Additional Proxy Soliciting Materials (definitive) (defa14a)

May 11 2021 - 4:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange

Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

SEACOAST BANKING CORPORATION

OF FLORIDA

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Dated Filed:

|

SEACOAST BANKING CORPORATION OF FLORIDA

SUPPLEMENT TO DEFINITIVE PROXY STATEMENT DATED

APRIL 9, 2021

FOR THE 2021 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, MAY 26, 2021

This supplement (the “Supplement”)

amends and supplements the Definitive Proxy Statement of Seacoast Banking Corporation of Florida, (the “Company”) filed with

the Securities and Exchange Commission on April 9, 2021 and amended on April 30, 2021 (the “Proxy Statement”) and provided

to shareholders of the Company in connection with the Company’s 2021 Annual Meeting of Shareholders to be held on Wednesday, May

26, 2021. This Supplement is being filed with the Securities and Exchange Commission and is being made available to shareholders on or

about May 11, 2021.

Additional Information Related to

Proposal 2: Approval and Adoption of the Company’s 2021 Incentive Plan

On May 10, 2021, the Company elected to revise

the Company’s 2021 Incentive Compensation Plan (the “2021 Plan”) to reduce the number of shares available for grant

thereunder from 2,250,000 to 1,750,000.

In addition, the Company wishes to provide

updated information regarding outstanding awards. Following March 29, 2021 (the “Record Date”), the Company granted additional

awards to employees with respect to approximately 321,834 shares. As of May 7, 2021, there were outstanding awards of approximately 761,434

previously granted stock options, which have a weighted-average exercise price of $22.32 per share and a weighted-average remaining contractual

life of 4.8 years, and approximately 716,242 shares underlying outstanding full value awards; and as of that date approximately 272,741

shares remained available for grant under the Company’s 2013 Incentive Plan (“2013 Plan”). The Company will limit additional

grants in the aggregate under the 2013 Plan between May 7, 2021 and the 2021 Annual Meeting of Shareholders to be held on May 26, 2021

to no more than 70,000 shares in total. If approved, the 2021 Plan will replace the 2013 Plan in its entirety and shares under the 2013

Plan will no longer remain available for grant as of the approval of the 2021 Plan.

The revision to the 2021 Plan, in its entirety,

consists of the following changes to Section 5.1 of the 2021 Plan:

“5.1. NUMBER

OF SHARES. Subject to adjustment as provided in Sections 5.2 and Section 14.1, the aggregate number of Shares reserved and available

for issuance pursuant to Awards granted under the Plan shall be 1,750,000, plus a number of shares (not to exceed 716,242) underlying

awards outstanding as of the Effective Date under the Prior Plan that thereafter terminate or expire unexercised or are cancelled, forfeited

or lapse for any reason. The maximum number of Shares that may be issued upon exercise of Incentive Stock Options granted under the Plan

shall be 1,750,000. From and after the Effective Date, no further awards shall

be granted under the Prior Plan and the Prior Plan shall remain in effect only so long as awards granted thereunder shall remain outstanding.”

Except as specifically supplemented

by the information contained herein, all information set forth in the Proxy Statement remains unchanged. From and after the date of this

Supplement, all references to the “Proxy Statement” are to the Proxy Statement as supplemented hereby. The Proxy Statement

contains important information, and this Supplement should be read in conjunction with the Proxy Statement.

Your vote is important. Please carefully consider

the proposals included in the Proxy Statement, as well as matters disclosed in these supplemental proxy materials, and vote in favor of

such proposals, including in favor of Proposal 2, Approval and Adoption of the Company’s 2021 Incentive Plan.

If you have voted against Proposal 2 and would

like to revoke your prior vote and vote in favor of Proposal 2, you can do so at any time before the polls close at the Annual Meeting

by:

|

|

(1)

|

timely submitting another proxy via the telephone or internet;

|

|

|

(2)

|

delivering to Seacoast a written notice bearing a date later than the date of the proxy card, stating that you revoke the proxy, with

such written notice to be sent to: 815 Colorado Avenue, P.O. Box 9012, Stuart, Florida 34995, Attention: Corporate Secretary;

|

|

|

(3)

|

signing and delivering to Seacoast a proxy card relating to the same shares and bearing a later date; or

|

|

|

(4)

|

attending the Annual Meeting and voting in person by written ballet, although attendance at the meeting will not, by itself, revoke

a proxy.

|

Please note that if you have voted through your

broker, bank or other nominee and you wish to change your vote on Proposal 2, you must follow the instructions received from such entity

to change your vote.

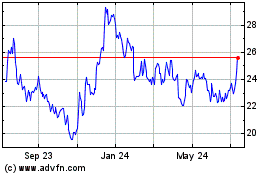

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

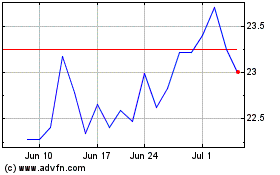

Seacoast Banking Corpora... (NASDAQ:SBCF)

Historical Stock Chart

From Apr 2023 to Apr 2024