false

0001023994

0001023994

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 1, 2024

SAFE

& GREEN HOLDINGS CORP.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-38037 |

|

95-4463937 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification Number) |

990

Biscayne Blvd.

#501,

Office 12

Miami,

FL 33132

(Address

of Principal Executive Offices, Zip Code)

(Former

name or former address, if changed since last report.)

Registrant’s

telephone number, including area code: 646-240-4235

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common Stock, par value

$0.01 |

|

SGBX |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

August 1, 2024 (the “Effective Date”), Safe & Green Holdings Corp. (the “Company”), SG Echo LLC (“SG

Echo”), a wholly owned subsidiary of the Company, and SG Environmental Solutions Corp. (“SG Environmental”), a wholly

owned subsidiary of the Company, entered into a settlement agreement (the “Settlement”) with Farnam Street Financial, Inc.

(“Farnam”) to resolve pending litigation between Farnam and the Company (the “Litigation”). The Litigation is

currently pending before the United States District Court for the District of Minnesota (Case No. 23-CV-3212) and is based on alleged

breaches by the Company of that certain lease agreement between Farnam and the Company, entered into on or around October 13, 2021 (the

“Lease”), and the related Lease Schedule No. 001 entered into in connection with the Lease (“Schedule 1”).

Simultaneously with the execution of the Settlement,

(i) the Company, SG Environmental and Farnam entered into an assignment and assumption agreement (the “Assignment”), pursuant

to which SG Environmental was substituted for the Company as the lessee under the Lease, and (ii) SG Environmental and Farnam executed

a new Lease Schedule No. 001R (“Schedule 1R”), which replaced Schedule 1 in its entirety. The salient terms of the Lease and

Schedule 1R are as follows: (i) SG Environmental will be the signatory under the “Lessee” under the Lease; (ii) the initial

term (the “Initial Term”) of Schedule 1R is 18 months; (iii) the “Commencement Date” of Schedule 1R is August

1, 2024; (iv) the original cost of the equipment subject to Schedule 1R is $1,556,163.00; (v) so long as there has been no “Default”

under the Lease and Schedule 1R, SG Environmental shall have the option to purchase the equipment at the end of the Initial Term for thirty-five

percent (35%) of the original cost of the equipment, or $544,657.05, plus applicable taxes; (vi) the “Monthly Lease Charge”

under Schedule 1R is $65,880.95, plus applicable taxes; and (vii) SG Environmental shall provide a new security deposit under Schedule

1R in the amount of $167,056.00 (“New Deposit”), which shall be paid on or before August 1, 2024.

Simultaneously

with the execution of the Settlement, the Company and SG Echo executed a guaranty (the “Guaranty”), whereby each of the Company

and SG Echo jointly and severally guarantee SG Environmental’s full and prompt payment and performance under the Lease and Schedule

1R.

Per

the Settlement, Farnam shall retain as income all prior payments from the Company (or any Company affiliate) under the Lease, Schedule

1, or any other agreement with the Company or its affiliates, including all monthly lease charges, interim rent, taxes, interest, fees,

late charges, and any security deposits, including the Schedule 1 deposit. Additionally, Farnam and the Company shall prepare and file

a stipulation dismissing the Litigation within five (5) business days of the Effective Date.

Under

the terms of the Settlement, Farnam and the Company each agree to waive and release any and all claims against the other, except with

respect to each party’s performance under the Settlement and each party’s future obligations under the Lease, Schedule 1R

and Guaranty agreements. Simultaneously with the execution of the Settlement, the Company, SG Echo, and SG Environmental have executed

a confession of judgment (the “Confession”).

The

foregoing descriptions of the Settlement, Schedule 1R, the Assignment, the Guaranty, and the Confession are qualified in their entirety

by reference to the full text of the Settlement, Schedule 1R, the Assignment, the Guaranty and the Confession, copies of which are attached

hereto as Exhibits 10.1, 10.2, 10.3, 10.4 and 10.5, respectively, and are incorporated herein in their entirety by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information provided in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits

Exhibit

Number |

|

Description |

| 10.1 |

|

Settlement Agreement, dated as of August 1, 2024, by and among Farnam Street Financial, Inc., Safe & Green Holdings Corp., SG Echo LLC, and SG Environmental Solutions Corp. |

| 10.2 |

|

Lease Schedule No. 001R, dated as of August 1, 2024, by and between Farnam Street Financial, Inc., Safe & Green Holdings Corp., and SG Environmental Solutions Corp. |

| 10.3 |

|

Assignment and Assumption, dated as of August 1, 2024, by and between Farnam Street Financial, Inc., Safe & Green Holdings Corp. and SG Environmental Solutions Corp. |

| 10.4 |

|

Unconditional Continuing Guaranty, dated as of August 1, 2024, by Safe & Green Holdings Corp. and SG Echo, LLC in favor of Farnam Street Financial, Inc. |

| 10.5 |

|

Confession of Judgment in favor of Farnam Street Financial, Inc., by Safe & Green Holdings Corp., SG Echo LLC, and SG Environmental Solutions Corp. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

SAFE & GREEN HOLDINGS CORP. |

| |

|

|

| Dated: August 7, 2024 |

By: |

/s/ Patricia

Kaelin |

| |

|

Name: Patricia Kaelin |

| |

|

Title: Chief Financial Officer |

2

Exhibit

10.1

SETTLEMENT

AGREEMENT

This

Settlement Agreement (“Agreement”) is entered into this 22nd day of July, 2024 (“Effective Date”), by and among Farnam

Street Financial, Inc. (“Farnam Street”), Safe & Green Holdings Corp. (“S&G”), SG Echo, LLC (“SG Echo”),

and SG Environmental Solutions Corp. (“SG Environmental”).

RECITALS

WHEREAS,

in October 2021 S&G, formerly known as SG Blocks, Inc., and Farnam Street entered into that certain Lease Agreement identified by

number SG101321 (the “Lease Agreement”);

WHEREAS,

in connection with the Lease Agreement, S&G and Farnam Street entered into Lease Schedule 001 (“Schedule l”);

WHEREAS,

S&G accepted and installed $1,556,163.00 worth of equipment pursuant to the Lease Agreement and Schedule 1;

WHEREAS,

the equipment accepted and installed by S&G is identified on the Certificates of Acceptance executed by S&G, and more particularly

described on Exhibit A hereto (the “Equipment”);

WHEREAS,

SG Echo, a wholly-owned subsidiary of S&G, was in possession of and using the Equipment;

WHEREAS,

SG Environmental, another wholly-owned subsidiary of S&G and affiliate of SG Echo, will take possession of and use the Equipment

moving forward;

WHEREAS,

pursuant to the Lease Agreement and Schedule 1, S&G provided a deposit to Farnam Street in the amount of $167,056.00

(“Schedule 1 Deposit”);

WHEREAS,

Farnam Street commenced litigation against S&G based on alleged breaches of the Lease Agreement and Schedule 1, which is currently

pending before the United States District Court for the District of Minnesota (Case No. 23-CV-3212) (the “Litigation”);

WHEREAS,

S&G denies the relief requested by Farnam Street in the Litigation; and

WHEREAS, to avoid the expense and inconvenience of further

litigation, Farnam Street, and S&G, along with SG Echo and SG Environmental (collectively referred to as the “Parties”

or “Party” in the singular) desire to settle their disputes and claims arising out of the leasing transaction, including the

claims asserted in the Litigation, in accordance with the terms and conditions as set forth below.

NOW

THEREFORE, in consideration of the above Recitals and the mutual promises contained in this Agreement, and for other good and valuable

consideration, the receipt and sufficiency of which the Parties each hereby acknowledge, it is agreed as follows:

AGREEMENT

1. Recitals. The recitals set forth above are incorporated herein.

2.

Assignment and Assumption of Lease Agreement. Simultaneously with the execution of this Agreement, S&G and SG Environmental shall

execute an Assignment and Assumption agreement in the form attached hereto as Exhibit B, (the “Assignment”),

thereby substituting SG Environmental for S&G as the Lessee under the Lease.

3. New

Lease Schedule 001R. Simultaneously with the execution of this Agreement, SG Environmental and Farnam Street shall execute a new

Lease Schedule 001R (“Schedule 1R”) in the form attached hereto as Exhibit C, thereby replacing Schedule 1 in

its entirety. The salient terms of the Lease Agreement and Schedule 1R will be follows:

| i. | SG

Environmental will be the signatory and “Lessee” under the Lease; |

| ii. | The

“Initial Term” of Schedule 1R is 18 months. |

| iii. | The

“Commencement Date” of Schedule 1R is August 1, 2024. |

| iv. | The

original cost of the Equipment subject to Schedule 1R is $1,556,163.00 (“OEC”). |

| v. | So

long as there has been no “Default” under the Lease Agreement and Schedule 1R, SG Environmental shall have an option to purchase

the Equipment at the end of the Initial Term for thirty-five percent (35%) of the OEC, or $544,657.05, plus applicable taxes. |

| vi. | The

“Monthly Lease Charge” under Schedule 1R is $65,880.95, plus applicable taxes. |

| vii. | SG Environmental shall

provide a new security deposit under Schedule 1R in the amount of $1,67,056.00 (“New Deposit”), which shall be paid on

or before the August 1, 2024, Commencement Date of Schedule 1R. |

To

the extent of a conflict between the terms of this Section 3 and the terms of the Lease Agreement and Schedule 1R, the terms of the Lease

Agreement and Schedule 1R shall control.

4. Guaranty of Lease. Simultaneously with the execution of this Agreement, S&G and SG Echo shall execute the attached Guaranty in the form attached hereto as Exhibit D, each of S&G and SG Echo thereby jointly and severally guaranteeing SG Environmental’s full and prompt payment and performance under the Lease Agreement and Schedule 1R.

5.

Retention of Prior Lease Payments. Farnam Street shall retain as income all prior payments made by S&G (or any affiliate of

S&G) under the Lease Agreement, Schedule 1, or any other agreement with Farnam Street, including, without limitation, all

monthly lease charges, interim rent, taxes, interest, fees, late charges, and any security deposits, including the Schedule 1

Deposit. For the avoidance of doubt, S&G, SG Echo, and SG Environmental (or any affiliate of such parties) shall not have any

right to a return or recovery of any lease payments, security deposits, or any other amounts received by Farnam Street prior to the

Effective Date.

6.

Dismissal of Litigation. Within five (5) business days after the Effective Date, Farnam Street and S&G shall prepare and file

a stipulation dismissing the Litigation with prejudice. Each Party shall bear its own fees and costs.

7.

Mutual Waiver and Release of Claims. Except with respect to each Party’s performance, obligations, and representations

under this Agreement and the Parties’ future obligations under the Lease Agreement, Schedule 1R and Guaranty agreements (and

any related documents executed in connection therewith), each Party and their respective officers, directors, shareholders,

employees, affiliates, parents, subsidiaries, successors, assigns, attorneys, and agents, hereby forever waives, releases, acquits,

and discharges any and all claims, demands, causes of action, obligations, controversies, debts, damages, losses, suits,

proceedings, contracts, judgments, damages, defenses, accounts, and liabilities of any kind or nature whatsoever (collectively,

“Claims”), whether or not previously asserted, known or unknown, present or future, against the other Party or any of

its officers, directors, shareholders, employees, affiliates, predecessors, subsidiaries, successors, assigns, consultants and

agents, whether based in contract, tort, strict liability, statute, equity, or otherwise and that arise from the beginning of time

through the Effective Date of this Agreement, including, without limitation, all claims asserted in the Litigation.

8. Confession

of Judgment. Simultaneously with the execution of this Agreement, S&G, SG Echo, and SG Environmental shall fully execute and

deliver to Farnam Street a confession of judgment in the form attached hereto as Exhibit E (“Confession”). S&G,

SG Echo, and SG Environmental each confirm that the “Judgment Amount” of $2,000,000.00 as stated in the Confession is justly

due to Farnam Street.

9. Binding

Effect. This Agreement shall bind and inure to the benefit of the Parties and their respective representatives, receivers, trustees,

successors, parent companies, subsidiaries and affiliates, predecessors, officers, directors, employees, agents, and assigns.

10. Modifications.

This Agreement contains the entire understanding of the Parties with respect to the specific matters addressed and supersedes all

prior understandings, discussions, and negotiations. Any change, amendment, or alteration to this Agreement must be in writing and signed

by all Parties to be effective. Each Party warrants that is it not relying on any other representations, written or oral, in entering

into this Agreement.

11. Full

Understanding; Legal Counsel. Each Party to this Agreement acknowledges, represents, and agrees that it has read this Agreement and

that it fully understands and voluntarily accepts this Agreement for final resolution and settlement of the Litigation as set forth in

this Agreement. Each Party to this Agreement further acknowledges, represents, and agrees that it has had the opportunity to consult

with its own legal counsel prior to execution of this Agreement.

12. Construction.

This Agreement is a product of negotiations among the Parties and has been jointly drafted and approved by each Party. For these

reasons, no provision of this Agreement shall be interpreted or construed against a Party for the reason that said Party proffered or

drafted the language at issue.

13. Authority

to Sign. Each person executing this Agreement expressly represents and warrants that he or she is fully authorized to enter into

this Agreement on behalf of his or her respective Party for the purpose of binding that Party to the terms and conditions of this Agreement,

and binding that Party’s respective subsidiaries and affiliates, predecessors and successors, officers, directors, employees, and assigns.

14.

Headings. Section headings in this Agreement are included only for the convenience of reference and shall not affect the

interpretation of any provision of this Agreement nor any of the rights or obligations of the Parties.

15. Severability.

If any covenant, condition, term, or provision of this Agreement is deemed illegal, or if the application of any covenant, condition,

term, or provision of this Agreement to any person or in any circumstance shall to any extent be judicially determined to be invalid

or unenforceable, the remainder of this Agreement, or the application of such covenant, condition, term, or provision to persons or in

circumstances other than those to which it is held to be invalid or unenforceable, shall not be affected, and each covenant, condition,

term and provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

16. Attorneys’

Fees and Costs. The Parties shall bear their own attorneys’ fees incurred in connection with the negotiation and implementation of

this Agreement. Notwithstanding the foregoing, in any action brought by either Party to enforce the terms of this Agreement, the prevailing

party shall be entitled to recover its reasonable attorneys’ fees and costs incurred therein.

17. Governing

Law; Venue. This Agreement shall be construed and interpreted according to the laws of the State of Minnesota. Venue for any dispute

arising out of this Agreement shall be in the federal or state courts located in Hennepin County, Minnesota.

18. Counterparts.

This Agreement may be executed by electronic signature (e.g., .pdf) and in counterparts, each of which shall be deemed an original,

and said counterparts shall constitute one and the same instrument.

(signature

page follows)

By

signing below, the Parties enter into this Agreement as of the Effective Date.

| SAFE & GREEN HOLDINGS CORP., |

|

FARNAM

STREET FINANCIAL, |

| a Delaware corporation |

|

INC., a Minnesota corporation

|

| |

|

|

|

|

| By |

/s/ Caleb Zobrist |

|

By |

/s/

Steve Morgan |

| Title |

Legal

officer |

|

Title |

President |

| Date |

7/31/2024 |

|

Date |

8-1-2024 |

| |

|

|

|

|

| SG

ECHO, LLC, a Delaware limited |

|

|

|

| liability

company |

|

|

|

| |

|

|

|

|

| By |

/s/ Caleb Zobrist |

|

|

|

| Title |

Legal

officer |

|

|

|

| Date |

7/31/2024 |

|

|

|

| |

|

|

|

|

| SG

ENVIRONMENTAL SOLUTIONS |

|

|

|

| CORP.,

a Delaware corporation |

|

|

|

| |

|

|

|

|

| By |

/s/ Caleb Zobrist |

|

|

|

| Title |

Legal

officer |

|

|

|

| Date |

7/31/2024 |

|

|

|

6

Exhibit 10.2

LEASE SCHEDULE NO. 001R

“This Lease Schedule No. 001R replaces

Lease Schedule No. 001.”

This Lease Schedule is issued pursuant

to the Lease Agreement Number SG101321 dated October 13, 2021. The terms of the Lease Agreement and serial numbers contained on Certificate

of Acceptance Numbers SG101321-001- 001 thru SG101321-001-006 are a part hereof and are incorporated by reference herein.

| |

LESSOR |

LESSEE |

| |

Farnam Street Financial, Inc. |

SG Environmental Solutions Corp. |

| |

5850 Opus Parkway, Suite 240 |

990 Biscayne Boulevard |

| |

Minnetonka, MN 55343 |

Miami, FL 33132 |

| |

SUPPLIER OF EQUIPMENT |

LOCATION OF EQUIPMENT |

| |

Various |

2917 Big Lots Parkway

Durant, OK 74701 |

Initial Term of Lease from Commencement

Date: 18 Months

Monthly Lease Charge: $65,880.95

Delivery and Installation: June

2022 – July 2024

Commencement Date: August 1, 2024

Security Deposit: Due on or before August

1, 2024, Lessee shall deliver a security deposit in the amount of $167,056.00. Provided that there has been no event of default and

Lessee has returned all of the Equipment under this Lease Schedule per the terms of the Lease Agreement, this security deposit will

be returned to Lessee.

EQUIPMENT

MANUFACTURER QTY MACHINE/MODEL EQUIPMENT DESCRIPTION

(including features)

See Attachment A

The total Equipment cost on this Lease

Schedule is $1,556,163.00. Interim rent billed prior to the Commencement date shall not reduce or

offset Lessee’s post-Commencement Monthly Lease Charge obligations hereunder.

Every Term is Agreed to and Accepted:

FARNAM STREET FINANCIAL, INC. |

|

Every Term is Agreed to and Accepted:

SG ENVIRONMENTAL SOLUTIONS CORP. |

| “LESSOR” |

|

“LESSEE” |

| |

|

|

|

|

| By: |

/s/

Steve Morgan |

|

By: |

/s/

Paul M Galvin |

| Print Name: |

Steve

Morgan |

|

Print Name: |

Paul

M Galvin |

| Title: |

President |

|

Title: |

CEO |

| Date: |

Aug

1, 2024 |

|

Date: |

Aug

1, 2024 |

| Lease Agreement Number: SG101321 |

Page: 1 of 2 |

| Lease Schedule Number: |

001R |

ATTACHMENT A

| MANUFACTURER |

QTY |

MACHINE/MODEL |

EQUIPMENT DESCRIPTION (incl. features) |

| SANITEC INDUSTRIES |

1 |

|

Freight |

| SANITEC INDUSTRIES |

1 |

|

Tariffs/Fees |

| SANITEC INDUSTRIES |

1 |

HG-A-250S |

Microwave Medical Waste Disinfection Unit, Dimensions: 24’6“L X 9’4“W X 10’11” H, Weight 22,000Lbs., Waste Throughput Capacity Based On An Average Waste Density of 11lb/ft(3) (180KG/M(3): 1,800Lbs./Hr, Water Connection: 3/4” N.P.T. (15 Gal/Hr Or 54 Liters/Hr), In-Feed Hopper, Microwave Screw, and Discharge Screw Material Composition: Stainless Steel Product Housing & Waste Contact Surfaces With External Insulation/With Cover |

| SANITEC INDUSTRIES |

1 |

|

Waste Cart Charging System |

| SANITEC INDUSTRIES |

1 |

|

In-Feed Hopper |

| SANITEC INDUSTRIES |

1 |

|

Extraction Filter System |

| SANITEC INDUSTRIES |

1 |

|

Shredding Assembly, Reversible |

| SANITEC INDUSTRIES |

1 |

|

Transfer Hopper |

| SANITEC INDUSTRIES |

1 |

|

Microwave Section |

| SANITEC INDUSTRIES |

1 |

|

Microwave Generator (6) |

| SANITEC INDUSTRIES |

1 |

|

Temperature Holding Section (THS) |

| SANITEC INDUSTRIES |

1 |

|

Treaded Waste Discharge Screw (THS Screw) |

| SANITEC INDUSTRIES |

1 |

|

Built-In Generator, Steam Generator |

| SANITEC INDUSTRIES |

1 |

|

Hydrualic System |

| SANITEC INDUSTRIES |

1 |

|

Enclosure Ventilation Fan & Automatic Louvers |

| SANITEC INDUSTRIES |

1 |

|

Microwave Survery |

| SANITEC INDUSTRIES |

1 |

|

Water Pump |

| SANITEC INDUSTRIES |

1 |

|

Additional Components Supplied |

| SANITEC INDUSTRIES |

1 |

HG-A-250S |

Microwave Medical Waste Disinfection Unit, Dimensions: 24’6“L X 9’4“W X 10’11” H, Weight 22,000Lbs., Waste Throughput Capacity Based On An Average Waste Density of 11lb/ft(3) (180KG/M(3): 1,800Lbs./Hr, Water Connection: 3/4” N.P.T. (15 Gal/Hr Or 54 Liters/Hr), In-Feed Hopper, Microwave Screw, and Discharge Screw Material Composition: Stainless Steel Product Housing & Waste Contact Surfaces With External Insulation/With Cover |

| SANITEC INDUSTRIES |

1 |

|

Waste Cart Charging System |

| SANITEC INDUSTRIES |

1 |

|

In-Feed Hopper |

| SANITEC INDUSTRIES |

1 |

|

Extraction Filter System |

| SANITEC INDUSTRIES |

1 |

|

Shredding Assembly, Reversible |

| SANITEC INDUSTRIES |

1 |

|

Transfer Hopper |

| SANITEC INDUSTRIES |

1 |

|

Microwave Section |

| SANITEC INDUSTRIES |

1 |

|

Microwave Generator (6) |

| SANITEC INDUSTRIES |

1 |

|

Temperature Holding Section (THS) |

| SANITEC INDUSTRIES |

1 |

|

Treaded Waste Discharge Screw (THS Screw) |

| SANITEC INDUSTRIES |

1 |

|

Built-In Generator, Steam Generator |

| SANITEC INDUSTRIES |

1 |

|

Hydrualic System |

| SANITEC INDUSTRIES |

1 |

|

Enclosure Ventilation Fan & Automatic Louvers |

| SANITEC INDUSTRIES |

1 |

|

Microwave Survery |

| SANITEC INDUSTRIES |

1 |

|

Water Pump |

| SANITEC INDUSTRIES |

1 |

|

Additional Components Supplied |

| PROSERV CRANE & EQUIPMENT, INC. |

4 |

|

5 Ton “SET” Single Girder Electric Top Running Bridge Cranes X 60’=0” Spans |

| PROSERV CRANE &

EQUIPMENT, INC. |

1 |

|

175 Ft. of Four-Conductor Runway Electrification Complete with all Necessary Hardware for Installation |

| PROSERV CRANE & EQUIPMENT, INC. |

1 |

|

350 Linear Ft. of 30# ASCE Rail Complete with Hook Bolts and Splice Bars |

| PROSERV CRANE & EQUIPMENT, INC. |

1 |

|

Freight |

| PROSERV CRANE & EQUIPMENT, INC. |

1 |

|

Start Up &

Load Test |

| Lease Agreement Number: SG101321 |

Page: 2 of 2 |

| Lease Schedule Number: |

001R |

| Agreed to and Accepted: |

|

Agreed to and Accepted: |

| |

|

|

| FARNAM STREET FINANCIAL, INC. |

|

SG ENVIRONMENTAL SOLUTIONS CORP. |

| |

|

|

| “LESSOR” |

|

“LESSEE” |

| |

|

|

|

|

| By: |

/s/

Steve Morgan |

|

By: |

/s/

Paul M Galvin |

| Print

Name: |

Steve

Morgan |

|

Print

Name: |

Paul

M Galvin |

| Title: |

President |

|

Title: |

CEO |

| Date: |

Aug

1, 2024 |

|

Date: |

Aug

1, 2024 |

| Rider Number: |

003 |

| |

|

| Lease Agreement Number: |

SG101321 |

| |

|

| Lease Schedule Number: |

001 |

| |

|

| Lessee Name: |

SG ENVIRONMENTAL SOLUTIONS CORP. |

| |

|

| Lease Agreement Dated: |

OCTOBER 13, 2021 |

PURCHASE OPTION

If (i) an Event of Default has

not occurred, and (ii) Lessor has received all of the Lease Charges currently due under Lease Schedule No. 001 (including all late fees

whether billed or unbilled), Lessee shall have the option to purchase the Equipment in its physical possession and on this Lease Schedule

on the last day of the initial term, in whole and not in part, for thirty-five percent (35%) of the original Equipment cost (plus applicable

taxes). If the conditions above have been met, Lessee can exercise this option by providing written notification of its election to exercise

not less than one hundred twenty (120) days prior to the last date of the initial term of this Lease Schedule. If a sale is not consummated,

the notice provided to exercise this option shall be accepted as a notice to terminate and return all the Equipment, and Lessee will return

all the Equipment on this Lease Schedule in accordance with the Lease Agreement. If Lessee does not return all the Equipment, the Lease

Schedule will continue in accordance with the Lease Agreement.

Lessee will receive title to the

Equipment free and clear of all known liens only after Lessee has performed all its obligations associated with the Lease Agreement and

Lessor has been paid all sums due or becoming due under both this purchase option and the Lease Agreement, including, whether billed or

not, all lease charges, taxes, and late fees. Lessor shall retain as income all monies received in association with the Lease Schedule

including all rent, taxes, and other monthly lease charges, excluding the security deposit, and Lessee hereby waives any right to offset

these monies against the costs associated with the exercise of this purchase option. Any sales or use tax due and not paid on these monies

shall be added to the purchase price above.

| Every Term is Agreed to and Accepted: |

|

Every Term is Agreed to and Accepted: |

| |

|

|

| FARNAM STREET FINANCIAL, INC. |

|

SG ENVIRONMENTAL SOLUTIONS CORP. |

| “LESSOR” |

|

“LESSEE” |

| |

|

|

|

|

| By |

/s/

Steve Morgan |

|

By: |

/s/

Paul M Galvin |

| Print |

|

|

Print |

|

| Name: |

Steve

Morgan |

|

Name: |

Paul

M Galvin |

| Title: |

President |

|

Title: |

CEO |

| Date: |

Aug

1, 2024 |

|

Date: |

Aug

1, 2024 |

Exhibit 10.3

Assignment

and Assumption

This Assignment and Assumption

with Lessor’s Consent (“Agreement”) dated the August 1, 2024 (“Effective Date”) is by and between FARNAM

STREET FINANCIAL, INC. (“Lessor”), with an office located at 5850 Opus Parkway, Suite 240, Minnetonka, MN 55343, SAFE

& GREEN HOLDINGS CORP. F/K/A SG BLOCKS, INC. (“Lessee”) with an office located at 990 Biscayne Boulevard, Miami, FLA

33132 and SG ENVIRONMENTAL SOLUTIONS CORP. (“New Lessee”) with an office located at 990 Biscayne Boulevard, Miami,

FLA 33132. (Lessor, Lessee and New Lessee are collectively referred to herein as the “Parties”).

W I T N E S S E T H:

WHEREAS, Lessor and Lessee entered

into Lease Agreement Number SG101321 dated October 13, 2021 (the “Lease Agreement”);

WHEREAS, on

October 26, 2021, Lessor and Lessee executed the following lease documents: (i) a Monthly Lease Charge Adjustment Rider; and (ii) a Right

of First Refusal;

WHEREAS, on October 26, 2021, Lessor

and Lessee entered into Lease Schedule No. 001 to the Lease Agreement (“Schedule 001”) with a total committed Equipment cost

of $2,000,000.00, a projected commencement date of February 1, 2022, a security deposit of $167,056.00, and an initial term following

commencement of twenty-four (24) months; Lessee accepted and installed $1,556,163.00 of Equipment , less than the committed Equipment

cost; as a result, Schedule 001 was not commenced. (The Lease Agreement, the Schedule 001, and all related documents are sometimes hereafter

collectively referred to in this Agreement as the “Lease”);

WHEREAS, in December 2022, SG Blocks,

Inc. changed its name to Safe & Green Holdings Corp;

WHEREAS, New Lessee is a wholly

owned subsidiary of Lessee, and is in possession of, and using the Equipment installed under the Lease;

WHEREAS, in 2024 Lessor began breach

of contract proceedings against Lessee in United States District Court for the District of Minnesota. The parties agreed on settlement

terms pursuant to a settlement agreement (the “Settlement Agreement”) for the purpose of, among other things, foregoing further

costs in the litigation proceedings; and

WHEREAS, under

the terms of the Settlement Agreement, Lessor and Lessee agree that (i) Lessee will assign the Lease to New Lessee and New Lessee agrees

to assume the Lease pursuant to this Agreement, and (ii) immediately upon assignment of the Lease pursuant to this Agreement, New Lessee

and Lessor will execute a new Lease Schedule No. 001R in the form attached to the Settlement Agreement (“Schedule 001R”),

thereby replacing Schedule 001.

NOW, THEREFORE,

in consideration of the foregoing recitals and mutual covenants contained herein, and for other good and valuable consideration, the receipt

and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

Assignment

& Assumption. As of the Effective Date, Lessee hereby assigns, conveys, and transfers all rights and interests in

the Lease to the New Lessee. The New Lessee hereby desires to and does accept Lessee’s assignment and assumes the Lease and

all the associated debts, liabilities, obligations, and duties. New Lessee now and forever agrees to be unconditionally bound by all

the terms, conditions, covenants, duties, and obligations contained in the Lease. Further, the New Lessee now and forever

unconditionally agrees that the terms, conditions, covenants, duties, and obligations contained in the Lease are valid and legally

enforceable against the New Lessee. Lessor does not waive any rights which it may have been entitled to exercise prior to this

Agreement. Further, Lessee agrees that Lessor shall retain as income all monies received from Lessee under the Lease including all

security deposits.

Waiver & Estoppel.

New Lessee agrees and acknowledges that the Lease is a true lease under Article 2A of the Uniform Commercial Code, adopted in Minnesota

by Minn. Stat. Sec. 336.2A, et. seq., and that the Lessor is now and continues to be the owner of the equipment subject to the Lease (the

“Equipment”). New Lessee agrees to waive the right to assert, and acknowledges that it is hereby estopped from asserting,

that the Lease that is the subject of this Agreement is a secured financing. New Lessee agrees to be bound by all Certificates of Acceptance

as if it had executed the Certificates of Acceptance and further acknowledges that it is accepting the Equipment on an “as-is”

“where-is” basis, thereby waiving any and all claims that the condition of the Equipment renders New Lessee’s obligations

under this Agreement unenforceable.

Release.

The Lessee and New Lessee hereby release, acquit, and forever discharge Lessor and each and every past and present subsidiary, affiliate,

stockholder, officer, director, agent, servant, employee, representative, and attorney of the Lessor from any and all claims, causes of

action, suits, debts, liens, obligations, liabilities, demands, losses, costs and expenses (including attorneys’ fees) of any kind,

character, or nature whatsoever, known or unknown, fixed or contingent, which either of them may have or claim to have now or which may

hereafter arise out of or be connected with any act of commission or omission of Lessor existing or occurring prior to the date of this

Agreement or any instrument executed prior to the date of this Agreement including, without limitation, any claims, liabilities or obligations

arising with respect to the Lease. The provisions of this Section shall survive payment and performance of all obligations and shall be

binding upon the Lessee and New Lessee and shall inure to the benefit of Lessor and its successors and assigns.

Incorporation by Reference.

Lessor, Lessee and New Lessee agree that the terms and conditions of the Lease are incorporated herein by reference.

Lessor’s Consent.

Based on the terms and conditions contained in this Agreement, the Lessor hereby consents to the above assignment from Lessee to New Lessee

as of the Effective Date, provided that: (i) that Lessee is not in default under the Lease; (ii) that all sums due, including taxes and

rental payments, have been paid; (iii) that such consent is not interpreted as consent to any further assignments; (iv) that such consent

shall not be construed as a waiver or release of any right, debt, liability, or obligation which may accrue or has accrued under the Lease;

and

(v)

that both the Lessee and New Lessee have executed this document. Lessor’s consent shall not be valid until an executed original

has been received by the Lessor.

Lease Agreement Unmodified.

This Assignment and Assumption does not alter the terms and conditions of the Lease except as expressly provided herein.

Execution;

Counterparts. Lessor, Lessee and New Lessee have executed and delivered this Agreement or caused this Agreement to be executed

and delivered by its duly authorized officer. This Agreement may be executed in any number of counterparts, each of which will be considered

an original, and all such counterparts shall constitute one and the same instrument. This Agreement may be executed and delivered via

facsimile or transmitted electronically in either “Tagged Image Format Files” (“TIFF”) or “Portable Document

Format” (“PDF”). Upon such delivery, each Party’s facsimile, TIFF or PDF signature (as applicable) will have the

same force and effect as an original signature.

| LESSOR: |

AGREED TO AND ACCEPTED BY: |

| |

|

| |

FARNAM STREET FINANCIAL, INC. |

| |

|

|

| |

Authorized |

|

| |

Signature: |

/s/ Steve Morgan |

| |

Print Name: |

Steve Morgan |

| |

Title: |

President |

| LESSEE: |

AGREED TO AND ACCEPTED BY: |

| |

|

| |

SAFE & GREEN HOLDINGS CORP. F/K/A SG BLOCKS, INC. |

| |

|

| |

Authorized |

|

| |

Signature: |

/s/ Paul M Galvin |

| |

Print Name: |

Paul M Galvin |

| |

Title: |

CEO |

| NEW LESSEE: |

AGREED TO AND ACCEPTED BY: |

| |

|

| |

SG ENVIRONMENTAL SOLUTIONS CORP. |

| |

|

| |

Authorized |

|

| |

Signature: |

/s/ Paul M Galvin |

| |

Print Name: |

Paul M Galvin |

| |

Title: |

CEO |

3

Exhibit 10.4

This

Unconditional Continuing Guaranty (the “Guaranty”), is made and entered into as of August 1, 2024, by Safe & Green

Holdings Corp. and SG Echo, LLC (the “Guarantors”) both with principal offices at 990 Biscayne Boulevard, Miami, Florida

33132 in favor of Farnam Street Financial, Inc., with an office at 5850 Opus Parkway, Suite 240, Minnetonka, MN 55343 (the “Lessor”).

In consideration of Lessor and SG Environmental Solutions Corp., with an office at 990 Biscayne Boulevard, Miami, Florida 33132 (the

“Lessee”) becoming parties to Lease Agreement Number SG101321, the Guarantors (and all successors) agrees as follows:

1.

Definitions. As used in this Guaranty: “Obligation(s)” means all rents, monies, debts, liabilities, agreements

and other obligations of the Lessee to the Lessor, whether direct or indirect, absolute or contingent, due or to become due, secured

or unsecured, now existing or hereafter arising or acquired under the Lease, the Lease Schedules entered into pursuant and subject to

the Lease and any other agreement or writing evidencing, securing or otherwise executed in connection with the Lease or any above referenced

Obligation.

2.

Guaranty of Payment and Performance. The Guarantors hereby guarantee to the Lessor the full and punctual payment when due

(whether at maturity, by acceleration or otherwise) at the place specified therefor or, if no place of payment is specified, at the office

designated by the Lessor, and the performance, of each Obligation of the Lessee to the Lessor. This Guaranty is an absolute, unconditional

and continuing guaranty of the full and punctual payment and performance of the Obligations and not of their collectability only and

is in no way conditioned upon any requirement that the Lessor first attempt to collect any of the Obligations from the Lessee or resort

to any security or other means of obtaining their payment. Should the Lessee default in the payment or performance of any of the Obligations,

the obligations of the Guarantors hereunder shall become immediately due and payable to the Lessor, without demand or notice of any nature,

all of which are expressly waived by the Guarantors. Payments by the Guarantors hereunder may be required by the Lessor on any number

of occasions.

3.

Guarantor’s Agreement to Pay. The Guarantors further agree, as the principal obligors and not as a guarantors only,

to pay to the Lessor, on demand, in funds immediately available to the Lessor: (a) the amount of each Obligation which has not been paid

when due at the place of payment specified therefor, or if no place of payment is specified, at the office designated by the Lessor;

and (b) all costs and expenses (including court costs and legal expenses) incurred or expended by the Lessor in connection with the Obligations,

this Guaranty and the enforcement thereof, together with interest on amounts recoverable under this Guaranty from the time such amounts

become due until payment, at the rate equal to one and one-half percent (1½%) per month; provided that if such interest exceeds

the maximum amount permitted to be paid under applicable law, then such interest shall be reduced to such maximum permitted amount. This

Guaranty shall remain in full force and effect until all the Obligations are paid in full. This Guaranty shall continue to be effective

or be reinstated, if at any time any payment made or value received with respect to an Obligation is rescinded or must otherwise be returned

by the Lessor upon the insolvency, bankruptcy or reorganization of the Lessee, or otherwise, all as though such payment had not been

made or value received. Guarantors expressly waive the right to revoke or terminate this Guaranty. The liability of the Guarantors hereunder

shall be unlimited and be continuing until all of the Obligations are paid in full.

4. Waivers

by Guarantor. The Guarantors agree that the Obligations will be paid and performed strictly in accordance with their

respective terms regardless of any law, regulation or order now or hereafter in effect in any jurisdiction affecting any of the

rights of the Lessor with respect thereto. The Guarantors waive presentment, demand, protest, notice of acceptance, notice of

Obligations incurred and all other notices of any kind, all defenses which may be available by virtue of any valuation, stay,

moratorium law or other similar law now or hereafter in effect, any right to require the marshaling of assets of the Lessee, and all

defenses available to a surety, guarantor or accommodation co-obligor. Without limiting the generality of the foregoing, the

Guarantors agree to the provisions of the Lease and agrees that the obligations of the Guarantors hereunder shall not be released or

discharged, in whole or in part, or otherwise affected by (i) the failure of the Lessor to assert any claim or demand or to enforce

any right or remedy against the Lessee; (ii) any extensions or renewals of any Obligation; (iii) any rescissions, waivers,

amendments or modifications of any of the terms or provisions of the Lease; (iv) the substitution or release of any entity primarily

or secondarily liable for any Obligation; (v) the adequacy of any rights the Lessor may have against any collateral or other means

of obtaining repayment of the Obligations; (vi) the impairment of any collateral securing the Obligations, including without

limitation the failure to perfect or preserve any rights the Lessor might have in such collateral or the substitution, exchange,

surrender, release, loss or destruction of any such collateral; or (vii) any other act or omission which might in any manner or to

any extent vary the risk of the Guarantors or otherwise operate as a release or discharge of the Guarantors, all of which may be

done without notice to the Guarantors. No amendment or waiver of any provision of this Guaranty nor consent to any departure by the

Guarantors therefrom shall be effective unless put in writing and signed by the Lessor. No failure on the part of the Lessor to

exercise, and no delay in exercising, any right hereunder shall operate as a waiver thereof; nor shall any single or partial

exercise of any right hereunder preclude any other or further exercise thereof or the exercise of any other right.

5.

Unenforceability of Obligations Against Lessee. If for any reason the Lessee has no legal existence or is under no legal obligation

to discharge any of the Obligations, this Guaranty shall nevertheless be binding on the Guarantors to the same extent as if the Guarantors

at all times had been the principal obligor on all such Obligations. In the event that acceleration of the time for payment of the Obligations

is stayed upon the insolvency, bankruptcy or reorganization of the Lessee, or for any other reason, all such amounts otherwise subject

to acceleration under the terms of the Lease shall be immediately due and payable by the Guarantors.

6.

Further Assurances/Financial Condition of Lessee. The Guarantors agree that they will, from time to time at the request of

Lessor, provide to the Lessor their most recent balance sheets and related statements of income and changes in financial condition and

such other information relating to the business and affairs of the Guarantors as the Lessor may reasonably request. The Guarantors assume

the responsibility for being and keeping themselves informed of the financial condition of Lessee and of all other circumstances bearing

upon the risk of liability hereunder. Lessor shall have no duty to advise Guarantors of information known to it regarding the Lessee

or its financial condition. The Guarantors also agree to do all such things and execute all such documents, including financing statements,

as the Lessor may consider necessary or desirable to give full effect to this Guaranty and to perfect and preserve the rights and powers

of the Lessor hereunder.

7.

Attorneys’ Fees and other Costs. Guarantors, in addition to all other sums which Guarantors may be called upon to pay

to the Lessor pursuant to this Guaranty, shall pay to or Lessor, on demand, all costs, expenses and fees paid or payable related to or

arising under this Guaranty or the Lease, including, but not limited to, attorneys’ fees and out-of-pocket costs, including travel

and related expenses incurred by Lessor or its attorneys. The term “attorneys’ fees” means the full cost of legal services

relating to any action, suit, counterclaim, post-judgment motions, bankruptcy litigation, appeal, arbitration or mediation related to

or arising under this Guaranty or the Lease.

8.

Subordination/Subrogation. Until the payment and performance in full of all Obligations, the Guarantors shall not exercise

any rights against the Lessee arising as a result of payment by the Guarantors hereunder, by way of subrogation, contribution, indemnity,

reimbursement or otherwise. The Guarantors agree that after the occurrence of any default in the payment or performance of the Obligations,

the Guarantors will not demand, sue for or otherwise attempt to collect any such indebtedness of the Lessee to the Guarantors until the

Obligations shall have been paid in full.

9. Successors and Assigns.

This Guaranty shall be binding upon the Guarantors, their successors and assigns, and shall inure to the benefit of and be enforceable

by the Lessor and its successors, transferees and assigns. Without limiting the generality of the foregoing sentence, the Lessor may

assign or otherwise transfer any Lease or any note held by it evidencing the Obligations, and such other person or entity shall thereupon

become vested, to the extent set forth in the agreement evidencing such assignment, transfer or participation, with all the rights in

respect thereof granted to the Lessor herein.

10. Governing

Law. This Guaranty shall be governed by, and construed in accordance with, the substantive laws and decisions of the State

of Minnesota. The Guarantors agree that any suit for the enforcement of this Guaranty may be brought in the courts of Minnesota or

any Federal Court sitting in Minnesota and consent to the jurisdiction of such court and to service of process in any such suit

being made upon the Guarantors by mail at the address specified herein. The Guarantors agree that the State of Minnesota is where

the Lease and this Guaranty were documented and signed by the Lessor, and where all of the monies associated with the Lease and this

Guaranty are sent. The Guarantors hereby waive any objection that it may now or hereafter have to the venue of any such suit or any

such court or that such suit was brought in an inconvenient court.

11.

Miscellaneous. This Guaranty constitutes the entire agreement of the Guarantors with respect to the matters set forth herein.

The rights and remedies herein provided are cumulative and not exclusive of any remedies provided by law or any other agreement, and

this Guaranty shall be in addition to any other guaranty of the Obligations. The invalidity or unenforceability of any one or more sections

of this Guaranty shall not affect the validity or enforceability of its remaining provisions. Captions are for ease of reference only

and shall not affect the meaning of the relevant provisions. The meanings of all defined terms used in this Guaranty shall be equally

applicable to the singular and plural forms of the terms defined. Each Guarantor shall be jointly and severally liable to Lessor hereunder.

The

Guarantors have executed and delivered this Guaranty or caused this Guaranty to be executed and delivered by its duly authorized officer,

as of the date appearing on page one (1).

| AGREED TO AND ACCEPTED BY: |

|

| |

|

|

| SAFE & GREEN HOLDINGS CORP. |

|

| |

|

|

| By |

/s/

Paul M Galvin |

|

| Print

Name |

Paul

M Galvin |

|

| Title |

CEO |

|

| |

|

|

| SG ECHO, LLC |

|

| |

|

|

| By |

/s/

Paul M Galvin |

|

| Print

Name |

Paul

M Galvin |

|

| Title |

CEO |

|

Exhibit 10.5

UNITED

STATES DISTRICT COURT

DISTRICT OF MINNESOTA

| |

|

|

| |

|

|

| Farnam

Street Financial, Inc., a Minnesota corporation, |

|

Case

No. ________________ |

| |

|

|

| Plaintiff, |

|

|

| |

|

|

| vs. |

|

VERIFIED

CONFESSION OF

JUDGMENT |

| |

|

|

| Safe

& Green Holdings Corp., a Delaware corporation, SG Environmental Solutions Corp., a Delaware corporation, and SG Echo, LLC, a

Delaware limited liability company, |

|

|

| |

|

|

| Defendants. |

|

|

| |

|

|

| |

|

|

CONFESSION

OF JUDGMENT

In

accordance with that certain Settlement Agreement dated July 22, 2024 (the “Agreement”), entered into by and among

Farnam Street Financial, Inc. (“Farnam Street”), Safe & Green Holdings Corp. (“S&G”), SG Echo, LLC

(“SG Echo”), and SG Environmental Solutions Corp. (“SG Environmental, together with S&G and SG Echo, the

“Debtors”), the Debtors hereby execute this verified statement and Confession of Judgment pursuant to Minn. Stat. §

548.22 and all other applicable statutes or regulations, and hereby confesses judgment and authorizes the court administrator or

clerk of court for the United States District Court, District of Minnesota to enter judgment in favor of Farnam Street and against

S&G, SG Echo, and SG Environmental jointly and severally, in the amount of Two Million Dollars ($2,000,000.00), (“Judgment

Amount”). All payments made by the Debtors after the date of the Agreement will reduce the Judgment Amount.

Capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Agreement.

STATEMENT

OF FACTS OUT OF WHICH DEBT AROSE

1. Farnam

Street, as lessor, and S&G (formerly known as SG Blocks, Inc.), as lessee, are parties to an equipment lease agreement, identified

as Lease Agreement Number SG101321 (the “Lease Agreement”) and Lease Schedule No. 001 (“Schedule 1”).

2. Farnam

Street commenced a civil action against S&G in the United States District Court of Minnesota (Case No. 23-CV-3212), (the “Litigation”)

based on allegations that S&G breached the Lease Agreement and Schedule 1 by failing to make payments when due. S&G denies the

allegations.

3. SG

Echo and SG Environmental are using the equipment leased by Farnam Street to S&G.

4. To

resolve the claims of Farnam Street against the Debtors, including those asserted in the Litigation, S&G, SG Echo, SG Environmental,

and Farnam Street (the “Parties”) entered into the Agreement.

5. The

Agreement provides, among other things, that: (i) SG Environmental is required to become the lessee under the Lease, (ii) SG

Environmental and Farnam Street enter into a new Lease Schedule 001R (“Schedule 1R”) with a lease commencement date of

August 1, 2024 (“Commencement Date”); (iii) S&G and SG Echo will guaranty all obligations of SG Environmental under

the Lease Agreement and Schedule 1R (the “Lease”); (iv) SG Environmental will pay a security deposit under Schedule 1R

in the amount of $167,056.00 (“Deposit”) on or before August 1, 2024; and (v) SG Environmental will make monthly lease

payments in the amount of $65,880.95, plus applicable taxes, when due under the Lease Agreement and Schedule 1R. Failure to pay the

Deposit or any monthly lease payment when due under the Lease constitutes a default under the Agreement

(“Default”).

6. In

the event of any Default under the Agreement, Farnam Street to proceed to enter judgment against the Debtors pursuant to this Confession.

JUDGMENT

AMOUNT

7. The

Judgment Amount is justly due to Farnam Street from S&G, SG Echo, and SG Environmental under the terms of the Lease. Upon occurrence

of a Default under the Agreement, S&G, SG Echo, and SG Environmental each agree that the Judgment Amount may be conclusively established

by an affidavit of Farnam Street or its attorney, setting forth: (a) the portion of the Judgment Amount then owing to Farnam Street on

this Confession; (b) that the portion of the Judgment Amount is justly due; and (c) that a Default has occurred under the Agreement.

8. If

a Default occurs under the terms of the Agreement, S&G, SG Echo, and SG Environmental hereby authorize any attorney designated by

Farnam Street to appear in person or by affidavit on behalf of Farnam Street in the United States District Court of Minnesota (“Court”)

to confess judgment against S&G, SG Echo, and SG Environmental, jointly and severally, and in favor of Farnam Street for the Judgment

Amount, as reduced by any payments made after execution of the Agreement.

9. S&G,

SG Echo, and SG Environmental hereby specifically and voluntarily waives any right to notice, hearing, or opportunity to protest which

may be required by court rule or statute prior to Farnam Street obtaining entry of judgment pursuant to this Confession; acknowledges

that it has read this Confession; and acknowledges that, in reading and signing this Confession, it has been assisted by legal counsel

and understands and agrees to each and every provision hereof.

10. S&G,

SG Echo, and SG Environmental acknowledge that (i) the Court may exercise personal jurisdiction over it under the terms of the lease

documents and this Confession; (ii) venue in the judicial district of the Court is also proper under the terms of the lease documents

and this Confession; and (iii) subject matter jurisdiction exists in the Court under 28 U.S.C. § 1332(a) as S&G, SG Echo, and

SG Environmental are not citizens of Minnesota and Farnam Street is a citizen of Minnesota.

11. This Confession of Judgment is given pursuant to Minn. Stat. § 548.22.

12. If

any provision herein is held to be invalid or unenforceable by a court of competent jurisdiction, the other provisions of this Confession

shall remain in full force and effect.

13. Farnam

Street's failure to enforce this Confession shall not constitute a waiver of its right to do so at any subsequent time.

(verifications

and signatures on subsequent pages)

VERIFICATION

I,

[NAME], [TITLE] of SG Echo, LLC, being first duly sworn upon oath, do depose and state that I have read the foregoing Verified

Confession of Judgment and that the same is true of my own knowledge and that I executed the foregoing Verified Confession of

Judgment on behalf of SG Echo, LLC and acknowledge such instrument to be the free act and deed of said limited liability

company.

| |

SG Echo, LLC |

| |

|

|

| |

By: |

/s/

Paul M Galvin |

| |

Name: |

Paul

Galvin |

| |

Its |

Chief

Executive Officer |

NOTARY:

| |

State of Florida |

| |

|

|

| |

County of Miami-Dade |

| |

|

|

| |

This

foregoing instrument was acknowledged before me by means of online notarization, this 08/01/2024 by Paul Galvin as CEO of SG. Echo,

LLC |

| |

|

|

| |

/s/ Jose Caraballo |

|

| |

Jose Caraballo |

| |

Online Notary |

| |

|

|

| |

___Personally Known OR __✔__ Produced Identification |

| |

|

|

| |

Type of Identification Produced DRIVER LICENSE |

| |

|

|

| |

Notarized remotely online using communication technology via Proof. |

VERIFICATION

I,

[NAME], [TITLE] of Safe & Green Holding Corp., being first duly sworn upon oath, do depose and state that I have read the

foregoing Verified Confession of Judgment and that the same is true of my own knowledge and that I executed the foregoing Verified

Confession of Judgment on behalf of Safe & Green Holding Corp. and acknowledge such instrument to be the free act and deed of

said corporation.

| |

Safe & Green Holding Corp. |

| |

|

|

| |

By: |

/s/ Paul

M Galvin |

| |

Name: |

Paul

Galvin |

| |

Its: |

Chief

Executive Officer |

NOTARY:

| |

State of Florida |

| |

|

|

| |

County of Miami-Dade |

| |

|

|

| |

This

foregoing instrument was acknowledged before me by means of online notarization, this 08/01/2024 by Paul Galvin as CEO of Safe & Green Holding Corp. |

| |

|

|

| |

/s/ Jose Caraballo |

|

| |

Jose Caraballo |

| |

Online Notary |

| |

|

|

| |

___Personally Known OR __✔__ Produced Identification |

| |

|

|

| |

Type of Identification Produced DRIVER LICENSE |

| |

|

|

| |

Notarized remotely online using communication technology via Proof. |

VERIFICATION

I,

[NAME], [TITLE] of SG Environmental Solutions Corp., being first duly sworn upon oath, do depose and state that I have read the

foregoing Verified Confession of Judgment and that the same is true of my own knowledge and that I executed the foregoing Verified

Confession of Judgment on behalf of SG Environmental Solutions Corp. and acknowledge such instrument to be the free act and deed of

said corporation.

| |

SG Environmental Solutions Corp. |

| |

|

|

| |

By: |

/s/

Paul M Galvin |

| |

Name: |

Paul

Galvin |

| |

Its: |

Chief

Executive Officer |

NOTARY:

| |

State of Florida |

| |

|

|

| |

County of Miami-Dade |

| |

|

|

| |

This

foregoing instrument was acknowledged before me by means of online notarization, this 08/01/2024 by Paul Galvin as CEO of SG

Environmental Solutions Corp. |

| |

|

|

| |

/s/ Jose Caraballo |

|

| |

Jose Caraballo |

| |

Online Notary |

| |

|

|

| |

___Personally Known OR __✔__ Produced Identification |

| |

|

|

| |

Type of Identification Produced DRIVER LICENSE |

| |

|

|

| |

Notarized remotely online using communication technology via Proof. |

6

v3.24.2.u1

Cover

|

Aug. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 01, 2024

|

| Entity File Number |

001-38037

|

| Entity Registrant Name |

SAFE

& GREEN HOLDINGS CORP.

|

| Entity Central Index Key |

0001023994

|

| Entity Tax Identification Number |

95-4463937

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

990

Biscayne Blvd.

|

| Entity Address, Address Line Two |

#501

|

| Entity Address, Address Line Three |

Office 12

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33132

|

| City Area Code |

646

|

| Local Phone Number |

240-4235

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value

$0.01

|

| Trading Symbol |

SGBX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

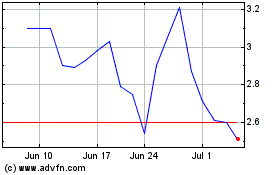

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Safe and Green (NASDAQ:SGBX)

Historical Stock Chart

From Dec 2023 to Dec 2024