other reserves, net

0.7

1.5

3.6

Litigation costs, net

0.9

0.1

—

Investment (gains) losses, reserves and

impairments, net

(0.2

)

(0.2

)

1.9

Amortization of deferred financing

costs

2.1

2.4

1.8

Write-off of deferred financing costs

—

5.5

3.7

Loss on extinguishment of debt

—

144.7

—

Goodwill impairment

—

—

2.3

Total Non-GAAP adjustments before

taxes

27.5

175.6

40.2

Associated tax effect

0.4

2.8

(0.5

)

Total of supplemental information, net of

taxes

27.9

178.4

39.7

Non-GAAP net income attributable to

common stockholders

$

20.3

$

8.1

$

1.5

GAAP diluted loss per share

$

(0.10

)

$

(2.61

)

$

(0.60

)

Adjustments per above

0.36

2.72

0.62

Non-GAAP diluted earnings per

share

$

0.26

$

0.11

$

0.02

Weighted-average number of shares used

in computing diluted (loss) earnings per share:

GAAP

75,319

65,281

64,216

Non-GAAP

78,581

71,787

64,304

SEMTECH CORPORATION

SUPPLEMENTAL INFORMATION:

RECONCILIATION OF GAAP TO NON-GAAP RESULTS (CONTINUED)

(in millions, except per share

data)

(unaudited)

Three Months Ended

October 27,

2024

July 28, 2024

October 29,

2023

Q325

Q225

Q324

GAAP net loss attributable to common

stockholders

$

(7.6

)

$

(170.3

)

$

(38.3

)

Interest expense

20.8

28.6

28.3

Interest income

(0.5

)

(0.4

)

(0.6

)

Loss on extinguishment of debt

—

144.7

—

Non-operating expense (income), net

1.1

1.0

(3.5

)

Investment impairments and credit loss

reserves, net

—

—

2.0

Provision (benefit) for income taxes

4.0

4.2

(0.3

)

Share-based compensation

18.4

17.1

6.5

Depreciation and amortization

10.1

12.6

22.5

Transaction and integration related costs,

net

3.2

1.5

5.5

Restructuring and other reserves, net

0.7

1.5

3.6

Litigation costs, net

0.9

0.1

—

Goodwill impairment

—

—

2.3

Adjusted EBITDA

$

51.1

$

40.5

$

28.1

Adjusted EBITDA margin

21.6

%

18.8

%

14.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241122904051/en/

Sara Kesten Semtech Corporation (805) 480-2004

webir@semtech.com

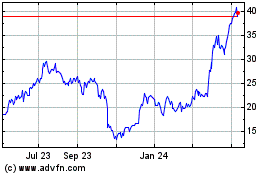

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Oct 2024 to Nov 2024

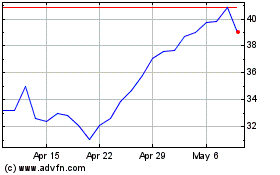

Semtech (NASDAQ:SMTC)

Historical Stock Chart

From Nov 2023 to Nov 2024