Rezolute Reports Full Year Fiscal 2023 Results and Highlights Company Progress

September 14 2023 - 4:05PM

Rezolute, Inc. (Nasdaq: RZLT), a clinical-stage biopharmaceutical

company dedicated to developing transformative therapies with the

potential to disrupt treatment paradigms for devastating metabolic

diseases, today announced its financial results for the fourth

quarter and full fiscal year ended June 30, 2023.

“We are delighted that we are poised to initiate sunRIZE – our

Phase 3 study of RZ358, which we hope will bring us one step closer

to making this therapy available to patients and their families

suffering from congenital hyperinsulinism. We are also anticipating

results from our Phase 2 study of RZ402 in the first quarter of

2024, where we hope to demonstrate the safety and proof-of-concept

of our oral therapy for diabetic macular edema,” said Nevan Charles

Elam, Chief Executive Officer and Founder of Rezolute. “As we look

ahead to these upcoming milestones, we remain committed to our

mission of delivering transformative therapies to patients with

devastating metabolic diseases.”

Corporate and Clinical Highlights

- RZ358,

monoclonal antibody for the treatment of congenital hyperinsulinism

(HI)

- Following the

successful Phase 2b RIZE study of RZ358 in congenital HI, which

demonstrated that RZ358 safely and substantially improved

hypoglycemia, the Company plans to initiate sunRIZE, a pivotal

Phase 3 clinical study of RZ358, in Europe and other geographies

outside the US in Q4 2023. Topline results from the sunRIZE study

are expected in the first half of 2025.

- RZ402, oral

plasma kallikrein inhibitor to treat diabetic macular edema

(DME)

- In December 2022, Rezolute announced the initiation of a Phase

2 study of RZ402 in patients with DME. This is a multi-center,

randomized, double-masked, placebo-controlled, parallel-arm study

to evaluate the safety, efficacy, and pharmacokinetics of RZ402

administered as a monotherapy over a 12-week treatment period in

participants with DME who are naïve to or have received limited

anti-VEGF injections. Study enrollment is ongoing, and the Company

anticipates topline results from this study in the first quarter of

2024.

Fourth Quarter and Full Year Fiscal 2023 Financial

Results

- Cash and cash equivalents totaled $16.0 million and investments

in marketable debt securities totaled $102.3 million as of June 30,

2023.

- Research and development (R&D) expenses were $10.9 million

for the fourth quarter of fiscal 2023, compared to $8.6 million for

the same period in fiscal 2022. Full fiscal year 2023 R&D

expenses were $43.8 million, compared to $32.5 million in fiscal

year 2022. The increase from fiscal year 2022 to fiscal year 2023

was primarily due to increased expenditures in clinical trial

activities, manufacturing costs and higher personnel-related

expenses, which included employee compensation and stock-based

compensation.

- General and administrative (G&A) expenses were $3.3 million

for the fourth quarter of fiscal 2023, compared to $2.7 million for

the same period in fiscal 2022. Full fiscal year 2023 G&A

expenses were $12.2 million, compared to $9.4 million in fiscal

year 2022. The increase from fiscal year 2022 to fiscal year 2023

was primarily due to higher personnel-related expenses, including

employee compensation and stock-based compensation.

- Net loss was $12.7

million for the fourth quarter of fiscal 2023, compared to $9.4

million for the same period in fiscal 2022. Full year fiscal 2023

net loss was $51.8 million compared to net loss of $41.1 million

for the fiscal year 2022.

About Rezolute, Inc.

Rezolute strives to disrupt current treatment

paradigms by developing transformative therapies for devastating

rare and chronic metabolic diseases. Its novel therapies hold the

potential to both significantly improve outcomes and reduce the

treatment burden for patients, the treating physician, and the

healthcare system. Patient, clinician, and advocate voices are

integrated in the Company’s drug development process, enabling

Rezolute to boldly address a range of severe conditions. Rezolute

is steadfast in its mission to create profound, positive, and

lasting impact on patients’ lives. The Company’s lead clinical

asset, RZ358, is in late-stage development for the treatment of

congenital hyperinsulinism, a rare pediatric endocrine disorder.

Rezolute is also developing RZ402, an orally available plasma

kallikrein inhibitor, for the treatment of diabetic macular edema.

For more information, visit www.rezolutebio.com or follow us on

Twitter or LinkedIn.

Forward-Looking Statements

The information provided herein contain

"forward-looking statements" within the meaning of the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by words such as

"anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "will" and similar references to future periods.

The “forward-looking statements” include, but are not limited to,

statements regarding receiving results from the Phase 2 study of

RZ402 in the first quarter of 2024, the ability of RZ358 to treat

congenital hyperinsulinism, the timing of the release topline

results from sunRIZE, and our ability to meet trial enrollment

goals.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on Rezolute’s current beliefs, expectations and

assumptions regarding the future of its businesses, results of and

timing of clinical trials, financial condition and results of

operations, future plans and strategies, projections, anticipated

events and trends, the economy and other future conditions.

Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of Rezolute’s control. Rezolute’s actual results

including the timing and results of clinical trials may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not place undue reliance on any of these

forward-looking statements. Important factors that could cause

Rezolute’s actual results including the timing and results of

clinical trials to differ materially from those indicated in the

forward-looking statements are discussed or identified in

Rezolute’s filings made with the U.S. Securities and Exchange

Commission. Any forward-looking statements made by Rezolute in this

information are based only on information currently available to

Rezolute and speak only as of the date on which the statement is

made. Rezolute undertakes no obligation to update any

forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise except as required by applicable

law.

Investor:

Kimberly Minarovich

Argot Partners

rezolute@argotpartners.com

212-600-1902

Media:

media-relations@rezolutebio.com

|

|

|

|

|

|

|

|

|

|

|

Rezolute, Inc. |

|

Condensed Consolidated Financial Statements

Data |

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

Condensed Consolidated Statements of Operations

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

10,933 |

|

|

$ |

8,574 |

|

|

$ |

43,813 |

|

|

$ |

32,486 |

|

|

General and administrative |

|

|

3,305 |

|

|

|

2,725 |

|

|

|

12,177 |

|

|

|

9,357 |

|

|

Total operating expenses |

|

|

14,238 |

|

|

|

11,299 |

|

|

|

55,990 |

|

|

|

41,843 |

|

|

Loss from operations |

|

|

(14,238 |

) |

|

|

(11,299 |

) |

|

|

(55,990 |

) |

|

|

(41,843 |

) |

|

Non-operating income (expense), net |

|

|

1,510 |

|

|

|

1,876 |

|

|

|

4,203 |

|

|

|

783 |

|

|

Net loss |

|

$ |

(12,728 |

) |

|

$ |

(9,423 |

) |

|

$ |

(51,787 |

) |

|

$ |

(41,060 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.01 |

) |

|

$ |

(2.26 |

) |

|

Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.37 |

) |

|

$ |

(1.01 |

) |

|

$ |

(2.32 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

51,410 |

|

|

|

31,429 |

|

|

|

51,188 |

|

|

|

18,197 |

|

|

Diluted |

|

|

51,410 |

|

|

|

36,302 |

|

|

|

51,188 |

|

|

|

19,487 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets Data: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

|

|

$ |

16,036 |

|

|

$ |

150,410 |

|

|

Investments in marketable debt securities |

|

|

|

|

|

|

102,330 |

|

|

|

- |

|

|

Working capital |

|

|

|

|

|

|

99,710 |

|

|

|

149,642 |

|

|

Total assets |

|

|

|

|

|

|

123,721 |

|

|

|

152,420 |

|

|

Accumulated deficit |

|

|

|

|

|

|

(260,984 |

) |

|

|

(209,198 |

) |

|

Total stockholders’ equity |

|

|

|

|

|

|

123,721 |

|

|

|

149,471 |

|

| |

|

|

|

|

|

|

|

|

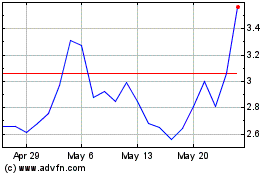

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Apr 2024 to May 2024

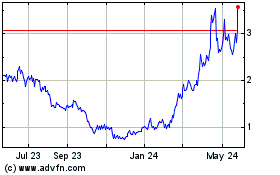

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From May 2023 to May 2024